Home > Comparison > Healthcare > BSX vs STE

The strategic rivalry between Boston Scientific Corporation and STERIS plc shapes the healthcare medical devices sector’s evolution. Boston Scientific leads as a diversified medical device innovator with broad interventional specialties. STERIS operates as a specialized provider of infection prevention and sterilization technologies, emphasizing services and consumables. This analysis contrasts their growth models and capital allocation to identify which trajectory offers superior risk-adjusted returns for diversified portfolios.

Table of contents

Companies Overview

Boston Scientific Corporation and STERIS plc both command significant roles in the medical devices sector, shaping healthcare worldwide.

Boston Scientific Corporation: Interventional Medical Devices Leader

Boston Scientific dominates the interventional medical devices market. Its core revenue stems from developing and marketing devices across MedSurg, Rhythm and Neuro, and Cardiovascular segments. In 2026, Boston Scientific sharpened its focus on expanding innovative cardiac and neurovascular technologies, reinforcing its competitive advantage in minimally invasive procedures.

STERIS plc: Infection Prevention and Sterilization Specialist

STERIS specializes in infection prevention and procedural products, generating revenue from healthcare, life sciences, and dental sectors. Its strategic emphasis in 2026 lies in enhancing sterilization technologies and expanding contract sterilization services. The company’s market position benefits from comprehensive service offerings and equipment solutions across sterile processing departments.

Strategic Collision: Similarities & Divergences

Both companies operate within the medical devices ecosystem but diverge in business philosophy. Boston Scientific pursues a closed innovation model focusing on device development, whereas STERIS adopts an integrated service and equipment approach. Their primary battleground is hospital and procedural environments, competing subtly but distinctly. Investors face contrasting profiles: Boston Scientific offers growth through innovation, STERIS through service diversification.

Income Statement Comparison

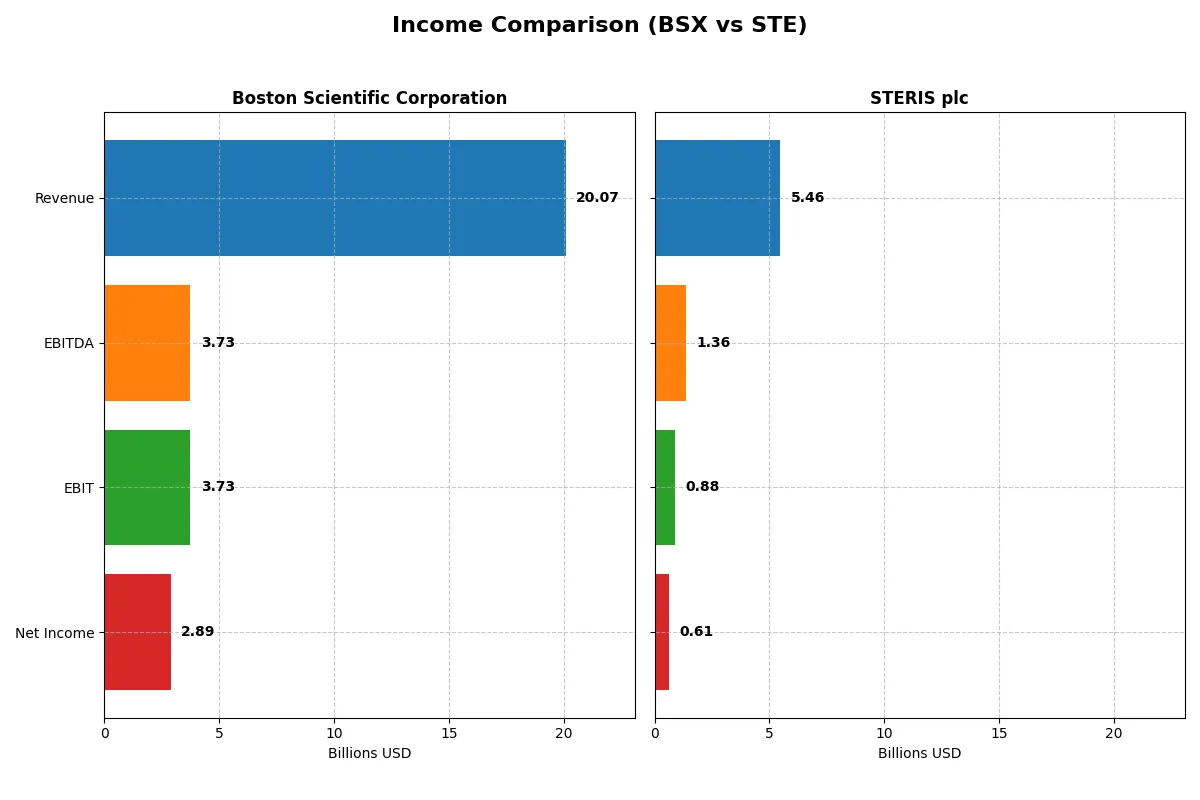

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Boston Scientific (BSX) | STERIS plc (STE) |

|---|---|---|

| Revenue | 20B | 5.5B |

| Cost of Revenue | 6.2B | 3.1B |

| Operating Expenses | 9.9B | 1.5B |

| Gross Profit | 13.9B | 2.4B |

| EBITDA | 3.7B | 1.4B |

| EBIT | 3.7B | 882M |

| Interest Expense | 349M | 86M |

| Net Income | 2.9B | 615M |

| EPS | 1.96 | 6.24 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company converts revenue into profit more efficiently, spotlighting operational effectiveness and momentum.

Boston Scientific Corporation Analysis

Boston Scientific’s revenue jumped from 12.7B in 2022 to 20.1B in 2025, showcasing robust growth. Net income surged from 642M to 2.9B, reflecting strong bottom-line expansion. Gross margin stood at a favorable 69%, and net margin improved to 14.4%, evidencing disciplined cost control despite rising operating expenses. Momentum peaked in 2025 with a 20% revenue increase and nearly 30% net margin growth.

STERIS plc Analysis

STERIS grew revenue from 3.1B in 2021 to 5.5B in 2025, a solid rise but at a slower pace. Net income rose from 397M to 615M, with a significant EPS boost of 63% in the latest year. Gross margin settled at a healthy 44%, and net margin improved to 11.3%. However, revenue growth moderated to 6.2% in 2025, signaling less momentum compared to its peer.

Verdict: High Margin Growth vs. Steady Expansion

Boston Scientific dominates with superior gross and net margins and a sharp acceleration in revenue and earnings growth. STERIS offers steady expansion but lags in profitability and margin gains. For investors prioritizing efficient profit conversion and growth velocity, Boston Scientific’s profile appears more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Boston Scientific Corporation (BSX) | STERIS plc (STE) |

|---|---|---|

| ROE | 8.5% (2024) | 9.3% (2025) |

| ROIC | 6.1% (2024) | 7.2% (2025) |

| P/E | 70.9 (2024) | 36.3 (2025) |

| P/B | 6.0 (2024) | 3.4 (2025) |

| Current Ratio | 1.08 (2024) | 1.96 (2025) |

| Quick Ratio | 0.64 (2024) | 1.39 (2025) |

| D/E | 0.51 (2024) | 0.33 (2025) |

| Debt-to-Assets | 28.3% (2024) | 21.7% (2025) |

| Interest Coverage | 6.8x (2024) | 10.0x (2025) |

| Asset Turnover | 0.43 (2024) | 0.54 (2025) |

| Fixed Asset Turnover | 4.47 (2024) | 2.58 (2025) |

| Payout ratio | 0% (2024) | 36% (2025) |

| Dividend yield | 0% (2024) | 0.98% (2025) |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence that raw numbers alone cannot expose.

Boston Scientific Corporation

Boston Scientific shows a favorable net margin of 14.38%, highlighting solid profitability. However, its ROE and ROIC are both zero, signaling weak capital efficiency. The stock trades at a stretched P/E of 48.91, indicating expensive valuation. The absence of dividends suggests reinvestment into R&D, with a notable 10.2% revenue share fueling growth.

STERIS plc

STERIS delivers a lower net margin at 11.26% but maintains a positive ROE of 9.31%, reflecting moderate profitability. Its P/E ratio of 36.35 is less stretched than Boston Scientific’s, though still high. The company returns value via a modest 0.98% dividend yield, balancing shareholder income with investments in steady operational efficiency.

Premium Valuation vs. Operational Safety

Boston Scientific’s valuation is more expensive and its capital returns weaker, posing higher risk despite strong margins. STERIS offers a better risk-reward balance with moderate profitability, reasonable leverage, and dividend income. Investors prioritizing operational stability may prefer STERIS’s profile, while growth seekers face Boston Scientific’s stretched multiples.

Which one offers the Superior Shareholder Reward?

I observe Boston Scientific (BSX) pays no meaningful dividends and shows zero payout ratio, focusing on internal reinvestment. STERIS (STE) offers a strong 0.98% dividend yield with a 36% payout ratio, reflecting a balanced distribution approach. STE also pursues aggressive buybacks, boosting total shareholder return. BSX’s zero dividend and buybacks suggest a growth reinvestment strategy, but STE’s blend of yield and buybacks appears more sustainable and attractive for income plus growth in 2026. I conclude STE offers the superior total shareholder reward given its stable dividend, solid free cash flow coverage, and active capital return program.

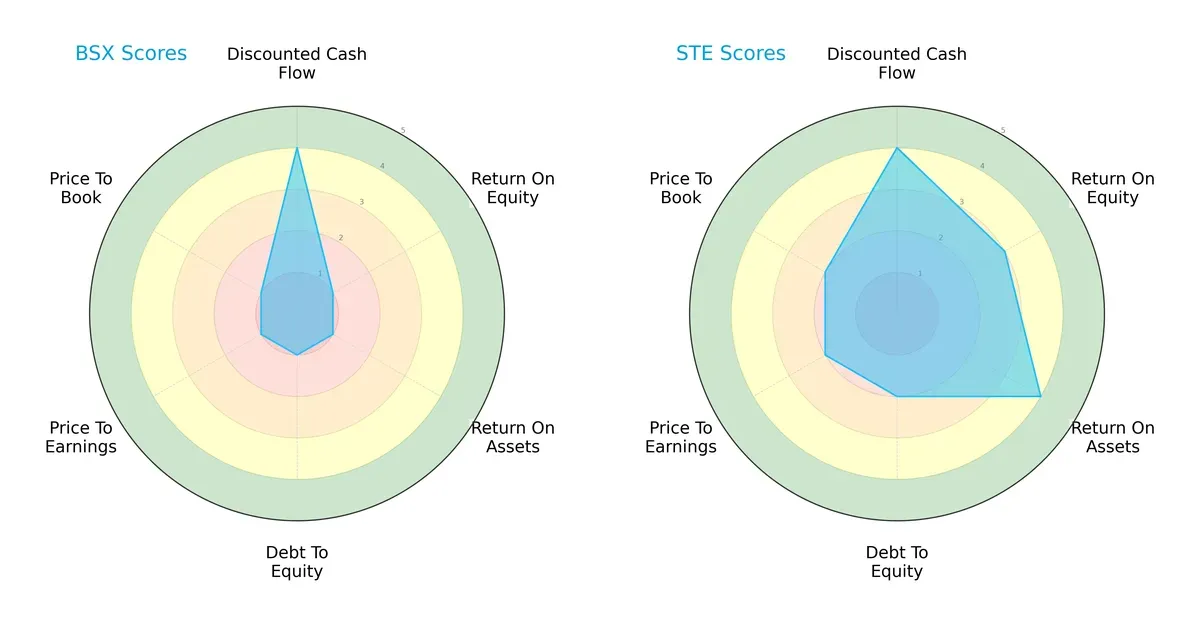

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Boston Scientific Corporation and STERIS plc, highlighting their core financial strengths and weaknesses:

STERIS delivers a more balanced financial profile with moderate-to-favorable scores in ROE (3), ROA (4), and DCF (4). Boston Scientific struggles with very unfavorable scores across ROE (1), ROA (1), and leverage metrics, despite a favorable DCF score (4). STERIS’s moderate debt-to-equity and valuation scores suggest prudent capital allocation, while Boston Scientific appears reliant on future cash flow optimism alone.

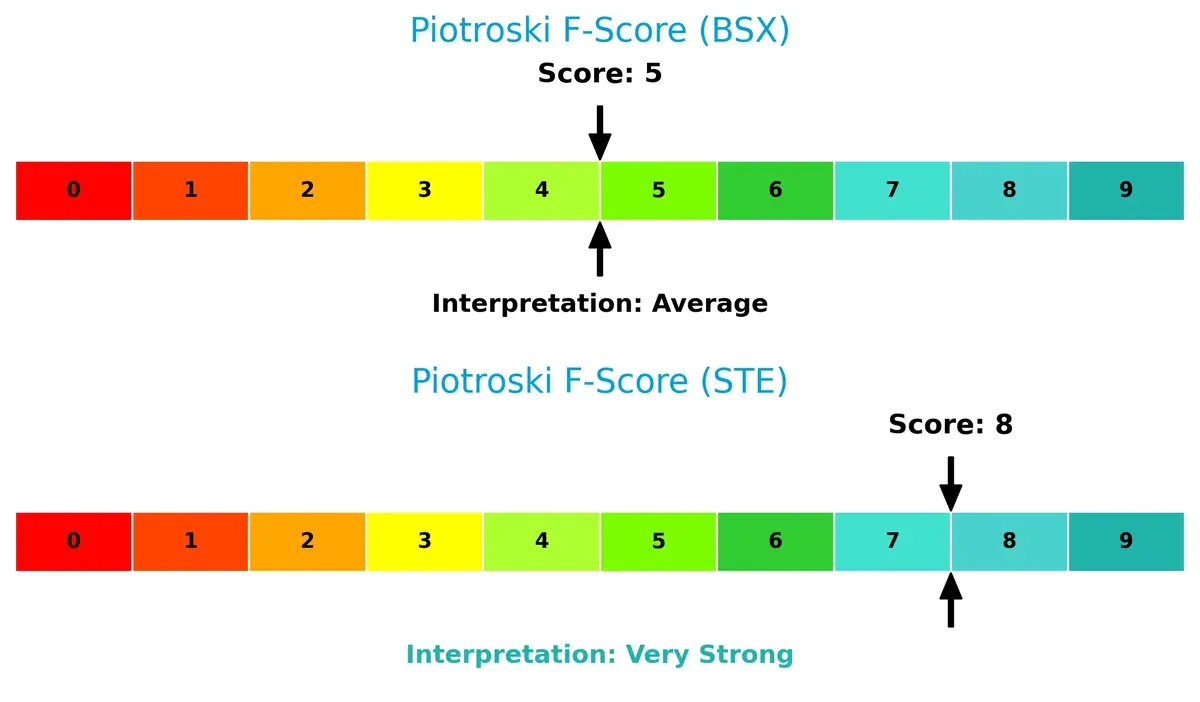

Bankruptcy Risk: Solvency Showdown

STERIS’s Altman Z-Score of 5.75 comfortably exceeds Boston Scientific’s 4.63, placing both firms in the safe zone but favoring STERIS’s stronger cushion against financial distress:

Financial Health: Quality of Operations

STERIS’s Piotroski F-Score of 8 signals robust internal financial health, outperforming Boston Scientific’s average 5 and indicating fewer operational red flags:

How are the two companies positioned?

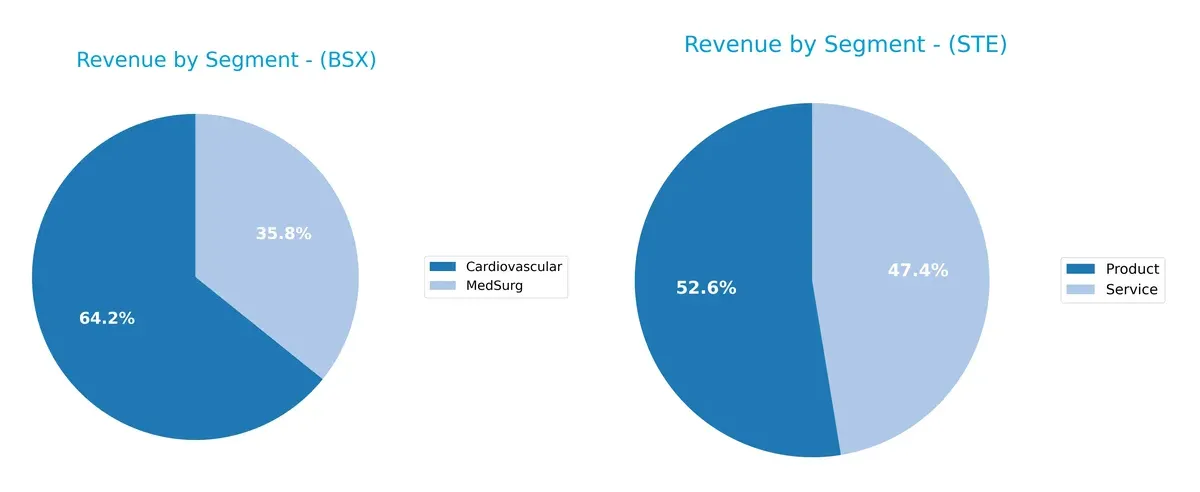

This section dissects the operational DNA of Boston Scientific and STERIS by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Boston Scientific Corporation and STERIS plc diversify income streams and where their primary sector bets lie:

Boston Scientific leans heavily on Cardiovascular, which dwarfs its MedSurg segment at $10.8B vs. $6.0B in 2024. This concentration anchors its strategy in a high-barrier medical device ecosystem. In contrast, STERIS balances Product and Service revenues closely, $2.76B and $2.37B respectively in 2024, reflecting a diversified mix that pivots on integrated solutions. Boston Scientific faces concentration risk; STERIS mitigates this with a two-pronged revenue base.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Boston Scientific Corporation and STERIS plc:

Boston Scientific Corporation Strengths

- Diverse product segments including Cardiovascular and MedSurg

- Strong U.S. and Non-U.S. geographic revenue balance

- Favorable net margin at 14.38%

- Low debt to assets ratio with strong interest coverage

STERIS plc Strengths

- Balanced revenue from Product and Service segments

- Solid current and quick ratios indicating liquidity

- Favorable net margin of 11.26%

- Moderate debt levels with good interest coverage

- Slightly favorable global ratios evaluation

Boston Scientific Corporation Weaknesses

- Unfavorable ROE and ROIC, indicating weak capital returns

- Unavailable WACC limits cost of capital analysis

- High P/E ratio at 48.91 suggests overvaluation

- Poor liquidity ratios (current and quick ratio at 0)

- Unfavorable asset turnover metrics

STERIS plc Weaknesses

- ROE at 9.31% is below optimal levels

- Neutral ROIC and WACC indicate average capital efficiency

- Unfavorable P/B ratio of 3.38 implies valuation concerns

- Low dividend yield below 1%

- Neutral asset turnover ratios suggest moderate operational efficiency

Both companies exhibit strengths in profitability and geographic diversification. However, Boston Scientific faces more pronounced weaknesses in capital efficiency and liquidity, while STERIS shows moderate valuation and efficiency challenges. These factors are critical for shaping their financial strategies going forward.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion. Let’s dissect the moats of two medical device firms:

Boston Scientific Corporation: Innovation-Driven Switching Costs

Boston Scientific’s moat rests on high switching costs from its specialized cardiac and vascular devices. This manifests in strong gross margins (69%) and expanding net margins (14.4%) in 2025. New product launches in neuro and rhythm management could deepen this advantage, though declining ROIC trends warrant caution.

STERIS plc: Service-Integrated Cost Advantage

STERIS differentiates with its integrated sterilization services and capital equipment, creating a cost advantage ecosystem. Its gross margin is lower (44%) than Boston Scientific’s but steady. Growing ROIC and recent margin improvements signal operational efficiency gains. Expansion into life sciences sterilization offers growth opportunities amid competitive pressure.

Innovation Lock-in vs. Service Ecosystem Efficiency

Boston Scientific boasts a wider moat through higher margins and robust income growth, driven by innovation and entrenched device usage. STERIS shows a slightly unfavorable moat with value erosion but improving profitability. Boston Scientific is better positioned to defend market share long term.

Which stock offers better returns?

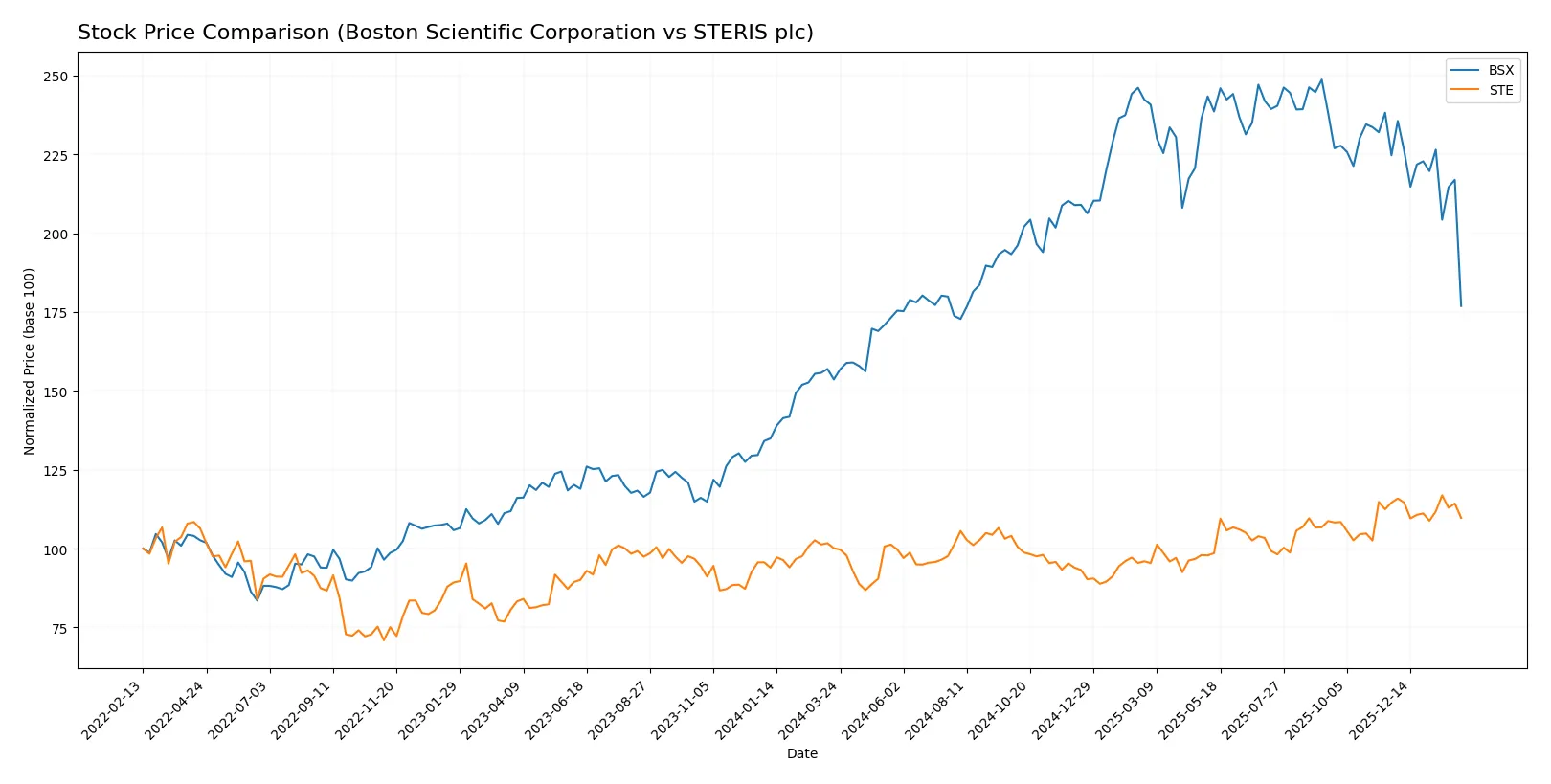

The past year shows bullish trends for both stocks, with Boston Scientific leading in price gains despite recent deceleration and a pullback in late 2025 to early 2026.

Trend Comparison

Boston Scientific’s stock rose 15.16% over 12 months, marking a bullish trend with decelerating momentum and a notable high of 107.22. Recent months reveal a 21.27% drop, signaling short-term weakness.

STERIS plc gained 9.61% in the same period, also bullish but with a higher volatility of 16.0. Its recent decline of 4.23% is milder, indicating a more stable but slowing uptrend.

Boston Scientific outperformed STERIS over the full year, delivering stronger returns despite greater recent volatility and short-term decline.

Target Prices

Analysts present a solid target consensus for Boston Scientific Corporation and STERIS plc, reflecting moderate upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Boston Scientific Corporation | 94 | 130 | 108.53 |

| STERIS plc | 245 | 265 | 256.67 |

Boston Scientific’s consensus target of 108.53 suggests roughly 42% upside from the current 76.27 price. STERIS’s target consensus of 256.67 indicates a modest 2% upside versus the 252.16 share price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following summarizes recent institutional grades for Boston Scientific Corporation and STERIS plc:

Boston Scientific Corporation Grades

Below is a summary of institutional grades for Boston Scientific Corporation as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Canaccord Genuity | Maintain | Buy | 2026-02-05 |

| RBC Capital | Maintain | Outperform | 2026-02-05 |

| JP Morgan | Maintain | Overweight | 2026-02-05 |

| Citigroup | Maintain | Buy | 2026-02-05 |

| TD Cowen | Maintain | Buy | 2026-02-05 |

| UBS | Maintain | Buy | 2026-02-05 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-05 |

| Morgan Stanley | Maintain | Overweight | 2026-02-05 |

| Truist Securities | Maintain | Buy | 2026-02-05 |

| Needham | Maintain | Buy | 2026-02-05 |

STERIS plc Grades

The table below shows institutional grades for STERIS plc during 2025:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-08-08 |

| Keybanc | Maintain | Overweight | 2025-07-22 |

| Morgan Stanley | Upgrade | Overweight | 2025-07-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-05-19 |

| JMP Securities | Maintain | Market Outperform | 2025-05-16 |

| Stephens & Co. | Maintain | Overweight | 2025-05-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-05-12 |

| JMP Securities | Maintain | Market Outperform | 2025-04-10 |

| Needham | Maintain | Hold | 2025-04-07 |

| JMP Securities | Maintain | Market Outperform | 2025-02-06 |

Which company has the best grades?

Boston Scientific Corporation consistently earns Buy and Outperform ratings from leading firms, reflecting strong confidence. STERIS plc receives mostly Overweight and Market Outperform grades but includes some Hold ratings, indicating more cautious views. Investors may see Boston Scientific as favored by analysts, potentially implying stronger near-term support.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Boston Scientific Corporation

- Faces fierce competition in medical devices with high R&D costs and pricing pressures.

STERIS plc

- Competes in infection prevention and procedural products amid evolving healthcare protocols and tech advances.

2. Capital Structure & Debt

Boston Scientific Corporation

- Displays favorable debt ratios but lacks liquidity, posing short-term funding risks.

STERIS plc

- Maintains moderate debt with solid coverage and good liquidity, reducing financial risk.

3. Stock Volatility

Boston Scientific Corporation

- Beta of 0.66 suggests lower volatility and defensive stock behavior.

STERIS plc

- Beta over 1.0 indicates higher volatility and sensitivity to market swings.

4. Regulatory & Legal

Boston Scientific Corporation

- Subject to stringent FDA regulations and risk of product recalls impacting reputation.

STERIS plc

- Faces regulatory scrutiny in sterilization standards and global compliance challenges.

5. Supply Chain & Operations

Boston Scientific Corporation

- Complex global supply chain vulnerable to disruptions and component shortages.

STERIS plc

- Relies on specialized sterilization facilities and service networks; operational disruptions affect revenue.

6. ESG & Climate Transition

Boston Scientific Corporation

- Increasing pressure to reduce carbon footprint and enhance product sustainability.

STERIS plc

- Advancement in eco-friendly sterilization technologies critical amid rising ESG demands.

7. Geopolitical Exposure

Boston Scientific Corporation

- US-centric but exposed to global trade uncertainties affecting supply and sales.

STERIS plc

- Ireland-based with broader EU exposure, facing Brexit and global trade policy risks.

Which company shows a better risk-adjusted profile?

Boston Scientific’s key risk is its weak liquidity despite strong debt management, which could strain operations during market stress. STERIS contends with higher stock volatility and regulatory complexity but benefits from superior liquidity and financial strength. STERIS’s stronger Altman Z-Score and Piotroski Score reflect a better risk-adjusted profile. Notably, Boston Scientific’s unfavorable liquidity ratios in 2025 raise a red flag for near-term financial flexibility.

Final Verdict: Which stock to choose?

Boston Scientific Corporation (BSX) showcases a superpower in its robust income growth and high gross margins, highlighting operational strength and innovation in medical technology. Its declining ROIC trend is a point of vigilance, signaling challenges in capital efficiency. BSX suits aggressive growth portfolios willing to tolerate some risk for outsized returns.

STERIS plc (STE) benefits from a strategic moat rooted in steady operational returns and strong financial health, backed by solid liquidity and a very strong Piotroski score. Compared to BSX, STE offers better balance sheet stability and more consistent cash flow generation. It fits well in GARP portfolios seeking a balance of growth and safety.

If you prioritize rapid income and margin expansion, BSX is the compelling choice due to its dynamic growth trajectory and market position. However, if you seek better financial stability and a proven capital efficiency trend, STE offers superior risk management and steady value creation. Both present distinct profiles demanding careful alignment with investor risk tolerance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Boston Scientific Corporation and STERIS plc to enhance your investment decisions: