Home > Comparison > Industrials > VRSK vs BAH

The strategic rivalry between Verisk Analytics, Inc. and Booz Allen Hamilton Holding Corporation defines the current trajectory of the consulting services sector. Verisk operates as a data analytics specialist focusing on insurance, energy, and financial services, while Booz Allen Hamilton excels in management and technology consulting with a strong emphasis on government and cyber solutions. This analysis will assess which company offers a superior risk-adjusted return for a diversified portfolio amid evolving sector dynamics.

Table of contents

Companies Overview

Verisk Analytics and Booz Allen Hamilton are key players in the consulting services sector, each commanding distinct market niches.

Verisk Analytics, Inc.: Data Analytics Powerhouse

Verisk Analytics dominates as a provider of predictive analytics and decision support across insurance, energy, and financial services. Its core revenue stems from advanced machine learning models that forecast risks and detect fraud. In 2026, Verisk sharpens its focus on expanding AI-driven analytics to enhance risk assessment accuracy for property and casualty customers.

Booz Allen Hamilton Holding Corporation: Strategic Consulting Leader

Booz Allen stands out in management and technology consulting, delivering AI, cyber risk, and engineering services primarily to government clients. It generates revenue through customized digital transformation and analytics solutions. In 2026, Booz Allen emphasizes expanding quantum computing and cyber defense capabilities to meet evolving national security demands.

Strategic Collision: Similarities & Divergences

Both firms leverage advanced analytics but diverge sharply: Verisk builds a data-centric ecosystem focused on commercial risk, while Booz Allen offers open, multidisciplinary consulting with a government tilt. Their primary battleground is analytics-driven decision-making. Verisk appeals to investors favoring specialized data moats; Booz Allen suits those valuing diversified government contracts and innovation in cyber and quantum fields.

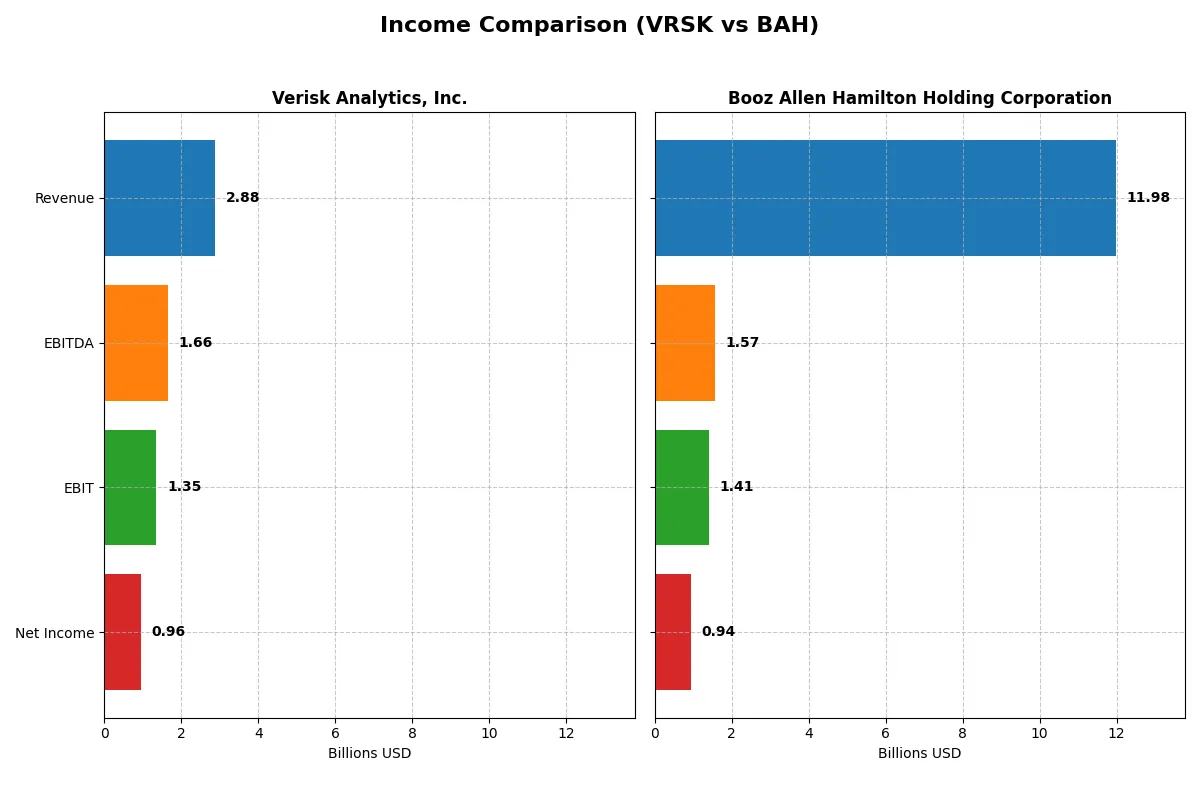

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Verisk Analytics, Inc. (VRSK) | Booz Allen Hamilton Holding Corporation (BAH) |

|---|---|---|

| Revenue | 2.88B | 11.98B |

| Cost of Revenue | 901M | 5.42B |

| Operating Expenses | 727M | 5.19B |

| Gross Profit | 1.98B | 6.56B |

| EBITDA | 1.66B | 1.57B |

| EBIT | 1.35B | 1.41B |

| Interest Expense | 125M | 196M |

| Net Income | 958M | 935M |

| EPS | 6.74 | 7.28 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes the true operational efficiency and profitability of each company’s business model.

Verisk Analytics, Inc. Analysis

Verisk grew revenue by 7.5% in 2024, reaching $2.88B, while net income surged 56% to $958M. Its gross margin of 68.7% and net margin of 33.2% remain robust, underscoring strong pricing power and cost control. Verisk’s EBIT margin climbed to 47%, reflecting efficient expense management despite a slight rise in operating costs.

Booz Allen Hamilton Holding Corporation Analysis

Booz Allen posted a 12.4% revenue increase to $11.98B in 2025, with net income rising 54% to $935M. Its gross margin stands at 54.8%, and net margin at 7.8%, indicating thinner profitability compared to Verisk. Yet, Booz Allen’s EBIT margin improved to 11.8%, driven by disciplined expense growth aligned with revenue momentum.

Margin Strength vs. Scale Expansion

Verisk dominates in margin strength, delivering nearly triple the net margin of Booz Allen despite a smaller revenue base. Booz Allen leads in scale and faster revenue growth but operates with considerably lower profitability. For investors prioritizing efficiency and cash flow generation, Verisk’s profile stands out as the more attractive fundamental choice.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Verisk Analytics (VRSK) | Booz Allen Hamilton (BAH) |

|---|---|---|

| ROE | 9.57% | 0.93% |

| ROIC | 27.2% | 18.8% |

| P/E | 40.9 | 14.3 |

| P/B | 391.1 | 13.3 |

| Current Ratio | 0.74 | 1.79 |

| Quick Ratio | 0.74 | 1.79 |

| D/E (Debt-to-Equity) | 32.4 | 4.21 |

| Debt-to-Assets | 76.1% | 57.7% |

| Interest Coverage | 10.1 | 7.0 |

| Asset Turnover | 0.68 | 1.64 |

| Fixed Asset Turnover | 3.78 | 33.7 |

| Payout Ratio | 23.1% | 28.7% |

| Dividend Yield | 0.57% | 2.01% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering operational strengths and hidden risks that shape investment decisions.

Verisk Analytics, Inc.

Verisk delivers robust profitability with a 33.23% net margin and an exceptional 956.54% ROE, signaling strong capital efficiency. However, its valuation is stretched, reflected in a high 40.89 P/E and an extreme 391.15 P/B ratio. The company pays a modest 0.57% dividend, suggesting a cautious return approach amid aggressive reinvestment in growth.

Booz Allen Hamilton Holding Corporation

Booz Allen shows moderate profitability with a 7.8% net margin but a solid 93.22% ROE, indicating effective use of equity. Valuation remains reasonable at a 14.29 P/E, making the stock more affordable than Verisk. The firm offers a healthy 2.01% dividend yield, balancing shareholder returns with steady operational efficiency.

Premium Valuation vs. Operational Safety

Verisk commands a premium valuation driven by extraordinary profitability but raises caution with stretched multiples and weak liquidity. Booz Allen provides a more balanced risk-reward profile with reasonable valuation and consistent dividends. Investors seeking growth may lean Verisk’s profile; those prioritizing stability might prefer Booz Allen.

Which one offers the Superior Shareholder Reward?

Verisk Analytics (VRSK) delivers a modest 0.56% dividend yield with a 23% payout ratio, supported by robust free cash flow coverage at 80%. Its buybacks are consistent, enhancing shareholder returns sustainably. Booz Allen Hamilton (BAH) offers a higher 2% yield but with a riskier 42% payout ratio and a less efficient free cash flow conversion. BAH’s buyback program is aggressive but less sustainable due to lower margins and higher leverage. I favor Verisk for superior long-term value and balanced capital allocation in 2026.

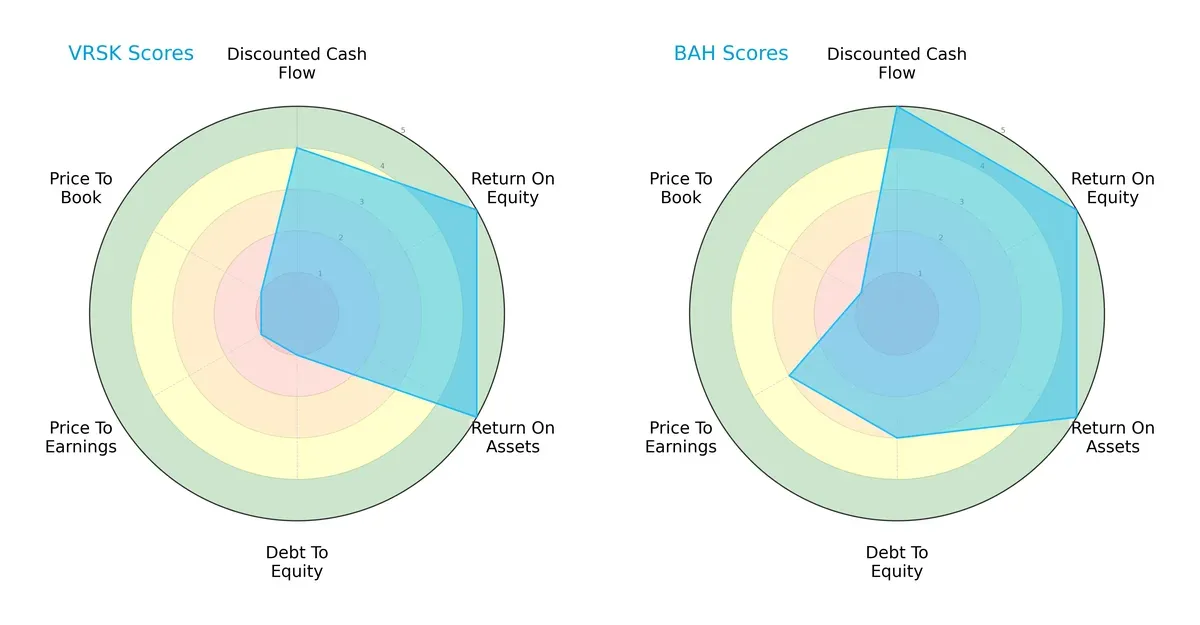

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their core financial strengths and vulnerabilities:

Verisk Analytics (VRSK) shows strong operational efficiency with top ROE and ROA scores but suffers from a weak balance sheet and valuation metrics. Booz Allen Hamilton (BAH) boasts a more balanced profile, excelling in cash flow and leverage management, with moderate valuation scores. BAH’s diversified strengths suggest steadier long-term resilience, while VRSK relies heavily on profitability metrics amid financial risk.

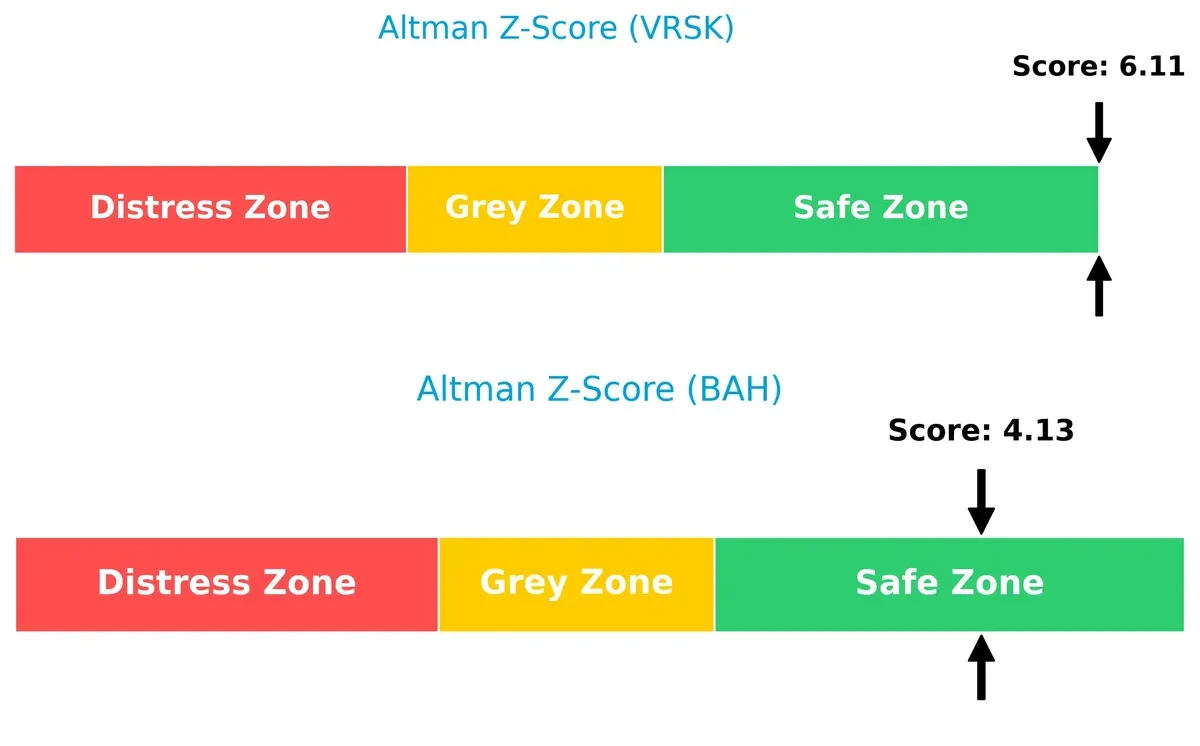

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap favors Verisk, indicating a stronger buffer against bankruptcy risks in this cycle:

Verisk’s Z-score of 6.1 places it well within the safe zone, reflecting robust solvency. Booz Allen’s 4.1, while also safe, signals moderate vulnerability compared to Verisk’s cushion, important in cyclical downturns.

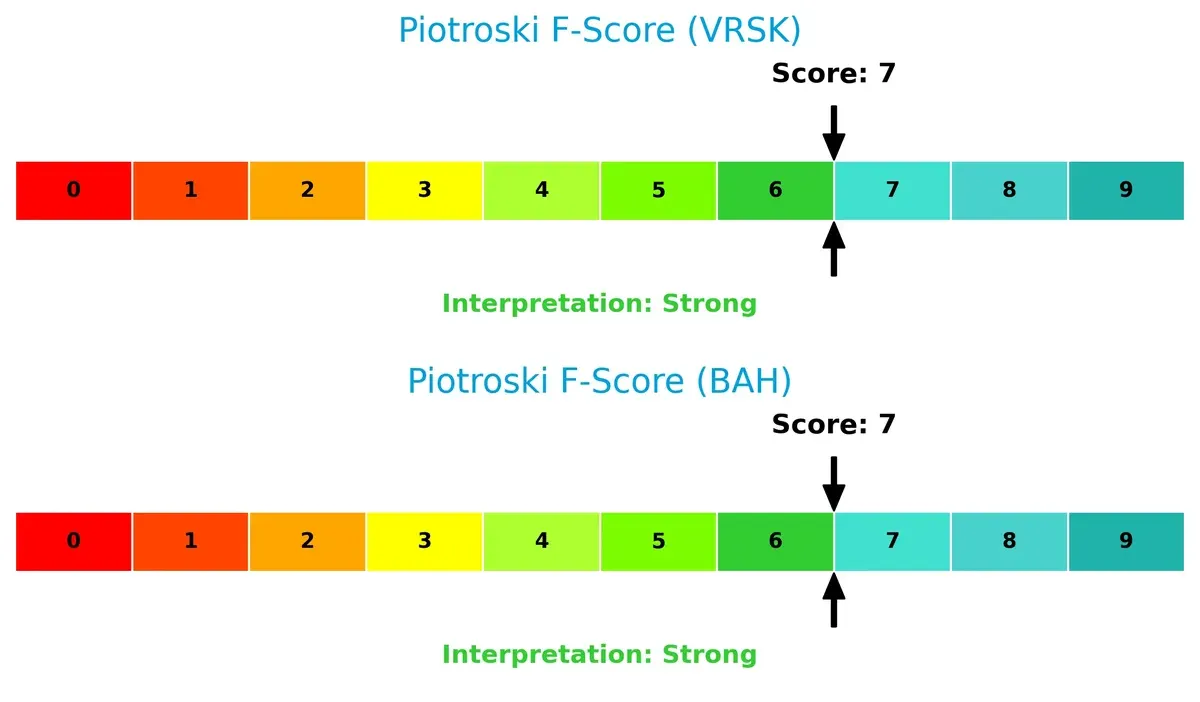

Financial Health: Quality of Operations

Both firms demonstrate strong financial health with identical Piotroski F-Scores, indicating solid internal metrics and operational efficiency:

Their scores of 7 suggest strong profitability, liquidity, and leverage management, with no immediate red flags. This parity implies both companies maintain sound fundamentals supporting their investment cases.

How are the two companies positioned?

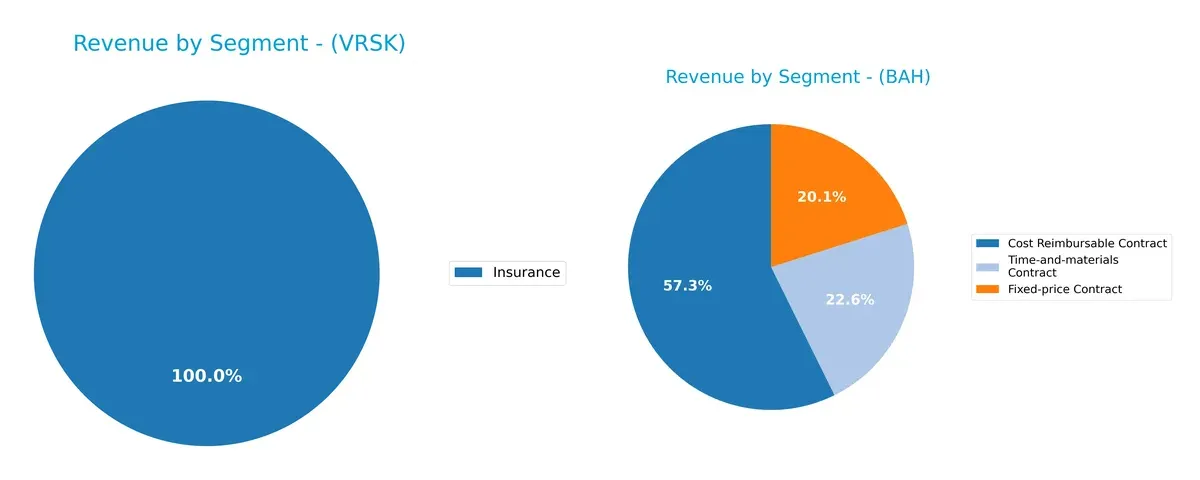

This section dissects the operational DNA of Verisk and Booz Allen by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Verisk Analytics and Booz Allen Hamilton diversify their income streams and where their primary sector bets lie:

Verisk Analytics anchors revenue heavily in Insurance, with $2.88B in 2024, showing less diversification. Booz Allen Hamilton exhibits a more balanced mix: $6.87B from Cost Reimbursable, $2.41B Fixed-price, and $2.71B Time-and-materials contracts in 2025. Booz Allen’s diverse contract types reduce concentration risk, while Verisk’s Insurance dominance signals strong ecosystem lock-in but higher sector dependency.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Verisk Analytics, Inc. and Booz Allen Hamilton Holding Corporation:

Verisk Analytics Strengths

- Strong profitability with 33.23% net margin

- Exceptional ROE at 956.54%

- ROIC well above WACC at 27.21%

- Favorable interest coverage at 10.86

- Diverse revenue streams including insurance and specialized markets

- Global presence in US, UK, and other countries

Booz Allen Hamilton Strengths

- Favorable ROE of 93.22% and ROIC at 18.8%

- Solid liquidity with current and quick ratios at 1.79

- Attractive P/E of 14.29

- High fixed asset turnover at 33.75

- Diverse contract types including cost reimbursable, fixed-price, and time-and-materials

- Dominant US market presence

Verisk Analytics Weaknesses

- Low current and quick ratios at 0.74 indicating liquidity risk

- High debt-to-assets at 76.11%

- Elevated P/B ratio at 391.15 suggests valuation concerns

- Moderate asset turnover at 0.68

- Low dividend yield at 0.57%

- High debt/equity ratio of 32.43

Booz Allen Hamilton Weaknesses

- Moderate debt-to-assets at 57.7% and debt/equity at 4.21

- Slightly unfavorable P/B at 13.32

- Lower net margin at 7.8%

- Dividend yield moderate at 2.01%

- Interest coverage lower than Verisk but still favorable at 7.19

Verisk excels in profitability and international diversification but faces liquidity and leverage pressures. Booz Allen shows balanced financial health with strong operational efficiency concentrated in the US. These factors shape each company’s strategic focus on risk management and growth opportunities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from the erosion of competition. Let’s dissect their core moats:

Verisk Analytics, Inc.: Data-Driven Predictive Analytics Moat

Verisk’s moat stems from its intangible assets and proprietary data sets, visible in its stellar 47% EBIT margin and 20% ROIC premium over WACC. Its AI-driven forecasting deepens this moat, but evolving tech risks remain in 2026.

Booz Allen Hamilton Holding Corporation: Government Contract Expertise Moat

Booz Allen leverages mission-critical government contracts and deep domain expertise, contrasting Verisk’s data focus. Its ROIC advantage is smaller but steady, supported by 12% premium over WACC and expanding digital services in cybersecurity.

Verdict: Proprietary Data Moat vs. Contractual Expertise Moat

Verisk’s wider and growing moat, fueled by high margins and data barriers, outpaces Booz Allen’s steady but narrower government contract moat. Verisk is better positioned to defend and expand its market share in 2026.

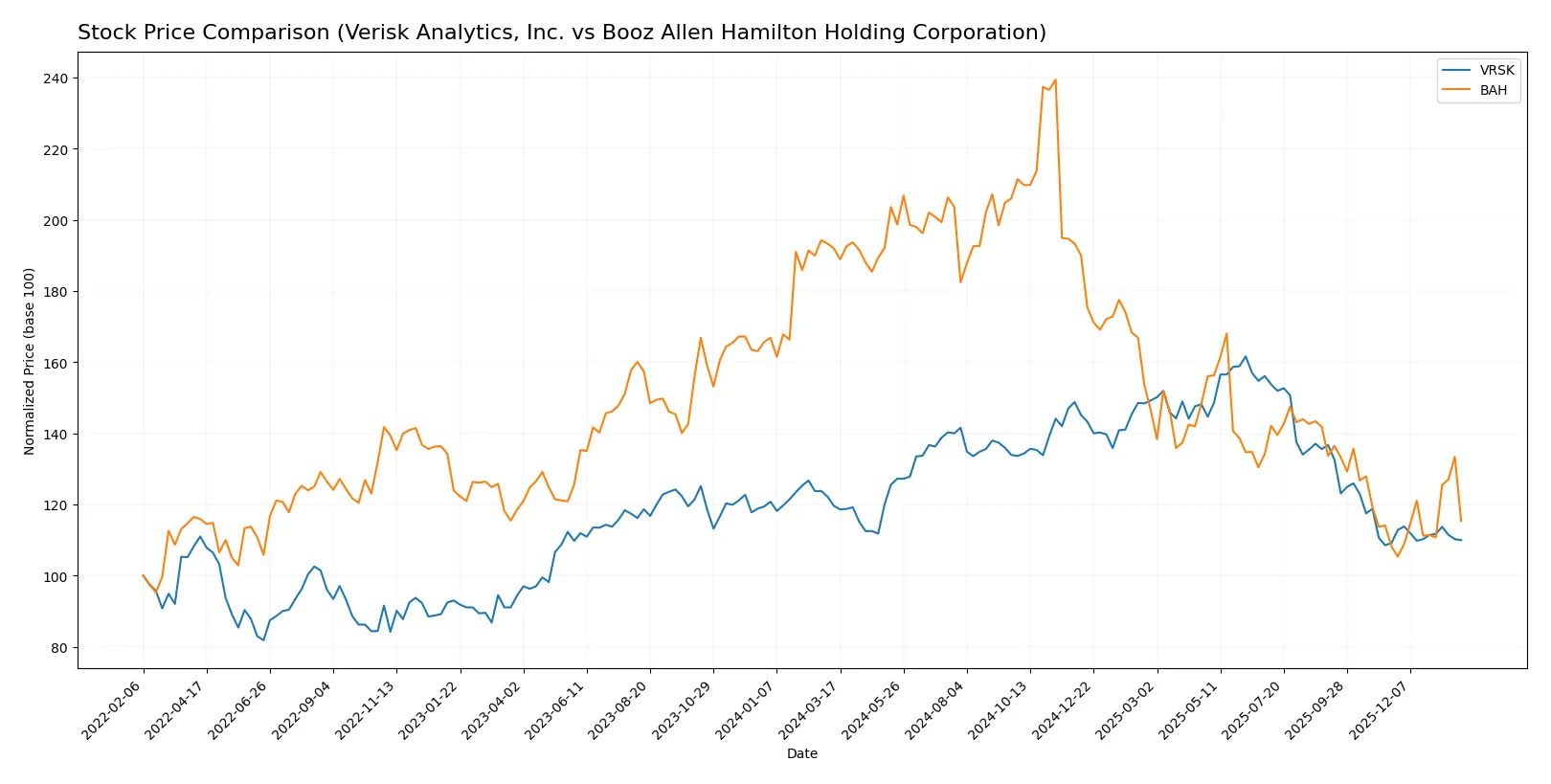

Which stock offers better returns?

Over the past year, both Verisk Analytics and Booz Allen Hamilton experienced significant price declines, with varying recent recovery signs and notable trading volume dynamics.

Trend Comparison

Verisk Analytics’ stock fell 8.06% over the past 12 months, marking a bearish trend with accelerating decline and wide price swings between 215 and 320. Recently, it showed a mild 0.75% uptick with stable volatility but a slightly negative slope.

Booz Allen Hamilton’s shares dropped sharply by 39.91% over the same period, also bearish with accelerating losses and a price range from 81 to 184. Its recent trend rebounded by 6.65%, displaying moderate volatility and a strong upward slope.

Booz Allen Hamilton’s stock delivered a much larger overall price decline but a stronger recent recovery, while Verisk Analytics showed a smaller loss and steadier recent price action.

Target Prices

Analysts project moderate upside potential for Verisk Analytics and Booz Allen Hamilton.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Verisk Analytics, Inc. | 239 | 334 | 281.33 |

| Booz Allen Hamilton Holding Corporation | 80 | 115 | 94.33 |

Verisk’s consensus target of 281.33 implies a 29% premium to the current 217.46 price. Booz Allen’s 94.33 target suggests an 7% upside from 88.42. Analysts expect steady gains but with limited margin for error.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Verisk Analytics, Inc. Grades

Here are the recent institutional grades assigned to Verisk Analytics, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-12-17 |

| Barclays | upgrade | Overweight | 2025-10-30 |

| Goldman Sachs | maintain | Neutral | 2025-10-30 |

| RBC Capital | maintain | Outperform | 2025-10-30 |

| Wells Fargo | maintain | Overweight | 2025-10-30 |

| JP Morgan | maintain | Overweight | 2025-10-30 |

| Evercore ISI Group | maintain | In Line | 2025-10-30 |

| Rothschild & Co | downgrade | Sell | 2025-10-16 |

| Evercore ISI Group | maintain | In Line | 2025-10-14 |

| Wells Fargo | maintain | Overweight | 2025-09-17 |

Booz Allen Hamilton Holding Corporation Grades

Below are the most recent grades issued by institutions for Booz Allen Hamilton Holding Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Hold | 2026-01-26 |

| Citigroup | maintain | Neutral | 2026-01-13 |

| Jefferies | maintain | Hold | 2025-12-18 |

| Goldman Sachs | maintain | Sell | 2025-10-27 |

| UBS | maintain | Neutral | 2025-10-27 |

| JP Morgan | maintain | Underweight | 2025-10-27 |

| TD Cowen | downgrade | Hold | 2025-10-17 |

| JP Morgan | maintain | Underweight | 2025-07-28 |

| Stifel | maintain | Hold | 2025-07-28 |

| UBS | maintain | Neutral | 2025-07-28 |

Which company has the best grades?

Verisk Analytics consistently receives more favorable grades, including multiple Overweight and Outperform ratings. Booz Allen Hamilton faces weaker sentiment, marked by Hold and Sell ratings. Stronger grades for Verisk suggest greater institutional confidence, potentially attracting more investor interest.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Verisk Analytics, Inc.

- Faces pressure from data analytics rivals and evolving AI technologies disrupting consulting services.

Booz Allen Hamilton Holding Corporation

- Competes in government and commercial consulting with rising cybersecurity and digital transformation demands.

2. Capital Structure & Debt

Verisk Analytics, Inc.

- High debt-to-assets ratio at 76.1% signals leverage risk despite strong interest coverage.

Booz Allen Hamilton Holding Corporation

- Lower debt level but moderate debt-to-assets at 57.7%, indicating better balance sheet strength.

3. Stock Volatility

Verisk Analytics, Inc.

- Beta of 0.81 suggests moderate sensitivity to market swings, relatively stable.

Booz Allen Hamilton Holding Corporation

- Beta of 0.34 indicates low volatility, appealing for risk-averse investors.

4. Regulatory & Legal

Verisk Analytics, Inc.

- Subject to data privacy and insurance regulatory changes that could increase compliance costs.

Booz Allen Hamilton Holding Corporation

- Faces strict government contracting regulations and cybersecurity compliance demands.

5. Supply Chain & Operations

Verisk Analytics, Inc.

- Relies on data sourcing and technological infrastructure; operational risks from IT disruptions.

Booz Allen Hamilton Holding Corporation

- Operational complexity from large workforce and government mission-critical projects.

6. ESG & Climate Transition

Verisk Analytics, Inc.

- Exposure to climate risk in natural resources analytics; must adapt ESG data offerings.

Booz Allen Hamilton Holding Corporation

- Increasing focus on sustainability consulting and cybersecurity resilience amid climate threats.

7. Geopolitical Exposure

Verisk Analytics, Inc.

- International data services expose it to geopolitical tensions and trade restrictions.

Booz Allen Hamilton Holding Corporation

- Heavy U.S. government exposure limits international geopolitical risk but ties growth to federal budgets.

Which company shows a better risk-adjusted profile?

Booz Allen Hamilton’s moderate leverage, low stock volatility, and diversified government contracts provide a more balanced risk-adjusted profile. Verisk’s high leverage and valuation multiples represent pronounced financial risks despite strong profitability. The key risk for Verisk lies in its heavy debt load, which could pressure cash flows if market conditions tighten. For Booz Allen, dependency on U.S. government spending is the primary vulnerability amid shifting budget priorities. Booz Allen’s safer Altman Z-score (4.13 vs. Verisk’s 6.11) and stronger overall financial ratios confirm its more prudent risk posture despite slightly lower profit margins.

Final Verdict: Which stock to choose?

Verisk Analytics, Inc. impresses with its remarkable capital efficiency and value creation, boasting a robust economic moat reflected in consistently high ROIC well above its WACC. Its main point of vigilance lies in its elevated leverage and liquidity ratios, which could pressure financial flexibility. This stock fits well in an aggressive growth portfolio willing to tolerate some balance sheet risk for strong returns.

Booz Allen Hamilton Holding Corporation benefits from a strategic moat grounded in stable government contracts and recurring revenue streams. It offers a more balanced safety profile with healthier liquidity and a lower valuation multiple, appealing to investors wary of overpaying. This company suits a GARP (Growth at a Reasonable Price) portfolio prioritizing steady growth with moderate risk.

If you prioritize high return on invested capital and are comfortable with elevated leverage, Verisk Analytics is the compelling choice due to its durable competitive advantage and superior profitability. However, if you seek better financial stability and a more attractive valuation, Booz Allen Hamilton offers superior downside protection and consistent cash flow growth. Both scenarios warrant careful risk management given recent bearish price trends and market volatility.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Verisk Analytics, Inc. and Booz Allen Hamilton Holding Corporation to enhance your investment decisions: