In today’s fast-evolving tech landscape, Bentley Systems, Incorporated (BSY) and SoundHound AI, Inc. (SOUN) represent two dynamic players within the software application industry. Bentley excels in infrastructure engineering software, while SoundHound pioneers voice AI platforms. Their market overlap and innovative approaches make them compelling subjects for comparison. Join me as we explore which company could offer the most promising opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Bentley Systems and SoundHound AI by providing an overview of these two companies and their main differences.

Bentley Systems Overview

Bentley Systems, Incorporated specializes in infrastructure engineering software solutions, serving markets in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. Its offerings include modeling, simulation, project delivery, and asset performance systems that cater to civil, structural, and geotechnical engineers, architects, planners, and contractors. Founded in 1984 and headquartered in Exton, Pennsylvania, Bentley operates with 5,500 employees and a market cap of $11.4B.

SoundHound AI Overview

SoundHound AI, Inc. develops an independent voice AI platform designed to enable businesses to create conversational voice assistants. Its flagship product, the Houndify platform, provides tools such as automatic speech recognition and natural language understanding to enhance customer interactions. Headquartered in Santa Clara, California, the company employs 842 people and has a market cap of $4.7B, reflecting its more recent IPO in 2022.

Key similarities and differences

Both Bentley and SoundHound operate in the technology sector within the software application industry, focusing on innovative solutions for specialized markets. Bentley targets infrastructure and engineering professionals with comprehensive modeling and simulation tools, while SoundHound emphasizes voice AI and conversational platforms for broad industry applications. Bentley’s larger scale and longer market presence contrast with SoundHound’s higher beta and focus on emerging AI technology.

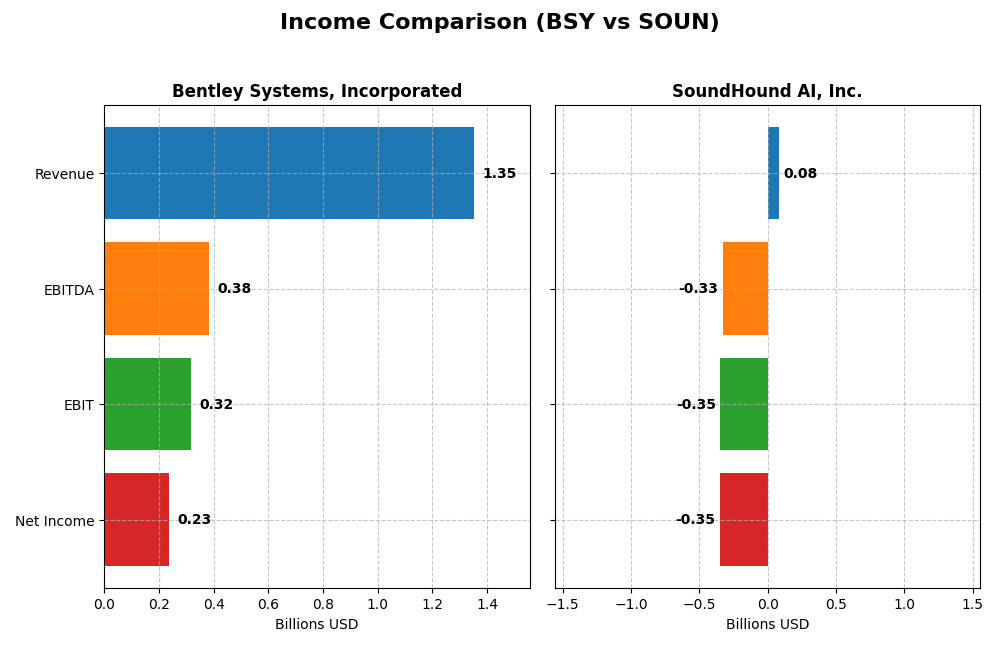

Income Statement Comparison

The table below compares key income statement metrics for Bentley Systems, Incorporated and SoundHound AI, Inc. for the fiscal year ended 2024.

| Metric | Bentley Systems, Incorporated | SoundHound AI, Inc. |

|---|---|---|

| Market Cap | 11.4B | 4.7B |

| Revenue | 1.35B | 85M |

| EBITDA | 382M | -329M |

| EBIT | 318M | -348M |

| Net Income | 235M | -351M |

| EPS | 0.75 | -1.04 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Bentley Systems, Incorporated

Bentley Systems showed steady revenue growth from $801M in 2020 to $1.35B in 2024, with net income rising from $126M to $241M over the same period. Gross and EBIT margins remained strong, around 81% and 23%, respectively. In 2024, revenue grew 10.15% but net margin and EPS declined, signaling some margin pressure despite solid top-line expansion.

SoundHound AI, Inc.

SoundHound AI’s revenue increased notably from $13M in 2020 to $85M in 2024, reflecting rapid growth. However, the company consistently reported net losses, widening to -$351M in 2024. Gross margin was stable at nearly 49%, but EBIT and net margins were deeply negative, and operating expenses surged faster than revenues, signaling ongoing profitability challenges.

Which one has the stronger fundamentals?

Bentley Systems exhibits stronger fundamentals with consistent profitability, favorable margins, and sustained revenue and net income growth over the five-year span. Conversely, SoundHound AI, despite high revenue growth, faces significant losses and poor operating efficiency, resulting in an unfavorable income statement profile. Bentley’s stable earnings contrast SoundHound’s ongoing deficits and margin weaknesses.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Bentley Systems, Incorporated (BSY) and SoundHound AI, Inc. (SOUN) based on their 2024 fiscal year-end data, allowing for a direct comparison of key performance and financial health metrics.

| Ratios | Bentley Systems, Inc. (BSY) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| ROE | 22.6% | -191.99% |

| ROIC | 9.3% | -68.1% |

| P/E | 62.6 | -19.1 |

| P/B | 14.1 | 36.8 |

| Current Ratio | 0.54 | 3.77 |

| Quick Ratio | 0.54 | 3.77 |

| D/E (Debt-to-Equity) | 1.37 | 0.02 |

| Debt-to-Assets | 42.0% | 0.79% |

| Interest Coverage | 12.2 | -28.1 |

| Asset Turnover | 0.40 | 0.15 |

| Fixed Asset Turnover | 20.5 | 14.3 |

| Payout Ratio | 30.7% | 0% |

| Dividend Yield | 0.49% | 0% |

Interpretation of the Ratios

Bentley Systems, Incorporated

Bentley Systems shows a mix of strong and weak ratios. Its net margin at 17.35% and ROE at 22.55% are favorable, but valuation multiples like P/E of 62.63 and P/B of 14.13 are high, indicating expensive valuation. The current and quick ratios below 1 signal liquidity concerns. Bentley pays dividends with a yield of 0.49%, though this is considered low, suggesting limited shareholder returns.

SoundHound AI, Inc.

SoundHound AI has predominantly unfavorable ratios, including a negative net margin of -414.06% and ROE of -191.99%, reflecting weak profitability and operational challenges. However, its low debt-to-equity ratio of 0.02 and high current ratio of 3.77 indicate strong liquidity and low leverage. The company does not pay dividends, consistent with its negative earnings and focus on growth and R&D.

Which one has the best ratios?

Comparing both, Bentley Systems has a more balanced financial profile with favorable profitability and some liquidity issues, while SoundHound AI exhibits significant profitability weaknesses despite strong liquidity and low debt. Bentley’s dividend payments contrast with SoundHound’s growth-oriented reinvestment approach. Overall, Bentley’s ratios appear more favorable, though both companies present risks.

Strategic Positioning

This section compares the strategic positioning of Bentley Systems, Incorporated and SoundHound AI, Inc., including market position, key segments, and exposure to technological disruption:

Bentley Systems, Incorporated

- Established software provider with a $11.4B market cap and moderate competitive pressure in infrastructure engineering software.

- Focuses on infrastructure engineering software including modeling, simulation, and project delivery systems for civil and geotechnical engineers.

- Moderate exposure to disruption; leverages established software suites in infrastructure with less direct AI disruption risk.

SoundHound AI, Inc.

- Smaller player with $4.7B market cap facing high volatility and competition in voice AI platforms.

- Develops voice AI platform offering speech recognition and conversational tools across industries.

- High exposure to technological disruption in AI voice recognition and natural language processing innovations.

Bentley Systems vs SoundHound AI Positioning

Bentley Systems shows a diversified portfolio across infrastructure software segments, offering stability but facing moderate competition. SoundHound AI is more concentrated in voice AI technology, exposing it to rapid innovation risks but with growth potential. Both face different market pressures based on their sector focus.

Which has the best competitive advantage?

Both companies are evaluated as slightly unfavorable in MOAT terms, with Bentley shedding value amid declining profitability and SoundHound destroying value but improving profitability. Neither currently demonstrates a strong sustainable competitive advantage based on ROIC versus WACC.

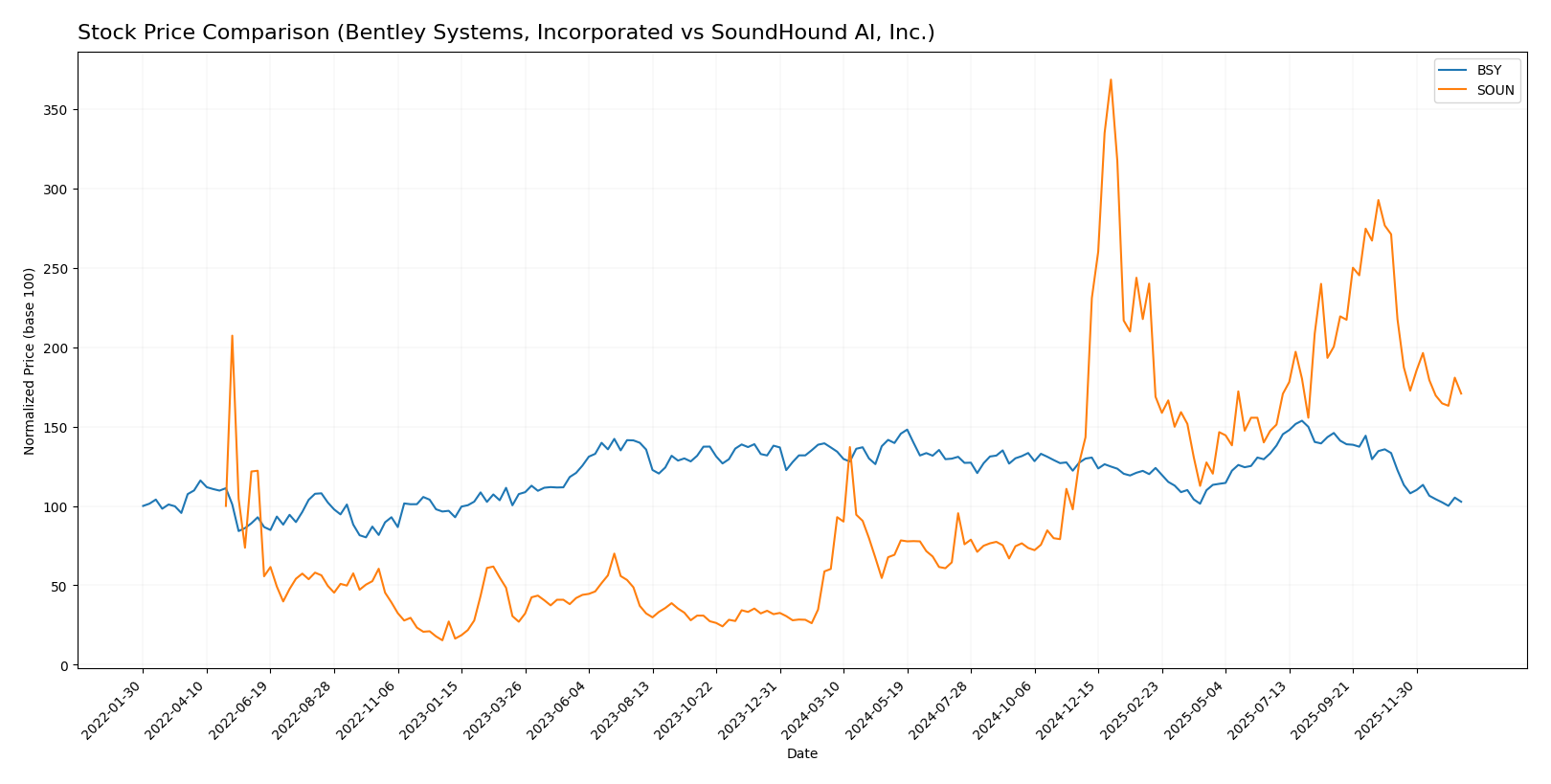

Stock Comparison

The stock price movements over the past 12 months reveal contrasting dynamics between Bentley Systems, Incorporated (BSY) and SoundHound AI, Inc. (SOUN), with BSY showing a sustained decline and SOUN exhibiting strong growth followed by recent weakness.

Trend Analysis

Bentley Systems, Incorporated (BSY) experienced a bearish trend over the past 12 months with a -24.99% price change, accompanied by deceleration and a standard deviation of 4.63. The stock’s highest and lowest prices were 58.59 and 38.15 respectively.

SoundHound AI, Inc. (SOUN) showed a bullish trend over the same period, gaining 183.16%, though recent months revealed a -37.0% decline with deceleration and lower volatility (std deviation 1.88). The stock’s price ranged from 3.55 to 23.95.

Comparing both, SOUN delivered the highest market performance over the past year despite recent setbacks, while BSY showed a consistent bearish trajectory throughout the period.

Target Prices

Analysts present a cautiously optimistic consensus for Bentley Systems and SoundHound AI.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Bentley Systems, Incorporated | 55 | 45 | 48.75 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

The target consensus for Bentley Systems at 48.75 suggests a potential upside from its current price of 39.14 USD. SoundHound AI’s consensus of 13.33 also indicates expected growth above its present 11.1 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Bentley Systems, Incorporated (BSY) and SoundHound AI, Inc. (SOUN):

Rating Comparison

BSY Rating

- Rating: B-, categorized as Very Favorable.

- Discounted Cash Flow Score: 4, considered Favorable.

- ROE Score: 4, indicating Favorable performance.

- ROA Score: 4, indicating Favorable performance.

- Debt To Equity Score: 1, considered Very Unfavorable.

- Overall Score: 3, considered Moderate.

SOUN Rating

- Rating: C-, categorized as Very Favorable.

- Discounted Cash Flow Score: 1, considered Very Unfavorable.

- ROE Score: 1, indicating Very Unfavorable performance.

- ROA Score: 1, indicating Very Unfavorable performance.

- Debt To Equity Score: 4, considered Favorable.

- Overall Score: 1, considered Very Unfavorable.

Which one is the best rated?

Based strictly on the data, BSY holds higher ratings across most financial metrics except for debt-to-equity, where SOUN scores better. BSY’s overall and profitability scores notably surpass those of SOUN.

Scores Comparison

This section compares the Altman Z-Score and Piotroski Score of Bentley Systems, Incorporated and SoundHound AI, Inc.:

BSY Scores

- Altman Z-Score: 3.74, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 9, classified as very strong financial health.

SOUN Scores

- Altman Z-Score: 6.62, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial health.

Which company has the best scores?

SoundHound AI has a higher Altman Z-Score suggesting stronger bankruptcy safety, while Bentley Systems shows a much stronger Piotroski Score, indicating better overall financial health. The scores highlight different strengths for each company.

Grades Comparison

The following section compares the recent grades assigned to Bentley Systems, Incorporated and SoundHound AI, Inc.:

Bentley Systems, Incorporated Grades

This table summarizes recent grades from major financial institutions for Bentley Systems, Incorporated.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Rosenblatt | Upgrade | Buy | 2025-10-17 |

| Piper Sandler | Maintain | Overweight | 2025-08-07 |

| Goldman Sachs | Maintain | Sell | 2025-08-07 |

Bentley Systems shows a mix of Hold-equivalent and Buy-equivalent ratings, with recent downgrades to Neutral and a single Sell rating maintained.

SoundHound AI, Inc. Grades

The table below details recent grades from recognized grading companies for SoundHound AI, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI has mostly Buy and Outperform ratings, with an upgrade to Overweight and no Sell or negative ratings.

Which company has the best grades?

SoundHound AI, Inc. has received consistently stronger grades, with multiple Buy and Outperform ratings and no Sell grades, compared to Bentley Systems, which has mixed ratings including a Sell. This suggests a generally more positive market sentiment toward SoundHound AI, potentially influencing investor confidence differently.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Bentley Systems, Incorporated (BSY) and SoundHound AI, Inc. (SOUN) based on the latest financial and operational data.

| Criterion | Bentley Systems, Incorporated (BSY) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | Strongly diversified with multiple subscription types and services, including enterprise licenses and professional services (total revenues over 1.3B USD in 2024) | Limited diversification, mainly hosted services and licensing with total revenues around 84M USD in 2024 |

| Profitability | Positive net margin (17.35%), favorable ROE (22.55%), neutral ROIC (9.3%) but slightly unfavorable overall profitability trend | Negative profitability metrics (net margin -414%, ROE -192%, ROIC -68%), indicating current losses despite growing ROIC |

| Innovation | Moderate innovation reflected in consistent subscription growth and a broad product offering | High growth in ROIC suggests improving innovation and operational efficiency, though still unprofitable |

| Global presence | Established global presence with a broad customer base in engineering software and services | Smaller scale, focused on AI-driven voice recognition technology with potential for expansion |

| Market Share | Strong market share in engineering and design software with high recurring subscription revenues | Emerging player in AI voice tech market, currently small market share but with growth potential |

Key takeaways: Bentley Systems shows solid diversification and profitability but faces challenges in maintaining ROIC growth, signaling caution. SoundHound AI is still unprofitable but exhibits promising improvement in operational efficiency and innovation, suitable for investors with higher risk tolerance.

Risk Analysis

Below is a comparison of key risks faced by Bentley Systems, Incorporated (BSY) and SoundHound AI, Inc. (SOUN) based on recent financial and operational data from 2024.

| Metric | Bentley Systems, Incorporated (BSY) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Risk | Moderate (Beta 1.21, stable range 36.51-59.25) | High (Beta 2.88, volatile range 6.52-22.17) |

| Debt level | Moderate (Debt-to-Equity 1.37, Debt-to-Assets 42%) | Low (Debt-to-Equity 0.02, Debt-to-Assets <1%) |

| Regulatory Risk | Moderate (Technology sector US-based, subject to software and data regulations) | Moderate (Emerging AI tech, regulatory scrutiny on data privacy) |

| Operational Risk | Low (Strong product portfolio, 5,500 employees, stable operations) | High (Smaller scale, 842 employees, dependency on AI platform success) |

| Environmental Risk | Low (Software company, minimal direct impact) | Low (Primarily software and AI services) |

| Geopolitical Risk | Moderate (Global presence, infrastructure software) | Moderate (US-based but AI industry sensitive to export controls) |

The most impactful risk for SoundHound AI is its high market volatility and weak financial metrics, including a negative net margin and unfavorable return ratios, reflecting operational challenges and high uncertainty. Bentley Systems faces moderate market and debt risks but benefits from strong financial health and stability. Investors should weigh SoundHound’s growth potential against its financial fragility and market risk.

Which Stock to Choose?

Bentley Systems, Incorporated (BSY) shows a favorable income evolution with strong gross and EBIT margins, yet recent net margin and EPS growth are negative. Financial ratios reveal mixed signals: high ROE and interest coverage contrast with unfavorable valuation and liquidity ratios. Its debt remains moderate, and the overall rating is very favorable despite some financial weaknesses.

SoundHound AI, Inc. (SOUN) presents a volatile income evolution with unfavorable EBIT and net margins, though revenue growth is robust. Financial ratios mostly indicate weaknesses, including negative profitability metrics, but favorable leverage ratios and a strong quick ratio stand out. The company’s rating is very favorable, but financial stability scores are weak, reflecting high risk.

Investors focused on quality and stable profitability might find BSY more aligned with their profile due to its favorable income statement and higher rating despite certain valuation concerns. Conversely, risk-tolerant growth investors could perceive SOUN’s strong revenue expansion and improving profitability as potential, acknowledging its current financial challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Bentley Systems, Incorporated and SoundHound AI, Inc. to enhance your investment decisions: