Unity Software Inc. and Bentley Systems, Incorporated are two leading players in the software application industry, each driving innovation in real-time 3D content and infrastructure engineering software, respectively. While Unity focuses on interactive digital experiences across multiple platforms, Bentley excels in advanced infrastructure design and simulation solutions. This comparison explores their distinct market positions and growth strategies to help you identify which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Unity Software Inc. and Bentley Systems, Incorporated by providing an overview of these two companies and their main differences.

Unity Software Inc. Overview

Unity Software Inc. creates and operates an interactive real-time 3D content platform, offering software solutions to create, run, and monetize interactive 2D and 3D content across multiple devices. Serving developers, artists, and designers worldwide, Unity focuses on enabling content creation for mobile, PC, consoles, and augmented and virtual reality. Founded in 2004 and headquartered in San Francisco, Unity is a key player in the application software industry.

Bentley Systems, Incorporated Overview

Bentley Systems, Incorporated provides infrastructure engineering software solutions globally, specializing in open modeling and simulation applications for infrastructure design and asset performance systems. The company serves a diverse clientele including engineers, architects, and planners with a comprehensive suite of software for infrastructure project delivery and asset management. Founded in 1984 and based in Exton, Pennsylvania, Bentley is a prominent software provider in the infrastructure sector.

Key similarities and differences

Both Unity and Bentley operate in the technology sector, focusing on application software serving specialized professional markets. Unity emphasizes interactive real-time 3D content creation for various digital platforms, whereas Bentley concentrates on engineering software for infrastructure design and asset management. While Unity targets content creators and developers, Bentley’s clientele primarily consists of engineers and infrastructure professionals, reflecting distinct but complementary market focuses.

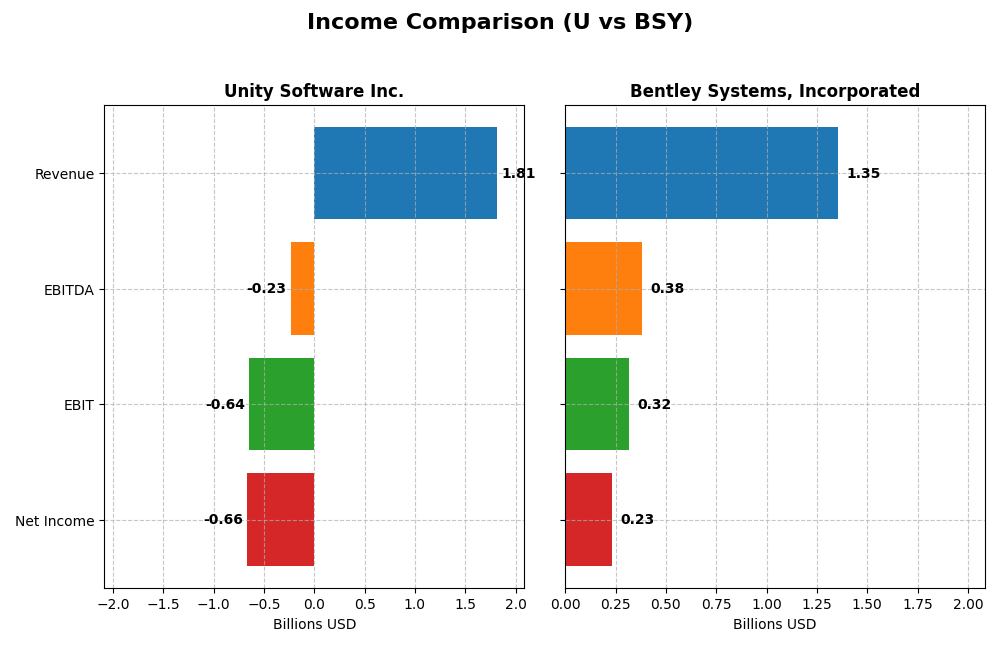

Income Statement Comparison

This table presents a clear comparison of key income statement metrics for Unity Software Inc. and Bentley Systems, Incorporated for the fiscal year 2024.

| Metric | Unity Software Inc. (U) | Bentley Systems, Incorporated (BSY) |

|---|---|---|

| Market Cap | 17.5B | 11.4B |

| Revenue | 1.81B | 1.35B |

| EBITDA | -235M | 382M |

| EBIT | -644M | 318M |

| Net Income | -664M | 235M |

| EPS | -1.68 | 0.75 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Unity Software Inc.

Unity Software’s revenue rose substantially by 135% from 2020 to 2024, peaking at $1.81B in 2024, despite a 17.1% decline in the latest year. Net income remained negative, with a loss of $664M in 2024, though this marked an improvement from prior years. Gross margins stayed strong at 73.5%, but EBIT and net margins remained unfavorable, reflecting ongoing operating challenges.

Bentley Systems, Incorporated

Bentley Systems showed steady revenue growth of 69% over five years, reaching $1.35B in 2024 with a 10.2% increase from 2023. Net income improved significantly, reporting $235M in 2024. Margins are robust, with an 81% gross margin and a 17.4% net margin, although net margin growth declined recently. EBIT margin increased strongly, indicating operational efficiency gains.

Which one has the stronger fundamentals?

Bentley Systems demonstrates stronger fundamentals with consistent revenue and net income growth, favorable margins across the board, and positive operating income. Unity Software’s impressive revenue growth is tempered by persistent net losses and unfavorable profitability metrics. Bentley’s overall financial health appears more stable and profitable based on the income statement analysis.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Unity Software Inc. and Bentley Systems, Incorporated based on their most recent fiscal year data (2024).

| Ratios | Unity Software Inc. (U) | Bentley Systems, Inc. (BSY) |

|---|---|---|

| ROE | -20.8% | 22.6% |

| ROIC | -12.8% | 9.3% |

| P/E | -13.4 | 62.6 |

| P/B | 2.79 | 14.13 |

| Current Ratio | 2.50 | 0.54 |

| Quick Ratio | 2.50 | 0.54 |

| D/E (Debt-to-Equity) | 0.74 | 1.37 |

| Debt-to-Assets | 34.9% | 41.96% |

| Interest Coverage | -32.1 | 12.2 |

| Asset Turnover | 0.27 | 0.40 |

| Fixed Asset Turnover | 18.35 | 20.47 |

| Payout Ratio | 0 | 30.7% |

| Dividend Yield | 0% | 0.49% |

Interpretation of the Ratios

Unity Software Inc.

Unity shows several unfavorable profitability ratios, including a negative net margin of -36.63% and a return on equity of -20.81%, indicating operational challenges and inefficiencies. Its balance sheet strength is reflected in a favorable current and quick ratio of 2.5. The company does not pay dividends, likely due to ongoing reinvestment and a growth-focused strategy, with no recent share buybacks reported.

Bentley Systems, Incorporated

Bentley displays favorable profitability metrics such as a 17.35% net margin and 22.55% return on equity, though its high price-to-earnings ratio of 62.63 and price-to-book of 14.13 suggest a rich valuation. Liquidity ratios are weak, with current and quick ratios around 0.54, and debt levels are elevated. The company pays a modest dividend with a 0.49% yield, but this is considered unfavorable in yield terms.

Which one has the best ratios?

Both companies present a mix of strengths and weaknesses, resulting in an overall slightly unfavorable global ratio opinion for each. Unity excels in liquidity but struggles with profitability, while Bentley shows stronger profitability but weaker liquidity and higher leverage. Neither stands out definitively superior in overall ratio quality based on the 2024 data.

Strategic Positioning

This section compares the strategic positioning of Unity Software Inc. and Bentley Systems, Incorporated, focusing on Market position, Key segments, and Exposure to technological disruption:

Unity Software Inc.

- Leading interactive real-time 3D platform provider facing high competitive pressure in software applications.

- Focuses on Create and Operate Solutions for 2D/3D content creators, developers, and designers.

- Operates in real-time 3D and AR/VR content, exposed to evolving interactive technology trends.

Bentley Systems, Incorporated

- Established provider of infrastructure engineering software with moderate competitive pressure.

- Offers diverse infrastructure design, simulation, and asset performance software for engineering professionals.

- Provides open modeling and simulation applications with some exposure to digital infrastructure innovations.

Unity Software Inc. vs Bentley Systems, Incorporated Positioning

Unity Software pursues a concentrated approach centered on interactive content creation and operation, while Bentley Systems maintains a diversified portfolio across infrastructure engineering software segments. Unity’s specialization may limit market breadth but enhances focus, whereas Bentley’s diversified offerings spread risk but face complex integration challenges.

Which has the best competitive advantage?

Both companies show declining profitability with ROIC below WACC, indicating value shedding. Bentley Systems has a slightly less unfavorable moat status, suggesting a marginally stronger competitive position, though both face risks in sustaining advantages.

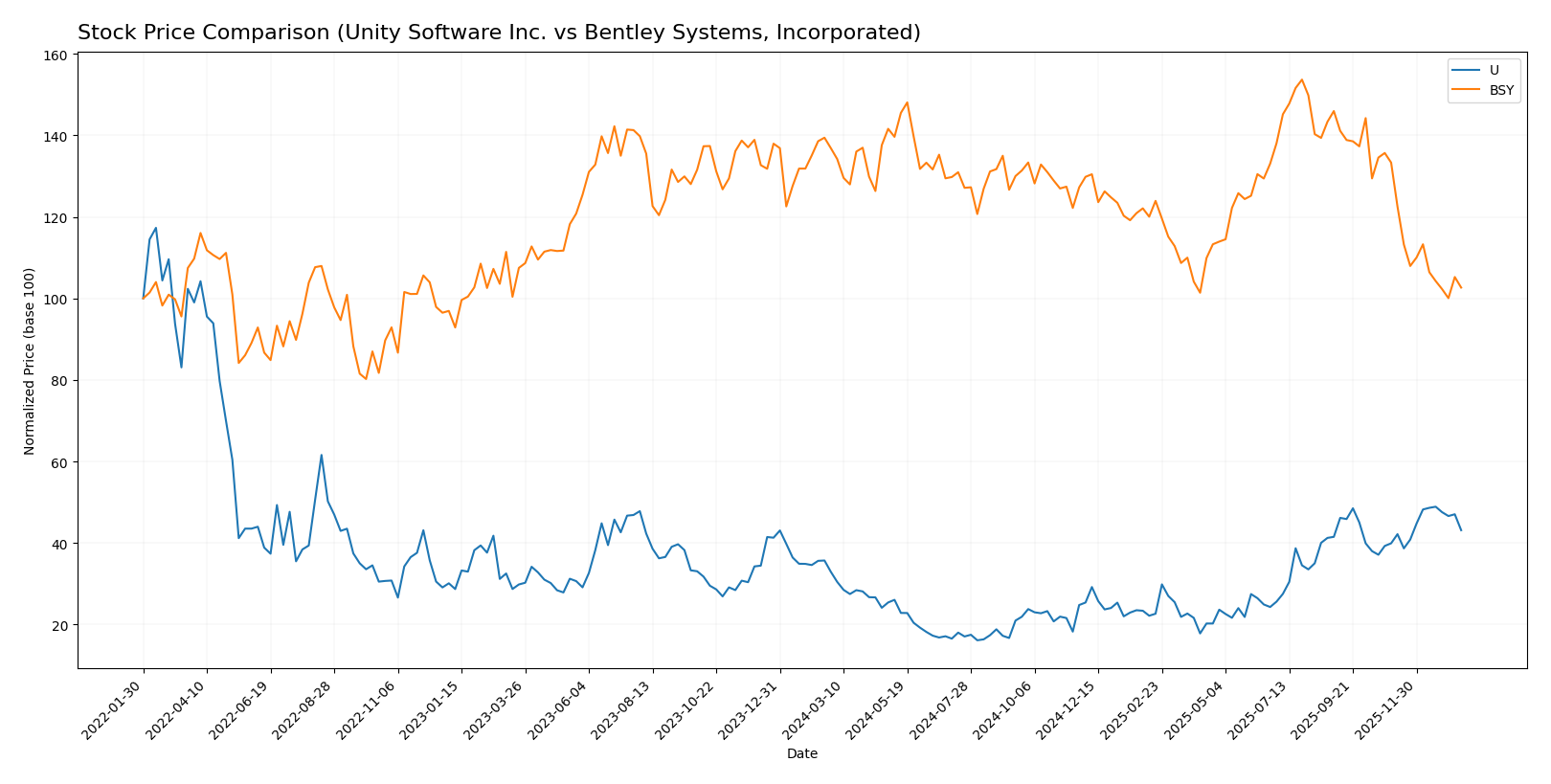

Stock Comparison

The stock prices of Unity Software Inc. and Bentley Systems, Incorporated over the past year reveal contrasting dynamics, with Unity showing strong upward momentum and Bentley facing significant declines amid shifting buyer-seller activity.

Trend Analysis

Unity Software Inc. experienced a 31.0% price increase over the past year, demonstrating a bullish trend with accelerating momentum and a notable price range between 15.32 and 46.42.

Bentley Systems, Incorporated recorded a 24.99% decline in stock price over the same period, reflecting a bearish trend with decelerating movement and prices fluctuating between 38.15 and 58.59.

Comparatively, Unity Software delivered the highest market performance with a clear bullish trend, whereas Bentley Systems showed a bearish trend and lower relative gains.

Target Prices

The current analyst consensus reflects moderate upside potential for both Unity Software Inc. and Bentley Systems, Incorporated.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Unity Software Inc. | 60 | 39 | 50.98 |

| Bentley Systems, Incorporated | 55 | 45 | 48.75 |

Analysts expect Unity Software’s price to rise significantly above its current 40.95 USD, while Bentley Systems shows potential to increase moderately from its 39.14 USD trading level.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for Unity Software Inc. (U) and Bentley Systems, Incorporated (BSY):

Rating Comparison

U Rating

- Rated D+, considered very favorable overall.

- Discounted Cash Flow Score is 1, very unfavorable, indicating weak future cash flow projections.

- Return on Equity Score is 1, very unfavorable, reflecting low profitability from equity.

- Return on Assets Score is 1, very unfavorable, showing poor asset utilization.

- Debt to Equity Score is 1, very unfavorable, suggesting high financial risk.

- Overall Score is 1, very unfavorable, reflecting weak overall financial health.

BSY Rating

- Rated B-, considered very favorable overall.

- Discounted Cash Flow Score is 4, favorable, showing strong future cash flow expectations.

- Return on Equity Score is 4, favorable, indicating efficient profit generation from equity.

- Return on Assets Score is 4, favorable, showing effective asset utilization.

- Debt to Equity Score is 1, very unfavorable, also indicating high financial risk.

- Overall Score is 3, moderate, indicating a stronger overall financial position.

Which one is the best rated?

Based on the provided data, BSY holds a better rating overall with a B- and higher scores in discounted cash flow, ROE, and ROA. U has consistently low scores with a D+ rating, indicating weaker financial metrics comparatively.

Scores Comparison

The following table presents a comparison of the Altman Z-Score and Piotroski Score for Unity Software Inc. and Bentley Systems, Incorporated:

Unity Software Inc. Scores

- Altman Z-Score: 2.93, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 4, average financial strength and investment potential.

Bentley Systems, Incorporated Scores

- Altman Z-Score: 3.74, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 9, very strong financial strength and investment potential.

Which company has the best scores?

Bentley Systems has the best scores overall with a higher Altman Z-Score in the safe zone and a very strong Piotroski Score of 9. Unity Software shows moderate risk and average financial strength by comparison.

Grades Comparison

Here is a comparison of recent grades from reputable financial institutions for both companies:

Unity Software Inc. Grades

The following table summarizes Unity Software Inc.’s latest grades from well-known analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-13 |

| Goldman Sachs | Maintain | Neutral | 2026-01-13 |

| Wells Fargo | Maintain | Overweight | 2026-01-08 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Piper Sandler | Upgrade | Overweight | 2025-12-11 |

| BTIG | Upgrade | Buy | 2025-12-11 |

| Wells Fargo | Upgrade | Overweight | 2025-12-05 |

| Arete Research | Upgrade | Buy | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-11-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

Overall, Unity Software’s grades trend positively with multiple upgrades and strong buy and overweight recommendations.

Bentley Systems, Incorporated Grades

The table below shows Bentley Systems’ recent grades from established grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Rosenblatt | Upgrade | Buy | 2025-10-17 |

| Piper Sandler | Maintain | Overweight | 2025-08-07 |

| Goldman Sachs | Maintain | Sell | 2025-08-07 |

Bentley Systems shows a mixed pattern, with some downgrades and a notable sell rating alongside several outperform and buy ratings.

Which company has the best grades?

Unity Software has received more consistent positive ratings, including multiple upgrades and a clear consensus of “Buy,” suggesting stronger analyst confidence. Bentley Systems shows more variability in opinions, which may imply higher uncertainty for investors evaluating its stock.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Unity Software Inc. (U) and Bentley Systems, Incorporated (BSY) based on the most recent financial and operational data.

| Criterion | Unity Software Inc. (U) | Bentley Systems, Incorporated (BSY) |

|---|---|---|

| Diversification | Moderate: Revenue split between Create Solutions (614M) and Operate Solutions (1.2B) in 2024 | High: Diverse revenue streams with subscriptions, licenses, services totaling over 1.5B in 2024 |

| Profitability | Weak: Negative net margin (-36.63%), ROIC -12.78%, declining profitability | Moderate: Positive net margin (17.35%), ROIC 9.3%, but declining ROIC trend |

| Innovation | Strong focus on real-time 3D and gaming tech, but value destruction hints at operational challenges | Established software innovation in infrastructure, but high valuation metrics may limit upside |

| Global presence | Significant presence in gaming and real-time 3D markets worldwide | Strong global footprint in infrastructure software markets |

| Market Share | Leading in its niche but losing value and profitability | Solid market position with steady subscription growth |

Unity struggles with profitability and capital efficiency despite innovative products, while Bentley demonstrates stable profitability with a broader product base but faces challenges with valuation and declining ROIC trends.

In summary, Bentley offers a more balanced risk profile with moderate profitability and diversification, whereas Unity’s high innovation potential is currently overshadowed by value destruction and financial weakness. Investors should weigh innovation against financial health carefully.

Risk Analysis

Below is a comparative risk table for Unity Software Inc. (U) and Bentley Systems, Incorporated (BSY) based on the most recent 2024 data:

| Metric | Unity Software Inc. (U) | Bentley Systems, Incorporated (BSY) |

|---|---|---|

| Market Risk | High beta 2.05; volatile price range $15.33-$52.15 | Moderate beta 1.21; price range $36.51-$59.25 |

| Debt Level | Moderate leverage; D/E 0.74, debt/assets 35% | Higher leverage; D/E 1.37, debt/assets 42% |

| Regulatory Risk | Moderate; operates globally with exposure to tech regulations | Moderate; software for infrastructure with regional regulatory exposure |

| Operational Risk | Negative net margin (-36.6%) and ROE (-20.8%) signals operational inefficiencies | Positive net margin (17.35%) and ROE (22.55%), more stable operations |

| Environmental Risk | Low direct exposure; primarily software-based | Low direct exposure; infrastructure-focused software |

| Geopolitical Risk | Moderate; global presence including China and Europe could face trade tensions | Moderate; global infrastructure markets subject to geopolitical shifts |

In synthesis, Unity Software faces higher market and operational risks with significant losses and volatility, while Bentley Systems shows stronger profitability but carries higher debt risk. Market volatility and operational inefficiency in Unity are the most impactful risks, whereas Bentley’s financial leverage and price valuation present notable concerns. Investors should weigh Unity’s growth potential against its financial distress signals and Bentley’s stability against its higher debt burden.

Which Stock to Choose?

Unity Software Inc. shows a declining income trend with unfavorable profitability and negative returns on equity and assets. Its debt levels are moderate, but financial ratios overall appear slightly unfavorable, and the company’s rating is very unfavorable.

Bentley Systems, Incorporated exhibits favorable income growth and profitability, with positive returns on equity and assets. Despite higher debt levels and some unfavorable valuation ratios, its financial ratios are slightly unfavorable overall, but it holds a more moderate and very favorable rating.

Investors prioritizing growth might find Unity’s bullish price trend and potential upside appealing despite its current financial challenges, while those seeking a company with stronger profitability and a safer financial score could lean toward Bentley. Risk-averse investors may view Bentley’s profile as more stable, whereas risk-tolerant ones might interpret Unity’s metrics as opportunities in a turnaround scenario.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Unity Software Inc. and Bentley Systems, Incorporated to enhance your investment decisions: