In today’s fast-evolving tech landscape, Datadog, Inc. and Bentley Systems, Incorporated stand out as leaders in software application solutions. Both companies operate in the technology sector, offering innovative platforms that serve overlapping markets—cloud infrastructure monitoring for Datadog and infrastructure engineering software for Bentley. This comparison will explore their growth, innovation strategies, and market positions to identify which company presents a more compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Datadog and Bentley Systems by providing an overview of these two companies and their main differences.

Datadog Overview

Datadog, Inc. operates a SaaS platform that offers monitoring and analytics for developers, IT operations, and business users worldwide. Its services include infrastructure monitoring, application performance, log management, and security monitoring, providing real-time observability across technology stacks. Headquartered in New York City, Datadog serves a broad customer base focused on cloud environments and developer-centric observability.

Bentley Systems Overview

Bentley Systems, Incorporated delivers infrastructure engineering software solutions globally, supporting civil, structural, geotechnical, and geospatial professionals. Its portfolio includes modeling, simulation, project delivery, and asset performance applications designed to enhance infrastructure design and management. Based in Exton, Pennsylvania, Bentley targets infrastructure project delivery enterprises and asset operations across multiple continents.

Key similarities and differences

Both Datadog and Bentley Systems operate in the technology sector, specifically in software applications, and serve professional users with specialized platforms. Datadog focuses on cloud-based monitoring and analytics, emphasizing IT infrastructure and application performance, while Bentley Systems specializes in infrastructure engineering software with a broader scope of modeling and asset management tools. Their business models differ primarily in target markets and product focus, with Datadog centered on SaaS observability and Bentley emphasizing engineering and infrastructure software solutions.

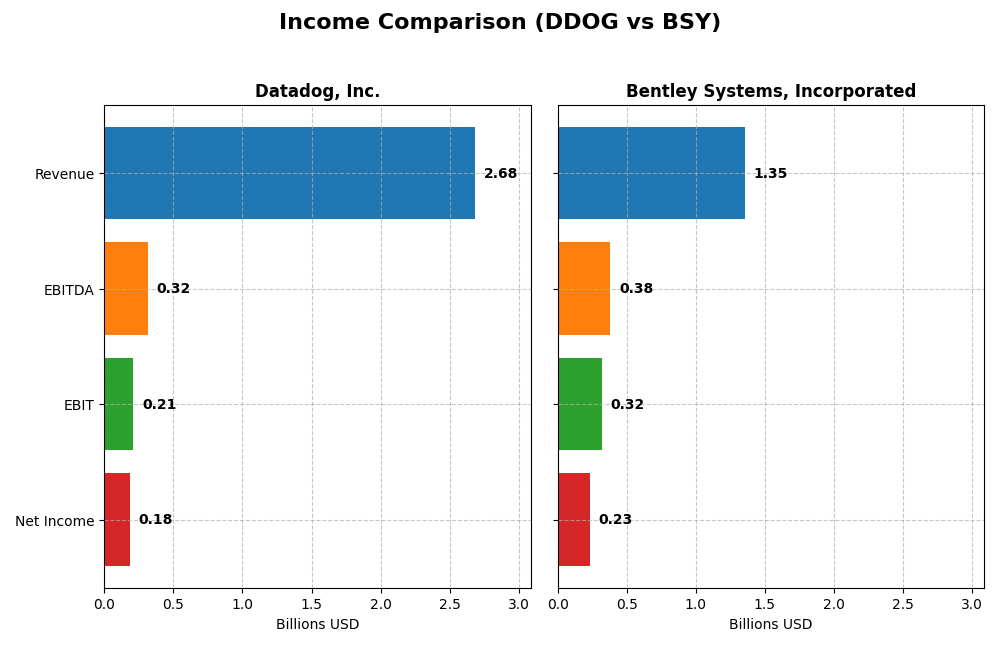

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Datadog, Inc. and Bentley Systems, Incorporated for the fiscal year 2024.

| Metric | Datadog, Inc. (DDOG) | Bentley Systems, Inc. (BSY) |

|---|---|---|

| Market Cap | 41.7B | 11.4B |

| Revenue | 2.68B | 1.35B |

| EBITDA | 318M | 382M |

| EBIT | 211M | 318M |

| Net Income | 184M | 235M |

| EPS | 0.55 | 0.75 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Datadog, Inc.

Datadog exhibited strong revenue and net income growth from 2020 to 2024, with revenue expanding by 345% and net income surging by 849%. Its gross margin remained consistently favorable around 81%, while net margin improved notably to 6.85% in 2024. The latest year showed accelerated growth, with a 26% revenue increase and a nearly 200% rise in net margin, reflecting enhanced operational efficiency.

Bentley Systems, Incorporated

Bentley Systems showed steady revenue growth of nearly 69% over five years, with net income also rising by 86%. The company maintained a favorable gross margin near 81% and a robust EBIT margin of 23.5% in 2024. However, net margin growth slowed recently, declining by 35%, and EPS decreased by 28% in 2024 despite a 10% revenue increase, indicating some pressure on profitability.

Which one has the stronger fundamentals?

Datadog outperforms Bentley Systems in terms of rapid revenue and net income expansion, alongside improving margins and EPS growth. Bentley benefits from higher absolute profitability margins but faced recent declines in net margin and EPS. Overall, Datadog’s accelerating growth and margin improvements suggest stronger momentum, while Bentley’s fundamentals reflect greater stability but recent margin pressures.

Financial Ratios Comparison

The table below presents a clear comparison of key financial ratios for Datadog, Inc. and Bentley Systems, Incorporated, based on their most recent fiscal year data (2024).

| Ratios | Datadog, Inc. (DDOG) | Bentley Systems, Inc. (BSY) |

|---|---|---|

| ROE | 6.77% | 22.55% |

| ROIC | 1.07% | 9.30% |

| P/E | 261.4x | 62.6x |

| P/B | 17.7x | 14.1x |

| Current Ratio | 2.64 | 0.54 |

| Quick Ratio | 2.64 | 0.54 |

| D/E (Debt-to-Equity) | 0.68 | 1.37 |

| Debt-to-Assets | 31.8% | 41.96% |

| Interest Coverage | 7.68x | 12.20x |

| Asset Turnover | 0.46 | 0.40 |

| Fixed Asset Turnover | 6.72 | 20.47 |

| Payout Ratio | 0% | 30.7% |

| Dividend Yield | 0% | 0.49% |

Interpretation of the Ratios

Datadog, Inc.

Datadog shows a mixed ratio profile with a favorable liquidity position, evidenced by a strong current and quick ratio of 2.64, and excellent interest coverage at 29.85. However, profitability and valuation metrics like ROE (6.77%), ROIC (1.07%), PE (261.42), and PB (17.7) are unfavorable, indicating potential overvaluation and modest returns. The company does not pay dividends, likely prioritizing reinvestment during its growth phase.

Bentley Systems, Incorporated

Bentley exhibits favorable profitability ratios, including a high net margin of 17.35% and ROE of 22.55%, though liquidity ratios are weak with a current and quick ratio of 0.54, signaling potential short-term solvency concerns. The company pays a dividend with a 0.49% yield, but payout sustainability may be questioned given its relatively high debt-to-equity ratio of 1.37 and unfavorable valuation multiples like PE (62.63) and PB (14.13).

Which one has the best ratios?

Both companies present slightly unfavorable overall ratio profiles, each with 28.57% favorable and around 43–50% unfavorable ratios. Datadog excels in liquidity and interest coverage but lags in profitability and valuation, while Bentley shines in profitability but faces liquidity and leverage challenges. Neither clearly dominates; the decision depends on investor preference for growth versus income stability.

Strategic Positioning

This section compares the strategic positioning of Datadog and Bentley Systems including market position, key segments, and exposure to technological disruption:

Datadog, Inc.

- Strong presence in cloud monitoring with global reach; faces competition in SaaS application monitoring.

- Provides cloud-based monitoring, analytics, security, and observability platform for IT and developers.

- Positioned in cloud-native SaaS space; exposed to evolving cloud and security technology disruptions.

Bentley Systems, Incorporated

- Focused on infrastructure engineering software with global operations; competitive niche market.

- Offers infrastructure design, simulation, project delivery, and asset performance software.

- Operates in infrastructure software with potential disruption from digital twin and simulation advances.

Datadog, Inc. vs Bentley Systems, Incorporated Positioning

Datadog pursues a diversified SaaS platform targeting cloud operations and security, while Bentley concentrates on infrastructure engineering software. Datadog benefits from cloud integration breadth; Bentley leverages specialized engineering tools but faces narrower market scope.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOAT evaluations. Datadog has growing profitability despite value destruction, while Bentley shows declining profitability without value creation, indicating Datadog has a marginally stronger competitive advantage.

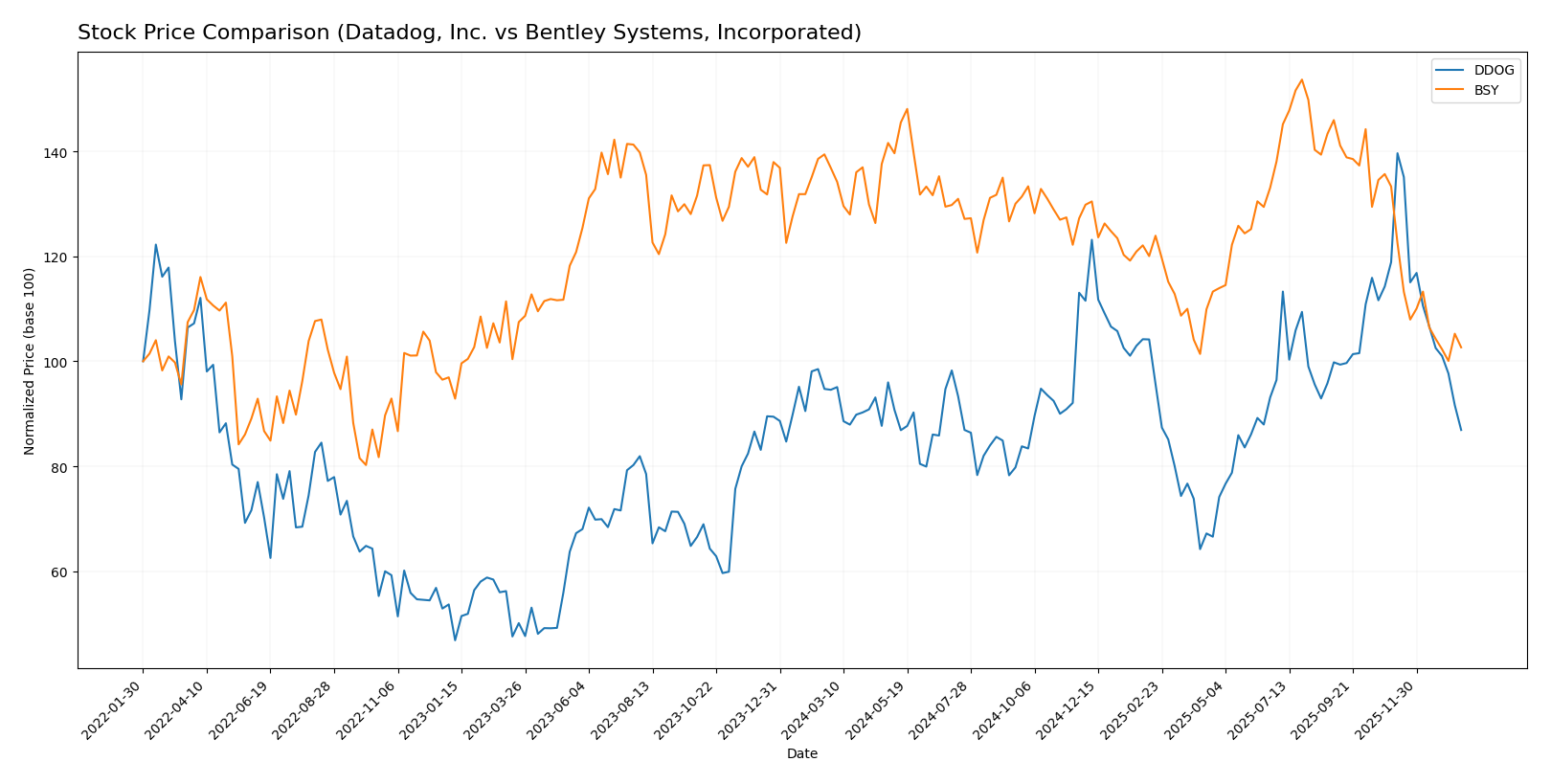

Stock Comparison

The stock price movements of Datadog, Inc. (DDOG) and Bentley Systems, Incorporated (BSY) over the past 12 months reveal significant bearish trends with varying degrees of deceleration and volume dynamics.

Trend Analysis

Datadog, Inc. (DDOG) experienced a bearish trend with an 8.1% price decline over the past year, showing deceleration and high volatility with a standard deviation of 18.63%. Recent months indicate an accelerated downward slope of -26.9%.

Bentley Systems, Incorporated (BSY) faced a more pronounced bearish trend, with a 24.99% price drop over 12 months and deceleration in trend strength. Volatility remained low at 4.63%, with recent losses near 23%.

Comparatively, DDOG outperformed BSY in relative terms, delivering a smaller price decline and higher volatility, indicating a less severe market performance.

Target Prices

Analysts present a clear consensus on target prices for Datadog, Inc. and Bentley Systems, Incorporated.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Datadog, Inc. | 215 | 105 | 177.67 |

| Bentley Systems, Inc. | 55 | 45 | 48.75 |

The consensus target prices for both companies suggest potential upside from their current prices of $119.02 for Datadog and $39.14 for Bentley Systems, reflecting generally positive analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Datadog, Inc. and Bentley Systems, Incorporated:

Rating Comparison

Datadog, Inc. Rating

- Rating: C+ with a “Very Favorable” status

- Discounted Cash Flow Score: 4, considered “Favorable”

- ROE Score: 2, assessed as “Moderate”

- ROA Score: 3, rated “Moderate”

- Debt To Equity Score: 2, classified as “Moderate”

- Overall Score: 2, evaluated as “Moderate”

Bentley Systems, Inc. Rating

- Rating: B- with a “Very Favorable” status

- Discounted Cash Flow Score: 4, considered “Favorable”

- ROE Score: 4, assessed as “Favorable”

- ROA Score: 4, rated “Favorable”

- Debt To Equity Score: 1, classified as “Very Unfavorable”

- Overall Score: 3, evaluated as “Moderate”

Which one is the best rated?

Bentley Systems holds a higher overall rating (B-) and scores better in return on equity and assets, while Datadog shows a slightly better debt to equity position. Overall, Bentley’s metrics indicate a stronger rating based on the data provided.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

DDOG Scores

- Altman Z-Score: 11.37, indicating a safe zone.

- Piotroski Score: 6, classified as average strength.

BSY Scores

- Altman Z-Score: 3.74, also in the safe zone.

- Piotroski Score: 9, representing very strong financial health.

Which company has the best scores?

BSY shows a safer financial position with a very strong Piotroski Score of 9 compared to DDOG’s average 6. Both are in the safe zone for Altman Z-Score, but DDOG’s is significantly higher.

Grades Comparison

The following presents a comparison of the recent grades assigned to Datadog, Inc. and Bentley Systems, Incorporated by recognized grading companies:

Datadog, Inc. Grades

This table summarizes recent grades awarded to Datadog, Inc. by established financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2026-01-12 |

| Keybanc | maintain | Overweight | 2026-01-12 |

| Morgan Stanley | upgrade | Overweight | 2026-01-12 |

| Truist Securities | maintain | Hold | 2026-01-07 |

| RBC Capital | maintain | Outperform | 2026-01-05 |

| Jefferies | maintain | Buy | 2026-01-05 |

| Piper Sandler | maintain | Overweight | 2026-01-05 |

| Citigroup | maintain | Buy | 2025-11-12 |

| Truist Securities | maintain | Hold | 2025-11-07 |

| DA Davidson | maintain | Buy | 2025-11-07 |

Datadog’s grades predominantly signal a favorable outlook, with multiple upgrades and consistent “Overweight,” “Buy,” and “Outperform” ratings from reputable firms.

Bentley Systems, Incorporated Grades

The following table lists recent grades assigned to Bentley Systems, Incorporated by recognized grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | downgrade | Neutral | 2026-01-13 |

| Barclays | maintain | Equal Weight | 2026-01-12 |

| RBC Capital | maintain | Outperform | 2026-01-05 |

| Baird | maintain | Outperform | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

| Piper Sandler | maintain | Overweight | 2025-11-06 |

| JP Morgan | maintain | Neutral | 2025-11-06 |

| Rosenblatt | upgrade | Buy | 2025-10-17 |

| Piper Sandler | maintain | Overweight | 2025-08-07 |

| Goldman Sachs | maintain | Sell | 2025-08-07 |

Bentley Systems shows a mixed pattern with some downgrades and a recent “Neutral” rating, though it retains a number of “Outperform,” “Buy,” and “Overweight” grades.

Which company has the best grades?

Datadog, Inc. has received more consistent and predominantly positive grades, including multiple “Buy” and “Overweight” ratings, compared to Bentley Systems, which shows a wider spread including downgrades and a recent “Neutral” rating. This stronger consensus for Datadog may influence investor perceptions regarding its growth potential and risk profile.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses of Datadog, Inc. (DDOG) and Bentley Systems, Incorporated (BSY) based on their latest financial and operational data.

| Criterion | Datadog, Inc. (DDOG) | Bentley Systems, Incorporated (BSY) |

|---|---|---|

| Diversification | Focused primarily on cloud monitoring and analytics services, less diversified | Diversified product lines including subscriptions, licenses, and professional services |

| Profitability | Net margin 6.85% (neutral); ROE 6.77% (unfavorable); ROIC 1.07% (unfavorable) | Net margin 17.35% (favorable); ROE 22.55% (favorable); ROIC 9.3% (neutral) |

| Innovation | High innovation in cloud-native monitoring, but high valuation multiples (PE 261.42, PB 17.7) suggest pricing risks | Strong innovation in software solutions for infrastructure, but also high valuation multiples (PE 62.63, PB 14.13) |

| Global presence | Strong cloud-based global reach via SaaS model | Global presence with enterprise software subscriptions and licenses |

| Market Share | Growing ROIC trend (+224.5%) but currently shedding value (ROIC vs WACC negative) | Declining ROIC trend (-45.2%) and slightly unfavorable moat, currently shedding value |

Key takeaways: Datadog shows promising growth in profitability metrics despite currently destroying value, indicating potential if trends continue. Bentley Systems is more profitable with better margins but faces challenges in sustaining its economic moat. Both have slightly unfavorable overall investment ratings requiring cautious consideration.

Risk Analysis

Below is a comparative risk overview of Datadog, Inc. (DDOG) and Bentley Systems, Incorporated (BSY) based on the most recent 2024 assessments:

| Metric | Datadog, Inc. (DDOG) | Bentley Systems, Inc. (BSY) |

|---|---|---|

| Market Risk | Beta 1.263, moderate volatility | Beta 1.214, moderate volatility |

| Debt level | Debt-to-Equity 0.68 (neutral) | Debt-to-Equity 1.37 (unfavorable) |

| Regulatory Risk | Moderate, typical for SaaS tech | Moderate, infrastructure software sector |

| Operational Risk | Medium, depends on cloud platform stability | Medium, depends on infrastructure project cycles |

| Environmental Risk | Low, software company | Low, software company |

| Geopolitical Risk | Moderate, global cloud exposure | Moderate, global infrastructure exposure |

The most impactful risks are credit-related: Bentley’s higher debt level (DE 1.37) poses a greater financial risk compared to Datadog’s moderate debt. Both face typical market volatility given their betas above 1.2. Regulatory and operational risks remain moderate due to sector characteristics. Datadog’s strong Altman Z-Score indicates low bankruptcy risk, while Bentley’s higher leverage suggests more caution.

Which Stock to Choose?

Datadog, Inc. shows strong income growth with a 344.81% revenue increase over five years and favorable income statement metrics. Yet, its financial ratios are slightly unfavorable, with low ROE and high valuation multiples, while debt levels remain moderate and rating is C+ (very favorable).

Bentley Systems, Incorporated presents favorable profitability and solid income metrics, including a 68.81% revenue growth over five years, with mostly moderate to favorable financial ratios. However, it carries higher debt, reflected in weaker liquidity ratios, and holds a B- rating (very favorable).

Investors focused on high growth might find Datadog’s rapidly improving profitability appealing, despite its valuation concerns, while those prioritizing financial stability and consistent returns could see Bentley Systems as more aligned with their profile, given its stronger profitability ratios but higher leverage.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Datadog, Inc. and Bentley Systems, Incorporated to enhance your investment decisions: