In the competitive landscape of medical instruments and supplies, Becton, Dickinson and Company (BDX) and West Pharmaceutical Services, Inc. (WST) stand out as key players driving innovation and market growth. Both companies specialize in advanced healthcare products, focusing on improving drug delivery and patient care globally. This comparison explores their strategies and market positions to help you decide which stock might be a more compelling addition to your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Becton, Dickinson and Company and West Pharmaceutical Services, Inc. by providing an overview of these two companies and their main differences.

Becton, Dickinson and Company Overview

Becton, Dickinson and Company focuses on developing, manufacturing, and selling medical supplies, devices, laboratory equipment, and diagnostic products worldwide. Serving healthcare institutions, researchers, and the pharmaceutical industry, it operates through multiple segments including medical, life sciences, and interventional products. Founded in 1897 and based in Franklin Lakes, NJ, BDX is a leading player in medical instruments and supplies with a broad product portfolio.

West Pharmaceutical Services, Inc. Overview

West Pharmaceutical Services, Inc. designs and manufactures containment and delivery systems for injectable drugs and healthcare products globally. It operates two main segments: Proprietary Products, offering packaging components and self-injection devices, and Contract-Manufactured Products, focused on surgical and drug delivery systems. Founded in 1923 and headquartered in Exton, PA, WST serves pharmaceutical, diagnostic, and medical device companies with advanced packaging solutions.

Key similarities and differences

Both BDX and WST operate in the healthcare sector, specializing in medical instruments and supplies with a focus on injectable drug delivery systems. However, BDX offers a broader range of products including diagnostic equipment and surgical instruments, while WST concentrates on drug containment and delivery technologies, including custom packaging and self-injection devices. BDX is larger with 70K employees, compared to WST’s 10.6K, reflecting differences in scale and product diversification.

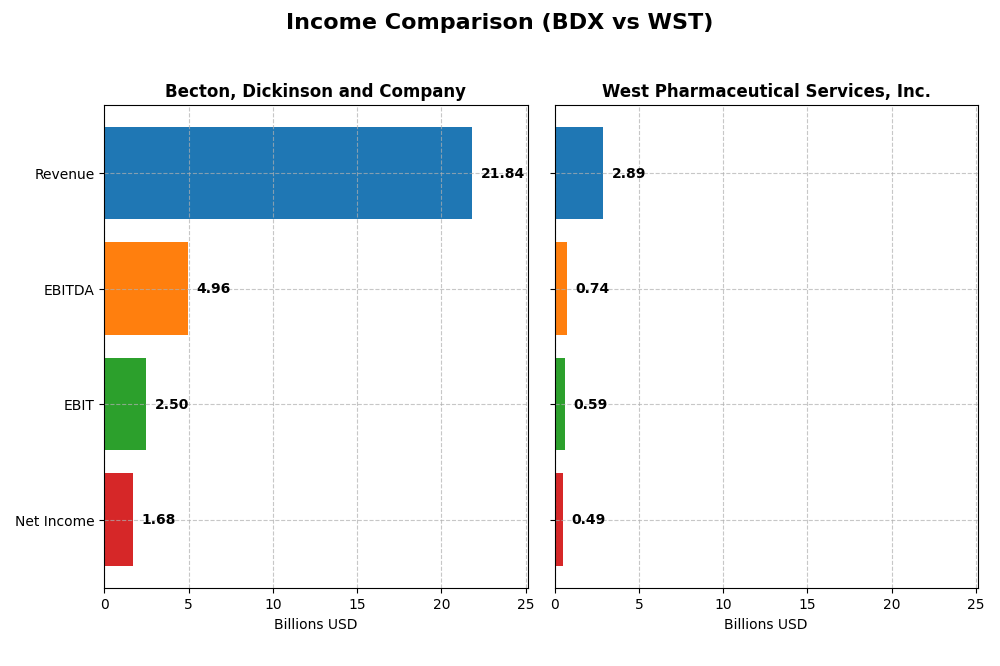

Income Statement Comparison

The following table presents a side-by-side comparison of key income statement metrics for Becton, Dickinson and Company and West Pharmaceutical Services, Inc. for their most recent fiscal years.

| Metric | Becton, Dickinson and Company | West Pharmaceutical Services, Inc. |

|---|---|---|

| Market Cap | 58.3B | 19.8B |

| Revenue | 21.8B | 2.9B |

| EBITDA | 4.96B | 744M |

| EBIT | 2.50B | 588M |

| Net Income | 1.68B | 493M |

| EPS | 5.84 | 6.75 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Becton, Dickinson and Company

From 2021 to 2025, Becton, Dickinson and Company experienced steady revenue growth of 14.16%, reaching $21.8B in 2025. However, net income declined by 19.79% over the period, with net margin shrinking by 29.74%. The latest year saw an 8.23% revenue increase but a 9.07% decrease in net margin, indicating pressure on profitability despite higher sales.

West Pharmaceutical Services, Inc.

West Pharmaceutical Services posted a 34.75% revenue increase over 2020-2024, with 2024 revenues at $2.89B. Net income grew 42.32%, supported by a 5.61% net margin expansion to 17.03%. The latest year showed a slight 1.98% revenue decline and an 11.52% gross profit drop, alongside a 15.29% net margin contraction, signaling recent challenges after a strong overall growth trend.

Which one has the stronger fundamentals?

West Pharmaceutical Services demonstrates stronger fundamentals with higher net margins (17.03% vs. 7.68%) and positive net income growth of 42.32% over the period, compared to Becton’s net income decline. Despite West’s recent revenue and profit setbacks, its overall income statement evaluation remains favorable, while Becton shows mixed results with neutral opinion due to margin and net income declines.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Becton, Dickinson and Company (BDX) and West Pharmaceutical Services, Inc. (WST) based on their fiscal year 2025 and 2024 data respectively, offering a snapshot of key performance and financial health metrics.

| Ratios | Becton, Dickinson and Company (BDX) FY 2025 | West Pharmaceutical Services, Inc. (WST) FY 2024 |

|---|---|---|

| ROE | 6.61% | 18.37% |

| ROIC | 4.73% | 15.69% |

| P/E | 31.97 | 48.53 |

| P/B | 2.11 | 8.91 |

| Current Ratio | 1.11 | 2.79 |

| Quick Ratio | 0.64 | 2.11 |

| D/E | 0.76 | 0.11 |

| Debt-to-Assets | 34.7% | 8.38% |

| Interest Coverage | 4.21 | 205.03 |

| Asset Turnover | 0.39 | 0.79 |

| Fixed Asset Turnover | 3.12 | 1.72 |

| Payout ratio | 71.3% | 12.0% |

| Dividend yield | 2.23% | 0.25% |

Interpretation of the Ratios

Becton, Dickinson and Company

Becton, Dickinson and Company shows a mixed ratio profile with 21.43% favorable, 35.71% unfavorable, and 42.86% neutral ratios, leading to a slightly unfavorable overall view. Key concerns include weak return on equity (6.61%) and return on invested capital (4.73%), alongside a low quick ratio (0.64). The dividend yield is favorable at 2.23%, indicating steady shareholder returns with manageable payout risks.

West Pharmaceutical Services, Inc.

West Pharmaceutical Services presents a strong ratio set, with 57.14% favorable and only 21.43% unfavorable metrics, reflecting a favorable global opinion. Notable strengths include high returns on equity (18.37%) and invested capital (15.69%), excellent liquidity ratios, and very strong interest coverage. The dividend yield is low at 0.25%, suggesting a conservative payout approach in favor of reinvestment or debt management.

Which one has the best ratios?

West Pharmaceutical Services exhibits a more favorable ratio profile overall, supported by higher profitability, stronger liquidity, and lower leverage than Becton, Dickinson and Company. Despite West’s less attractive dividend yield, its financial health and operational efficiency metrics outweigh the slightly unfavorable and mixed ratios seen in Becton, Dickinson and Company.

Strategic Positioning

This section compares the strategic positioning of Becton, Dickinson and Company and West Pharmaceutical Services, Inc., including market position, key segments, and exposure to technological disruption:

Becton, Dickinson and Company

- Large market cap of 58B with broad healthcare presence, facing moderate competitive pressure.

- Diversified segments: Medical supplies, Life Sciences, and Interventional products driving revenue.

- Limited explicit exposure to technological disruption mentioned; broad product range in medical devices.

West Pharmaceutical Services, Inc.

- Smaller market cap of 19.8B, focused on injectable drug delivery, with higher beta risk.

- Two main segments: Proprietary Products and Contract-Manufactured Products for drug containment.

- Focused on advanced reconstitution, mixing, transfer technologies, and quality enhancement processes.

Becton, Dickinson and Company vs West Pharmaceutical Services, Inc. Positioning

BDX exhibits a diversified business model across multiple healthcare segments, offering broad market coverage but facing varied competitive pressures. WST concentrates on injectable drug delivery systems, leveraging specialized technologies but with narrower market scope and higher volatility.

Which has the best competitive advantage?

WST shows a very favorable moat with strong ROIC above WACC and growing profitability, indicating a durable competitive advantage. BDX’s moat is slightly favorable, with growing ROIC but currently shedding value relative to its cost of capital.

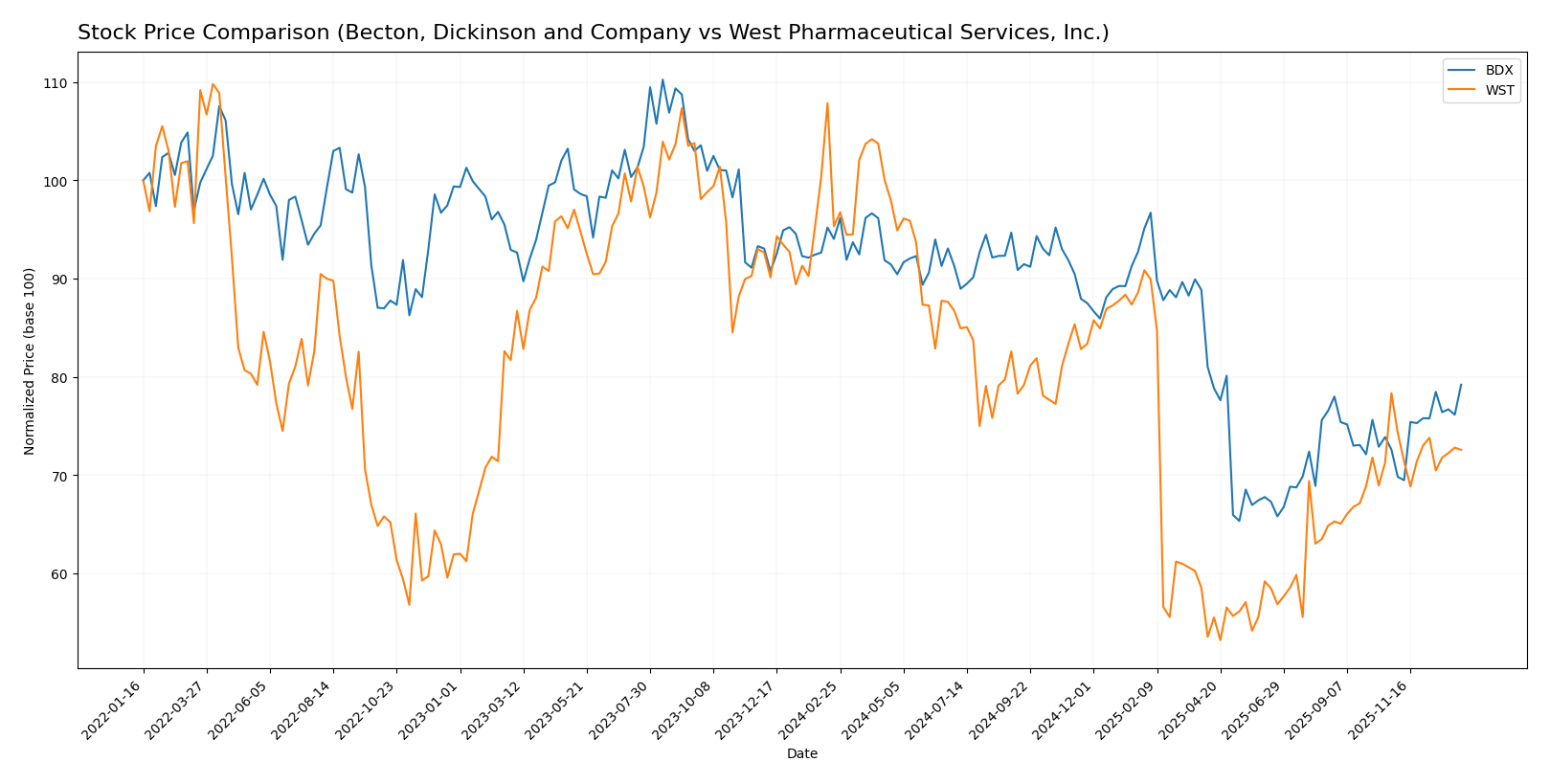

Stock Comparison

The stock price movements over the past year reveal contrasting bearish trends for both Becton, Dickinson and Company (BDX) and West Pharmaceutical Services, Inc. (WST), with notable price declines and trading volume dynamics shaping their performance.

Trend Analysis

Becton, Dickinson and Company (BDX) experienced a bearish trend over the past 12 months, with a price decline of -15.79% and accelerating downward momentum. The stock ranged between 167.22 and 247.6, showing high volatility with a 25.0 standard deviation.

West Pharmaceutical Services, Inc. (WST) also showed a bearish trend, with a larger 12-month price drop of -23.9% and acceleration in the decline. Its price fluctuated between 201.9 and 395.71, with even higher volatility indicated by a 52.92 standard deviation.

Comparatively, BDX outperformed WST by delivering a smaller percentage loss over the year, indicating relatively better market performance despite both trending downward.

Target Prices

The current analyst consensus presents a moderate upside potential for both Becton, Dickinson and Company and West Pharmaceutical Services, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Becton, Dickinson and Company | 215 | 210 | 211.67 |

| West Pharmaceutical Services, Inc. | 390 | 285 | 335.17 |

Analysts expect Becton, Dickinson and Company’s stock to appreciate slightly from its current price of 202.75 USD, while West Pharmaceutical Services shows a broader range with a consensus significantly above its current 275.52 USD, indicating stronger growth potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Becton, Dickinson and Company (BDX) and West Pharmaceutical Services, Inc. (WST):

Rating Comparison

BDX Rating

- Rating: B, classified as Very Favorable overall.

- Discounted Cash Flow Score: 5, Very Favorable.

- ROE Score: 3, Moderate efficiency in equity use.

- ROA Score: 3, Moderate asset utilization.

- Debt To Equity Score: 1, Very Unfavorable risk.

- Overall Score: 3, Moderate overall rating.

WST Rating

- Rating: B+, also classified as Very Favorable.

- Discounted Cash Flow Score: 3, Moderate.

- ROE Score: 4, Favorable efficiency in equity use.

- ROA Score: 5, Very Favorable asset utilization.

- Debt To Equity Score: 3, Moderate financial risk.

- Overall Score: 3, Moderate overall rating.

Which one is the best rated?

WST holds a slightly better rating with a B+ versus B for BDX, supported by stronger ROE and ROA scores and a more moderate debt-to-equity risk profile. BDX excels in discounted cash flow but has higher financial risk.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

BDX Scores

- Altman Z-Score: 2.11, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

WST Scores

- Altman Z-Score: 14.29, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 6, classified as average financial health.

Which company has the best scores?

WST shows a much stronger Altman Z-Score, suggesting lower bankruptcy risk, while BDX has a higher Piotroski Score indicating stronger financial strength. Each excels in a different score category based on the data provided.

Grades Comparison

Here is a comparison of the recent grades assigned to Becton, Dickinson and Company and West Pharmaceutical Services, Inc.:

Becton, Dickinson and Company Grades

The table below summarizes recent grades from recognized grading firms for Becton, Dickinson and Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-01-07 |

| B of A Securities | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-17 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| RBC Capital | Maintain | Sector Perform | 2025-11-07 |

| RBC Capital | Maintain | Sector Perform | 2025-10-16 |

| Morgan Stanley | Maintain | Overweight | 2025-08-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-08 |

| Piper Sandler | Maintain | Neutral | 2025-08-08 |

The overall trend for Becton, Dickinson and Company shows a stable rating consensus centered on hold/neutral with occasional buy and overweight designations.

West Pharmaceutical Services, Inc. Grades

The table below summarizes recent grades from recognized grading firms for West Pharmaceutical Services, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2025-10-27 |

| UBS | Maintain | Buy | 2025-10-24 |

| Keybanc | Maintain | Overweight | 2025-10-24 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-23 |

| Barclays | Maintain | Equal Weight | 2025-10-02 |

| UBS | Maintain | Buy | 2025-07-25 |

| Barclays | Maintain | Equal Weight | 2025-07-25 |

| Evercore ISI Group | Maintain | Outperform | 2025-07-25 |

| Keybanc | Maintain | Overweight | 2025-02-14 |

| B of A Securities | Maintain | Buy | 2024-12-13 |

West Pharmaceutical Services, Inc. consistently receives buy and outperform ratings with fewer hold or neutral assessments, indicating a generally more positive outlook.

Which company has the best grades?

West Pharmaceutical Services, Inc. has received notably better grades overall, including multiple buy and outperform ratings, compared to Becton, Dickinson and Company’s predominantly hold and neutral consensus. This difference may influence investors’ confidence and portfolio positioning.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Becton, Dickinson and Company (BDX) and West Pharmaceutical Services, Inc. (WST) based on their latest financial and strategic data.

| Criterion | Becton, Dickinson and Company (BDX) | West Pharmaceutical Services, Inc. (WST) |

|---|---|---|

| Diversification | Highly diversified across Interventional (4.98B), Life Sciences (5.19B), and Medical (10.07B) segments | More concentrated with Proprietary Products (2.33B) and Contract Manufactured Products (559M) |

| Profitability | Moderate net margin (7.68%), ROIC (4.73%) below WACC, slightly unfavorable overall ratios | Strong profitability with net margin at 17.03%, ROIC at 15.69%, favorable ratios overall |

| Innovation | Growing ROIC trend but no strong economic moat; innovation impact moderate | Very favorable moat with durable competitive advantage and growing ROIC, indicating strong innovation |

| Global presence | Large multinational footprint with broad medical segment | Global presence focused on specialized pharmaceutical solutions |

| Market Share | Large market share in medical products but facing value creation challenges | Smaller but growing market share with value creation and strong financial health |

Key takeaways: WST displays a stronger competitive advantage with favorable profitability and robust financial health, supported by a durable moat. BDX offers greater diversification but currently struggles with value creation and less favorable profitability metrics. Investors should weigh diversification against growth and profitability when deciding between these stocks.

Risk Analysis

The table below summarizes key risk factors for Becton, Dickinson and Company (BDX) and West Pharmaceutical Services, Inc. (WST) based on the latest available data.

| Metric | Becton, Dickinson and Company (BDX) | West Pharmaceutical Services, Inc. (WST) |

|---|---|---|

| Market Risk | Low beta (0.26) indicates low volatility relative to the market | Higher beta (1.17) suggests higher market sensitivity |

| Debt level | Moderate debt-to-assets at 34.7%, interest coverage ratio of 4.07 | Low debt-to-assets at 8.4%, strong interest coverage of 203 |

| Regulatory Risk | High due to global medical device regulations and FDA scrutiny | Moderate, with exposure to pharmaceutical packaging regulations |

| Operational Risk | Large workforce (70K), complex global supply chain | Smaller (10.6K employees), but reliance on contract manufacturing |

| Environmental Risk | Moderate, with increasing focus on sustainable medical products | Moderate, with emphasis on materials and packaging innovation |

| Geopolitical Risk | Exposed to global markets, potential trade and tariff issues | Global exposure, particularly in emerging markets |

The most impactful risks are regulatory and debt-related. BDX faces moderate leverage and regulatory scrutiny with some financial caution (Altman Z-score in grey zone). WST shows strong financial health with low debt and a safe Altman Z-score but higher market volatility. Investors should weigh BDX’s operational complexity and moderate financial risk against WST’s higher valuation multiples and market sensitivity.

Which Stock to Choose?

Becton, Dickinson and Company (BDX) shows mixed income evolution with favorable revenue growth of 8.23% in 2025 but declining net income and margin. Its financial ratios are slightly unfavorable overall, with moderate profitability, neutral debt levels, and a very favorable rating of B. The company has a slightly favorable moat with a growing ROIC but currently shedding value.

West Pharmaceutical Services, Inc. (WST) displays favorable income evolution overall, despite a recent slight revenue decline in 2024. Its financial ratios are generally favorable, reflecting strong profitability, low debt, and a very favorable rating of B+. WST benefits from a very favorable moat with a durable competitive advantage and increasing profitability.

Investors focused on value creation and strong profitability might find WST’s favorable ratios and very favorable moat more appealing, while those considering a company with stable rating and improving ROIC could see BDX as a potential candidate. The choice could depend on whether an investor prioritizes consistent competitive advantage or improving financial metrics despite some income setbacks.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Becton, Dickinson and Company and West Pharmaceutical Services, Inc. to enhance your investment decisions: