In today’s dynamic tech landscape, Block, Inc. and Informatica Inc. stand out as influential players in the software infrastructure sector. Block focuses on innovative payment solutions and small business tools, while Informatica leads in AI-driven data management platforms for enterprises. Their shared industry and emphasis on technological innovation make them compelling rivals. In this article, I will help you uncover which company offers the most promising investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Block, Inc. and Informatica Inc. by providing an overview of these two companies and their main differences.

Block, Inc. Overview

Block, Inc. focuses on creating tools that enable sellers to accept card payments, offering both hardware and software solutions such as card readers, point-of-sale systems, and payment terminals. Additionally, it provides Cash App for money transfers and Weebly for website hosting. Block operates across multiple countries and serves various industries with a market cap of approximately 40B USD.

Informatica Inc. Overview

Informatica Inc. develops an AI-powered platform designed to connect, manage, and unify data across multi-cloud and hybrid systems, targeting enterprise-scale clients. Its product suite includes data integration, API management, data quality, master data management, and governance tools. Founded in 1993, Informatica is headquartered in Redwood City, California, with a market cap near 7.5B USD.

Key similarities and differences

Both companies operate in the software infrastructure sector but differ in focus: Block centers on payment processing and point-of-sale hardware/software, while Informatica specializes in data management and integration solutions. Block has a broader geographic reach and a larger workforce of 12K employees compared to Informatica’s 5.2K, reflecting distinct market approaches and product offerings.

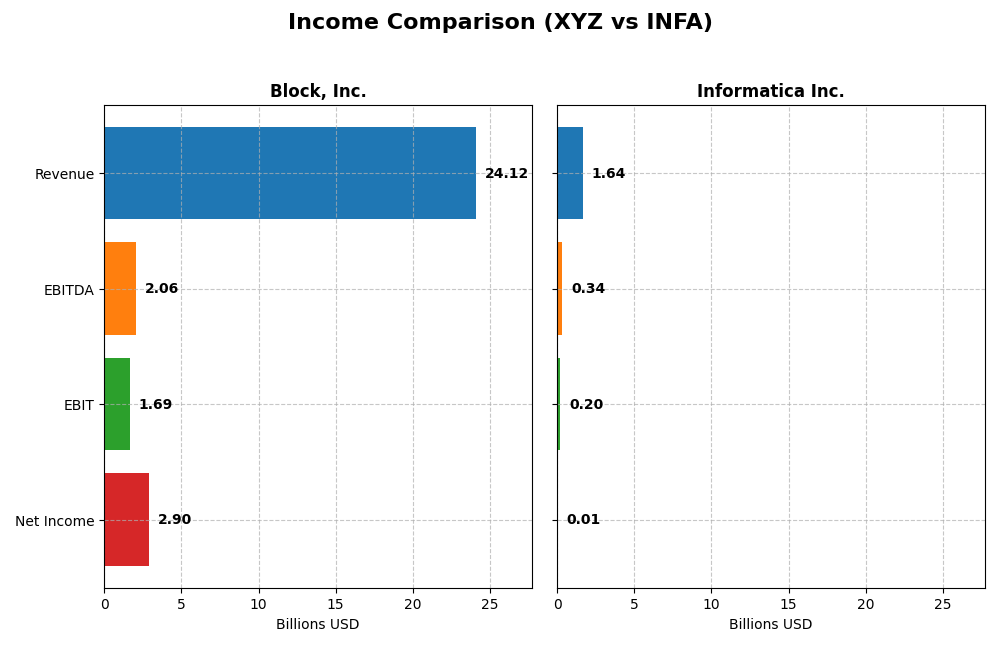

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent fiscal year income statement metrics for Block, Inc. and Informatica Inc., highlighting key financial figures.

| Metric | Block, Inc. (XYZ) | Informatica Inc. (INFA) |

|---|---|---|

| Market Cap | 40.2B | 7.54B |

| Revenue | 24.12B | 1.64B |

| EBITDA | 2.06B | 339M |

| EBIT | 1.69B | 199M |

| Net Income | 2.90B | 9.93M |

| EPS | 4.7 | 0.033 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Block, Inc.

Block, Inc. experienced strong revenue growth from 2020 to 2024, rising from $9.5B to $24.1B, with net income swinging from a $540M loss in 2022 to a $2.9B profit in 2024. Margins improved significantly, with gross margin at 36.85% and net margin reaching 12.01%. The 2024 year showed accelerated growth, marked by a 10.06% revenue increase and a substantial rise in net margin and EPS.

Informatica Inc.

Informatica’s revenue grew steadily from $1.3B in 2020 to $1.64B in 2024, but net income fluctuated, with a loss of $167M in 2020 and a marginal profit of $10M in 2024. Gross margin remained strong at 80.11%, while net margin was modest at 0.61%. In 2024, revenue growth slowed to 2.81%, yet EBIT and net margin showed favorable improvement, indicating better operational efficiency.

Which one has the stronger fundamentals?

Block, Inc. demonstrates stronger fundamentals with robust revenue and net income growth, favorable margin expansions, and significant EPS gains. Informatica, while maintaining a higher gross margin, shows inconsistent profitability and slower revenue growth. Both companies have favorable overall income statement evaluations, but Block’s scale and margin improvements position it with a more compelling income statement trajectory.

Financial Ratios Comparison

The table below presents key financial ratios for Block, Inc. and Informatica Inc. based on their most recent fiscal year data from 2024.

| Ratios | Block, Inc. (XYZ) | Informatica Inc. (INFA) |

|---|---|---|

| ROE | 13.62% | 0.43% |

| ROIC | 3.03% | 0.56% |

| P/E | 18.10 | 787.95 |

| P/B | 2.47 | 3.39 |

| Current Ratio | 2.33 | 1.82 |

| Quick Ratio | 2.31 | 1.82 |

| D/E | 0.37 | 0.81 |

| Debt-to-Assets | 21.53% | 35.24% |

| Interest Coverage | 95.93 | 0.87 |

| Asset Turnover | 0.66 | 0.31 |

| Fixed Asset Turnover | 45.14 | 8.75 |

| Payout ratio | 0.00% | 0.12% |

| Dividend yield | 0.00% | 0.00015% |

Interpretation of the Ratios

Block, Inc.

Block, Inc. shows a balanced mix of favorable and neutral ratios with half rated positively and about 21% unfavorable, indicating some financial strengths alongside areas needing attention. Key strengths include a strong current ratio (2.33) and low debt levels (debt-to-assets 21.53%), while its return on invested capital (3.03%) and WACC (14.27%) are less encouraging. The company does not pay dividends, reflecting a possible reinvestment or growth focus.

Informatica Inc.

Informatica Inc. lacks available data for key ratios, key metrics, and dividend information, making a financial ratio assessment impossible. Without these metrics, no evaluation of profitability, leverage, liquidity, or shareholder returns can be made, limiting insight into the company’s financial health or dividend policy.

Which one has the best ratios?

Based on available data, Block, Inc. presents a more complete and slightly favorable ratio profile with solid liquidity and manageable debt. Informatica Inc.’s missing data prevents any meaningful comparison, leaving Block, Inc. as the only company with a quantifiable ratio evaluation.

Strategic Positioning

This section compares the strategic positioning of Block, Inc. and Informatica Inc., focusing on Market position, Key segments, and Exposure to technological disruption:

Block, Inc.

- Large market cap of 40B with significant competitive pressure in software infrastructure payments.

- Revenue driven by cryptocurrency assets, software, and transaction services, plus hardware sales.

- Exposure includes payments technology hardware and cryptocurrency, facing evolving fintech trends.

Informatica Inc.

- Smaller market cap of 7.5B focused on enterprise data management in the software infrastructure sector.

- Key segments include AI-powered data integration, subscription revenue, and professional services.

- Focused on AI and cloud-based data management, exposed to disruption from cloud adoption and AI advances.

Block, Inc. vs Informatica Inc. Positioning

Block pursues a diversified revenue mix including hardware, software, and cryptocurrency assets, while Informatica concentrates on AI-driven data management and cloud subscriptions. Block’s broader exposure contrasts with Informatica’s specialized enterprise focus.

Which has the best competitive advantage?

Based on MOAT evaluation, Block has a slightly unfavorable moat, indicating value destruction despite improving profitability. Informatica lacks sufficient data for MOAT assessment, preventing a conclusive competitive advantage comparison.

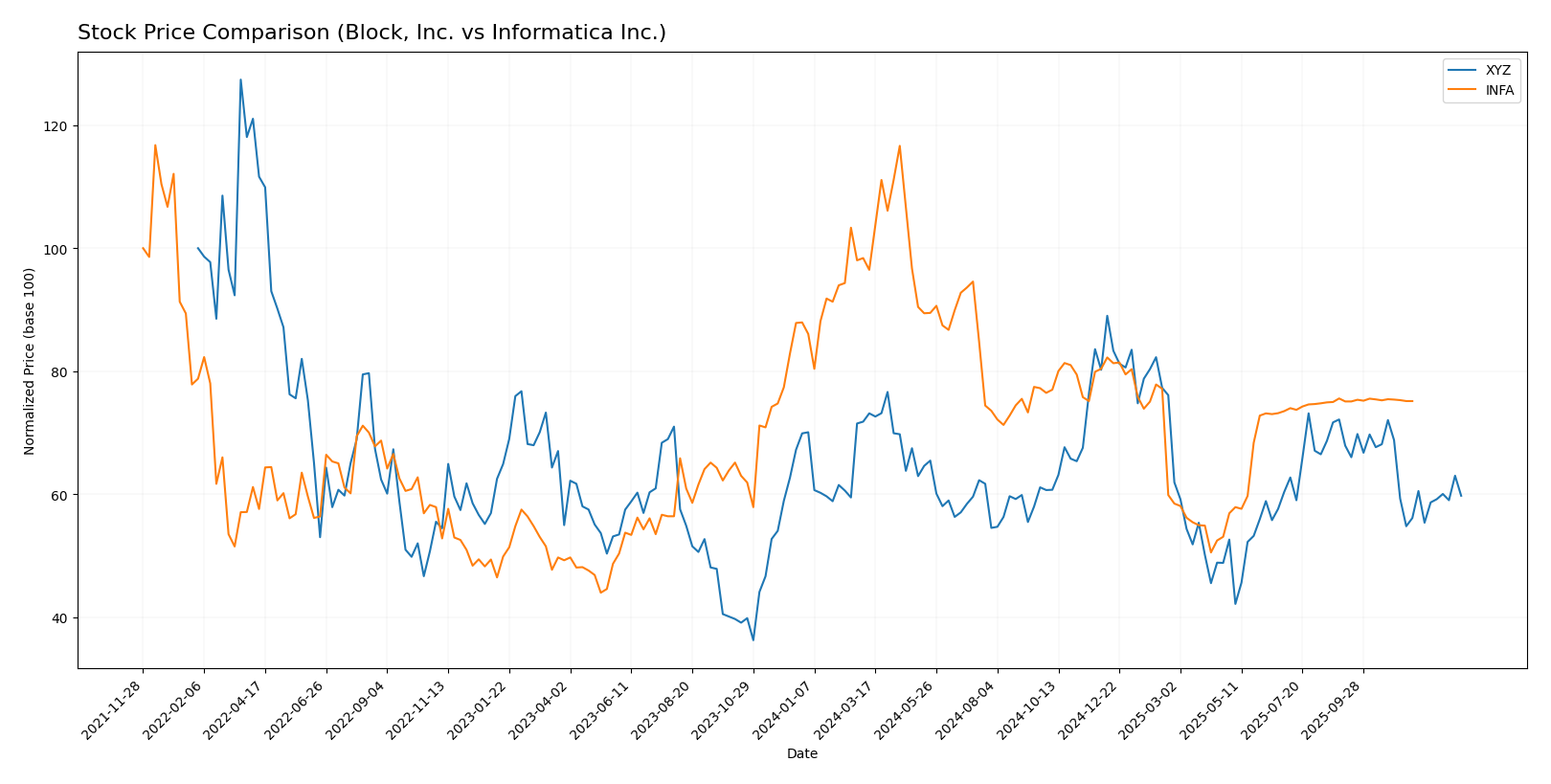

Stock Comparison

The past year revealed notable bearish trends for both Block, Inc. and Informatica Inc., with significant price declines and diverging recent momentum patterns influencing trading dynamics.

Trend Analysis

Block, Inc. (XYZ) displayed a 16.43% price decline over the past 12 months, confirming a bearish trend with deceleration and high volatility reflected by a 10.43 std deviation. The stock peaked at 98.25 and bottomed at 46.53.

Informatica Inc. (INFA) experienced a 12.68% price drop over the same period, also bearish but with acceleration in decline and lower volatility at 4.46 std deviation. Recent movement shows neutral trend with a slight 0.08% increase.

Comparing both, Block, Inc. showed a larger negative price change than Informatica Inc., delivering weaker market performance over the last year.

Target Prices

Analysts present a clear consensus on target prices for Block, Inc. and Informatica Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Block, Inc. | 100 | 65 | 84.91 |

| Informatica Inc. | 27 | 27 | 27 |

The consensus target price for Block, Inc. at 84.91 suggests upside potential from its current price of 65.95 USD. Informatica Inc.’s target price aligns closely with its current price of 24.79 USD, indicating a more neutral outlook.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Block, Inc. and Informatica Inc.:

Rating Comparison

Block, Inc. Rating

- Rating: B+ with a Very Favorable status

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 4, Favorable

- ROA Score: 4, Favorable

- Debt To Equity Score: 2, Moderate

- Overall Score: 3, Moderate

Informatica Inc. Rating

- No rating data available

- No discounted cash flow score provided

- No ROE score provided

- No ROA score provided

- No debt to equity score provided

- No overall score provided

Which one is the best rated?

Based strictly on the provided data, Block, Inc. is better rated with a B+ rating and multiple financial scores available, whereas Informatica Inc. has no rating or score data for comparison.

Scores Comparison

Here is a comparison of the financial scores for Block, Inc. and Informatica Inc.:

Block, Inc. Scores

- Altman Z-Score: 2.70, positioned in the grey zone, indicating moderate bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

Informatica Inc. Scores

- Altman Z-Score: 1.94, positioned in the grey zone, indicating moderate bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

Which company has the best scores?

Both Block, Inc. and Informatica Inc. have Altman Z-Scores in the grey zone, indicating moderate bankruptcy risk. Their Piotroski Scores are identical at 6, reflecting average financial strength. Neither company shows a clear advantage based on these scores.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Block, Inc. and Informatica Inc.:

Block, Inc. Grades

The table below presents recent grades and actions from various reputable grading companies for Block, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Underweight | 2026-01-14 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-02 |

| Needham | Maintain | Buy | 2025-11-24 |

| B of A Securities | Maintain | Buy | 2025-11-21 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-21 |

| BTIG | Maintain | Buy | 2025-11-20 |

| RBC Capital | Maintain | Outperform | 2025-11-20 |

| Stephens & Co. | Maintain | Overweight | 2025-11-20 |

| Mizuho | Maintain | Outperform | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-14 |

The grades for Block, Inc. predominantly indicate positive sentiment, with multiple buy and outperform ratings and no recent downgrades.

Informatica Inc. Grades

The table below summarizes recent grades and rating changes from recognized grading firms for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Informatica Inc.’s grades show a trend of downgrades and predominantly neutral or hold ratings, reflecting a more cautious stance by analysts.

Which company has the best grades?

Block, Inc. has received consistently stronger grades, with multiple buy and outperform ratings, while Informatica Inc. faces several downgrades and mainly neutral or hold grades. This difference may influence investors’ perceptions of growth prospects and risk profiles for each company.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Block, Inc. (XYZ) and Informatica Inc. (INFA) based on their most recent available data.

| Criterion | Block, Inc. (XYZ) | Informatica Inc. (INFA) |

|---|---|---|

| Diversification | High – multiple revenue streams including Software & Data Products (7.16B), Cryptocurrency Assets (10.2B), Transactions (6.6B), Hardware | Moderate – primarily Subscription (1.1B) and Professional Services (78M) |

| Profitability | Moderate – Net margin 12.0%, ROE 13.6%, but ROIC (3.0%) below WACC (14.3%) indicates value destruction | Data unavailable for profitability evaluation |

| Innovation | Strong – growing ROIC trend (+13.7%), significant investment in software and crypto sectors | Data unavailable for innovation metrics |

| Global presence | Significant – operates in global digital payments and crypto markets | Moderate – focus on data management and cloud services with subscription growth |

| Market Share | Large in digital payments and crypto asset management | Niche in data integration and cloud subscription markets |

Key takeaway: Block, Inc. shows diversified revenue sources and improving profitability despite current value destruction, signaling potential growth. Informatica’s data limitations restrict assessment, but its focus on subscription services suggests steady niche positioning. Investors should weigh Block’s innovation-driven growth against profitability challenges and seek additional data on Informatica before decision-making.

Risk Analysis

Below is a comparative overview of key risks for Block, Inc. (XYZ) and Informatica Inc. (INFA) as of 2026:

| Metric | Block, Inc. (XYZ) | Informatica Inc. (INFA) |

|---|---|---|

| Market Risk | High beta (2.67) indicating strong volatility | Moderate beta (1.14) with average volatility |

| Debt level | Low debt-to-equity (0.37), favorable leverage | Data unavailable but likely moderate given sector |

| Regulatory Risk | Moderate, due to fintech and payments regulation | Moderate, with data privacy and cloud regulations |

| Operational Risk | Medium, reliant on technology and hardware integration | Medium, dependent on AI platform performance |

| Environmental Risk | Low, technology sector with minimal direct impact | Low, primarily software with limited environmental footprint |

| Geopolitical Risk | Moderate, exposure to multiple countries including Europe and Asia | Moderate, US-based with global cloud customers |

The most impactful and likely risks relate to market volatility for Block, Inc. due to its high beta and fintech regulatory pressures. Informatica faces moderate risks from regulatory changes in data privacy and operational continuity of its AI-powered platform. Both companies show stable debt profiles and limited environmental risks.

Which Stock to Choose?

Block, Inc. (XYZ) shows strong income growth with a 10.06% revenue increase in 2024 and favorable net margin at 12.01%. Financial ratios are slightly favorable overall, with solid liquidity and low debt levels. Profitability is moderate but improving, though the company is currently shedding value as ROIC is below WACC. The rating is very favorable with a B+ grade.

Informatica Inc. (INFA) also reports a favorable income statement, with an 80.11% gross margin and an EBIT margin of 12.15%. However, revenue growth is slower at 2.81% in 2024, and profitability margins are neutral. Debt levels appear higher, with limited ratio data available, and no rating provided. The company’s financial stability is less transparent due to missing comprehensive data.

For investors prioritizing growth and improving profitability, Block, Inc. might appear more favorable given its strong income growth and solid rating. Conversely, those seeking a company with higher gross margins and stable EBIT might find Informatica Inc. more aligned, despite less complete financial data. The choice could depend on the investor’s risk tolerance and preference for transparency in financial metrics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Block, Inc. and Informatica Inc. to enhance your investment decisions: