In the dynamic world of technology infrastructure, Block, Inc. and GoDaddy Inc. stand out as influential players shaping digital commerce and online presence. Both companies operate in overlapping markets, offering innovative tools for payments, website hosting, and business management. As they evolve with distinct strategies, comparing their strengths is crucial for investors seeking growth and stability. Join me as we explore which company offers the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Block, Inc. and GoDaddy Inc. by providing an overview of these two companies and their main differences.

Block, Inc. Overview

Block, Inc. operates in the software infrastructure industry, focusing on tools that enable sellers to accept card payments with hardware and software solutions. Its product range includes payment terminals, point-of-sale systems, and the Cash App for money transfers and storage. Headquartered in Oakland, California, Block serves customers across several countries, including the US, Canada, and the UK, positioning itself as a comprehensive payment and commerce technology provider.

GoDaddy Inc. Overview

GoDaddy Inc. develops cloud-based technology products aimed at facilitating digital identity and online presence for small businesses and individuals. Its offerings include domain registration, website hosting, marketing tools, and business applications such as email and online stores. Based in Tempe, Arizona, GoDaddy focuses on enabling customers to build and manage their websites and digital marketing efforts with a wide array of services tailored to online business growth.

Key similarities and differences

Both companies operate in the technology sector within the software infrastructure industry, serving business customers with tools for online commerce and presence. Block emphasizes payment processing and point-of-sale hardware combined with software, while GoDaddy focuses on domain services, web hosting, and digital marketing solutions. Block has a larger workforce and broader international reach, whereas GoDaddy targets small businesses primarily through cloud-based hosting and marketing platforms.

Income Statement Comparison

The following table compares key income statement metrics for Block, Inc. and GoDaddy Inc. for the fiscal year 2024, providing a snapshot of their financial performance.

| Metric | Block, Inc. (XYZ) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Cap | 40.2B | 14.5B |

| Revenue | 24.1B | 4.57B |

| EBITDA | 2.06B | 1.06B |

| EBIT | 1.69B | 924M |

| Net Income | 2.90B | 937M |

| EPS | 4.7 | 6.63 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Block, Inc.

Block, Inc. has shown strong revenue growth, rising from $9.5B in 2020 to $24.1B in 2024, with net income swinging from a loss of $540M in 2022 to a profit of $2.9B in 2024. Gross margin improved to 36.85%, while net margin reached 12.01%, both favorable. The latest year saw a 10% revenue increase and a remarkable 268% net margin growth, despite a slight unfavorable rise in operating expenses relative to revenue.

GoDaddy Inc.

GoDaddy’s revenue increased steadily from $3.3B in 2020 to $4.6B in 2024, with net income rising from a loss of $495M in 2020 to $937M in 2024. Margins remain robust, with a gross margin of 63.88% and net margin of 20.49%, both classified as favorable. The most recent year reflected moderate 7.5% revenue growth, but net margin declined by 36.6%, and earnings per share fell nearly 29%, indicating some pressure on profitability.

Which one has the stronger fundamentals?

Block, Inc. displays stronger fundamentals with higher overall revenue and net income growth rates, significant improvement in margins, and a more favorable income statement evaluation (85.7% favorable vs. GoDaddy’s 78.6%). While GoDaddy maintains higher margins, its recent net margin and EPS declines suggest some challenges. Block’s rapid recovery and expansive growth offer a more compelling fundamental trajectory.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Block, Inc. (XYZ) and GoDaddy Inc. (GDDY) based on their most recent fiscal year 2024 data.

| Ratios | Block, Inc. (XYZ) | GoDaddy Inc. (GDDY) |

|---|---|---|

| ROE | 13.62% | 135.37% |

| ROIC | 3.03% | 16.02% |

| P/E | 18.10 | 29.76 |

| P/B | 2.47 | 40.28 |

| Current Ratio | 2.33 | 0.72 |

| Quick Ratio | 2.31 | 0.72 |

| D/E (Debt-to-Equity) | 0.37 | 5.63 |

| Debt-to-Assets | 21.53% | 47.29% |

| Interest Coverage | 95.93 | 5.64 |

| Asset Turnover | 0.66 | 0.56 |

| Fixed Asset Turnover | 45.14 | 22.22 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Block, Inc.

Block, Inc. shows a mix of favorable and neutral ratios with strengths in liquidity, low leverage, and strong interest coverage, but its return on invested capital (3.03%) and WACC (14.27%) are unfavorable. The company does not pay dividends, reflecting a reinvestment strategy likely aimed at growth and development in its technology infrastructure. Shareholder returns rely on capital gains rather than income distributions.

GoDaddy Inc.

GoDaddy Inc. presents strong profitability ratios, including a high net margin (20.49%) and exceptional return on equity (135.37%), supported by favorable WACC and interest coverage. However, its valuation metrics like price-to-book (40.28) and price-to-earnings (29.76) ratios are considered unfavorable, and liquidity ratios are weak. The company does not pay dividends, probably focusing on growth and reinvestment, without share buybacks.

Which one has the best ratios?

Block, Inc. has a slightly favorable overall ratio profile with solid liquidity and manageable debt levels, while GoDaddy exhibits strong profitability but faces concerns with high valuation multiples and weak liquidity. The balance of favorable versus unfavorable ratios renders Block, Inc. marginally better positioned in terms of ratio quality compared to GoDaddy’s more polarized financial metrics.

Strategic Positioning

This section compares the strategic positioning of Block, Inc. and GoDaddy Inc. in terms of market position, key segments, and exposure to technological disruption:

Block, Inc.

- Market leader in payment processing with significant competitive pressure from fintech peers.

- Diverse revenue streams from software, cryptocurrency assets, hardware, and transaction services.

- Exposure includes payments technology and cryptocurrency, facing rapid fintech innovation.

GoDaddy Inc.

- Established in cloud-based technology products with moderate competitive pressure in domain and hosting markets.

- Revenue driven by core platform, applications, commerce, domains, and hosting services.

- Focuses on cloud services and web presence, vulnerable to shifts in digital marketing and hosting technologies.

Block, Inc. vs GoDaddy Inc. Positioning

Block, Inc. pursues a diversified strategy with multiple revenue streams including cryptocurrency and hardware, while GoDaddy concentrates on cloud-based platforms and online presence services. Block’s broad scope offers multiple growth drivers but also wider exposure, whereas GoDaddy’s focus allows specialization but may limit market breadth.

Which has the best competitive advantage?

GoDaddy demonstrates a very favorable moat with ROIC exceeding WACC and strong growth, indicating efficient capital use and durable competitive advantage. Block shows a slightly unfavorable moat, shedding value though with improving profitability, suggesting weaker competitive positioning.

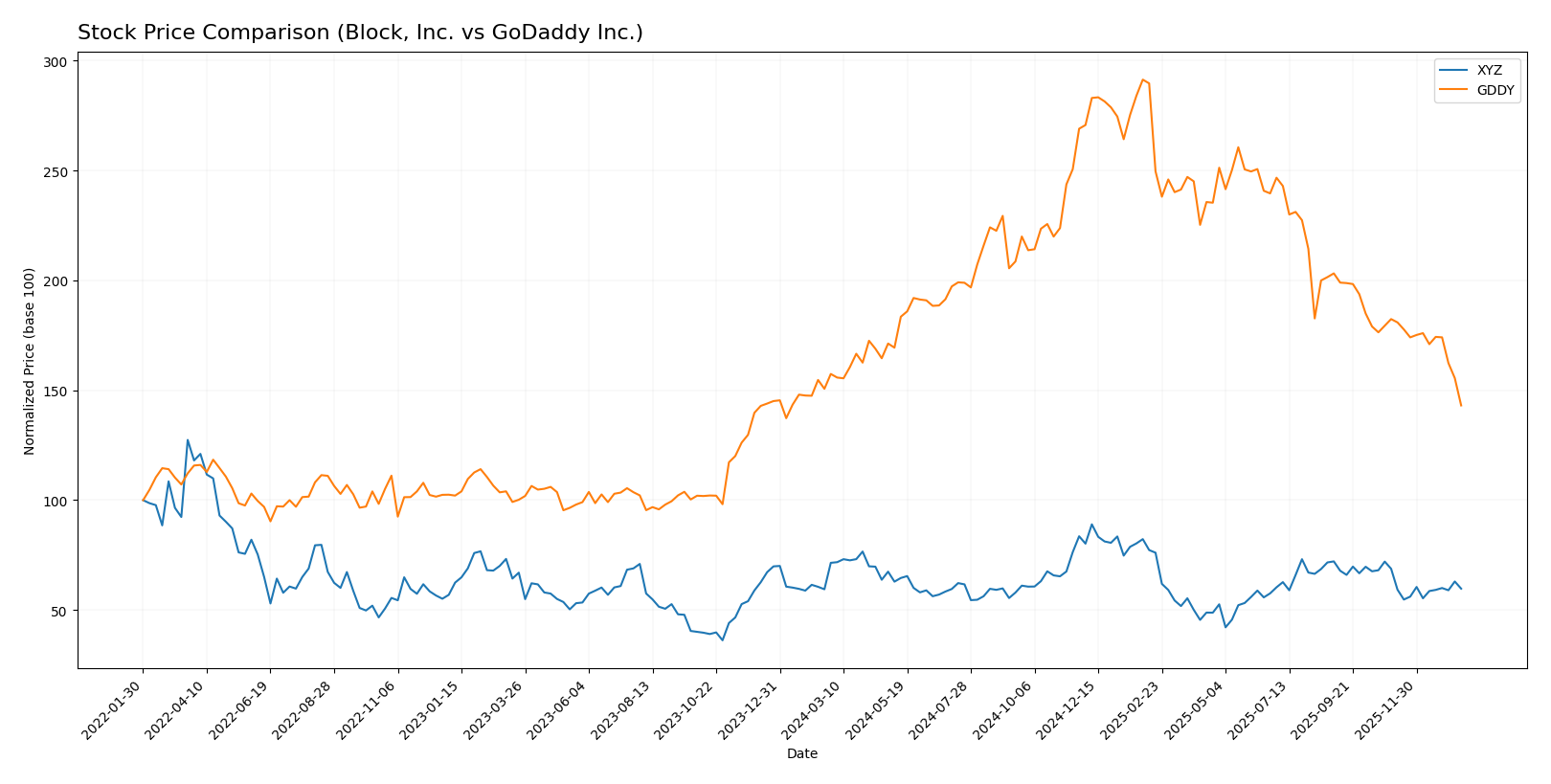

Stock Comparison

The stock prices of Block, Inc. and GoDaddy Inc. have both experienced notable declines over the past 12 months, reflecting bearish trends with decelerating momentum and distinct trading volume dynamics.

Trend Analysis

Block, Inc. (XYZ) showed a bearish trend over the past year, with a price decline of 16.43%, decelerating downward momentum, and a standard deviation of 10.43. The stock fluctuated between a high of 98.25 and a low of 46.53.

GoDaddy Inc. (GDDY) also exhibited a bearish trend with a 9.09% price drop over the same period. This decline decelerated as well, but with higher volatility reflected by a 27.35 standard deviation. The price ranged between 212.65 and 104.46.

Comparing both stocks, Block, Inc. delivered a larger percentage loss than GoDaddy Inc., indicating that GoDaddy had the relatively better market performance despite both trending downward.

Target Prices

Analysts provide a clear consensus on target prices for Block, Inc. and GoDaddy Inc., indicating potential upside from current levels.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Block, Inc. | 100 | 65 | 84.91 |

| GoDaddy Inc. | 182 | 70 | 143.33 |

The consensus target prices suggest moderate to strong upside potential for Block, Inc. and significant upside for GoDaddy Inc., both above their current trading prices of 65.95 and 104.46 respectively.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Block, Inc. and GoDaddy Inc.:

Rating Comparison

Block, Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate, rated 3 out of 5.

- ROE Score: Favorable, rated 4 out of 5.

- ROA Score: Favorable, rated 4 out of 5.

- Debt To Equity Score: Moderate risk, rated 2 out of 5.

- Overall Score: Moderate, rated 3 out of 5.

GoDaddy Inc. Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: Very favorable, rated 5 out of 5.

- ROE Score: Very favorable, rated 5 out of 5.

- ROA Score: Favorable, rated 4 out of 5.

- Debt To Equity Score: Very unfavorable risk, rated 1 out of 5.

- Overall Score: Moderate, rated 3 out of 5.

Which one is the best rated?

Both Block, Inc. and GoDaddy Inc. share the same overall B+ rating and moderate overall score. However, GoDaddy leads with stronger discounted cash flow and ROE scores, while Block has a more favorable debt-to-equity score, indicating differing strengths in their financial profiles.

Scores Comparison

This section compares the Altman Z-Score and Piotroski Score of Block, Inc. and GoDaddy Inc.:

Block, Inc. Scores

- Altman Z-Score: 2.70, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 6, reflecting average financial strength.

GoDaddy Inc. Scores

- Altman Z-Score: 1.53, indicating high bankruptcy risk in the distress zone.

- Piotroski Score: 8, reflecting very strong financial strength.

Which company has the best scores?

GoDaddy Inc. shows a stronger Piotroski Score at 8 versus Block’s 6, indicating better financial health. However, Block has a safer Altman Z-Score in the grey zone compared to GoDaddy’s distress zone score.

Grades Comparison

The following section presents a detailed comparison of grades assigned to Block, Inc. and GoDaddy Inc. by reputable grading companies:

Block, Inc. Grades

This table summarizes recent grades issued by well-known financial institutions for Block, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Underweight | 2026-01-14 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-02 |

| Needham | Maintain | Buy | 2025-11-24 |

| B of A Securities | Maintain | Buy | 2025-11-21 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-21 |

| BTIG | Maintain | Buy | 2025-11-20 |

| RBC Capital | Maintain | Outperform | 2025-11-20 |

| Stephens & Co. | Maintain | Overweight | 2025-11-20 |

| Mizuho | Maintain | Outperform | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-14 |

The overall trend for Block, Inc. shows mostly positive grades with several “Buy” and “Outperform” ratings, although a recent “Underweight” from Piper Sandler indicates some caution.

GoDaddy Inc. Grades

This table provides an overview of recent grades from established grading companies for GoDaddy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

Grades for GoDaddy Inc. display a mix of “Buy,” “Hold,” and “Neutral” ratings, reflecting a balanced market view with moderate optimism.

Which company has the best grades?

Both companies have received a consensus “Buy” rating, but Block, Inc. shows stronger buy-side support with numerous “Buy” and “Outperform” grades from multiple firms. This may suggest relatively higher analyst confidence, potentially impacting investor sentiment more positively compared to GoDaddy’s more mixed evaluations.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of Block, Inc. (XYZ) and GoDaddy Inc. (GDDY) based on their recent financial and operational data.

| Criterion | Block, Inc. (XYZ) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Diversification | Highly diversified across software, crypto assets, hardware, and transactions (largest in crypto assets at $10.2B in 2024) | Focused on core platform and commerce applications with steady growth ($2.9B in core platform in 2024) |

| Profitability | Moderate net margin (12.0%), but ROIC (3.03%) below WACC (14.27%), indicating value destruction | Strong profitability with 20.5% net margin and ROIC (16.0%) well above WACC (7.42%), creating value |

| Innovation | Growing ROIC trend (+13.7%) suggests increasing operational efficiency and innovation | Very favorable moat status with rapidly growing ROIC (+147%), reflecting durable competitive advantage |

| Global presence | Broad, with significant crypto and software market reach | Strong global web services presence, but more focused on domain and hosting markets |

| Market Share | Substantial in crypto transaction processing and software | Leading in domain registration and web hosting with expanding commerce solutions |

Key takeaways: GoDaddy demonstrates a clear competitive advantage with strong profitability and value creation, despite some liquidity and leverage concerns. Block shows promising growth in operational efficiency but currently destroys value due to high capital costs; diversification and innovation remain strengths to monitor.

Risk Analysis

Below is a comparative table of key risks for Block, Inc. and GoDaddy Inc. based on the most recent 2024 data:

| Metric | Block, Inc. (XYZ) | GoDaddy Inc. (GDDY) |

|---|---|---|

| Market Risk | High beta (2.665), volatile tech sector | Moderate beta (0.948), more stable market position |

| Debt level | Low debt-to-equity (0.37), favorable leverage | High debt-to-equity (5.63), significant financial risk |

| Regulatory Risk | Moderate, fintech and payments regulations | Moderate, internet and data privacy regulations |

| Operational Risk | Moderate, reliance on payment hardware and software | Moderate, cloud infrastructure and hosting services |

| Environmental Risk | Low, limited direct impact | Low, limited direct impact |

| Geopolitical Risk | Moderate, international operations in multiple countries | Moderate, US-focused with some international presence |

Block, Inc. faces notable market risk due to its high beta and exposure to fintech volatility, but its debt levels are low and well managed. GoDaddy carries higher financial risk with substantial leverage, despite strong profitability metrics. Regulatory and operational risks are moderate for both, with geopolitical factors impacting their diverse markets. The most impactful risk is GoDaddy’s high debt burden, which could constrain flexibility in downturns.

Which Stock to Choose?

Block, Inc. (XYZ) shows strong income growth with a 10.06% revenue increase and favorable net margin of 12.01%. Its financial ratios are slightly favorable, supported by low debt levels and a very favorable rating of B+. However, its ROIC is below WACC, indicating slight value destruction despite improving profitability.

GoDaddy Inc. (GDDY) presents stable income with a 7.5% revenue growth and a higher net margin of 20.49%. Financial ratios are neutral due to high leverage and weaker liquidity, but it boasts a very favorable rating B+ and a very favorable moat with ROIC exceeding WACC, signaling value creation and strong competitive advantage.

Investors seeking growth with improving profitability might find Block, Inc. appealing given its favorable income growth and financial stability. Conversely, those prioritizing value creation and competitive moat strength could see GoDaddy as a potentially attractive option despite its higher leverage and liquidity concerns.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Block, Inc. and GoDaddy Inc. to enhance your investment decisions: