In the dynamic semiconductor industry, Broadcom Inc. (AVGO) and IPG Photonics Corporation (IPGP) stand out as leaders with distinct innovation strategies and market focuses. Broadcom’s extensive portfolio spans wired and wireless infrastructure, while IPG Photonics specializes in high-performance fiber lasers and amplifiers. This comparison explores their growth potential and risks, helping you decide which company is the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Broadcom Inc. and IPG Photonics Corporation by providing an overview of these two companies and their main differences.

Broadcom Inc. Overview

Broadcom Inc. is a global technology company specializing in semiconductor and infrastructure software solutions. Headquartered in Palo Alto, California, it operates through four segments including Wired Infrastructure and Wireless Communications. Broadcom’s products serve diverse markets such as data centers, telecommunications, and industrial automation, employing around 37,000 people worldwide.

IPG Photonics Corporation Overview

IPG Photonics Corporation develops and sells high-performance fiber lasers and amplifiers used mainly in materials processing and communications. Based in Marlborough, Massachusetts, IPG offers a broad range of laser systems and accessories targeting OEMs, system integrators, and end users. The company has approximately 4,740 employees and focuses on advanced laser technologies for industrial and medical applications.

Key similarities and differences

Both Broadcom and IPG Photonics operate within the technology sector, specifically in semiconductors and related hardware. Broadcom has a broader product portfolio and larger scale, servicing multiple infrastructure markets with 37,000 employees. In contrast, IPG focuses on fiber laser technology with a more specialized product range and smaller workforce. Their business models differ in scope, with Broadcom emphasizing infrastructure software and semiconductor solutions, while IPG concentrates on laser and amplifier systems.

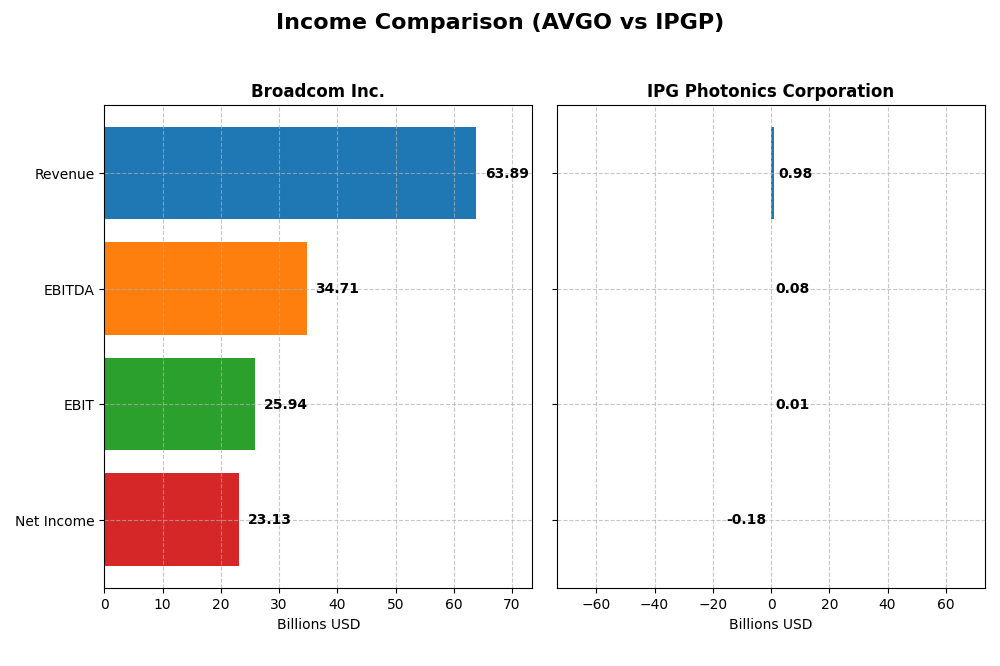

Income Statement Comparison

Below is a comparison of the most recent fiscal year income statement metrics for Broadcom Inc. and IPG Photonics Corporation, highlighting their revenue, profitability, and earnings per share figures.

| Metric | Broadcom Inc. (AVGO) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Cap | 1.60T | 3.27B |

| Revenue | 63.9B | 977M |

| EBITDA | 34.7B | 76M |

| EBIT | 25.9B | 14M |

| Net Income | 23.1B | -182M |

| EPS | 4.91 | -4.09 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Broadcom Inc.

Broadcom Inc. demonstrated strong growth in revenue, rising from $27.45B in 2021 to $63.89B in 2025, with net income increasing significantly from $6.44B to $23.13B over the same period. Margins have improved notably, with gross margin at 67.77% and net margin at 36.2% in 2025. The latest year showed accelerated growth, with revenue up 23.87% and net margin surging 216.69%, reflecting robust operational efficiency.

IPG Photonics Corporation

IPG Photonics experienced declining revenue, down from $1.46B in 2021 to $977M in 2024, with net income turning negative to -$182M in 2024 from a positive $278M in 2021. Margins deteriorated, with a gross margin of 34.61% but a negative net margin of -18.58% in 2024. The most recent year saw worsening profitability, with revenue shrinking 24.1% and net margin declining sharply, indicating operational challenges and reduced earnings quality.

Which one has the stronger fundamentals?

Broadcom Inc. exhibits stronger fundamentals characterized by consistent and substantial growth in revenue and net income, alongside improving margins and favorable profitability metrics. Conversely, IPG Photonics faces unfavorable trends with declining revenues, negative net income, and deteriorating margins. Therefore, Broadcom’s income statement reflects more robust and stable financial health relative to IPG Photonics.

Financial Ratios Comparison

This table compares key financial ratios for Broadcom Inc. and IPG Photonics Corporation based on their most recent fiscal year data, providing a snapshot of profitability, liquidity, and leverage.

| Ratios | Broadcom Inc. (2025) | IPG Photonics Corp. (2024) |

|---|---|---|

| ROE | 28.4% | -8.97% |

| ROIC | 16.4% | -9.97% |

| P/E | 73.9 | -17.8 |

| P/B | 21.0 | 1.59 |

| Current Ratio | 1.71 | 6.98 |

| Quick Ratio | 1.58 | 5.59 |

| D/E (Debt-to-Equity) | 0.80 | 0.009 |

| Debt-to-Assets | 38.1% | 0.78% |

| Interest Coverage | 7.94 | 0 |

| Asset Turnover | 0.37 | 0.43 |

| Fixed Asset Turnover | 25.3 | 1.66 |

| Payout Ratio | 48.2% | 0% |

| Dividend Yield | 0.65% | 0% |

Interpretation of the Ratios

Broadcom Inc.

Broadcom’s ratios show a generally strong financial position with favorable net margin at 36.2%, return on equity at 28.45%, and return on invested capital at 16.36%. However, valuation ratios like P/E at 73.87 and P/B at 21.01 are unfavorable, indicating high market expectations. The dividend yield is low at 0.65%, with consistent payouts supported by free cash flow but limited by the elevated valuation.

IPG Photonics Corporation

IPG Photonics exhibits weak profitability ratios, including a negative net margin of -18.58% and negative returns on equity and invested capital. The company does not pay dividends, likely due to this negative income and a reinvestment strategy. Favorable liquidity and leverage ratios contrast with ongoing operational challenges and a dividend yield of zero, reflecting a focus on growth or restructuring.

Which one has the best ratios?

Broadcom Inc. presents a more favorable ratio profile overall, with strong profitability and coverage ratios, despite some valuation concerns. IPG Photonics shows a weaker financial stance, marked by negative profitability and no dividend payments, leading to a slightly unfavorable ratio evaluation. Thus, Broadcom’s ratios are comparatively better based on these metrics.

Strategic Positioning

This section compares the strategic positioning of Broadcom Inc. and IPG Photonics Corporation, including market position, key segments, and exposure to technological disruption:

Broadcom Inc.

- Leading global semiconductor player with Nasdaq listing and significant market cap pressure from industry peers.

- Diversified segments: Infrastructure Software and Semiconductor Solutions drive revenues broadly across tech markets.

- Products include complex sub-systems and firmware, with hardware interfacing optoelectronic sensors, showing moderate disruption risk.

IPG Photonics Corporation

- Smaller semiconductor firm specializing in high-performance fiber lasers, facing niche market competition.

- Concentrated on laser products and related systems primarily for materials processing and communications.

- Focus on fiber lasers and amplifiers with specialized technology, exposed to innovation in laser applications.

Broadcom Inc. vs IPG Photonics Corporation Positioning

Broadcom operates a diversified business model across semiconductor and software sectors, leveraging scale advantages. IPG Photonics maintains a more concentrated focus on laser technologies, offering specialized products but with narrower market exposure. Broadcom’s broader portfolio may mitigate segment-specific risks compared to IPG’s specialization.

Which has the best competitive advantage?

Broadcom demonstrates a very favorable moat with growing ROIC above WACC, indicating durable competitive advantage and value creation. Conversely, IPG shows a very unfavorable moat with declining ROIC below WACC, reflecting value destruction and weaker competitive positioning.

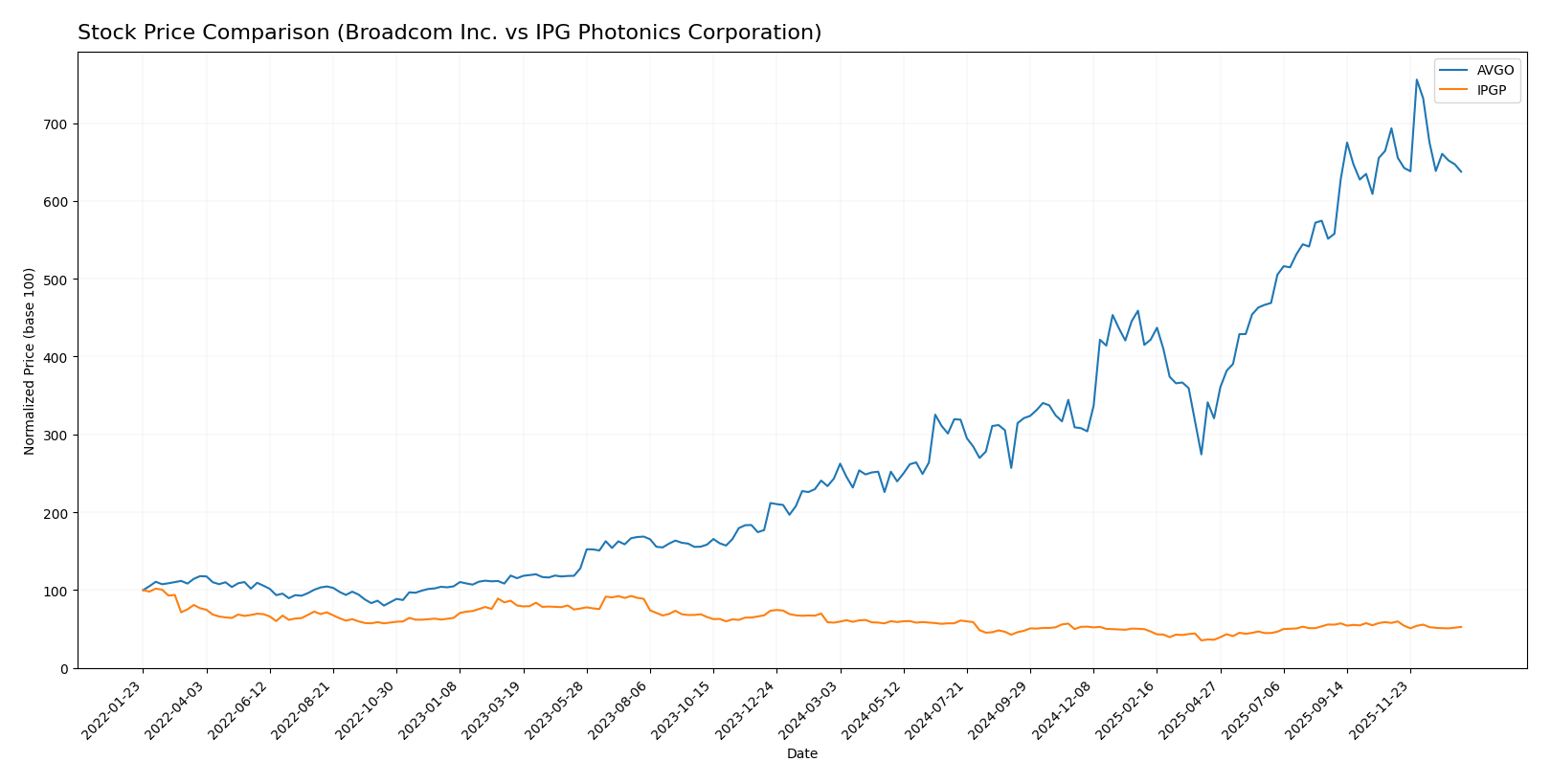

Stock Comparison

The stock price movements over the past 12 months reveal Broadcom Inc. (AVGO) experienced a strong bullish trend with significant gains and high volatility, while IPG Photonics Corporation (IPGP) faced a bearish trend marked by steady declines and lower volatility.

Trend Analysis

Broadcom Inc. (AVGO) showed a 162.18% price increase over the past year, indicating a bullish trend with deceleration in growth and substantial volatility, reaching a high of 402.96 and a low of 120.47.

IPG Photonics Corporation (IPGP) experienced a 9.39% price decrease, reflecting a bearish trend with decelerating downward momentum and moderate volatility, with prices ranging from 52.12 to 90.69.

Comparing both, Broadcom delivered the highest market performance with a pronounced bullish trend, while IPGP’s stock exhibited a bearish trajectory over the same period.

Target Prices

The current analyst consensus shows promising upside potential for both Broadcom Inc. and IPG Photonics Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Broadcom Inc. | 510 | 370 | 454.8 |

| IPG Photonics Corporation | 96 | 92 | 94 |

Analysts expect Broadcom’s stock to trade significantly above its current price of $339.89, suggesting notable upside. IPG Photonics’ consensus target near $94 also indicates moderate appreciation potential from its current price of $77.54.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Broadcom Inc. and IPG Photonics Corporation:

Rating Comparison

Broadcom Inc. Rating

- Rating: B, classified as Very Favorable

- Discounted Cash Flow Score: 3, Moderate valuation indicator

- ROE Score: 5, Very Favorable efficiency in generating profit

- ROA Score: 5, Very Favorable asset utilization

- Debt To Equity Score: 1, Very Unfavorable high financial risk

- Overall Score: 3, Moderate overall financial standing

IPG Photonics Corporation Rating

- Rating: B+, classified as Very Favorable

- Discounted Cash Flow Score: 4, Favorable valuation signal

- ROE Score: 2, Moderate efficiency in profit generation

- ROA Score: 3, Moderate asset utilization

- Debt To Equity Score: 4, Favorable low financial risk

- Overall Score: 3, Moderate overall financial standing

Which one is the best rated?

IPG Photonics holds a higher rating of B+ compared to Broadcom’s B. While Broadcom excels in profitability metrics (ROE and ROA), IPG shows better valuation and financial risk scores, reflecting a more balanced assessment.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

Broadcom Inc. Scores

- Altman Z-Score: 12.13, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

IPG Photonics Corporation Scores

- Altman Z-Score: 9.65, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

Broadcom Inc. has higher scores in both the Altman Z-Score and Piotroski assessments, placing it in a safer financial zone and indicating stronger overall financial health compared to IPG Photonics Corporation based on the provided data.

Grades Comparison

Here is the comparison of recent grades and rating consensus for Broadcom Inc. and IPG Photonics Corporation:

Broadcom Inc. Grades

The following table summarizes recent grades from reliable grading companies for Broadcom Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-15 |

| Benchmark | Maintain | Buy | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-12 |

| Piper Sandler | Maintain | Overweight | 2025-12-12 |

| TD Cowen | Maintain | Buy | 2025-12-12 |

| B of A Securities | Maintain | Buy | 2025-12-12 |

| JP Morgan | Maintain | Overweight | 2025-12-12 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

Broadcom’s grades consistently show strong positive ratings, predominantly “Buy” and “Outperform,” indicating stable analyst confidence.

IPG Photonics Corporation Grades

Below is a summary of recent grades from reliable grading companies for IPG Photonics Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Stifel | Maintain | Buy | 2025-02-12 |

| Needham | Maintain | Hold | 2025-02-12 |

| Seaport Global | Downgrade | Neutral | 2024-08-01 |

| Stifel | Maintain | Buy | 2024-07-31 |

| Raymond James | Maintain | Strong Buy | 2024-07-31 |

IPG Photonics shows a mix of grades ranging from “Strong Buy” to “Sell,” reflecting some divergence in analyst opinions and moderate uncertainty.

Which company has the best grades?

Broadcom Inc. has received more consistent and broadly positive grades, largely “Buy” and “Outperform,” while IPG Photonics presents a wider spread including some “Sell” and “Neutral” ratings. This consistency in Broadcom’s grades may indicate steadier analyst confidence, which investors might consider when assessing portfolio risk.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses of Broadcom Inc. (AVGO) and IPG Photonics Corporation (IPGP) based on recent financial and market data.

| Criterion | Broadcom Inc. (AVGO) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Diversification | Highly diversified with Infrastructure Software ($27B) and Semiconductor Solutions ($36.9B) segments | Less diversified, focused on laser products and systems with varied laser types but narrower scope |

| Profitability | Strong profitability: net margin 36.2%, ROIC 16.36%, ROE 28.45% | Negative profitability: net margin -18.58%, ROIC -9.97%, ROE -8.97% |

| Innovation | High innovation with durable competitive advantage, growing ROIC (+34.4%) | Declining innovation indicated by sharply falling ROIC (-275.8%) and value destruction |

| Global presence | Extensive global operations in semiconductors and software infrastructure | Global laser systems presence but smaller scale and niche markets |

| Market Share | Large market share in semiconductor solutions and infrastructure software segments | Smaller market share concentrated in laser system markets with moderate growth |

Key takeaways: Broadcom demonstrates a robust financial position with strong profitability, diversification, and a durable competitive moat, making it a favorable investment candidate. In contrast, IPG Photonics struggles with declining profitability and value destruction, signaling higher risk and less attractive investment prospects at this time.

Risk Analysis

Below is a comparison table highlighting key risks for Broadcom Inc. (AVGO) and IPG Photonics Corporation (IPGP) based on the most recent data available.

| Metric | Broadcom Inc. (AVGO) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Market Risk | Beta 1.22 indicates moderate market sensitivity | Beta 1.02 shows near-market average sensitivity |

| Debt level | Debt-to-Equity ratio 0.8 (neutral risk) | Very low debt-to-equity 0.01 (low risk) |

| Regulatory Risk | Moderate, due to global semiconductor regulations | Moderate, with some export controls on laser tech |

| Operational Risk | Complex supply chain for semiconductors | Specialized manufacturing complexity |

| Environmental Risk | Exposure to energy use and waste management in manufacturing | Less intensive but still relevant due to production processes |

| Geopolitical Risk | High, given global supply chain and US-China tensions | Moderate, export controls and global market exposure |

The most impactful and likely risks for Broadcom stem from geopolitical tensions affecting semiconductor supply chains, while IPG Photonics faces operational risks tied to manufacturing specialization and regulatory controls. Both companies maintain strong financial health, but Broadcom’s higher debt level and market sensitivity warrant close monitoring.

Which Stock to Choose?

Broadcom Inc. (AVGO) shows a strong income evolution with 23.87% revenue growth in 2025 and sustained profitability, reflected by a 36.2% net margin. Its financial ratios are slightly favorable, with solid returns on equity (28.45%) and invested capital (16.36%). The company maintains moderate debt levels and a very favorable rating of B, indicating overall financial strength.

IPG Photonics Corporation (IPGP) experienced a decline in income with negative growth rates and a -18.58% net margin in 2024. Its financial ratios are slightly unfavorable, marked by negative returns on equity (-8.97%) and invested capital (-9.97%), but the company has minimal debt and a favorable overall rating of B+, supported by strong liquidity ratios.

For investors, Broadcom’s very favorable rating combined with robust income growth and solid financial metrics might appeal to those seeking quality and growth potential. Conversely, IPG Photonics’ strong liquidity and low debt could be more attractive for risk-tolerant investors interested in turnaround opportunities, though its financial challenges and unfavorable income trends suggest caution.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Broadcom Inc. and IPG Photonics Corporation to enhance your investment decisions: