Home > Comparison > Healthcare > ISRG vs BAX

The strategic rivalry between Intuitive Surgical, Inc. and Baxter International Inc. defines the current trajectory of the healthcare instruments and supplies sector. Intuitive Surgical operates as a high-tech innovator focused on minimally invasive surgical systems. Baxter International functions as a diversified healthcare products provider with broad clinical applications. This analysis will reveal which company’s operational model offers superior risk-adjusted returns for diversified portfolios amid evolving medical technologies.

Table of contents

Companies Overview

Intuitive Surgical and Baxter International shape the future of medical instruments and healthcare solutions globally.

Intuitive Surgical, Inc.: Pioneer in Minimally Invasive Surgery

Intuitive Surgical dominates the minimally invasive surgical systems market. Its revenue stems from sales and services of the da Vinci Surgical System and Ion endoluminal system. In 2026, the company emphasizes expanding its digital capabilities and integrated solutions to enhance surgical precision and hospital efficiency worldwide.

Baxter International Inc.: Comprehensive Healthcare Innovator

Baxter International leads in diverse healthcare products, including dialysis therapies, intravenous solutions, and critical care devices. Its broad portfolio generates revenue through direct sales and partnerships across 100 countries. The strategic focus in 2026 includes advancing connected care solutions and expanding critical care offerings to meet evolving hospital and homecare demands.

Strategic Collision: Similarities & Divergences

Both firms operate in medical instruments but diverge in approach: Intuitive Surgical pursues a closed ecosystem with high-tech surgical robotics, while Baxter embraces an open infrastructure spanning multiple therapy areas. The primary battleground lies in hospital procurement budgets and technology integration. Their investment profiles differ sharply: Intuitive’s growth hinges on innovation leadership, Baxter on diversified healthcare resilience.

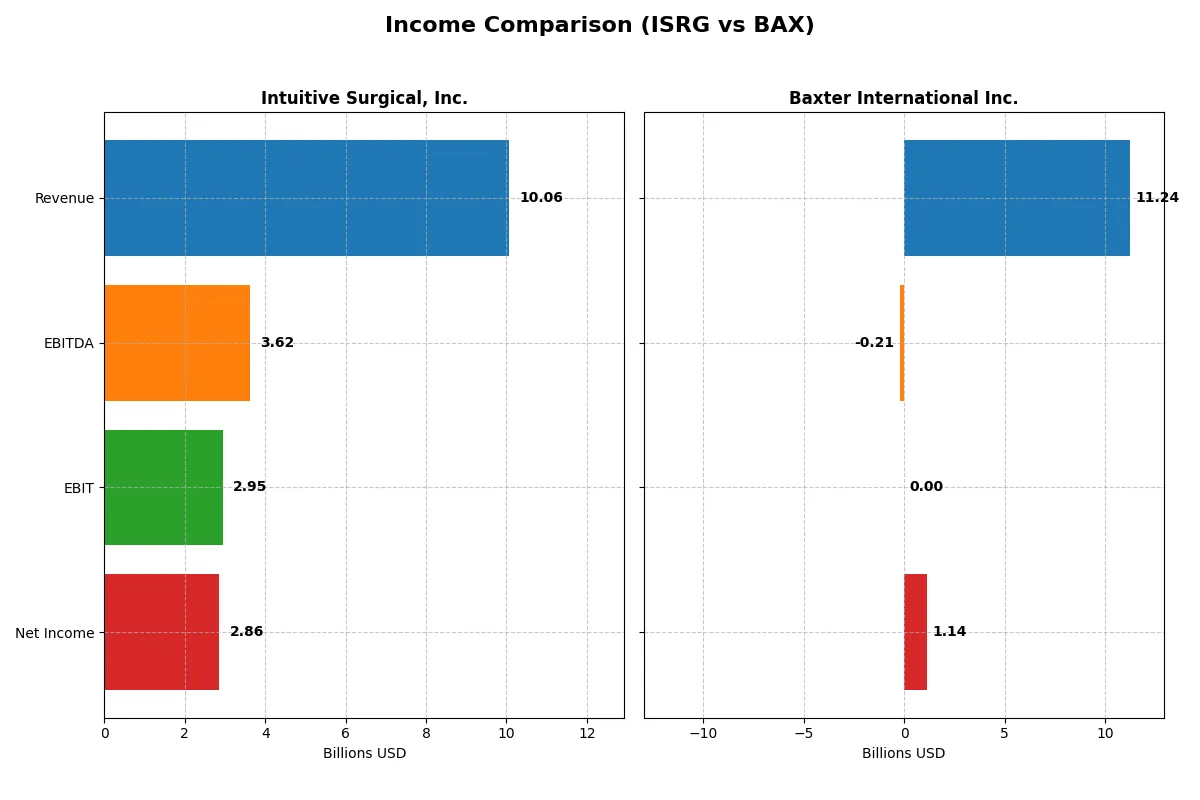

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Intuitive Surgical, Inc. (ISRG) | Baxter International Inc. (BAX) |

|---|---|---|

| Revenue | 10.1B | 11.2B |

| Cost of Revenue | 3.4B | 7.9B |

| Operating Expenses | 3.7B | 0.1B |

| Gross Profit | 6.6B | 3.4B |

| EBITDA | 3.6B | -206M |

| EBIT | 2.9B | 0 |

| Interest Expense | 0 | 238M |

| Net Income | 2.9B | 1.1B |

| EPS | 8 | -1.87 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The upcoming income statement comparison reveals how Intuitive Surgical and Baxter International harness revenues and control costs to drive profitability and efficiency.

Intuitive Surgical, Inc. Analysis

Intuitive Surgical shows a robust revenue climb from 5.7B in 2021 to 10.1B in 2025, with net income growing from 1.7B to 2.9B. Its gross margin steadies at a strong 66%, while net margin nears 28%. In 2025, the company accelerates EBIT growth by 25%, signaling efficient cost control and sustained momentum.

Baxter International Inc. Analysis

Baxter’s revenue fluctuates, peaking at 14.5B in 2022 before dropping to 11.2B in 2025. Net income swings wildly, turning negative in 2022 and 2024 but recovering to 1.1B in 2025. Gross margin remains modest at 30%, with net margin at 10%. The latest year’s negative EBIT and volatile profitability highlight operational challenges and margin pressure.

Margin Strength vs. Revenue Volatility

Intuitive Surgical dominates with consistent revenue growth and superior margin health, reflecting disciplined capital allocation and operational efficiency. Baxter’s results reveal revenue and profit instability, undermining its bottom-line reliability. Investors seeking stable, high-margin growth will find Intuitive’s profile more compelling for long-term value creation.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Intuitive Surgical, Inc. (ISRG) | Baxter International Inc. (BAX) |

|---|---|---|

| ROE | 16.0% | 18.5% |

| ROIC | 13.7% | -0.04% |

| P/E | 70.8 | 8.6 |

| P/B | 11.3 | 1.6 |

| Current Ratio | 4.87 | 2.31 |

| Quick Ratio | 3.96 | 1.56 |

| D/E | 0.017 | 1.58 |

| Debt-to-Assets | 1.5% | 48.4% |

| Interest Coverage | 0 | -0.03 |

| Asset Turnover | 0.49 | 0.02 |

| Fixed Asset Turnover | 1.88 | 0.11 |

| Payout ratio | 0 | 31% |

| Dividend yield | 0% | 3.55% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence that shape investment decisions.

Intuitive Surgical, Inc.

Intuitive Surgical demonstrates strong profitability with a 16.02% ROE and 28.38% net margin, signaling efficient operations. However, its valuation appears stretched, with a P/E of 70.78 and P/B at 11.34. The company retains earnings for growth, reinvesting heavily in R&D, as it pays no dividends.

Baxter International Inc.

Baxter posts a higher ROE of 18.53% and a favorable P/E of 8.63, indicating an attractive valuation. Despite strong net margin figures, the company’s negative ROIC and high debt-to-equity ratio (1.58) raise caution. Baxter offers a 3.55% dividend yield, balancing returns with moderate leverage.

Premium Valuation vs. Operational Safety

Intuitive Surgical trades at a premium for operational excellence and growth reinvestment, while Baxter offers value with dividend income but carries higher financial risk. Investors seeking growth may prefer Intuitive’s profile; income-focused investors might lean toward Baxter’s yield and valuation.

Which one offers the Superior Shareholder Reward?

Intuitive Surgical (ISRG) pays no dividends but retains strong free cash flow (7B in 2025) fueling growth and share buybacks, supporting a high valuation (P/E ~70). Baxter (BAX) offers a 3.5% dividend yield with a 31% payout ratio, but suffers negative free cash flow and heavy debt (D/E >1.5), limiting sustainable distributions. ISRG’s consistent buybacks and cash-rich balance sheet promise superior total returns over BAX’s riskier, dividend-dependent model in 2026. I favor ISRG for durable shareholder reward.

Comparative Score Analysis: The Strategic Profile

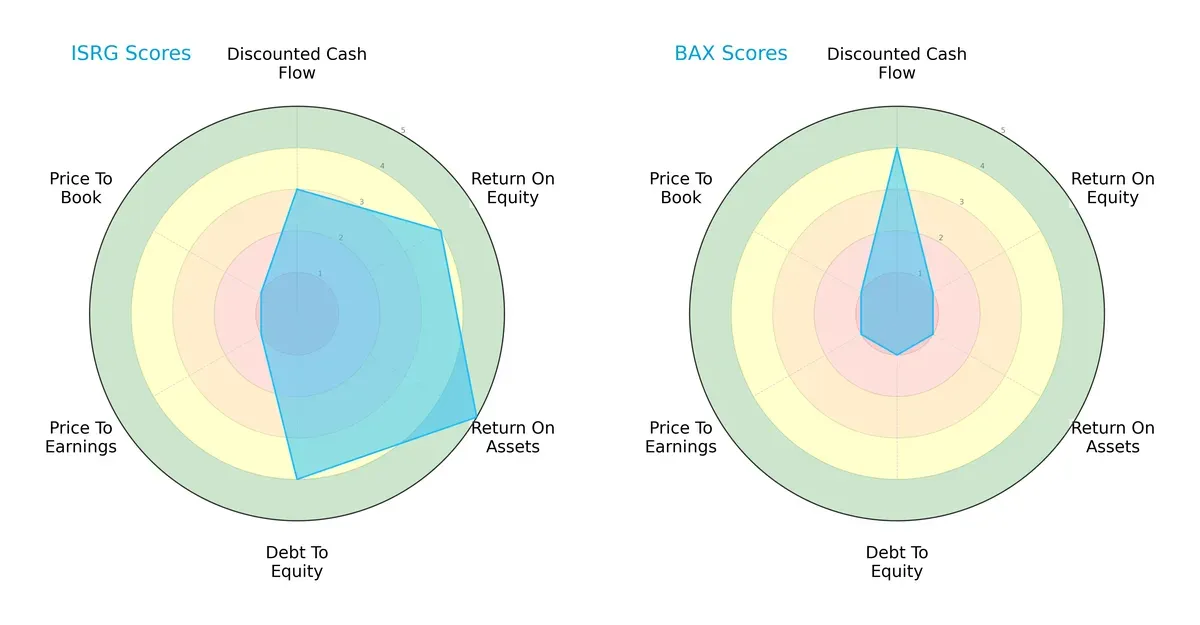

The radar chart reveals the fundamental DNA and trade-offs of Intuitive Surgical, Inc. and Baxter International Inc., highlighting their core strengths and vulnerabilities:

Intuitive Surgical shows a balanced profile with strong ROE (4) and ROA (5) scores and a favorable debt-to-equity ratio (4). Conversely, Baxter relies on its discounted cash flow strength (4) but scores very low in profitability and leverage metrics. Intuitive Surgical’s moderate valuation scores contrast sharply with Baxter’s uniformly weak valuation, underscoring ISRG’s superior operational efficiency and financial discipline.

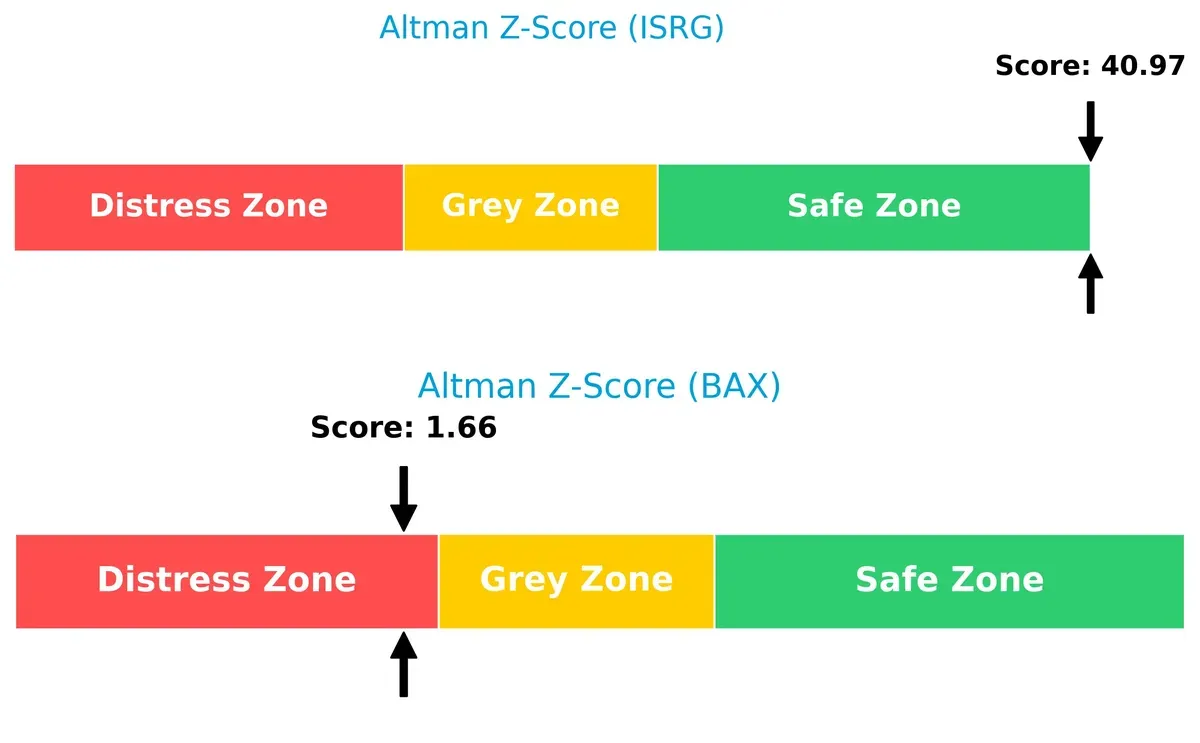

Bankruptcy Risk: Solvency Showdown

Intuitive Surgical’s Altman Z-Score of 40.97 places it well within the safe zone, while Baxter’s 1.66 signals distress risk. This gap implies ISRG’s long-term survival is far more secure in this market cycle:

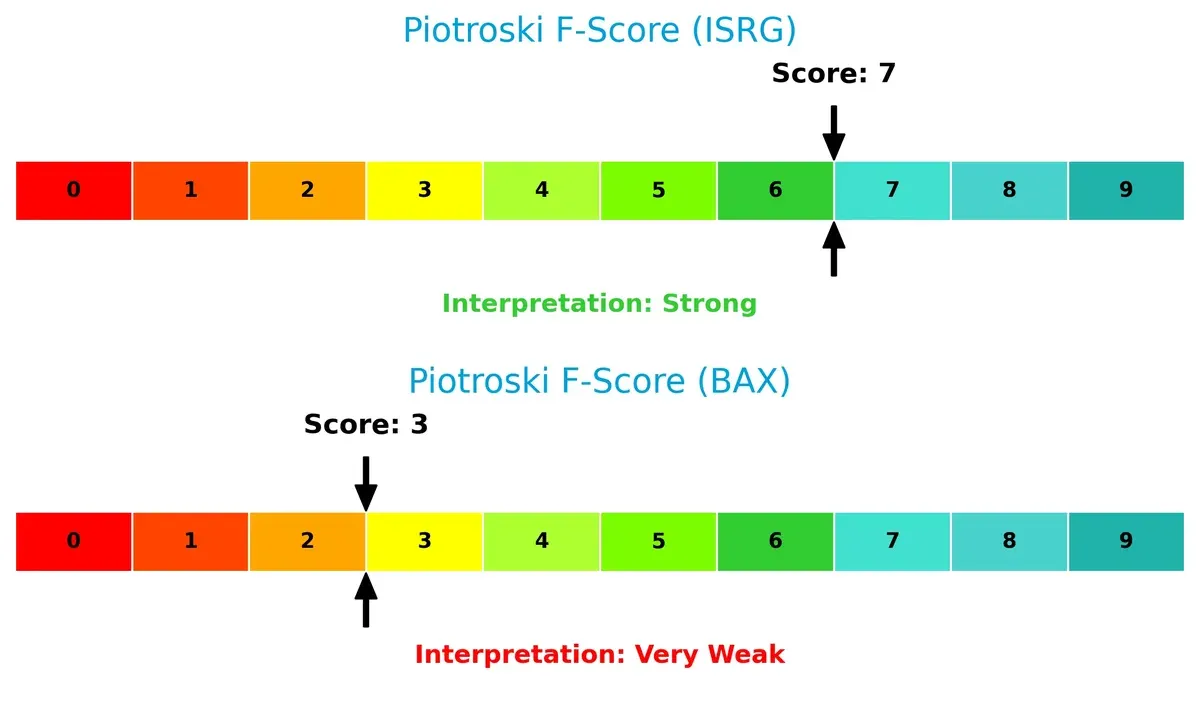

Financial Health: Quality of Operations

Intuitive Surgical scores a strong 7 on the Piotroski F-Score, indicating robust financial health and operational quality. Baxter’s weak score of 3 raises red flags on internal metrics and financial resilience:

How are the two companies positioned?

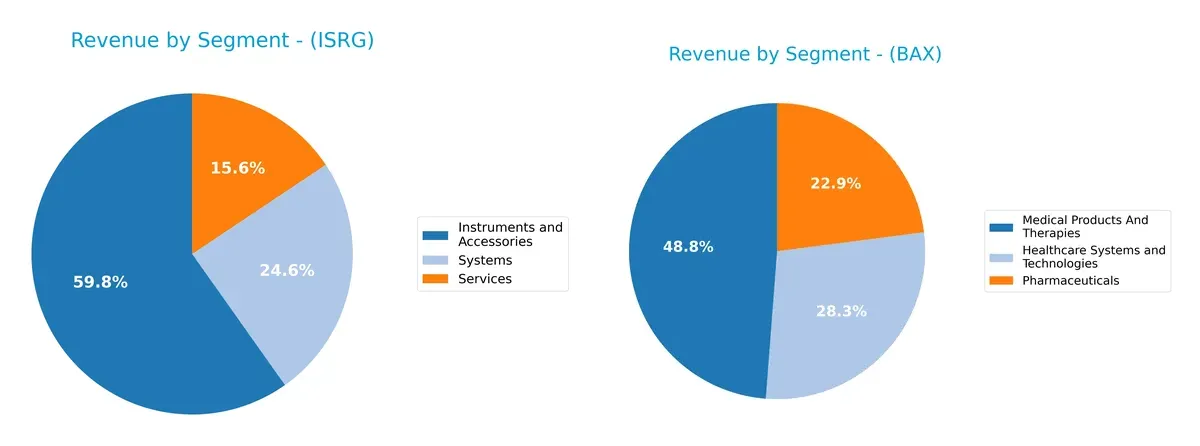

This section dissects the operational DNA of ISRG and BAX by comparing their revenue distribution by segment and internal dynamics. The goal is to confront their economic moats to reveal which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This comparison dissects how Intuitive Surgical and Baxter International diversify their income streams and where their primary sector bets lie:

Intuitive Surgical anchors 6B in Instruments and Accessories, dwarfs 2.5B in Systems, and pivots on 1.57B Services, showing moderate diversification. Baxter International spreads 5.3B in Medical Products and Therapies, 3.1B Healthcare Systems, and 2.5B Pharmaceuticals, revealing a broader mix. Intuitive’s reliance on a dominant segment risks concentration, while Baxter’s diverse portfolio mitigates sector-specific shocks and supports ecosystem resilience.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Intuitive Surgical (ISRG) and Baxter International (BAX):

ISRG Strengths

- High net margin at 28.38%

- Strong ROE of 16.02%

- Favorable ROIC at 13.71%

- Very low debt-to-equity at 0.02

- Excellent interest coverage

- Robust quick ratio at 3.96

- Substantial revenue from diverse product segments

BAX Strengths

- Exceptionally high net margin at 322.73%

- Strong ROE of 18.53%

- Low WACC at 4.58%

- Attractive P/E of 8.63

- Solid current and quick ratios

- Offers dividend yield of 3.55%

- Broad geographic presence including US, EMEA, and APAC

ISRG Weaknesses

- Unfavorable high P/E at 70.78

- Elevated P/B ratio at 11.34

- High current ratio at 4.87 may indicate inefficient asset use

- Unfavorable asset turnover at 0.49

- No dividend yield

- WACC above ROIC signals capital cost concerns

BAX Weaknesses

- Negative ROIC at -0.04

- High debt-to-equity at 1.58

- Unfavorable interest coverage at 0.0

- Very low asset and fixed asset turnover

- Neutral P/B at 1.6

- Lower operating efficiency indicated by turnover ratios

Both companies show strong profitability metrics but face distinct challenges. ISRG’s elevated valuation multiples contrast with BAX’s high leverage and weak asset efficiency, shaping their strategic capital allocation and risk profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion in evolving markets:

Intuitive Surgical, Inc.: Precision Robotics and Network Effects

I see Intuitive Surgical’s moat rooted in strong network effects and intangible assets tied to its da Vinci Surgical System. Its financials show a robust 29% EBIT margin and growing 2.3% ROIC above WACC, signaling sustained value creation. Expansion into diagnostic robotics with Ion endoluminal systems could deepen this advantage in 2026.

Baxter International Inc.: Broad Product Portfolio but Fading Capital Efficiency

Baxter relies on a diversified healthcare product portfolio, contrasting ISRG’s niche specialization. However, its declining ROIC, negative trend, and zero EBIT margin expose a weakening moat. Opportunities exist in connected care solutions, but value destruction warns of mounting competitive pressures and operational challenges.

Robotics Precision vs. Diversification Strain: The Moat Verdict

Intuitive Surgical’s deepening network effects and superior capital efficiency create a significantly wider moat than Baxter’s fragmented and deteriorating competitive position. ISRG is clearly better equipped to defend and grow its market share amid healthcare innovation pressures.

Which stock offers better returns?

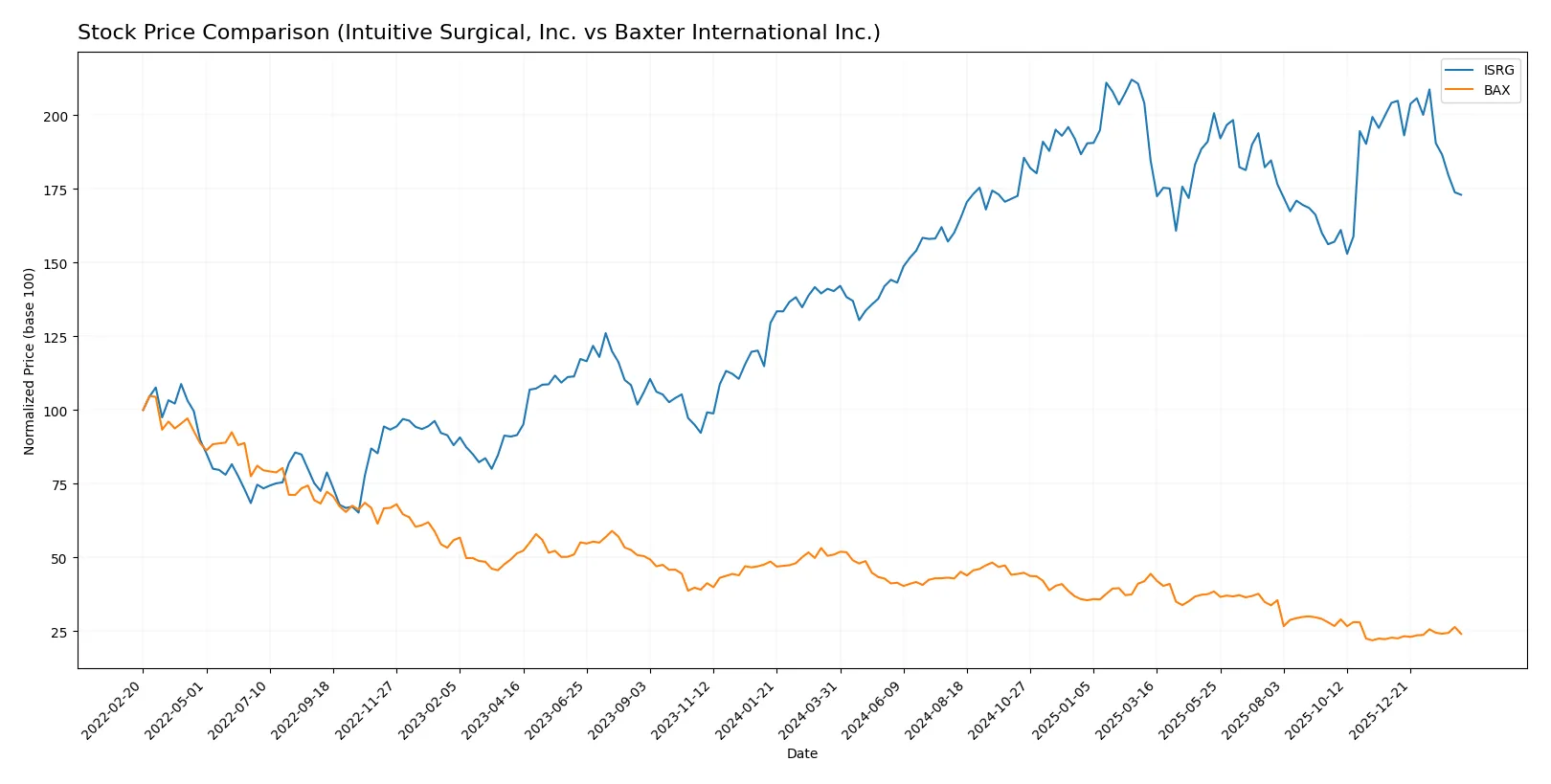

Over the past 12 months, Intuitive Surgical, Inc. gained 23.3% with decelerating momentum, while Baxter International Inc. declined 52.8% despite accelerating losses, reflecting contrasting trading dynamics.

Trend Comparison

Intuitive Surgical’s stock shows a bullish 23.3% rise over 12 months with price deceleration and high volatility, hitting a high of 595.55 and a low of 366.34. Recent months reveal a bearish 15.3% dip.

Baxter’s stock posted a bearish 52.8% decline over the year with accelerating downward pressure, trading between 18.0 and 42.74. Recently, it showed a modest 5.6% rebound with neutral buyer dominance.

Intuitive Surgical delivered the stronger market performance with sustained long-term gains, contrasting Baxter’s steep annual losses despite a recent minor recovery.

Target Prices

Analysts present a clear upward target consensus for Intuitive Surgical, Inc. and Baxter International Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Intuitive Surgical, Inc. | 550 | 750 | 641.25 |

| Baxter International Inc. | 15 | 25 | 20.71 |

The consensus targets imply substantial upside potential from current prices of $485.84 for ISRG and $19.79 for BAX. Analysts expect growth well above recent trading levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Below is a summary of recent institutional grades for Intuitive Surgical, Inc. and Baxter International Inc.:

Intuitive Surgical, Inc. Grades

This table shows recent ratings from established financial institutions for Intuitive Surgical, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | Buy | Buy | 2026-01-27 |

| Barclays | Maintain | Overweight | 2026-01-26 |

| Citigroup | Maintain | Neutral | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2026-01-23 |

| Piper Sandler | Maintain | Overweight | 2026-01-23 |

| Evercore ISI Group | Maintain | In Line | 2026-01-23 |

| BTIG | Maintain | Buy | 2026-01-23 |

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Barclays | Maintain | Overweight | 2026-01-07 |

| BTIG | Maintain | Buy | 2026-01-07 |

Baxter International Inc. Grades

This table shows recent ratings from established financial institutions for Baxter International Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-02-13 |

| Barclays | Maintain | Overweight | 2026-01-09 |

| Morgan Stanley | Maintain | Underweight | 2025-12-02 |

| Citigroup | Maintain | Neutral | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Argus Research | Downgrade | Hold | 2025-10-31 |

| Goldman Sachs | Maintain | Neutral | 2025-10-31 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-07 |

| Barclays | Maintain | Overweight | 2025-08-04 |

| Stifel | Downgrade | Hold | 2025-08-04 |

Which company has the best grades?

Intuitive Surgical, Inc. holds predominantly Buy and Overweight ratings, with no downgrades. Baxter International Inc. shows a mix of Overweight and Neutral ratings but includes recent downgrades to Hold. Investors may view Intuitive Surgical’s more consistent positive grades as a signal of stronger institutional confidence.

Risks specific to each company

The following categories highlight critical pressure points and systemic threats facing Intuitive Surgical, Inc. and Baxter International Inc. in the 2026 market environment:

1. Market & Competition

Intuitive Surgical, Inc.

- Dominates minimally invasive surgery with strong innovation but faces high P/E valuation risk.

Baxter International Inc.

- Broader healthcare product portfolio but struggles with low asset turnover and intense competition.

2. Capital Structure & Debt

Intuitive Surgical, Inc.

- Extremely low debt levels (D/E 0.02) and strong interest coverage; very conservative leverage.

Baxter International Inc.

- High debt (D/E 1.58) and zero interest coverage pose significant financial risk.

3. Stock Volatility

Intuitive Surgical, Inc.

- High beta (1.66) indicates sensitivity to market swings and higher volatility.

Baxter International Inc.

- Low beta (0.59) suggests defensive stock behavior and lower volatility.

4. Regulatory & Legal

Intuitive Surgical, Inc.

- Subject to stringent medical device regulations globally; innovation must keep pace with compliance.

Baxter International Inc.

- Faces complex regulatory environment across diverse product lines and geographies.

5. Supply Chain & Operations

Intuitive Surgical, Inc.

- Relies on cutting-edge manufacturing and digital integration; risks if technology supply disrupted.

Baxter International Inc.

- Complex global supply chain with risks in raw material sourcing and manufacturing efficiency.

6. ESG & Climate Transition

Intuitive Surgical, Inc.

- Increasing focus on sustainable medical technologies; ESG initiatives still evolving.

Baxter International Inc.

- Faces pressure to improve ESG metrics amid diverse product portfolio and energy-intensive operations.

7. Geopolitical Exposure

Intuitive Surgical, Inc.

- Moderate exposure with international sales; sensitive to trade policies affecting medical exports.

Baxter International Inc.

- Broad geographic footprint increases exposure to geopolitical tensions and regulatory changes.

Which company shows a better risk-adjusted profile?

Intuitive Surgical’s most impactful risk is its high market valuation coupled with exposure to regulatory shifts in medical technology. Baxter’s greatest risk lies in its heavy debt burden and weak asset efficiency, which threaten financial stability. Despite Intuitive’s higher stock volatility, its low leverage and strong profitability yield a better risk-adjusted profile. Baxter’s distress-zone Altman Z-score and weak Piotroski score confirm elevated financial risk, underscoring the need for cautious allocation.

Final Verdict: Which stock to choose?

Intuitive Surgical, Inc. (ISRG) boasts a powerful competitive edge as a value creator with a sustainable moat. Its ability to generate returns above its cost of capital speaks to operational excellence and robust profitability. However, its lofty valuation and asset turnover warrant caution. It suits investors targeting aggressive growth with a tolerance for premium pricing.

Baxter International Inc. (BAX) presents a strategic moat rooted in recurring revenue and a strong yield profile. Its lower valuation offers a margin of safety compared to ISRG, but the company’s declining profitability and financial distress signals require vigilant risk management. BAX fits portfolios seeking growth at a reasonable price with higher risk tolerance.

If you prioritize durable competitive advantage and consistent value creation, ISRG outshines due to its expanding ROIC and income quality. However, if you seek undervaluation and income with some risk, BAX offers better stability on valuation metrics despite its financial challenges. Each scenario suits distinct investor profiles demanding disciplined risk assessment.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Intuitive Surgical, Inc. and Baxter International Inc. to enhance your investment decisions: