Home > Comparison > Industrials > EFX vs BAH

The strategic rivalry between Equifax Inc. and Booz Allen Hamilton defines the trajectory of the consulting services sector. Equifax operates as a data-driven information solutions provider with a focus on credit and workforce analytics. In contrast, Booz Allen Hamilton excels as a management and technology consulting powerhouse, emphasizing advanced analytics and cyber services. This analysis will determine which business model offers a superior risk-adjusted return for a diversified portfolio in 2026.

Table of contents

Companies Overview

Equifax Inc. and Booz Allen Hamilton Holding Corporation both lead in consulting services, influencing diverse sectors globally.

Equifax Inc.: Data-Driven Information Solutions Leader

Equifax Inc. dominates as an information solutions provider specializing in credit and employment verification. Its core revenue stems from Workforce Solutions, U.S. Information Solutions, and International segments. In 2026, Equifax focuses strategically on expanding digital identity protection and advanced credit analytics to enhance client decision-making.

Booz Allen Hamilton Holding Corporation: Advanced Tech Consulting Powerhouse

Booz Allen Hamilton holds a commanding position in management and technology consulting, blending analytics, engineering, and cyber services. Its revenue primarily comes from consulting in AI, data science, and cyber risk management. The company’s 2026 strategy prioritizes innovation in AI-driven solutions and quantum computing to serve government and commercial clients.

Strategic Collision: Similarities & Divergences

Both firms excel in consulting but differ sharply in approach. Equifax emphasizes data-driven decision support with a closed ecosystem of information services. Booz Allen champions open architecture and advanced technology consulting. Their primary battleground is digital transformation in the public and private sectors. Equifax offers a data-centric investment profile; Booz Allen presents a tech innovation-driven risk-reward balance.

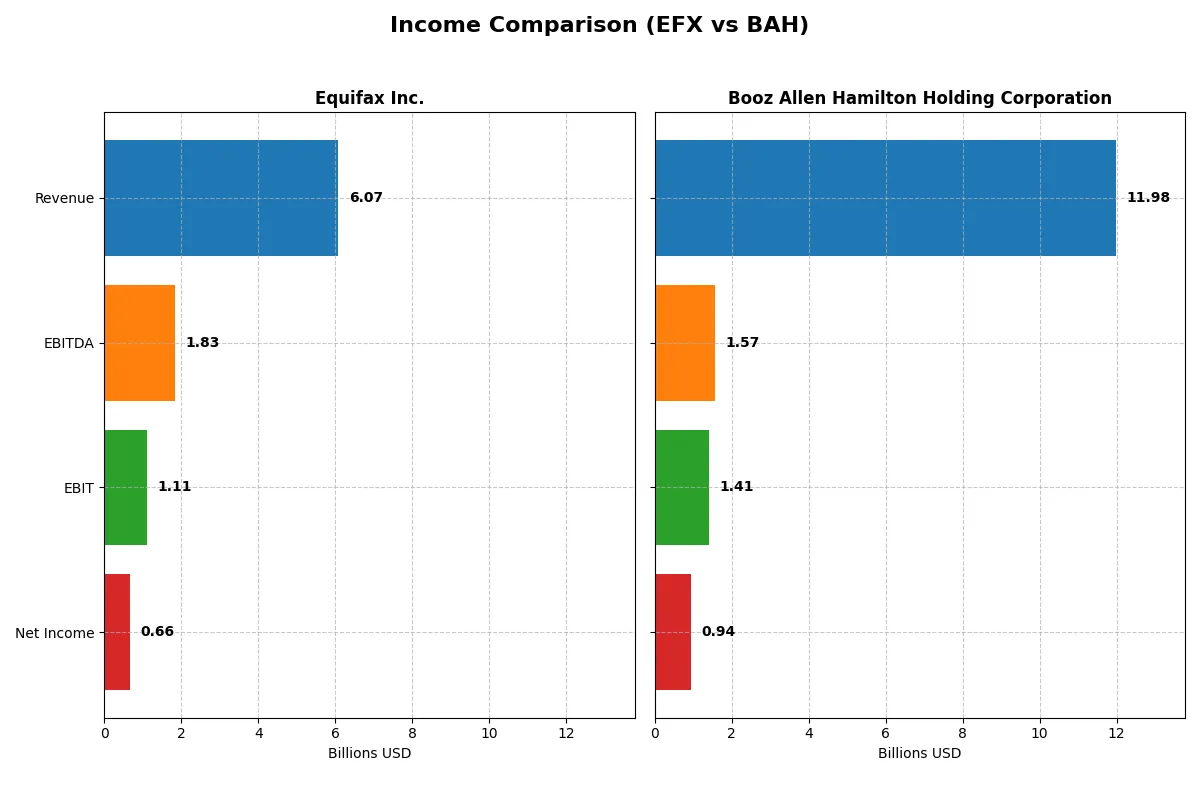

Income Statement Comparison

The table below dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Equifax Inc. (EFX) | Booz Allen Hamilton (BAH) |

|---|---|---|

| Revenue | 6.07B | 11.98B |

| Cost of Revenue | 3.37B | 5.42B |

| Operating Expenses | 1.61B | 5.19B |

| Gross Profit | 2.71B | 6.56B |

| EBITDA | 1.83B | 1.57B |

| EBIT | 1.11B | 1.41B |

| Interest Expense | 212M | 196M |

| Net Income | 660M | 935M |

| EPS | 5.36 | 7.28 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The following income statement comparison exposes the true efficiency and momentum behind Equifax and Booz Allen’s corporate engines over recent years.

Equifax Inc. Analysis

Equifax’s revenue grew steadily from 4.9B in 2021 to 6.1B in 2025, showing a 23% overall increase. Net income, however, declined by 11% over this period, settling at 660M in 2025. Gross margin contracted from around 58% to 44.6%, while net margin remains modest at 10.87%. The company improved EBIT by 6.5% and EPS by nearly 10% in the latest year, signaling cautious efficiency gains despite margin pressure.

Booz Allen Hamilton Holding Corporation Analysis

Booz Allen’s revenue surged from 7.9B in 2021 to 12.0B in 2025, marking robust 52% growth. Net income expanded even more sharply by 54% to 930M in 2025. The firm maintains superior gross margin at 54.77%, though EBIT margin sits lower at 11.76%. Booz Allen posted strong one-year growth across all metrics, including a 58% EPS jump, reflecting accelerating momentum and disciplined cost management.

Momentum and Margin: Growth Scale vs. Margin Expansion

Booz Allen outpaces Equifax in revenue and net income growth, sustaining higher gross margins and impressive EPS gains. Equifax shows resilient profitability but faces margin compression and slower net income growth. For investors focused on rapid scaling and margin improvement, Booz Allen’s profile offers a more compelling growth trajectory with efficient capital deployment.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Equifax Inc. (EFX) | Booz Allen Hamilton (BAH) |

|---|---|---|

| ROE | 14.3% | 93.2% |

| ROIC | 7.7% | 18.8% |

| P/E | 40.5 | 14.3 |

| P/B | 5.81 | 13.3 |

| Current Ratio | 0.60 | 1.79 |

| Quick Ratio | 0.60 | 1.79 |

| D/E (Debt/Equity) | 1.11 | 4.21 |

| Debt-to-Assets | 42.9% | 57.7% |

| Interest Coverage | 5.16 | 6.99 |

| Asset Turnover | 0.51 | 1.64 |

| Fixed Asset Turnover | 3.14 | 33.75 |

| Payout Ratio | 35.3% | 28.7% |

| Dividend Yield | 0.87% | 2.01% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational excellence through clear, quantifiable signals.

Equifax Inc.

Equifax shows moderate profitability with a 14.3% ROE and a favorable 10.9% net margin, but its valuation appears stretched at a 40.5 P/E. The company maintains a low dividend yield of 0.87%, suggesting limited shareholder returns and possible reinvestment in intangible assets. Its weak liquidity signals caution on financial flexibility.

Booz Allen Hamilton Holding Corporation

Booz Allen delivers exceptional profitability, boasting a 93.2% ROE and a solid 7.8% net margin. Its valuation is attractive, with a 14.3 P/E reflecting reasonable market expectations. The firm offers a 2.01% dividend yield and shows strong liquidity and operational efficiency, underlined by a high asset turnover and favorable capital returns.

Premium Valuation vs. Operational Safety

Booz Allen balances superior profitability and favorable valuation metrics, contrasting with Equifax’s stretched value and weaker liquidity. Investors prioritizing operational strength and income may lean toward Booz Allen, while those accepting valuation risks for stable margins might consider Equifax’s profile.

Which one offers the Superior Shareholder Reward?

I see Equifax (EFX) delivers a modest dividend yield near 0.87% with a payout ratio around 35%, backed by solid free cash flow coverage above 70%. Its buyback activity is moderate but consistent, supporting shareholder value steadily. Booz Allen Hamilton (BAH) pays a higher dividend yield near 2.0%, with a slightly lower payout ratio around 29%, and demonstrates a stronger buyback intensity reflected in free cash flow reinvestment near 90%. BAH’s distribution is more aggressive yet sustainable given its robust operating cash flow and lower leverage ratios. I judge BAH’s blend of higher yield and stronger buybacks offers a superior total return profile for 2026 investors focused on income and capital appreciation.

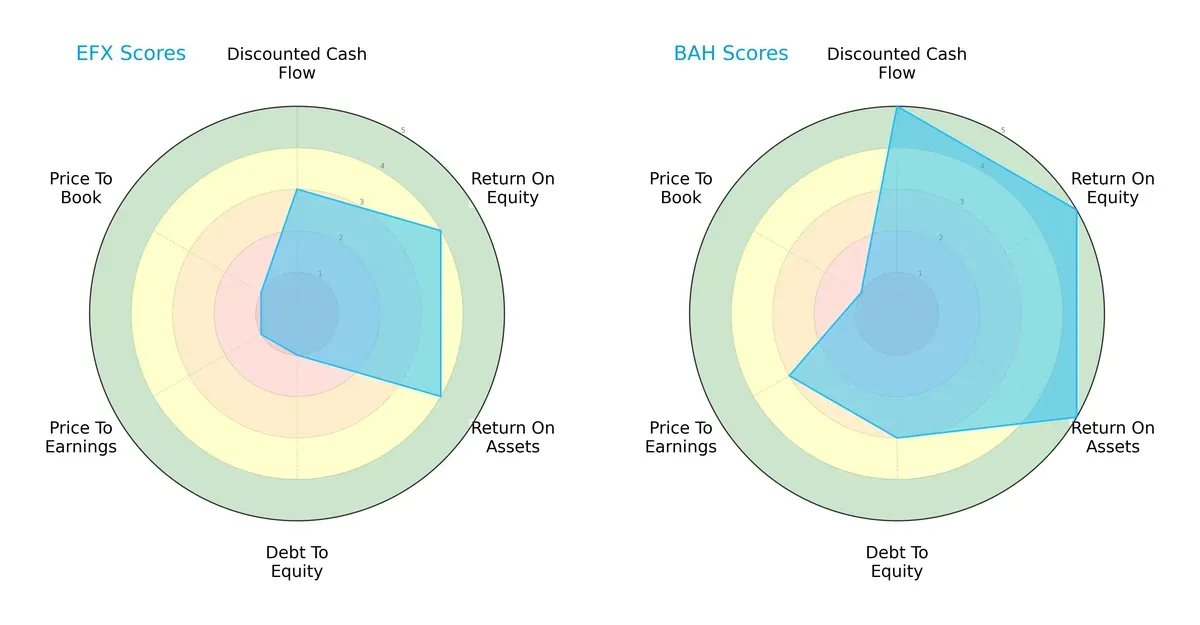

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Equifax Inc. and Booz Allen Hamilton Holding Corporation:

Booz Allen Hamilton dominates in discounted cash flow, ROE, and ROA, showing operational efficiency and strong valuation metrics. Equifax exhibits weaknesses in debt-to-equity and valuation scores, indicating financial risk and potential overvaluation. Booz Allen presents a more balanced financial profile, while Equifax relies on moderate operational returns amid financial leverage concerns.

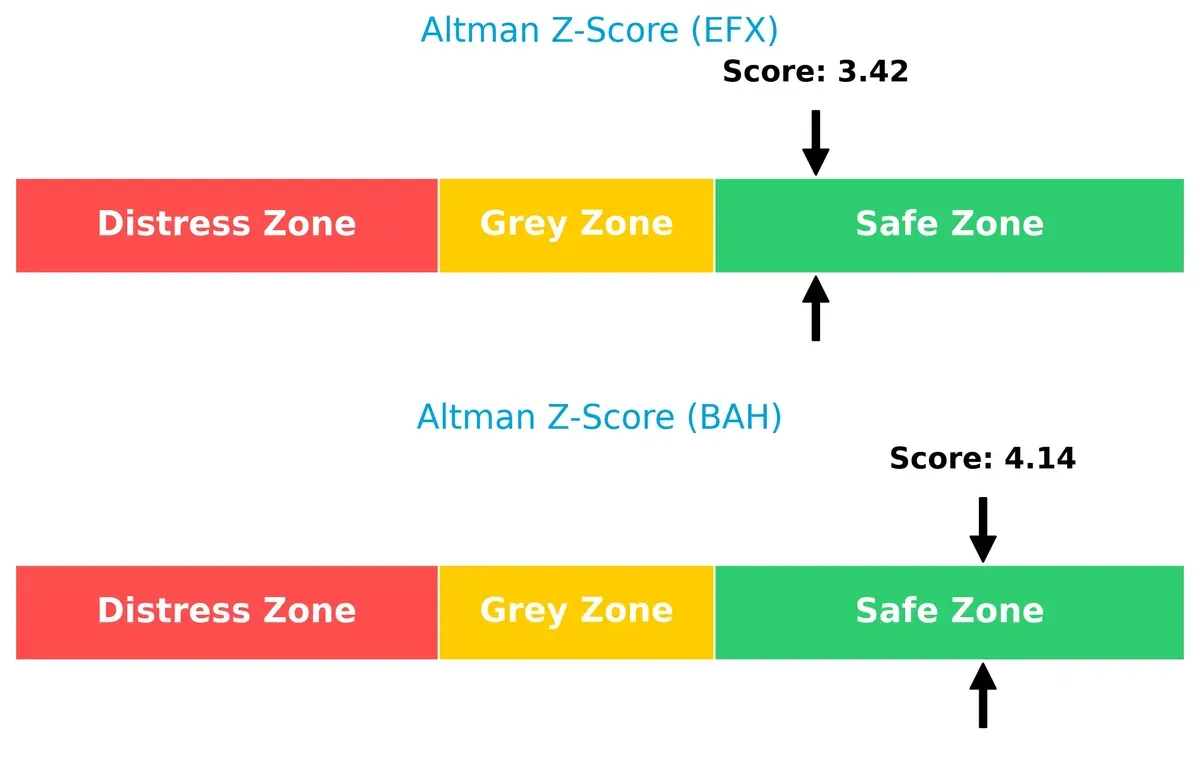

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score differential favors Booz Allen Hamilton, signaling stronger long-term solvency and lower bankruptcy risk in this economic cycle:

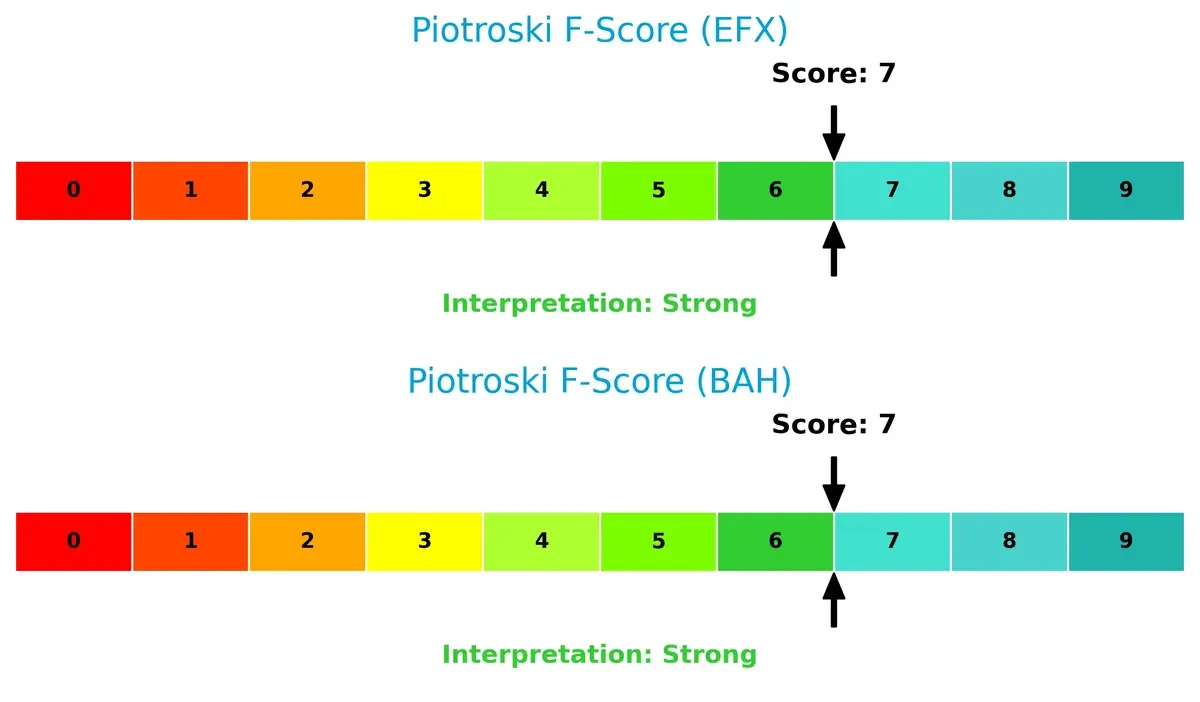

Financial Health: Quality of Operations

Both companies score 7 on the Piotroski F-Score, reflecting strong financial health with no immediate red flags in operational quality or internal metrics:

How are the two companies positioned?

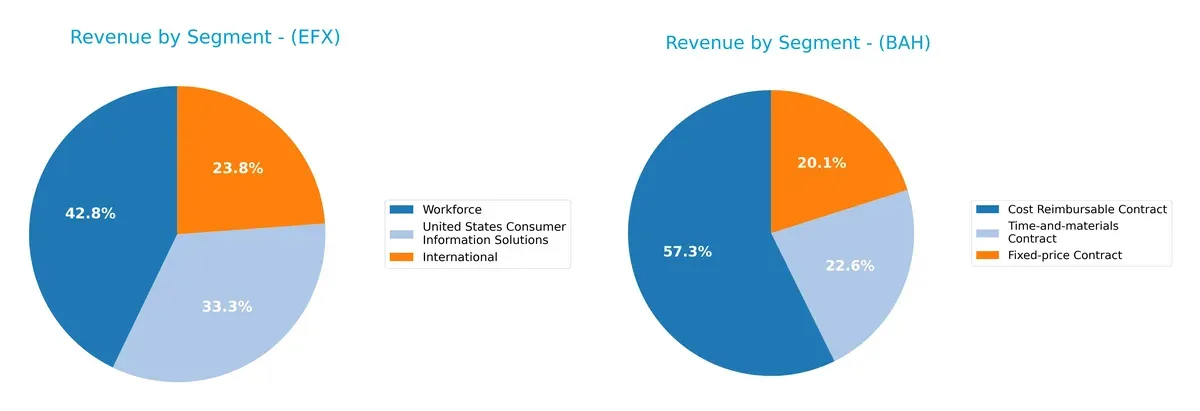

This section dissects EFX and BAH’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Equifax and Booz Allen diversify their income streams and where their primary sector bets lie:

Equifax anchors its revenue in Workforce with $2.43B, followed by US Consumer Information Solutions at $1.89B and International at $1.35B in 2024. Booz Allen dominates with a heavy concentration in Cost Reimbursable Contracts at $6.87B, while Fixed-price and Time-and-materials Contracts contribute $2.41B and $2.71B, respectively. Equifax shows a more balanced product mix, reducing concentration risk. Booz Allen’s reliance on government contracting signals strong infrastructure dominance but exposes it to budget shifts.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Equifax Inc. and Booz Allen Hamilton Holding Corporation:

EFX Strengths

- Diverse revenue streams across International, Workforce, and U.S. Consumer segments

- Strong presence in multiple countries including U.S., U.K., Australia

- Favorable net margin and interest coverage ratio

- Efficient fixed asset turnover

BAH Strengths

- High ROE and ROIC well above WACC indicating strong capital allocation

- Favorable net margin and liquidity ratios

- Dominant U.S. market presence with large contract revenues

- Favorable asset turnover and dividend yield

EFX Weaknesses

- Unfavorable valuation metrics with high P/E and P/B ratios

- Low current and quick ratios indicating liquidity concerns

- Debt-to-equity slightly high, raising leverage risk

- Dividend yield below sector average

BAH Weaknesses

- High debt-to-equity and debt-to-assets ratios increase financial risk

- Unfavorable P/B ratio suggests potential overvaluation

- Concentrated U.S.-only geographic exposure limits diversification

Overall, EFX shows geographic and product diversification but faces liquidity and valuation challenges. BAH excels in profitability and capital efficiency but carries higher leverage and geographic concentration risks. Both companies’ strengths and weaknesses suggest different strategic priorities in managing growth and financial stability.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive pressure. Here’s how Equifax and Booz Allen stack up:

Equifax Inc.: Data Network Effects and Intangible Assets

Equifax’s moat stems from vast data assets and network effects in credit information. High gross margins reflect pricing power, but declining ROIC signals value erosion. Expansion into new markets faces profitability challenges in 2026.

Booz Allen Hamilton: Intellectual Capital and Client Relationships

Booz Allen leverages deep government ties and specialized tech consulting as its moat, contrasting Equifax’s data focus. Rising ROIC and double-digit revenue growth confirm efficient capital use. Their AI and cyber services promise moat expansion in 2026.

Verdict: Data Network Effects vs. Intellectual Capital Resilience

Booz Allen’s growing ROIC and robust margin expansion reveal a deeper, more sustainable moat than Equifax’s shrinking profitability. Booz Allen stands better equipped to defend and grow its market share.

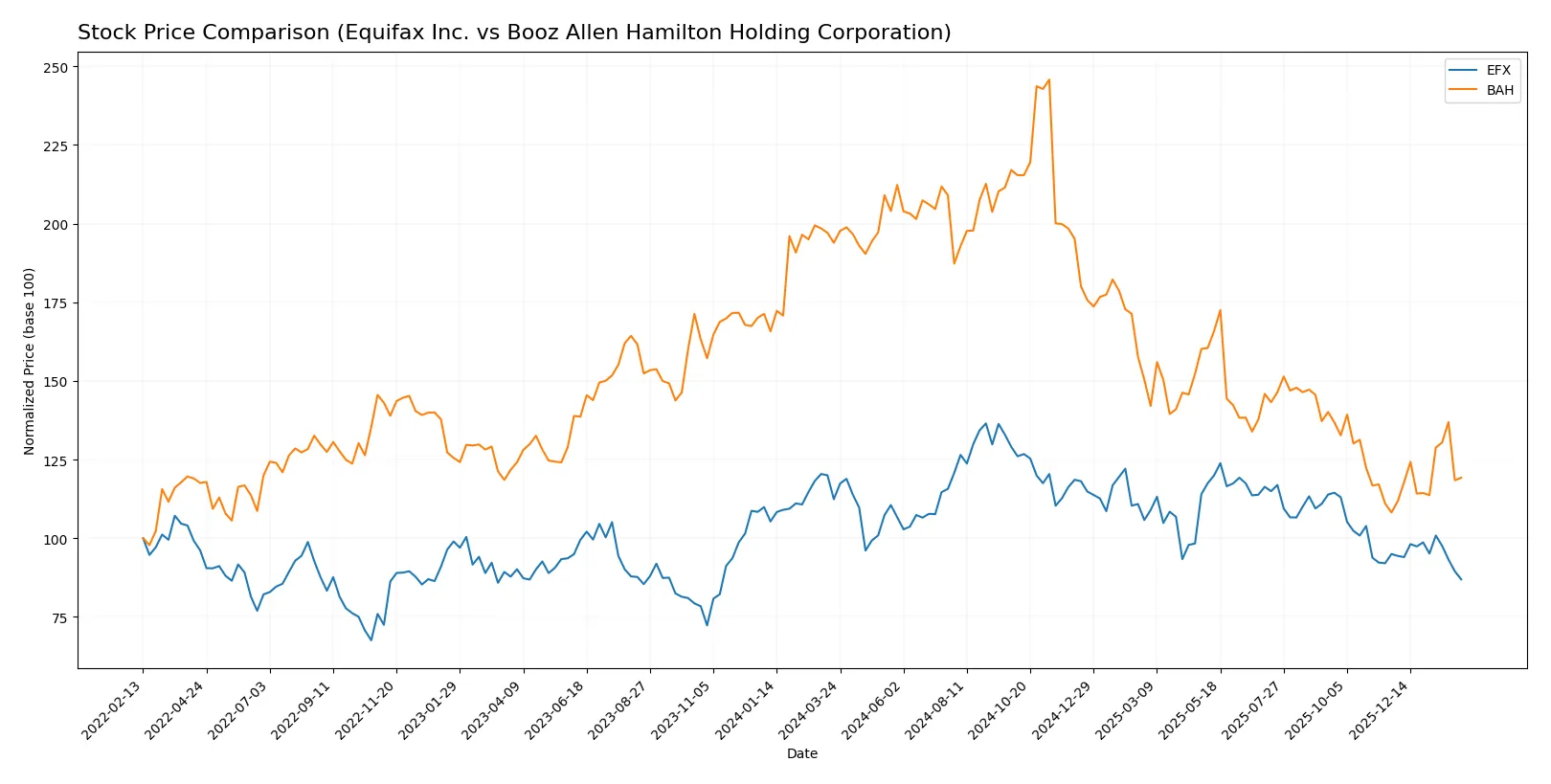

Which stock offers better returns?

The past year shows contrasting price dynamics for Equifax Inc. and Booz Allen Hamilton Holding Corporation, with notable declines and shifting trading dominance shaping their trajectories.

Trend Comparison

Equifax Inc. exhibits a bearish trend with a -22.66% price decline over the past year. The trend decelerated, hitting a high of 307.13 and a low of 195.62, with a high volatility of 24.47%.

Booz Allen Hamilton shows a steeper bearish trend, down -38.52% over the same period. However, the trend accelerates despite volatility at 26.45%, with prices ranging from 183.5 to 80.78.

While both stocks declined annually, Equifax’s smaller loss and decelerating trend contrast Booz Allen’s sharper drop but recent positive momentum, making Equifax the better performer overall.

Target Prices

Analysts offer a clear consensus on target prices for Equifax Inc. and Booz Allen Hamilton Holding Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Equifax Inc. | 195 | 285 | 238.18 |

| Booz Allen Hamilton Holding Corporation | 80 | 115 | 94.33 |

The consensus target for Equifax at 238.18 suggests a 22% upside from its current 195.62 price. Booz Allen’s 94.33 target indicates a modest 6% potential gain versus its 89.01 trading price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of the latest institutional grades for Equifax Inc. and Booz Allen Hamilton Holding Corporation:

Equifax Inc. Grades

The table below shows recent grades from well-known financial institutions for Equifax Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Buy | 2026-02-05 |

| Morgan Stanley | maintain | Overweight | 2026-02-05 |

| Wells Fargo | maintain | Overweight | 2026-02-05 |

| RBC Capital | maintain | Outperform | 2026-02-05 |

| Barclays | maintain | Equal Weight | 2026-02-05 |

| Needham | maintain | Buy | 2026-02-05 |

| JP Morgan | maintain | Overweight | 2026-02-05 |

| Wells Fargo | maintain | Overweight | 2026-01-14 |

| Oppenheimer | maintain | Outperform | 2026-01-12 |

| Morgan Stanley | maintain | Overweight | 2025-12-17 |

Booz Allen Hamilton Holding Corporation Grades

Below is a list of recent institutional grades for Booz Allen Hamilton Holding Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | maintain | Hold | 2026-01-26 |

| Citigroup | maintain | Neutral | 2026-01-13 |

| Jefferies | maintain | Hold | 2025-12-18 |

| Goldman Sachs | maintain | Sell | 2025-10-27 |

| JP Morgan | maintain | Underweight | 2025-10-27 |

| UBS | maintain | Neutral | 2025-10-27 |

| TD Cowen | downgrade | Hold | 2025-10-17 |

| Stifel | maintain | Hold | 2025-07-28 |

| JP Morgan | maintain | Underweight | 2025-07-28 |

| UBS | maintain | Neutral | 2025-07-28 |

Which company has the best grades?

Equifax Inc. consistently receives positive grades such as Buy, Overweight, and Outperform from multiple reputable firms. Booz Allen Hamilton’s ratings trend lower, ranging from Hold to Sell and Underweight. Investors might interpret Equifax’s stronger grades as greater confidence in its growth prospects.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Equifax Inc.

- Faces intense competition in data solutions with pressure to innovate rapidly.

Booz Allen Hamilton Holding Corporation

- Competes in government and commercial consulting with reliance on federal contracts.

2. Capital Structure & Debt

Equifax Inc.

- Moderate debt with a debt-to-equity ratio of 1.11 signals cautious leverage but weak liquidity ratios.

Booz Allen Hamilton Holding Corporation

- High debt ratio (4.21) increases financial risk despite strong coverage ratios.

3. Stock Volatility

Equifax Inc.

- Beta at 1.54 reflects higher stock volatility than market average.

Booz Allen Hamilton Holding Corporation

- Beta at 0.35 indicates lower volatility, offering relative stability.

4. Regulatory & Legal

Equifax Inc.

- Subject to strict data privacy regulations globally, posing compliance risks.

Booz Allen Hamilton Holding Corporation

- Faces regulatory scrutiny mainly in government contracting and cybersecurity sectors.

5. Supply Chain & Operations

Equifax Inc.

- Relies on global data infrastructure vulnerable to cyber threats and operational disruptions.

Booz Allen Hamilton Holding Corporation

- Operations depend on skilled labor and technological capacity, sensitive to talent shortages.

6. ESG & Climate Transition

Equifax Inc.

- Growing ESG demands pressure transparency on data ethics and carbon footprint.

Booz Allen Hamilton Holding Corporation

- Increasing focus on ESG consulting services aligns with market trends but adds operational costs.

7. Geopolitical Exposure

Equifax Inc.

- Exposure to international markets includes risks from geopolitical tensions and data sovereignty laws.

Booz Allen Hamilton Holding Corporation

- Heavy reliance on U.S. government contracts reduces international geopolitical risk but concentrates political exposure.

Which company shows a better risk-adjusted profile?

Booz Allen Hamilton’s most significant risk lies in its high leverage, but its strong liquidity and stable stock volatility mitigate this concern. Equifax’s key risk is its weak liquidity ratios compounded by high stock volatility and regulatory complexity. Booz Allen Hamilton shows a better risk-adjusted profile, supported by a safer Altman Z-score (4.14 vs. 3.42) and stronger overall financial ratios. The recent surge in Booz Allen’s stock price amid steady dividend growth confirms investor confidence despite debt levels.

Final Verdict: Which stock to choose?

Equifax Inc. (EFX) excels as a cash generator with solid operational efficiency, sustaining favorable income margins despite industry headwinds. Its challenge lies in liquidity constraints and elevated valuation multiples, signaling a point of vigilance. This profile suits investors targeting aggressive growth with an appetite for cyclical risk.

Booz Allen Hamilton (BAH) boasts a strategic moat rooted in its robust consulting franchise and consistently superior returns on invested capital. It offers a safer financial footing, reflected in stronger liquidity and a more attractive valuation relative to EFX. BAH fits well in GARP portfolios seeking steady growth paired with prudent risk management.

If you prioritize aggressive growth and can tolerate valuation and liquidity risks, Equifax’s efficiency and margin resilience make it compelling. However, if you seek value creation backed by a sustainable competitive advantage and better financial stability, Booz Allen Hamilton outshines as a more balanced choice. Both require careful monitoring, but BAH’s growing ROIC and earnings momentum offer a stronger stability narrative.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Equifax Inc. and Booz Allen Hamilton Holding Corporation to enhance your investment decisions: