In the rapidly evolving technology sector, Fidelity National Information Services, Inc. (FIS) and BigBear.ai Holdings, Inc. (BBAI) represent two distinct yet overlapping forces in information technology services. FIS, a well-established giant, offers comprehensive financial technology solutions, while BigBear.ai focuses on cutting-edge artificial intelligence and machine learning for decision support. This comparison explores their market positions and innovation strategies to help you identify the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Fidelity National Information Services, Inc. and BigBear.ai Holdings, Inc. by providing an overview of these two companies and their main differences.

Fidelity National Information Services, Inc. Overview

Fidelity National Information Services, Inc. (FIS) delivers technology solutions to merchants, banks, and capital markets firms worldwide. Operating through Merchant, Banking, and Capital Market Solutions segments, it offers services such as enterprise acquiring, core processing, digital banking, risk management, and securities processing. Founded in 1968 and headquartered in Jacksonville, Florida, FIS is a major player with a market cap of $33B and a workforce of 50,000 employees.

BigBear.ai Holdings, Inc. Overview

BigBear.ai Holdings, Inc. (BBAI) specializes in artificial intelligence and machine learning to support decision-making. Its two segments, Cyber & Engineering and Analytics, provide consulting and technology services in cloud engineering, cybersecurity, big data computing, and predictive analytics. Founded more recently and based in Columbia, Maryland, BBAI has a market cap of $2.3B and employs approximately 630 people.

Key similarities and differences

Both companies operate in the technology sector focusing on information services but differ significantly in scale and specialization. FIS offers broad financial technology solutions across multiple segments, serving large financial institutions globally. In contrast, BBAI concentrates on AI-driven decision support and analytics, with a niche in cybersecurity and big data. FIS’s extensive employee base contrasts with BBAI’s smaller, specialized workforce, reflecting their differing market positions and business models.

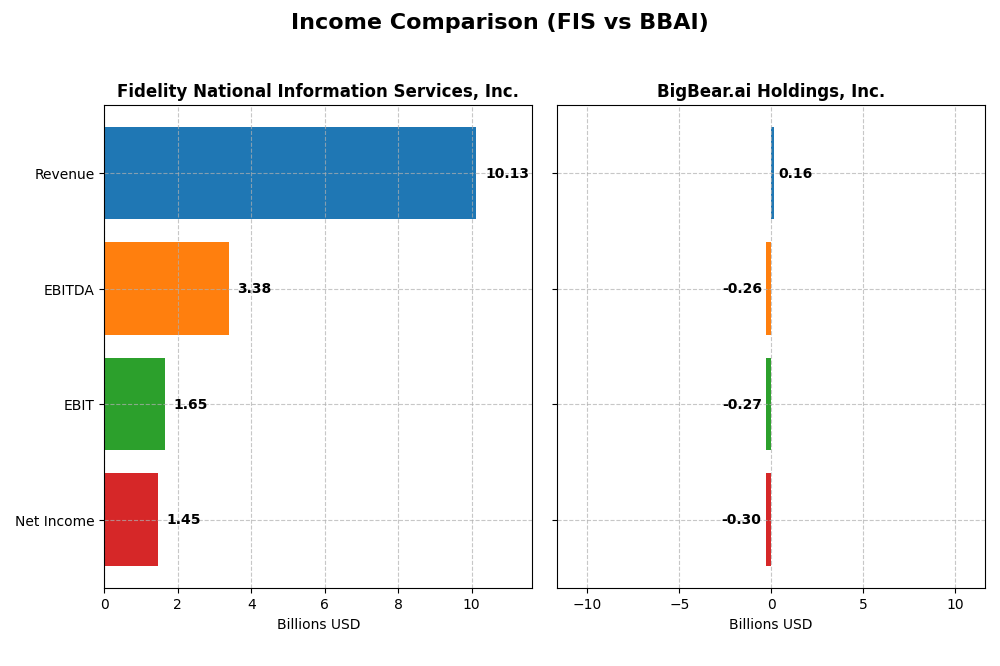

Income Statement Comparison

The following table presents the key income statement figures for Fidelity National Information Services, Inc. (FIS) and BigBear.ai Holdings, Inc. (BBAI) for the fiscal year 2024, allowing investors to evaluate their recent financial performance side by side.

| Metric | Fidelity National Information Services, Inc. (FIS) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| Market Cap | 33.1B | 2.3B |

| Revenue | 10.1B | 158M |

| EBITDA | 3.39B | -258M |

| EBIT | 1.65B | -270M |

| Net Income | 1.45B | -296M |

| EPS | 1.42 | -1.27 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Fidelity National Information Services, Inc.

FIS’s revenue showed a slight increase in the most recent year to $10.13B, with net income rebounding strongly to $1.45B after previous losses. Margins improved significantly, with a gross margin of 37.56% and net margin of 14.32%. The 2024 performance reflects stabilized growth and healthier profitability, supported by favorable margin expansions.

BigBear.ai Holdings, Inc.

BBAI’s revenue increased marginally to $158M in 2024, but it remained deeply unprofitable with a net loss of $296M. Gross margin is positive at 28.58%, yet EBIT and net margins are heavily negative, indicating high operating costs and interest expenses. The latest year saw deteriorating profitability despite modest revenue growth, highlighting ongoing financial challenges.

Which one has the stronger fundamentals?

FIS demonstrates stronger fundamentals with favorable margin profiles and a positive net income turnaround, despite modest revenue growth. Conversely, BBAI faces significant losses, negative margins, and declining profitability despite revenue gains. The clearer margin stability and income growth position FIS as fundamentally more robust based on income statement metrics.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Fidelity National Information Services, Inc. (FIS) and BigBear.ai Holdings, Inc. (BBAI) based on their most recent fiscal year data for 2024.

| Ratios | Fidelity National Information Services, Inc. (FIS) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| ROE | 9.24% | 79.58% |

| ROIC | 3.99% | -93.42% |

| P/E | 30.8 | -3.52 |

| P/B | 2.85 | -279.9 |

| Current Ratio | 0.85 | 0.46 |

| Quick Ratio | 0.85 | 0.46 |

| D/E | 0.74 | -39.42 |

| Debt-to-Assets | 34.2% | 42.6% |

| Interest Coverage | 4.87 | -5.20 |

| Asset Turnover | 0.30 | 0.46 |

| Fixed Asset Turnover | 11.56 | 14.61 |

| Payout ratio | 55.2% | 0% |

| Dividend yield | 1.79% | 0% |

Interpretation of the Ratios

Fidelity National Information Services, Inc. (FIS)

FIS shows a mixed ratio profile with a favorable net margin of 14.32% but weaker returns on equity (9.24%) and invested capital (3.99%). Its liquidity ratios are below the ideal threshold, suggesting some short-term risk. The dividend yield is moderate at 1.79%, supported by consistent payouts, though payout sustainability should be monitored given free cash flow pressures.

BigBear.ai Holdings, Inc. (BBAI)

BBAI displays mostly unfavorable ratios, including a negative net margin (-186.78%) and poor liquidity (current ratio 0.46). Despite an unusually high return on equity, this is likely due to financial distortions. The company does not pay dividends, reflecting its focus on reinvestment and growth amid ongoing operational losses and cash flow challenges.

Which one has the best ratios?

Between the two, FIS presents a more stable financial condition with several neutral or favorable ratios, especially profitability and dividend yield. BBAI’s ratios indicate significant operational and liquidity weaknesses, with a high proportion of unfavorable metrics. Overall, FIS’s financial ratios appear comparatively stronger and more balanced.

Strategic Positioning

This section compares the strategic positioning of Fidelity National Information Services, Inc. (FIS) and BigBear.ai Holdings, Inc. (BBAI) regarding market position, key segments, and exposure to technological disruption:

FIS

- Large market cap of 33B USD with established presence in IT services, facing moderate competitive pressure.

- Diversified segments: Banking Solutions, Capital Market, and Merchant Solutions drive revenue.

- Exposure centered on IT services for finance, with digital and risk management innovations.

BBAI

- Smaller market cap of 2.3B USD, operating in niche AI and machine learning, higher volatility.

- Focused on Cyber & Engineering and Analytics segments, specializing in AI and decision support.

- High exposure to AI disruption with emphasis on predictive analytics and cybersecurity.

FIS vs BBAI Positioning

FIS pursues a diversified approach targeting multiple financial technology segments, offering scale advantages but facing broad competitive pressures. BBAI is more concentrated in AI-driven analytics and cybersecurity, leveraging specialized technology but with limited scale and higher risk.

Which has the best competitive advantage?

Based on MOAT evaluation, FIS shows slightly unfavorable value destruction but improving profitability, while BBAI displays very unfavorable value destruction with declining profitability, indicating FIS currently maintains a relatively stronger competitive advantage.

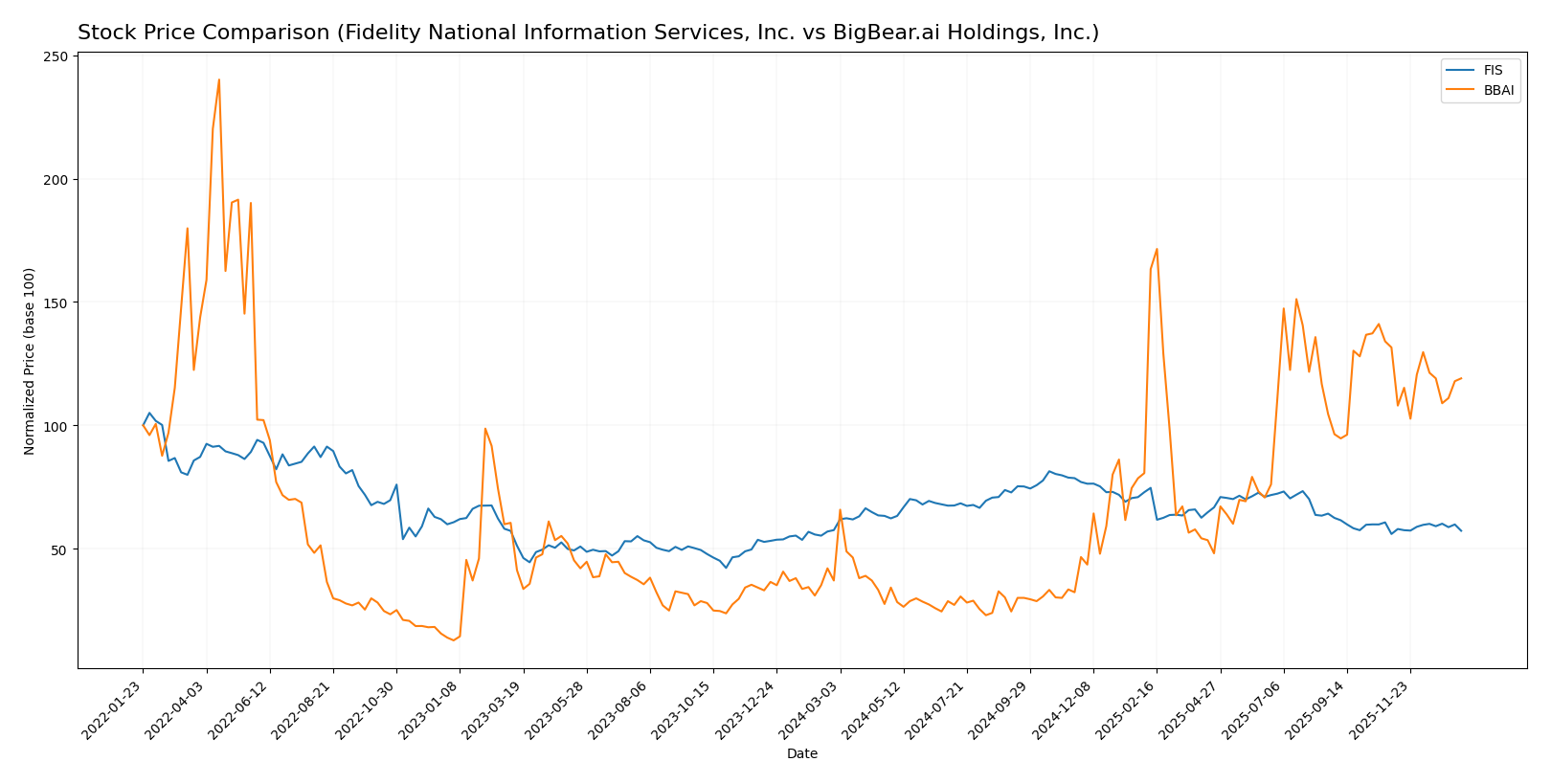

Stock Comparison

The stock prices of Fidelity National Information Services, Inc. (FIS) and BigBear.ai Holdings, Inc. (BBAI) have shown contrasting movements over the past 12 months, with FIS exhibiting mild bearish pressure and recent modest recovery, while BBAI experienced a strong bullish surge followed by recent decline.

Trend Analysis

FIS recorded an overall price decrease of 0.47% over the past year, indicating a neutral to slightly bearish trend with accelerating movement and a high volatility of 7.01. Recently, its price increased by 2.34%, showing a short-term bullish reversal.

BBAI’s stock price surged by 221.03% during the same period, reflecting a strong bullish trend despite deceleration and moderate volatility of 2.19. However, recent data show a 9.54% price drop, signaling a short-term bearish correction.

Comparing the two, BBAI delivered the highest market performance with a substantial overall price increase, while FIS maintained a relatively stable price with minor fluctuations.

Target Prices

The current analyst consensus reflects moderate upside potential for these technology service companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Fidelity National Information Services, Inc. | 82 | 69 | 75.5 |

| BigBear.ai Holdings, Inc. | 6 | 6 | 6 |

Analysts expect Fidelity National Information Services, Inc. to trade above its current price of 63.98 USD, indicating potential appreciation. BigBear.ai Holdings, Inc.’s target consensus aligns closely with its current price of 6.26 USD, suggesting limited near-term price movement.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Fidelity National Information Services, Inc. (FIS) and BigBear.ai Holdings, Inc. (BBAI):

Rating Comparison

FIS Rating

- Rating: C+, considered Very Favorable overall.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation assessment.

- ROE Score: 2, showing Moderate efficiency in generating profit from equity.

- ROA Score: 2, reflecting Moderate asset utilization efficiency.

- Debt To Equity Score: 1, a Very Unfavorable sign of higher financial risk.

- Overall Score: 2, categorized as Moderate overall financial standing.

BBAI Rating

- Rating: C-, also considered Very Favorable overall.

- Discounted Cash Flow Score: 1, indicating a Very Unfavorable valuation.

- ROE Score: 1, indicating Very Unfavorable profit generation from equity.

- ROA Score: 1, indicating Very Unfavorable asset utilization.

- Debt To Equity Score: 3, Moderate level of financial risk.

- Overall Score: 1, categorized as Very Unfavorable overall financial standing.

Which one is the best rated?

FIS has a higher overall rating (C+) and better scores in discounted cash flow, ROE, and ROA, despite a weak debt-to-equity score. BBAI scores lower overall with a C- rating and mostly very unfavorable financial metrics, except for a moderate debt-to-equity score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Fidelity National Information Services, Inc. (FIS) and BigBear.ai Holdings, Inc. (BBAI):

FIS Scores

- Altman Z-Score: 0.46, indicating financial distress (distress zone).

- Piotroski Score: 8, reflecting very strong financial health.

BBAI Scores

- Altman Z-Score: 2.93, indicating moderate bankruptcy risk (grey zone).

- Piotroski Score: 3, indicating very weak financial health.

Which company has the best scores?

Based strictly on the provided data, FIS has a weaker Altman Z-Score but a much stronger Piotroski Score compared to BBAI. Overall, FIS shows stronger financial health through its Piotroski Score despite higher bankruptcy risk indicated by its Z-Score.

Grades Comparison

A comparison of the latest grades and ratings from reputable grading companies for the two companies follows:

Fidelity National Information Services, Inc. Grades

The following table summarizes recent grades assigned by verified grading firms for Fidelity National Information Services, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2025-11-19 |

| RBC Capital | Maintain | Outperform | 2025-11-06 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

| UBS | Maintain | Buy | 2025-11-06 |

| Truist Securities | Maintain | Hold | 2025-10-24 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-01 |

| UBS | Upgrade | Buy | 2025-09-30 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-08-06 |

| Truist Securities | Maintain | Hold | 2025-07-17 |

Overall, Fidelity National Information Services shows a consistent trend of buy and outperform ratings with several holds, indicating moderate to positive sentiment across multiple analysts.

BigBear.ai Holdings, Inc. Grades

The table below presents recent grades from recognized grading companies for BigBear.ai Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Downgrade | Neutral | 2026-01-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-11 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-12 |

| HC Wainwright & Co. | Maintain | Buy | 2025-07-01 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-07 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-30 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-10-15 |

| Cantor Fitzgerald | Maintain | Overweight | 2024-08-21 |

BigBear.ai Holdings has mostly buy and overweight ratings, with a recent downgrade to neutral by Cantor Fitzgerald, indicating some caution emerging among analysts.

Which company has the best grades?

Fidelity National Information Services has received a broader base of positive grades including multiple outperform and buy ratings, while BigBear.ai Holdings presents predominantly buy ratings but with a recent downgrade to neutral. Investors might view Fidelity’s more balanced but consistently positive grades as reflecting steadier analyst confidence.

Strengths and Weaknesses

Below is a comparison table of key strengths and weaknesses for Fidelity National Information Services, Inc. (FIS) and BigBear.ai Holdings, Inc. (BBAI) based on their latest financial and operational data.

| Criterion | Fidelity National Information Services, Inc. (FIS) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| Diversification | Highly diversified with strong Banking and Capital Market Solutions segments; revenue 9.87B USD in 2024 | Limited diversification; single reportable segment with 158M USD revenue in 2024 |

| Profitability | Positive net margin of 14.32%, but ROIC (3.99%) below WACC (6.54%), indicating value destruction | Negative net margin (-186.78%) with declining ROIC (-93.42%), showing major profitability issues |

| Innovation | Moderate innovation indicated by strong fixed asset turnover (11.56) and growing ROIC trend | Innovation constrained by declining profitability and unfavorable ROIC trend |

| Global presence | Large global presence with revenues primarily from financial solutions worldwide | Smaller scale, mostly focused on analytics and cyber solutions in niche markets |

| Market Share | Significant market share in financial services technology | Small market share in AI and analytics sectors |

Key takeaways: FIS benefits from strong diversification and a growing ROIC trend, but struggles with profitability efficiency as ROIC remains below WACC. BBAI faces severe profitability challenges and shrinking returns, limiting its investment appeal despite some favorable ratio signals. Caution is advised when considering BBAI for long-term holdings.

Risk Analysis

Below is a risk comparison table for Fidelity National Information Services, Inc. (FIS) and BigBear.ai Holdings, Inc. (BBAI) based on 2024 data and market conditions:

| Metric | Fidelity National Information Services, Inc. (FIS) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| Market Risk | Moderate (Beta 0.94, stable tech sector) | High (Beta 3.21, volatile AI sector) |

| Debt level | Moderate (Debt-to-Assets 34%, Interest Coverage 4.7) | Neutral (Debt-to-Assets 43%, negative interest coverage) |

| Regulatory Risk | Moderate (Financial tech compliance focus) | Moderate to High (AI and cybersecurity regulations evolving) |

| Operational Risk | Moderate (Large scale, diversified segments) | High (Small size, growth phase, tech dependency) |

| Environmental Risk | Low (Tech services, minimal direct impact) | Low (AI services, minimal direct impact) |

| Geopolitical Risk | Moderate (Global operations, US base) | Moderate (US focused, sensitive to tech export controls) |

FIS faces moderate market and regulatory risks but has a solid operational base with manageable debt. BBAI has higher market volatility and operational risks due to its small size and sector but less financial stability, indicated by negative interest coverage and weaker liquidity. The most impactful risks are BBAI’s financial distress signals and high market volatility, while FIS’s moderate debt and sector exposure require monitoring.

Which Stock to Choose?

Fidelity National Information Services, Inc. (FIS) shows a favorable income statement with a 14.32% net margin and positive growth in net income and EPS. Its financial ratios are slightly unfavorable overall, with a moderate debt level and some weak profitability metrics, while the rating is very favorable at C+.

BigBear.ai Holdings, Inc. (BBAI) presents an unfavorable income statement marked by a -186.78% net margin and declining profitability despite strong revenue growth overall. Financial ratios are mostly unfavorable, though some leverage metrics are favorable, and its rating is very favorable at C- despite financial challenges.

For investors, FIS might appear more suitable for those prioritizing income stability and improving profitability, while BBAI could be interpreted as fitting for risk-tolerant investors focused on growth potential despite financial volatility. The ratings and income evaluations suggest differing risk-return profiles to consider.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fidelity National Information Services, Inc. and BigBear.ai Holdings, Inc. to enhance your investment decisions: