In today’s fast-evolving technology landscape, choosing the right company to invest in requires careful analysis. CrowdStrike Holdings, Inc. and Block, Inc. both operate in the software infrastructure sector, yet they serve distinct but overlapping markets with innovative cloud-based solutions. CrowdStrike focuses on cybersecurity, while Block revolutionizes payment processing and financial tools. This article will help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between CrowdStrike Holdings, Inc. and Block, Inc. by providing an overview of these two companies and their main differences.

CrowdStrike Overview

CrowdStrike Holdings, Inc. specializes in cloud-delivered protection across endpoints and cloud workloads, focusing on threat intelligence, managed security services, and Zero Trust identity protection. Founded in 2011 and based in Austin, Texas, CrowdStrike primarily sells subscriptions to its Falcon platform through direct and channel partner sales, positioning itself as a leader in cybersecurity software infrastructure.

Block Overview

Block, Inc., formerly Square, Inc., develops payment and point-of-sale hardware and software solutions for sellers, including card readers, POS terminals, and software suites like Square for Retail and Restaurants. Founded in 2009 and headquartered in Oakland, California, Block also offers the Cash App for personal finance and website hosting services via Weebly, serving multiple countries with a broad technology infrastructure focus.

Key similarities and differences

Both companies operate in the software infrastructure industry within the technology sector, providing cloud-based solutions. CrowdStrike focuses on cybersecurity protection and threat management, while Block emphasizes payment processing and merchant services through hardware and software integration. CrowdStrike’s model centers on subscription sales for security, whereas Block offers a mix of hardware products, software platforms, and financial services.

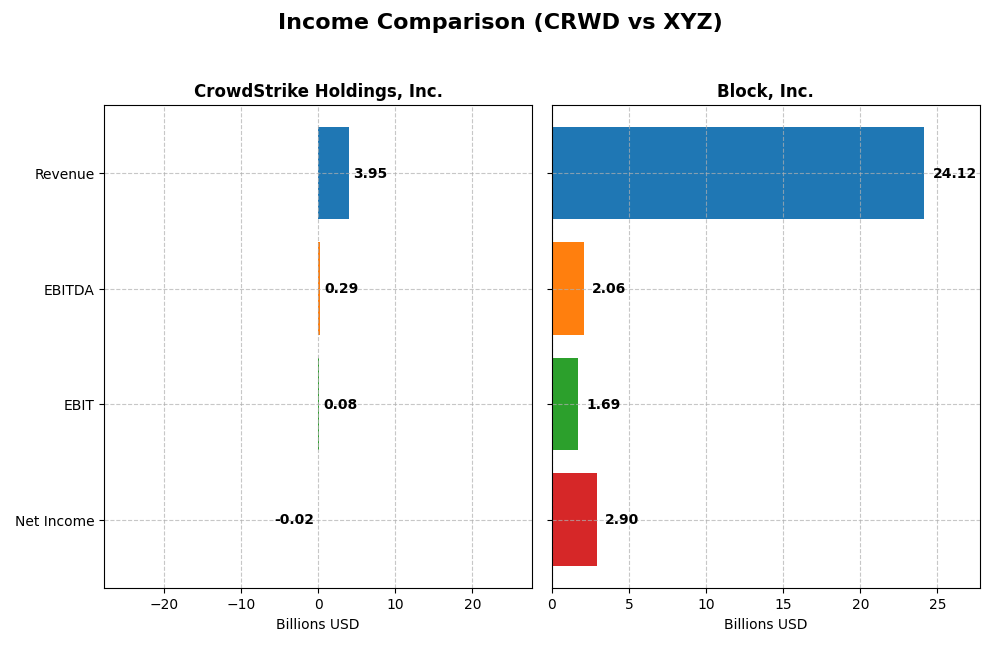

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent fiscal year income statement figures for CrowdStrike Holdings, Inc. and Block, Inc., reflecting key profitability and earnings metrics.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | Block, Inc. (XYZ) |

|---|---|---|

| Market Cap | 114.4B | 40.2B |

| Revenue | 3.95B | 24.12B |

| EBITDA | 295M | 2.06B |

| EBIT | 81M | 1.69B |

| Net Income | -19.3M | 2.90B |

| EPS | -0.08 | 4.70 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

CrowdStrike Holdings, Inc.

From 2021 to 2025, CrowdStrike’s revenue grew substantially from 874M to 3.95B, reflecting a strong upward trend. Gross margins remained favorable around 75%, though net income turned negative in 2025 at -19M, marking a decline from prior positive results. The latest year showed slowed EBIT and net margin declines despite continued revenue growth, signaling margin pressure.

Block, Inc.

Block’s revenue steadily increased from 9.5B in 2020 to 24.1B in 2024, with gross margin holding favorably at 37%. Net income surged to nearly 2.9B in 2024 from a modest 9.8M in 2023, driven by a sharp improvement in EBIT margin to 7%. The recent year exhibited strong profitability gains and margin expansion, reflecting operational leverage.

Which one has the stronger fundamentals?

Block demonstrates stronger fundamentals with consistently favorable gross and net margins, significant net income growth, and robust earnings expansion over the period. CrowdStrike shows impressive revenue growth but recent margin contractions and negative net income raise caution. Block’s higher proportion of favorable income statement metrics indicates a more solid financial footing.

Financial Ratios Comparison

The table presents a side-by-side comparison of key financial ratios for CrowdStrike Holdings, Inc. and Block, Inc. based on their latest fiscal year data, allowing a clear view of their financial performance and stability.

| Ratios | CrowdStrike Holdings, Inc. (2025) | Block, Inc. (2024) |

|---|---|---|

| ROE | -0.59% | 13.62% |

| ROIC | 0.70% | 3.03% |

| P/E | -5056 | 18.10 |

| P/B | 29.71 | 2.47 |

| Current Ratio | 1.67 | 2.33 |

| Quick Ratio | 1.67 | 2.31 |

| D/E (Debt-to-Equity) | 0.24 | 0.37 |

| Debt-to-Assets | 9.07% | 21.53% |

| Interest Coverage | -4.58 | 95.93 |

| Asset Turnover | 0.45 | 0.66 |

| Fixed Asset Turnover | 4.76 | 45.14 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

CrowdStrike Holdings, Inc.

CrowdStrike shows a mixed ratio profile with strong liquidity (current and quick ratios at 1.67) and low leverage (debt-to-equity 0.24), but weak profitability metrics such as negative net margin (-0.49%) and return on equity (-0.59%). Asset turnover is low, indicating potential operational inefficiency. The company does not pay dividends, reflecting a focus on reinvestment and growth rather than shareholder payouts.

Block, Inc.

Block presents a generally positive ratio set, with a favorable net margin of 12.01% and strong liquidity ratios above 2.0. Debt metrics are sound, and interest coverage is robust at 181.31, suggesting low financial risk. However, some concerns include an unfavorable weighted average cost of capital (14.27%) and no dividend payments, consistent with a strategy prioritizing reinvestment and expansion over dividends.

Which one has the best ratios?

Block, Inc. holds a slightly favorable overall ratio profile with stronger profitability and liquidity compared to CrowdStrike, which faces notable profitability challenges despite solid liquidity and leverage ratios. Both companies refrain from dividend payments, but Block’s combination of higher net margin and interest coverage tips the balance in its favor from a ratios perspective.

Strategic Positioning

This section compares the strategic positioning of CrowdStrike and Block, including Market position, Key segments, and disruption:

CrowdStrike Holdings, Inc.

- Leading cloud-delivered cybersecurity provider facing competition in software infrastructure.

- Focuses on subscription sales of Falcon platform and professional services in cybersecurity.

- Exposure to cloud security innovation but limited info on disruption risk from emerging tech.

Block, Inc.

- Payment solutions leader with competitive pressures in fintech hardware and software.

- Diverse revenue streams: software, hardware, transactions, and cryptocurrency assets.

- Faces disruption risks from evolving payment technologies and cryptocurrency markets.

CrowdStrike Holdings, Inc. vs Block, Inc. Positioning

CrowdStrike concentrates on cybersecurity subscriptions and services, while Block offers a diversified mix of software, hardware, and crypto assets. CrowdStrike’s specialization contrasts with Block’s broader fintech ecosystem presence.

Which has the best competitive advantage?

Both companies currently shed value but show improving profitability trends. Neither demonstrates a strong economic moat, indicating limited competitive advantage based on ROIC versus WACC analysis.

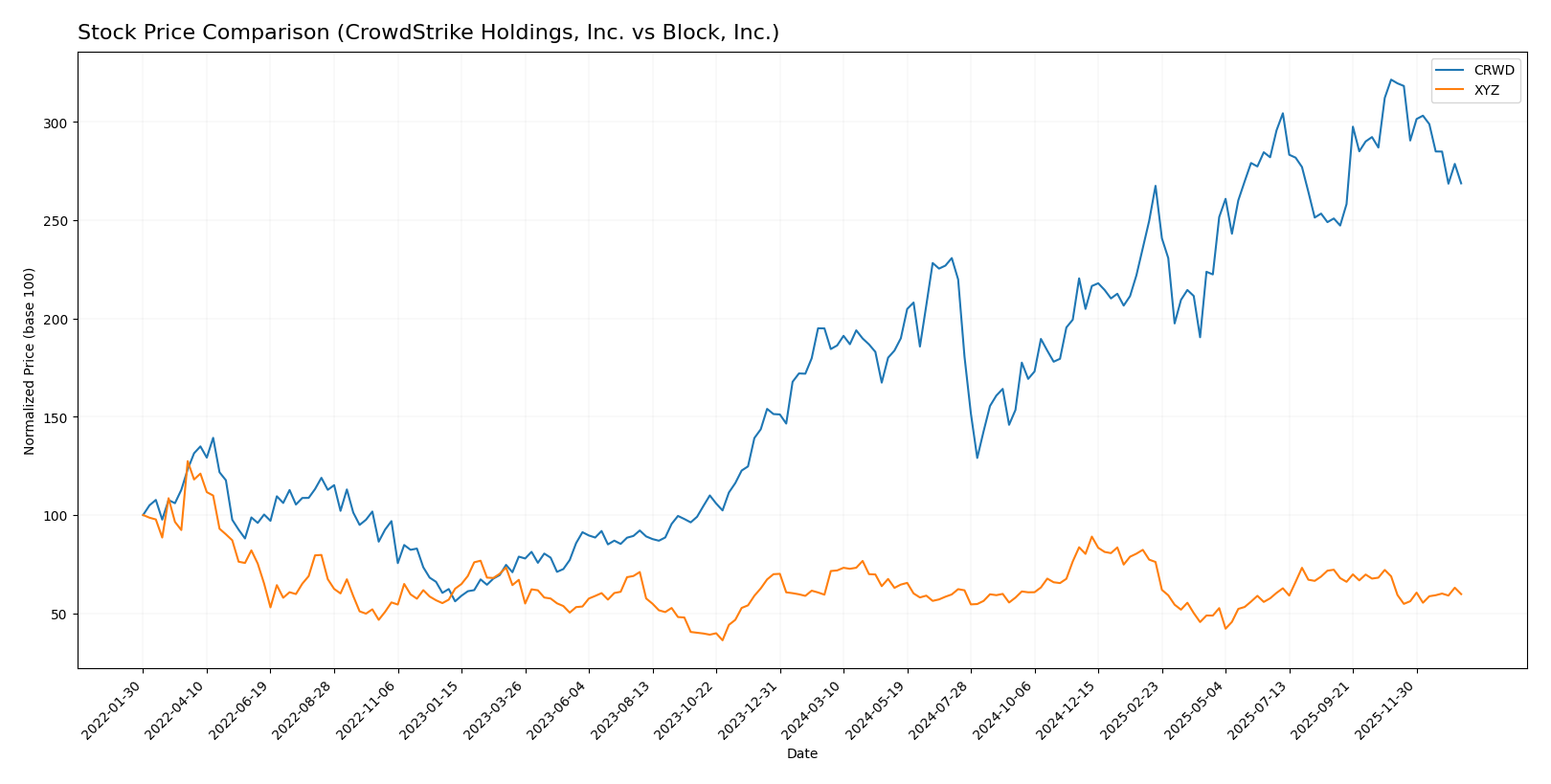

Stock Comparison

The stock prices of CrowdStrike Holdings, Inc. and Block, Inc. have exhibited contrasting trends over the past 12 months, with significant movement in CrowdStrike’s shares and a steady decline in Block’s stock, reflecting divergent market dynamics.

Trend Analysis

CrowdStrike Holdings, Inc. showed a bullish trend over the past year with a 45.71% price increase, despite deceleration and high volatility marked by an 80.53 standard deviation and a recent negative slope since November 2025.

Block, Inc. demonstrated a bearish trend with a 16.43% price decline over the same period, also decelerating, accompanied by lower volatility (10.43 standard deviation) and a mild negative slope in recent months.

Comparing both stocks, CrowdStrike delivered the highest market performance over the past year, outperforming Block which faced a consistent downward trend.

Target Prices

Analysts present a clear consensus on target prices for CrowdStrike Holdings, Inc. and Block, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| CrowdStrike Holdings, Inc. | 706 | 353 | 553.47 |

| Block, Inc. | 100 | 65 | 84.91 |

The consensus target price for CrowdStrike is significantly above its current price of 453.88, indicating optimistic growth expectations. Block’s target consensus at 84.91 also suggests upside potential compared to its current price of 65.95.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for CrowdStrike Holdings, Inc. and Block, Inc.:

Rating Comparison

CRWD Rating

- Rating: C, evaluated as Very Favorable overall.

- Discounted Cash Flow Score: 4, marked Favorable.

- ROE Score: 1, marked Very Unfavorable.

- ROA Score: 1, marked Very Unfavorable.

- Debt To Equity Score: 3, marked Moderate.

- Overall Score: 2, marked Moderate.

XYZ Rating

- Rating: B+, evaluated as Very Favorable overall.

- Discounted Cash Flow Score: 3, marked Moderate.

- ROE Score: 4, marked Favorable.

- ROA Score: 4, marked Favorable.

- Debt To Equity Score: 2, marked Moderate.

- Overall Score: 3, marked Moderate.

Which one is the best rated?

Based strictly on the provided data, Block, Inc. (XYZ) holds a stronger rating (B+) and higher overall, ROE, and ROA scores than CrowdStrike (CRWD). CrowdStrike has a favorable discounted cash flow score but weaker profitability metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for CrowdStrike and Block:

CrowdStrike Scores

- Altman Z-Score: 12.38, indicating a safe zone status.

- Piotroski Score: 4, classified as average financial strength.

Block Scores

- Altman Z-Score: 2.70, indicating a grey zone status.

- Piotroski Score: 6, classified as average financial strength.

Which company has the best scores?

CrowdStrike has a notably higher Altman Z-Score, placing it firmly in the safe zone, while Block’s score is in the grey zone. Block has a higher Piotroski Score, but both are classified as average.

Grades Comparison

Here is a comparison of the latest grades from reputable grading companies for the two companies:

CrowdStrike Holdings, Inc. Grades

The following table summarizes the recent grades assigned to CrowdStrike by established financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-03 |

Overall, CrowdStrike’s grades mostly indicate a positive outlook with multiple buy ratings and some overweight or outperform positions, despite a single downgrade to sector weight.

Block, Inc. Grades

The table below shows recent grades from well-known grading companies for Block, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Underweight | 2026-01-14 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-02 |

| Needham | Maintain | Buy | 2025-11-24 |

| B of A Securities | Maintain | Buy | 2025-11-21 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-21 |

| BTIG | Maintain | Buy | 2025-11-20 |

| RBC Capital | Maintain | Outperform | 2025-11-20 |

| Stephens & Co. | Maintain | Overweight | 2025-11-20 |

| Mizuho | Maintain | Outperform | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-14 |

Block, Inc. shows a mixed rating profile with a range from underweight to outperform, but multiple buy and outperform ratings suggest general positivity.

Which company has the best grades?

Both companies have a consensus “Buy” rating, but CrowdStrike exhibits a stronger concentration of buy and outperform grades from major analysts. This may indicate relatively higher confidence among analysts, potentially impacting investor perception positively regarding CrowdStrike’s growth prospects.

Strengths and Weaknesses

Here is a comparative overview of key strengths and weaknesses for CrowdStrike Holdings, Inc. (CRWD) and Block, Inc. (XYZ) based on the latest available data.

| Criterion | CrowdStrike Holdings, Inc. (CRWD) | Block, Inc. (XYZ) |

|---|---|---|

| Diversification | Moderate; mainly subscription services (3.76B) with growing professional services (192M) | High; broad revenue streams including software (7.16B), cryptocurrency assets (10.2B), hardware (143M), and transactions (6.61B) |

| Profitability | Low profitability; negative net margin (-0.49%) and ROE (-0.59%), ROIC slightly positive (0.7%) but below WACC | Moderate profitability; positive net margin (12.01%), neutral ROE (13.62%), but ROIC (3.03%) below high WACC (14.27%) |

| Innovation | Strong growth in ROIC (+114%), indicating improving operational efficiency | Steady ROIC growth (+13.7%), supported by innovation in crypto and fintech sectors |

| Global presence | Growing presence, supported by subscription growth and scalable cloud services | Strong global footprint with diverse fintech and crypto offerings |

| Market Share | Rapidly increasing subscription revenue, but still shedding value overall | Diverse product adoption with favorable financial ratios and expanding market segments |

Key takeaways: Both companies are currently shedding value as ROIC remains below WACC, though each shows improving profitability trends. Block, Inc. benefits from greater diversification and stronger current profitability, while CrowdStrike demonstrates rapid operational improvement but faces margin challenges. Investors should weigh growth potential against short-term value destruction cautiously.

Risk Analysis

Below is a comparative table outlining key risk factors for CrowdStrike Holdings, Inc. (CRWD) and Block, Inc. (XYZ) based on the most recent data available.

| Metric | CrowdStrike Holdings, Inc. (CRWD) | Block, Inc. (XYZ) |

|---|---|---|

| Market Risk | Moderate (Beta 1.03) | High (Beta 2.67) |

| Debt level | Low (Debt/Equity 0.24) | Moderate (Debt/Equity 0.37) |

| Regulatory Risk | Moderate (Tech sector scrutiny) | Moderate (Fintech regulations) |

| Operational Risk | Moderate (Cloud service reliance) | Moderate (Hardware & software mix) |

| Environmental Risk | Low (Software industry) | Low (Software & hardware) |

| Geopolitical Risk | Moderate (US based, global clients) | Moderate (US based, international exposure) |

The most impactful risks include Block’s high market volatility (beta 2.67) which increases price swings, and CrowdStrike’s operational challenges related to maintaining cloud security services amid growing cyber threats. Both companies face moderate regulatory scrutiny typical of technology and fintech sectors, requiring attention to compliance and data privacy changes. Debt levels remain manageable, reducing financial distress risk.

Which Stock to Choose?

CrowdStrike Holdings, Inc. (CRWD) has shown strong revenue growth of 29.4% in 2025 with a favorable income statement but unfavorable profitability ratios, including a negative net margin (-0.49%) and return on equity (-0.59%). Its debt levels are low and manageable, supported by a current ratio of 1.67 and favorable leverage metrics, with a very favorable company rating despite mixed financial ratios.

Block, Inc. (XYZ) posted moderate revenue growth of 10.1% in 2024 alongside favorable income metrics, including a 12.0% net margin and positive returns on equity (13.6%) and assets. The company maintains strong liquidity with a current ratio of 2.33 and low debt, reflected in favorable debt-to-equity ratios and a very favorable overall rating, supported by mostly positive financial ratios.

For investors, the choice might depend on risk tolerance and investment objectives: those seeking higher growth potential could find CRWD’s accelerating revenue compelling despite mixed profitability, while more risk-averse investors focusing on stable profitability and balance sheet strength may view XYZ’s consistent income and favorable ratios as more appealing. Both companies show improving profitability trends but remain value destroyers per MOAT analysis.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of CrowdStrike Holdings, Inc. and Block, Inc. to enhance your investment decisions: