Block, Inc. and Rubrik, Inc. both operate within the software infrastructure sector, yet they serve distinct yet complementary niches—Block focuses on payment solutions and commerce tools, while Rubrik specializes in data security and cloud protection. Their innovative approaches address critical needs in digital business operations. This article will explore which company offers the most compelling investment opportunity for those looking to strengthen their portfolios in technology.

Table of contents

Companies Overview

I will begin the comparison between Block, Inc. and Rubrik, Inc. by providing an overview of these two companies and their main differences.

Block, Inc. Overview

Block, Inc. focuses on creating tools that enable sellers to accept card payments, offering hardware and software solutions like Magstripe readers, Square Stand, and Square Register. Its services include payment processing, reporting, analytics, and next-day settlement. The company also operates Cash App and Weebly, serving markets in the US, Canada, Japan, Australia, and Europe, positioning itself as a comprehensive payment and commerce platform.

Rubrik, Inc. Overview

Rubrik, Inc. specializes in data security solutions, including enterprise and cloud data protection, data threat analytics, and cyber recovery. It serves a wide range of industries such as financial, healthcare, education, and public sectors globally. Founded in 2013 and rebranded in 2014, Rubrik is positioned as a key player in cybersecurity and data management with a focus on safeguarding unstructured and SaaS data.

Key similarities and differences

Both Block and Rubrik operate in the technology sector with a focus on software infrastructure, but Block centers on payment processing and commerce tools, while Rubrik concentrates on data security and protection services. Block has a larger workforce and market cap at $40B compared to Rubrik’s $13B, and Block’s products target merchant solutions, whereas Rubrik’s offerings address enterprise data resilience and cyber threats.

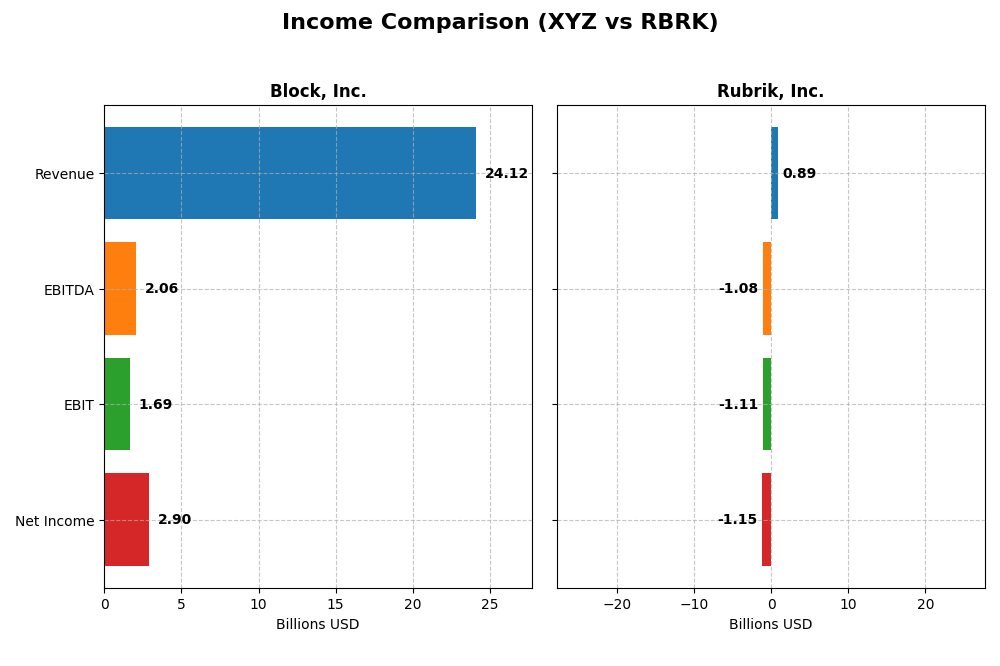

Income Statement Comparison

This table presents a side-by-side comparison of the key income statement metrics for Block, Inc. and Rubrik, Inc. for their most recent fiscal years.

| Metric | Block, Inc. (2024) | Rubrik, Inc. (2025) |

|---|---|---|

| Market Cap | 40B | 13.4B |

| Revenue | 24.1B | 886.5M |

| EBITDA | 2.06B | -1.08B |

| EBIT | 1.69B | -1.11B |

| Net Income | 2.90B | -1.15B |

| EPS | 4.7 | -7.48 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Block, Inc.

Block, Inc. demonstrated strong revenue growth from 2020 to 2024, rising from $9.5B to $24.1B, with net income turning positive and reaching $2.9B in 2024. Gross margin remained favorable at 36.85%, while net margin improved significantly to 12.01%. The latest year showcased accelerated growth in revenue and substantial margin enhancement, reflecting operational improvements.

Rubrik, Inc.

Rubrik, Inc. experienced steady revenue growth between 2021 and 2025, increasing from $388M to $887M. Gross margin was robust at 70.02%, but EBIT and net margins remained negative, with the net margin at -130.26% in 2025. Despite higher revenue, the company’s profitability declined, impacted by increasing operating expenses and negative earnings growth.

Which one has the stronger fundamentals?

Block, Inc. presents stronger fundamentals with favorable revenue and net income growth, solid gross and net margins, and an overall positive income statement evaluation. Conversely, Rubrik, Inc. shows favorable revenue growth but suffers from persistent losses and unfavorable profitability metrics, resulting in a less favorable financial position over the assessed period.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Block, Inc. and Rubrik, Inc. based on their most recent fiscal year data.

| Ratios | Block, Inc. (XYZ) 2024 | Rubrik, Inc. (RBRK) 2025 |

|---|---|---|

| ROE | 13.62% | 208.55% |

| ROIC | 3.03% | -234.85% |

| P/E | 18.10 | -9.79 |

| P/B | 2.47 | -20.42 |

| Current Ratio | 2.33 | 1.13 |

| Quick Ratio | 2.31 | 1.13 |

| D/E (Debt/Equity) | 0.37 | -0.63 |

| Debt-to-Assets | 21.53% | 24.65% |

| Interest Coverage | 95.93 | -27.49 |

| Asset Turnover | 0.66 | 0.62 |

| Fixed Asset Turnover | 45.14 | 16.67 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Block, Inc.

Block, Inc. shows a balanced ratio profile with 50% favorable and 21.4% unfavorable metrics. Its net margin at 12.01% is strong, while return on equity at 13.62% is neutral; however, return on invested capital and WACC are unfavorable. The company maintains a solid liquidity position with a current ratio of 2.33. Block, Inc. does not pay dividends, likely prioritizing reinvestment and growth strategies.

Rubrik, Inc.

Rubrik, Inc. presents a mixed but overall favorable ratio set, with 57.1% favorable and 28.6% unfavorable metrics. Despite a large negative net margin of -130.26%, it reports a high return on equity of 208.55%. Liquidity ratios are moderate, with a current ratio of 1.13. Rubrik also pays no dividends, reflecting its negative earnings and focus on R&D and expansion.

Which one has the best ratios?

Rubrik, Inc. has a higher proportion of favorable ratios at 57.1% compared to Block’s 50%, but also faces more significant profitability challenges with a deeply negative net margin. Block, Inc.’s ratios show more stability in profitability and liquidity. The choice depends on whether investors prioritize growth potential or more consistent financial fundamentals.

Strategic Positioning

This section compares the strategic positioning of Block, Inc. and Rubrik, Inc., including market position, key segments, and exposure to technological disruption:

Block, Inc.

- Large market cap of 40B with high beta, facing competitive pressure in payment and software infrastructure

- Diversified revenue streams: software, cryptocurrency assets, hardware, and transaction services

- Exposure to disruption through cryptocurrency and payment technologies

Rubrik, Inc.

- Mid-sized market cap of 13B, lower beta, competing in data security software

- Focused on subscription-based data protection and security services with maintenance revenue

- Exposure via cybersecurity and cloud data protection innovation in multiple industries

Block, Inc. vs Rubrik, Inc. Positioning

Block pursues a diversified strategy spanning hardware, software, and cryptocurrency, offering multiple revenue streams. Rubrik focuses on data security solutions with a subscription model, concentrating on enterprise and cloud protection. Each approach bears distinct risk and growth profiles.

Which has the best competitive advantage?

Both companies are currently shedding value with negative ROIC compared to WACC. Block shows improving profitability trends, while Rubrik’s declining ROIC indicates worsening value destruction, reflecting a stronger competitive advantage for Block based on MOAT evaluation.

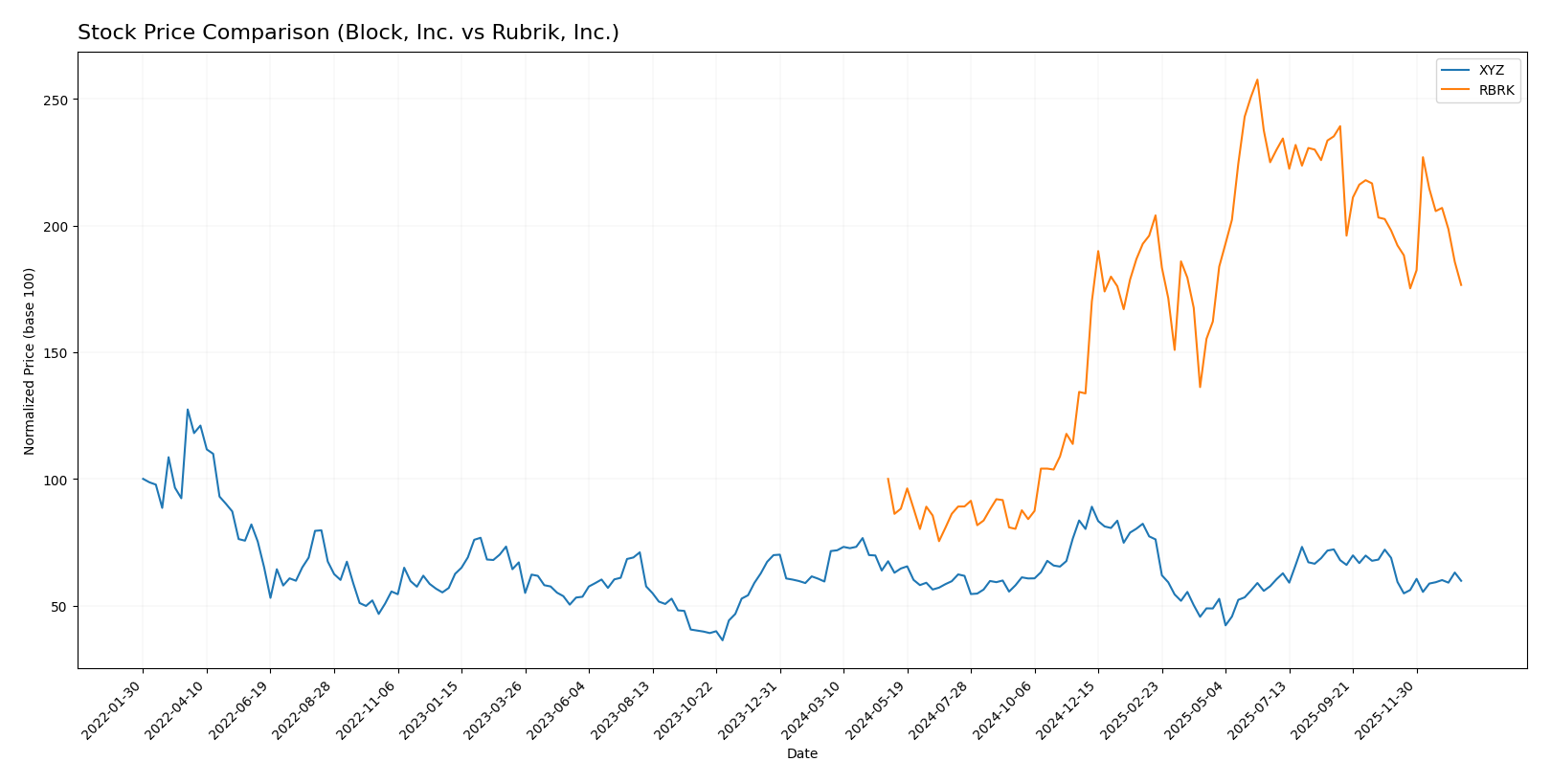

Stock Comparison

The stock prices of Block, Inc. and Rubrik, Inc. have shown contrasting dynamics over the past 12 months, with Block, Inc. experiencing a notable decline while Rubrik, Inc. posted significant gains before recent downturns in both stocks’ trading volumes and price momentum.

Trend Analysis

Block, Inc. exhibited a bearish trend over the past year, with a price decline of 16.43%. The trend showed deceleration, a high volatility level (std deviation 10.43), and price ranged between 46.53 and 98.25. Recent months continued downward with a 13.16% drop.

Rubrik, Inc. demonstrated a bullish trend over the same period, gaining 76.58% despite deceleration in momentum. It showed higher volatility (std deviation 21.4) and price fluctuation from 28.65 to 97.91. Recently, it faced a 10.85% price decline.

Comparing both, Rubrik, Inc. delivered the highest market performance with a large overall price increase, while Block, Inc. experienced a significant bearish shift.

Target Prices

Here is the current analyst consensus on target prices for Block, Inc. and Rubrik, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Block, Inc. | 100 | 65 | 84.91 |

| Rubrik, Inc. | 113 | 105 | 109.33 |

Analysts expect Block, Inc. to appreciate moderately above its current price of 65.95 USD, while Rubrik, Inc.’s consensus target significantly exceeds its present price of 67.10 USD, indicating strong growth potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Block, Inc. and Rubrik, Inc.:

Rating Comparison

Block, Inc. Rating

- Rating: B+, considered very favorable.

- Discounted Cash Flow Score: 3, moderate rating.

- ROE Score: 4, favorable efficiency in equity.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

Rubrik, Inc. Rating

- Rating: C, considered very favorable.

- Discounted Cash Flow Score: 1, very unfavorable.

- ROE Score: 5, very favorable efficiency in equity.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 1, very unfavorable financial risk.

Which one is the best rated?

Block, Inc. holds a higher overall rating (B+) with moderate to favorable scores in key financial metrics, while Rubrik, Inc. shows mixed results with a lower overall rating (C) and mostly very unfavorable scores except for ROE. Block, Inc. is better rated based on this data.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Block, Inc. and Rubrik, Inc.:

Block, Inc. Scores

- Altman Z-Score: 2.70, indicating moderate risk in the grey zone.

- Piotroski Score: 6, showing average financial strength.

Rubrik, Inc. Scores

- Altman Z-Score: 1.41, indicating high risk in the distress zone.

- Piotroski Score: 4, showing average financial strength.

Which company has the best scores?

Block, Inc. has a higher Altman Z-Score in the grey zone, suggesting lower bankruptcy risk compared to Rubrik’s distress zone score. Both have average Piotroski Scores, with Block’s score being slightly higher.

Grades Comparison

Here is the grades comparison for Block, Inc. and Rubrik, Inc.:

Block, Inc. Grades

This table summarizes the latest grades and actions from major grading companies for Block, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Underweight | 2026-01-14 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-02 |

| Needham | Maintain | Buy | 2025-11-24 |

| B of A Securities | Maintain | Buy | 2025-11-21 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-21 |

| BTIG | Maintain | Buy | 2025-11-20 |

| RBC Capital | Maintain | Outperform | 2025-11-20 |

| Stephens & Co. | Maintain | Overweight | 2025-11-20 |

| Mizuho | Maintain | Outperform | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-14 |

Overall, Block, Inc.’s grades show a majority of “Buy” and “Outperform” ratings, with a notable “Underweight” from Piper Sandler, indicating mixed but generally positive sentiment.

Rubrik, Inc. Grades

This table outlines the recent grades and actions from reputable grading companies for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

Rubrik, Inc. consistently receives “Overweight,” “Buy,” and “Outperform” ratings, with a recent upgrade from William Blair, reflecting strong positive analyst confidence.

Which company has the best grades?

Rubrik, Inc. has received more consistent “Overweight” and “Outperform” grades with no negative ratings, whereas Block, Inc. shows a broader range from “Buy” to “Underweight.” This suggests Rubrik may be viewed more favorably by analysts, potentially affecting investor sentiment and portfolio allocation choices.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Block, Inc. and Rubrik, Inc. based on their diversification, profitability, innovation, global presence, and market share using the most recent data available.

| Criterion | Block, Inc. (XYZ) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Diversification | Highly diversified revenue streams: software, crypto assets, hardware, transactions totaling over $25B in 2024 | Revenue concentrated mainly in subscription services ($828M) with smaller maintenance and other product revenues |

| Profitability | Moderate net margin (12.01%), improving ROIC but still below WACC, indicating slight value destruction | Negative net margin (-130%), sharply declining ROIC, signaling significant value destruction |

| Innovation | Strong growth in software and crypto product segments, indicating high innovation and market adaptation | Focused on cloud data management with subscription model, but financials suggest challenges in scaling profitably |

| Global presence | Large global footprint, especially in crypto and transaction processing markets | More niche, primarily serving enterprise customers with specialized data management solutions |

| Market Share | Significant market share in fintech and crypto sectors with growing transaction volumes | Smaller market share in data management, competing with larger cloud service providers |

Block, Inc. demonstrates strong diversification and innovation with improving profitability trends despite current slight value destruction. Rubrik, Inc. struggles with profitability and value creation, showing a need for operational improvements to sustain growth. Investors should weigh Block’s broader market exposure against Rubrik’s concentrated but challenged business model.

Risk Analysis

Below is a risk comparison table for Block, Inc. and Rubrik, Inc. based on the most recent data from 2025-2026.

| Metric | Block, Inc. (XYZ) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Market Risk | High (Beta 2.67 indicates strong volatility) | Low (Beta 0.28 shows low volatility) |

| Debt level | Low (Debt-to-equity 0.37, favorable) | Low (Debt-to-equity negative, favorable) |

| Regulatory Risk | Moderate (Financial services and payments industry) | Moderate (Data security regulations impact) |

| Operational Risk | Moderate (Complex hardware/software integration) | Moderate (Cybersecurity solution dependencies) |

| Environmental Risk | Low (Technology sector, limited direct impact) | Low (Technology sector, limited direct impact) |

| Geopolitical Risk | Moderate (Global operations including US, Canada, Europe) | Moderate (Global client base, sensitive data sectors) |

The most likely and impactful risks are market volatility for Block, Inc. due to its high beta and operational complexity for both companies given their reliance on technology infrastructure and regulatory environments. Rubrik’s financial distress signals and lower Altman Z-score suggest higher bankruptcy risk despite favorable debt levels. Investors should monitor these closely for risk management.

Which Stock to Choose?

Block, Inc. (XYZ) shows favorable income evolution with a 10% revenue growth in 2024 and strong net margin at 12%. Its financial ratios are slightly favorable overall, with a solid current ratio of 2.33 and low debt levels. Profitability metrics like ROE stand neutral at 13.6%, while the company is shedding value given ROIC below WACC, though ROIC is growing. The rating is very favorable at B+, supported by moderate overall financial scores.

Rubrik, Inc. (RBRK) presents mixed income evolution: high revenue growth of 41% but unfavorable net margin at -130%, reflecting negative profitability. Its financial ratios are favorable overall but with key weaknesses in interest coverage and negative asset returns. The company is destroying value with declining ROIC below WACC. Despite a very favorable rating C, its financial stability and cash flow scores are weak, placing it in the distress zone on bankruptcy risk.

For investors prioritizing stability and consistent profitability, Block, Inc. might appear more favorable due to its improving income statement and solid financial ratios despite value shedding. Conversely, those focused on high-growth potential but accepting higher risk could find Rubrik, Inc.’s rapid revenue expansion and favorable rating suggestive of opportunity, albeit with caution given profitability and financial health concerns.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Block, Inc. and Rubrik, Inc. to enhance your investment decisions: