In today’s fast-evolving technology landscape, Block, Inc. and CCC Intelligent Solutions Holdings Inc. stand out as innovative players within the software infrastructure sector. Both companies leverage cutting-edge technology—Block in digital payments and seller tools, and CCC in AI-driven insurance solutions—targeting overlapping markets that demand agility and modernization. This analysis will help you uncover which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Block, Inc. and CCC Intelligent Solutions Holdings Inc. by providing an overview of these two companies and their main differences.

Block, Inc. Overview

Block, Inc. operates in the technology sector, focusing on software infrastructure. The company develops tools that enable sellers to accept card payments and offers a range of hardware products like contactless and chip card readers. It also provides software solutions including point-of-sale systems, appointment scheduling, and online checkout services. Block serves customers primarily in the US, Canada, and several other countries, aiming to simplify commerce through integrated payment and business management solutions.

CCC Intelligent Solutions Holdings Inc. Overview

CCC Intelligent Solutions Holdings Inc. also operates in software infrastructure within the technology sector. The company provides cloud, mobile, AI, and telematics technologies tailored to the property and casualty insurance economy. Its SaaS platform supports AI-enabled workflows and commerce connectivity for insurance carriers, repair shops, parts suppliers, and financial institutions. Founded in 1980 and based in Chicago, CCC offers specialized solutions including insurance, repair, parts management, and payments.

Key similarities and differences

Both companies operate in the technology sector focusing on software infrastructure, but their target markets differ significantly. Block, Inc. concentrates on payment processing and business solutions for sellers across various industries and countries, while CCC Intelligent Solutions specializes in AI-driven software platforms for the insurance and automotive repair ecosystem. Block has a larger workforce and market capitalization compared to CCC, reflecting differences in scale and market presence.

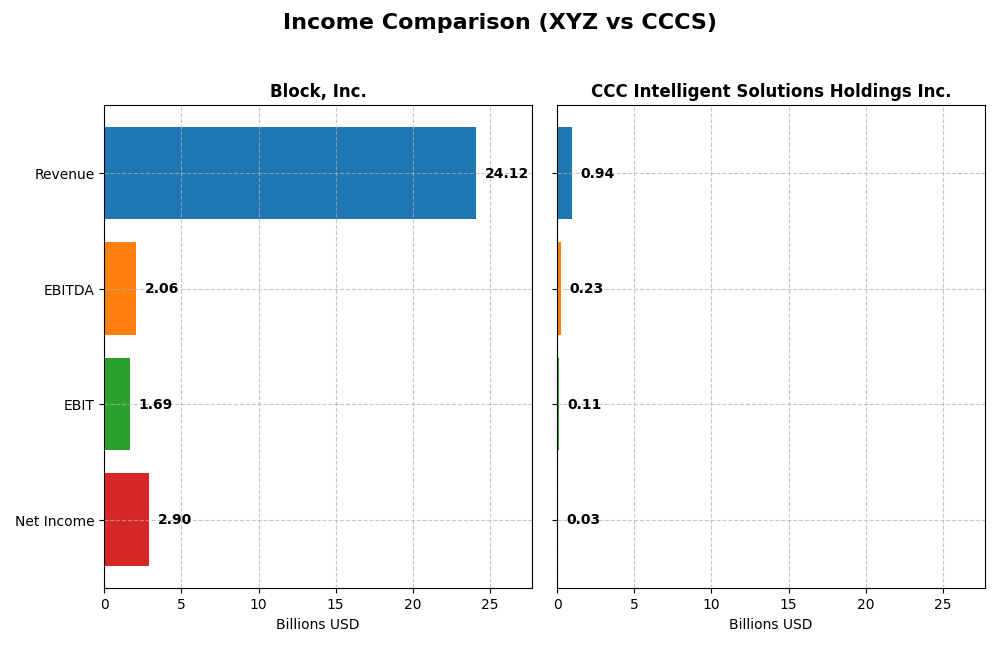

Income Statement Comparison

Below is a side-by-side comparison of key income statement metrics for Block, Inc. and CCC Intelligent Solutions Holdings Inc. for the fiscal year 2024.

| Metric | Block, Inc. (XYZ) | CCC Intelligent Solutions Holdings Inc. (CCCS) |

|---|---|---|

| Market Cap | 40.2B | 5.6B |

| Revenue | 24.1B | 945M |

| EBITDA | 2.1B | 233M |

| EBIT | 1.7B | 109M |

| Net Income | 2.9B | 26M |

| EPS | 4.7 | 0.043 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Block, Inc.

Block, Inc. shows strong revenue growth from 2020 to 2024, rising from $9.5B to $24.1B, with net income recovering from a loss in 2022 to $2.9B in 2024. Gross margins improved to 36.85%, while net margins expanded significantly to 12.01%. The latest year saw favorable earnings growth and margin expansion despite higher operating expenses.

CCC Intelligent Solutions Holdings Inc.

CCC Intelligent Solutions Holdings experienced steady revenue growth from $633M in 2020 to $945M in 2024, with net income turning positive after losses in earlier years, reaching $26M in 2024. Its gross margin is robust at 75.55%, and EBIT margin improved to 11.53%. The recent year reflected favorable profit growth and stable expense control.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement trends with strong revenue and profit growth. Block, Inc. exhibits higher absolute scale and a more dramatic turnaround in margins and net income, whereas CCC Intelligent Solutions holds stronger gross and EBIT margins with consistent positive earnings growth. Each displays solid fundamentals, with Block showing scale advantage and CCC excelling in profitability ratios.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Block, Inc. (XYZ) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on their most recent fiscal year data (2024).

| Ratios | Block, Inc. (XYZ) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| ROE | 13.6% | 1.31% |

| ROIC | 3.03% | 1.86% |

| P/E | 18.1 | 274.0 |

| P/B | 2.47 | 3.59 |

| Current Ratio | 2.33 | 3.65 |

| Quick Ratio | 2.31 | 3.65 |

| D/E (Debt-to-Equity) | 0.37 | 0.42 |

| Debt-to-Assets | 21.5% | 26.7% |

| Interest Coverage | 95.9 | 1.24 |

| Asset Turnover | 0.66 | 0.30 |

| Fixed Asset Turnover | 45.1 | 4.68 |

| Payout ratio | 0.0% | 0.0% |

| Dividend yield | 0.0% | 0.0% |

Interpretation of the Ratios

Block, Inc.

Block, Inc. shows a mix of strong and moderate financial ratios, with favorable liquidity ratios (current ratio 2.33, quick ratio 2.31) and low leverage (debt-to-equity 0.37). Profitability is decent with a net margin of 12.01% but return on invested capital (3.03%) and WACC (14.27%) are unfavorable. The company does not pay dividends, reflecting a possible reinvestment or growth strategy.

CCC Intelligent Solutions Holdings Inc.

Financial ratio data for CCC Intelligent Solutions Holdings Inc. is unavailable, preventing a detailed analysis. Without key metrics such as profitability, leverage, or liquidity ratios, assessing its financial health or dividend policy cannot be conducted with the current information.

Which one has the best ratios?

Based on available data, Block, Inc. presents a slightly favorable financial profile with balanced liquidity, manageable debt, and positive net margin. In contrast, the absence of ratio data for CCC Intelligent Solutions Holdings Inc. precludes comparison, making Block, Inc. the only company with analyzable financial ratios at this time.

Strategic Positioning

This section compares the strategic positioning of Block, Inc. and CCC Intelligent Solutions Holdings Inc., focusing on market position, key segments, and exposure to technological disruption:

Block, Inc.

- Large market cap of 40B with high beta indicating strong competitive pressure.

- Diverse revenue from software, cryptocurrency assets, hardware, and transaction services.

- Offers integrated payment hardware and software platforms; potential disruption from fintech innovations.

CCC Intelligent Solutions Holdings Inc.

- Smaller market cap of 5.6B with lower beta suggesting moderate competitive pressure.

- Revenue mainly from software subscriptions and related services in insurance tech.

- Provides AI-driven SaaS for insurance economy; exposed to AI and cloud technology shifts.

Block, Inc. vs CCC Intelligent Solutions Holdings Inc. Positioning

Block shows a diversified business model across payments and crypto, with large scale but value destruction risk. CCC focuses on insurance technology SaaS, smaller scale, with concentrated market exposure but no profitability metrics available.

Which has the best competitive advantage?

Block’s moat evaluation shows a slightly unfavorable position due to value destruction despite increasing profitability, while CCC lacks sufficient data to assess its competitive advantage.

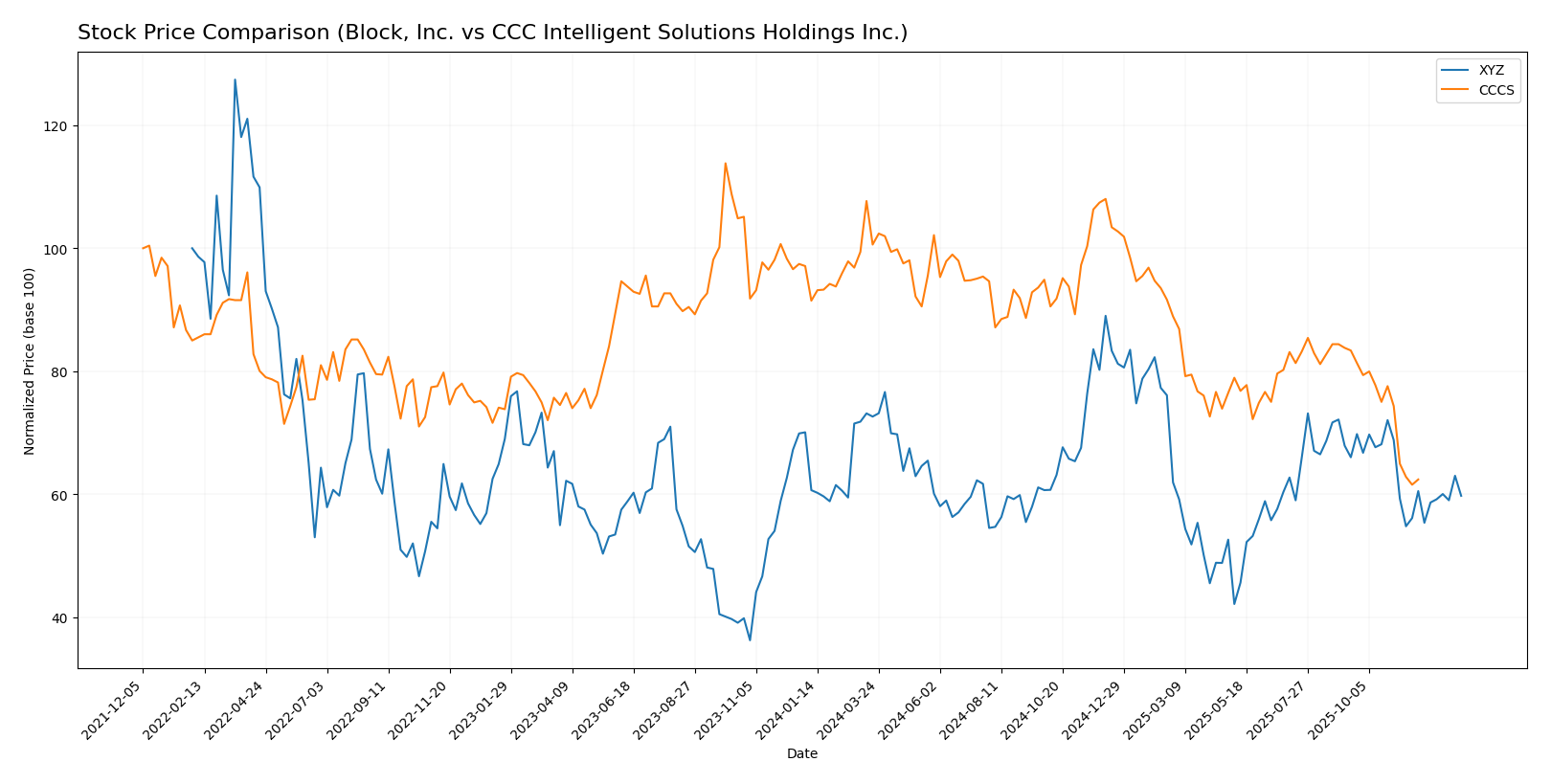

Stock Comparison

The stock price movements of Block, Inc. and CCC Intelligent Solutions Holdings Inc. over the past year reveal significant bearish trends, with notable price declines and changing trading volumes impacting investor sentiment.

Trend Analysis

Block, Inc.’s stock has experienced a bearish trend over the past 12 months, declining by 16.43%. This decelerating downtrend shows a high volatility with a standard deviation of 10.43, hitting a high of 98.25 and a low of 46.53.

CCC Intelligent Solutions Holdings Inc. also shows a bearish trend, with a sharper 31.78% decline over the same period. Its trend is decelerating with lower volatility, reflected in a standard deviation of 1.24, and a trading range between 12.67 and 7.22.

Comparing both, Block, Inc. delivered a higher market performance with a smaller percentage loss, while CCC Intelligent Solutions faced a more pronounced decrease in stock price over the past year.

Target Prices

The current analyst consensus presents a mixed but informative target outlook for Block, Inc. and CCC Intelligent Solutions Holdings Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Block, Inc. | 100 | 65 | 84.91 |

| CCC Intelligent Solutions Holdings Inc. | 11 | 11 | 11 |

Analysts expect Block, Inc.’s stock to appreciate from its current price of 65.95 USD toward a consensus target near 85 USD. CCC Intelligent Solutions Holdings Inc.’s target price is steady at 11 USD, modestly above its current price of 8.75 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Block, Inc. (XYZ) and CCC Intelligent Solutions Holdings Inc. (CCCS):

Rating Comparison

XYZ Rating

- Rating: B+ indicating a Very Favorable status according to the latest evaluation.

- Discounted Cash Flow Score: 3, considered Moderate in assessing valuation based on future cash flow.

- ROE Score: 4, Favorable, showing efficient profit generation from shareholders’ equity.

- ROA Score: 4, Favorable, reflecting effective use of assets to generate earnings.

- Debt To Equity Score: 2, Moderate, indicating a balanced financial risk profile.

- Overall Score: 3, Moderate, summarizing the company’s financial standing.

CCCS Rating

- No rating data available.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

Which one is the best rated?

Based strictly on the available data, Block, Inc. (XYZ) is better rated with a B+ rating and detailed scores indicating moderate to favorable financial health. CCC Intelligent Solutions Holdings Inc. (CCCS) has no rating information provided for comparison.

Scores Comparison

The comparison of scores for Block, Inc. and CCC Intelligent Solutions Holdings Inc. is presented below:

Block, Inc. Scores

- Altman Z-Score: 2.70, indicating a moderate bankruptcy risk in the grey zone.

- Piotroski Score: 6, reflecting average financial strength.

CCC Intelligent Solutions Holdings Inc. Scores

- Altman Z-Score: 2.18, indicating a moderate bankruptcy risk in the grey zone.

- Piotroski Score: 3, reflecting very weak financial strength.

Which company has the best scores?

Block, Inc. has a higher Altman Z-Score and a notably stronger Piotroski Score compared to CCC Intelligent Solutions, indicating relatively better financial health based on these metrics.

Grades Comparison

Here is the grades comparison based on recent analyst evaluations for the two companies:

Block, Inc. Grades

The following table summarizes recent grades assigned by reputable grading companies to Block, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Underweight | 2026-01-14 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-02 |

| Needham | Maintain | Buy | 2025-11-24 |

| B of A Securities | Maintain | Buy | 2025-11-21 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-21 |

| BTIG | Maintain | Buy | 2025-11-20 |

| RBC Capital | Maintain | Outperform | 2025-11-20 |

| Stephens & Co. | Maintain | Overweight | 2025-11-20 |

| Mizuho | Maintain | Outperform | 2025-11-20 |

| BTIG | Maintain | Buy | 2025-11-14 |

Overall, Block, Inc. shows a predominantly positive analyst consensus with multiple buy and outperform ratings, balanced by a few neutral and one underweight grade.

CCC Intelligent Solutions Holdings Inc. Grades

No reliable grading data from verifiable grading companies is available for CCC Intelligent Solutions Holdings Inc. Thus, no formal grade table can be provided. The absence of analyst grades limits direct comparative analysis based on formal ratings.

Which company has the best grades?

Block, Inc. has received significantly more analyst coverage with mostly buy and outperform grades, indicating stronger market confidence compared to CCC Intelligent Solutions Holdings Inc., which lacks formal grading data. This disparity may impact investor perception and portfolio decisions due to greater visibility and clearer consensus on Block, Inc.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Block, Inc. (XYZ) and CCC Intelligent Solutions Holdings Inc. (CCCS) based on the latest available data.

| Criterion | Block, Inc. (XYZ) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| Diversification | High: Revenue from software, crypto assets, hardware, transactions | Moderate: Primarily software subscriptions and other services |

| Profitability | Moderate: Net margin 12%, ROE neutral at 13.6%, but ROIC unfavorable at 3% versus WACC 14.3% | Data unavailable for profitability metrics |

| Innovation | Strong: Significant revenue from cryptocurrency and software data products | Unknown due to missing data |

| Global presence | Large: Operates globally with diverse products and services | Likely smaller scale, focused on niche software subscriptions |

| Market Share | Significant in fintech and crypto-related markets | Unclear, limited data available |

Key takeaways: Block, Inc. shows a well-diversified business with growing profitability despite currently destroying value on invested capital. CCC Intelligent Solutions lacks sufficient data for a solid evaluation but appears more specialized and smaller in scale. Investors should weigh Block’s innovation and scale against its capital efficiency challenges.

Risk Analysis

The table below summarizes key risk factors for Block, Inc. and CCC Intelligent Solutions Holdings Inc. based on the most recent data available for 2024.

| Metric | Block, Inc. (XYZ) | CCC Intelligent Solutions (CCCS) |

|---|---|---|

| Market Risk | High beta (2.665) indicates strong sensitivity to market fluctuations | Low beta (0.721) suggests lower market volatility exposure |

| Debt level | Low debt-to-equity ratio (0.37) and favorable interest coverage | Data unavailable, increasing uncertainty |

| Regulatory Risk | Moderate, operating in financial tech with evolving payments regulations | Moderate, exposed to insurance sector regulatory changes |

| Operational Risk | Moderate; reliance on hardware and software integration | Moderate; cloud and AI platform complexity |

| Environmental Risk | Low; primarily software-focused with limited direct environmental impact | Low; software services with minimal environmental footprint |

| Geopolitical Risk | Moderate; operates internationally but primarily in stable markets | Moderate; US-based but insurance sector can be affected by geopolitical shifts |

Block, Inc.’s most significant risk stems from its high market volatility sensitivity, as shown by its beta above 2.5. Its strong balance sheet with low debt mitigates financial risk. CCC Intelligent Solutions shows lower market risk but suffers from incomplete financial disclosure, raising transparency concerns. Both face moderate regulatory and operational risks given their industries’ nature. Investors should weigh Block’s market sensitivity against its robust financial health and consider CCC’s data gaps carefully.

Which Stock to Choose?

Block, Inc. (XYZ) shows a favorable income evolution with a 10.06% revenue growth in 2024 and strong profitability metrics, including a 12.01% net margin. Financial ratios reveal a slightly favorable profile with a solid current ratio of 2.33 and low debt. However, its ROIC is below WACC, indicating value destruction despite improving profitability. The company holds a very favorable B+ rating.

CCC Intelligent Solutions Holdings Inc. (CCCS) reports favorable income growth with a 9.05% revenue increase in 2024 and a strong gross margin of 75.55%. While profitability is moderate, with a 2.77% net margin, detailed financial ratios and rating data are unavailable. The stock experienced a bearish price trend with a 31.78% decline over the past year.

Investors focused on financial transparency and solid ratings might find Block, Inc.’s profile more informative and slightly favorable, while those valuing higher gross margins could consider CCC Intelligent Solutions. Risk-averse investors might prefer the better-documented stability of Block, Inc., whereas risk-tolerant investors could see potential in CCC Intelligent Solutions’ growth despite limited data.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Block, Inc. and CCC Intelligent Solutions Holdings Inc. to enhance your investment decisions: