In today’s fast-evolving tech landscape, Cloudflare, Inc. (NET) and Block, Inc. (XYZ) stand out as key players in software infrastructure, each driving innovation in cloud services and payment solutions. Both headquartered in California, they serve global markets with cutting-edge technologies, making them natural competitors. This analysis will help you uncover which company holds the most promise for your investment portfolio in 2026.

Table of contents

Companies Overview

I will begin the comparison between Cloudflare and Block by providing an overview of these two companies and their main differences.

Cloudflare Overview

Cloudflare, Inc. is a cloud services provider focused on delivering integrated security and performance solutions to businesses globally. It offers a wide range of products including cloud firewall, bot management, DDoS protection, and content delivery services. Founded in 2009 and headquartered in San Francisco, Cloudflare serves diverse industries such as technology, healthcare, and financial services, positioning itself as a key player in software infrastructure.

Block Overview

Block, Inc. develops tools enabling sellers to accept card payments alongside providing reporting, analytics, and next-day settlement. Its product portfolio includes hardware like card readers and payment terminals, as well as software solutions such as point-of-sale systems and Cash App for money management. Established in 2009 and based in Oakland, Block operates in multiple countries, catering primarily to retail and service sectors within the software infrastructure industry.

Key similarities and differences

Both Cloudflare and Block operate within the software infrastructure sector and are headquartered in California, emphasizing technology-driven solutions. Cloudflare focuses on cloud-based security and performance optimization, while Block concentrates on payment processing and point-of-sale hardware and software. Despite overlapping in serving business customers, their core offerings diverge: Cloudflare centers on network security and content delivery, whereas Block prioritizes financial transactions and merchant services.

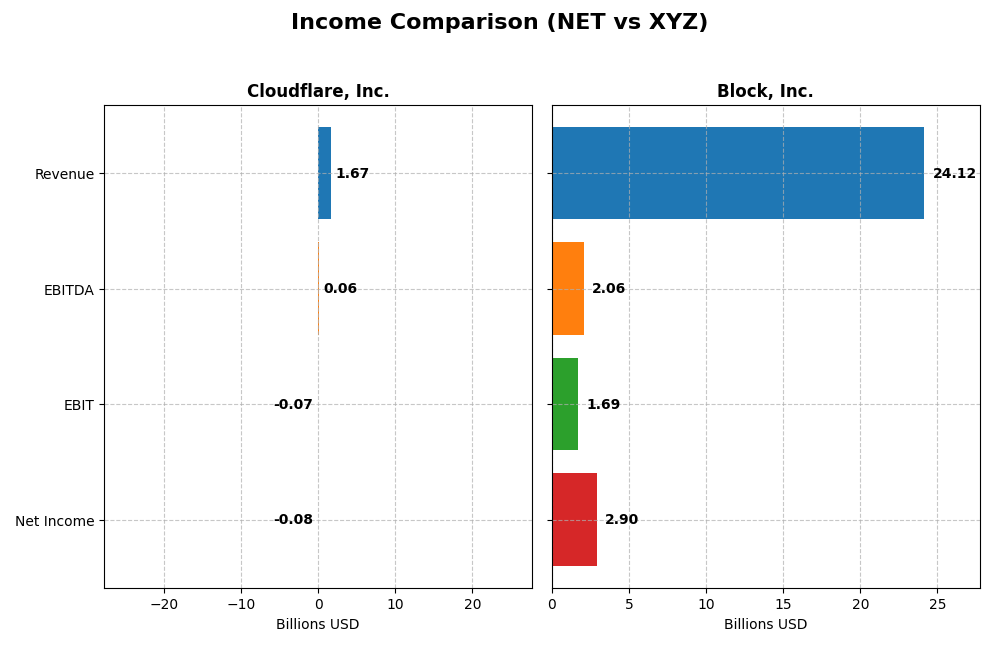

Income Statement Comparison

The table below compares key income statement metrics for Cloudflare, Inc. and Block, Inc. for the fiscal year 2024, highlighting their financial scale and profitability.

| Metric | Cloudflare, Inc. (NET) | Block, Inc. (XYZ) |

|---|---|---|

| Market Cap | 64.5B | 40.2B |

| Revenue | 1.67B | 24.1B |

| EBITDA | 62.0M | 2.06B |

| EBIT | -65.7M | 1.69B |

| Net Income | -78.8M | 2.90B |

| EPS | -0.23 | 4.70 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Cloudflare, Inc.

Cloudflare’s revenue showed strong growth from 2020 to 2024, increasing from $431M to $1.67B, with net income losses narrowing from -$119M to -$79M. Gross margins remained high and favorable at 77.3%, while net margin stayed negative but improved significantly. The 2024 fiscal year saw a notable revenue increase of 28.8% and margin improvements, signaling operational progress despite ongoing losses.

Block, Inc.

Block’s revenue grew consistently from $9.5B in 2020 to $24.1B in 2024, with net income turning positive in 2023 and reaching $2.9B in 2024. Gross margin was stable and favorable at 36.9%, with net margin rising to 12%. The latest year showed solid revenue and profit growth, alongside a sharp rise in EBIT and EPS, reflecting successful margin expansion and improved profitability.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement trends with significant revenue growth. Cloudflare excels in gross margin and improving operational efficiency but remains unprofitable. Block shows strong profitability improvements with positive net income and a solid net margin. Block’s ability to generate positive net income and scale earnings suggests relatively stronger fundamentals as of 2024.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Cloudflare, Inc. (NET) and Block, Inc. (XYZ) as of fiscal year 2024, facilitating a clear comparison of their financial performance and position.

| Ratios | Cloudflare, Inc. (NET) | Block, Inc. (XYZ) |

|---|---|---|

| ROE | -7.53% | 13.62% |

| ROIC | -6.06% | 3.03% |

| P/E | -466.54 | 18.10 |

| P/B | 35.14 | 2.47 |

| Current Ratio | 2.86 | 2.33 |

| Quick Ratio | 2.86 | 2.31 |

| D/E | 1.40 | 0.37 |

| Debt-to-Assets | 44.32% | 21.53% |

| Interest Coverage | -29.78 | 95.93 |

| Asset Turnover | 0.51 | 0.66 |

| Fixed Asset Turnover | 2.63 | 45.14 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Cloudflare, Inc.

Cloudflare’s financial ratios show weakness, with negative net margin (-4.72%), return on equity (-7.53%), and return on invested capital (-6.06%), signaling operational and profitability challenges. Its current and quick ratios at 2.86 indicate solid short-term liquidity, but a high price-to-book ratio (35.14) raises valuation concerns. The company does not pay dividends, reflecting its reinvestment strategy during growth.

Block, Inc.

Block demonstrates stronger financial health, with a favorable net margin of 12.01% and a positive return on equity of 13.62%, though its return on invested capital is slightly unfavorable at 3.03%. Liquidity ratios exceed 2.3, and debt levels remain moderate with a debt-to-equity of 0.37. Block does not pay dividends either, likely prioritizing reinvestment and growth initiatives.

Which one has the best ratios?

Based on the evaluations, Block, Inc. exhibits a more favorable ratio profile, with half of its ratios rated positively and only about 21% unfavorable. In contrast, Cloudflare, Inc. has predominantly unfavorable ratios at 57%, reflecting weaker profitability and valuation metrics. Therefore, Block shows comparatively better financial stability and operational efficiency.

Strategic Positioning

This section compares the strategic positioning of Cloudflare, Inc. and Block, Inc., including market position, key segments, and exposure to technological disruption:

Cloudflare, Inc.

- Market position and competitive pressure

- Key segments and business drivers

- Exposure to technological disruption

Block, Inc.

- Operates globally in cloud infrastructure with integrated security services, facing tech sector competition.

- Focuses on cloud security, performance, and reliability solutions spanning diverse industries.

- Engaged in evolving cloud, IoT, and cybersecurity technologies with continuous innovation in cloud solutions.

Cloudflare, Inc. vs Block, Inc. Positioning

Cloudflare maintains a focused strategy in cloud infrastructure and security, while Block pursues a more diversified approach across payments, software, and cryptocurrency. Cloudflare’s narrower segment focus contrasts with Block’s multifaceted business model, each with distinct operational advantages and challenges.

Which has the best competitive advantage?

Both companies show a slightly unfavorable MOAT, with ROIC below WACC but improving profitability trends. Neither currently demonstrates a strong competitive advantage based on value creation, though both are enhancing their operational efficiency.

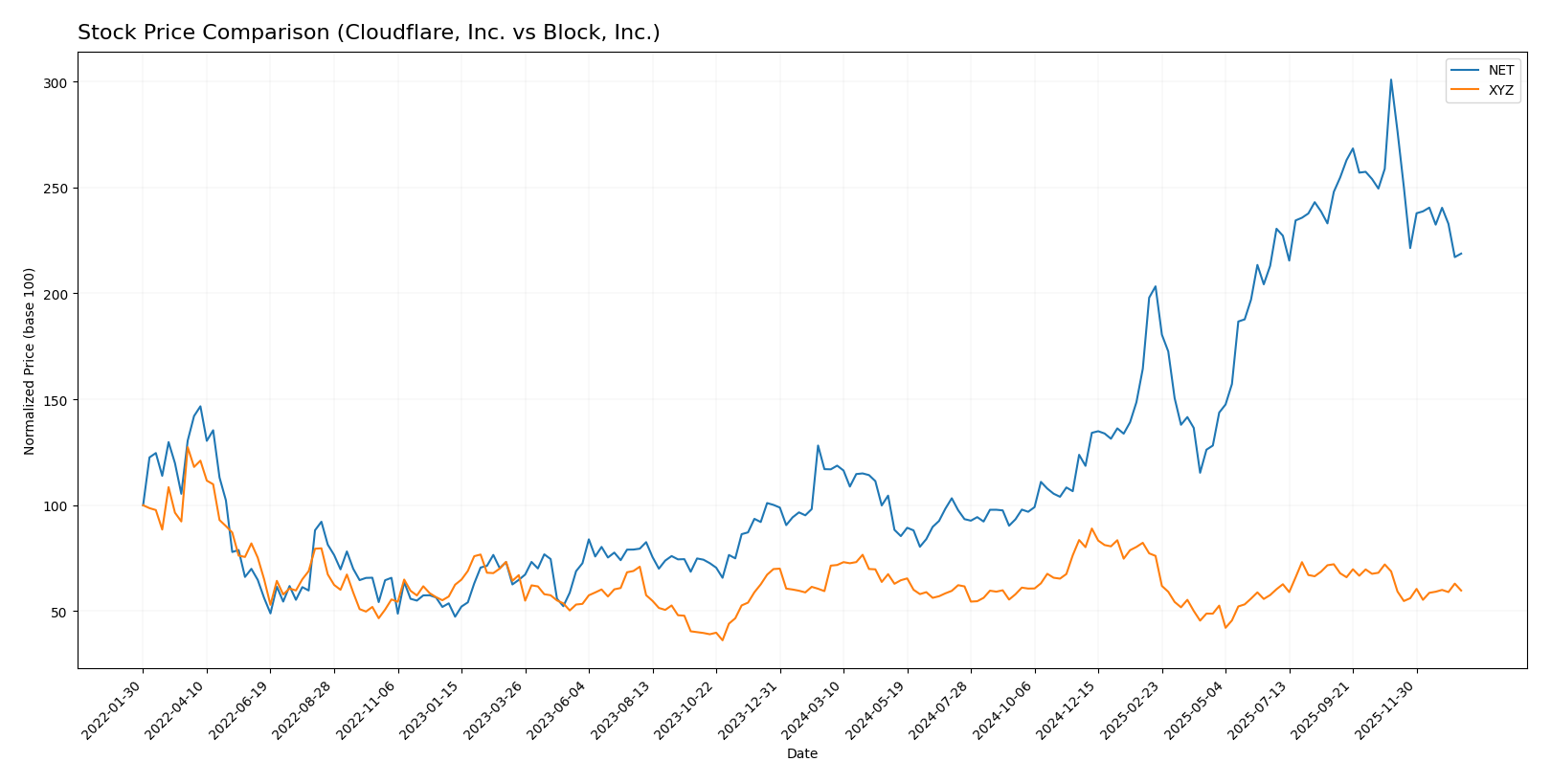

Stock Comparison

The past year saw Cloudflare, Inc. (NET) experience a strong bullish trend with significant price gains, while Block, Inc. (XYZ) faced a bearish trajectory amid declining volume and price. Recent months indicate some deceleration in both stocks’ momentum.

Trend Analysis

Cloudflare, Inc. (NET) recorded an 87.07% price increase over the past 12 months, reflecting a bullish trend with decelerating acceleration. The stock fluctuated between 67.69 and 253.3, showing high volatility (std deviation 52.73).

Block, Inc. (XYZ) showed a 16.43% price decline over the same period, confirming a bearish trend with deceleration. Price ranged from 46.53 to 98.25, with lower volatility (std deviation 10.43).

Comparing the two, Cloudflare delivered the highest market performance with a substantial bullish return, contrasting with Block’s sustained bearish trend and lower volatility.

Target Prices

The target price consensus for Cloudflare, Inc. and Block, Inc. reflects optimistic analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cloudflare, Inc. | 300 | 210 | 248.86 |

| Block, Inc. | 100 | 65 | 84.91 |

Analysts expect Cloudflare’s stock to rise significantly from the current $184.17, while Block’s consensus target price of $84.91 suggests moderate upside from its $65.95 level.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Cloudflare, Inc. and Block, Inc.:

Rating Comparison

Cloudflare, Inc. (NET) Rating

- Rating: D+; status Very Favorable

- Discounted Cash Flow Score: 1, Very Unfavorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 1, Very Unfavorable

Block, Inc. (XYZ) Rating

- Rating: B+; status Very Favorable

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 4, Favorable

- ROA Score: 4, Favorable

- Debt To Equity Score: 2, Moderate

- Overall Score: 3, Moderate

Which one is the best rated?

Based strictly on the provided data, Block, Inc. holds a better overall rating and scores across key financial metrics compared to Cloudflare, Inc., which shows very unfavorable scores throughout.

Scores Comparison

Here is a direct comparison of the Altman Z-Score and Piotroski Score for Cloudflare, Inc. and Block, Inc.:

Cloudflare, Inc. Scores

- Altman Z-Score of 9.47, indicating a safe financial zone.

- Piotroski Score of 2, categorized as very weak financial health.

Block, Inc. Scores

- Altman Z-Score of 2.70, placing it in the grey zone.

- Piotroski Score of 6, showing average financial strength.

Which company has the best scores?

Cloudflare, Inc. has a significantly higher Altman Z-Score, indicating stronger bankruptcy safety, but a very weak Piotroski Score. Block, Inc. has a moderate Altman Z-Score and a better Piotroski Score, reflecting a more balanced financial health profile.

Grades Comparison

The following presents the recent grades assigned by reputable financial institutions for Cloudflare, Inc. and Block, Inc.:

Cloudflare, Inc. Grades

Below is a summary of recent grades by recognized grading companies for Cloudflare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-11-10 |

| Susquehanna | Maintain | Neutral | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Cloudflare’s grades mostly indicate a stable to positive outlook, with a consensus leaning toward Buy and several Neutral ratings.

Block, Inc. Grades

Below is a summary of recent grades by recognized grading companies for Block, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Underweight | 2026-01-14 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-02 |

| Needham | Maintain | Buy | 2025-11-24 |

| B of A Securities | Maintain | Buy | 2025-11-21 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-21 |

| BTIG | Maintain | Buy | 2025-11-20 |

| RBC Capital | Maintain | Outperform | 2025-11-20 |

| Stephens & Co. | Maintain | Overweight | 2025-11-20 |

| Mizuho | Maintain | Outperform | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-14 |

Block shows a mix of strong Buy and Outperform ratings, but also includes an Underweight and Equal Weight, reflecting a more varied analyst perspective.

Which company has the best grades?

Both Cloudflare and Block have consensus ratings of Buy, but Cloudflare’s grades are more consistently Buy or Neutral, while Block’s ratings are more mixed, ranging from Underweight to Outperform. This suggests Cloudflare’s outlook is steadier, potentially implying lower rating risk for investors compared to Block’s more polarized analyst views.

Strengths and Weaknesses

Below is a comparative table outlining the strengths and weaknesses of Cloudflare, Inc. (NET) and Block, Inc. (XYZ) based on recent financial and strategic data.

| Criterion | Cloudflare, Inc. (NET) | Block, Inc. (XYZ) |

|---|---|---|

| Diversification | Limited product range focused on cloud services (USD 1.67B revenue) | Highly diversified: software, crypto assets, hardware, transactions (total > USD 23B revenue) |

| Profitability | Negative net margin (-4.72%) and ROIC (-6.06%), shedding value | Positive net margin (12.01%), ROIC slightly unfavorable (3.03%), overall improving profitability |

| Innovation | Growing ROIC trend suggests improving efficiency despite current losses | Growing ROIC and strong asset turnover (45.14 fixed asset turnover) indicate innovation and operational strength |

| Global presence | Strong cloud infrastructure with growing returns but value destruction | Broad global reach in payment and crypto sectors with favorable debt and liquidity ratios |

| Market Share | Moderate market share in cloud security with growth potential | Significant market share in multiple fintech segments, steady revenue growth |

Key takeaways: Block, Inc. exhibits greater diversification and profitability with strong financial health, making it a more favorable investment option currently. Cloudflare shows promising innovation and growth potential but faces challenges in profitability and value creation. Caution and close monitoring of Cloudflare’s turnaround are advised.

Risk Analysis

Below is a comparison of key risks faced by Cloudflare, Inc. (NET) and Block, Inc. (XYZ) as of 2024:

| Metric | Cloudflare, Inc. (NET) | Block, Inc. (XYZ) |

|---|---|---|

| Market Risk | High beta (1.97) indicates volatility; reliance on tech sector growth | Higher beta (2.67) suggests even greater volatility; exposure to fintech market shifts |

| Debt level | Debt to equity ratio 1.4 (unfavorable), interest coverage negative | Debt to equity 0.37 (favorable), strong interest coverage (181.3) |

| Regulatory Risk | Moderate, due to cybersecurity and data privacy laws | Elevated, fintech subject to evolving payment regulations |

| Operational Risk | Exposure to cyber threats and service outages | Risks in payment processing operations and hardware reliability |

| Environmental Risk | Low direct impact; some risk from data center energy use | Low, but sustainability pressures growing for fintech firms |

| Geopolitical Risk | Moderate, global service footprint including sensitive regions | Moderate, with operations in multiple countries subject to trade policies |

The most impactful risks are market volatility and regulatory challenges for both companies. Cloudflare’s high leverage and negative interest coverage raise financial risk, while Block’s strong liquidity and lower debt reduce its financial vulnerability. Regulatory changes in fintech and cybersecurity remain key uncertainties affecting growth potential.

Which Stock to Choose?

Cloudflare, Inc. (NET) shows strong revenue growth of 28.76% in 2024 with favorable income statement metrics overall, yet it struggles with profitability and high debt levels. Its financial ratios are mostly unfavorable, reflecting value destruction despite a growing ROIC trend and a very weak Piotroski score. The company holds a very favorable rating label but scores very low on key financial health indicators.

Block, Inc. (XYZ) reports moderate revenue growth of 10.06% in 2024, with generally favorable profitability and financial ratios, including low leverage and solid liquidity. It demonstrates a growing ROIC but remains a slight value destroyer, supported by a moderate Altman Z-Score and average Piotroski score. Its rating is very favorable with better overall financial stability compared to NET.

Investors focused on growth might find Cloudflare’s accelerating revenue appealing despite its weaker financial ratios and valuation concerns, whereas those prioritizing financial stability and moderate profitability may view Block as a slightly more favorable option given its stronger balance sheet and consistent earnings. This interpretation depends on individual risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cloudflare, Inc. and Block, Inc. to enhance your investment decisions: