Home > Comparison > Healthcare > ISRG vs BDX

The strategic rivalry between Intuitive Surgical, Inc. and Becton, Dickinson and Company shapes the healthcare instruments sector’s evolution. Intuitive Surgical operates as a technology-driven innovator focused on minimally invasive surgical systems. In contrast, Becton, Dickinson functions as a diversified medical supplies giant with broad product lines. This analysis explores their distinct operational models to identify which offers a superior risk-adjusted profile for a balanced, diversified portfolio in 2026.

Table of contents

Companies Overview

Intuitive Surgical and Becton, Dickinson hold pivotal roles in the medical instruments and supplies sector.

Intuitive Surgical, Inc.: Pioneer in Minimally Invasive Surgical Systems

Intuitive Surgical dominates the market with its da Vinci Surgical System, enabling complex, minimally invasive surgeries. Its revenue stems from hardware sales and recurring instrument and service contracts. In 2026, the company prioritizes expanding its diagnostic offerings and integrated digital capabilities to enhance hospital efficiency.

Becton, Dickinson and Company: Comprehensive Medical Supply Leader

Becton, Dickinson offers a broad portfolio, including syringes, diagnostic instruments, and surgical products. It generates revenue through diverse medical segments serving healthcare, research, and pharmaceutical sectors. Its 2026 strategy focuses on innovation across medication delivery and laboratory automation systems to maintain market breadth.

Strategic Collision: Similarities & Divergences

Both firms lead in medical instruments but differ strategically; Intuitive Surgical focuses on a high-tech surgical ecosystem, while Becton emphasizes a broad product portfolio. The primary battleground is hospital and clinical adoption of advanced medical devices. Their distinct investment profiles reflect a trade-off between Intuitive’s innovation-driven growth and Becton’s diversified stability.

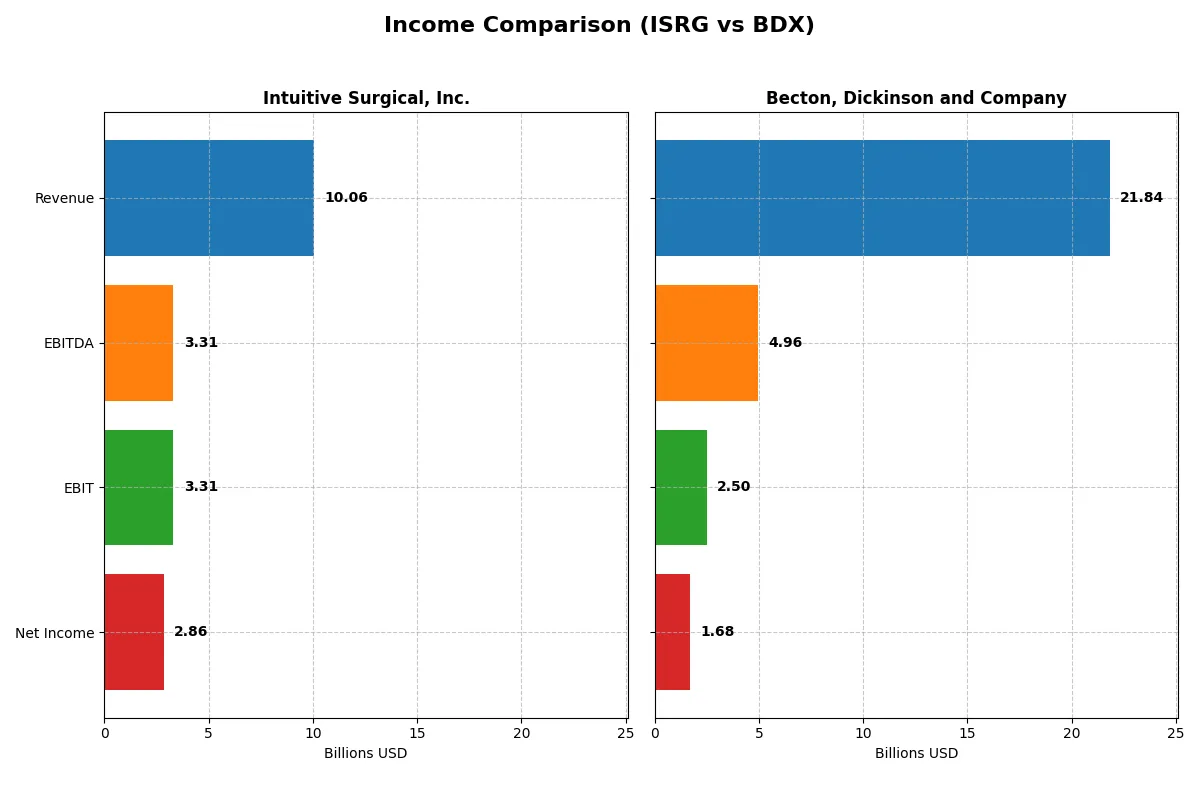

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Intuitive Surgical, Inc. (ISRG) | Becton, Dickinson and Company (BDX) |

|---|---|---|

| Revenue | 10.1B | 21.8B |

| Cost of Revenue | 3.41B | 11.9B |

| Operating Expenses | 3.71B | 7.35B |

| Gross Profit | 6.66B | 9.92B |

| EBITDA | 3.31B | 4.96B |

| EBIT | 3.31B | 2.50B |

| Interest Expense | 0 | 613M |

| Net Income | 2.86B | 1.68B |

| EPS | 8.00 | 5.84 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates more efficiently by scrutinizing revenue growth, profitability, and margin trends.

Intuitive Surgical, Inc. Analysis

Intuitive Surgical’s revenue surged from 5.7B in 2021 to 10.1B in 2025, showing robust growth. Net income expanded from 1.7B to 2.9B, reflecting strong profitability momentum. Its gross margin holds a healthy 66.1%, while net margin stands at a solid 28.4%. The latest year shows exceptional EBIT growth of 41%, signaling operational efficiency.

Becton, Dickinson and Company Analysis

Becton Dickinson posted revenue growth from 19.1B in 2021 to 21.8B in 2025, a modest 14% rise. Net income declined from 2.0B to 1.7B, indicating profit pressures. Its gross margin is 45.4%, and net margin just 7.7%, substantially lower than its peer. The latest year’s EBIT fell 1.5%, reflecting challenges in cost control and margin expansion.

Growth Efficiency vs. Scale Stability

Intuitive Surgical outperforms with superior revenue growth and margin expansion, driving a nearly 68% net income increase over five years. Becton Dickinson’s slower revenue growth and shrinking net income suggest operational inefficiencies. For investors, Intuitive Surgical’s profile offers stronger efficiency and profitability momentum, while Becton Dickinson presents a steadier but less dynamic scale.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Intuitive Surgical, Inc. (ISRG) | Becton, Dickinson and Company (BDX) |

|---|---|---|

| ROE | 14.13% (2024) | 6.61% (2025) |

| ROIC | 11.99% (2024) | 4.73% (2025) |

| P/E | 79.82 (2024) | 31.97 (2025) |

| P/B | 11.28 (2024) | 2.11 (2025) |

| Current Ratio | 4.07 (2024) | 1.11 (2025) |

| Quick Ratio | 3.22 (2024) | 0.64 (2025) |

| D/E | 0.009 (2024) | 0.76 (2025) |

| Debt-to-Assets | 0.008 (2024) | 0.35 (2025) |

| Interest Coverage | 0 (2024) | 4.21 (2025) |

| Asset Turnover | 0.44 (2024) | 0.39 (2025) |

| Fixed Asset Turnover | 1.75 (2024) | 3.12 (2025) |

| Payout Ratio | 0% (2024) | 71.28% (2025) |

| Dividend Yield | 0% (2024) | 2.23% (2025) |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and operational excellence critical for informed investment decisions.

Intuitive Surgical, Inc.

Intuitive Surgical posts a strong net margin of 28.38%, signaling high profitability, yet its ROE and ROIC are unfavorable or unavailable. The stock trades at a stretched P/E of 70.78, reflecting premium valuation. Absence of dividends suggests reinvestment focused on innovation, supported by robust R&D spending near 13%.

Becton, Dickinson and Company

Becton, Dickinson shows moderate profitability with a 7.68% net margin and ROE at 6.61%, both underwhelming versus sector norms. Its P/E of 31.97 is more reasonable but still elevated. The company yields a 2.23% dividend, balancing shareholder returns with sustained R&D investment near 5.8%, reflecting steady capital allocation.

Premium Valuation vs. Operational Safety

Intuitive Surgical commands a premium valuation driven by superior margins and reinvestment in growth, but with weak return on equity. Becton, Dickinson offers a more balanced profile, trading cheaper with modest profitability and dividend income. Growth-oriented investors may prefer Intuitive; income-focused investors might favor Becton’s steadier returns.

Which one offers the Superior Shareholder Reward?

Intuitive Surgical (ISRG) offers no dividends, focusing on reinvesting free cash flow into innovation and growth. Its payout ratio is 0%, and buybacks appear minimal or unreported. Becton, Dickinson (BDX) pays a 2.2% dividend yield with a payout ratio near 65-71%, showing strong commitment to shareholder cash returns. BDX’s buybacks complement dividends, enhancing total return. ISRG’s model suits growth investors valuing capital appreciation, while BDX delivers steady income plus buyback-driven gains. I regard BDX’s balanced distribution—dividends plus buybacks—as more sustainable and attractive for total returns in 2026.

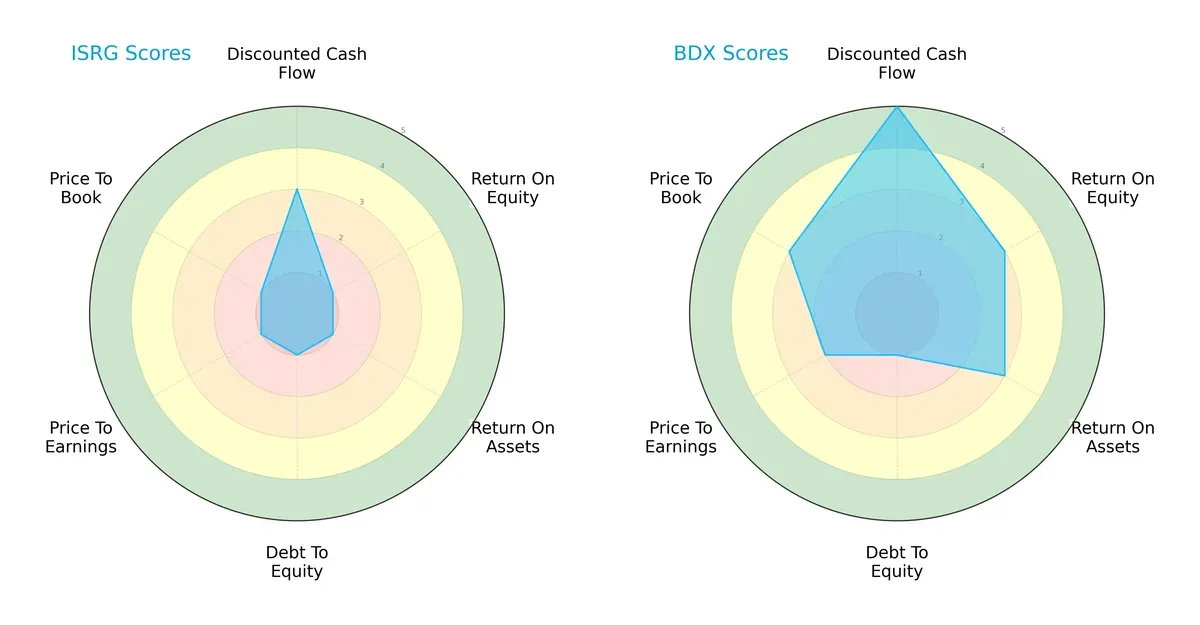

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Intuitive Surgical, Inc. and Becton, Dickinson and Company:

Becton, Dickinson demonstrates a more balanced profile with very favorable DCF (5) and moderate ROE (3) and ROA (3) scores. Intuitive Surgical relies heavily on a moderate DCF (3) but lags significantly in profitability and valuation metrics, all rated very unfavorable (1). BDX’s leverage risk is equally high (debt/equity score 1), yet its valuation scores outperform ISRG, making BDX the strategically stronger choice.

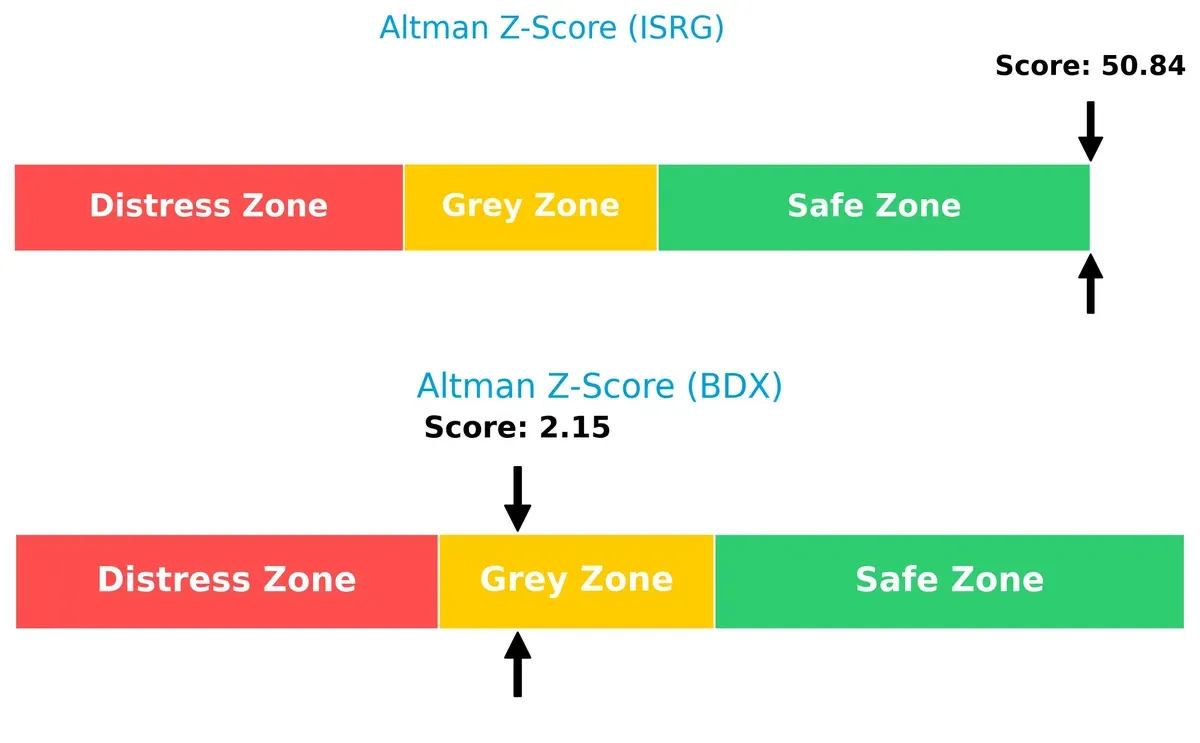

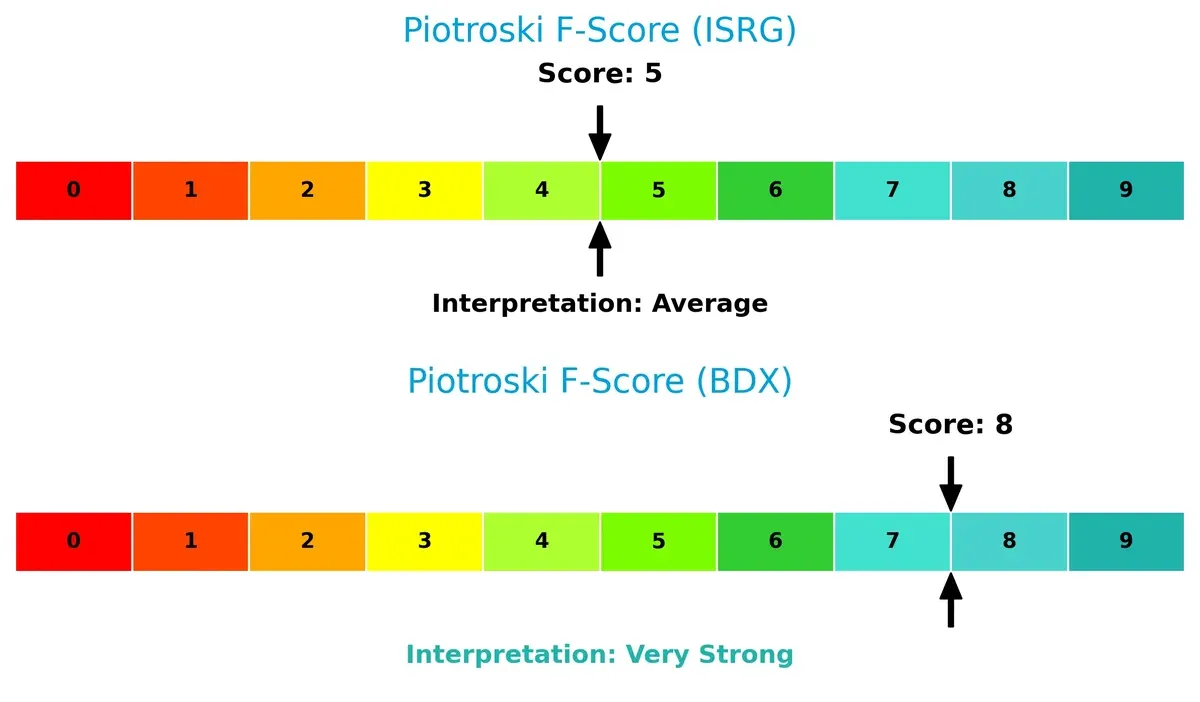

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap signals a stark contrast: Intuitive Surgical’s score of 50.8 places it firmly in the safe zone. Becton, Dickinson’s 2.15 score sits in the grey zone, indicating moderate bankruptcy risk in this cycle:

Financial Health: Quality of Operations

Becton, Dickinson scores an impressive 8 on the Piotroski F-Score, signaling very strong financial health. Intuitive Surgical’s 5 is average, highlighting potential red flags in operational efficiency and internal metrics:

How are the two companies positioned?

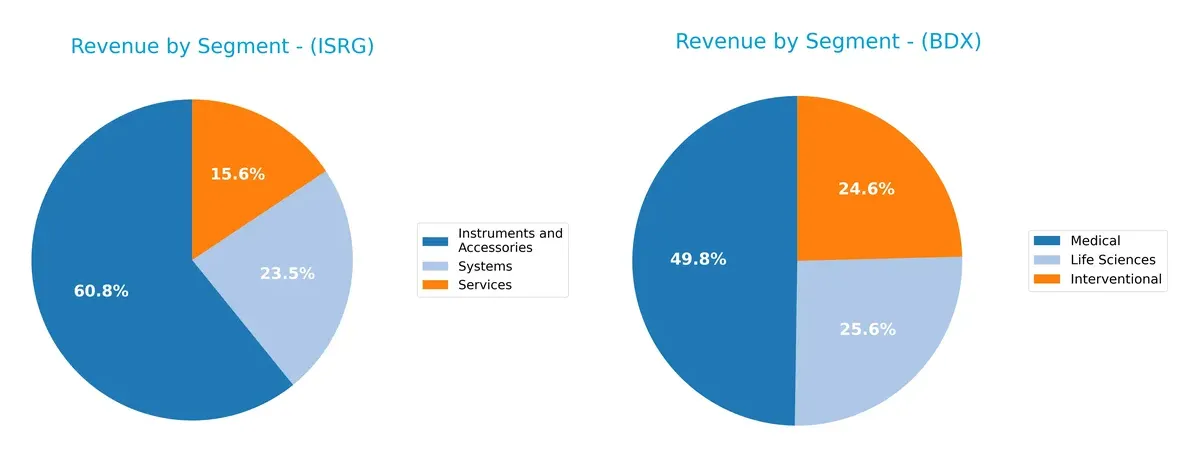

This section dissects ISRG and BDX’s operational DNA by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which business model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Intuitive Surgical, Inc. and Becton, Dickinson and Company diversify their income streams and where their primary sector bets lie:

Intuitive Surgical anchors revenue in “Instruments and Accessories” at $5.08B, with “Systems” and “Services” trailing at $1.97B and $1.31B. This concentration signals reliance on a specialized surgical ecosystem. Becton, Dickinson and Company boasts a more balanced mix, with “Medical” at $10.07B, “Life Sciences” $5.19B, and “Interventional” $4.98B. BDx’s diversification mitigates concentration risk and underpins infrastructure dominance across healthcare segments.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Intuitive Surgical, Inc. and Becton, Dickinson and Company:

Intuitive Surgical Strengths

- High net margin at 28.38%

- Zero debt levels with favorable debt-to-asset ratio

- Infinite interest coverage indicates strong solvency

- Diverse revenue streams from instruments, services, and systems

Becton, Dickinson Strengths

- Diverse business segments including Interventional, Life Sciences, Medical

- Geographic diversification with strong US, Europe, and Asia presence

- Favorable WACC at 4.65% supports investment returns

- Positive dividend yield at 2.23%

- Strong fixed asset turnover at 3.12

Intuitive Surgical Weaknesses

- Zero ROE and ROIC indicate poor capital efficiency

- Unfavorable liquidity ratios (current and quick ratio)

- High P/E ratio at 70.78 suggests overvaluation risk

- Low asset turnover reflects inefficiency

Becton, Dickinson Weaknesses

- Moderate profitability with 7.68% net margin

- ROE and ROIC below optimal levels

- Quick ratio below 1 signals liquidity concerns

- Unfavorable asset turnover at 0.39

- Elevated debt-to-equity ratio at 0.76

Intuitive Surgical excels in profitability and financial stability but faces challenges in capital efficiency and liquidity. Becton, Dickinson shows broader diversification and geographic reach but struggles with profitability and operational efficiency. Both companies must address these weaknesses to enhance strategic positioning.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive pressures, and here’s how two leaders compare:

Intuitive Surgical, Inc.: Innovation-Driven Switching Costs

Intuitive Surgical’s primary moat stems from high switching costs embedded in its da Vinci Surgical System. This is evident in its robust 33% EBIT margin and 28% net margin. However, declining ROIC poses a threat; expansion into diagnostic procedures in 2026 could either deepen or challenge this moat.

Becton, Dickinson and Company: Diversified Scale Advantage

Becton Dickinson leverages a broad product portfolio and global scale, creating a cost advantage unlike Intuitive’s focused switching costs. Its lower margins (11% EBIT, 7.7% net) reflect this. Yet, a growing ROIC trend suggests improving capital efficiency, with international market expansions offering upside in 2026.

Innovation Lock-in vs. Scale Efficiency: The Moat Faceoff

Intuitive Surgical commands a deeper moat through innovation-driven switching costs, but its eroding ROIC clouds sustainability. Becton exhibits a wider moat in scale and improving profitability. Overall, Intuitive is better positioned to defend market share if it arrests ROIC decline.

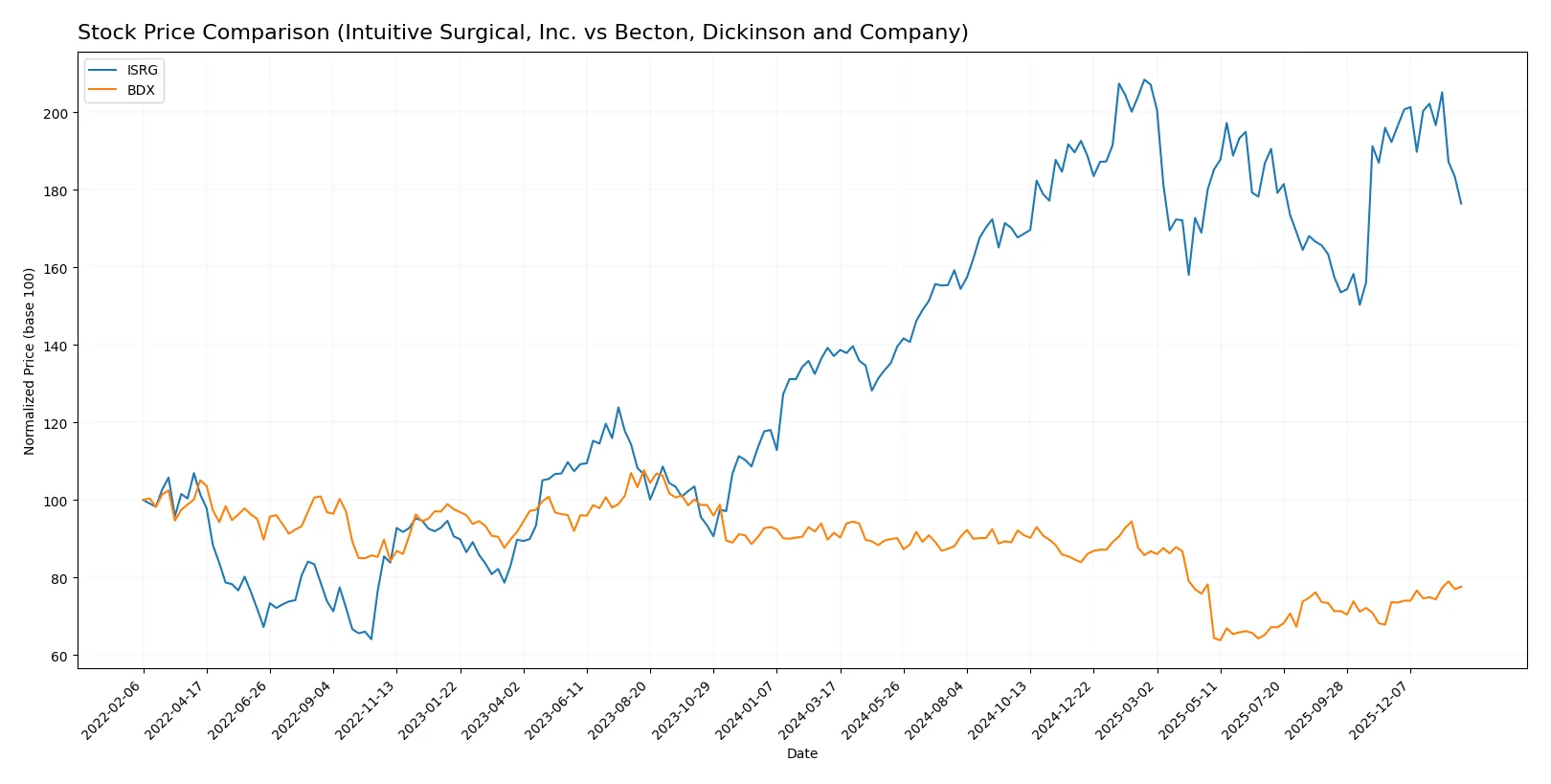

Which stock offers better returns?

The past year shows contrasting price dynamics: Intuitive Surgical, Inc. gained notably but slowed recently, while Becton, Dickinson and Company declined overall yet gained momentum late in the period.

Trend Comparison

Intuitive Surgical’s stock rose 28.68% over the past 12 months, signaling a bullish trend with decelerating momentum. It reached a high of 595.55 and bottomed at 366.34 during this span.

Becton, Dickinson’s stock fell 15.18% over the last year, marking a bearish trend with accelerating decline. Its highest price was 247.6, with a low of 167.22, reflecting notable weakness.

Comparing the two, Intuitive Surgical delivered the strongest market performance with a significant positive return, while Becton, Dickinson trended downward despite recent gains.

Target Prices

Analysts present a confident target consensus reflecting growth potential for these healthcare leaders.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Intuitive Surgical, Inc. | 550 | 750 | 641.25 |

| Becton, Dickinson and Company | 205 | 215 | 210 |

The consensus target for Intuitive Surgical at 641.25 exceeds its current 504 price, signaling upside potential. Becton Dickinson’s target of 210 also suggests modest appreciation from the current 203.48 price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Intuitive Surgical, Inc. Grades

The following table summarizes recent grades for Intuitive Surgical from established grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | Buy | Buy | 2026-01-27 |

| Barclays | Maintain | Overweight | 2026-01-26 |

| Bernstein | Maintain | Outperform | 2026-01-23 |

| Citigroup | Maintain | Neutral | 2026-01-23 |

| Evercore ISI Group | Maintain | In Line | 2026-01-23 |

| BTIG | Maintain | Buy | 2026-01-23 |

| Piper Sandler | Maintain | Overweight | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Barclays | Maintain | Overweight | 2026-01-07 |

| BTIG | Maintain | Buy | 2026-01-07 |

Becton, Dickinson and Company Grades

Below is a summary of recent grading data for Becton, Dickinson and Company by recognized firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-28 |

| Stifel | Maintain | Buy | 2026-01-07 |

| B of A Securities | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-17 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| RBC Capital | Maintain | Sector Perform | 2025-11-07 |

| RBC Capital | Maintain | Sector Perform | 2025-10-16 |

| Morgan Stanley | Maintain | Overweight | 2025-08-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-08 |

Which company has the best grades?

Intuitive Surgical consistently receives buy and outperform ratings from multiple firms. Becton, Dickinson mostly earns neutral to sector perform grades. ISRG’s stronger grades could signal higher analyst conviction, potentially attracting more investor interest.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Intuitive Surgical, Inc. (ISRG)

- Faces intense competition in surgical robotics with high innovation demands.

Becton, Dickinson and Company (BDX)

- Competes broadly in medical supplies with diversified product lines but slower innovation pace.

2. Capital Structure & Debt

Intuitive Surgical, Inc. (ISRG)

- Virtually no debt, strong interest coverage, but weak liquidity ratios raise operational risk.

Becton, Dickinson and Company (BDX)

- Moderate leverage with debt-to-assets at 35%, manageable interest coverage but higher financial risk.

3. Stock Volatility

Intuitive Surgical, Inc. (ISRG)

- High beta of 1.67 indicates significant price swings and investor sensitivity.

Becton, Dickinson and Company (BDX)

- Low beta of 0.26 suggests stable price movement and defensive stock characteristics.

4. Regulatory & Legal

Intuitive Surgical, Inc. (ISRG)

- Subject to stringent FDA approvals and potential liability in surgical device innovation.

Becton, Dickinson and Company (BDX)

- Exposed to extensive healthcare regulations and recalls risk in diverse product segments.

5. Supply Chain & Operations

Intuitive Surgical, Inc. (ISRG)

- Relies on complex, high-tech manufacturing with potential for bottlenecks in component sourcing.

Becton, Dickinson and Company (BDX)

- Large global supply chain with exposure to operational disruptions but benefits from scale.

6. ESG & Climate Transition

Intuitive Surgical, Inc. (ISRG)

- Emerging ESG initiatives but limited disclosure; pressure to improve sustainability in manufacturing.

Becton, Dickinson and Company (BDX)

- Stronger ESG focus with active climate transition programs and reporting commitments.

7. Geopolitical Exposure

Intuitive Surgical, Inc. (ISRG)

- Global sales expose it to trade tensions and regulatory divergence across regions.

Becton, Dickinson and Company (BDX)

- Broad international presence with moderate geopolitical risk but diversified market base.

Which company shows a better risk-adjusted profile?

Intuitive Surgical’s highest risk is market volatility amplified by high valuation and weak liquidity. Becton’s leverage and operational complexity top its risk list. Despite this, BDX’s diversified business and strong ESG stance offer a more balanced risk-adjusted profile. Recent ISRG valuation metrics signal potential overvaluation risk, while BDX’s steady dividend yield reflects resilience.

Final Verdict: Which stock to choose?

Intuitive Surgical, Inc. (ISRG) wields unmatched innovation power, driving strong revenue and cash flow growth through cutting-edge surgical robotics. Its point of vigilance lies in a stretched valuation and declining ROIC trend, signaling caution. ISRG fits an aggressive growth portfolio seeking breakthrough leaders.

Becton, Dickinson and Company (BDX) boasts a durable strategic moat rooted in medical supply scale and steady recurring revenue streams. Its improving ROIC and solid income quality offer a relatively safer profile versus ISRG’s growth volatility. BDX suits a GARP investor prioritizing stable income with moderate growth.

If you prioritize breakthrough innovation and are comfortable with valuation risk, ISRG outshines as a high-growth candidate. However, if you seek better stability and income with a gradually improving moat, BDX offers a compelling, more balanced scenario. Both require vigilance on capital efficiency and market cycles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Intuitive Surgical, Inc. and Becton, Dickinson and Company to enhance your investment decisions: