Home > Comparison > Consumer Cyclical > IP vs BALL

The strategic rivalry between International Paper Company and Ball Corporation shapes the landscape of the packaging & containers sector. International Paper operates as a capital-intensive industrial giant focused on containerboards and cellulose fibers. Ball Corporation combines aluminum packaging leadership with a diversified aerospace segment. This analysis contrasts their operational models to identify which offers superior risk-adjusted returns for a diversified portfolio amid evolving industry demands.

Table of contents

Companies Overview

International Paper Company and Ball Corporation are dominant players in the global packaging sector. Both shape the packaging landscape with distinct approaches to material innovation and market reach.

International Paper Company: Global Packaging Leader

International Paper Company dominates the packaging & containers market with a focus on industrial packaging and cellulose fibers. Its core revenue stems from manufacturing containerboards and specialty pulps used in hygiene, textiles, and construction. In 2026, the company emphasizes expanding sustainable fiber solutions while serving diverse markets worldwide.

Ball Corporation: Aluminum Packaging & Aerospace Innovator

Ball Corporation leads in aluminum packaging for beverages and personal care products across multiple continents. It generates revenue primarily from aluminum cans and aerospace technologies, including satellite and defense systems. In 2026, Ball is sharpening its strategy around aerospace innovation alongside its core beverage packaging business.

Strategic Collision: Similarities & Divergences

Both companies compete in packaging but diverge sharply in material focus—fiber-based versus aluminum-based solutions. Their strategic battleground centers on sustainable packaging innovation and global market penetration. International Paper offers scale and fiber expertise, while Ball blends packaging with aerospace tech, creating distinct investment profiles rooted in material science and diversification.

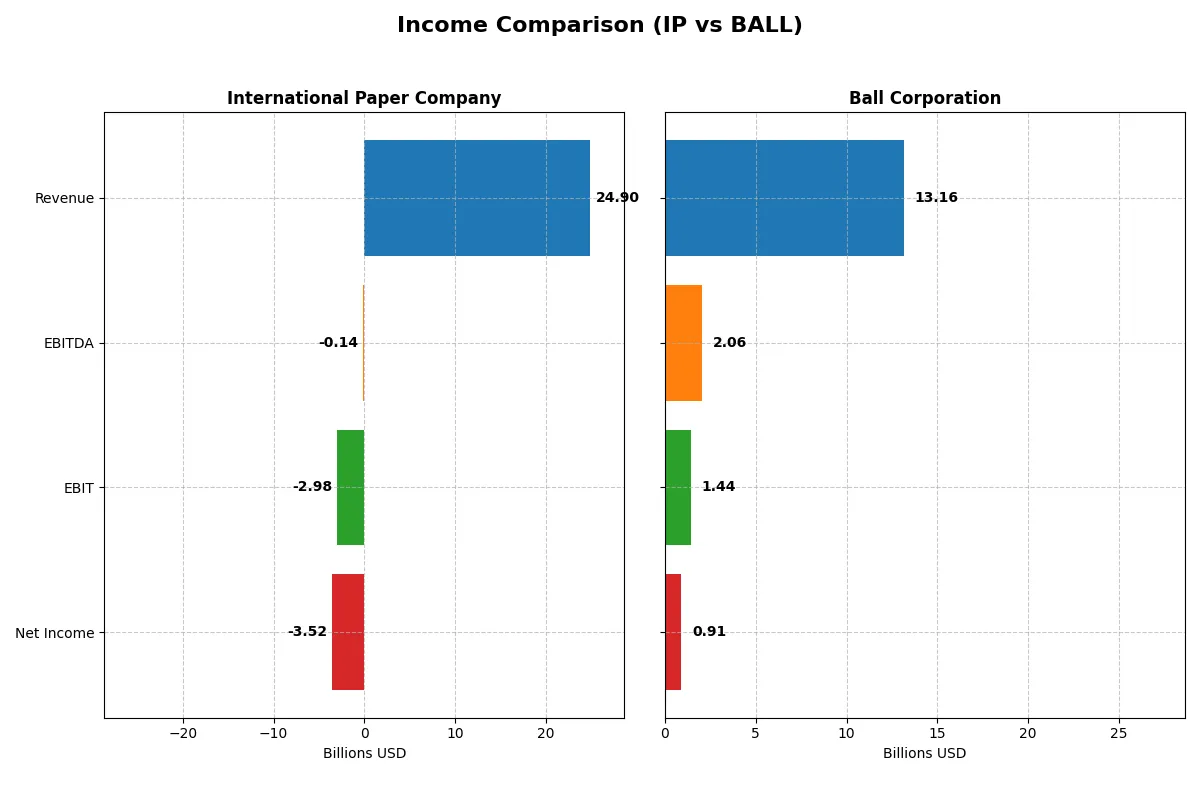

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | International Paper Company (IP) | Ball Corporation (BALL) |

|---|---|---|

| Revenue | 24.9B | 13.2B |

| Cost of Revenue | 17.5B | 11.2B |

| Operating Expenses | 10.2B | 566M |

| Gross Profit | 7.4B | 2.0B |

| EBITDA | -138M | 2.1B |

| EBIT | -3.0B | 1.4B |

| Interest Expense | 372M | 314M |

| Net Income | -3.5B | 912M |

| EPS | -6.71 | 3.33 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The upcoming income statement comparison reveals which company operates with superior efficiency and profitability through shifting market conditions.

International Paper Company Analysis

International Paper grew revenue by 33.7% in 2025 to $24.9B but swung to a net loss of $3.5B from $557M profit the prior year. The 29.5% gross margin remains solid, yet operating losses dragged EBIT margin to -12%, signaling deteriorating core profitability. Rising costs and a sharp net margin decline reflect weakening operational momentum.

Ball Corporation Analysis

Ball Corporation posted 11.6% revenue growth to $13.2B in 2025 with net income at $912M, down from $4B in 2024 due to discontinued operations. Gross margin held steady near 15%, while EBIT margin expanded to 11%, indicating strong operational leverage. Despite a recent net margin dip, Ball maintains favorable earnings growth and margin improvement over time.

Margin Stability vs. Earnings Volatility

International Paper’s impressive top-line growth contrasts sharply with its plunge into losses and negative net margins in 2025. Ball offers steadier earnings with positive EBIT and net margins, despite slower revenue expansion. For investors prioritizing consistent profitability and margin health, Ball’s profile appears more resilient amid market fluctuations.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | International Paper (IP) | Ball Corporation (BALL) |

|---|---|---|

| ROE | -23.7% (2025) | 16.8% (2025) |

| ROIC | -7.6% (2025) | 7.8% (2025) |

| P/E | -5.92 (2025) | 15.9 (2025) |

| P/B | 1.40 (2025) | 2.68 (2025) |

| Current Ratio | 1.28 (2025) | 1.11 (2025) |

| Quick Ratio | 1.02 (2025) | 0.75 (2025) |

| D/E (Debt-to-Equity) | 0.73 (2025) | 1.29 (2025) |

| Debt-to-Assets | 28.5% (2025) | 35.9% (2025) |

| Interest Coverage | -7.58 (2025) | 4.43 (2025) |

| Asset Turnover | 0.66 (2025) | 0.67 (2025) |

| Fixed Asset Turnover | 1.64 (2025) | 1.98 (2025) |

| Payout Ratio | -27.8% (2025) | 24.1% (2025) |

| Dividend Yield | 4.70% (2025) | 1.51% (2025) |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s DNA, exposing hidden risks while highlighting operational strengths and valuation realities.

International Paper Company

International Paper struggles with negative profitability, posting a -23.7% ROE and -14.1% net margin, signaling operational challenges. Yet, its valuation appears attractive with a favorable P/E and a 4.7% dividend yield, rewarding shareholders amid reinvestment constraints. The company balances moderate leverage and liquidity, reflecting cautious financial management in a tough market.

Ball Corporation

Ball demonstrates stronger profitability, boasting a 16.8% ROE and positive net margin near 7%, indicating efficient capital use. Its P/E of 15.9 suggests a fairly valued stock, though a higher debt level and weaker liquidity ratios raise caution. Dividends yield 1.5%, reflecting moderate shareholder returns alongside sustained growth efforts.

Profitability vs. Valuation: Balancing Risk and Growth

International Paper trades cheaper with a strong dividend but suffers from poor returns and operational losses. Ball offers healthier profitability and stable growth metrics but carries higher leverage and moderate yield. Investors seeking income may prefer International Paper’s yield, while those valuing operational efficiency might lean toward Ball.

Which one offers the Superior Shareholder Reward?

I see International Paper (IP) delivers a robust dividend yield near 4.7%, but its negative free cash flow in 2025 signals payout risk. Ball Corporation (BALL) yields just 1.5%, yet maintains a low payout ratio (~24%) and positive free cash flow, fueling steady buybacks. IP’s shrinking buybacks amid profit pressure contrast BALL’s consistent capital returns. BALL’s conservative payout and buyback balance form a more sustainable reward model. For 2026, I favor BALL for superior total shareholder return potential due to its disciplined capital allocation and healthier cash flow profile.

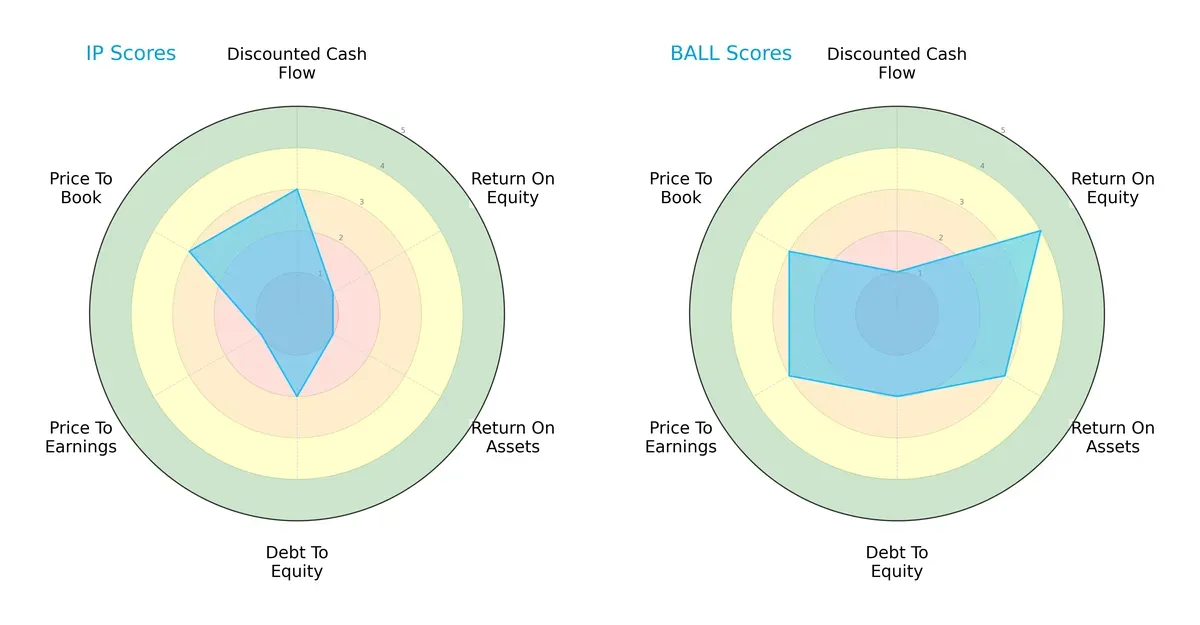

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their distinct financial strengths and vulnerabilities:

Ball Corporation presents a more balanced profile with strong ROE (4) and ROA (3) scores, reflecting operational efficiency. However, its DCF score (1) signals potential valuation concerns. International Paper shows moderate DCF strength (3) but struggles with profitability metrics—ROE (1) and ROA (1) are very weak. Both share similar debt-to-equity risk (2), but IP’s valuation metrics lag with very unfavorable P/E (1) versus Ball’s moderate scores (3). Overall, Ball leverages profitability while IP relies on discounted cash flow projections.

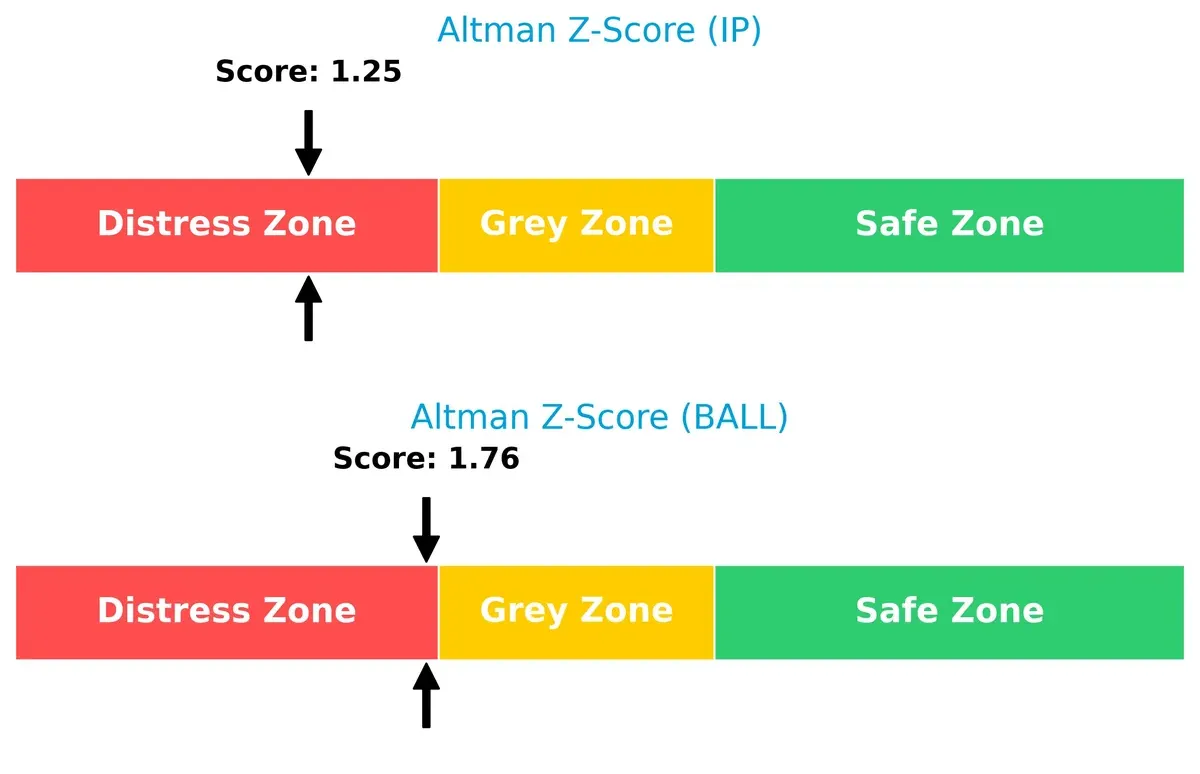

Bankruptcy Risk: Solvency Showdown

The Altman Z-Scores place both companies in the distress zone, signaling elevated bankruptcy risk in this cycle:

International Paper’s Z-score (1.25) is notably lower than Ball Corporation’s (1.76), indicating a higher probability of financial distress and weaker solvency. Both firms must strengthen liquidity and leverage to survive long-term market pressures.

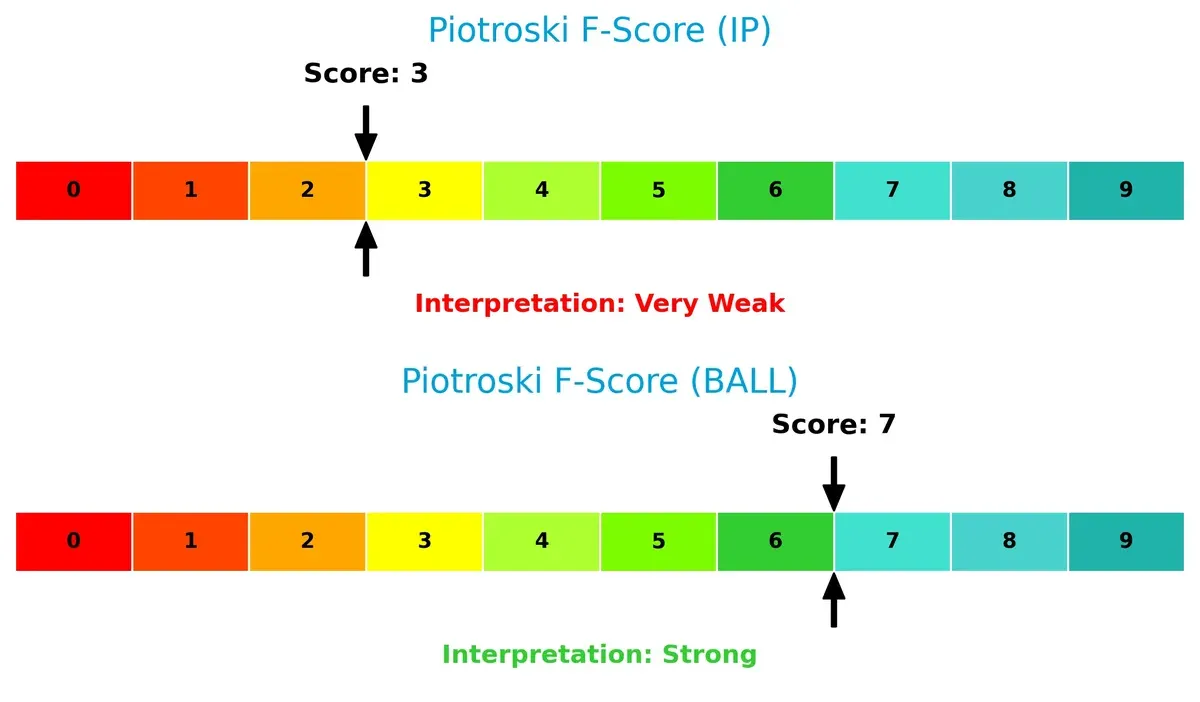

Financial Health: Quality of Operations

Piotroski F-Scores highlight stark contrasts in internal financial health between the two companies:

Ball scores a robust 7, reflecting strong profitability, liquidity, and operational efficiency. International Paper’s score of 3 signals red flags in internal metrics, suggesting weaker financial discipline and operational challenges. This gap indicates Ball’s superior quality of earnings and balance sheet resilience.

How are the two companies positioned?

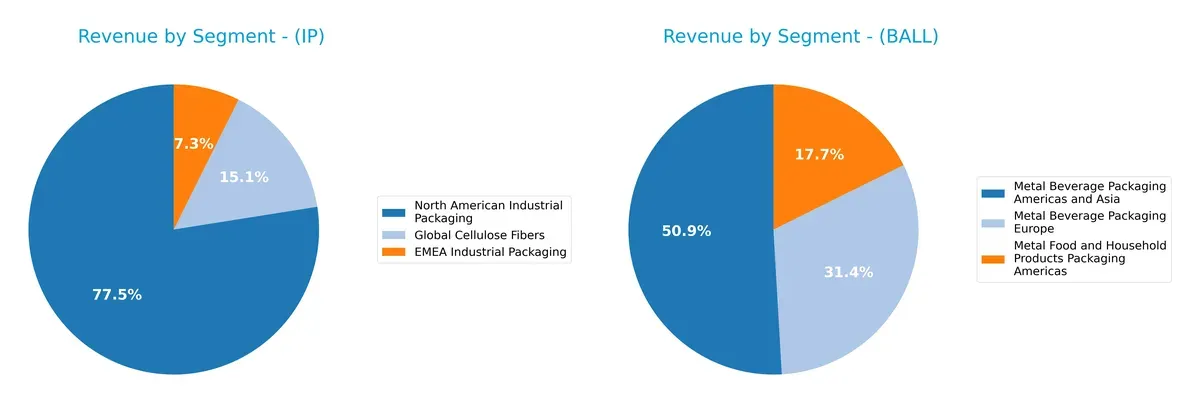

This section dissects the operational DNA of IP and BALL by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which model delivers the most resilient, sustainable advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how International Paper Company and Ball Corporation diversify their income streams and where their primary sector bets lie:

International Paper pivots heavily on North American Industrial Packaging, generating $14.3B in 2024, dwarfing its other segments. Global Cellulose Fibers and EMEA Industrial Packaging trail far behind, showing moderate diversification. Conversely, Ball Corporation maintains a more balanced mix between Metal Beverage Packaging Americas & Asia ($5.6B) and Europe ($3.5B), with Metal Food and Household Products Packaging Americas adding $1.95B. IP’s concentration signals concentration risk but also infrastructure dominance. Ball’s diversity supports ecosystem resilience amid market shifts.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of International Paper Company and Ball Corporation:

International Paper Company Strengths

- Large North American Industrial Packaging revenue

- Diverse product segments including Cellulose Fibers and Packaging

- Favorable debt-to-assets ratio at 28.46%

- Dividend yield at 4.7% supports shareholder returns

Ball Corporation Strengths

- Strong revenue from Metal Beverage Packaging in Americas and Europe

- Favorable WACC supports capital efficiency

- Positive ROE at 16.82% indicates profitability

- Solid presence in multiple geographic regions including U.S. and Others

International Paper Company Weaknesses

- Negative net margin (-14.12%) and ROE (-23.71%) indicate profitability challenges

- Negative interest coverage (-8.01) raises financial risk

- Neutral current ratio at 1.28 limits liquidity flexibility

Ball Corporation Weaknesses

- Unfavorable quick ratio (0.75) suggests liquidity concerns

- Higher debt-to-equity ratio (1.29) implies leverage risk

- Neutral net margin (6.93%) and ROIC (7.83%) limit earnings strength

International Paper shows strengths in scale and balance sheet conservatism but faces profitability and coverage challenges. Ball Corporation delivers better profitability metrics but bears liquidity and leverage risks. These aspects shape each company’s strategic priorities in capital allocation and operational management.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat alone shields long-term profits from relentless competition’s erosion. Let’s dissect each firm’s moat and its financial impact:

International Paper Company: Cost Advantage in Industrial Packaging

International Paper leverages a cost advantage through scale in containerboard production. Yet, declining ROIC and negative margins signal weakening profitability in 2026. Expansion into specialty pulps may help but risks persist.

Ball Corporation: Innovation-Driven Product Differentiation

Ball’s moat stems from technological innovation in aluminum packaging and aerospace segments. Its slightly favorable ROIC trend and stable margins contrast IP’s struggles. New aerospace contracts may strengthen Ball’s competitive edge moving forward.

Cost Leadership vs. Innovation Edge: The Moat Showdown

International Paper’s deep but eroding cost moat contrasts with Ball’s narrower but expanding innovation moat. I see Ball better positioned to defend and grow market share amid rising competition and evolving industry demands.

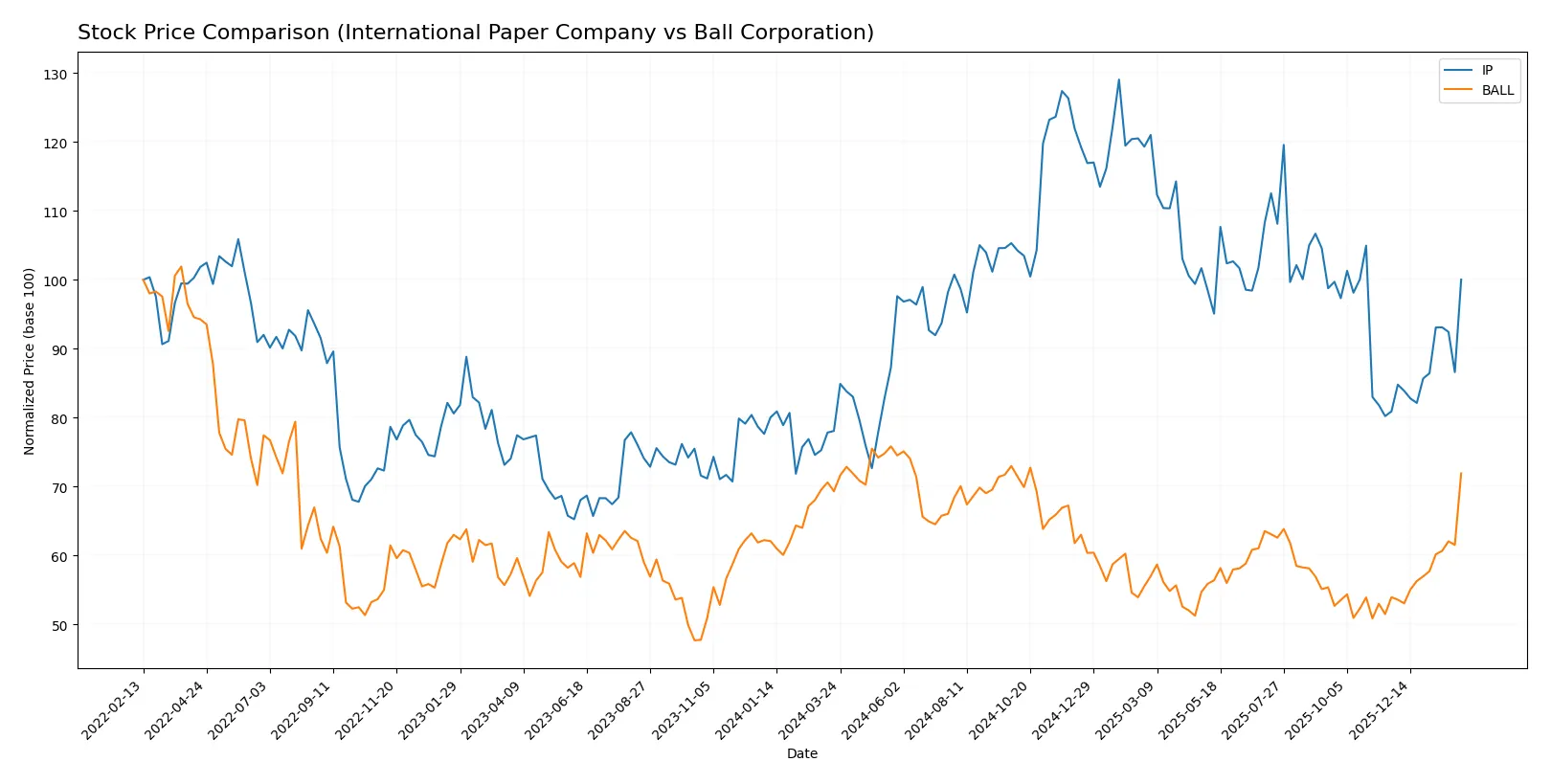

Which stock offers better returns?

Over the past year, International Paper Company’s stock surged 28.14%, showing accelerating strength and a high near 60.09. Ball Corporation climbed 3.73%, also accelerating but with a more moderate gain.

Trend Comparison

International Paper Company’s stock price rose 28.14% over the last 12 months, reflecting a clear bullish trend with acceleration and moderate volatility (6.09 std deviation). It hit a low of 33.83 and peaked at 60.09.

Ball Corporation’s shares gained 3.73% over the same period, signaling a mild bullish trend with acceleration. It experienced slightly higher volatility (6.67 std deviation), with prices ranging from 47.0 to 70.11.

Comparing both, International Paper’s stock delivered markedly stronger market performance over 12 months, outpacing Ball Corporation by over 24 percentage points.

Target Prices

Analysts present a clear target price consensus for International Paper Company and Ball Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| International Paper Company | 40 | 57.8 | 48.3 |

| Ball Corporation | 66 | 75 | 69.86 |

The consensus targets for both stocks exceed current prices, signaling moderate to strong upside potential. International Paper’s consensus is slightly above its $46.58 market price, while Ball Corporation’s target notably surpasses its $66.47 level.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following summarizes recent institutional grades for International Paper Company and Ball Corporation:

International Paper Company Grades

This table shows the latest grades issued by reputable firms for International Paper Company.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Downgrade | Neutral | 2026-02-02 |

| Citigroup | Maintain | Buy | 2026-02-02 |

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| Wells Fargo | Upgrade | Equal Weight | 2026-01-30 |

| UBS | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-06 |

| Argus Research | Maintain | Buy | 2025-12-22 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Wells Fargo | Maintain | Underweight | 2025-10-31 |

Ball Corporation Grades

This table presents the most recent grades from leading institutions for Ball Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-05 |

| JP Morgan | Maintain | Neutral | 2026-02-04 |

| Wells Fargo | Maintain | Overweight | 2026-02-04 |

| Mizuho | Maintain | Outperform | 2026-02-04 |

| Truist Securities | Maintain | Buy | 2026-02-04 |

| Jefferies | Maintain | Buy | 2026-02-04 |

| UBS | Maintain | Neutral | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-06 |

| Citigroup | Upgrade | Buy | 2026-01-06 |

| Wells Fargo | Upgrade | Overweight | 2026-01-06 |

Which company has the best grades?

Ball Corporation consistently earns more positive ratings, including multiple “Buy” and “Outperform” grades. International Paper shows mixed grades with some downgrades and Neutral ratings. Investors may perceive Ball as having stronger institutional endorsement.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

International Paper Company

- Faces margin pressure with a -14.12% net margin and negative ROIC, signaling competitive challenges.

Ball Corporation

- Maintains positive margins and ROE, but faces intense competition in beverage packaging.

2. Capital Structure & Debt

International Paper Company

- Moderate debt-to-equity ratio (0.73) with negative interest coverage (-8.01) raises solvency concerns.

Ball Corporation

- Higher debt-to-equity (1.29) with positive interest coverage (4.59) shows manageable leverage risk.

3. Stock Volatility

International Paper Company

- Beta 1.07 indicates moderate volatility aligned with market swings.

Ball Corporation

- Beta 1.14 suggests slightly higher volatility, reflecting sensitivity to market changes.

4. Regulatory & Legal

International Paper Company

- Global operations expose it to varying packaging industry regulations and compliance costs.

Ball Corporation

- Aerospace and defense segments increase regulatory complexity and legal risk.

5. Supply Chain & Operations

International Paper Company

- Broad geographic footprint exposes IP to supply chain disruptions in multiple regions.

Ball Corporation

- Dependence on specialized aerospace components adds operational risk and supplier dependency.

6. ESG & Climate Transition

International Paper Company

- Paper industry faces rising sustainability demands impacting raw material sourcing and emissions.

Ball Corporation

- Aluminum packaging and aerospace sectors face carbon reduction pressures and evolving ESG standards.

7. Geopolitical Exposure

International Paper Company

- Operates in diverse regions including Middle East and Asia, vulnerable to geopolitical tensions.

Ball Corporation

- International beverage and aerospace markets expose Ball to trade and defense policy risks.

Which company shows a better risk-adjusted profile?

International Paper’s most impactful risk is its poor profitability and negative interest coverage, raising financial distress concerns. Ball Corporation’s key risk lies in its high leverage and reliance on aerospace contracts amid regulatory complexities. Ball’s stronger ROE, Piotroski score of 7, and moderate Altman Z-Score suggest a better risk-adjusted profile. The recent negative margins and Altman Z-Score of 1.25 for International Paper justify heightened caution.

Final Verdict: Which stock to choose?

International Paper’s superpower lies in its resilient cash flow generation, supported by strong operational efficiency despite recent earnings volatility. Its key point of vigilance is the ongoing value erosion reflected in declining returns on invested capital. It fits portfolios seeking cyclical recovery plays with a tolerance for operational turnaround risk.

Ball Corporation’s strategic moat comes from its solid recurring revenue streams and improving profitability, underpinned by a steadily growing return on capital. Compared to International Paper, it offers a safer financial profile but commands a moderate valuation premium. It suits investors targeting steady growth with an emphasis on capital discipline.

If you prioritize opportunistic value plays with potential for operational rebound, International Paper presents a compelling scenario despite its current challenges. However, if you seek more consistent profitability and financial stability, Ball Corporation outshines as the better fit, offering a smoother risk-reward balance in today’s market. Both cases require careful risk monitoring given their respective financial dynamics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of International Paper Company and Ball Corporation to enhance your investment decisions: