Booking Holdings Inc. (BKNG) and Expedia Group, Inc. (EXPE) are two giants in the online travel services industry, each offering a diverse portfolio of travel booking platforms and innovative solutions. Both companies compete globally, striving to capture market share through technological advancements and customer-centric strategies. In this article, I will compare these industry leaders to help you identify which one holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Booking Holdings Inc. and Expedia Group, Inc. by providing an overview of these two companies and their main differences.

Booking Holdings Inc. Overview

Booking Holdings Inc. operates globally in the travel services sector, offering online travel and restaurant reservation services. Its portfolio includes well-known brands such as Booking.com, Rentalcars.com, Priceline, Agoda, KAYAK, and OpenTable. The company focuses on providing consumers with diverse travel options, from accommodation and car rentals to restaurant bookings and travel insurance. Headquartered in Norwalk, Connecticut, Booking Holdings commands a strong market position with a $177B market cap.

Expedia Group, Inc. Overview

Expedia Group, Inc. is a U.S.-based online travel company serving leisure and corporate travelers worldwide. It operates through multiple segments and a broad brand portfolio including Expedia, Hotels.com, Vrbo, Orbitz, Travelocity, Hotwire, and Trivago, among others. The company offers a variety of services encompassing lodging, alternative accommodations, car rentals, cruises, and corporate travel management. With a market cap of $35B, Expedia is a significant player in the consumer cyclical sector headquartered in Seattle, Washington.

Key similarities and differences

Both Booking Holdings and Expedia Group operate in the travel services industry, providing online booking platforms for accommodations, car rentals, and other travel-related services. They each manage multiple brands and target both leisure and corporate travelers. However, Booking Holdings is considerably larger by market capitalization and includes restaurant reservation services, whereas Expedia emphasizes a wider segment diversification including media solutions and corporate travel management. Their operational scale and brand strategies reflect distinct approaches within the same sector.

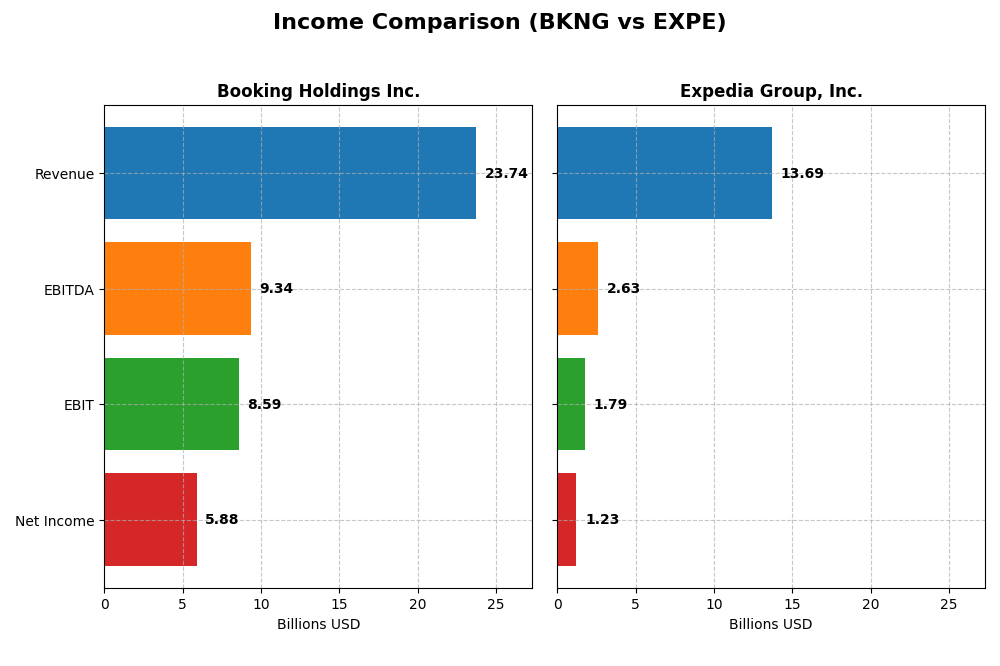

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Booking Holdings Inc. and Expedia Group, Inc. for the fiscal year 2024.

| Metric | Booking Holdings Inc. | Expedia Group, Inc. |

|---|---|---|

| Market Cap | 177B | 35B |

| Revenue | 23.7B | 13.7B |

| EBITDA | 9.3B | 2.6B |

| EBIT | 8.6B | 1.8B |

| Net Income | 5.9B | 1.2B |

| EPS | 174.96 | 9.39 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Booking Holdings Inc.

Booking Holdings shows strong revenue and net income growth from 2020 to 2024, with revenue rising from $6.8B to $23.7B and net income surging from $59M to $5.9B. Margins remain robust, with a consistent gross margin at 100% and a net margin near 25%. In 2024, revenue growth accelerated by 11.1%, and net margins improved by 23.4%, evidencing enhanced profitability.

Expedia Group, Inc.

Expedia’s revenue increased steadily from $5.2B in 2020 to $13.7B in 2024, while net income rose from a loss of $2.7B to a positive $1.2B. Margins improved, with gross margin at 89.5% and net margin around 9% in 2024. The latest year showed modest revenue growth of 6.6%, but a strong 45.2% increase in net margin, reflecting better cost management and profitability gains.

Which one has the stronger fundamentals?

Booking Holdings demonstrates stronger fundamentals with higher profitability margins, exceptional net income growth over the period, and favorable margin expansion in 2024. Expedia shows solid recovery and margin improvement but lags behind in overall margin levels and net income scale. Both companies present favorable income statements, though Booking’s metrics are comparatively more robust.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Booking Holdings Inc. (BKNG) and Expedia Group, Inc. (EXPE) based on their latest fiscal year 2024 data.

| Ratios | Booking Holdings Inc. (BKNG) | Expedia Group, Inc. (EXPE) |

|---|---|---|

| ROE | -146.3% | 79.3% |

| ROIC | 44.1% | 10.7% |

| P/E | 28.4 | 19.8 |

| P/B | -41.6 | 15.7 |

| Current Ratio | 1.31 | 0.72 |

| Quick Ratio | 1.31 | 0.72 |

| D/E (Debt-to-Equity) | -4.25 | 4.19 |

| Debt-to-Assets | 61.6% | 29.2% |

| Interest Coverage | 5.83 | 5.36 |

| Asset Turnover | 0.86 | 0.61 |

| Fixed Asset Turnover | 17.1 | 5.04 |

| Payout Ratio | 20.0% | 0% |

| Dividend Yield | 0.70% | 0% |

Interpretation of the Ratios

Booking Holdings Inc.

Booking Holdings shows a mixed ratio profile with strong net margin (24.78%) and return on invested capital (44.14%), but a significantly negative return on equity (-146.32%) raising concerns about shareholder profitability. Liquidity ratios are neutral to favorable, yet high debt-to-assets (61.65%) flags leverage risk. The company pays dividends with a low yield (0.7%), and coverage appears sustainable though payout risks exist.

Expedia Group, Inc.

Expedia presents a neutral to favorable ratio set, including a solid return on equity (79.25%) and decent return on invested capital (10.66%), but weak liquidity ratios (current and quick ratio at 0.72) pose short-term solvency concerns. Debt-to-equity is high (4.19), though debt-to-assets remains favorable (29.17%). Expedia does not pay dividends, likely prioritizing reinvestment and growth strategies.

Which one has the best ratios?

Booking Holdings demonstrates stronger profitability metrics and coverage ratios but carries higher leverage and negative return on equity. Expedia offers better equity returns and lower leverage risk but struggles with liquidity and lacks dividend payouts. Overall, Booking’s ratios are slightly more favorable, while Expedia shows a more balanced but neutral financial profile.

Strategic Positioning

This section compares the strategic positioning of Booking Holdings Inc. and Expedia Group, Inc., including their market position, key segments, and exposure to technological disruption:

Booking Holdings Inc.

- Market leader with large market cap and moderate beta, facing competitive pressure in travel services.

- Diversified portfolio including accommodation, car rentals, flights, restaurant bookings, and travel insurance.

- Exposure to disruption through online price comparison and multiple reservation platforms across travel and dining.

Expedia Group, Inc.

- Smaller market cap, higher beta, operates under significant competitive pressure in online travel.

- Broad brand portfolio with retail, B2B, metasearch, lodging, air travel, and corporate travel segments.

- Faces disruption via hotel metasearch, media solutions, and diversified online travel booking services.

Booking Holdings Inc. vs Expedia Group, Inc. Positioning

Booking Holdings adopts a diversified approach across travel and dining services, leveraging multiple brands and segments, while Expedia focuses on a broad portfolio of online travel brands, including corporate and metasearch segments. Booking’s scale may offer operational advantages; Expedia’s brand diversity targets varied customer types.

Which has the best competitive advantage?

Booking Holdings shows a very favorable moat with a strong ROIC exceeding WACC substantially and growing profitability, indicating a durable competitive advantage. Expedia’s moat is slightly favorable, with modest ROIC growth but currently shedding value relative to its cost of capital.

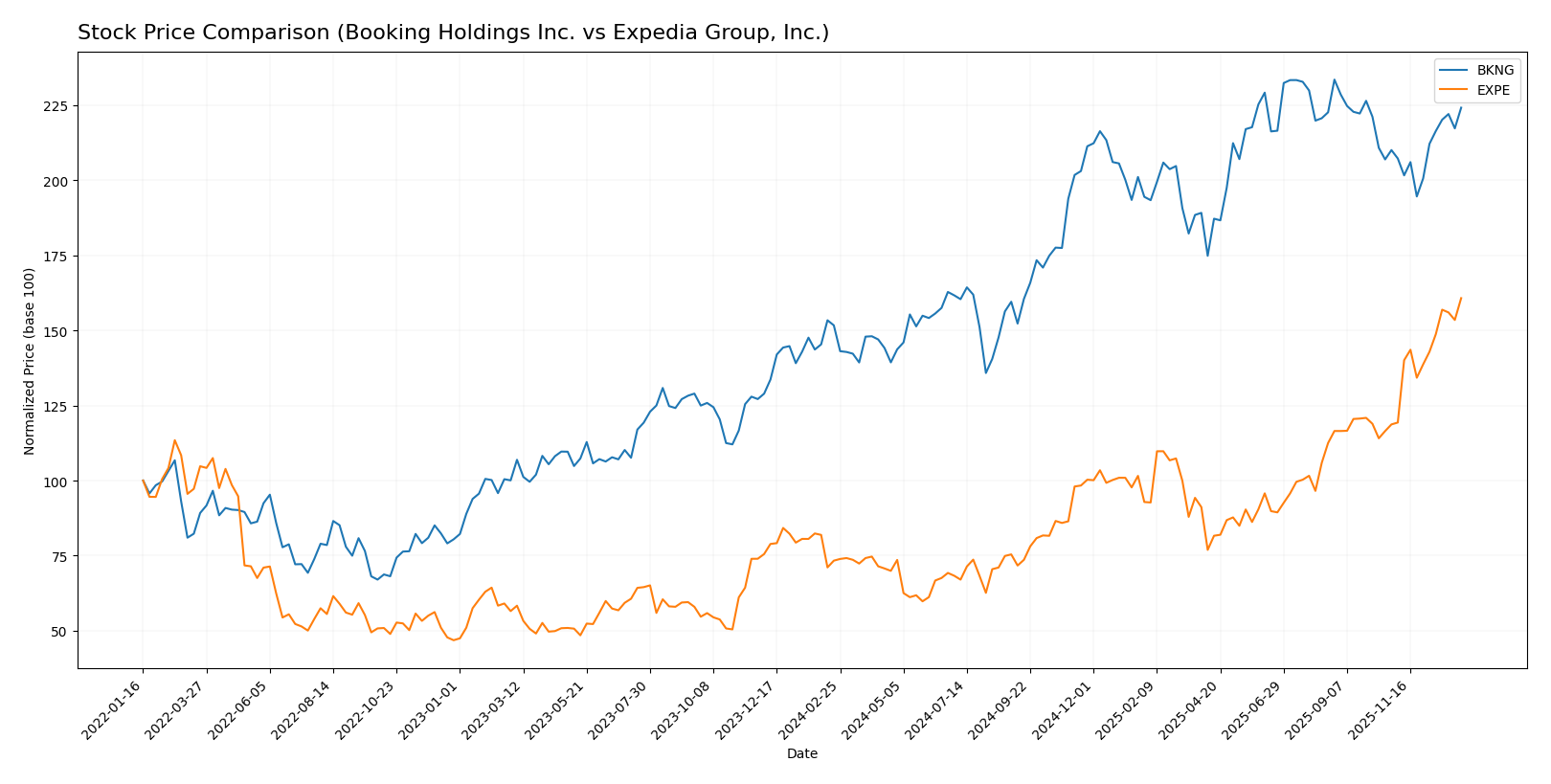

Stock Comparison

The stock price chart reveals significant upward momentum for both Booking Holdings Inc. and Expedia Group, Inc. over the past year, highlighting strong bullish trends with notable acceleration in price growth and distinct trading volume dynamics.

Trend Analysis

Booking Holdings Inc. (BKNG) experienced a 47.76% price increase over the past year, indicating a bullish trend with accelerating momentum and a high volatility level, as reflected by a standard deviation of 733.55.

Expedia Group, Inc. (EXPE) showed an even stronger bullish trend, with a 119.1% price increase over the same period, also accelerating but with lower volatility at 44.59 standard deviation.

Comparing both, Expedia Group’s stock delivered the highest market performance, more than doubling its price, while Booking Holdings showed solid gains but at a comparatively lower rate.

Target Prices

Analysts present a clear target price consensus for both Booking Holdings Inc. and Expedia Group, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Booking Holdings Inc. | 6806 | 5407 | 6141.38 |

| Expedia Group, Inc. | 330 | 190 | 259.45 |

For Booking Holdings Inc., the consensus target price of 6141.38 suggests upside potential from the current price of 5492.11. Expedia Group’s consensus target of 259.45 indicates a slightly bearish view compared to its current price of 296.33.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Booking Holdings Inc. and Expedia Group, Inc.:

Rating Comparison

Booking Holdings Inc. Rating

- Rating: B- with a very favorable status

- Discounted Cash Flow Score: 5, indicating very favorable DCF valuation

- ROE Score: 1, very unfavorable, showing weak equity returns

- ROA Score: 5, very favorable, demonstrating excellent asset utilization

- Debt To Equity Score: 1, very unfavorable, implying high financial risk

- Overall Score: 3, moderate overall financial standing

Expedia Group, Inc. Rating

- Rating: B with a very favorable status

- Discounted Cash Flow Score: 2, indicating a moderate DCF valuation

- ROE Score: 5, very favorable, reflecting strong profitability from equity

- ROA Score: 4, favorable, indicating good asset efficiency

- Debt To Equity Score: 1, very unfavorable, also indicating high financial risk

- Overall Score: 3, moderate overall financial standing

Which one is the best rated?

Expedia Group holds a higher overall rating (B) compared to Booking Holdings (B-), with stronger scores in ROE and ROA. However, both share moderate overall scores and face similar debt-to-equity challenges.

Scores Comparison

Here is a comparison of the financial scores for Booking Holdings Inc. and Expedia Group, Inc.:

BKNG Scores

- Altman Z-Score: 7.16, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

EXPE Scores

- Altman Z-Score: 1.59, indicating distress zone, high bankruptcy risk.

- Piotroski Score: 9, classified as very strong financial health.

Which company has the best scores?

Booking Holdings shows a much stronger Altman Z-Score, placing it in the safe zone, while Expedia is in distress. However, Expedia has the higher Piotroski Score, indicating very strong financial health compared to Booking’s strong rating.

Grades Comparison

Here is the comparison of recent grades assigned to Booking Holdings Inc. and Expedia Group, Inc.:

Booking Holdings Inc. Grades

The table below summarizes recent grades from reputable grading firms for Booking Holdings Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-09 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Bernstein | Maintain | Market Perform | 2026-01-06 |

| Argus Research | Maintain | Buy | 2026-01-06 |

| BTIG | Maintain | Buy | 2025-12-23 |

| B of A Securities | Upgrade | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-24 |

| Wedbush | Upgrade | Outperform | 2025-11-13 |

| DA Davidson | Maintain | Buy | 2025-10-29 |

| UBS | Maintain | Buy | 2025-10-29 |

Booking Holdings shows a predominantly positive grading trend, with multiple upgrades and a consensus rating of “Buy.”

Expedia Group, Inc. Grades

The following table presents recent grades assigned to Expedia Group, Inc. by recognized grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-09 |

| Bernstein | Maintain | Market Perform | 2026-01-06 |

| BTIG | Maintain | Buy | 2026-01-06 |

| B of A Securities | Maintain | Buy | 2025-12-19 |

| Wedbush | Maintain | Neutral | 2025-12-19 |

| Jefferies | Maintain | Hold | 2025-12-11 |

| DA Davidson | Maintain | Neutral | 2025-12-11 |

| Mizuho | Maintain | Neutral | 2025-11-17 |

| Citigroup | Maintain | Neutral | 2025-11-11 |

| Jefferies | Maintain | Hold | 2025-11-10 |

Expedia Group’s grades are more mixed with a consensus rating of “Hold,” reflecting a cautious stance from analysts.

Which company has the best grades?

Booking Holdings Inc. has received generally stronger grades and upgrades compared to Expedia Group, Inc., which holds more neutral to hold ratings. This suggests that investors may perceive Booking Holdings as having better near-term prospects or stability.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Booking Holdings Inc. (BKNG) and Expedia Group, Inc. (EXPE) based on recent financial performance and market position.

| Criterion | Booking Holdings Inc. (BKNG) | Expedia Group, Inc. (EXPE) |

|---|---|---|

| Diversification | Strong revenue diversification with Merchant ($14.1B), Agency ($8.5B), and Advertising ($1.07B) segments | Primarily focused on Lodging ($10.95B), with smaller Air ($0.43B) and Advertising ($0.95B) segments |

| Profitability | High net margin (24.78%), strong ROIC (44.14%), but negative ROE (-146%) and some leverage concerns | Moderate net margin (9.01%), positive ROE (79.25%) and ROIC (10.66%), better debt-to-assets ratio |

| Innovation | Very favorable economic moat with strong ROIC growth and durable competitive advantage | Slightly favorable moat; growing ROIC but no clear competitive advantage yet |

| Global presence | Extensive global footprint reflected in large agency and merchant revenues | Also global but with less scale and more concentrated lodging revenue |

| Market Share | Leading market share with significant revenues in multiple segments | Smaller market share; revenue concentrated in lodging with less diversification |

Key takeaways: Booking Holdings shows a robust competitive advantage with diversified revenue streams and superior profitability metrics, despite some leverage issues. Expedia is improving profitability and ROIC but lacks a strong moat and has more concentrated revenue sources, implying higher risk and less stability for investors.

Risk Analysis

Below is a comparative risk overview for Booking Holdings Inc. and Expedia Group, Inc. based on the most recent 2024 financial and operational data.

| Metric | Booking Holdings Inc. (BKNG) | Expedia Group, Inc. (EXPE) |

|---|---|---|

| Market Risk | Beta 1.23 – Moderate volatility | Beta 1.43 – Higher volatility |

| Debt Level | High debt to assets (61.65%) – Unfavorable | Moderate debt to assets (29.17%) – Favorable |

| Regulatory Risk | Moderate, travel regulations impact | Moderate, global travel compliance challenges |

| Operational Risk | Diversified platforms, moderate operational complexity | Multiple brands, higher operational complexity |

| Environmental Risk | Moderate, travel industry impact on emissions | Moderate, focus on sustainable travel initiatives |

| Geopolitical Risk | Exposure to global travel disruptions | Exposure to global travel disruptions |

Booking Holdings faces higher leverage risk with a 61.65% debt-to-assets ratio, increasing financial risk despite strong operational cash flow. Expedia’s lower leverage is positive but its Altman Z-Score near distress zone signals caution. Market volatility is higher for Expedia due to its beta. Both companies must manage geopolitical and regulatory uncertainties impacting global travel.

Which Stock to Choose?

Booking Holdings Inc. (BKNG) shows strong income growth with favorable margins and profitability, a slightly favorable overall ratio profile, low net debt, and a very favorable rating of B-. Its economic moat is very favorable, indicating durable competitive advantage and value creation.

Expedia Group, Inc. (EXPE) presents moderate income growth and profitability with a neutral ratio profile, higher net debt, and a very favorable B rating. Its economic moat is slightly favorable, reflecting improving profitability but no clear competitive advantage yet.

Investors prioritizing durable competitive advantages and strong value creation might view BKNG as more appealing, while those focusing on improving profitability and potentially higher growth could find EXPE more suitable. The choice could depend on the investor’s risk tolerance and strategic focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Booking Holdings Inc. and Expedia Group, Inc. to enhance your investment decisions: