Home > Comparison > Healthcare > BDX vs RMD

The strategic rivalry between Becton, Dickinson and Company and ResMed Inc. shapes the healthcare instruments and supplies sector’s future. Becton, Dickinson operates as a diversified medical device manufacturer with a broad product portfolio, while ResMed focuses on high-margin respiratory care and cloud-based healthcare software. This analysis pits industrial scale against tech-driven specialization, aiming to identify which model delivers superior risk-adjusted returns for diversified investors in 2026.

Table of contents

Companies Overview

Becton, Dickinson and Company and ResMed Inc. command leading roles in the medical instruments and supplies market.

Becton, Dickinson and Company: Global Medical Technology Leader

Becton, Dickinson dominates as a global developer and manufacturer of medical supplies and devices. Its revenue stems from diverse segments including intravenous catheters, diagnostic products, and surgical instruments. In 2026, the company focuses strategically on expanding its portfolio in drug delivery systems and laboratory automation to enhance healthcare outcomes worldwide.

ResMed Inc.: Innovator in Respiratory Care and Software

ResMed stands out as a pioneer in respiratory care devices and cloud-based healthcare solutions. It generates revenue through sales of ventilation devices, mask systems, and software platforms that support patient monitoring. The company’s 2026 strategy emphasizes growth in remote patient management software and integrated care solutions for sleep and respiratory disorders.

Strategic Collision: Similarities & Divergences

Both companies operate in healthcare but diverge in approach: Becton, Dickinson emphasizes broad medical device manufacturing, while ResMed prioritizes a hybrid of hardware and cloud software. They compete primarily in respiratory and critical care markets. Investors will find Becton, Dickinson with a broad industrial moat and ResMed offering nimble innovation in digital health.

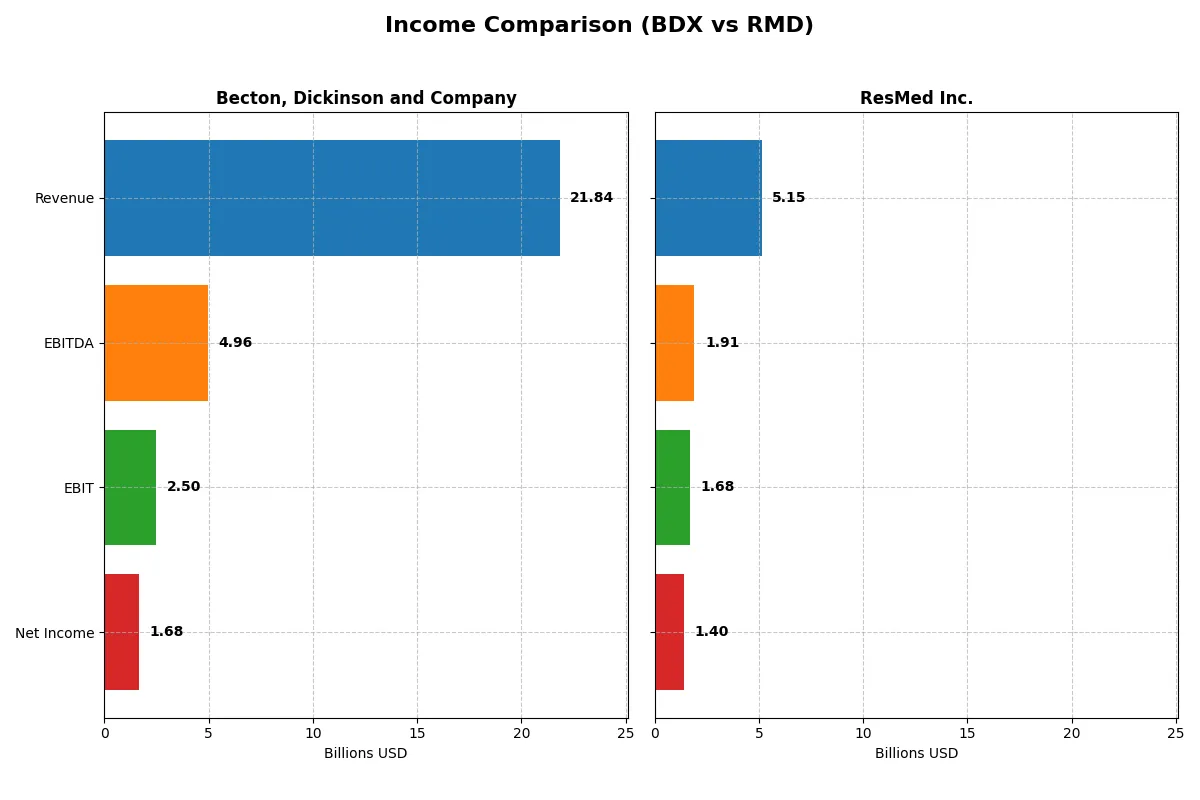

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Becton, Dickinson and Company (BDX) | ResMed Inc. (RMD) |

|---|---|---|

| Revenue | 21.8B | 5.1B |

| Cost of Revenue | 11.9B | 2.1B |

| Operating Expenses | 7.3B | 1.4B |

| Gross Profit | 9.9B | 3.1B |

| EBITDA | 5.0B | 1.9B |

| EBIT | 2.5B | 1.7B |

| Interest Expense | 613M | 13M |

| Net Income | 1.7B | 1.4B |

| EPS | 5.84 | 9.55 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company drives superior operational efficiency and profitability in their respective markets.

Becton, Dickinson and Company Analysis

Becton, Dickinson’s revenue climbed steadily to $21.8B in 2025, yet net income slipped to $1.68B. Its gross margin holds firm at 45.4%, but net margin contracted to 7.7%. Despite strong top-line growth, earnings and net margin declined, signaling margin pressure and efficiency challenges in the latest fiscal year.

ResMed Inc. Analysis

ResMed’s revenue surged 9.8% to $5.15B in 2025, with net income jumping 37% to $1.4B. The company exhibits robust margin health, with a 59.4% gross margin and an impressive 27.2% net margin. Momentum accelerates as profitability and margins expand sharply, reflecting operational leverage and disciplined cost control.

Margin Strength vs. Growth Momentum

ResMed outperforms Becton, Dickinson on every key profitability metric, posting higher margins and stronger earnings growth. Becton’s larger scale contrasts with ResMed’s superior margin expansion and net income momentum. For investors prioritizing profitability and margin resilience, ResMed’s profile appears more compelling in this comparison.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Becton, Dickinson and Company (BDX) | ResMed Inc. (RMD) |

|---|---|---|

| ROE | 6.6% | 23.5% |

| ROIC | 4.7% | 19.6% |

| P/E | 32.0 | 27.0 |

| P/B | 2.11 | 6.34 |

| Current Ratio | 1.11 | 3.44 |

| Quick Ratio | 0.64 | 2.53 |

| D/E | 0.76 | 0.14 |

| Debt-to-Assets | 34.7% | 10.4% |

| Interest Coverage | 4.21 | 134.0 |

| Asset Turnover | 0.39 | 0.63 |

| Fixed Asset Turnover | 3.12 | 7.16 |

| Payout Ratio | 71.3% | 22.2% |

| Dividend Yield | 2.23% | 0.82% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, unveiling hidden risks and operational excellence critical for investment decisions.

Becton, Dickinson and Company

BDX posts modest profitability with a 6.61% ROE and 7.68% net margin, signaling subdued returns. Its valuation appears stretched, with a P/E of 32, above typical benchmarks. The firm rewards shareholders with a 2.23% dividend yield, balancing moderate returns amid a slightly unfavorable overall ratio profile.

ResMed Inc.

RMD delivers strong profitability, boasting a 23.47% ROE and a robust 27.22% net margin. Its valuation, while expensive at a P/E of 27, reflects premium growth expectations. Despite a modest 0.82% dividend yield, RMD’s favorable ratios and efficient capital structure underscore solid operational discipline and shareholder value focus.

Premium Profitability Meets Valuation Stretch

RMD outperforms BDX on profitability and capital efficiency, despite a higher valuation multiple. BDX offers steadier dividend income but lags in return metrics. Investors prioritizing growth and operational strength may prefer RMD, while those seeking income stability might lean toward BDX’s profile.

Which one offers the Superior Shareholder Reward?

I compare Becton, Dickinson and Company (BDX) and ResMed Inc. (RMD) on dividends, payout ratios, and buybacks. BDX yields 2.23% with a high 71% payout, indicating a strong income focus but less free cash flow cushioning. RMD yields 0.82%, with a modest 22% payout, prioritizing reinvestment and buybacks. RMD’s free cash flow per share of 11.3 supports sustainable buybacks and growth, unlike BDX’s higher payout risk. Buybacks at RMD are intense and sustainable given its 95% free cash flow coverage, while BDX’s buyback data is limited but payout ratio suggests less room for buybacks. I favor RMD for superior total shareholder return in 2026 due to balanced dividends, aggressive buybacks, and healthier cash flow coverage.

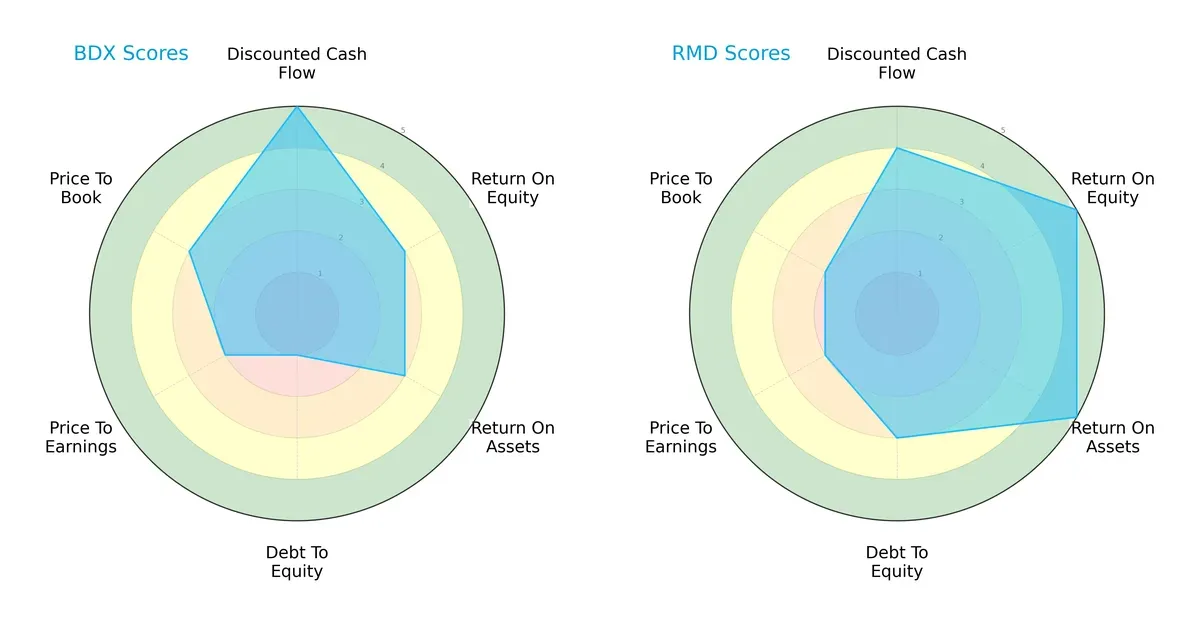

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Becton, Dickinson and Company and ResMed Inc., highlighting their strategic strengths and weaknesses:

Becton, Dickinson excels in discounted cash flow valuation with a top score of 5 but struggles with debt management, posting a very unfavorable 1 in debt-to-equity. ResMed, by contrast, shows a more balanced profile, boasting superior profitability metrics (ROE 5, ROA 5) and moderate leverage (3). While Becton relies heavily on cash flow strength, ResMed delivers consistent operational efficiency and financial stability across the board.

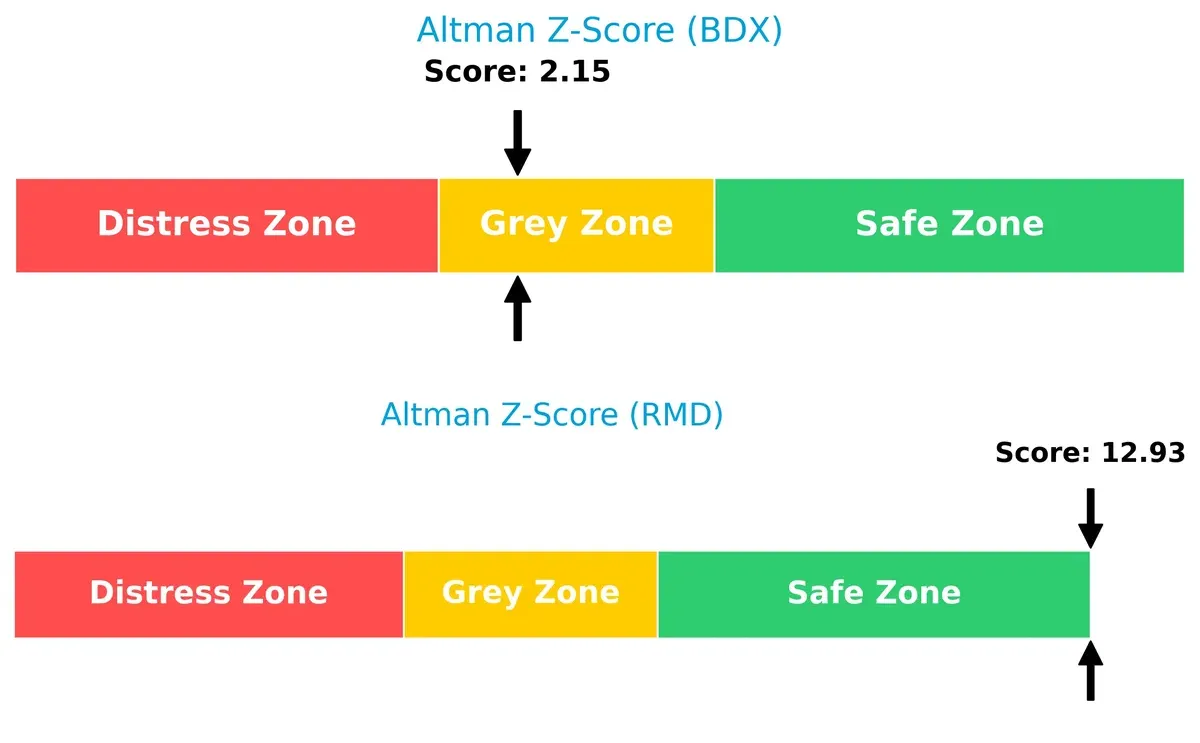

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap signals differing survival prospects in this cycle:

Becton, Dickinson’s Z-Score of 2.15 places it in the grey zone, implying moderate bankruptcy risk. ResMed’s robust 12.93 score situates it comfortably in the safe zone, reflecting strong solvency and resilience against downturns.

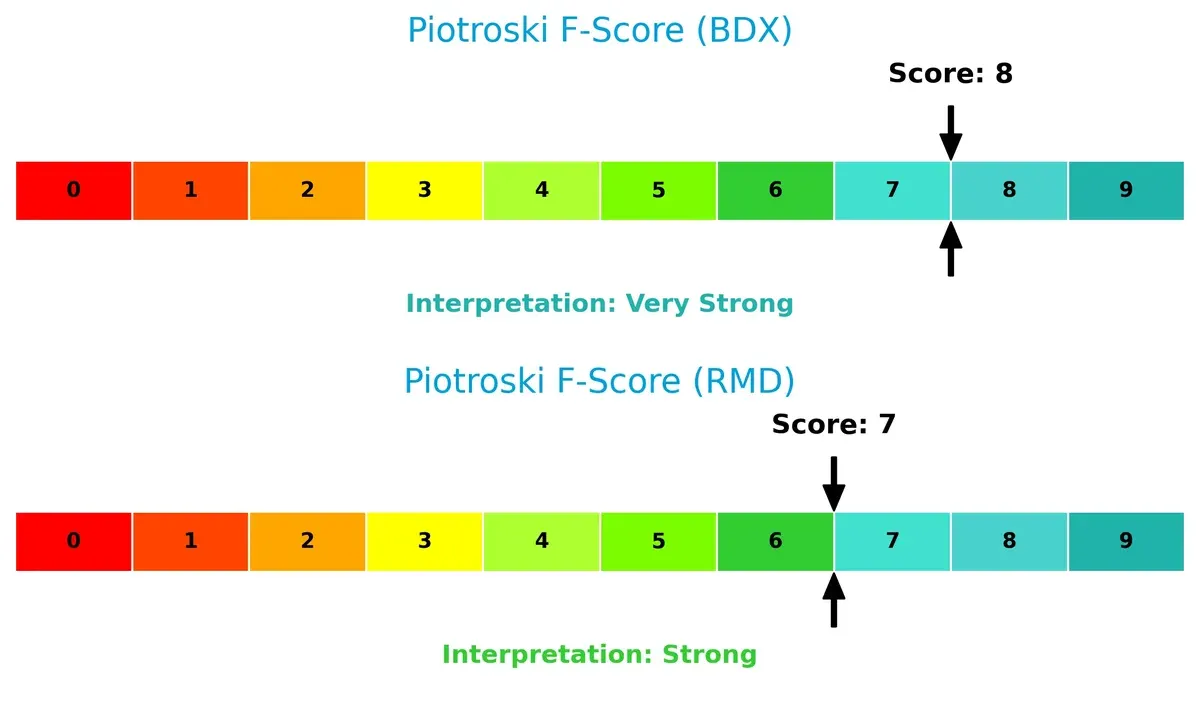

Financial Health: Quality of Operations

Piotroski F-Scores confirm operational robustness and internal financial strength:

Becton, Dickinson scores an impressive 8, indicating very strong financial health with solid profitability and efficiency. ResMed’s score of 7 is strong but slightly below Becton’s, suggesting marginally less internal financial strength yet still signaling a quality operation. Neither shows red flags, but Becton edges out slightly in quality metrics.

How are the two companies positioned?

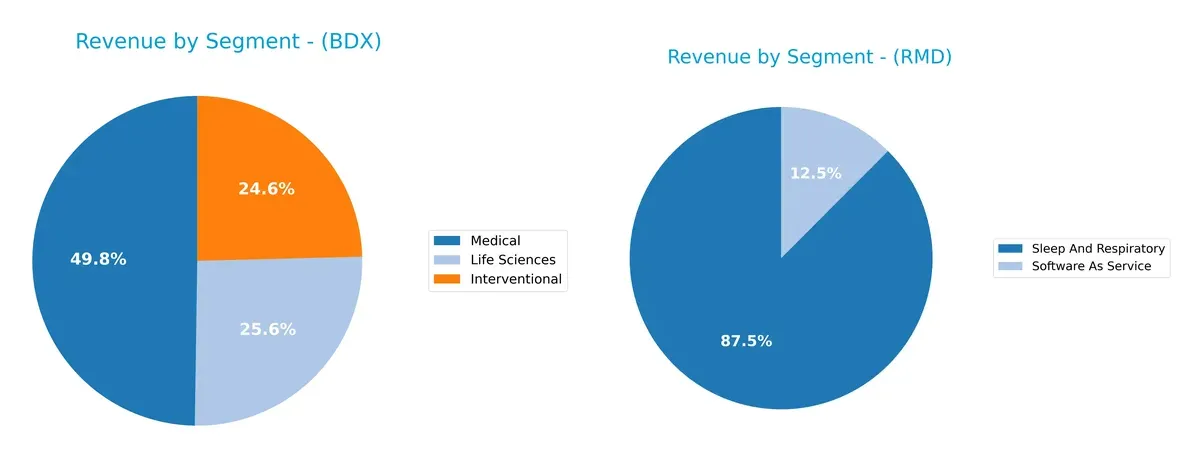

This section dissects BDX and RMD’s operational DNA by comparing revenue distribution and analyzing internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers superior competitive resilience.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Becton, Dickinson and Company and ResMed Inc. diversify their income streams and highlights their primary sector bets:

Becton, Dickinson and Company anchors revenue in Medical ($10B) with strong contributions from Life Sciences ($5.2B) and Interventional ($5B), showing balanced diversification. ResMed Inc. pivots heavily on Sleep And Respiratory ($4.1B), dwarfing its Software As Service segment ($584M). BDX’s mix reduces concentration risk, while RMD’s focus on respiratory care signals ecosystem lock-in but raises dependency concerns.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Becton, Dickinson and Company (BDX) and ResMed Inc. (RMD):

BDX Strengths

- Diversified revenue across Interventional, Life Sciences, and Medical segments

- Strong US and Europe geographic presence

- Favorable fixed asset turnover at 3.12

- Dividend yield at 2.23% supports income investors

RMD Strengths

- High profitability with net margin of 27.22% and ROE at 23.47%

- Favorable capital structure with low debt-to-assets at 10.42%

- Strong interest coverage ratio at 133.05

- Growing Software as Service segment adds innovation

BDX Weaknesses

- Low ROE of 6.61%, slightly above WACC at 4.65%, indicating weak capital efficiency

- Unfavorable quick ratio at 0.64 suggests liquidity pressure

- High P/E at 31.97 may reflect overvaluation risk

- Neutral to unfavorable asset turnover at 0.39

RMD Weaknesses

- Unfavorable P/B ratio at 6.34 indicates high market valuation

- Current ratio of 3.44 flagged as unfavorable, possibly due to asset structure

- Lower dividend yield at 0.82% may deter income-focused investors

BDX shows solid diversification and stable income but struggles with capital efficiency and some liquidity concerns. RMD demonstrates robust profitability and innovation but faces valuation premiums and mixed liquidity signals, shaping their strategic focus differently.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competitive pressure and market erosion. Let’s dissect how Becton, Dickinson and Company and ResMed Inc. defend their turf:

Becton, Dickinson and Company: Incremental Efficiency Through Scale

BDX’s primary moat lies in cost advantage driven by its extensive global supply chain and product breadth. This manifests in stable gross margins near 45%, though EBIT margins have softened slightly. In 2026, new product launches and geographic expansion could deepen efficiency but face margin pressure from rising opex.

ResMed Inc.: Technology-Driven Network Effects

RMD’s moat hinges on network effects powered by its cloud-based software integrated with respiratory devices. It boasts best-in-class margins—59% gross and 32.6% EBIT—reflecting strong pricing power. The company’s accelerating ROIC and SaaS growth position it well to expand its ecosystem in 2026, disrupting traditional device markets.

Cost Advantage vs. Network Effects: Who Will Defend Their Moat?

RMD’s moat is both wider and deeper, evidenced by a ROIC 11.7 points above WACC and a sharp upward trend. BDX shows improving profitability but remains a slight value destroyer with smaller margin buffers. ResMed is better equipped to sustain and grow market share amid intensifying innovation and digital integration.

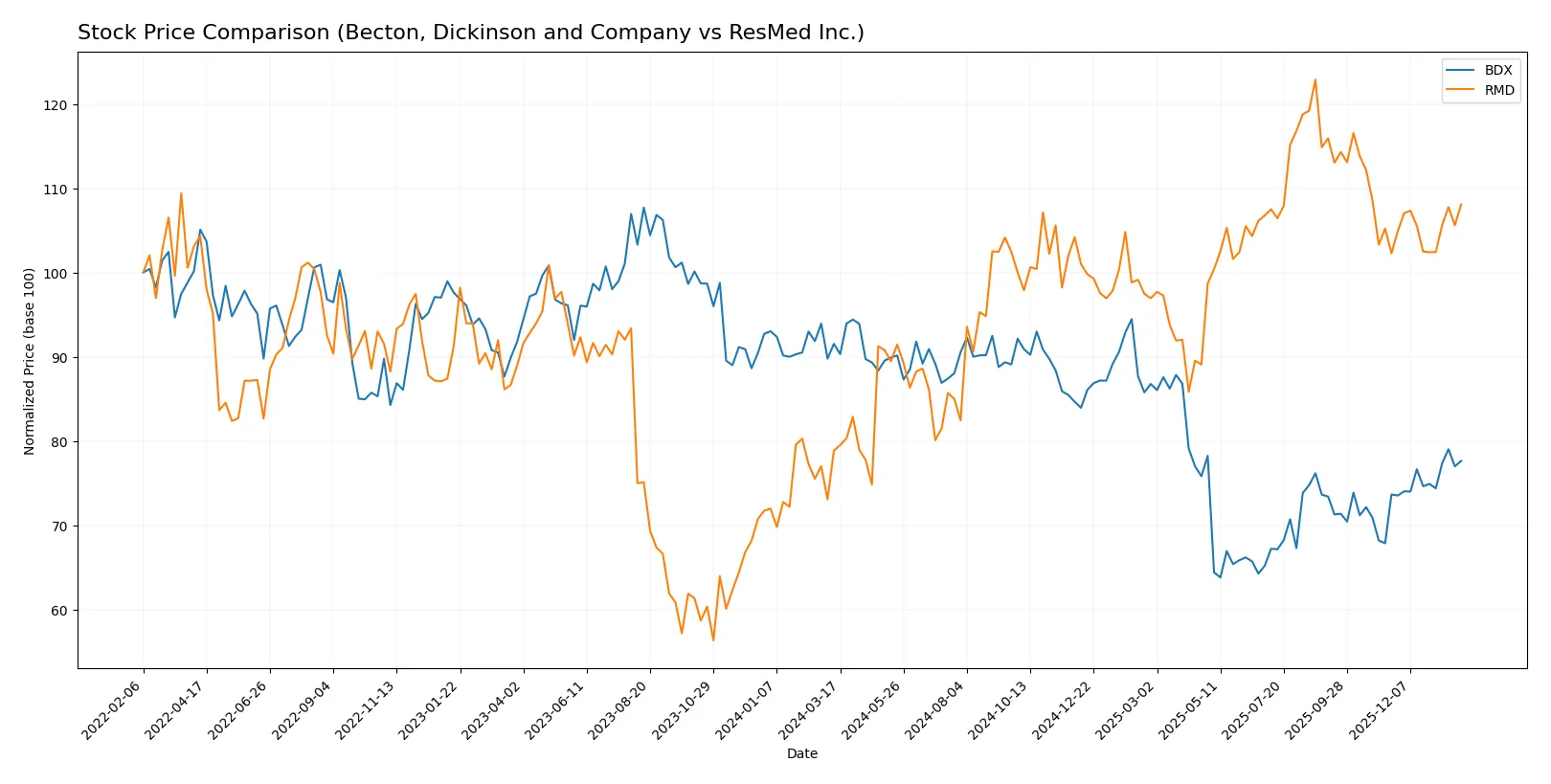

Which stock offers better returns?

Over the past 12 months, Becton, Dickinson and Company’s stock dropped sharply before showing a recent rebound, while ResMed Inc. sustained a strong upward trajectory with some deceleration.

Trend Comparison

Becton, Dickinson and Company’s stock fell 15.18% over the past year, marking a bearish trend with accelerating decline and high volatility (24.63 std dev). It rebounded 5.41% from November 2025 to February 2026.

ResMed Inc.’s stock rose 37.08% over the past year, reflecting a bullish trend with decelerating growth and slightly higher volatility (24.93 std dev). It gained 5.67% in the recent period.

ResMed clearly outperformed Becton, Dickinson with a strong annual gain versus a significant drop, delivering superior market returns in the 12-month span.

Target Prices

Analysts present a solid target consensus for Becton, Dickinson and Company and ResMed Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Becton, Dickinson and Company | 205 | 215 | 210 |

| ResMed Inc. | 265 | 345 | 295.88 |

The consensus target for BDX stands modestly above its current price of 203.48, signaling moderate upside. RMD’s target consensus at 295.88 suggests strong growth potential compared to its current 258.31 price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Becton, Dickinson and Company Grades

The following table summarizes recent grades from reputable financial institutions for Becton, Dickinson and Company.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-28 |

| Stifel | Maintain | Buy | 2026-01-07 |

| B of A Securities | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-17 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| RBC Capital | Maintain | Sector Perform | 2025-11-07 |

| RBC Capital | Maintain | Sector Perform | 2025-10-16 |

| Morgan Stanley | Maintain | Overweight | 2025-08-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-08 |

ResMed Inc. Grades

Below are recent institutional grades for ResMed Inc. from recognized financial firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Hold | 2026-01-30 |

| Piper Sandler | Maintain | Neutral | 2026-01-30 |

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-30 |

| Stifel | Maintain | Hold | 2025-12-18 |

| Baird | Downgrade | Neutral | 2025-12-16 |

| Baird | Maintain | Outperform | 2025-11-03 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Which company has the best grades?

ResMed holds generally stronger grades, with multiple “Outperform” ratings from RBC Capital and Mizuho, indicating positive institutional sentiment. Becton, Dickinson mostly receives “Neutral” to “Overweight” ratings, reflecting more cautious views. This divergence may influence investors differently depending on risk appetite and sector outlook.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Becton, Dickinson and Company

- Faces intense competition in medical supplies; growth constrained by slower asset turnover and moderate margins.

ResMed Inc.

- Benefits from high margins and strong innovation in respiratory care but faces premium valuation risks.

2. Capital Structure & Debt

Becton, Dickinson and Company

- Moderate leverage with debt-to-assets at 34.7%; interest coverage at 4.07x signals manageable but notable debt risk.

ResMed Inc.

- Low leverage with debt-to-assets at 10.4%; very strong interest coverage of 133x indicates conservative debt profile.

3. Stock Volatility

Becton, Dickinson and Company

- Low beta at 0.26 suggests defensive stock with limited price swings but low growth excitement.

ResMed Inc.

- Higher beta of 0.88 implies greater volatility and sensitivity to market cycles, reflecting growth orientation.

4. Regulatory & Legal

Becton, Dickinson and Company

- Exposed to broad regulatory risks across multiple product lines in medical instruments and diagnostics.

ResMed Inc.

- Faces regulatory scrutiny in medical devices and cloud software compliance, but more focused product scope.

5. Supply Chain & Operations

Becton, Dickinson and Company

- Complex global supply chain with 70K employees; operational efficiency is challenged by low asset turnover.

ResMed Inc.

- Smaller workforce with 10K employees; benefits from software integration reducing physical supply chain risks.

6. ESG & Climate Transition

Becton, Dickinson and Company

- Large manufacturing footprint may face rising ESG costs; pressure to improve sustainability metrics.

ResMed Inc.

- Cloud-based solutions and software services provide ESG advantages, but hardware production remains a factor.

7. Geopolitical Exposure

Becton, Dickinson and Company

- Global presence subjects it to trade tensions, tariffs, and foreign regulation complexities.

ResMed Inc.

- Also operates internationally but with more digital delivery, lessening some geopolitical risks.

Which company shows a better risk-adjusted profile?

ResMed’s strongest risk lies in its elevated stock volatility and premium valuation multiples, which could pressure returns if growth slows. Becton Dickinson faces its most significant risk from leverage and operational inefficiencies, reflected in weaker asset utilization and liquidity ratios. Overall, ResMed exhibits a superior risk-adjusted profile, supported by robust profitability, conservative debt, and a safer Altman Z-score (12.9 vs. 2.1 for BDX). This contrast underlines ResMed’s financial resilience and strategic agility in the evolving healthcare market.

Final Verdict: Which stock to choose?

Becton, Dickinson and Company (BDX) boasts a solid operational foundation with a growing return on invested capital, signaling improving profitability. Its superpower lies in steady asset utilization and moderate dividend yield. However, its relatively high debt and modest liquidity ratios remain points of vigilance. It suits investors seeking stable income with moderate growth exposure.

ResMed Inc. (RMD) stands out with a durable competitive moat, driven by exceptional margins and efficient capital deployment. Its cloud-like recurring revenue profile and strong balance sheet offer superior financial safety compared to BDX. RMD fits well in growth-at-a-reasonable-price (GARP) portfolios aiming for robust earnings growth and capital appreciation.

If you prioritize steady income and value resilience in a mature industry, BDX is the compelling choice due to its improving profitability and dividend yield. However, if you seek growth backed by a durable moat and stronger financial health, RMD outshines with superior margins and capital efficiency. Both present analytical scenarios tailored to distinct investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Becton, Dickinson and Company and ResMed Inc. to enhance your investment decisions: