In today’s fast-evolving software landscape, Bentley Systems, Incorporated (BSY) and monday.com Ltd. (MNDY) stand out as innovators in application software, each targeting distinct yet overlapping market needs. Bentley focuses on infrastructure engineering solutions, while monday.com excels in cloud-based work management platforms. Comparing these two tech firms reveals contrasting approaches to innovation and growth. Join me as we explore which company offers the most compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Bentley Systems and monday.com by providing an overview of these two companies and their main differences.

Bentley Systems Overview

Bentley Systems, Incorporated specializes in infrastructure engineering software solutions, serving regions including the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Its product portfolio includes applications for infrastructure design integration, geoprofessional modeling and simulation, project delivery systems, and asset and network performance systems. Founded in 1984 and headquartered in Exton, Pennsylvania, Bentley targets civil, structural, geotechnical, and geospatial professionals among others.

monday.com Overview

monday.com Ltd. develops cloud-based visual work operating systems and software applications used globally, including in the United States, Europe, and the Middle East. Its Work OS platform offers modular building blocks to create work management tools for marketing, CRM, project management, and more. Established in 2012 and based in Tel Aviv, Israel, monday.com serves organizations, educational institutions, and business units with a focus on improving workflow and collaboration.

Key similarities and differences

Both Bentley Systems and monday.com operate within the software application industry and serve international markets. However, Bentley focuses on infrastructure engineering and specialized technical applications, while monday.com provides cloud-based work management and collaboration tools. Bentley’s customer base is mainly technical professionals in engineering and geoscience, whereas monday.com targets a broader range of organizational users across multiple sectors. Their employee bases also differ, with Bentley employing around 5,500 and monday.com approximately 2,500 staff.

Income Statement Comparison

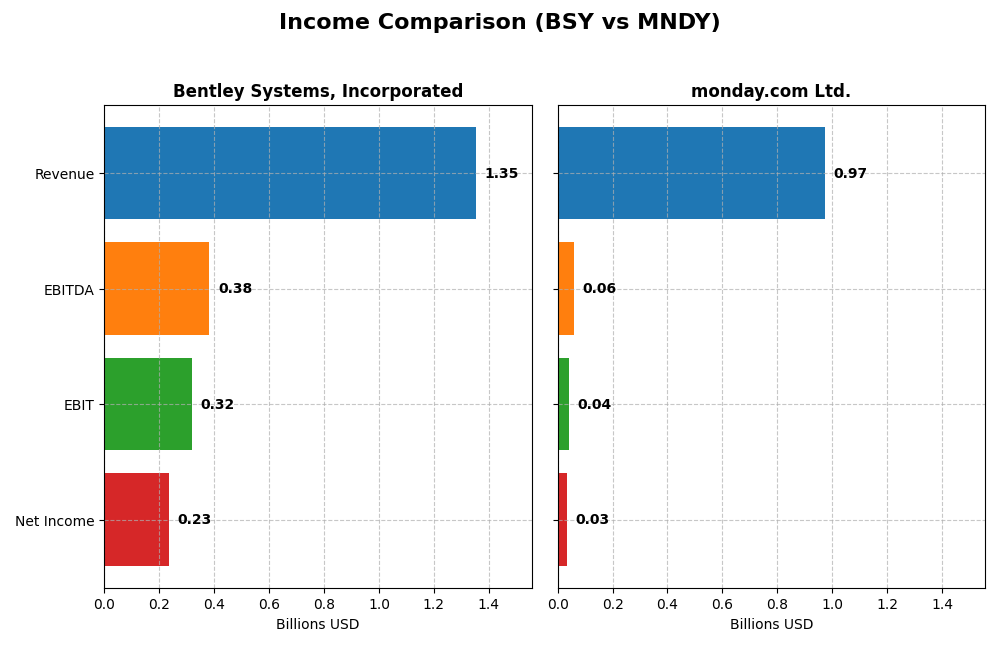

The table below compares the key income statement metrics for Bentley Systems, Incorporated (BSY) and monday.com Ltd. (MNDY) for the fiscal year 2024.

| Metric | Bentley Systems, Incorporated (BSY) | monday.com Ltd. (MNDY) |

|---|---|---|

| Market Cap | 11.4B USD | 6.5B USD |

| Revenue | 1.35B USD | 972M USD |

| EBITDA | 382M USD | 58M USD |

| EBIT | 318M USD | 40M USD |

| Net Income | 235M USD | 32M USD |

| EPS | 0.75 USD | 0.65 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Bentley Systems, Incorporated

Bentley Systems showed consistent revenue growth from 801M in 2020 to 1.35B in 2024, with net income rising from 126M to 241M over the same period. Margins remained solid, highlighted by an 80.95% gross margin and a 17.35% net margin in 2024. However, net margin and EPS declined in the latest year despite strong revenue and EBIT gains.

monday.com Ltd.

monday.com reported rapid revenue expansion from 161M in 2020 to 972M in 2024, with net income recovering from a 152M loss in 2020 to a 32M profit in 2024. Margins improved significantly, with a high 89.33% gross margin but modest 3.33% net margin in 2024. The latest year saw robust margin growth and a sharp EPS increase after prior losses.

Which one has the stronger fundamentals?

Bentley Systems presents stable margins and steady growth with mostly favorable income statement metrics, though recent margin compression and EPS decline are concerns. monday.com exhibits remarkable revenue and margin improvements with no unfavorable metrics, but net margins remain low. Both show favorable fundamentals; Bentley offers stability, while monday.com focuses on rapid expansion.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Bentley Systems, Incorporated (BSY) and monday.com Ltd. (MNDY) based on their most recent fiscal year data ending 2024.

| Ratios | Bentley Systems, Inc. (BSY) | monday.com Ltd. (MNDY) |

|---|---|---|

| ROE | 22.55% | 3.14% |

| ROIC | 9.30% | -1.73% |

| P/E | 62.63 | 363.0 |

| P/B | 14.13 | 11.41 |

| Current Ratio | 0.54 | 2.66 |

| Quick Ratio | 0.54 | 2.66 |

| D/E (Debt-to-Equity) | 1.37 | 0.10 |

| Debt-to-Assets | 41.96% | 6.29% |

| Interest Coverage | 12.20 | 0 (not meaningful) |

| Asset Turnover | 0.40 | 0.58 |

| Fixed Asset Turnover | 20.47 | 7.13 |

| Payout ratio | 30.72% | 0% |

| Dividend yield | 0.49% | 0% |

Interpretation of the Ratios

Bentley Systems, Incorporated

Bentley Systems shows a mixed profile with favorable net margin (17.35%) and ROE (22.55%), but struggles with high P/E (62.63) and P/B (14.13), and weak liquidity ratios (current and quick at 0.54). Debt levels are somewhat concerning with a D/E of 1.37. Dividend yield is low at 0.49%, indicating modest shareholder returns supported by steady dividends but limited yield.

monday.com Ltd.

monday.com reveals several weak profitability ratios, including a low net margin (3.33%) and ROE (3.14%), alongside negative ROIC (-1.73%). However, liquidity is strong with current and quick ratios above 2.6, and low leverage (D/E of 0.1). The company does not pay dividends, reflecting a focus on growth and reinvestment, typical for a high-growth tech firm.

Which one has the best ratios?

Bentley Systems benefits from stronger profitability and dividend payments but suffers from high valuation multiples and liquidity concerns. monday.com offers superior liquidity and low debt but shows weak profitability and no dividends. Overall, monday.com’s neutral rating reflects balanced liquidity and risk, while Bentley’s slightly unfavorable score highlights valuation and leverage challenges.

Strategic Positioning

This section compares the strategic positioning of Bentley Systems, Incorporated and monday.com Ltd., including market position, key segments, and exposure to technological disruption:

Bentley Systems, Incorporated

- Established player in infrastructure engineering software with competitive pressure in global markets.

- Focuses on infrastructure design, modeling, simulation, and project delivery systems for engineering sectors.

- Exposure to technological disruption primarily in software innovation for infrastructure and asset management.

monday.com Ltd.

- Emerging cloud-based Work OS provider facing competitive SaaS application market pressures.

- Provides modular cloud work management tools for marketing, CRM, project management, and software development.

- Exposed to disruption through cloud computing trends and evolving work management software demands.

Bentley Systems, Incorporated vs monday.com Ltd. Positioning

Bentley Systems has a diversified product portfolio centered on infrastructure software, catering to specialized engineering disciplines. monday.com concentrates on cloud-based work operating systems for diverse business functions, reflecting a more focused, modular approach. Each faces distinct market and technological challenges tied to their sector focus.

Which has the best competitive advantage?

Both companies are currently shedding value relative to their cost of capital, resulting in a slightly unfavorable moat status. Bentley Systems shows declining profitability, whereas monday.com exhibits improving profitability trends despite value destruction. Neither holds a strong competitive moat based on recent ROIC versus WACC data.

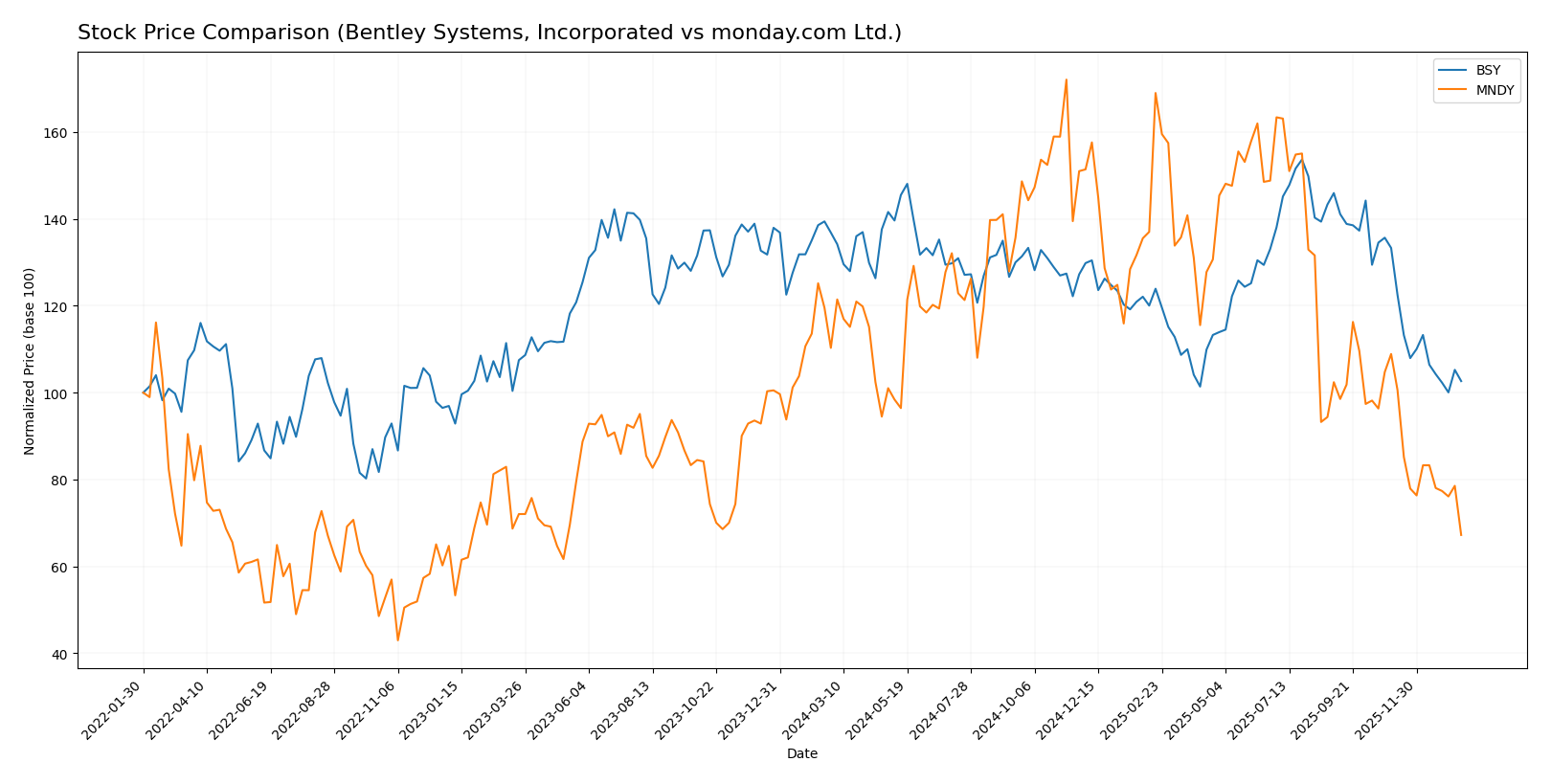

Stock Comparison

The stock price movements of Bentley Systems, Incorporated (BSY) and monday.com Ltd. (MNDY) over the past year reveal significant bearish trends with decelerating declines and dominant seller activity in recent trading sessions.

Trend Analysis

Bentley Systems, Incorporated’s stock has experienced a 24.99% decline over the past 12 months, indicating a bearish trend with deceleration. The price ranged from a high of 58.59 to a low of 38.15, with moderate volatility (std deviation 4.63).

monday.com Ltd. showed a steeper 39.06% decrease over the same period, confirming a bearish trend with deceleration. Its price fluctuated between 324.31 and 126.7, with notably higher volatility (std deviation 47.32).

Comparing the two, Bentley Systems has delivered a less severe market decline than monday.com, reflecting relatively stronger market performance over the last 12 months.

Target Prices

Analyst consensus target prices suggest significant upside potential for both Bentley Systems, Incorporated and monday.com Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Bentley Systems, Incorporated | 55 | 45 | 48.75 |

| monday.com Ltd. | 330 | 194 | 264.42 |

Bentley Systems’ consensus target price of 48.75 USD indicates a 24.6% upside from its current price of 39.14 USD. monday.com’s consensus target of 264.42 USD implies a strong potential gain of over 108% versus the current price near 126.7 USD. Both stocks show promising analyst expectations relative to their market prices.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Bentley Systems, Incorporated and monday.com Ltd.:

Rating Comparison

Bentley Systems, Incorporated Rating

- Rating: B-, rated as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable future cash flow projections.

- ROE Score: 4, showing strong efficiency in generating profit from equity.

- ROA Score: 4, reflecting effective asset utilization.

- Debt To Equity Score: 1, signaling very unfavorable financial risk due to high leverage.

- Overall Score: 3, representing a moderate overall financial position.

monday.com Ltd. Rating

- Rating: B-, also rated as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable future cash flow projections.

- ROE Score: 3, moderate efficiency in generating profit from equity.

- ROA Score: 3, indicating moderate asset utilization effectiveness.

- Debt To Equity Score: 3, indicating moderate financial risk and balance sheet strength.

- Overall Score: 3, also representing a moderate overall financial position.

Which one is the best rated?

Bentley Systems and monday.com share the same overall rating and score, but Bentley shows stronger profitability metrics (ROE and ROA) while monday.com has a better debt-to-equity score. Overall, ratings indicate balanced but different risk and efficiency profiles.

Scores Comparison

Here is a comparison of the financial scores for Bentley Systems, Incorporated and monday.com Ltd.:

BSY Scores

- Altman Z-Score: 3.74, indicates a safe zone, low bankruptcy risk

- Piotroski Score: 9, very strong financial health

MNDY Scores

- Altman Z-Score: 6.33, indicates a safe zone, very low bankruptcy risk

- Piotroski Score: 5, average financial health

Which company has the best scores?

Based on the Altman Z-Score, MNDY shows a stronger position with a higher score indicating very low bankruptcy risk. BSY has a superior Piotroski Score, indicating stronger financial health compared to MNDY’s average score.

Grades Comparison

Here is a comparison of the latest reliable grades from established grading companies for Bentley Systems, Incorporated and monday.com Ltd.:

Bentley Systems, Incorporated Grades

The following table summarizes recent grades assigned by recognized financial institutions for Bentley Systems:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Rosenblatt | Upgrade | Buy | 2025-10-17 |

| Piper Sandler | Maintain | Overweight | 2025-08-07 |

| Goldman Sachs | Maintain | Sell | 2025-08-07 |

Bentley Systems’ grades show a mix of neutral to outperform ratings, with one recent downgrade from Overweight to Neutral, indicating some caution among analysts.

monday.com Ltd. Grades

Below is a summary of recent grades from respected financial firms for monday.com:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-01-15 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-23 |

| Tigress Financial | Maintain | Buy | 2025-12-11 |

| Baird | Maintain | Outperform | 2025-11-11 |

| Wells Fargo | Maintain | Overweight | 2025-11-11 |

| DA Davidson | Maintain | Buy | 2025-11-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-11 |

| Piper Sandler | Maintain | Overweight | 2025-11-11 |

monday.com consistently receives strong buy and overweight ratings, reflecting broad analyst confidence without downgrades.

Which company has the best grades?

monday.com Ltd. has received notably stronger and more consistent buy and overweight grades compared to Bentley Systems, which displays a wider spread including neutral and even a sell rating. This could signal comparatively higher analyst confidence in monday.com’s outlook, potentially influencing investor sentiment accordingly.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Bentley Systems, Incorporated (BSY) and monday.com Ltd. (MNDY) based on their latest financial and operational data.

| Criterion | Bentley Systems, Incorporated (BSY) | monday.com Ltd. (MNDY) |

|---|---|---|

| Diversification | Strong product mix with various subscription and license types, plus professional services | Focused mainly on project management software, less diversified product portfolio |

| Profitability | Favorable net margin (17.35%) and ROE (22.55%), but slightly unfavorable overall profitability trend | Low net margin (3.33%) and ROE (3.14%), currently unprofitable but improving ROIC trend |

| Innovation | Moderate innovation indicated by subscription growth and recurring revenues | Innovation reflected in growing ROIC and strong operational ratios |

| Global presence | Well-established global footprint with broad enterprise licenses and subscriptions | Expanding global presence with strong liquidity and low leverage |

| Market Share | Large enterprise client base in infrastructure software, but facing profitability challenges | Growing market share in cloud collaboration software but high valuation multiples pose risk |

In summary, Bentley Systems shows solid profitability and a diversified revenue base but struggles with declining ROIC and liquidity concerns. monday.com is less profitable but demonstrates improving capital efficiency and financial health, supported by its expanding market position. Investors should weigh Bentley’s established presence against monday.com’s growth potential and risk profile.

Risk Analysis

Below is a comparative table of key risk factors for Bentley Systems, Incorporated (BSY) and monday.com Ltd. (MNDY) based on 2024 data:

| Metric | Bentley Systems, Incorporated (BSY) | monday.com Ltd. (MNDY) |

|---|---|---|

| Market Risk | Beta 1.214 (moderate volatility) | Beta 1.255 (moderate volatility) |

| Debt level | Debt/Equity 1.37 (unfavorable) | Debt/Equity 0.10 (favorable) |

| Regulatory Risk | Moderate (US-based, global presence) | Moderate (Israeli base, global exposure) |

| Operational Risk | Medium (complex software solutions) | Medium (cloud-based SaaS platform) |

| Environmental Risk | Low (software sector) | Low (software sector) |

| Geopolitical Risk | Moderate (US and international markets) | Moderate to high (Israeli HQ, global markets) |

The most impactful risks are Bentley’s higher leverage and valuation concerns, which increase financial risk despite strong profitability. monday.com faces price volatility with elevated valuation multiples but benefits from low debt and strong liquidity. Geopolitical exposure is higher for monday.com given its Israeli base amid regional uncertainties. Investors should weigh financial leverage and valuation risks carefully.

Which Stock to Choose?

Bentley Systems, Incorporated (BSY) shows favorable income evolution with 68.8% revenue growth over five years and strong profitability metrics, including a 17.35% net margin and 22.55% ROE. Its debt level is moderate with a net debt to EBITDA of 3.56, yet current and quick ratios are low at 0.54, indicating liquidity concerns. The overall rating is very favorable, despite some unfavorable valuation ratios.

monday.com Ltd. (MNDY) exhibits strong revenue growth of 503% over five years, but profitability remains low with a 3.33% net margin and 3.14% ROE. It maintains low debt levels, demonstrated by a 0.1 debt-to-equity ratio and high liquidity ratios around 2.66. Its rating is very favorable, supported by solid financial stability but tempered by high valuation multiples and modest returns.

For investors, BSY might appear more suitable for those prioritizing profitability and value creation despite some liquidity constraints, while MNDY could be more appealing to those favoring growth and financial stability with cautious attention to valuation. Both companies carry slightly unfavorable moats, reflecting challenges in sustaining excess returns.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Bentley Systems, Incorporated and monday.com Ltd. to enhance your investment decisions: