In today’s fast-evolving technology landscape, selecting the right software company for your portfolio requires careful analysis. Figma, Inc. and Bentley Systems, Incorporated both operate in the software-application sector but serve distinct niches—collaborative design tools versus infrastructure engineering solutions. Their innovation strategies and market focuses overlap enough to warrant comparison. Join me as we explore which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Figma and Bentley Systems by providing an overview of these two companies and their main differences.

Figma Overview

Figma, Inc. develops a browser-based design tool aimed at helping teams create user interfaces collaboratively. Its product suite includes Figma Design for prototyping and feedback, Dev Mode for code translation, and other tools like FigJam and Figma Slides. Founded in 2012 and based in San Francisco, Figma operates in the software application industry with a market cap of approximately 14.4B USD and 1,646 full-time employees.

Bentley Systems Overview

Bentley Systems, Incorporated offers infrastructure engineering software solutions across multiple continents. Its extensive portfolio includes modeling, simulation, project delivery, and asset performance systems tailored for civil, structural, and geotechnical engineers. Founded in 1984 and headquartered in Exton, Pennsylvania, Bentley serves a broad professional audience in infrastructure with a market cap near 11.4B USD and around 5,500 employees.

Key similarities and differences

Both companies operate in the software application sector but target different industries and user bases. Figma focuses on collaborative design tools for product development teams, while Bentley specializes in infrastructure engineering software with a comprehensive range of modeling and project management solutions. Bentley’s workforce and market capitalization exceed Figma’s, reflecting its established presence and broader service offering.

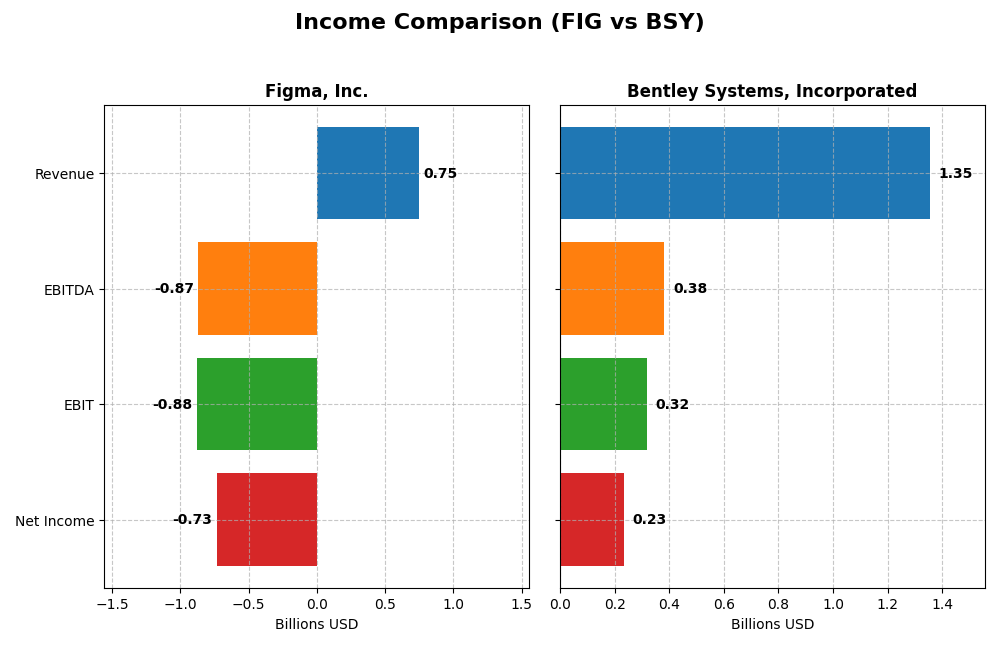

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Figma, Inc. and Bentley Systems, Incorporated for the fiscal year 2024.

| Metric | Figma, Inc. (FIG) | Bentley Systems, Incorporated (BSY) |

|---|---|---|

| Market Cap | 14.4B | 11.4B |

| Revenue | 749M | 1.35B |

| EBITDA | -870M | 382M |

| EBIT | -877M | 318M |

| Net Income | -732M | 235M |

| EPS | -3.11 | 0.75 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Figma, Inc.

Figma’s revenue increased sharply by 48.36% from 2023 to 2024, reaching $749M, but net income swung from a positive $286M to a negative $732M. Despite a strong gross margin of 88.32%, operating expenses surged disproportionately, driving EBIT and net margins deeply negative in 2024. The recent year shows slowed profitability despite revenue growth.

Bentley Systems, Incorporated

Bentley’s revenue grew steadily by 10.15% in 2024 to $1.35B, with net income declining by 34.77% to $235M. Margins remain healthy: gross margin at 80.95%, EBIT margin at 23.49%, and net margin at 17.35%. In 2024, EBIT improved by 41.35% while net margin and EPS declined, indicating mixed margin dynamics amid expanding revenues.

Which one has the stronger fundamentals?

Bentley demonstrates stronger fundamentals with consistent revenue and net income growth over a longer period, favorable margins, and positive EBIT. In contrast, Figma shows impressive revenue growth but deteriorating profitability, reflected by large net losses and negative EBIT margins. Bentley’s stable income metrics suggest a more balanced income statement profile.

Financial Ratios Comparison

The table below presents key financial ratios for Figma, Inc. and Bentley Systems, Incorporated based on their most recent fiscal year data, facilitating an objective comparison of their financial health and performance.

| Ratios | Figma, Inc. (FIG) | Bentley Systems, Inc. (BSY) |

|---|---|---|

| ROE | -55.3% | 22.6% |

| ROIC | -59.7% | 9.3% |

| P/E | -70.7 | 62.6 |

| P/B | 39.1 | 14.1 |

| Current Ratio | 3.66 | 0.54 |

| Quick Ratio | 3.66 | 0.54 |

| D/E (Debt-to-Equity) | 0.02 | 1.37 |

| Debt-to-Assets | 1.6% | 42.0% |

| Interest Coverage | 0 | 12.2 |

| Asset Turnover | 0.42 | 0.40 |

| Fixed Asset Turnover | 17.1 | 20.5 |

| Payout ratio | 0% | 30.7% |

| Dividend yield | 0% | 0.49% |

Interpretation of the Ratios

Figma, Inc.

Figma shows a mixed ratio profile with more unfavorable metrics, such as a negative net margin of -97.74% and a return on equity (ROE) of -55.29%, signaling profitability challenges. Its current ratio is high at 3.66 but considered unfavorable, while leverage ratios remain low and favorable. Figma does not pay dividends, likely reflecting its reinvestment strategy during growth and prioritization of product development over shareholder returns.

Bentley Systems, Incorporated

Bentley Systems presents a stronger profitability profile with a net margin of 17.35% and ROE of 22.55%, both favorable. However, its debt-to-equity ratio of 1.37 and current ratio of 0.54 are unfavorable, indicating higher leverage and liquidity concerns. The company pays a modest dividend yield of 0.49%, but payout and coverage details suggest cautious distribution. Overall, Bentley balances shareholder returns with financial risks.

Which one has the best ratios?

Bentley Systems offers more favorable profitability ratios and generates positive returns, though it carries higher leverage and weaker liquidity. Figma, while less profitable with several unfavorable ratios, maintains low debt and a strong quick ratio. The choice between them depends on weighing profitability against financial stability and growth orientation.

Strategic Positioning

This section compares the strategic positioning of Figma, Inc. and Bentley Systems, Incorporated including Market position, Key segments, and disruption:

Figma, Inc.

- Newer market entrant with $14.4B market cap, facing high competition in application software.

- Focuses on browser-based collaborative design tools for UI/UX, prototyping, and AI-assisted design products.

- Positioned in software innovation but no explicit data on exposure to rapid technological disruption.

Bentley Systems, Incorporated

- Established player with $11.4B market cap, serving global infrastructure engineering markets.

- Diverse portfolio across infrastructure engineering software, modeling, simulation, project delivery, and asset performance.

- Operates in engineering software with complex infrastructure solutions, limited info on direct disruption risk.

Figma, Inc. vs Bentley Systems, Incorporated Positioning

Figma is a focused, innovative software company targeting collaborative design, while Bentley offers a broad range of engineering software solutions. Figma’s concentration contrasts with Bentley’s diversified segment exposure and longer market presence.

Which has the best competitive advantage?

Both companies show declining ROIC trends and are currently shedding value. Bentley’s slightly unfavorable moat suggests a more stable yet challenged position, whereas Figma’s very unfavorable moat indicates more severe value destruction and weaker capital efficiency.

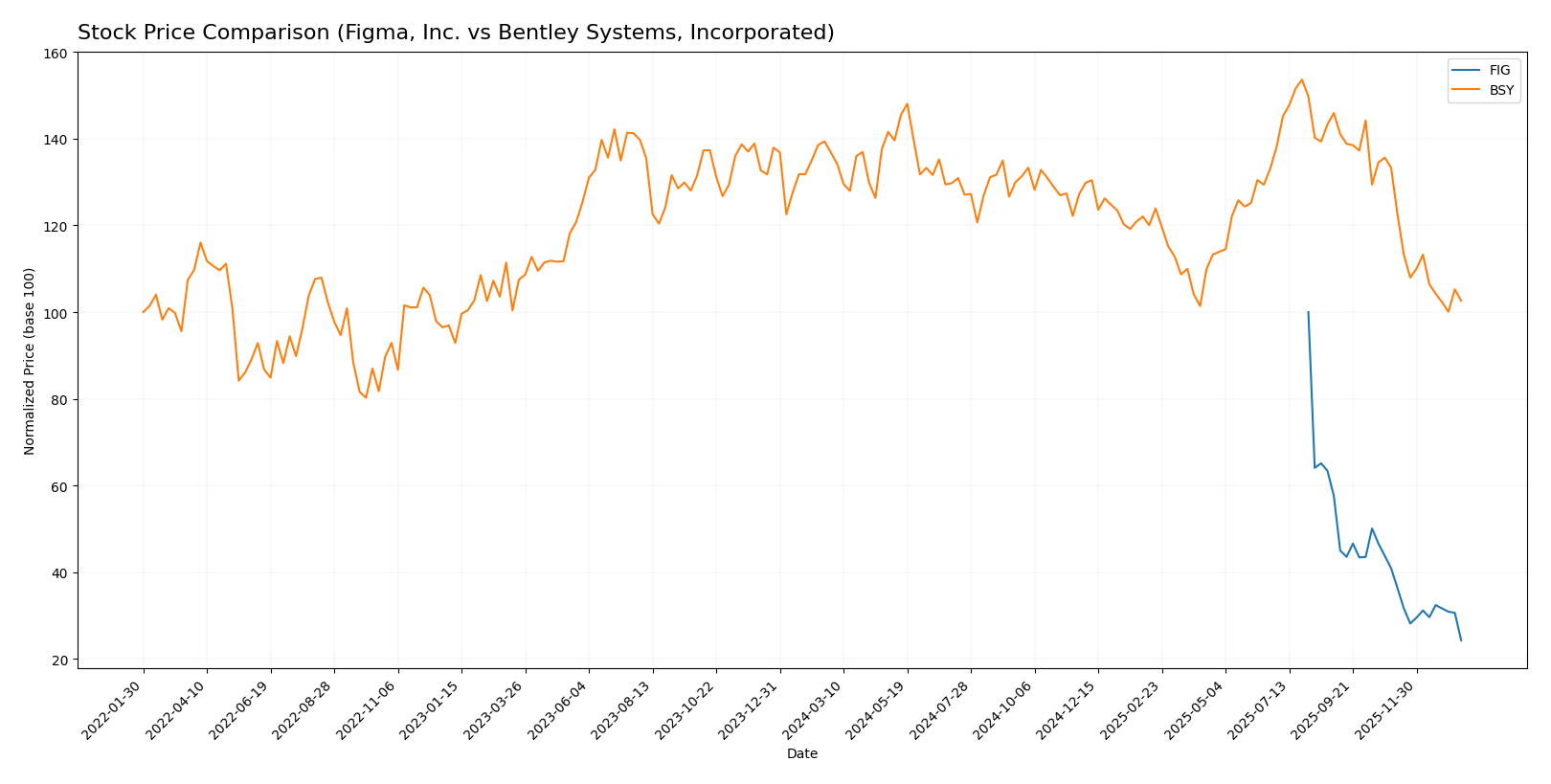

Stock Comparison

The stock price movements over the past 12 months reveal significant declines for both Figma, Inc. and Bentley Systems, Incorporated, with differing momentum and volume dynamics shaping their respective trading behaviors.

Trend Analysis

Figma, Inc. (FIG) experienced a bearish trend over the past year with a steep price drop of -75.76%, showing accelerating decline and high volatility, reflected by a standard deviation of 19.95. Recent months indicate continued strong downward momentum.

Bentley Systems, Incorporated (BSY) also showed a bearish trend with a -24.99% price decline over the same period, but with decelerating losses and lower volatility at 4.63 standard deviation, suggesting a moderation in selling pressure.

Comparing the two, Bentley Systems’ stock delivered a higher market performance, as its price decline was less severe than Figma’s, despite both trending downward over the past year.

Target Prices

Here is the consensus target price overview from verified analysts for the selected companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Figma, Inc. | 52 | 38 | 43.6 |

| Bentley Systems, Inc. | 55 | 45 | 48.75 |

Analysts expect both Figma and Bentley Systems to appreciate, with targets significantly above current prices of $29.57 and $39.14 respectively, indicating positive growth potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Figma, Inc. and Bentley Systems, Incorporated:

Rating Comparison

Figma, Inc. Rating

- Rating: C+ with a Very Favorable status

- Discounted Cash Flow Score: 4, Favorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 4, Favorable

- Overall Score: 2, Moderate

Bentley Systems, Incorporated Rating

- Rating: B- with a Very Favorable status

- Discounted Cash Flow Score: 4, Favorable

- ROE Score: 4, Favorable

- ROA Score: 4, Favorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 3, Moderate

Which one is the best rated?

Bentley Systems, Incorporated holds a higher rating (B- vs. C+) and scores better on ROE and ROA, indicating stronger profitability and asset use. However, Figma shows a stronger debt-to-equity position. Overall, Bentley has the better rating based on provided scores.

Scores Comparison

Here is the comparison of the financial health scores for Figma, Inc. and Bentley Systems, Incorporated:

FIG Scores

- Altman Z-Score: 14.34, indicating a safe zone status.

- Piotroski Score: 4, reflecting average financial strength.

BSY Scores

- Altman Z-Score: 3.74, indicating a safe zone status.

- Piotroski Score: 9, reflecting very strong financial strength.

Which company has the best scores?

Bentley Systems has a lower Altman Z-Score but still in the safe zone and a much higher Piotroski Score of 9, indicating stronger financial health compared to Figma’s average Piotroski Score of 4.

Grades Comparison

Here is a comparison of the recent grades issued by reputable financial institutions for both companies:

Figma, Inc. Grades

The following table shows the recent grades assigned to Figma, Inc. by major grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Wells Fargo | Upgrade | Overweight | 2026-01-08 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Goldman Sachs | Maintain | Neutral | 2025-11-07 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-04 |

| RBC Capital | Maintain | Sector Perform | 2025-09-04 |

Figma’s grades predominantly reflect a neutral to slightly positive outlook, with multiple “Equal Weight” and “Neutral” ratings and a few “Overweight” grades.

Bentley Systems, Incorporated Grades

The following table shows the recent grades assigned to Bentley Systems, Incorporated by major grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Rosenblatt | Upgrade | Buy | 2025-10-17 |

| Piper Sandler | Maintain | Overweight | 2025-08-07 |

| Goldman Sachs | Maintain | Sell | 2025-08-07 |

Bentley Systems shows a wider range of grades, from “Sell” to “Outperform” and “Buy,” with some recent downgrades but several strong positive ratings.

Which company has the best grades?

Bentley Systems, Incorporated has received more varied and generally stronger grades, including multiple “Buy” and “Outperform” ratings, compared to Figma, Inc., which is mostly rated “Hold” or “Equal Weight.” This difference could influence investors seeking either more stable or more opportunistic positions.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Figma, Inc. (FIG) and Bentley Systems, Incorporated (BSY) based on recent financial and operational data.

| Criterion | Figma, Inc. (FIG) | Bentley Systems, Inc. (BSY) |

|---|---|---|

| Diversification | Limited product range, focused on design software | Broad revenue streams including subscriptions, licenses, and services |

| Profitability | Negative net margin (-97.74%), value destroying (ROIC << WACC) | Positive net margin (17.35%), but slightly unfavorable ROIC vs WACC |

| Innovation | Historically strong in UI/UX innovation, but recent declining profitability | Moderate innovation, steady enterprise software updates |

| Global presence | Strong digital presence, but smaller scale globally | Established global presence in infrastructure software markets |

| Market Share | Growing in design tools market, but profitability issues | Solid market share in engineering software with expanding subscription base |

Key takeaways: Figma shows strong innovation but suffers from severe profitability and value destruction issues, marking it a risky investment. Bentley Systems offers more revenue diversification and positive margins but faces challenges with declining ROIC and some unfavorable financial ratios, calling for cautious optimism.

Risk Analysis

Below is a comparison of key risk factors for Figma, Inc. (FIG) and Bentley Systems, Incorporated (BSY) based on the most recent data from 2024.

| Metric | Figma, Inc. (FIG) | Bentley Systems, Inc. (BSY) |

|---|---|---|

| Market Risk | High volatility, beta -3.8 indicates unusual price swings | Moderate, beta 1.21 suggests typical market sensitivity |

| Debt level | Very low debt (D/E 0.02), minimal financial risk | Higher debt (D/E 1.37), moderate leverage risk |

| Regulatory Risk | Moderate, operating in highly regulated tech sector | Moderate, infrastructure software with some compliance exposure |

| Operational Risk | High, negative profitability and returns suggest operational challenges | Moderate, stable profitability but higher asset turnover risk |

| Environmental Risk | Low, primarily software with minimal direct environmental impact | Low to moderate, infrastructure focus may involve environmental considerations |

| Geopolitical Risk | Low, US-based with global user base, limited direct exposure | Moderate due to global infrastructure projects and geopolitical tensions |

Figma faces the most impactful risks from operational inefficiencies and extreme market volatility, reflected in its negative profitability and unusual beta. Bentley carries moderate financial leverage and geopolitical risks due to its global infrastructure focus, though its profitability and financial health are stronger. Investors should weigh Figma’s high volatility and operational risks against Bentley’s debt and market position for balanced risk management.

Which Stock to Choose?

Figma, Inc. (FIG) shows a strong revenue growth of 48.36% in 2024 but struggles with negative profitability, including a net margin of -97.74% and declining returns on equity and invested capital. The company maintains low debt levels and a favorable WACC, yet its overall financial ratios and income statement are rated unfavorable.

Bentley Systems, Incorporated (BSY) reports a favorable income statement with a net margin of 17.35% and solid revenue growth of 10.15% in 2024. Its return on equity is positive at 22.55%, but debt levels are relatively high with a debt-to-equity ratio rated very unfavorable. The company’s financial ratios are slightly unfavorable overall, despite good profitability metrics.

Considering ratings and financial evaluations, BSY’s profile might appeal to investors seeking profitability and moderate growth, whereas FIG’s unfavorable profitability and value metrics could signal higher risk. Thus, growth-focused investors might view FIG’s rapid revenue expansion as a potential opportunity, while those prioritizing financial stability and established profitability could find BSY more aligned with their criteria.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Figma, Inc. and Bentley Systems, Incorporated to enhance your investment decisions: