Home > Comparison > Technology > FICO vs BSY

The strategic rivalry between Fair Isaac Corporation and Bentley Systems defines the current trajectory of the technology sector. Fair Isaac excels as a data-driven analytics powerhouse specializing in decision management software. Bentley Systems leads with infrastructure engineering software tailored for complex design and project delivery. This analysis pits Fair Isaac’s scoring and automated decision tools against Bentley’s comprehensive modeling solutions to identify which offers superior risk-adjusted returns for diversified portfolios.

Table of contents

Companies Overview

Fair Isaac Corporation and Bentley Systems, Incorporated both hold influential positions in the software application industry, shaping critical sectors globally.

Fair Isaac Corporation: Analytics Pioneer in Decision Management

Fair Isaac Corporation leads in analytic software and data management, powering automated decision-making across multiple industries. Its revenue stems from two segments: Scores, offering scoring solutions, and Software, providing modular decision management systems. In 2026, the firm emphasizes advanced analytics integration to enhance marketing, fraud detection, and financial compliance capabilities.

Bentley Systems, Incorporated: Infrastructure Engineering Software Specialist

Bentley Systems commands the infrastructure engineering software niche with open modeling and simulation tools covering design, construction, and asset management. Its revenue derives from diverse applications like MicroStation and AssetWise, supporting civil and geotechnical professionals. The 2026 strategy centers on expanding collaborative project delivery and 4D construction modeling platforms for infrastructure enterprises.

Strategic Collision: Similarities & Divergences

Both companies focus on software solutions that enhance complex decision-making but diverge in ecosystem philosophy: Fair Isaac operates a modular, configurable platform, while Bentley champions open infrastructure integration. Their primary battleground is efficiency in large-scale enterprise workflows—financial versus engineering sectors. This contrast creates distinct investment profiles shaped by industry exposure and innovation pathways.

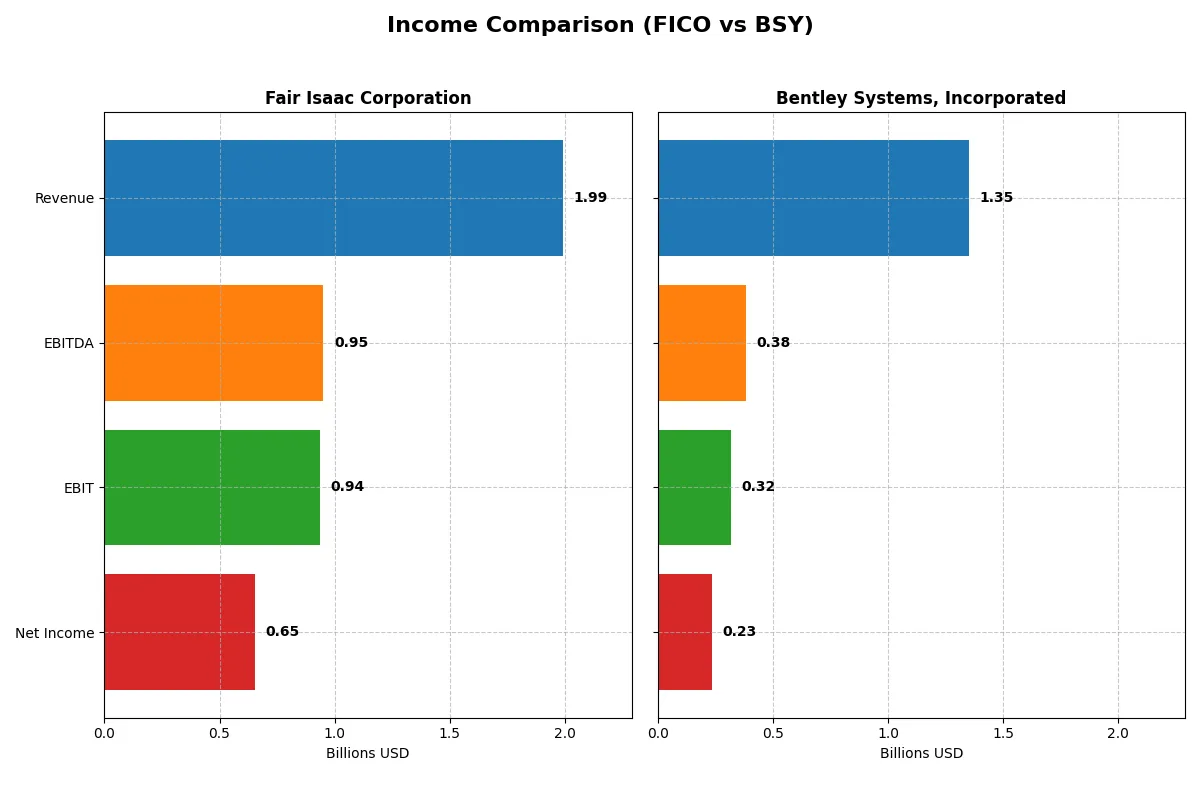

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Fair Isaac Corporation (FICO) | Bentley Systems, Incorporated (BSY) |

|---|---|---|

| Revenue | 1.99B | 1.35B |

| Cost of Revenue | 354M | 258M |

| Operating Expenses | 712M | 793M |

| Gross Profit | 1.64B | 1.10B |

| EBITDA | 951M | 382M |

| EBIT | 936M | 318M |

| Interest Expense | 134M | 25M |

| Net Income | 652M | 242M |

| EPS | 26.9 | 0.75 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine, key for investors’ portfolio decisions.

Fair Isaac Corporation Analysis

Fair Isaac’s revenue climbed steadily from 1.3B in 2021 to nearly 2.0B in 2025, driving net income growth from 392M to 652M. Its gross margin remains robust above 82%, while net margin expanded to 32.75% in 2025. Operating efficiency accelerated with EBIT rising 25% year-over-year, confirming strong momentum and disciplined cost management.

Bentley Systems, Incorporated Analysis

Bentley’s revenue surged from 801M in 2020 to 1.35B in 2024, with net income increasing from 126M to 242M. Gross margin holds a solid 81%, but net margin lags at 17.35%. Despite a 41% EBIT jump in 2024, net margin and EPS declined, signaling margin pressure and operational challenges amid growth.

Margin Leadership vs. Top-Line Expansion

Fair Isaac outperforms Bentley with superior margins and consistent net income growth, reflecting a more efficient profit engine. Bentley’s impressive revenue gains come with margin headwinds that dilute bottom-line gains. Investors favor Fair Isaac’s profile for steady profitability and margin resilience over Bentley’s growth-at-all-costs approach.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Fair Isaac Corporation (FICO) | Bentley Systems, Incorporated (BSY) |

|---|---|---|

| ROE | -37.3% | 22.6% |

| ROIC | 52.96% | 9.30% |

| P/E | 55.6 | 62.6 |

| P/B | -20.8 | 14.1 |

| Current Ratio | 0.83 | 0.54 |

| Quick Ratio | 0.83 | 0.54 |

| D/E | -1.76 | 1.37 |

| Debt-to-Assets | 164.6% | 41.96% |

| Interest Coverage | 6.92 | 12.2 |

| Asset Turnover | 1.07 | 0.40 |

| Fixed Asset Turnover | 21.2 | 20.5 |

| Payout ratio | 0% | 30.7% |

| Dividend yield | 0% | 0.49% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, exposing hidden risks and operational excellence through clear, quantifiable metrics.

Fair Isaac Corporation

Fair Isaac posts a strong net margin of 32.75%, signaling robust profitability, but a negative ROE of -37.34% raises concerns. The stock trades at a stretched P/E of 55.64, reflecting high valuation. With no dividend yield, Fair Isaac reinvests aggressively in R&D, fueling growth but challenging immediate shareholder returns.

Bentley Systems, Incorporated

Bentley Systems shows a positive ROE of 22.55% and a modest net margin of 17.35%, indicating efficient operations. However, its P/E ratio at 62.63 marks the stock as expensive. The company pays a small dividend yield of 0.49%, balancing shareholder returns with ongoing investments in research and development.

Premium Valuation vs. Operational Safety

Fair Isaac offers stronger profitability but at a stretched valuation and negative equity returns, while Bentley delivers consistent ROE with high expenses and a modest dividend. Investors seeking growth might favor Fair Isaac’s reinvestment, whereas those valuing steady returns may lean toward Bentley’s balanced profile.

Which one offers the Superior Shareholder Reward?

Fair Isaac Corporation (FICO) pays no dividends but boasts a robust free cash flow of $31.8/share in 2025, fueling aggressive buybacks and reinvestment in growth. Bentley Systems (BSY) offers a modest 0.49% dividend yield with a 31% payout ratio, balancing dividends and buybacks. FICO’s distribution model leans on capital allocation towards buybacks and innovation, enhancing long-term value sustainably. BSY’s dividend presence provides income but at the cost of slower reinvestment. Given FICO’s stronger free cash flow coverage, zero payout risk, and intense buyback activity, I conclude FICO delivers a more attractive total shareholder return in 2026.

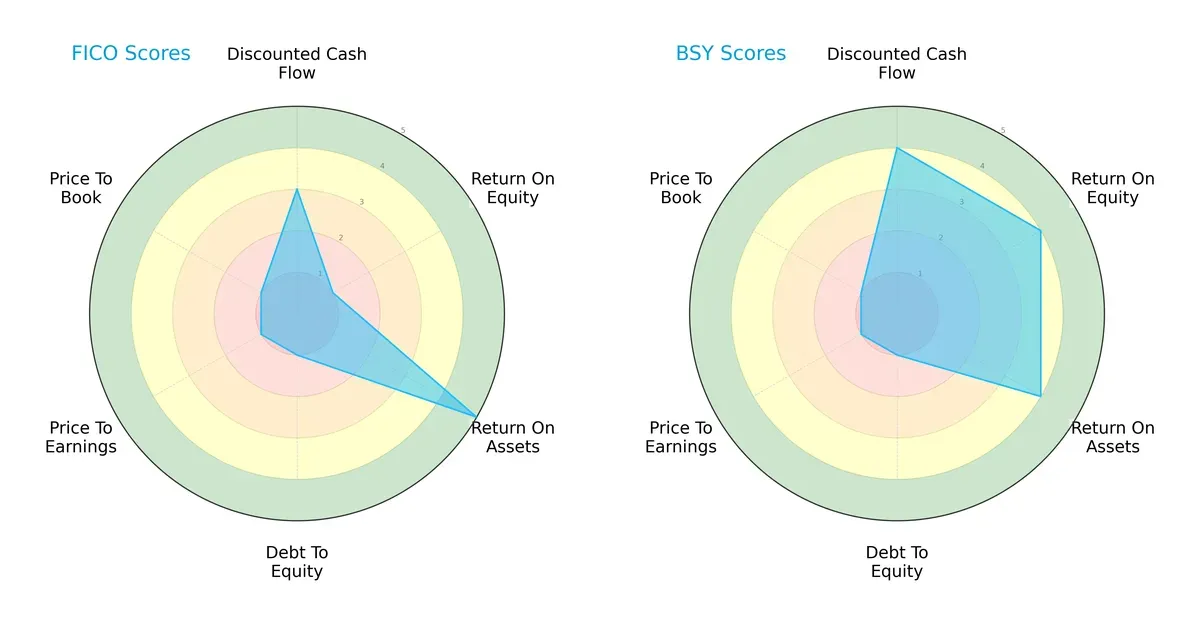

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Fair Isaac Corporation and Bentley Systems, Incorporated, highlighting their financial strengths and weaknesses:

Bentley Systems (BSY) demonstrates a more balanced profile with favorable DCF (4), ROE (4), and ROA (4) scores, signaling efficient asset use and profitability. Fair Isaac (FICO) relies heavily on asset efficiency (ROA 5) but suffers from weak profitability (ROE 1) and high leverage risks (Debt/Equity 1). Both firms share very unfavorable valuations (PE and PB scores at 1), but BSY’s diversified strengths make it the more robust choice.

Bankruptcy Risk: Solvency Showdown

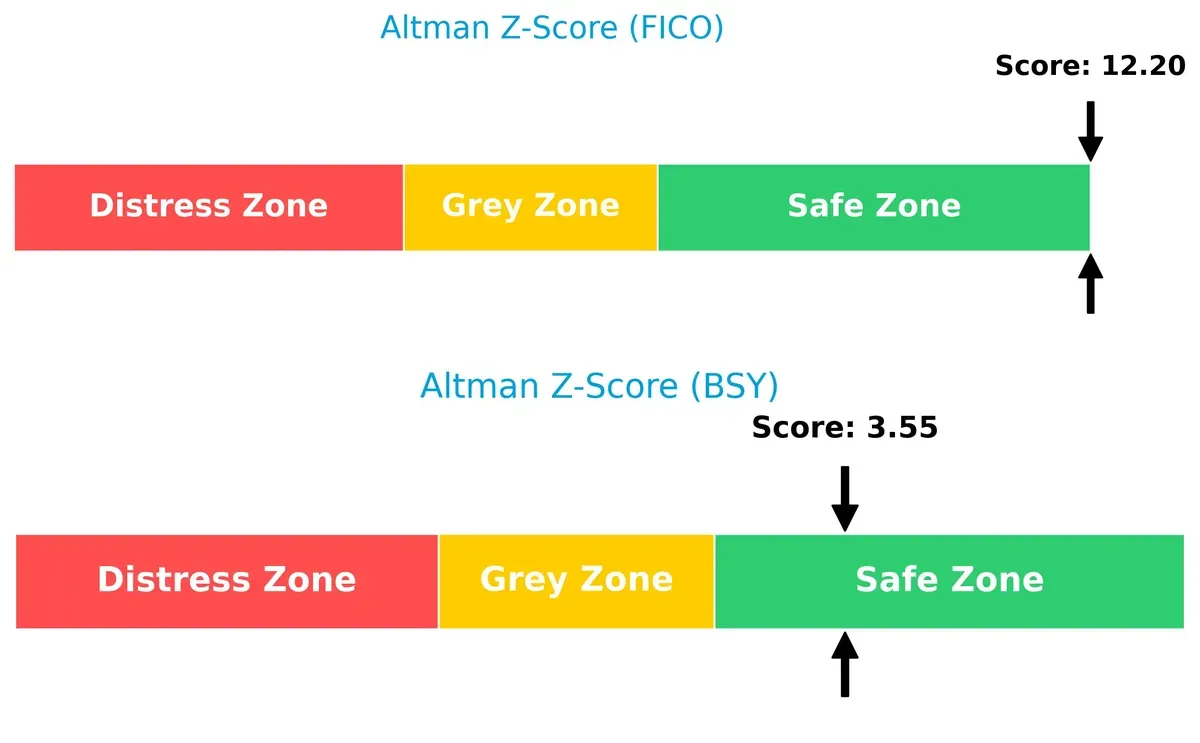

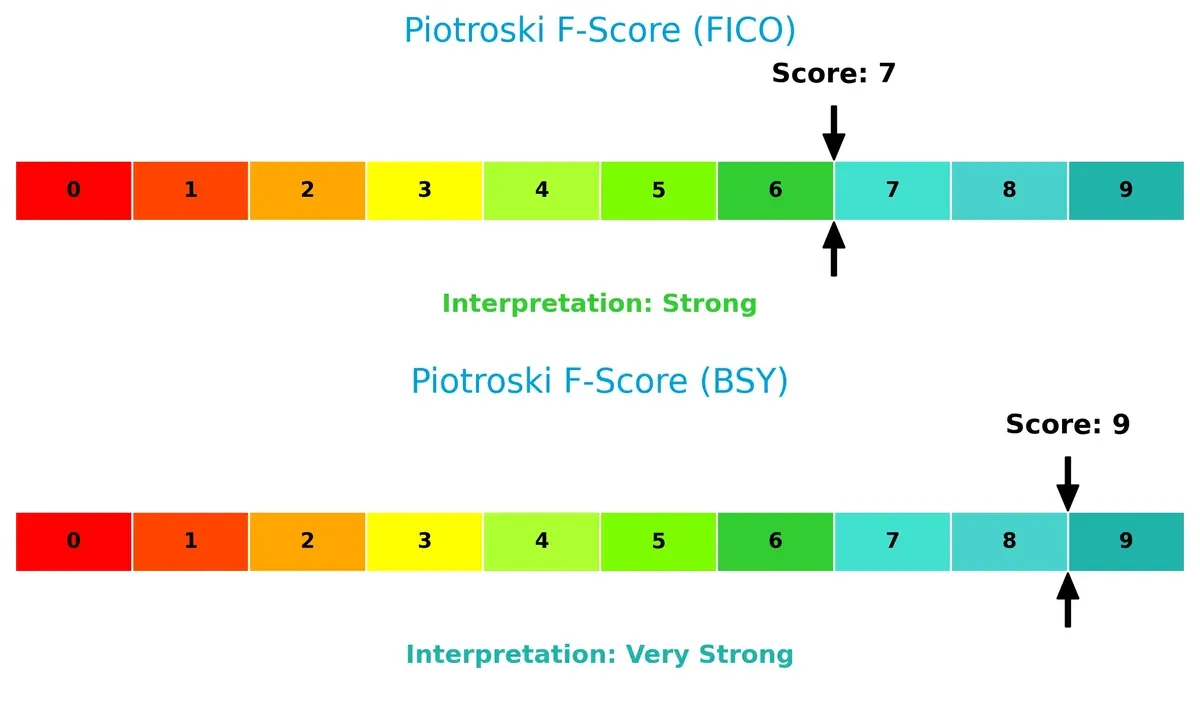

Fair Isaac’s Altman Z-Score (12.2) far exceeds Bentley’s (3.55), indicating a significantly stronger solvency position in this cycle:

FICO’s score places it well into the safe zone, suggesting minimal bankruptcy risk. BSY, while also safe, sits closer to the grey zone threshold. This difference underscores FICO’s superior buffer against financial distress despite some operational weaknesses.

Financial Health: Quality of Operations

Bentley Systems scores a perfect 9 on the Piotroski F-Score, indicating very strong financial health, while Fair Isaac posts a solid 7, signaling strong but not peak conditions:

BSY’s top score reflects excellent profitability, liquidity, and operational efficiency, whereas FICO, though healthy, shows room for improvement in internal metrics. Investors should note FICO’s moderate red flags relative to BSY’s near-flawless operational quality.

How are the two companies positioned?

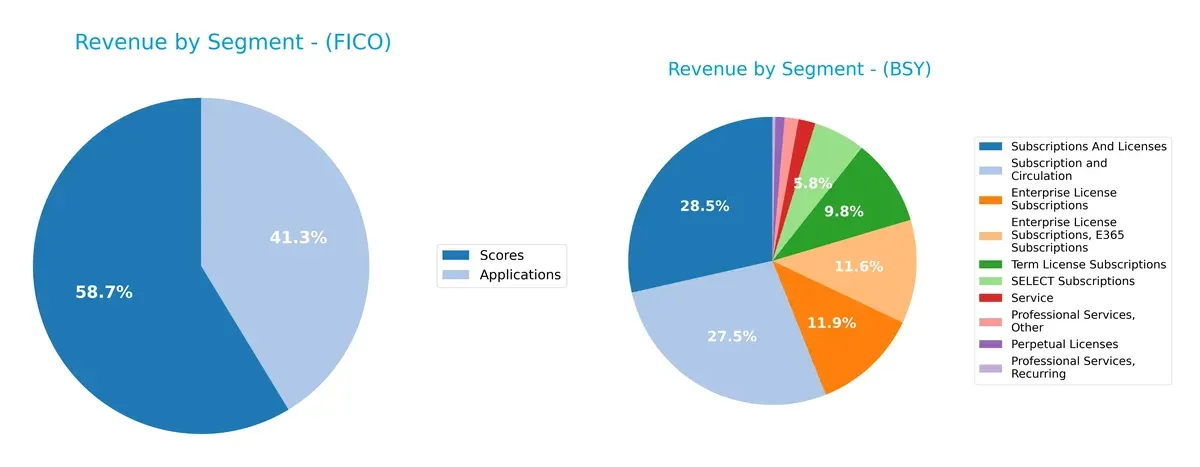

This section dissects the operational DNA of FICO and BSY by comparing their revenue distribution by segment and internal strengths and weaknesses. The goal is to confront their economic moats to identify which business model delivers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Fair Isaac Corporation and Bentley Systems diversify their income streams and where their primary sector bets lie:

Fair Isaac Corporation pivots mainly on two segments: Scores at $1.17B and Applications at $822M in 2025. Bentley Systems exhibits a broader mix, with Subscriptions and Licenses dominating at $1.27B, supported by diverse streams like Enterprise License Subscriptions ($530M) and Select Subscriptions ($259M). Bentley’s varied portfolio reduces concentration risk, while Fair Isaac’s focus on Scores anchors its ecosystem lock-in but increases dependency risk.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Fair Isaac Corporation (FICO) and Bentley Systems, Incorporated (BSY):

FICO Strengths

- High net margin at 32.75%

- Strong ROIC at 52.96% exceeding WACC

- Favorable asset turnover at 1.07 and fixed asset turnover 21.2

- Significant revenue from Scores and Software segments

- Large Americas revenue base over 1.7B

BSY Strengths

- Positive net margin at 17.35%

- Favorable ROE at 22.55%

- Strong interest coverage at 12.83

- Diversified subscription and license revenues exceeding 1.2B

- Balanced geographic presence across Americas, EMEA, Asia Pacific

FICO Weaknesses

- Negative ROE at -37.34% is a major red flag

- High debt to assets at 165% signals leverage risk

- Low current ratio at 0.83 indicates liquidity concerns

- Unfavorable P/E at 55.64 and no dividend yield

- Negative price to book ratio at -20.78

BSY Weaknesses

- Low current and quick ratios at 0.54 raise liquidity issues

- Unfavorable P/E at 62.63 and PB at 14.13 suggest high valuation

- Debt to equity at 1.37 and neutral debt to assets at 42%

- Lower asset turnover at 0.4 limits efficiency

- Dividend yield at 0.49% is negligible

Overall, FICO demonstrates strong profitability metrics and operational efficiency but faces significant financial structure and liquidity challenges. BSY shows healthier profitability ratios and revenue diversification yet struggles with liquidity and valuation concerns. These contrasting profiles highlight key strategic focus areas for each company.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from relentless competitive erosion. Let’s dissect the core moats of these two software firms:

Fair Isaac Corporation (FICO): Analytics Powerhouse with Durable Switching Costs

FICO’s moat hinges on switching costs embedded in its credit scoring and decision management software. This drives a very favorable 44% ROIC premium over WACC and margin stability. In 2026, expanding its AI-driven analytics and global reach could deepen this advantage.

Bentley Systems, Incorporated (BSY): Niche Infrastructure Software with Thin Moat

BSY’s moat lies in specialized infrastructure engineering software, but it shows a slight value erosion with ROIC barely above WACC and a declining trend. Unlike FICO, BSY faces margin pressure and must innovate aggressively to sustain growth and fend off disruption.

Moat Strength Showdown: Switching Costs vs. Specialized Software

FICO’s wide, durable moat built on entrenched switching costs outclasses BSY’s narrow, weakening moat. FICO is better positioned to defend market share and generate sustainable excess returns through 2026.

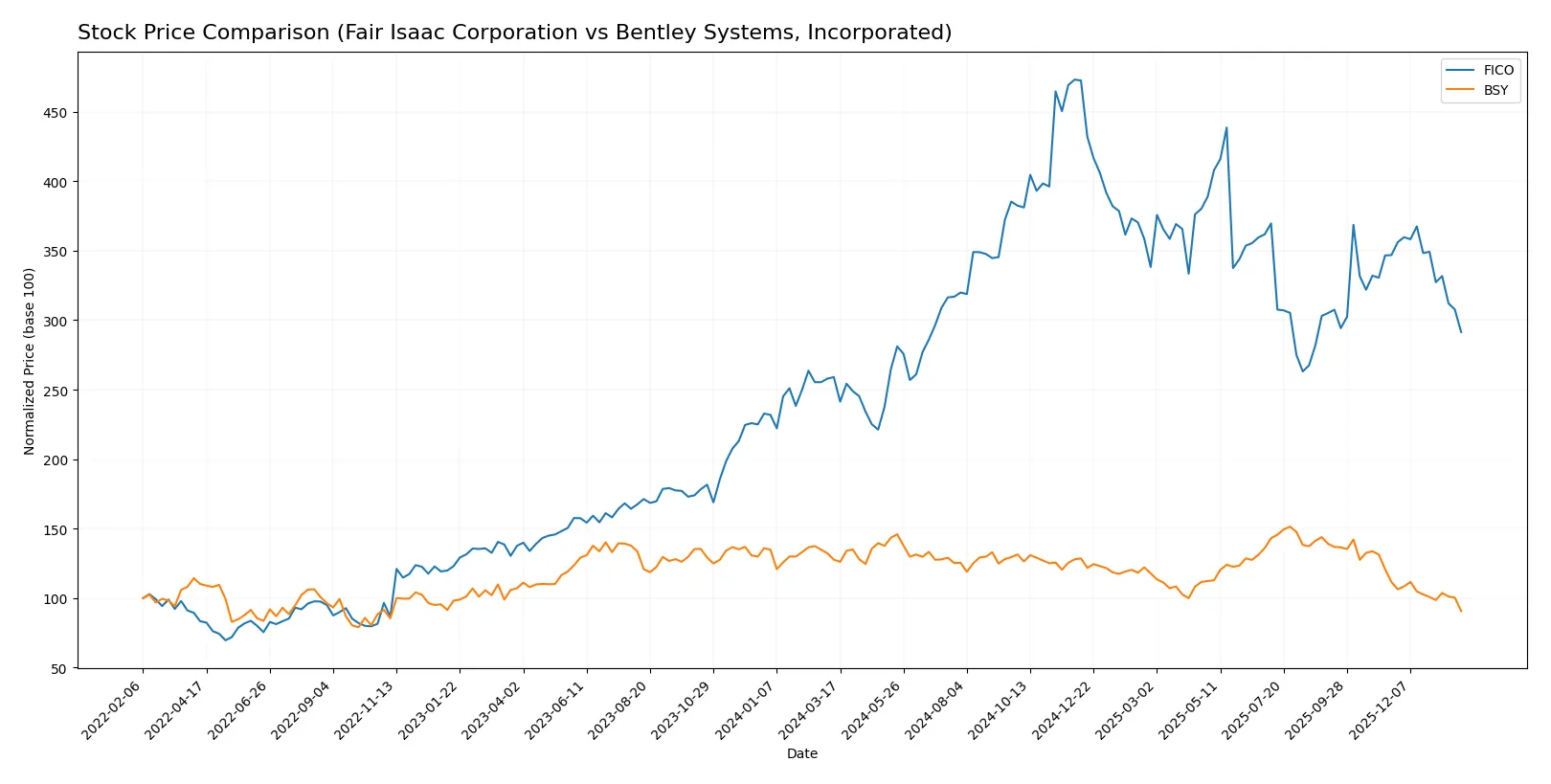

Which stock offers better returns?

Over the past 12 months, Fair Isaac Corporation’s shares rose 12.5% with decelerating momentum, while Bentley Systems’ stock declined sharply by 28.9%, reflecting contrasting market dynamics.

Trend Comparison

Fair Isaac Corporation shows a bullish trend with a 12.5% gain over 12 months. The price peaked at 2375.03 and bottomed at 1110.85, but the recent three-month trend reversed with a 16% drop.

Bentley Systems exhibits a bearish trend with a 28.9% decline over 12 months. Its price fluctuated between 58.59 and 35.12, with continued deceleration and a steeper 18.6% drop in the recent quarter.

Fair Isaac’s stock outperformed Bentley’s, delivering positive returns while Bentley’s shares significantly declined in the same period.

Target Prices

Analysts set a bullish consensus for both Fair Isaac Corporation and Bentley Systems, Incorporated.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Fair Isaac Corporation | 1,640 | 2,400 | 2,115 |

| Bentley Systems, Incorporated | 45 | 55 | 49.33 |

The target consensus for Fair Isaac stands roughly 45% above its current price of 1,463, signaling strong growth expectations. Bentley’s consensus price also exceeds its current 35.12, indicating moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Fair Isaac Corporation Grades

The following table summarizes the recent grades from recognized financial institutions for Fair Isaac Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-16 |

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-11-06 |

| BMO Capital | Maintain | Outperform | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-10-14 |

| Barclays | Maintain | Overweight | 2025-10-02 |

| Needham | Maintain | Buy | 2025-10-02 |

Bentley Systems, Incorporated Grades

The table below outlines recent institutional grades for Bentley Systems, Incorporated.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2026-01-20 |

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| Rosenblatt | Upgrade | Buy | 2025-10-17 |

| Oppenheimer | Maintain | Outperform | 2025-08-07 |

Which company has the best grades?

Fair Isaac Corporation holds consistently strong buy and outperform ratings from multiple top-tier firms. Bentley Systems shows a broader range, including downgrades and neutral ratings. Fair Isaac’s steadier grades suggest greater institutional confidence, which may influence investor perception more positively.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Fair Isaac Corporation

- Faces intense competition in analytics and decision software, requiring constant innovation to maintain market share.

Bentley Systems, Incorporated

- Competes in infrastructure engineering software with diverse solutions, but faces pressure from larger tech firms expanding into this niche.

2. Capital Structure & Debt

Fair Isaac Corporation

- High debt-to-assets ratio (165%) signals financial leverage risk despite favorable interest coverage.

Bentley Systems, Incorporated

- Moderate debt-to-assets (42%) but debt-to-equity ratio is unfavorable, indicating reliance on borrowing that could constrain flexibility.

3. Stock Volatility

Fair Isaac Corporation

- Beta at 1.29 reflects above-market volatility, increasing risk during downturns.

Bentley Systems, Incorporated

- Slightly lower beta at 1.21 still implies elevated volatility typical for software sector stocks.

4. Regulatory & Legal

Fair Isaac Corporation

- Operates globally with exposure to data privacy and compliance regulations that can raise costs.

Bentley Systems, Incorporated

- Faces regulatory scrutiny in infrastructure and engineering standards, potentially impacting project timelines and costs.

5. Supply Chain & Operations

Fair Isaac Corporation

- Software delivery reduces supply chain risks but depends on data and cloud infrastructure stability.

Bentley Systems, Incorporated

- Complex software solutions require robust operational support and integration, exposing it to execution risks.

6. ESG & Climate Transition

Fair Isaac Corporation

- Limited direct environmental impact but must address data governance and social responsibility.

Bentley Systems, Incorporated

- Infrastructure focus mandates strong ESG performance; climate transition could pressure product innovation and reporting.

7. Geopolitical Exposure

Fair Isaac Corporation

- Broad international footprint exposes it to geopolitical tensions affecting data transfers and market access.

Bentley Systems, Incorporated

- Global presence in critical infrastructure software increases exposure to geopolitical disruptions and trade restrictions.

Which company shows a better risk-adjusted profile?

Fair Isaac’s most impactful risk is its high leverage, which could amplify financial distress despite solid profitability. Bentley’s key risk lies in its unfavorable debt-to-equity ratio paired with lower asset efficiency. Bentley’s stronger profitability metrics and higher Piotroski score suggest better operational health, but its balance sheet risks weigh heavily. Considering overall risk and financial strength, Fair Isaac shows a slightly better risk-adjusted profile, supported by a robust Altman Z-score well into the safe zone.

Final Verdict: Which stock to choose?

Fair Isaac Corporation (FICO) wields unmatched capital efficiency as its superpower, consistently generating returns far above its cost of capital. Its main point of vigilance is a stretched liquidity position, which could pressure short-term flexibility. FICO fits well in aggressive growth portfolios seeking durable competitive advantages.

Bentley Systems, Incorporated (BSY) boasts a strategic moat anchored in specialized software with recurring revenue safety. While it offers a steadier earnings profile relative to FICO, its declining capital returns and higher leverage call for cautious optimism. BSY suits growth-at-a-reasonable-price (GARP) investors prioritizing stability over rapid expansion.

If you prioritize strong economic moats and value creation, FICO is the compelling choice due to its robust and growing ROIC well above WACC. However, if you seek safer income streams with moderate growth, BSY offers better stability despite weaker profitability metrics. Both present analytical scenarios for distinct investor profiles rather than a one-size-fits-all pick.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Fair Isaac Corporation and Bentley Systems, Incorporated to enhance your investment decisions: