In today’s fast-evolving digital economy, DoorDash, Inc. (DASH) and Baidu, Inc. (BIDU) stand out as influential players in the internet content and information sector. DoorDash excels in logistics and food delivery primarily in the U.S., while Baidu leads in AI-driven online marketing and cloud services in China. This comparison explores their innovative strategies and market positions to help you decide which company holds the most promise for your investment portfolio. Let’s uncover which stock might be the smarter choice for your wallet.

Table of contents

Companies Overview

I will begin the comparison between DoorDash and Baidu by providing an overview of these two companies and their main differences.

DoorDash Overview

DoorDash, Inc. operates a logistics platform connecting merchants, consumers, and dashers primarily in the US and internationally. It offers marketplaces like DoorDash and Wolt, membership services, white-label delivery, and digital ordering solutions. Founded in 2013 and headquartered in San Francisco, DoorDash focuses on solving critical merchant challenges including delivery, payment, and customer support, positioning itself as a leader in internet content and logistics.

Baidu Overview

Baidu, Inc. provides online marketing and cloud services through an internet platform mainly serving China. It operates two segments: Baidu Core, offering search-based marketing, cloud, and AI products, and iQIYI, an online entertainment video platform. Founded in 2000 and headquartered in Beijing, Baidu is a major player in internet content and communication services, focusing on digital advertising, AI, and streaming media.

Key similarities and differences

Both DoorDash and Baidu operate in the Communication Services sector with internet content at their core, but they target different markets and business models. DoorDash emphasizes logistics and on-demand delivery with membership and merchant services, while Baidu focuses on online marketing, cloud computing, AI, and entertainment streaming. Their geographic focus also differs, with DoorDash strong in the US and Baidu in China.

Income Statement Comparison

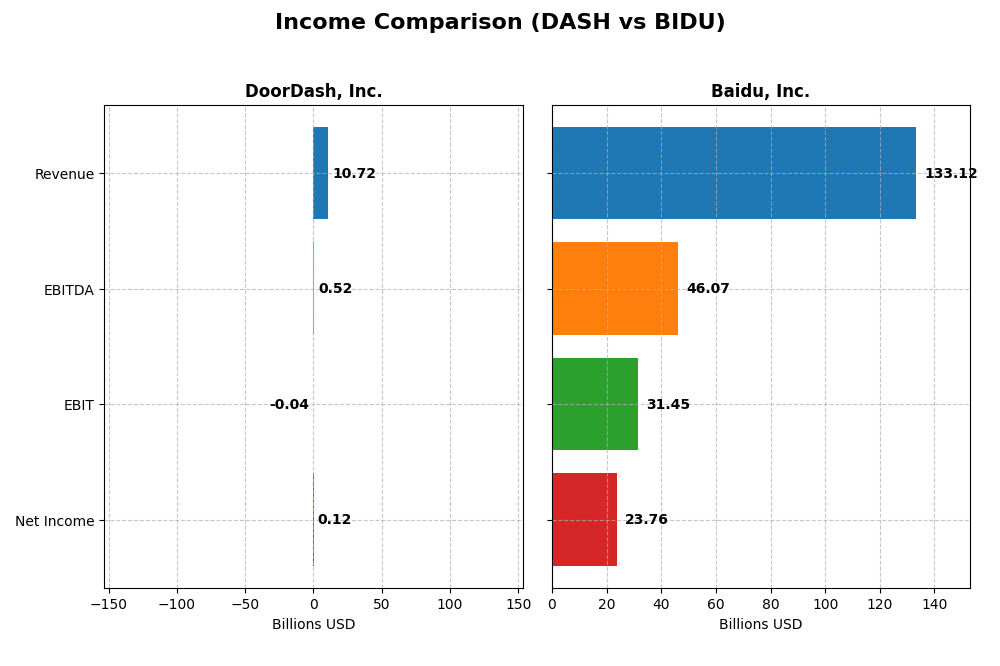

This table compares key income statement metrics for DoorDash, Inc. and Baidu, Inc. for the fiscal year 2024, reflecting their most recent financial results.

| Metric | DoorDash, Inc. (DASH) | Baidu, Inc. (BIDU) |

|---|---|---|

| Market Cap | 92.6B USD | 51.6B USD |

| Revenue | 10.7B USD | 133.1B CNY |

| EBITDA | 523M USD | 46.1B CNY |

| EBIT | -38M USD | 31.4B CNY |

| Net Income | 123M USD | 23.8B CNY |

| EPS | 0.30 USD | 66.48 CNY |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

DoorDash, Inc.

DoorDash showed strong revenue growth from 2020 to 2024, rising from $2.9B to $10.7B, with net income turning positive in 2024 at $123M after several years of losses. Gross margins improved steadily to 48.3%, reflecting efficient cost management. The latest year demonstrated a 24% revenue increase and a favorable margin expansion, signaling improving profitability dynamics.

Baidu, Inc.

Baidu’s revenue increased moderately over the period, reaching CNY 133B in 2024, though a slight decline of 1.1% occurred from 2023 to 2024. Net income grew to CNY 23.8B, supported by a stable gross margin of 50.3% and a strong EBIT margin of 23.6%. Despite the recent revenue dip, Baidu maintained favorable net margin growth and solid earnings per share expansion.

Which one has the stronger fundamentals?

DoorDash exhibits rapid revenue and net income growth with improving margins, but still posts a slim EBIT margin and modest net margin. Baidu shows higher absolute profitability and stronger EBIT and net margins but faces recent revenue contraction and margin pressures overall. Both have favorable income statement evaluations, with DoorDash emphasizing growth and Baidu stability and profitability.

Financial Ratios Comparison

Below is a comparison of key financial ratios for DoorDash, Inc. and Baidu, Inc. based on their most recent fiscal year data for 2024.

| Ratios | DoorDash, Inc. (DASH) | Baidu, Inc. (BIDU) |

|---|---|---|

| ROE | 1.58% | 9.01% |

| ROIC | -0.34% | 4.87% |

| P/E | 561.3 | 9.03 |

| P/B | 8.85 | 0.81 |

| Current Ratio | 1.66 | 2.09 |

| Quick Ratio | 1.66 | 2.01 |

| D/E | 0.069 | 0.301 |

| Debt-to-Assets | 4.17% | 18.54% |

| Interest Coverage | 0 | 7.53 |

| Asset Turnover | 0.83 | 0.31 |

| Fixed Asset Turnover | 9.19 | 3.25 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

DoorDash, Inc.

DoorDash’s financial ratios present a mixed picture with 35.7% favorable and 57.1% unfavorable indicators, signaling overall weakness. Profitability ratios such as net margin (1.15%) and return on equity (1.58%) are notably low, while valuation metrics like PE (561.28) and PB (8.85) appear stretched. The company does not pay dividends, likely due to its negative returns and reinvestment focus.

Baidu, Inc.

Baidu shows stronger financial health with 71.4% favorable ratios and 28.6% unfavorable, reflecting better profitability and valuation metrics. It boasts a healthy net margin (17.85%) and low PE (9.03), alongside solid liquidity (current ratio 2.09) and interest coverage (11.14). Baidu also does not pay dividends, possibly due to prioritizing growth and reinvestment in R&D and acquisitions.

Which one has the best ratios?

Baidu holds the advantage with a higher proportion of favorable ratios, supported by stronger profitability, valuation, and liquidity metrics. DoorDash, while showing some liquidity strengths and low leverage, faces significant challenges in profitability and valuation, leading to an overall unfavorable ratio assessment compared to Baidu.

Strategic Positioning

This section compares the strategic positioning of DoorDash and Baidu, including market position, key segments, and exposure to technological disruption:

DoorDash, Inc.

- Leading US and international logistics platform facing competitive pressure in delivery services.

- Focused on marketplaces, platform services, digital ordering, and delivery fulfillment solutions.

- Operates in logistics and digital ordering with moderate exposure to tech disruption in delivery innovation.

Baidu, Inc.

- Major Chinese internet platform with competitive pressure in online marketing and cloud.

- Key segments include online marketing, cloud services, AI products, and entertainment video platform.

- Exposed to technological disruption through AI initiatives and evolving online marketing trends.

DoorDash vs Baidu Positioning

DoorDash adopts a concentrated strategy centered on delivery and logistics marketplaces, while Baidu pursues a diversified approach across search, cloud, AI, and entertainment. DoorDash’s focus supports platform specialization; Baidu’s breadth spans multiple digital service sectors, each with distinct operational risks and opportunities.

Which has the best competitive advantage?

Baidu shows a slightly favorable moat with growing profitability, indicating improving competitive positioning. DoorDash is slightly unfavorable, shedding value despite rising ROIC, suggesting weaker current economic moat strength.

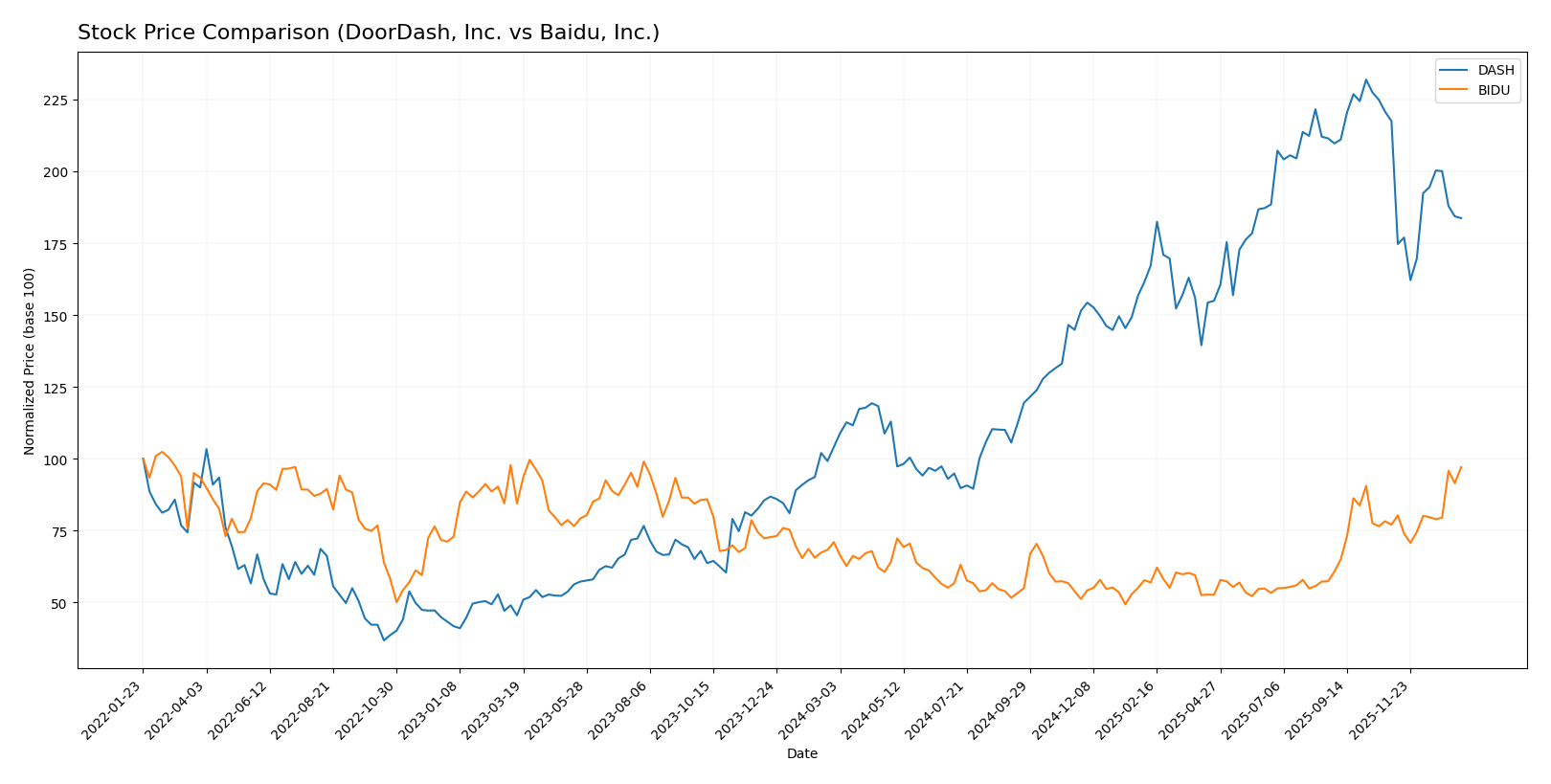

Stock Comparison

The stock price chart over the past 12 months highlights significant bullish trends for both DoorDash, Inc. and Baidu, Inc., with contrasting recent movements showing DoorDash’s deceleration and Baidu’s accelerating upward momentum.

Trend Analysis

DoorDash, Inc. (DASH) recorded a strong 76.47% price increase over the past year, indicating a bullish trend with deceleration. The stock exhibited high volatility, ranging from 104.74 to 271.22, but recently declined by 15.53%.

Baidu, Inc. (BIDU) posted a 36.73% gain over the year, confirming a bullish trend with acceleration. The price fluctuated between 77.43 and 152.26, and recently surged 25.97%, showing positive momentum.

Comparing both, DoorDash delivered the highest market performance with a 76.47% increase versus Baidu’s 36.73%, despite recent contrasting short-term trends.

Target Prices

The consensus target prices for DoorDash, Inc. and Baidu, Inc. reflect positive analyst expectations for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| DoorDash, Inc. | 350 | 239 | 292.45 |

| Baidu, Inc. | 215 | 110 | 162.13 |

Analysts see DoorDash’s stock price (214.87 USD) as undervalued relative to a consensus target of 292.45 USD. Baidu’s current price (152.26 USD) is close but still below its target consensus of 162.13 USD, suggesting further upside potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for DoorDash, Inc. and Baidu, Inc.:

Rating Comparison

DoorDash, Inc. Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: Moderate score of 3, indicating fair valuation.

- ROE Score: Moderate score of 3, showing average efficiency in equity use.

- ROA Score: Favorable score of 4, reflecting effective asset utilization.

- Debt To Equity Score: Moderate score of 2, suggesting balanced financial risk.

- Overall Score: Moderate score of 2, summarizing financial standing.

Baidu, Inc. Rating

- Rating: B-, also considered very favorable overall.

- Discounted Cash Flow Score: Moderate score of 3, indicating fair valuation.

- ROE Score: Moderate score of 2, slightly lower efficiency than DoorDash.

- ROA Score: Moderate score of 3, less effective asset use than DoorDash.

- Debt To Equity Score: Moderate score of 2, similar financial risk profile.

- Overall Score: Moderate score of 2, summarizing financial standing.

Which one is the best rated?

Both DoorDash and Baidu share an identical overall rating of B- and similar overall scores. DoorDash has slightly higher scores in ROE and ROA, indicating better efficiency and asset use, while other scores are comparable.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for DoorDash, Inc. and Baidu, Inc.:

DoorDash Scores

- Altman Z-Score: 7.42, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, considered average financial strength.

Baidu Scores

- Altman Z-Score: 0.89, indicating a distress zone with high bankruptcy risk.

- Piotroski Score: 3, considered very weak financial strength.

Which company has the best scores?

DoorDash has significantly better scores, with a strong Altman Z-Score in the safe zone and an average Piotroski Score, while Baidu’s scores indicate financial distress and very weak strength.

Grades Comparison

Here is the comparison of recent grades assigned to DoorDash, Inc. and Baidu, Inc.:

DoorDash, Inc. Grades

The table below shows recent grades and rating actions by recognized analysts for DoorDash, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-08 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-08 |

| Wedbush | Maintain | Outperform | 2025-12-19 |

| Argus Research | Maintain | Buy | 2025-12-12 |

| Jefferies | Maintain | Buy | 2025-12-11 |

| Jefferies | Upgrade | Buy | 2025-11-19 |

| Guggenheim | Maintain | Buy | 2025-11-19 |

| Needham | Maintain | Buy | 2025-11-14 |

| Wedbush | Upgrade | Outperform | 2025-11-13 |

| Mizuho | Maintain | Outperform | 2025-11-12 |

DoorDash’s grades show a strong consensus in the Buy to Outperform range, with several recent upgrades and no sell ratings.

Baidu, Inc. Grades

Below is a summary of recent grades and rating actions by reputable firms for Baidu, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | Maintain | Buy | 2026-01-07 |

| Jefferies | Maintain | Buy | 2026-01-02 |

| JP Morgan | Upgrade | Overweight | 2025-11-24 |

| Benchmark | Maintain | Buy | 2025-11-19 |

| B of A Securities | Maintain | Buy | 2025-11-19 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-19 |

| Barclays | Maintain | Equal Weight | 2025-11-19 |

| Goldman Sachs | Maintain | Buy | 2025-11-19 |

| Macquarie | Upgrade | Outperform | 2025-10-10 |

| DBS Bank | Upgrade | Buy | 2025-09-25 |

Baidu maintains a predominantly Buy consensus with some Equal Weight ratings, complemented by several recent upgrades but no sell recommendations.

Which company has the best grades?

Both DoorDash and Baidu have received primarily Buy and Outperform grades, reflecting positive analyst sentiment. DoorDash shows a slightly stronger emphasis on upgrades to Outperform, while Baidu has a mix of Buy and Equal Weight ratings. Investors might interpret DoorDash’s grades as indicating more consistent bullish momentum, whereas Baidu’s ratings suggest cautious optimism with balanced views.

Strengths and Weaknesses

Below is a comparative analysis of key strengths and weaknesses for DoorDash, Inc. (DASH) and Baidu, Inc. (BIDU) based on their most recent financial and operational data.

| Criterion | DoorDash, Inc. (DASH) | Baidu, Inc. (BIDU) |

|---|---|---|

| Diversification | Focused mainly on marketplaces and platform services; limited diversification across sectors. | Diversified with strong online marketing and other product/service segments. |

| Profitability | Low net margin (1.15%) and negative ROIC (-0.34%), indicating value destruction despite growing profitability. | Solid net margin (17.85%) but ROIC (4.87%) slightly below WACC, suggesting improving but not yet strong profitability. |

| Innovation | Moderate innovation with growing ROIC trend but high valuation multiples (PE 561.28) imply market expectations. | Consistent innovation in AI and search technologies with favorable valuation (PE 9.03) supporting growth potential. |

| Global presence | Primarily US-focused, limiting international market exposure. | Strong presence in China and expanding global reach in AI and cloud services. |

| Market Share | Leading in US food delivery with $10.7B revenue in 2024, but intense competition. | Leading in Chinese online marketing services with CNY 81.2B revenue in 2023, broadening product base. |

Key takeaways: DoorDash shows promising growth but struggles with profitability and diversification, posing higher investment risk. Baidu demonstrates more balanced strengths with favorable financial ratios and diversified revenue streams, making it a comparatively safer investment choice at this time.

Risk Analysis

Below is a comparative table outlining key risks for DoorDash, Inc. (DASH) and Baidu, Inc. (BIDU) as of 2024:

| Metric | DoorDash, Inc. (DASH) | Baidu, Inc. (BIDU) |

|---|---|---|

| Market Risk | High beta of 1.7 indicates elevated volatility and sensitivity to market swings. | Low beta of 0.29 suggests lower market volatility exposure. |

| Debt level | Very low debt-to-equity at 0.07; low financial leverage, favorable. | Moderate debt-to-equity at 0.3; manageable but higher leverage risk. |

| Regulatory Risk | Moderate, operating primarily in US with evolving gig economy regulations. | High, due to Chinese regulatory environment and government scrutiny of tech firms. |

| Operational Risk | Moderate, dependent on delivery logistics and marketplace performance. | Moderate, reliant on AI and content platforms with competitive tech landscape. |

| Environmental Risk | Low, limited direct environmental impact from platform business. | Low to moderate, some data center energy use but no heavy manufacturing. |

| Geopolitical Risk | Low, US-based with stable political environment. | High, exposed to China-US tensions and domestic regulatory shifts. |

In synthesis, Baidu faces the most impactful risks from regulatory and geopolitical pressures, significantly affecting its financial stability given its distress zone Altman Z-Score (0.89) and weak Piotroski score (3). DoorDash’s primary risks lie in market volatility and operational execution, although its strong balance sheet and safe zone bankruptcy score (7.42) provide a cushion. Investors should weigh Baidu’s regulatory and political uncertainties carefully against DoorDash’s higher market risk but better financial footing.

Which Stock to Choose?

DoorDash, Inc. (DASH) shows strong income growth with a 271.52% revenue increase over 2020-2024 and favorable profitability trends despite an unfavorable overall financial ratios evaluation. Its low debt and current ratio above 1.6 indicate solid liquidity, but its ROIC below WACC signals value destruction. The company holds a very favorable rating of B- with moderate scores on key metrics.

Baidu, Inc. (BIDU) presents a favorable income statement with a 24.33% revenue growth over the period and robust profitability margins. Its financial ratios are globally favorable, supported by reasonable debt levels and strong liquidity ratios. Although its ROIC is slightly below WACC, the trend is positive. BIDU’s rating is also very favorable at B-, but with some moderate scores and weaker bankruptcy risk indicators.

Investors seeking growth might view DoorDash’s accelerating income and improving profitability as attractive despite some financial ratio weaknesses and value shedding. Conversely, Baidu’s more balanced financial profile and favorable ratio evaluation could appeal to those prioritizing stability and quality with a slightly favorable moat. The choice may depend on one’s risk tolerance and investment focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of DoorDash, Inc. and Baidu, Inc. to enhance your investment decisions: