In the rapidly evolving Information Technology Services sector, Globant S.A. and BigBear.ai Holdings, Inc. stand out as innovative players shaping digital transformation and AI-driven decision support. While Globant excels in broad digital reinvention and cloud strategies, BigBear.ai specializes in advanced analytics and cybersecurity solutions. This article explores their market positions and innovation approaches to help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Globant and BigBear.ai by providing an overview of these two companies and their main differences.

Globant Overview

Globant S.A. is a Luxembourg-based technology services company focused on digital transformation and innovation. It offers a broad range of services including e-commerce, cloud transformation, AI-driven analytics, cybersecurity, and digital experience platforms. Founded in 2003, Globant serves multiple industries with a workforce of over 31,000 employees, positioning itself as a global leader in IT services and digital solutions.

BigBear.ai Overview

BigBear.ai Holdings, Inc., headquartered in Columbia, Maryland, specializes in artificial intelligence and machine learning to support decision-making. The company operates through Cyber & Engineering and Analytics segments, providing services in cybersecurity, cloud engineering, systems strategy, and big data analytics. With around 630 employees, BigBear.ai focuses on delivering predictive and prescriptive analytics solutions primarily for enterprise and government clients.

Key similarities and differences

Both Globant and BigBear.ai operate in the technology services sector, emphasizing advanced analytics and cloud solutions. However, Globant offers a wider range of digital transformation services across various industries, supported by a substantially larger workforce. In contrast, BigBear.ai is more specialized in AI-driven decision support and cybersecurity, with a narrower operational focus and significantly smaller scale, reflecting distinct business models within the same tech domain.

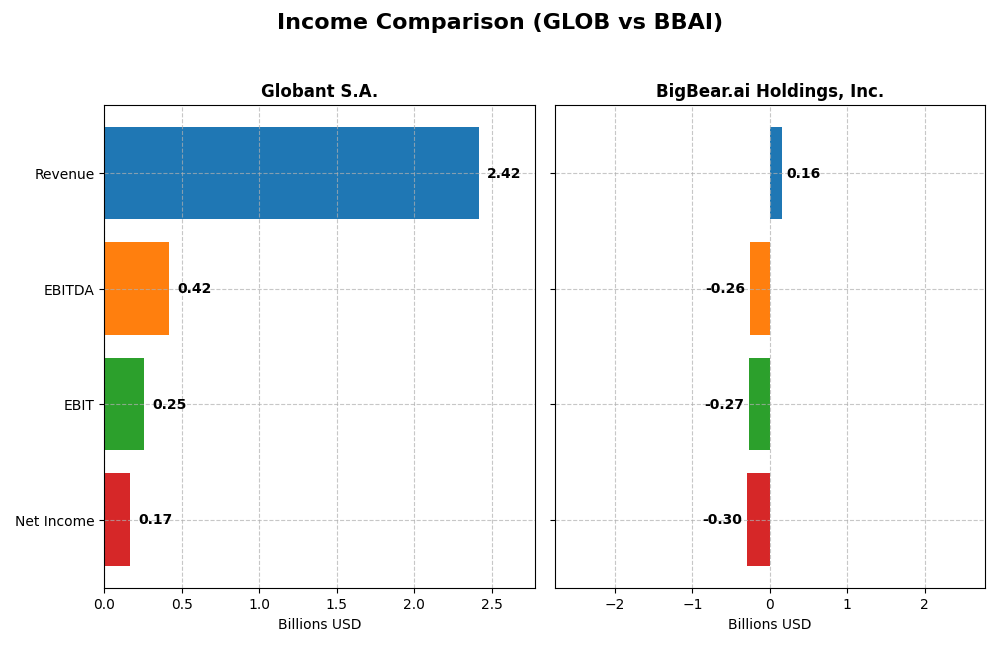

Income Statement Comparison

This table compares key income statement metrics for Globant S.A. and BigBear.ai Holdings, Inc. for the fiscal year 2024.

| Metric | Globant S.A. (GLOB) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| Market Cap | 2.99B | 2.32B |

| Revenue | 2.42B | 158M |

| EBITDA | 417M | -258M |

| EBIT | 254M | -270M |

| Net Income | 166M | -296M |

| EPS | 3.82 | -1.27 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Globant S.A.

Globant’s revenue and net income showed strong upward trends from 2020 to 2024, with revenue nearly tripling and net income more than tripling. Margins remained generally stable, with a favorable gross margin of 35.74% and a net margin of 6.86% in 2024. Despite a slight dip in net margin growth last year, earnings per share grew by 2.2%, reflecting solid operational performance.

BigBear.ai Holdings, Inc.

BigBear.ai’s revenue grew modestly by about 2% in 2024, but net income continued to decline significantly, posting a loss of nearly $296M. While its gross margin remained favorable at 28.58%, EBIT and net margins were deeply negative, highlighting ongoing operational challenges. The company’s earnings per share also deteriorated sharply, indicating persistent profitability issues.

Which one has the stronger fundamentals?

Based on income statement metrics, Globant exhibits stronger fundamentals with consistent revenue and net income growth and mostly favorable margin trends. In contrast, BigBear.ai faces considerable profitability headwinds, reflected in its negative margins and substantial net losses. Globant’s robust growth and margin stability contrast with BigBear.ai’s ongoing financial struggles.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Globant S.A. (GLOB) and BigBear.ai Holdings, Inc. (BBAI) based on their most recent fiscal year data from 2024.

| Ratios | Globant S.A. (GLOB) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| ROE | 8.44% | 7,958% |

| ROIC | 6.82% | -93.42% |

| P/E | 57.64 | -3.52 |

| P/B | 4.86 | -279.90 |

| Current Ratio | 1.54 | 0.46 |

| Quick Ratio | 1.54 | 0.46 |

| D/E | 0.21 | -39.42 |

| Debt-to-Assets | 13.0% | 42.6% |

| Interest Coverage | 7.87 | -5.20 |

| Asset Turnover | 0.76 | 0.46 |

| Fixed Asset Turnover | 8.70 | 14.61 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Globant S.A.

Globant shows a slightly favorable financial profile with 43% of ratios positive, including strong liquidity (current ratio 1.54) and low leverage (debt/equity 0.21). However, valuation metrics like PE (57.64) and PB (4.86) are unfavorable, signaling potential overvaluation. Globant does not pay dividends, focusing on reinvestment and growth instead.

BigBear.ai Holdings, Inc.

BigBear.ai’s ratios are mostly unfavorable with 57% negative, reflecting weak profitability (net margin -187%) and liquidity (current ratio 0.46). Favorable points include an extremely high ROE and low debt/equity, but these may be distorted by losses. The company also pays no dividends, likely prioritizing R&D and expansion during this growth phase.

Which one has the best ratios?

Based on ratio evaluations, Globant has a better overall financial standing with more favorable liquidity and leverage ratios, despite some valuation concerns. BigBear.ai faces significant profitability and liquidity challenges, resulting in a generally unfavorable ratio profile. Globant’s stability contrasts with BigBear.ai’s high-risk financial structure.

Strategic Positioning

This section compares the strategic positioning of Globant and BigBear.ai, focusing on market position, key segments, and exposure to technological disruption:

Globant

- Established player with $3B market cap, moderate beta 1.2, facing competitive technology services industry.

- Diverse technology services including e-commerce, cloud, digital transformation, and healthcare tech.

- Exposure through broad tech services including cloud, AI, blockchain, and metaverse innovations.

BigBear.ai

- Smaller $2.3B market cap, higher beta 3.2, operating in competitive AI-driven IT services sector.

- Two main segments: Cyber & Engineering and Analytics, focusing on AI, cybersecurity, and big data.

- Focused on AI and machine learning for decision support, with emphasis on cloud and cybersecurity.

Globant vs BigBear.ai Positioning

Globant pursues a diversified strategy across multiple technology verticals, offering broad industry exposure and innovation areas. BigBear.ai concentrates on AI-driven analytics and cybersecurity, providing focused but narrower service lines, with advantages in specialized decision support technologies.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC; Globant shows improving profitability, while BigBear.ai’s declining ROIC indicates weaker competitive sustainability. Globant’s slightly unfavorable moat status suggests a more resilient competitive advantage.

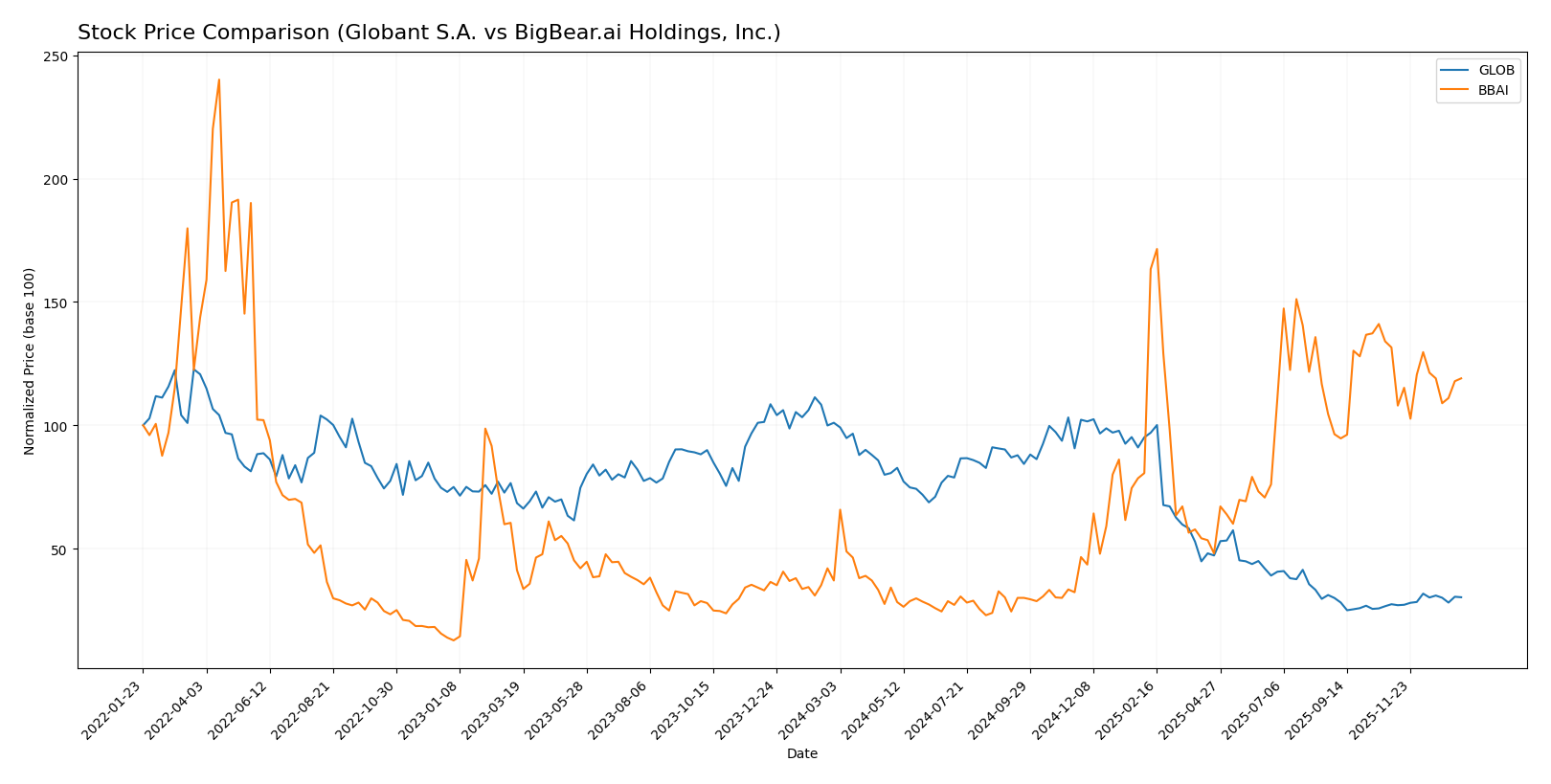

Stock Comparison

The stock price chart reveals contrasting trading dynamics over the past 12 months, with BigBear.ai Holdings, Inc. showing strong gains while Globant S.A. experienced a significant decline followed by a recent partial recovery.

Trend Analysis

Globant S.A. exhibited a bearish trend over the past year with a 70.01% price decline and accelerating downward momentum, despite a recent 10.31% uptick from November 2025 to January 2026. Volatility was high with a standard deviation of 61.44.

BigBear.ai Holdings, Inc. showed a bullish trend for the year with a 221.03% price increase but with decelerating momentum. Recently, it experienced a 9.54% decline, indicating short-term weakness amid low volatility (std. dev. 2.19).

Comparing both, BigBear.ai Holdings delivered substantially higher market performance over the year, while Globant faced steep losses but showed signs of recent recovery.

Target Prices

The current analyst consensus presents a balanced outlook for Globant S.A. and BigBear.ai Holdings, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Globant S.A. | 80 | 68 | 72.5 |

| BigBear.ai Holdings, Inc. | 6 | 6 | 6 |

Analysts expect Globant’s price to rise modestly above its current 67.93 USD, while BigBear.ai’s consensus target is slightly below its present 6.26 USD, indicating cautious sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Globant S.A. and BigBear.ai Holdings, Inc.:

Rating Comparison

GLOB Rating

- Rating: A- indicating a very favorable outlook.

- Discounted Cash Flow Score: 5, very favorable, suggesting strong valuation based on future cash flows.

- ROE Score: 3, moderate efficiency in generating profit from equity.

- ROA Score: 3, moderate asset utilization for earnings.

- Debt To Equity Score: 3, moderate financial risk with balanced debt levels.

- Overall Score: 4, favorable financial standing.

BBAI Rating

- Rating: C- indicating a very unfavorable outlook.

- Discounted Cash Flow Score: 1, very unfavorable, indicating weak valuation from cash flow perspective.

- ROE Score: 1, very unfavorable, showing poor profitability from equity.

- ROA Score: 1, very unfavorable, reflecting inefficient asset use.

- Debt To Equity Score: 3, moderate financial risk similar to GLOB.

- Overall Score: 1, very unfavorable financial standing.

Which one is the best rated?

Based strictly on the provided data, Globant S.A. is better rated than BigBear.ai Holdings, Inc. Globant shows a very favorable rating with higher scores across most financial metrics, while BigBear.ai has very unfavorable scores except for debt-to-equity, where both are moderate.

Scores Comparison

Below is a comparison of the Altman Z-Score and Piotroski Score for Globant and BigBear.ai:

Globant Scores

- Altman Z-Score: 3.05, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 5, classified as average financial strength.

BigBear.ai Scores

- Altman Z-Score: 2.93, indicating a grey zone with moderate bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

Which company has the best scores?

Globant shows stronger financial stability with a safe zone Altman Z-Score and an average Piotroski Score. BigBear.ai falls into the grey zone for bankruptcy risk and has a very weak Piotroski Score, indicating weaker financial health based on the data provided.

Grades Comparison

Here is the grades comparison for Globant S.A. and BigBear.ai Holdings, Inc.:

Globant S.A. Grades

Summary of recent grade updates from notable grading companies for Globant S.A.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Downgrade | Hold | 2025-11-20 |

| UBS | Maintain | Neutral | 2025-11-18 |

| JP Morgan | Maintain | Neutral | 2025-11-14 |

| Needham | Maintain | Buy | 2025-11-14 |

| Canaccord Genuity | Maintain | Hold | 2025-11-14 |

| Goldman Sachs | Maintain | Neutral | 2025-10-09 |

| UBS | Maintain | Neutral | 2025-08-20 |

| Goldman Sachs | Maintain | Neutral | 2025-08-18 |

| Needham | Maintain | Buy | 2025-08-15 |

| JP Morgan | Downgrade | Neutral | 2025-08-15 |

The trend shows a mix of Hold and Neutral grades with some Buy ratings maintained, indicating a cautious but generally moderate outlook.

BigBear.ai Holdings, Inc. Grades

Summary of recent grade updates from notable grading companies for BigBear.ai Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Downgrade | Neutral | 2026-01-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-11 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-12 |

| HC Wainwright & Co. | Maintain | Buy | 2025-07-01 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-07 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-30 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-10-15 |

| Cantor Fitzgerald | Maintain | Overweight | 2024-08-21 |

Grades generally show sustained Buy and Overweight ratings, with one recent downgrade to Neutral, reflecting consistent confidence with some recent caution.

Which company has the best grades?

Globant S.A. holds a Buy consensus with a balance of Hold and Neutral ratings, while BigBear.ai has mostly Buy and Overweight grades but a Hold consensus. BigBear.ai’s grades suggest stronger analyst confidence, potentially signaling greater growth expectations but also recent caution.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Globant S.A. (GLOB) and BigBear.ai Holdings, Inc. (BBAI) based on the most recent financial and strategic data available.

| Criterion | Globant S.A. (GLOB) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| Diversification | Moderate; primarily focused on digital transformation services but expanding | Limited; heavy reliance on analytics and cyber/engineering segments |

| Profitability | Neutral net margin at 6.86%; ROIC 6.82% slightly below WACC (8.92%), with growth | Unfavorable profitability; net margin deeply negative (-186.78%), ROIC -93% |

| Innovation | Strong emphasis on digital innovation, reflected in growing ROIC trend (26%) | Innovation impact unclear; declining ROIC trend (-235%) indicates struggle |

| Global presence | Established global footprint with stable asset turnover and low debt | Smaller global reach; higher debt-to-assets ratio (42.59%) and liquidity concerns |

| Market Share | Stable in digital services sector, supported by favorable liquidity ratios | Market share constrained by financial instability and operational losses |

Key takeaways: Globant demonstrates a stable financial position with improving profitability but must address value destruction risks. BigBear.ai faces serious profitability and liquidity challenges, reflected in its declining returns and unfavorable financial metrics, suggesting higher investment risk.

Risk Analysis

The table below presents a comparative risk overview for Globant S.A. (GLOB) and BigBear.ai Holdings, Inc. (BBAI) based on the latest 2024 data:

| Metric | Globant S.A. (GLOB) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| Market Risk | Moderate (Beta 1.2) | High (Beta 3.2) |

| Debt level | Low (Debt/Equity 0.21, favorable) | Moderate (Debt/Assets 42.6%, neutral) |

| Regulatory Risk | Moderate (Tech sector compliance) | Moderate to High (AI and cybersecurity regulations) |

| Operational Risk | Moderate (Large global operations) | High (Smaller scale, emerging tech) |

| Environmental Risk | Low (Tech services, limited impact) | Low (Tech services, limited impact) |

| Geopolitical Risk | Moderate (Based in Luxembourg, global exposure) | Moderate (US-based, sensitive to US policy changes) |

In synthesis, BigBear.ai exhibits higher market and operational risks due to its smaller size, volatile financials, and high beta, despite some favorable debt metrics. Globant shows more stability with low debt and safer Altman Z-Score but faces moderate regulatory and geopolitical risks typical for global IT service firms. Investors should weigh BigBear.ai’s higher growth potential against its financial vulnerability and market volatility.

Which Stock to Choose?

Globant S.A. (GLOB) shows strong income growth with a 196.72% revenue increase over five years and a favorable global income statement opinion. Its financial ratios are slightly favorable, with low debt levels and good liquidity, though some valuation metrics appear stretched. The company is shedding value as ROIC remains below WACC but shows an improving trend. Ratings are very favorable, supported by a safe Altman Z-Score and average Piotroski Score.

BigBear.ai Holdings, Inc. (BBAI) has a mixed income profile, with modest revenue growth but significant net income decline, leading to an unfavorable income statement evaluation. Its financial ratios are largely unfavorable, with weak liquidity and profitability measures, and a very unfavorable MOAT rating due to negative ROIC trends. The company’s rating is very unfavorable, with an Altman Z-Score in the grey zone and a very weak Piotroski Score.

Investors focused on stable profitability and improving financial health might find Globant’s profile more aligned with their goals, while those with a higher risk tolerance looking for potential turnaround plays could consider BigBear.ai’s situation, albeit with caution due to its financial challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Globant S.A. and BigBear.ai Holdings, Inc. to enhance your investment decisions: