In the dynamic semiconductor industry, Broadcom Inc. (AVGO) and Cirrus Logic, Inc. (CRUS) stand out as influential players with distinct market approaches. Broadcom’s extensive portfolio spans infrastructure and communications, while Cirrus Logic focuses on high-precision mixed-signal audio and industrial applications. Comparing these companies reveals insights into innovation strategies and market positioning. Join me as we analyze which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Broadcom and Cirrus Logic by providing an overview of these two companies and their main differences.

Broadcom Overview

Broadcom Inc. is a global technology company specializing in semiconductor and infrastructure software solutions. Headquartered in Palo Alto, California, Broadcom operates through four main segments: Wired Infrastructure, Wireless Communications, Enterprise Storage, and Industrial & Other. The company produces a diverse range of products used in networking, telecommunications, smartphones, data centers, and industrial automation, employing approximately 37,000 people.

Cirrus Logic Overview

Cirrus Logic, Inc. is a fabless semiconductor company based in Austin, Texas, focusing on low-power, high-precision mixed-signal processing solutions. Its product portfolio includes audio codecs, amplifiers, digital signal processors, and SoundClear technology used in consumer electronics like smartphones, tablets, and automotive entertainment systems. Cirrus Logic also provides mixed-signal products for industrial and energy applications, employing around 1,600 people.

Key similarities and differences

Both Broadcom and Cirrus Logic operate in the semiconductor industry, serving technology markets with specialized products. While Broadcom offers a broad range of semiconductor and software solutions across multiple sectors, Cirrus Logic concentrates on audio and mixed-signal processing technologies for consumer and industrial applications. Broadcom is significantly larger in market capitalization and workforce size, reflecting its broad product scope and global reach compared to Cirrus Logic’s more focused approach.

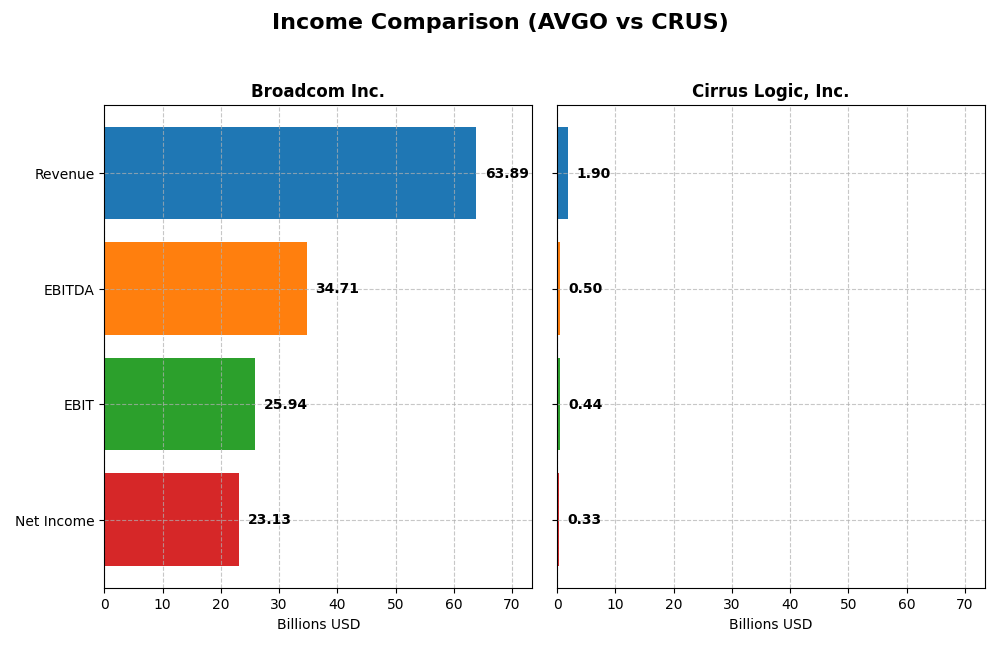

Income Statement Comparison

The table below compares the key income statement metrics for Broadcom Inc. and Cirrus Logic, Inc. based on their most recent fiscal year results.

| Metric | Broadcom Inc. (AVGO) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Market Cap | 1.6T | 6.3B |

| Revenue | 63.9B | 1.9B |

| EBITDA | 34.7B | 497M |

| EBIT | 25.9B | 445M |

| Net Income | 23.1B | 332M |

| EPS | 4.91 | 6.24 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Broadcom Inc.

Broadcom Inc. showed a strong upward trend in revenue, growing from $27.45B in 2021 to $63.89B in 2025, with net income rising from $6.44B to $23.13B over the same period. Margins improved significantly, highlighted by a gross margin of 67.77% and a net margin of 36.2% in 2025. The latest fiscal year demonstrated exceptional earnings growth, with net margin and EPS surging by over 200%.

Cirrus Logic, Inc.

Cirrus Logic’s revenue grew moderately from $1.37B in 2021 to $1.90B in 2025, while net income increased from $217M to $332M. The company maintained favorable gross and EBIT margins at 52.53% and 23.46%, respectively, with a net margin of 17.48% in 2025. Recent results showed steady but slower revenue growth of 6%, accompanied by consistent margin improvements and a 22% EPS increase.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement evaluations with strong margin profiles and positive growth trends. Broadcom’s substantially higher revenue and net income levels, combined with impressive margin expansions and robust profitability growth, contrast with Cirrus Logic’s smaller scale and steadier progress. Broadcom’s fundamentals appear stronger in scale and growth momentum, while Cirrus Logic maintains solid profitability with moderate expansion.

Financial Ratios Comparison

The table below presents a comparison of key financial ratios for Broadcom Inc. (AVGO) and Cirrus Logic, Inc. (CRUS) based on the most recent fiscal year data available as of 2025.

| Ratios | Broadcom Inc. (AVGO) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| ROE | 28.4% | 17.0% |

| ROIC | 16.4% | 14.2% |

| P/E | 73.9 | 15.9 |

| P/B | 21.0 | 2.7 |

| Current Ratio | 1.71 | 6.35 |

| Quick Ratio | 1.58 | 4.82 |

| D/E (Debt to Equity) | 0.80 | 0.07 |

| Debt-to-Assets | 38.1% | 6.2% |

| Interest Coverage | 7.94 | 457.0 |

| Asset Turnover | 0.37 | 0.81 |

| Fixed Asset Turnover | 25.3 | 6.62 |

| Payout Ratio | 48.2% | 0% |

| Dividend Yield | 0.65% | 0% |

Interpretation of the Ratios

Broadcom Inc.

Broadcom’s ratios reveal a slightly favorable profile with strong profitability metrics such as a 36.2% net margin and 28.45% ROE, supporting solid returns. However, valuation multiples like a PE of 73.87 and PB of 21.01 appear stretched, and asset turnover is low at 0.37, which might indicate efficiency concerns. The company pays dividends with a low 0.65% yield, suggesting cautious shareholder returns.

Cirrus Logic, Inc.

Cirrus Logic shows a favorable ratio profile, with healthy profitability including a 17.48% net margin and 17.01% ROE. Its balance sheet strength is evident with low debt-to-assets at 6.18% and a very high interest coverage ratio of 495.45, signaling low financial risk. The company does not pay dividends, likely prioritizing reinvestment and growth, which fits a smaller market cap of 6.3B.

Which one has the best ratios?

Cirrus Logic holds a generally more favorable ratio mix, especially in liquidity, leverage, and coverage, with fewer valuation concerns. Broadcom excels in profitability but faces challenges with high valuation and lower asset efficiency. Overall, Cirrus Logic’s ratios suggest a more balanced financial position, while Broadcom’s strength lies more in profitability metrics despite some risks.

Strategic Positioning

This section compares the strategic positioning of Broadcom Inc. and Cirrus Logic, Inc., including market position, key segments, and exposure to technological disruption:

Broadcom Inc.

- Large market cap of 1.6T in semiconductors with NASDAQ listing; faces competitive pressure typical of tech giants.

- Diversified segments: Infrastructure Software and Semiconductor Solutions drive revenue over 63B; broad end-market applications.

- Operates in semiconductors and infrastructure software; products interface with analog/digital systems, implying moderate disruption risk.

Cirrus Logic, Inc.

- Smaller market cap at 6.3B, fabless semiconductor niche; subject to competitive pressures in audio and mixed-signal markets.

- Concentrated on High-Performance Mixed Signal and Portable Audio Products totaling about 1.9B; focused on audio and industrial applications.

- Focus on low-power mixed-signal solutions and audio technologies; innovation in SoundClear and haptics targets evolving user experience.

Broadcom Inc. vs Cirrus Logic, Inc. Positioning

Broadcom’s diversified business model spans multiple semiconductor and software segments, supporting varied revenue streams, while Cirrus Logic maintains a concentrated focus on mixed-signal and audio products. Broadcom benefits from scale but faces complexity, whereas Cirrus Logic’s specialization offers targeted innovation with limited scale.

Which has the best competitive advantage?

Both companies demonstrate a very favorable moat with growing ROIC above WACC, indicating durable competitive advantages. Broadcom’s larger scale and diversified segments provide a stronger economic moat compared to Cirrus Logic’s smaller, niche market presence.

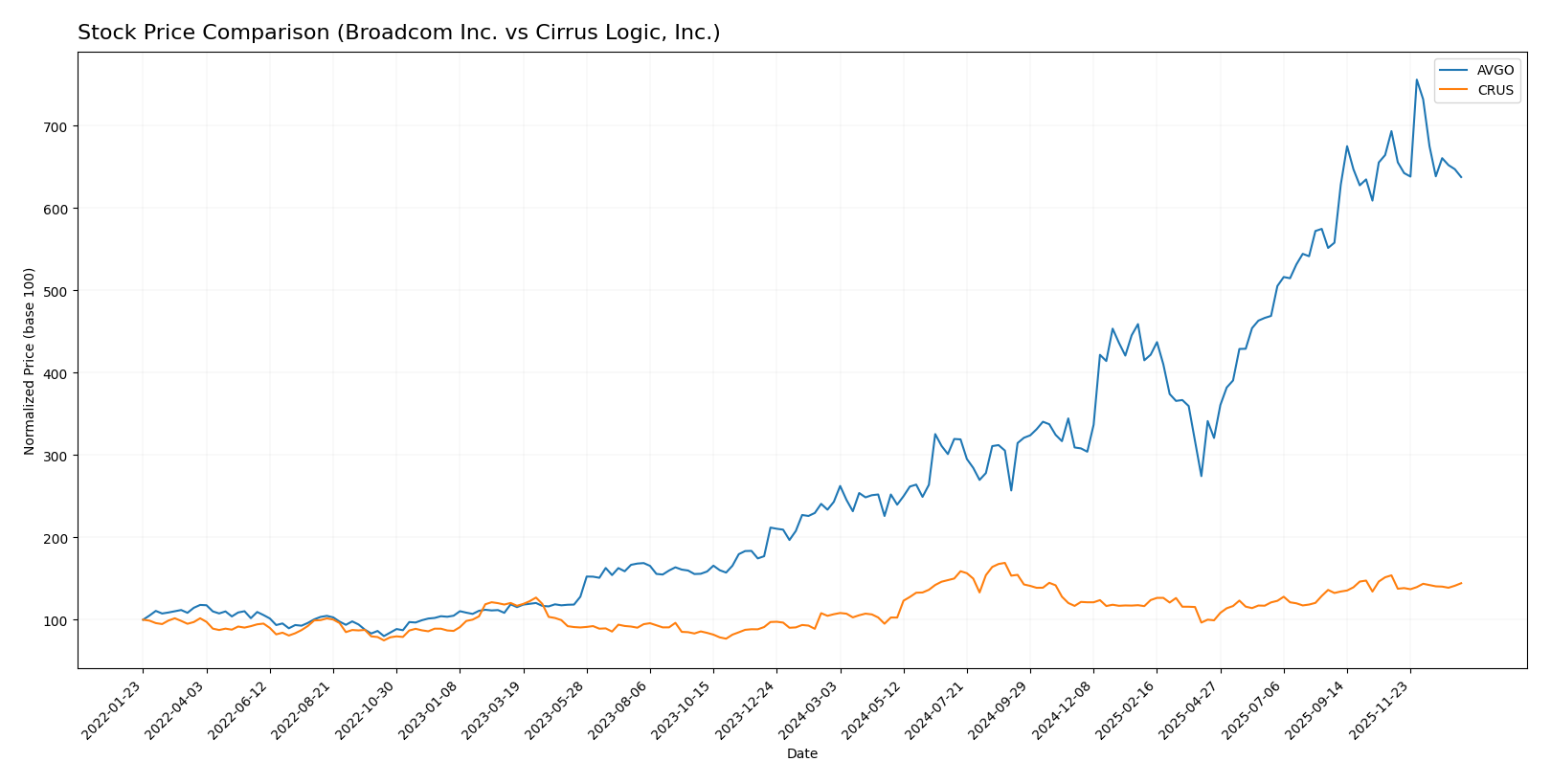

Stock Comparison

The stock price chart illustrates significant bullish trends for both Broadcom Inc. (AVGO) and Cirrus Logic, Inc. (CRUS) over the past 12 months, with notable price appreciation and recent short-term declines in trading activity.

Trend Analysis

Broadcom Inc. (AVGO) recorded a 162.18% price increase over the past year, indicating a strong bullish trend with deceleration and high volatility, peaking at 402.96 and bottoming at 120.47. Recent months show a slight bearish reversal with an 8.05% decline.

Cirrus Logic, Inc. (CRUS) showed a 35.25% price increase over the same period, confirming a bullish trend with deceleration and moderate volatility. The highest price reached 145.69, and the lowest was 82.02. Recent activity reveals a mild bearish trend with a 6.23% drop.

Comparing both, Broadcom’s stock delivered the highest market performance with a substantially larger price increase, despite recent weakness, while Cirrus Logic maintained moderate gains and less volatility.

Target Prices

Analysts present a cautiously optimistic consensus on the target prices for Broadcom Inc. and Cirrus Logic, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Broadcom Inc. | 510 | 370 | 454.8 |

| Cirrus Logic, Inc. | 155 | 95 | 137.5 |

The target consensus for Broadcom at 454.8 is significantly above its current price of 339.89, indicating potential upside. Cirrus Logic’s consensus of 137.5 also suggests upside compared to its current price of 124.38, reflecting moderate analyst confidence in growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Broadcom Inc. and Cirrus Logic, Inc.:

Rating Comparison

Broadcom Inc. Rating

- Rating: Broadcom holds a B rating classified as Very Favorable.

- Discounted Cash Flow Score: Moderate score of 3.

- ROE Score: Very Favorable top score of 5.

- ROA Score: Very Favorable top score of 5.

- Debt To Equity Score: Very Unfavorable low score of 1.

- Overall Score: Moderate score of 3.

Cirrus Logic, Inc. Rating

- Rating: Cirrus Logic has an A- rating, also Very Favorable.

- Discounted Cash Flow Score: Favorable score of 4.

- ROE Score: Favorable score of 4.

- ROA Score: Very Favorable top score of 5.

- Debt To Equity Score: Moderate score of 3.

- Overall Score: Favorable score of 4.

Which one is the best rated?

Based strictly on the provided data, Cirrus Logic holds a higher overall rating (A- vs. B) and better scores in discounted cash flow, debt-to-equity, and overall score than Broadcom. Broadcom scores higher in ROE but has a very unfavorable debt-to-equity score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Broadcom Inc. and Cirrus Logic, Inc.:

Broadcom Inc. Scores

- Altman Z-Score: 12.13, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health and value.

Cirrus Logic Scores

- Altman Z-Score: 11.57, also in the safe zone showing low bankruptcy risk.

- Piotroski Score: 7, considered strong financial health and value.

Which company has the best scores?

Broadcom Inc. has slightly higher Altman Z-Score and Piotroski Score values than Cirrus Logic. Both are in safe zones, but Broadcom’s scores reflect marginally stronger financial health based on the data provided.

Grades Comparison

Here is a comparison of the recent grades assigned to Broadcom Inc. and Cirrus Logic, Inc.:

Broadcom Inc. Grades

The following table summarizes recent analyst grades for Broadcom Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-15 |

| Benchmark | Maintain | Buy | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-12 |

| Piper Sandler | Maintain | Overweight | 2025-12-12 |

| TD Cowen | Maintain | Buy | 2025-12-12 |

| B of A Securities | Maintain | Buy | 2025-12-12 |

| JP Morgan | Maintain | Overweight | 2025-12-12 |

| Mizuho | Maintain | Outperform | 2025-12-12 |

Broadcom’s grades show a strong consensus around “Buy” and “Outperform,” with no downgrades or sell ratings noted.

Cirrus Logic, Inc. Grades

The following table summarizes recent analyst grades for Cirrus Logic, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Benchmark | Maintain | Buy | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

Cirrus Logic’s ratings are mixed but generally positive, including “Buy,” “Overweight,” and “Positive” grades, alongside several “Equal Weight” ratings and two sell ratings in consensus data.

Which company has the best grades?

Broadcom Inc. has received more consistent and stronger grades, predominantly “Buy” and “Outperform,” compared to Cirrus Logic’s more varied ratings including “Equal Weight” and some sell opinions. This consistency may suggest stronger analyst confidence in Broadcom’s outlook, which could influence investor sentiment and risk assessment.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of Broadcom Inc. (AVGO) and Cirrus Logic, Inc. (CRUS) based on the most recent financial and operational data.

| Criterion | Broadcom Inc. (AVGO) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Diversification | Highly diversified product portfolio with major revenue streams from Semiconductor Solutions (37B) and Infrastructure Software (27B) | More concentrated in audio-related products, with Portable Audio Products (~1.1B) and High-Performance Mixed Signal (~0.76B) |

| Profitability | Strong profitability: Net margin 36.2%, ROIC 16.4%, ROE 28.5% | Good profitability: Net margin 17.5%, ROIC 14.2%, ROE 17.0% |

| Innovation | Demonstrates durable competitive advantage with growing ROIC (+34% over 5 years) and strong R&D in semiconductor tech | Also shows durable moat with positive ROIC growth (+10%) but in a narrower tech niche |

| Global presence | Extensive global footprint supporting large-scale semiconductor and software markets | Smaller scale with niche market focus, less global diversification |

| Market Share | Large market share in semiconductor solutions and infrastructure software segments | Smaller market share concentrated in audio and mixed-signal semiconductor markets |

Broadcom’s broad diversification and superior profitability metrics reflect a robust competitive position with strong value creation and global reach. Cirrus Logic, while profitable and innovative, operates in a more specialized segment with less diversification, which may imply higher exposure to sector-specific risks.

Risk Analysis

Below is a comparative risk analysis table for Broadcom Inc. (AVGO) and Cirrus Logic, Inc. (CRUS) based on the most recent data from 2025.

| Metric | Broadcom Inc. (AVGO) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Market Risk | Beta 1.22 (moderate volatility) | Beta 1.08 (moderate volatility) |

| Debt level | Debt-to-Equity 0.8 (neutral) | Debt-to-Equity 0.07 (low) |

| Regulatory Risk | Moderate (global tech regulations) | Moderate (tech and trade policies) |

| Operational Risk | Large scale, complex supply chains | Smaller scale, specialized products |

| Environmental Risk | Exposure due to semiconductor manufacturing | Lower exposure, fabless model |

| Geopolitical Risk | High (global supply chain exposure) | Moderate (less global footprint) |

Broadcom faces higher geopolitical and operational risks due to its large global footprint and complex supply chains, while Cirrus Logic benefits from lower debt and less exposure but remains vulnerable to tech sector regulatory changes. Market volatility is moderate for both.

Which Stock to Choose?

Broadcom Inc. (AVGO) shows strong income growth with a 23.87% revenue increase and a 36.2% net margin in 2025, supported by favorable profitability and liquidity ratios. Its debt level is moderate, and its overall rating is very favorable with some caution on valuation metrics.

Cirrus Logic, Inc. (CRUS) demonstrates moderate income growth, with a 5.99% rise in revenue and a 17.48% net margin in 2025. Financial ratios suggest solid profitability and low debt, reflected in a very favorable rating and balanced valuation scores.

Investors seeking robust growth with a durable competitive advantage might find Broadcom’s higher income growth and very favorable moat appealing, while those prioritizing financial stability and moderate valuation could view Cirrus Logic as a favorable choice with strong fundamentals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Broadcom Inc. and Cirrus Logic, Inc. to enhance your investment decisions: