Home > Comparison > Healthcare > BSX vs PODD

The strategic rivalry between Boston Scientific Corporation and Insulet Corporation shapes the evolution of the healthcare medical devices sector. Boston Scientific operates as a capital-intensive industrial giant with a diversified portfolio across cardiovascular and neuro technologies. In contrast, Insulet focuses on high-margin, innovative insulin delivery systems, targeting a niche diabetic market. This analysis will determine which company presents a superior risk-adjusted investment opportunity for a diversified portfolio in an increasingly competitive healthcare landscape.

Table of contents

Companies Overview

Boston Scientific and Insulet Corporation stand as pivotal players in the medical devices sector with contrasting scales and strategies.

Boston Scientific Corporation: Global Medical Device Powerhouse

Boston Scientific dominates as a global leader in medical devices, generating revenue through diversified products across MedSurg, Rhythm and Neuro, and Cardiovascular segments. Its portfolio includes advanced cardiac and vascular technologies, diagnostic tools, and chronic pain management devices. In 2026, the company focuses strategically on expanding minimally invasive therapies and enhancing remote patient management.

Insulet Corporation: Innovator in Insulin Delivery

Insulet Corporation specializes in insulin delivery systems, primarily through its Omnipod tubeless device and wireless diabetes manager. Its revenue streams rely heavily on direct sales and distributors across the US, Europe, and other markets. The firm’s 2026 strategy emphasizes product innovation and geographic expansion to capture growing demand in insulin-dependent diabetes care.

Strategic Collision: Similarities & Divergences

Both companies operate in healthcare technology but diverge sharply in scale and niche focus. Boston Scientific pursues broad interventional medical device markets, while Insulet zeroes in on diabetes care with a closed-loop system approach. Their primary battleground is device innovation and market penetration in chronic disease management. Investors face distinct profiles: Boston Scientific’s diversified, stable cash flows contrast with Insulet’s growth-driven, higher-beta opportunity.

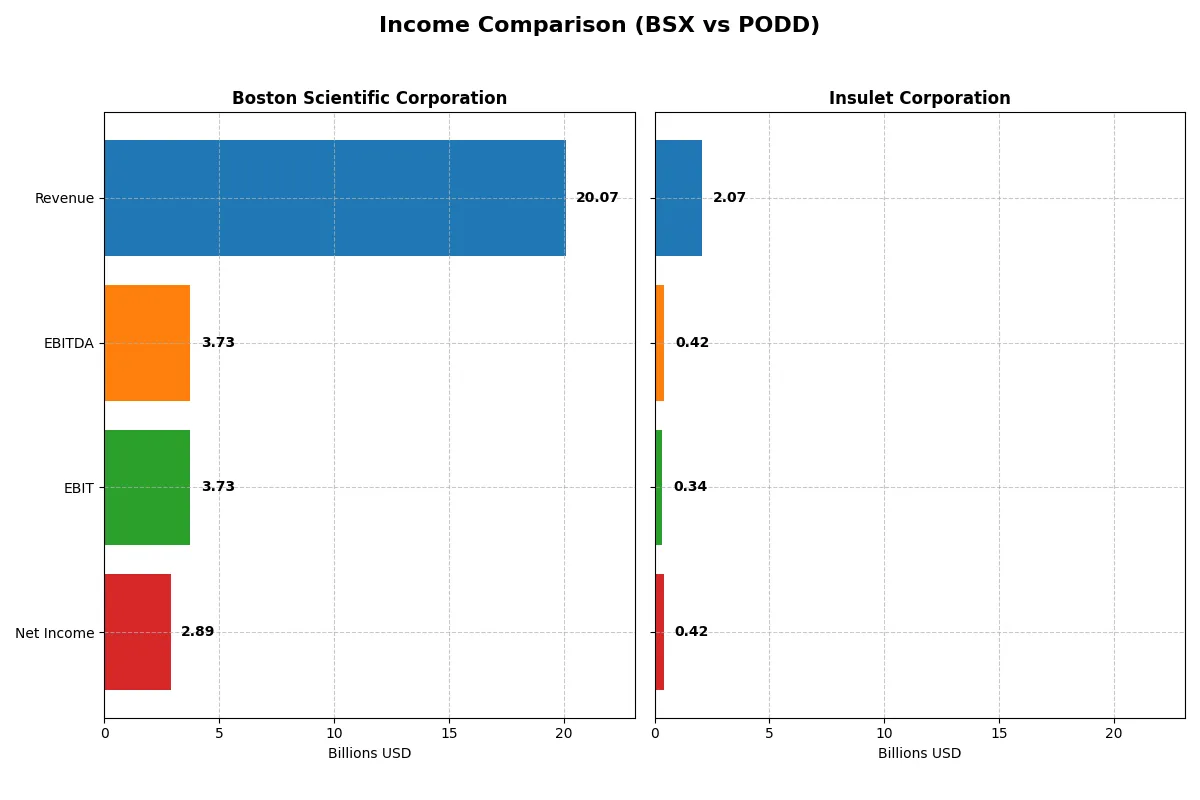

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Boston Scientific Corporation (BSX) | Insulet Corporation (PODD) |

|---|---|---|

| Revenue | 20B | 2.07B |

| Cost of Revenue | 6.22B | 626M |

| Operating Expenses | 9.88B | 1.14B |

| Gross Profit | 13.85B | 1.45B |

| EBITDA | 3.73B | 424M |

| EBIT | 3.73B | 343M |

| Interest Expense | 349M | 43M |

| Net Income | 2.89B | 418M |

| EPS | 1.96 | 5.97 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine through recent financial performance.

Boston Scientific Corporation Analysis

Boston Scientific’s revenue soared from $11.9B in 2021 to $20.1B in 2025, showcasing robust top-line growth. Net income climbed sharply to $2.9B in 2025, lifting net margins to a healthy 14.4%. Its gross margin remains strong at 69%, while EBIT margin expanded to 18.6%, signaling improved operational efficiency and momentum.

Insulet Corporation Analysis

Insulet’s revenue surged from $904M in 2020 to $2.1B in 2024, more than doubling over five years. Net income jumped dramatically to $418M in 2024, driving net margins above 20%. The company sustains a high gross margin near 70% and an EBIT margin of 16.6%, reflecting efficient cost control alongside impressive growth acceleration.

Growth Velocity vs. Scale and Margin Strength

Insulet outpaces Boston Scientific in revenue and net income growth rates, boasting exceptional margin expansion and EPS growth. However, Boston Scientific commands a much larger revenue base with solid margin improvements. For investors, Insulet’s high-growth, margin-rich profile offers rapid momentum, while Boston Scientific delivers scale and consistent profitability.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Boston Scientific (BSX) | Insulet Corporation (PODD) |

|---|---|---|

| ROE | 8.5% (2024) | 34.5% (2024) |

| ROIC | 6.1% (2024) | 11.7% (2024) |

| P/E | 70.9 (2024) | 43.7 (2024) |

| P/B | 6.0 (2024) | 15.1 (2024) |

| Current Ratio | 1.08 (2024) | 3.54 (2024) |

| Quick Ratio | 0.64 (2024) | 2.73 (2024) |

| D/E | 0.51 (2024) | 1.17 (2024) |

| Debt-to-Assets | 28.3% (2024) | 46.1% (2024) |

| Interest Coverage | 6.81x (2024) | 7.23x (2024) |

| Asset Turnover | 0.43 (2024) | 0.67 (2024) |

| Fixed Asset Turnover | 4.47 (2024) | 2.73 (2024) |

| Payout ratio | 0% (2024) | 0% (2024) |

| Dividend yield | 0% (2024) | 0% (2024) |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, uncovering hidden operational strengths and risks that raw numbers alone fail to reveal.

Boston Scientific Corporation

Boston Scientific posts a favorable net margin of 14.38% but shows an unfavorable zero return on equity, signaling weak profitability efficiency. The stock trades at a stretched P/E of 48.91, suggesting overvaluation versus industry norms. It offers no dividend yield, instead reinvesting heavily in R&D at over 9% of revenue to fuel future growth.

Insulet Corporation

Insulet shines with a robust 20.19% net margin and a strong 34.52% return on equity, reflecting high operational efficiency. Despite a high P/E of 43.74 and an elevated price-to-book of 15.1, the company maintains a healthy quick ratio and interest coverage. Like Boston Scientific, it pays no dividends, focusing on innovation and growth reinvestment.

Valuation Stretch vs. Operational Efficiency

Insulet offers superior profitability and capital returns, balancing its premium valuation with operational strength. Boston Scientific appears more overvalued with weaker equity returns. Investors seeking growth with solid financial health might lean toward Insulet’s profile, while those wary of high multiples could view Boston Scientific’s metrics as cautionary.

Which one offers the Superior Shareholder Reward?

I see Boston Scientific (BSX) pays a negligible dividend yield near 0.03%, with a very low payout ratio under 2%. It focuses on modest dividends plus steady buybacks, supporting shareholder returns sustainably. Insulet (PODD) pays no dividends, reinvesting heavily in R&D and growth, with free cash flow reinvestment around 70%. Both run active buyback programs, but BSX’s disciplined capital allocation balances cash returns and debt prudently. PODD’s aggressive reinvestment fuels growth but carries higher leverage risk. I favor BSX for superior, sustainable total returns in 2026 due to its balanced distribution and conservative financial leverage.

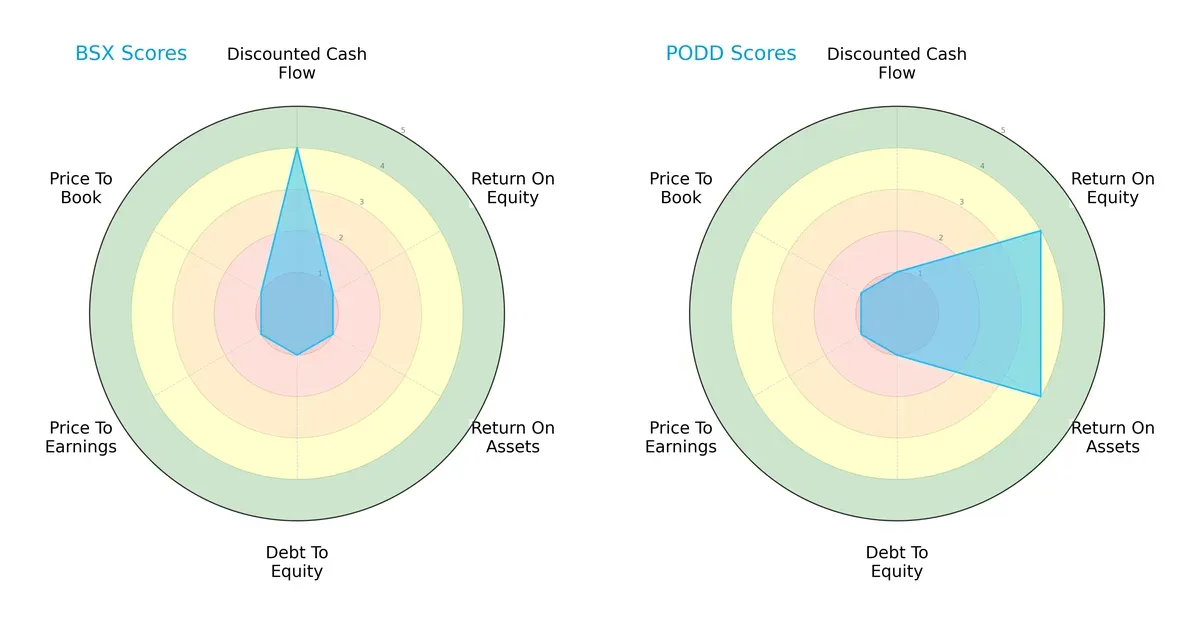

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Boston Scientific Corporation and Insulet Corporation, highlighting their core financial strengths and weaknesses:

Boston Scientific boasts a strong discounted cash flow score (4) but lags significantly in profitability and valuation metrics, with scores of 1 in ROE, ROA, debt-to-equity, P/E, and P/B. Insulet shows robust operational efficiency with top scores in ROE (4) and ROA (4) but struggles with cash flow valuation and leverage, scoring 1 in DCF and debt-to-equity. Overall, Insulet presents a more balanced profitability profile, while Boston Scientific relies heavily on its discounted cash flow advantage.

Bankruptcy Risk: Solvency Showdown

Insulet’s Altman Z-Score (8.24) far exceeds Boston Scientific’s (4.63), signaling superior financial stability and a safer long-term survival outlook in this cycle:

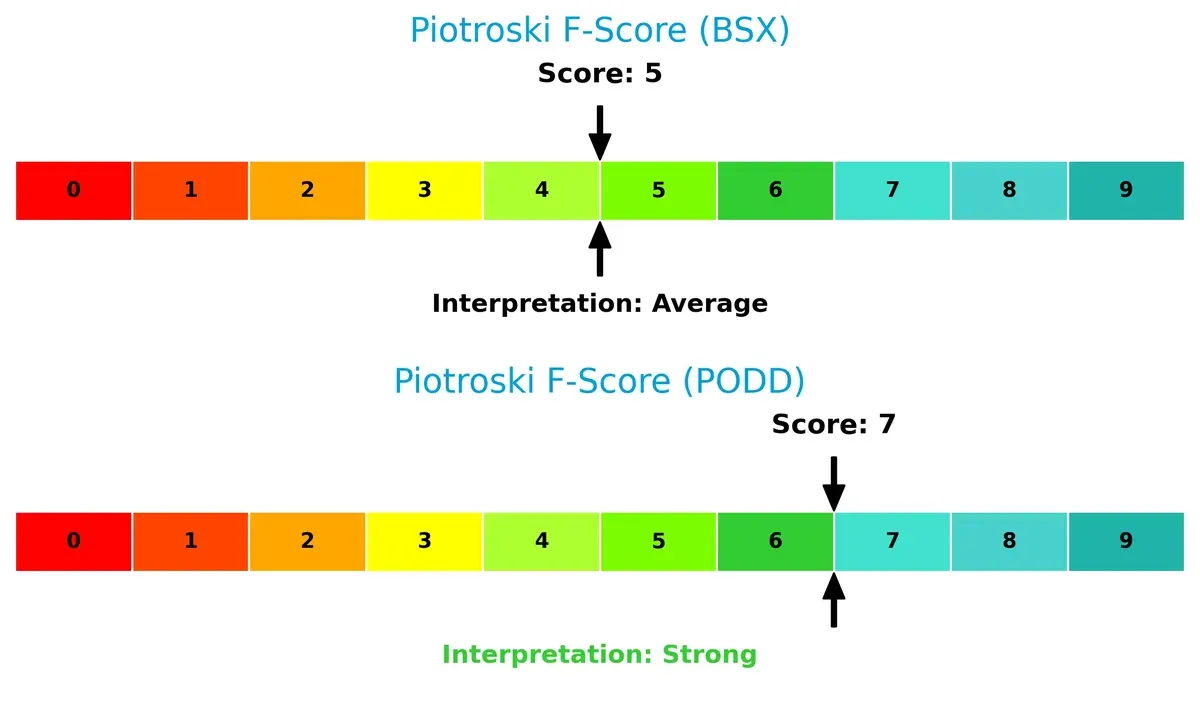

Financial Health: Quality of Operations

Insulet leads with a Piotroski F-Score of 7, indicating strong financial health, while Boston Scientific’s 5 suggests average operational quality and potential internal red flags:

How are the two companies positioned?

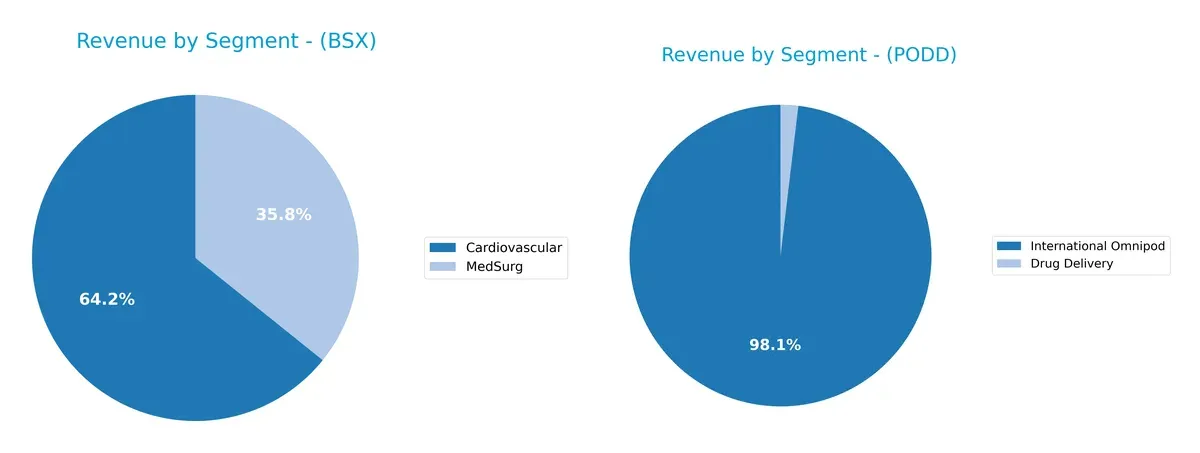

This section dissects the operational DNA of Boston Scientific and Insulet by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats to identify the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following comparison dissects how Boston Scientific Corporation and Insulet Corporation diversify their income streams and where their primary sector bets lie:

Boston Scientific diversifies with $10.8B in Cardiovascular and $6B in MedSurg, anchoring growth in two strong pillars. Insulet relies heavily on International Omnipod, generating $2B, dwarfing its $39M Drug Delivery segment. Boston Scientific’s broader mix reduces concentration risk and leverages ecosystem lock-in. In contrast, Insulet’s dependency on a dominant segment exposes it to higher market volatility but strengthens its infrastructure dominance in diabetes care.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Boston Scientific Corporation and Insulet Corporation:

BSX Strengths

- Diverse medical segments including Cardiovascular and MedSurg

- Large and growing global presence with $10.2B US and $6.5B Non-US revenue

- Favorable net margin of 14.38%

- Strong interest coverage ratio at 10.7

PODD Strengths

- Higher net margin at 20.19% and strong ROE of 34.52%

- Favorable ROIC at 11.68% exceeding WACC of 9.9%

- Solid quick ratio at 2.73 indicates liquidity

- Innovation focus in Drug Delivery and International Omnipod segments

BSX Weaknesses

- Unfavorable ROE and ROIC at 0%

- Poor liquidity with current and quick ratios at 0

- High P/E at 48.91 signals valuation risk

- Asset turnover ratios unavailable or unfavorable

- No dividend yield

- PB ratio at 0 may indicate accounting or data issues

PODD Weaknesses

- Unfavorable high P/E of 43.74 and PB of 15.1

- Current ratio at 3.54 flagged as unfavorable despite liquidity

- Debt to equity ratio at 1.17 indicates leverage risk

- No dividend yield

Boston Scientific shows strength in diversification and global scale but faces profitability and liquidity concerns. Insulet exhibits robust profitability and innovation but carries valuation and leverage risks. Both companies must balance growth with financial discipline to sustain competitive advantage.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from competition’s relentless pressure. Without it, market share and margins erode quickly:

Boston Scientific Corporation: Broad Product Portfolio and Scale Advantage

Boston Scientific’s moat stems from diversified medical devices and global scale. Its stable 18.6% EBIT margin reflects operational efficiency. Expanding cardiovascular and neuro segments could deepen the moat in 2026.

Insulet Corporation: Innovation-Driven Switching Costs

Insulet’s competitive edge lies in its unique tubeless insulin delivery system, creating high switching costs. With a rising ROIC and 20.2% net margin, its innovation fuels expanding market penetration and future growth.

Verdict: Diversification vs. Specialized Innovation

Boston Scientific’s broad product scale offers resilience across markets, but Insulet’s innovation-driven moat shows accelerating profitability and customer lock-in. I consider Insulet’s moat deeper and better positioned to defend market share in 2026.

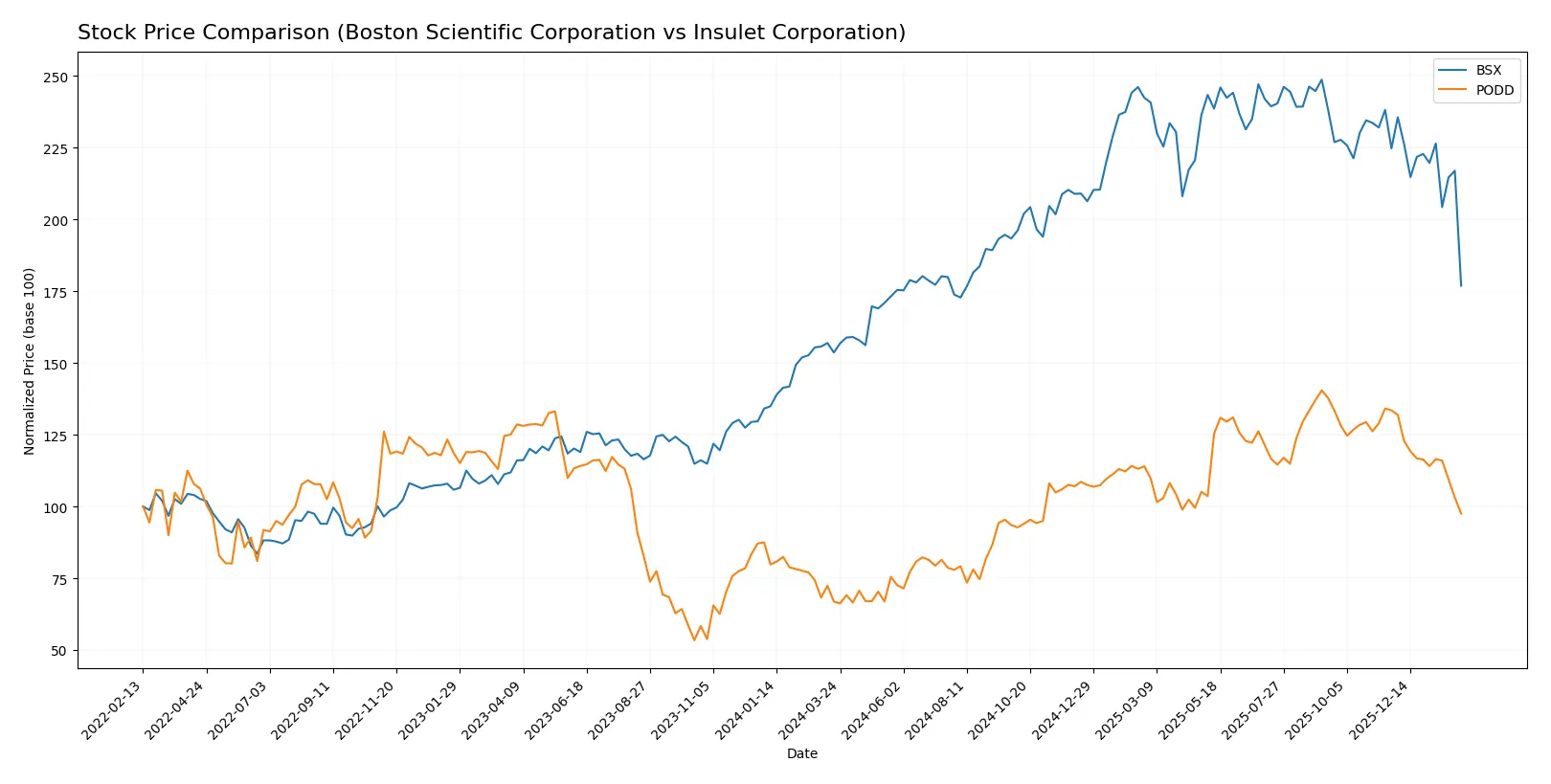

Which stock offers better returns?

The past year shows Boston Scientific and Insulet with strong bullish trends but recent deceleration and notable pullbacks in both stocks’ price dynamics.

Trend Comparison

Boston Scientific’s stock rose 15.16% over 12 months, showing a bullish trend with decelerating gains and a high volatility of 11.87%. The recent quarter marked a 21.27% decline, signaling short-term weakness.

Insulet’s stock surged 45.86% over the same period, also bullish but with decelerating momentum. Volatility is significantly higher at 51.97%. The recent quarter saw an even sharper 26.95% drop, reinforcing short-term selling pressure.

Insulet outperformed Boston Scientific over the past year with a higher overall return despite greater volatility and recent declines in both stocks.

Target Prices

Analysts present a bullish consensus for Boston Scientific Corporation and Insulet Corporation with significant upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Boston Scientific Corporation | 94 | 130 | 108.53 |

| Insulet Corporation | 274 | 450 | 376.27 |

Boston Scientific’s target consensus exceeds its current 76.27 price by over 40%, signaling strong growth expectations. Insulet’s consensus target is roughly 56% above its 241.93 price, reflecting high investor confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Boston Scientific Corporation and Insulet Corporation:

Boston Scientific Corporation Grades

This table presents the latest grades issued by reputable financial institutions for Boston Scientific Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Canaccord Genuity | Maintain | Buy | 2026-02-05 |

| RBC Capital | Maintain | Outperform | 2026-02-05 |

| JP Morgan | Maintain | Overweight | 2026-02-05 |

| Citigroup | Maintain | Buy | 2026-02-05 |

| TD Cowen | Maintain | Buy | 2026-02-05 |

| UBS | Maintain | Buy | 2026-02-05 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-05 |

| Morgan Stanley | Maintain | Overweight | 2026-02-05 |

| Truist Securities | Maintain | Buy | 2026-02-05 |

| Needham | Maintain | Buy | 2026-02-05 |

Insulet Corporation Grades

This table collects recent institutional grades for Insulet Corporation from recognized grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-02-04 |

| Barclays | Downgrade | Underweight | 2026-01-12 |

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Truist Securities | Maintain | Buy | 2025-12-18 |

| Canaccord Genuity | Maintain | Buy | 2025-12-17 |

| Canaccord Genuity | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| Truist Securities | Maintain | Buy | 2025-11-21 |

| UBS | Upgrade | Buy | 2025-11-19 |

Which company has the best grades?

Boston Scientific consistently receives strong buy and outperform ratings across multiple top firms. Insulet’s grades are generally positive but include a notable downgrade to underweight by Barclays. This contrast suggests Boston Scientific holds a more uniformly favorable institutional outlook, potentially impacting investor confidence and market sentiment.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Boston Scientific Corporation

- Faces intense competition in diversified medical devices with large incumbents; innovation pace critical to maintain market share.

Insulet Corporation

- Operates in niche insulin delivery systems; competition rising from established pharma and tech entrants in diabetes care.

2. Capital Structure & Debt

Boston Scientific Corporation

- Displays very favorable debt metrics with strong interest coverage; conservative leverage supports financial stability.

Insulet Corporation

- Carries higher debt-to-equity ratio (1.17), raising financial risk despite adequate interest coverage.

3. Stock Volatility

Boston Scientific Corporation

- Exhibits low beta (0.657), indicating relative stock stability versus market fluctuations.

Insulet Corporation

- Shows high beta (1.418), reflecting greater price volatility and market sensitivity.

4. Regulatory & Legal

Boston Scientific Corporation

- Subject to strict global medical device regulations; recalls or compliance issues can impact reputation and earnings.

Insulet Corporation

- Faces rigorous FDA scrutiny for insulin delivery; regulatory delays could stall product launches and sales growth.

5. Supply Chain & Operations

Boston Scientific Corporation

- Complex global supply chain vulnerable to disruptions; scale provides some mitigation but risk remains elevated.

Insulet Corporation

- Smaller scale limits supply chain flexibility, increasing exposure to supplier or logistics disruptions.

6. ESG & Climate Transition

Boston Scientific Corporation

- Increasing ESG demands on manufacturing and product lifecycle; sustainability initiatives underway but require ongoing investment.

Insulet Corporation

- ESG focus growing; reliance on plastics and batteries in devices may attract regulatory and consumer scrutiny.

7. Geopolitical Exposure

Boston Scientific Corporation

- Global footprint exposes it to trade tensions and currency fluctuations affecting costs and revenues.

Insulet Corporation

- International sales concentrated but less diversified; geopolitical risks in key markets could impact growth.

Which company shows a better risk-adjusted profile?

Boston Scientific faces a critical risk in market competition and supply chain complexity but benefits from a robust capital structure and lower stock volatility. Insulet’s greatest risk lies in its capital structure and regulatory hurdles amid higher stock volatility. Boston Scientific’s conservative debt and stable stock price present a better risk-adjusted profile. Insulet’s strong profitability contrasts with financial leverage concerns, underscoring elevated risk. Their Altman Z-scores confirm both are in the safe zone, yet Boston Scientific’s superior debt metrics and lower beta justify my concern over Insulet’s higher leverage and volatility.

Final Verdict: Which stock to choose?

Boston Scientific’s superpower lies in its consistent operational muscle and robust innovation pipeline, fueling steady revenue and profit growth. However, investors should monitor its declining returns on capital, signaling caution on long-term value creation. It suits portfolios targeting aggressive growth with a tolerance for some capital efficiency risks.

Insulet commands a strategic moat through its innovative insulin pump technology and strong recurring revenue model. Its improving profitability and growing returns on invested capital offer better financial stability compared to Boston Scientific. This makes it appealing for growth-at-a-reasonable-price (GARP) investors seeking a balance of expansion and resilience.

If you prioritize steady operational execution and aggressive market expansion, Boston Scientific presents a compelling scenario despite its capital efficiency challenges. However, if you seek a company with a strengthening moat and superior financial stability, Insulet outshines as a strategic choice for GARP-focused portfolios, albeit at a premium valuation. Prudence dictates weighing growth ambitions against efficiency metrics carefully.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Boston Scientific Corporation and Insulet Corporation to enhance your investment decisions: