Home > Comparison > Technology > DXC vs BBAI

The strategic rivalry between DXC Technology Company and BigBear.ai Holdings, Inc. shapes the evolution of the technology services sector. DXC operates as a capital-intensive giant delivering broad IT infrastructure and business process services globally. In contrast, BigBear.ai focuses on high-margin AI-driven analytics and cybersecurity consulting. This analysis pits scale and legacy transformation against innovation and agility to identify the superior risk-adjusted corporate trajectory for diversified portfolios.

Table of contents

Companies Overview

DXC Technology Company and BigBear.ai Holdings, Inc. shape critical niches in the evolving IT services landscape.

DXC Technology Company: Global IT Services Powerhouse

DXC Technology Company dominates the IT services sector with a focus on digital transformation and infrastructure management. It generates revenue by delivering analytics, software engineering, cloud migration, and cybersecurity solutions. In 2026, DXC prioritizes modernizing legacy applications and expanding its multi-cloud environment management to reduce clients’ operational risks and costs.

BigBear.ai Holdings, Inc.: AI-Driven Decision Support Innovator

BigBear.ai Holdings, Inc. specializes in artificial intelligence and machine learning for decision support. It earns revenue through consulting in cybersecurity, cloud engineering, and advanced analytics. The company’s 2026 strategy centers on enhancing predictive and prescriptive analytics to empower real-time decision-making for its clients across Cyber & Engineering and Analytics segments.

Strategic Collision: Similarities & Divergences

Both companies target IT services but differ sharply in approach. DXC offers a broad, integrated IT services portfolio with legacy system modernization. BigBear.ai adopts a narrower AI and analytics focus emphasizing real-time insights. Their primary battleground lies in delivering scalable, secure digital solutions. DXC appeals to large enterprises needing comprehensive IT transformation, while BigBear.ai attracts clients seeking cutting-edge AI-driven analytics.

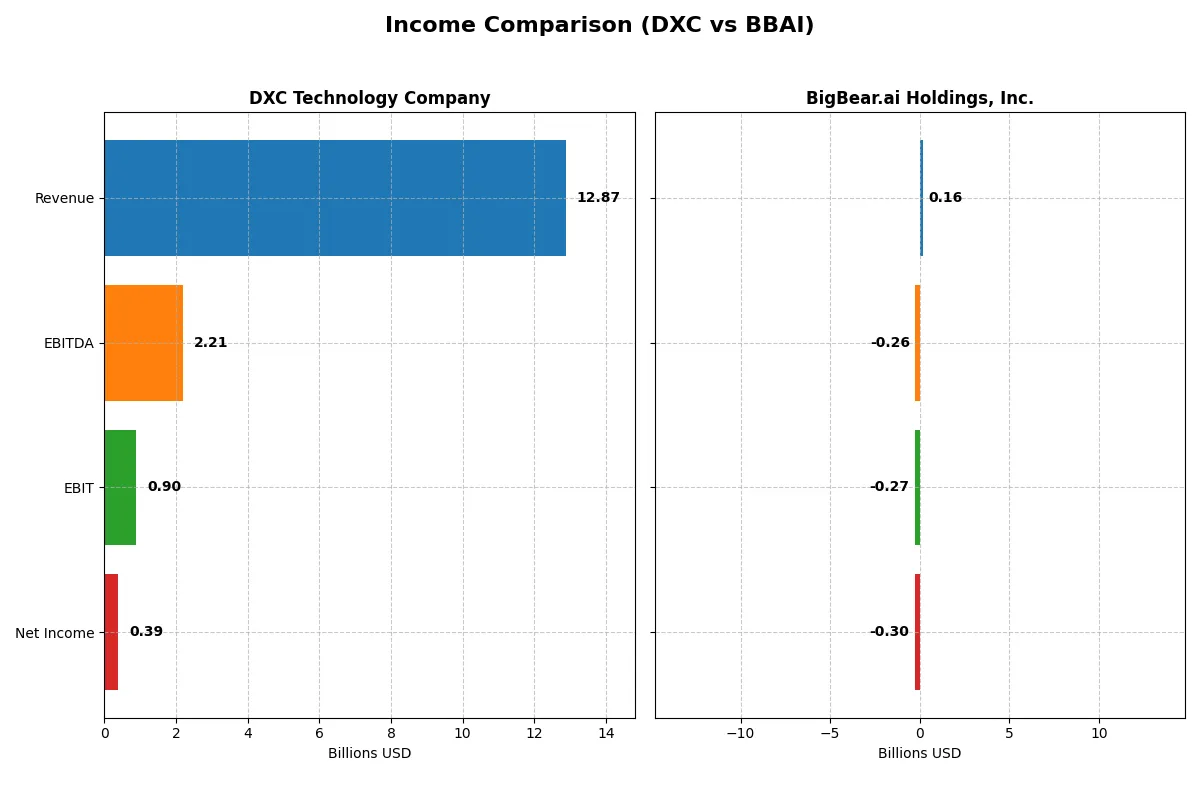

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | DXC Technology Company (DXC) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| Revenue | 12.87B | 158M |

| Cost of Revenue | 9.77B | 113M |

| Operating Expenses | 2.40B | 179M |

| Gross Profit | 3.10B | 45M |

| EBITDA | 2.21B | -258M |

| EBIT | 895M | -270M |

| Interest Expense | 265M | 26M |

| Net Income | 389M | -296M |

| EPS | 2.15 | -1.27 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This comparison reveals which company operates its business with superior efficiency and delivers better profitability under current market conditions.

DXC Technology Company Analysis

DXC’s revenue declined from 16.3B in 2021 to 12.9B in 2025, showing a 21% drop. Net income recovered sharply from a 568M loss in 2023 to 389M profit in 2025. Its gross margin steadied near 24%, while net margin improved to about 3%, signaling regained operational control and improving bottom-line momentum.

BigBear.ai Holdings, Inc. Analysis

BigBear.ai’s revenue grew steadily, reaching 158M in 2024 from 91M in 2020, a 73% increase. However, it posted consistent net losses, culminating at -296M in 2024. Gross margin improved to 28.6%, but EBIT and net margins remained deeply negative, reflecting high expenses and weak profitability despite top-line growth.

Margin Discipline vs. Growth Struggles

DXC demonstrates stronger margin discipline and a clear turnaround in net income, while BigBear.ai struggles with persistent losses despite revenue gains. DXC’s improving profitability makes it the fundamental winner in operational efficiency. Investors seeking stabilized earnings may find DXC’s profile more attractive than BigBear.ai’s high-risk growth trajectory.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | DXC Technology Company (DXC) | BigBear.ai Holdings, Inc. (BBAI) |

|---|---|---|

| ROE | 12.05% | 79.58% |

| ROIC | 4.43% | -93.42% |

| P/E | 7.92 | -3.52 |

| P/B | 0.95 | -279.90 |

| Current Ratio | 1.22 | 0.46 |

| Quick Ratio | 1.22 | 0.46 |

| D/E | 1.41 | -39.42 |

| Debt-to-Assets | 34.43% | 42.59% |

| Interest Coverage | 2.63 | -5.20 |

| Asset Turnover | 0.97 | 0.46 |

| Fixed Asset Turnover | 6.82 | 14.61 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and revealing operational excellence behind headline numbers.

DXC Technology Company

DXC posts a moderate 12.05% ROE and slim 3.02% net margin, showing restrained profitability. Its P/E of 7.92 and P/B below 1 indicate a fairly valued, even slightly undervalued stock. DXC does not pay dividends, suggesting reinvestment into stabilizing operations amid a neutral liquidity profile and manageable debt load.

BigBear.ai Holdings, Inc.

BBAI’s ratios paint a volatile picture: ROE is an extreme 7,958%, but net margin is deeply negative at -187%. Valuation metrics show negative P/E and P/B, reflecting losses and market uncertainty. Its weak current ratio of 0.46 flags liquidity risks, and no dividends underscore a focus on growth, albeit with operational struggles and heavy R&D spending.

Balanced Value vs. High-Risk Growth

DXC offers a more balanced risk-reward profile with stable valuation and moderate returns, while BBAI’s metrics signal high volatility and financial distress. Investors seeking operational safety may prefer DXC, whereas risk-tolerant growth seekers might find BBAI’s profile intriguing despite its challenges.

Which one offers the Superior Shareholder Reward?

I observe that DXC Technology Company offers no dividends but generates solid free cash flow of 4.5/share in 2025, supporting a moderate buyback program that sustains shareholder value. BigBear.ai Holdings, Inc. pays no dividends and suffers heavy losses with negative free cash flow, undermining buyback capacity. DXC’s distribution model is more sustainable, balancing reinvestment and shareholder returns amid moderate leverage. Conversely, BBAI’s aggressive growth stance carries elevated financial risk and no shareholder distributions. I conclude DXC delivers the superior total return profile for investors in 2026.

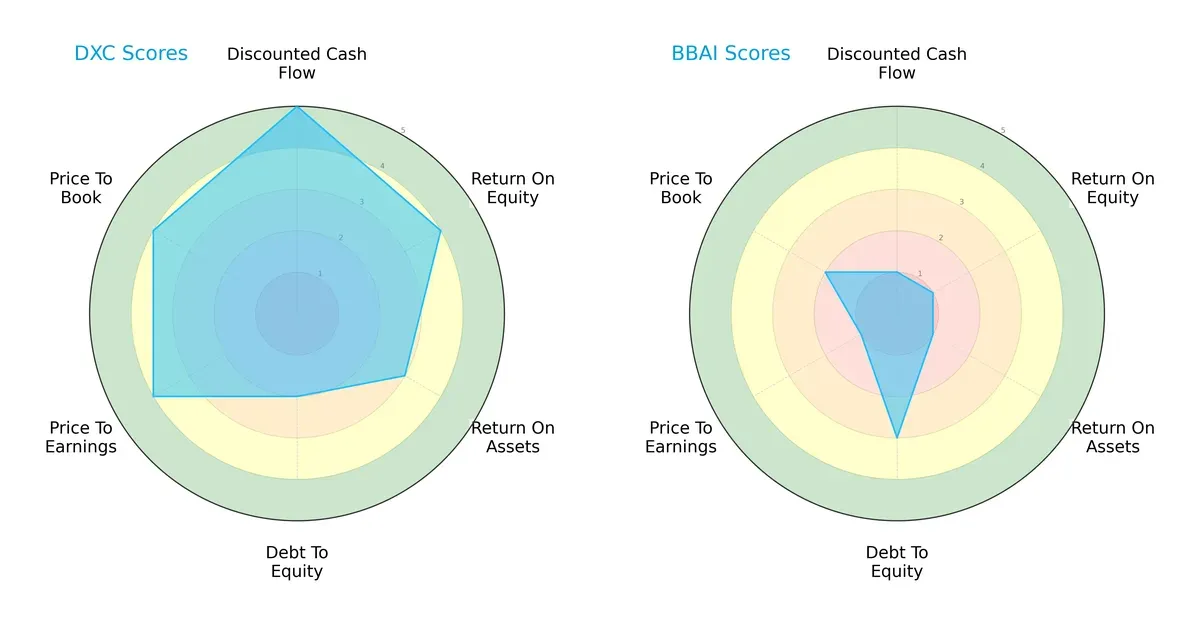

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of DXC Technology Company and BigBear.ai Holdings, Inc.:

DXC dominates with a balanced profile, scoring high in DCF (5), ROE (4), and valuation metrics (PE and PB at 4). BigBear.ai relies on a moderate debt-to-equity score (3) but scores very low across DCF, ROE, ROA, and valuation, indicating heavy operational and valuation challenges. DXC’s strength lies in consistent cash flows and efficient capital use, while BigBear.ai lacks core profitability and valuation appeal.

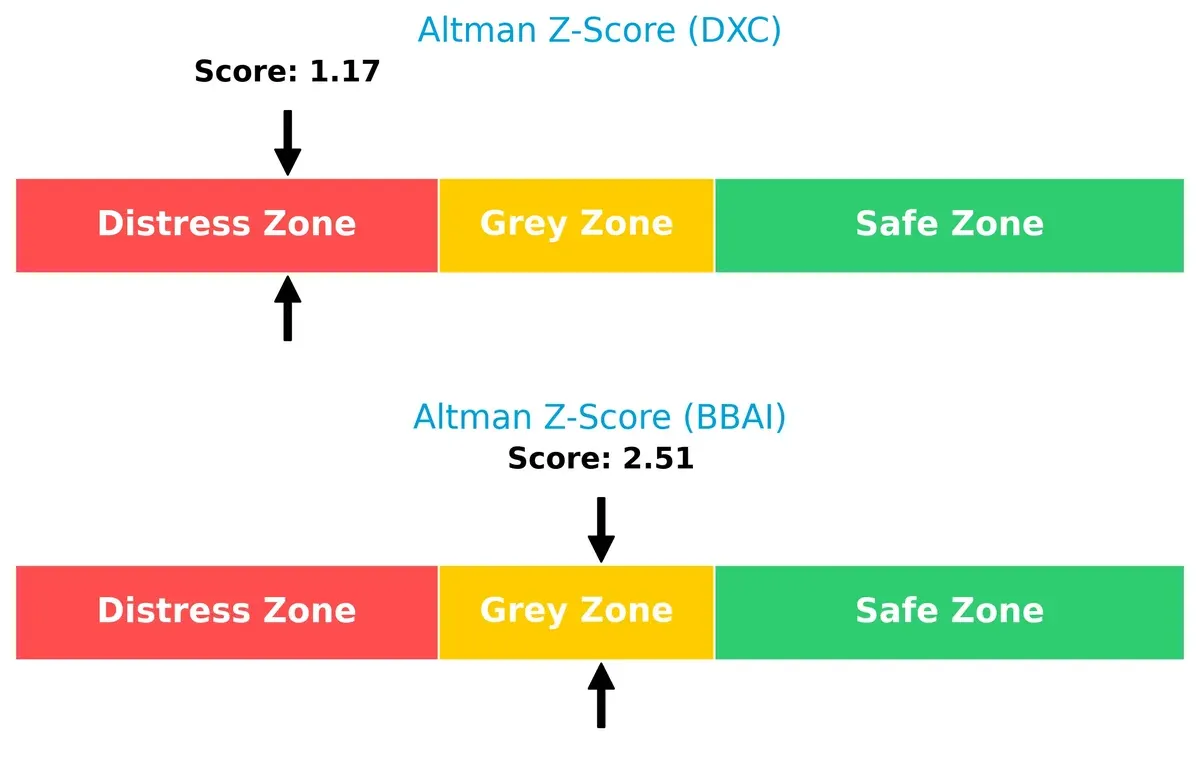

Bankruptcy Risk: Solvency Showdown

DXC’s Altman Z-Score of 1.17 places it in the distress zone, signaling elevated bankruptcy risk amid current market pressures. BigBear.ai scores 2.51, landing in the grey zone, which suggests moderate solvency risk but better resilience than DXC:

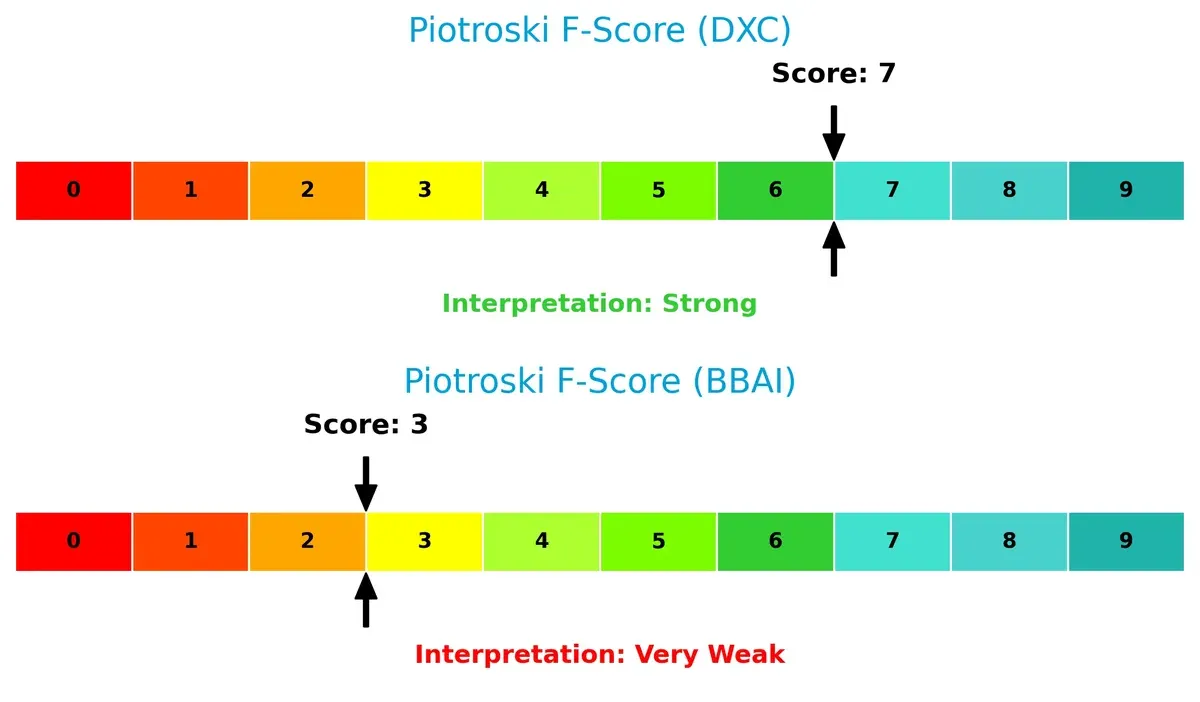

Financial Health: Quality of Operations

DXC’s Piotroski F-Score of 7 signals strong financial health with solid profitability and operational efficiency. BigBear.ai’s score of 3 flags significant internal weaknesses, raising red flags for value investors:

How are the two companies positioned?

This section dissects DXC and BBAI’s operational DNA by comparing their revenue distribution and internal dynamics. It confronts their economic moats to reveal which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how DXC Technology Company and BigBear.ai Holdings diversify their income streams and where their primary sector bets lie:

BigBear.ai shows a clear reliance on its Analytics segment, which anchors $84M in 2022 and $158M in 2024 under a broad reportable category. DXC lacks reported segment data, preventing direct comparison. BigBear.ai’s growth in Analytics signals a strategic pivot toward data-driven services, but the absence of other segments suggests concentration risk. This focus contrasts with typical diversified tech giants who balance infrastructure and analytics for ecosystem resilience.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of DXC Technology Company and BigBear.ai Holdings, Inc.:

DXC Strengths

- Favorable price-to-earnings and price-to-book ratios

- Quick ratio above 1 supports liquidity

- Fixed asset turnover very efficient at 6.82

BBAI Strengths

- Extremely high return on equity signals strong shareholder value creation

- Favorable P/E and P/B ratios despite losses

- Very high fixed asset turnover at 14.61

DXC Weaknesses

- Low net margin and ROIC below WACC highlight profitability challenges

- Debt-to-equity ratio above 1.4 suggests leverage risk

- Zero dividend yield limits income appeal

BBAI Weaknesses

- Negative net margin and ROIC show deep unprofitability

- Very low current and quick ratios indicate liquidity stress

- Negative interest coverage and unfavorable asset turnover raise financial stability concerns

DXC demonstrates stable liquidity and valuation metrics but struggles with profitability and leverage. BBAI shows operational intensity and shareholder returns but suffers significant liquidity and profitability weaknesses that pose material risks to its financial health.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting long-term profits from relentless competitive pressure. Let’s dissect how each firm’s moat shapes their future:

DXC Technology Company: Legacy Scale with Operational Efficiency

DXC leverages cost advantage from scale and deep client relationships, reflected in stable gross margins near 24%. However, declining ROIC signals erosion. New cloud and automation services could deepen its moat if managed well.

BigBear.ai Holdings, Inc.: AI Innovation with Growth Potential

BigBear.ai’s moat stems from intangible assets in AI and analytics, contrasting DXC’s scale. Despite favorable revenue growth, its negative ROIC and high interest costs reveal fragile profitability. Expansion into cybersecurity and predictive analytics may disrupt the market.

Legacy Scale vs. AI Innovation: The Moat Showdown

DXC’s moat is wider, anchored in operational scale and stable margins, though it faces value erosion. BigBear.ai’s moat is narrower and less durable, with heavy losses undermining its competitive edge. DXC is better positioned to defend market share in the near term.

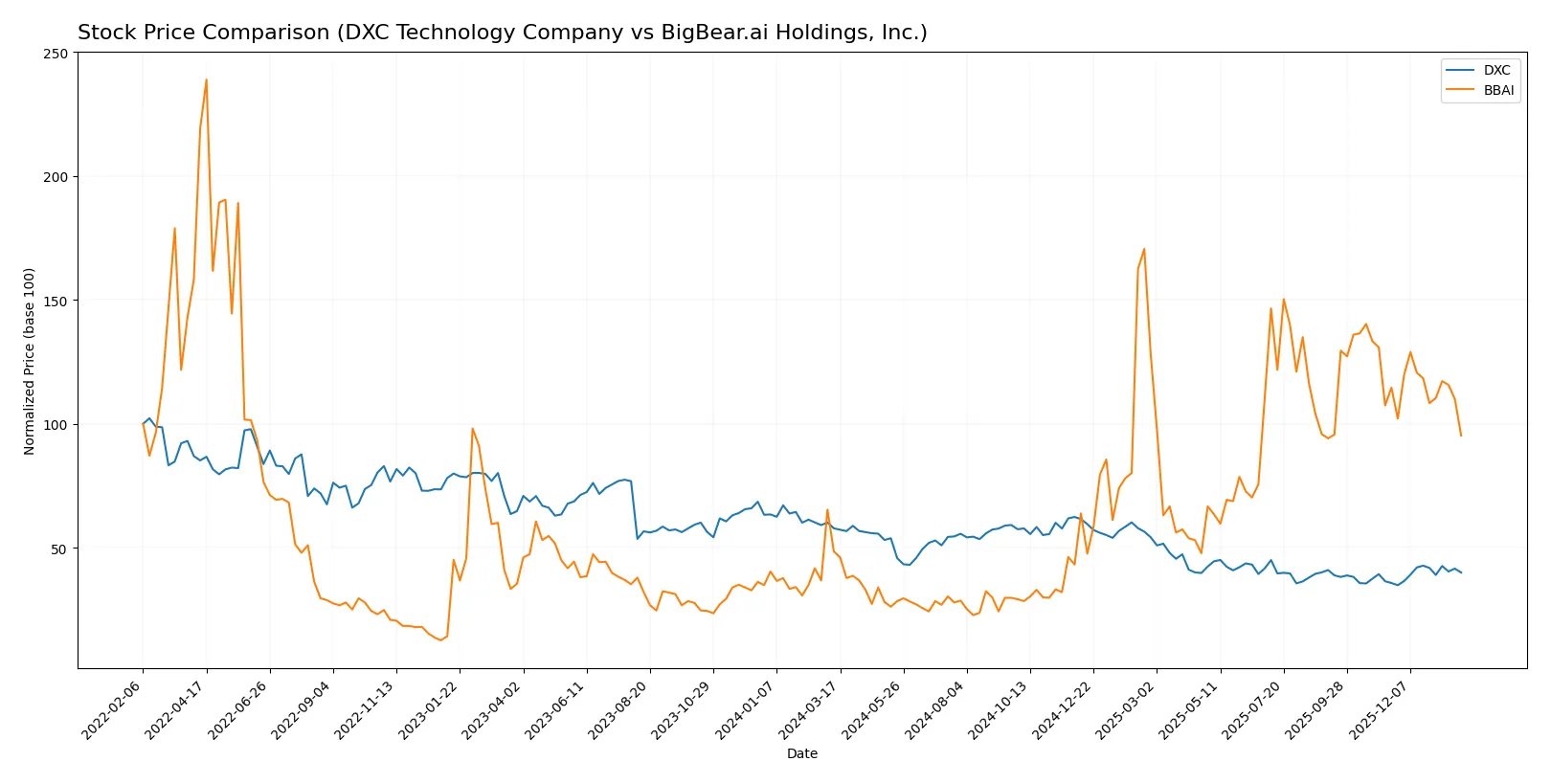

Which stock offers better returns?

The past year reveals starkly contrasting stock paths: DXC Technology Company shows a sharp decline with recent recovery signs, while BigBear.ai Holdings, Inc. rallies strongly but faces recent pullback pressures.

Trend Comparison

DXC Technology’s stock fell 30.82% over the past year, marking a bearish trend with accelerating decline. Recent months saw an 11.77% rebound, indicating early recovery amid moderate volatility.

BigBear.ai’s stock surged 96.11% over the year, reflecting a bullish trend with decelerating gains. However, the last months showed a 16.83% drop, signaling a short-term bearish correction with low volatility.

Comparing the two, BigBear.ai delivered the highest annual market performance despite recent weakness, while DXC’s steep loss was partially offset by a recent upward trend.

Target Prices

Analysts present a cautious consensus for DXC Technology Company and BigBear.ai Holdings, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| DXC Technology Company | 13 | 14 | 13.5 |

| BigBear.ai Holdings, Inc. | 6 | 6 | 6 |

DXC’s target consensus at 13.5 is slightly below its current price of 14.43, suggesting limited near-term upside. BigBear.ai’s target of 6 surpasses the current 5.04, indicating moderate growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

DXC Technology Company Grades

Here are recent grades from established financial institutions for DXC Technology Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Hold | 2025-10-31 |

| JP Morgan | Maintain | Underweight | 2025-08-20 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-01 |

| RBC Capital | Maintain | Sector Perform | 2025-08-01 |

| JP Morgan | Maintain | Underweight | 2025-05-21 |

| RBC Capital | Maintain | Sector Perform | 2025-05-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-05-15 |

| BMO Capital | Maintain | Market Perform | 2025-05-15 |

| Guggenheim | Maintain | Neutral | 2025-05-12 |

| Susquehanna | Maintain | Neutral | 2025-04-23 |

BigBear.ai Holdings, Inc. Grades

Below are recent grades from recognized financial firms for BigBear.ai Holdings, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Downgrade | Neutral | 2026-01-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-11 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-12 |

| HC Wainwright & Co. | Maintain | Buy | 2025-07-01 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-07 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-30 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-06 |

| HC Wainwright & Co. | Maintain | Buy | 2024-10-15 |

| Cantor Fitzgerald | Maintain | Overweight | 2024-08-21 |

Which company has the best grades?

BigBear.ai Holdings, Inc. consistently receives Buy and Overweight ratings, indicating stronger institutional confidence. DXC Technology Company’s grades cluster around Hold and Underweight, reflecting more cautious views. This disparity may affect investor sentiment and portfolio allocation preferences.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

DXC Technology Company

- Established player in IT services with diversified offerings and large client base.

BigBear.ai Holdings, Inc.

- Smaller, niche AI and analytics provider facing intense competition and rapid tech evolution.

2. Capital Structure & Debt

DXC Technology Company

- Debt-to-equity ratio of 1.41 signals moderate leverage; interest coverage ratio at 3.38 is adequate.

BigBear.ai Holdings, Inc.

- Negative debt-to-equity ratio suggests complex capital structure; interest coverage is poor at -10.53, indicating distress.

3. Stock Volatility

DXC Technology Company

- Beta of 1.045 indicates stock volatility near market average, offering relative stability.

BigBear.ai Holdings, Inc.

- High beta of 3.214 signals extreme volatility, exposing investors to higher risk and price swings.

4. Regulatory & Legal

DXC Technology Company

- Operates globally with exposure to data security and compliance regulations but has established controls.

BigBear.ai Holdings, Inc.

- Emerging firm with less regulatory track record, exposed to evolving AI governance and cybersecurity rules.

5. Supply Chain & Operations

DXC Technology Company

- Large scale operations with legacy system integration challenges but diversified global delivery model.

BigBear.ai Holdings, Inc.

- Smaller operation with agile systems but more vulnerable to supply disruptions and talent shortages.

6. ESG & Climate Transition

DXC Technology Company

- Moderate ESG initiatives in place; industry pressure to improve sustainability and reduce carbon footprint.

BigBear.ai Holdings, Inc.

- Early stage on ESG metrics; must accelerate climate transition efforts to meet investor expectations.

7. Geopolitical Exposure

DXC Technology Company

- Global footprint exposes DXC to geopolitical risks in North America, Europe, and Asia.

BigBear.ai Holdings, Inc.

- Primarily US-based, limiting geopolitical exposure but reliant on domestic policy stability.

Which company shows a better risk-adjusted profile?

DXC’s moderate leverage, stable market position, and lower volatility create a more balanced risk profile. BigBear.ai faces pronounced financial distress signals and high volatility that elevate investment risk. DXC’s Altman Z-score places it in the distress zone, but BigBear.ai’s score in the grey zone with a weak Piotroski score confirms deeper financial instability. I observe that BigBear.ai’s extreme beta (3.214) and negative profitability metrics amplify its risk exposure, whereas DXC’s more favorable valuation ratios and stronger operational scale mitigate some concerns. Overall, DXC demonstrates a better risk-adjusted profile in the 2026 environment.

Final Verdict: Which stock to choose?

DXC Technology’s superpower lies in its operational resilience and improving profitability metrics, making it a cash-efficient player in a challenging sector. Its point of vigilance is the ongoing value erosion reflected by a declining ROIC, signaling caution for long-term value investors. This stock suits portfolios aiming for steady value recovery.

BigBear.ai’s strategic moat is its cutting-edge AI capabilities, positioning it for growth in a nascent but fast-evolving market. However, its financial instability and negative cash flow present obvious risks, offering less safety compared to DXC. It fits aggressive growth portfolios willing to accept volatility for potential high upside.

If you prioritize operational stability and a path toward value creation, DXC outshines due to its stronger cash flow and more favorable risk profile. However, if you seek exposure to disruptive technology with high growth potential despite financial headwinds, BigBear.ai offers a compelling, albeit riskier, scenario.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of DXC Technology Company and BigBear.ai Holdings, Inc. to enhance your investment decisions: