Home > Comparison > Healthcare > RMD vs BAX

The strategic rivalry between ResMed Inc. and Baxter International Inc. shapes the Healthcare sector’s future. ResMed excels as a specialized medical device and cloud-software innovator focused on respiratory care. Baxter operates as a diversified healthcare product provider offering dialysis, critical care, and surgical solutions. This head-to-head contrasts focused innovation against broad-based healthcare services. This analysis will identify which trajectory delivers superior risk-adjusted returns for a diversified portfolio in a complex, evolving market.

Table of contents

Companies Overview

ResMed and Baxter International stand as key players in the medical instruments and supplies sector, each commanding significant global market presence.

ResMed Inc.: Leader in Respiratory and Sleep Care Solutions

ResMed Inc. dominates the respiratory care market with its innovative medical devices and cloud-based software. Its revenue stems primarily from products addressing sleep apnea and respiratory disorders, including ventilation devices and diagnostic tools. In 2026, ResMed’s strategic focus sharpened on expanding its Software as a Service offerings, enhancing remote patient monitoring and data-driven healthcare management.

Baxter International Inc.: Comprehensive Healthcare Product Provider

Baxter International offers a broad portfolio spanning dialysis, infusion therapies, and critical care products globally. It generates revenue from medical devices, biological products, and integrated patient monitoring systems used across hospitals and care centers. The company’s 2026 strategy emphasizes connected care solutions and partnerships to innovate in acute care and organ support therapies.

Strategic Collision: Similarities & Divergences

Both companies operate within healthcare but diverge in focus: ResMed pursues a software-driven, patient-centric model, while Baxter emphasizes diversified medical devices and integrated therapies. The primary battleground lies in respiratory and critical care markets, where innovation and connectivity drive competition. Their investment profiles differ sharply; ResMed bets on digital healthcare scalability, Baxter on broad clinical product breadth and service integration.

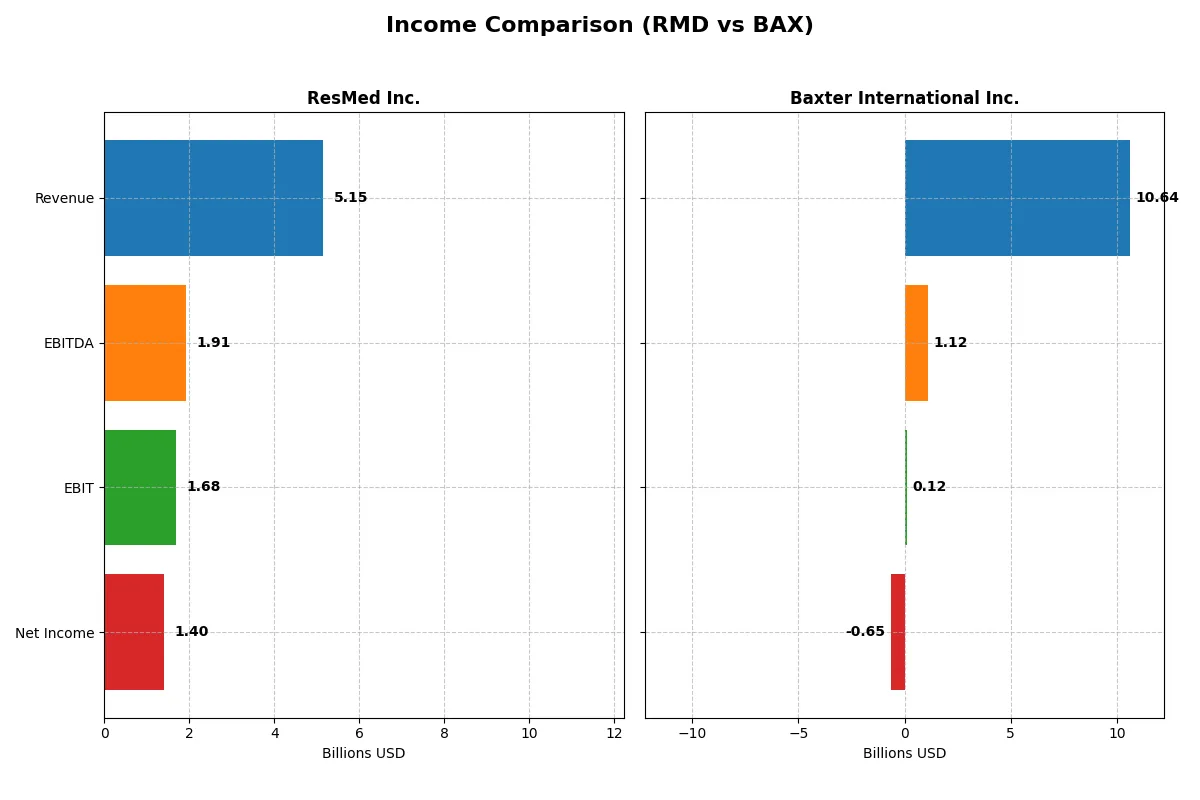

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | ResMed Inc. (RMD) | Baxter International Inc. (BAX) |

|---|---|---|

| Revenue | 5.15B | 10.64B |

| Cost of Revenue | 2.09B | 6.65B |

| Operating Expenses | 1.37B | 3.97B |

| Gross Profit | 3.05B | 3.98B |

| EBITDA | 1.91B | 1.12B |

| EBIT | 1.68B | 119M |

| Interest Expense | 12.6M | 408M |

| Net Income | 1.40B | -649M |

| EPS | 9.55 | -1.27 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true operational efficiency and profitability trends of two major healthcare companies.

ResMed Inc. Analysis

ResMed shows a strong upward revenue trajectory, growing from 3.2B in 2021 to 5.1B in 2025. Net income surged impressively from 474M to 1.4B, reflecting robust margin expansion. The latest fiscal year highlights exceptional efficiency with a gross margin of 59.4% and net margin of 27.2%, signaling solid profitability momentum.

Baxter International Inc. Analysis

Baxter’s revenue slightly declined from 11.7B in 2020 to 10.6B in 2024. Net income swung from a positive 1.1B in 2020 to a negative 649M in 2024, pressured by rising costs and discontinued operations. Its gross margin stands at 37.5%, but net margin slipped to -6.1%, indicating operational struggles and deteriorating profitability.

Efficiency and Profitability: Growth vs. Headwinds

ResMed dominates with consistent revenue and net income growth, backed by strong margins and efficient cost control. Baxter’s scale is notable, but deteriorating profitability and negative net margins mark significant challenges. For investors, ResMed’s profile of sustainable earnings growth and margin strength offers a clearer fundamental advantage.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | ResMed Inc. (RMD) | Baxter International Inc. (BAX) |

|---|---|---|

| ROE | 23.5% | -9.3% |

| ROIC | 19.6% | 0.06% |

| P/E | 27.0 | -22.9 |

| P/B | 6.3 | 2.14 |

| Current Ratio | 3.44 | 1.36 |

| Quick Ratio | 2.53 | 1.05 |

| D/E | 0.14 | 1.93 |

| Debt-to-Assets | 10.4% | 52.2% |

| Interest Coverage | 134x | 0.03x |

| Asset Turnover | 0.63 | 0.41 |

| Fixed Asset Turnover | 7.16 | 3.35 |

| Payout ratio | 22.2% | -90.9% |

| Dividend yield | 0.82% | 3.97% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence beyond surface-level statements.

ResMed Inc.

ResMed delivers strong profitability with a 23.47% ROE and 27.22% net margin, signaling operational efficiency. Its valuation appears stretched at a 27.02 P/E and 6.34 P/B, reflecting a premium market stance. The company maintains a modest 0.82% dividend yield, favoring reinvestment in R&D (6.4% of revenue) to fuel growth.

Baxter International Inc.

Baxter struggles with negative profitability: a -9.32% ROE and -6.1% net margin mark operational challenges. Its valuation metrics are mixed; a negative P/E contrasts with a reasonable 2.14 P/B ratio. The firm supports shareholders with a 3.97% dividend yield despite elevated debt (D/E 1.93), highlighting financial strain and a defensive capital allocation.

Premium Valuation vs. Operational Safety

ResMed commands a premium valuation justified by solid returns and prudent reinvestment, while Baxter faces operational headwinds with higher leverage but offers a more attractive dividend yield. Investors seeking stability may prefer ResMed’s profile; those prioritizing income might lean toward Baxter’s yield despite risks.

Which one offers the Superior Shareholder Reward?

I observe that ResMed (RMD) balances moderate dividends with strong, consistent buybacks, yielding about 0.82%-1.03% and payout ratios near 22%-28%. Baxter (BAX) offers higher dividend yields around 3%-4%, but with volatile profits and weaker free cash flow coverage. RMD’s free cash flow per share (~11.3 vs. BAX’s ~1.1) supports sustainable returns. Buybacks at RMD appear more disciplined, enhancing long-term shareholder value. In contrast, BAX’s heavy debt and erratic earnings undermine dividend safety. I conclude ResMed delivers a more attractive, sustainable total return profile for 2026 investors.

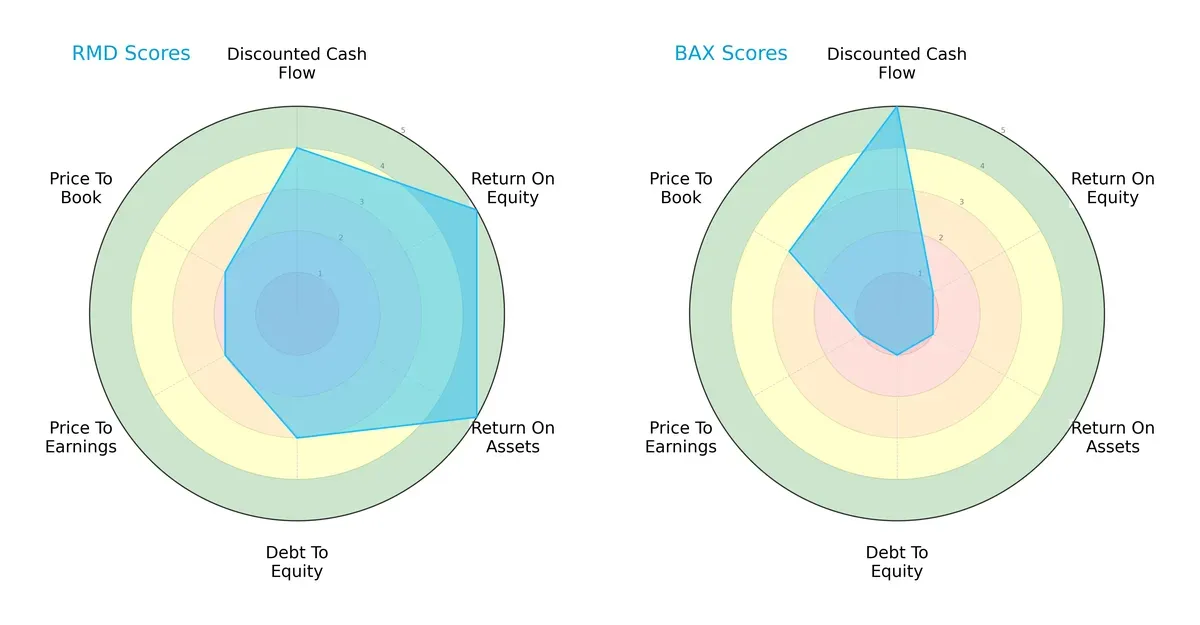

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of ResMed Inc. and Baxter International Inc., highlighting their financial strengths and vulnerabilities:

ResMed shows a balanced profile, excelling in ROE and ROA with scores of 5 each, indicating efficient profit and asset use. Its moderate debt-to-equity (3) suggests manageable leverage but slightly stretched valuation metrics (PE and PB scores of 2). Baxter leans heavily on its discounted cash flow strength (5) but suffers from weak profitability (ROE and ROA scores of 1) and high financial risk (debt-to-equity score of 1). ResMed’s diversified financial health contrasts with Baxter’s reliance on cash flow optimism.

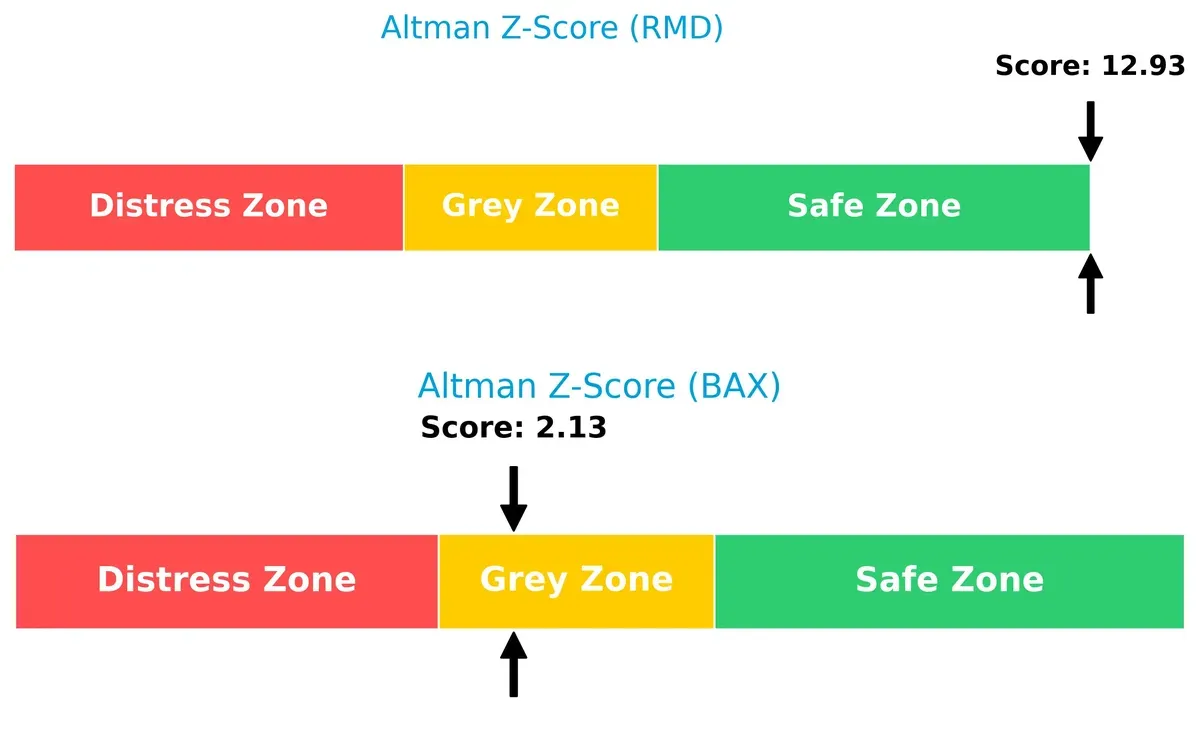

Bankruptcy Risk: Solvency Showdown

ResMed’s Altman Z-Score of 12.9 firmly places it in the safe zone, signaling robust solvency and low bankruptcy risk. Baxter’s score of 2.1, in the grey zone, implies a moderate risk of financial distress in this cycle:

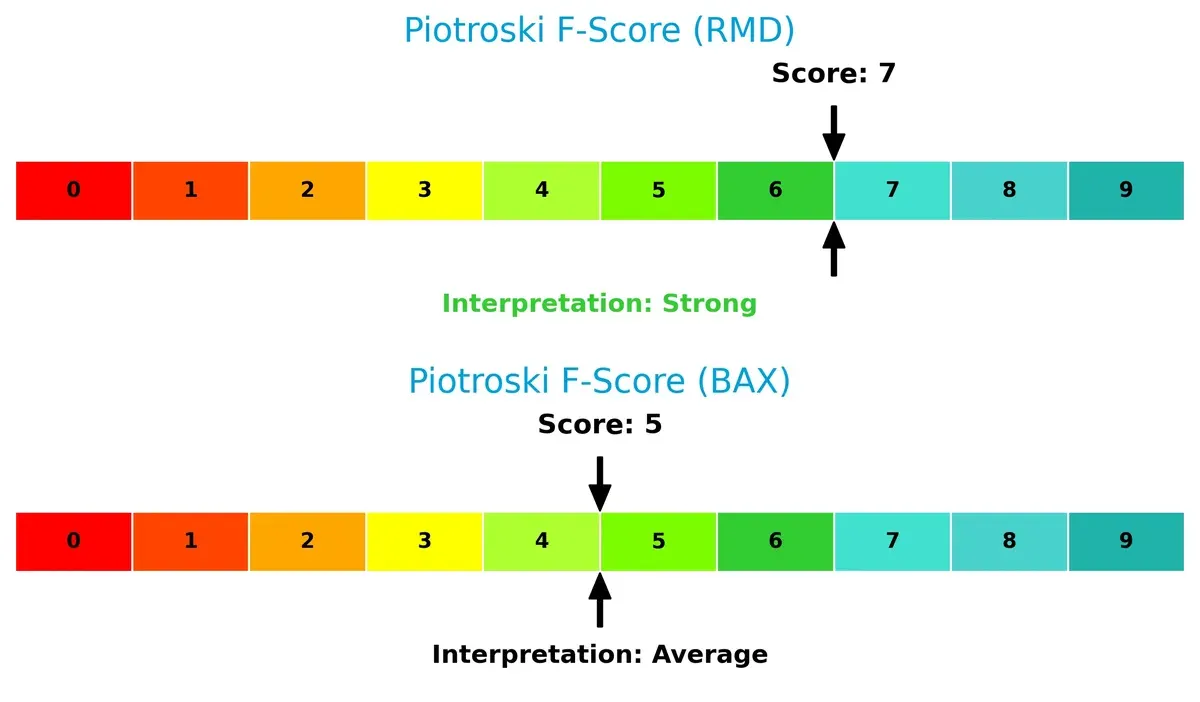

Financial Health: Quality of Operations

ResMed’s Piotroski F-Score of 7 indicates strong financial health with solid internal controls and profitability. Baxter’s score of 5 is average, raising caution about its operational quality relative to ResMed:

How are the two companies positioned?

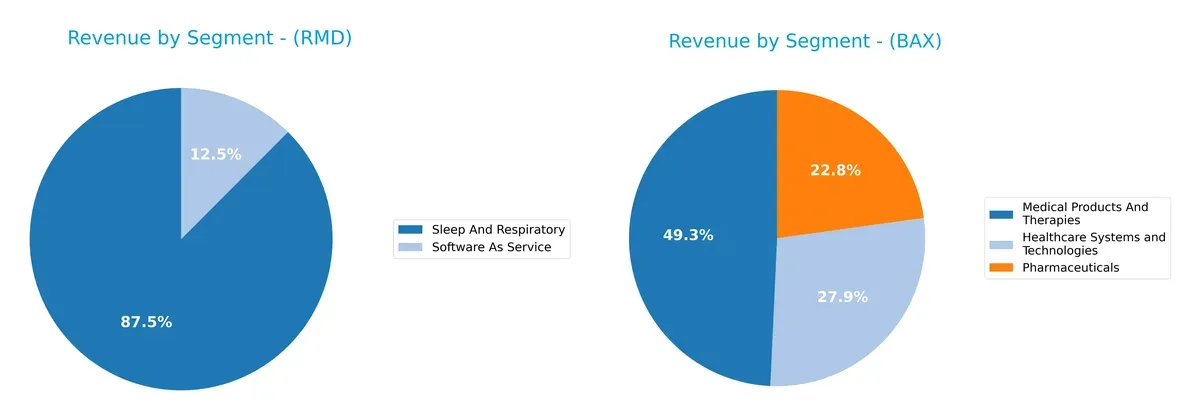

This section dissects the operational DNA of RMD and BAX by comparing their revenue distribution by segment and internal dynamics, including strengths and weaknesses. The goal is to confront their economic moats to identify which business model offers the most resilient and sustainable competitive advantage in today’s market landscape.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how ResMed Inc. and Baxter International Inc. diversify their income streams and where their primary sector bets lie:

ResMed anchors its revenue in Sleep And Respiratory at $4.1B, with Software As Service contributing $584M, showing moderate diversification. Baxter dwarfs ResMed in scale and diversification, generating $5.2B from Medical Products And Therapies, $2.95B from Healthcare Systems and Technologies, and $2.41B from Pharmaceuticals. Baxter’s broad segment base reduces concentration risk, while ResMed’s reliance on its core respiratory segment implies potential vulnerability but also strong ecosystem lock-in.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of ResMed Inc. and Baxter International Inc.:

ResMed Inc. Strengths

- High net margin of 27.22%

- Strong ROE at 23.47%

- Favorable ROIC of 19.56%

- Low debt to assets at 10.42%

- High interest coverage at 133.05

- Diverse product segments including Sleep and Respiratory and Software as Service

- Solid global presence with significant U.S. revenue

Baxter International Inc. Strengths

- Favorable WACC at 4.82%

- Positive PE ratio despite losses

- Favorable quick ratio at 1.05

- High dividend yield at 3.97%

- Diversified revenue streams across Healthcare Systems, Medical Products, and Pharmaceuticals

- Broad global footprint including U.S., EMEA, and Asia Pacific

ResMed Inc. Weaknesses

- Unfavorable PE ratio at 27.02

- High PB ratio at 6.34

- Current ratio unusually high at 3.44, indicating potential inefficiency

- Low dividend yield at 0.82%

- Moderate asset turnover at 0.63

Baxter International Inc. Weaknesses

- Negative net margin at -6.1%

- Negative ROE at -9.32%

- Near zero ROIC at 0.06%

- High debt to equity ratio at 1.93

- High debt to assets at 52.16%

- Very low interest coverage at 0.29

- Lower asset turnover at 0.41

Both companies show contrasting financial health profiles. ResMed excels in profitability and financial stability but has valuation concerns and lower dividend yield. Baxter offers strong diversification and dividend yield but struggles with profitability and high leverage, which may impact its risk profile.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole shield protecting long-term profits from relentless competitive erosion. Let’s dissect the moats of these healthcare stalwarts:

ResMed Inc.: Intangible Assets Powerhouse

ResMed’s moat stems from its proprietary cloud-based software and integrated respiratory devices. This creates sticky switching costs, reflected in a robust 27% net margin and soaring EPS growth. Its expanding SaaS offerings in 2026 promise to deepen this intangible asset moat.

Baxter International Inc.: Broad Product Portfolio, Weak Profit Defenses

Baxter relies on a diversified medical products lineup, but lacks ResMed’s software integration moat. Its shrinking ROIC and negative net margin signal weakening competitive positioning. Potential lies in connected care solutions, yet profitability hurdles may impair moat durability.

Verdict: Intangible Assets vs. Product Breadth

ResMed’s intangible asset moat is wider and more durable than Baxter’s product-based moat. ResMed’s growing ROIC and margin strength position it better to defend market share amid intensifying healthcare competition. Baxter faces uphill battles sustaining profitability and moat relevance.

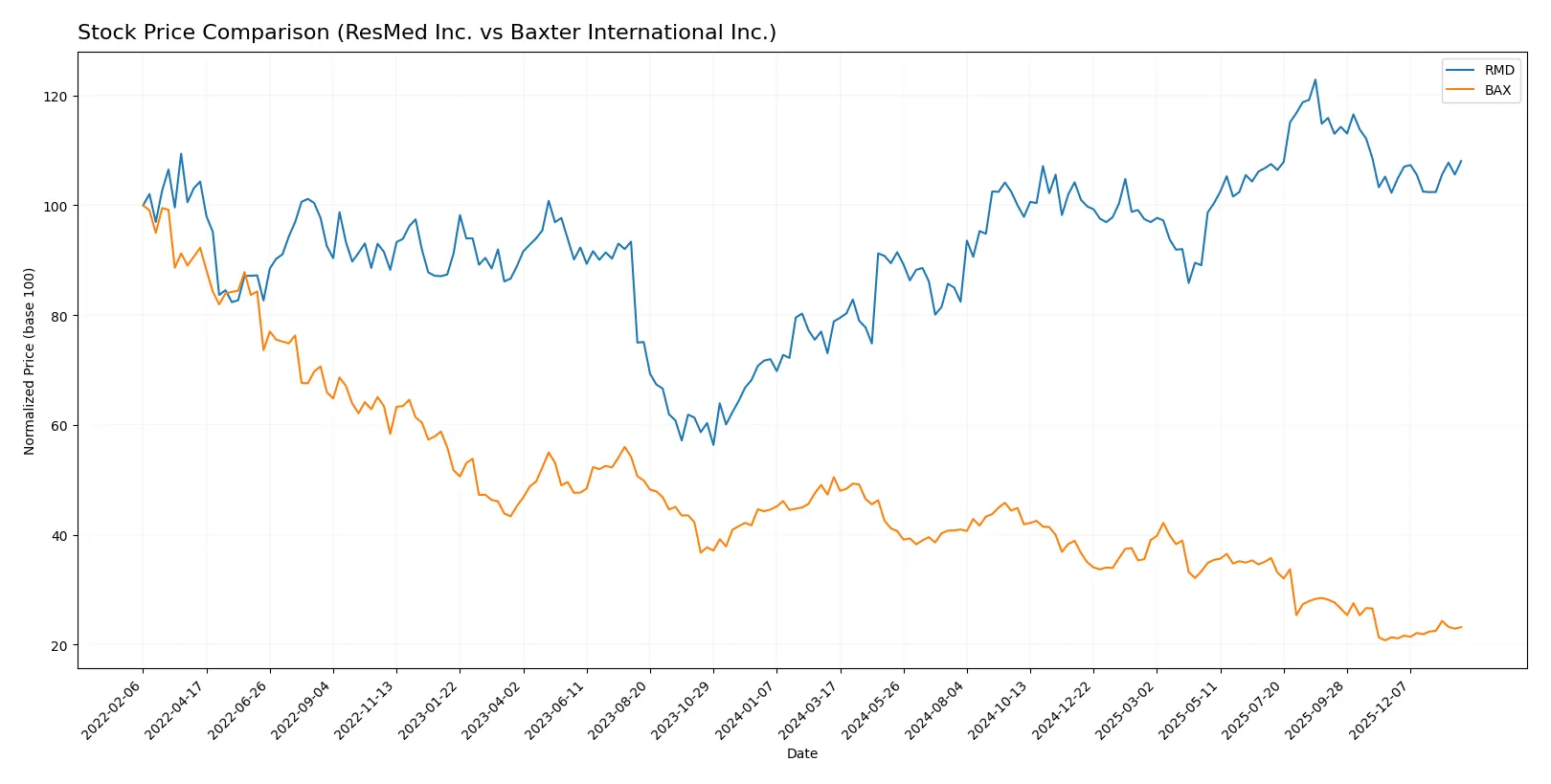

Which stock offers better returns?

The past 12 months reveal stark contrasts: ResMed’s stock rises sharply then slows, while Baxter’s plunges but gains recent modest momentum.

Trend Comparison

ResMed’s stock climbs 37.08% over the past year, marking a bullish trend with decelerating gains and a high volatility of 24.93%. It peaked at 293.73 and troughed at 178.85.

Baxter’s stock falls 54.15% over the same period, signaling a strong bearish trend despite accelerating decline. Volatility remains moderate at 6.75%, with prices ranging from 43.77 to 18.00.

ResMed outperforms Baxter by a wide margin, delivering the highest market returns despite decelerating momentum, compared to Baxter’s sustained and accelerating losses.

Target Prices

Analysts show a moderately bullish consensus for ResMed Inc. and a cautiously optimistic view on Baxter International Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| ResMed Inc. | 265 | 345 | 295.88 |

| Baxter International Inc. | 15 | 30 | 22.83 |

ResMed’s target consensus sits about 15% above the current price of 258, suggesting upside potential. Baxter’s consensus, near 23, implies modest gains from its 20 price, reflecting tempered expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a comparison of recent institutional grades for ResMed Inc. and Baxter International Inc.:

ResMed Inc. Grades

The table below summarizes recent grades assigned to ResMed Inc. by major financial institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Hold | 2026-01-30 |

| Piper Sandler | Maintain | Neutral | 2026-01-30 |

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-30 |

| Stifel | Maintain | Hold | 2025-12-18 |

| Baird | Downgrade | Neutral | 2025-12-16 |

| Baird | Maintain | Outperform | 2025-11-03 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

Baxter International Inc. Grades

Below is a summary of recent grades assigned to Baxter International Inc. by leading grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-09 |

| Morgan Stanley | Maintain | Underweight | 2025-12-02 |

| Argus Research | Downgrade | Hold | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Citigroup | Maintain | Neutral | 2025-10-31 |

| Goldman Sachs | Maintain | Neutral | 2025-10-31 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-07 |

| Barclays | Maintain | Overweight | 2025-08-04 |

| UBS | Maintain | Neutral | 2025-08-04 |

| Stifel | Downgrade | Hold | 2025-08-04 |

Which company has the best grades?

ResMed Inc. has a stronger consensus with multiple Outperform and Overweight grades, signaling higher institutional confidence. Baxter International shows mixed ratings, including Underweight and Hold downgrades, which may signal cautious investor sentiment. This divergence could influence portfolio positioning depending on risk tolerance.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

ResMed Inc.

- Strong market position in sleep and respiratory care with global reach in 140 countries.

Baxter International Inc.

- Broad healthcare portfolio but faces intense competition and slower innovation in dialysis and critical care.

2. Capital Structure & Debt

ResMed Inc.

- Low debt-to-equity ratio (0.14) signals conservative leverage and financial flexibility.

Baxter International Inc.

- High debt-to-equity ratio (1.93) exposes it to refinancing and interest rate risks.

3. Stock Volatility

ResMed Inc.

- Beta of 0.876 indicates moderate sensitivity to market swings.

Baxter International Inc.

- Lower beta at 0.589 suggests defensive stock characteristics but less growth potential.

4. Regulatory & Legal

ResMed Inc.

- Operates under strict healthcare regulations globally; risks from product approvals and compliance.

Baxter International Inc.

- Similar regulatory scrutiny, with additional risks linked to pharmaceutical and biological product lines.

5. Supply Chain & Operations

ResMed Inc.

- Relatively agile supply chain with cloud-based software integration aiding operational resilience.

Baxter International Inc.

- Larger operational scale with complex supply chains potentially vulnerable to disruptions.

6. ESG & Climate Transition

ResMed Inc.

- Focus on sustainable healthcare solutions; moderate ESG risks.

Baxter International Inc.

- Faces higher ESG scrutiny due to chemical and biological product manufacturing impact.

7. Geopolitical Exposure

ResMed Inc.

- Global footprint in 140 countries with exposure to trade tensions and regulatory variability.

Baxter International Inc.

- Broad international presence with substantial operations in politically sensitive regions.

Which company shows a better risk-adjusted profile?

ResMed’s most significant risk lies in competitive pressures within its niche markets, but its strong balance sheet and high Altman Z-score (12.9) indicate robust financial health. Baxter’s critical risk stems from its heavy debt load and weak profitability metrics, reflected in a precarious Altman Z-score (2.13). ResMed clearly offers a superior risk-adjusted profile, benefiting from conservative leverage and operational focus. Baxter’s recent negative net margins and low interest coverage raise concerns about financial sustainability under tightening credit conditions.

Final Verdict: Which stock to choose?

ResMed Inc. (RMD) impresses with its superpower of durable value creation, driven by a rising ROIC well above its cost of capital. Its strong cash generation and operational efficiency position it as a reliable growth engine. A point of vigilance remains its stretched valuation multiples, which might temper upside. RMD suits portfolios targeting aggressive growth with a focus on quality.

Baxter International Inc. (BAX) offers a strategic moat in its steady free cash flow and attractive dividend yield, appealing to income-focused investors. However, it faces challenges with declining profitability and high leverage, which raise safety concerns compared to RMD. BAX fits well within a GARP (Growth at a Reasonable Price) portfolio that tolerates some risk for income potential.

If you prioritize durable profitability and capital efficiency, ResMed outshines due to its consistent value creation and strong financial health. However, if you seek income with some growth upside and accept elevated risk, Baxter might offer better stability in dividends despite operational headwinds. Each scenario demands careful risk management aligned with your investment profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of ResMed Inc. and Baxter International Inc. to enhance your investment decisions: