Home > Comparison > Real Estate > AVB vs INVH

The strategic rivalry between AvalonBay Communities, Inc. and Invitation Homes Inc. shapes the competitive landscape of the residential REIT sector. AvalonBay operates as a capital-intensive developer and manager of large-scale apartment communities in key metropolitan regions. Invitation Homes focuses on single-family home leasing, emphasizing high-touch service and lifestyle adaptation. This analysis contrasts their operational models to determine which offers a superior risk-adjusted return for diversified portfolios amid evolving real estate dynamics.

Table of contents

Companies Overview

AvalonBay Communities and Invitation Homes dominate the US residential REIT market with distinct asset focuses and growth strategies.

AvalonBay Communities, Inc.: Premier Apartment REIT

AvalonBay Communities is a leading equity REIT specializing in apartment communities across key metropolitan areas. It generates revenue through developing, acquiring, and managing 291 apartment communities totaling 86K homes. In 2020, it strategically expanded in high-demand markets like New England, California, and Florida, emphasizing urban growth corridors and redevelopment projects.

Invitation Homes Inc.: Top Single-Family Rental Operator

Invitation Homes stands as the nation’s premier single-family home leasing company. It earns revenue by leasing high-quality, updated homes that cater to lifestyle demands near jobs and schools. Its 2020 focus centered on enhancing resident experiences through service and maintaining a portfolio optimized for suburban family living, reflecting a customer-centric growth approach.

Strategic Collision: Similarities & Divergences

Both companies operate in the residential REIT sector but follow different philosophies: AvalonBay invests in high-density urban apartments, while Invitation Homes targets single-family suburban homes. Their primary battleground is the US housing rental market, split between metropolitan and suburban demographics. This divergence creates distinct investment profiles—AvalonBay leans on urban scale and redevelopment, Invitation Homes on lifestyle-driven rental demand.

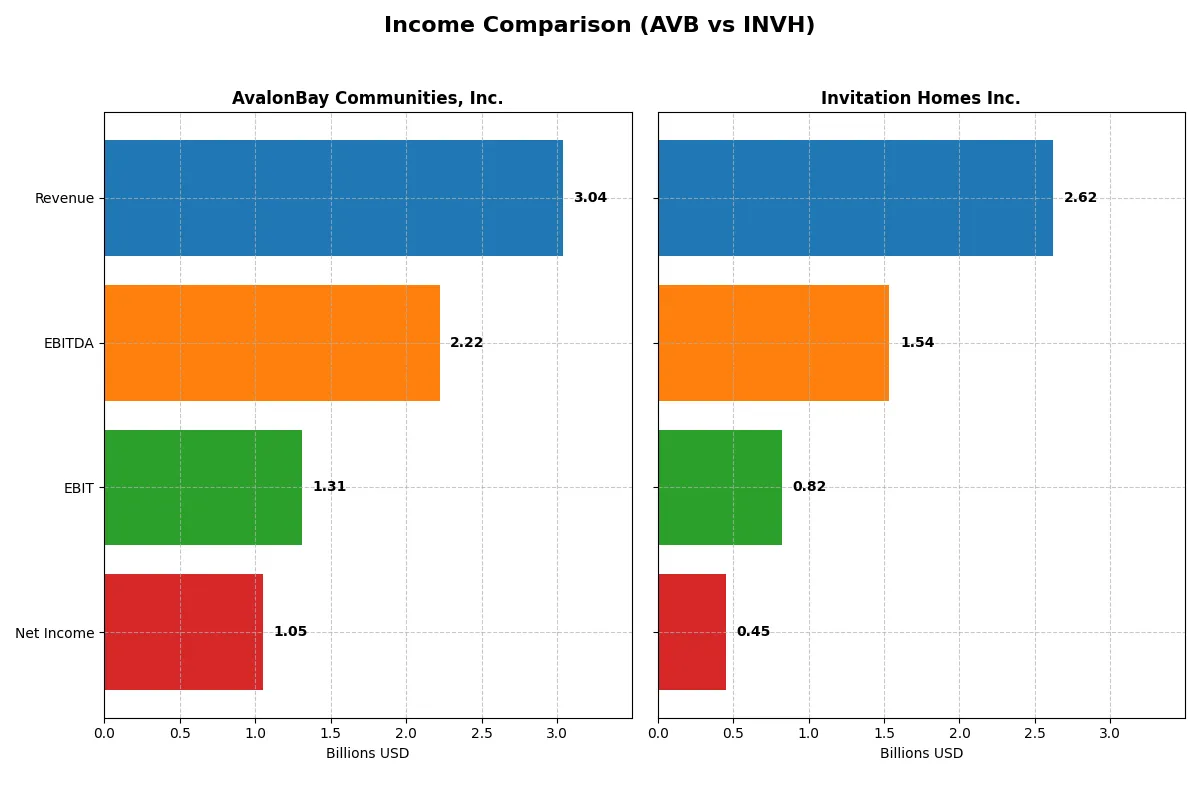

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | AvalonBay Communities, Inc. (AVB) | Invitation Homes Inc. (INVH) |

|---|---|---|

| Revenue | 3.04B | 2.62B |

| Cost of Revenue | 1.00B | 1.07B |

| Operating Expenses | 889M | 805M |

| Gross Profit | 2.04B | 1.55B |

| EBITDA | 2.22B | 1.54B |

| EBIT | 1.31B | 821M |

| Interest Expense | 259M | 366M |

| Net Income | 1.05B | 453M |

| EPS | 7.40 | 0.74 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability of AvalonBay Communities, Inc. and Invitation Homes Inc. over recent years.

AvalonBay Communities, Inc. Analysis

AvalonBay’s revenue grew steadily from 2.29B in 2021 to 3.04B in 2025, marking a 32% increase. Its net income rose modestly to 1.05B in 2025, reflecting strong gross (67%) and net margins (35%). Despite a slight dip in EBIT and net margin growth last year, AvalonBay maintains robust operational efficiency and margin discipline.

Invitation Homes Inc. Analysis

Invitation Homes expanded revenue from 1.83B in 2020 to 2.62B in 2024, a 44% jump. Net income more than doubled to 454M in 2024, supported by improving gross (59%) and net margins (17%). However, recent declines in EBIT and net margin growth signal margin pressure, while interest expenses weigh heavily on profitability.

Margin Resilience vs. Rapid Growth

AvalonBay leads with superior margin health and consistent profitability, emphasizing operational efficiency. Invitation Homes showcases stronger revenue and net income growth but struggles with higher interest costs and margin softness. Investors seeking stable, high-margin cash flow may favor AvalonBay’s profile, while those prioritizing growth might consider Invitation Homes’ expansive trajectory.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared here:

| Ratios | AvalonBay Communities, Inc. (AVB) | Invitation Homes Inc. (INVH) |

|---|---|---|

| ROE | 9.06% | 4.65% |

| ROIC | 4.52% | 4.02% |

| P/E | 28.87 | 43.14 |

| P/B | 2.62 | 2.01 |

| Current Ratio | 0.36 | 0.82 |

| Quick Ratio | 0.36 | 0.82 |

| D/E | 0.69 | 0.84 |

| Debt-to-Assets | 39.3% | 43.9% |

| Interest Coverage | 4.04 | 2.02 |

| Asset Turnover | 0.14 | 0.14 |

| Fixed Asset Turnover | 18.84 | 36.61 |

| Payout ratio | 88.9% | 152% |

| Dividend yield | 3.08% | 3.52% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and highlighting operational strengths or weaknesses.

AvalonBay Communities, Inc.

AvalonBay posts a solid net margin of 37.13% but a modest ROE of 9.06%, signaling limited equity efficiency. The P/E ratio at 28.87 flags a stretched valuation. Its 3.08% dividend yield rewards shareholders steadily, balancing slower growth with income stability.

Invitation Homes Inc.

Invitation Homes shows a lower net margin at 17.33% and a weaker ROE of 4.65%, reflecting less profitability. Its P/E ratio of 43.14 indicates an expensive stock. A 3.52% dividend yield compensates investors, though reinvestment in growth appears limited given subdued returns.

Valuation Stretch vs. Profitability Trade-Off

AvalonBay offers a better margin profile and a reasonable dividend yield, though its valuation is also stretched. Invitation Homes is pricier with weaker profitability but a slightly higher dividend. Investors seeking income with moderate operational efficiency may prefer AvalonBay’s profile.

Which one offers the Superior Shareholder Reward?

I compare AvalonBay Communities, Inc. (AVB) and Invitation Homes Inc. (INVH) on dividend yield, payout ratio, and buyback intensity for 2026. AVB yields 3.08% with an 89% payout ratio, demonstrating strong free cash flow coverage. INVH yields 3.52% but pays out 152% of earnings, signaling less sustainable dividends. AVB’s robust buyback program and prudent capital allocation align with long-term value creation. INVH’s aggressive payouts and weaker free cash flow coverage increase risk. I conclude AVB offers the superior total return profile in 2026, balancing yield and sustainability.

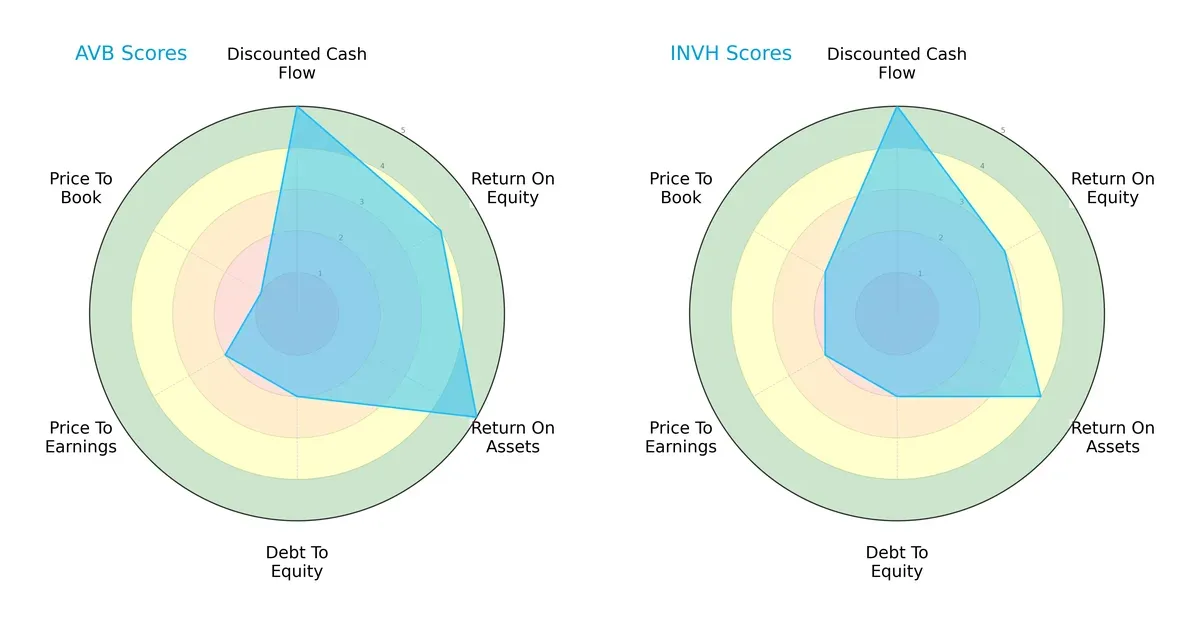

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of AvalonBay Communities, Inc. and Invitation Homes Inc., highlighting their financial strengths and vulnerabilities:

AvalonBay displays a more balanced profile with higher scores in ROE (4 vs. 3) and ROA (5 vs. 4), signaling better asset utilization and profitability. Both firms share identical DCF (5) and debt-to-equity (2) scores, indicating similar valuation appeal and financial risk. Invitation Homes edges slightly on price-to-book (2 vs. 1), suggesting a more favorable market valuation. AvalonBay’s strength lies in operational efficiency, while Invitation Homes relies more on valuation metrics.

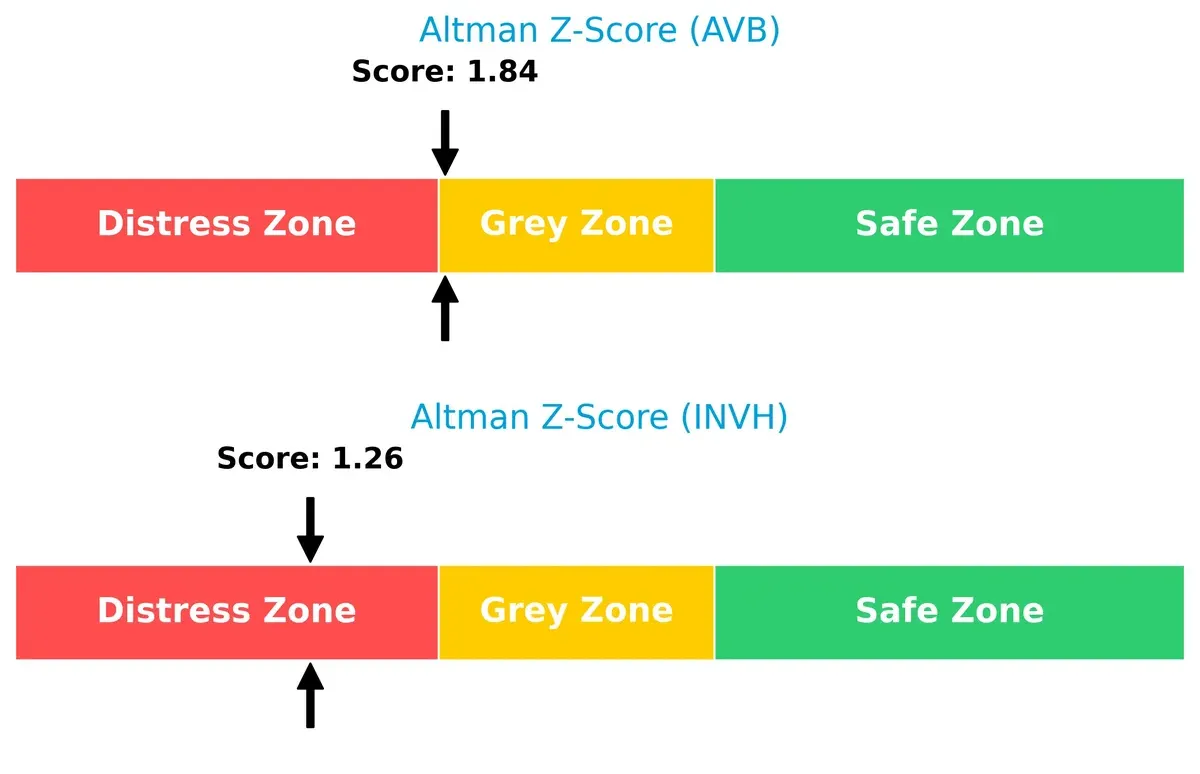

Bankruptcy Risk: Solvency Showdown

AvalonBay’s Altman Z-Score of 1.84 places it in the grey zone, indicating moderate bankruptcy risk. Invitation Homes scores lower at 1.26, residing in the distress zone, signaling higher financial vulnerability and survival risk in this cycle:

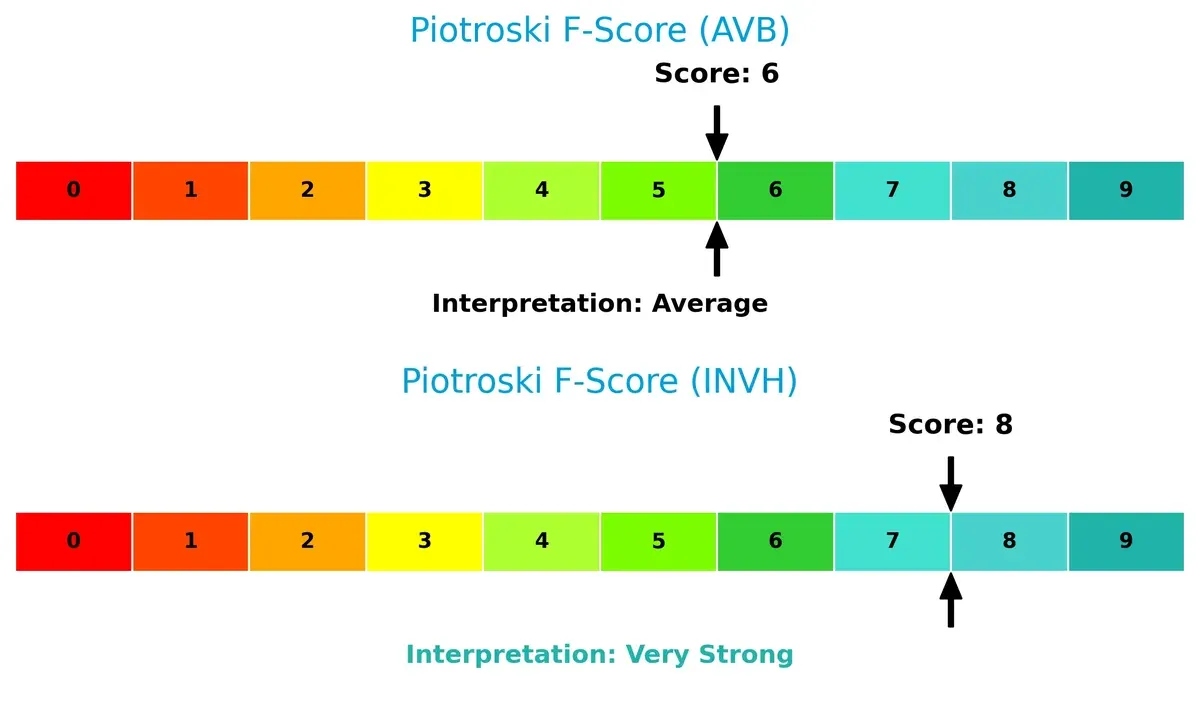

Financial Health: Quality of Operations

Invitation Homes scores an impressive 8 on the Piotroski F-Score, reflecting robust financial health and effective internal controls. AvalonBay’s score of 6 indicates average health, with some caution warranted compared to its peer:

How are the two companies positioned?

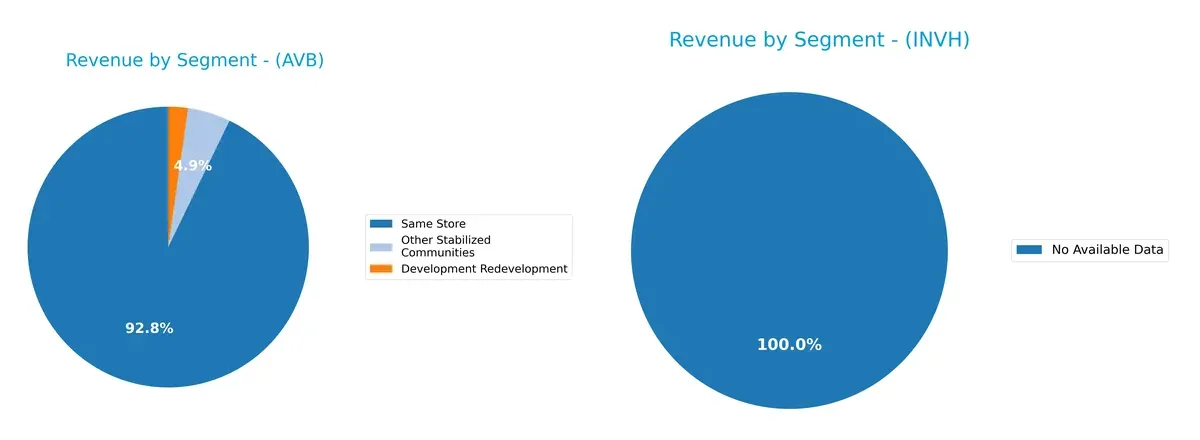

This section dissects AVB and INVH’s operational DNA by comparing their revenue distribution by segment alongside their internal strengths and weaknesses. The goal is to confront their economic moats to reveal which model delivers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how AvalonBay Communities, Inc. and Invitation Homes Inc. diversify their income streams and where their primary sector bets lie:

AvalonBay relies heavily on its “Same Store” or “Established Communities” segment, generating over 2.5B in 2023. Its “Development Redevelopment” and “Other Stabilized Communities” segments contribute modestly, around 61M and 135M respectively. Invitation Homes lacks available data, so I cannot assess its diversification. AvalonBay’s concentrated revenue underscores its ecosystem lock-in in residential real estate, but also reveals concentration risk if market conditions sour.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of AvalonBay Communities, Inc. (AVB) and Invitation Homes Inc. (INVH):

AVB Strengths

- High net margin at 37.13%

- Favorable interest coverage at 5.05

- Strong fixed asset turnover at 18.84

- Dividend yield of 3.08%

- Neutral debt-to-assets ratio at 39.29%

INVH Strengths

- Favorable net margin at 17.33%

- Higher fixed asset turnover at 36.61

- Dividend yield of 3.52%

- Neutral quick ratio at 0.82

- Neutral debt-to-assets at 43.86%

AVB Weaknesses

- Low current and quick ratios at 0.36

- Unfavorable ROE at 9.06% and ROIC at 4.52%

- PE ratio high at 28.87

- Low asset turnover at 0.14

- Slightly unfavorable global ratios opinion

INVH Weaknesses

- Low current ratio at 0.82

- Unfavorable ROE at 4.65% and ROIC at 4.02%

- PE ratio very high at 43.14

- Neutral interest coverage at 2.24

- Asset turnover low at 0.14

Both companies show strong profitability in net margins and dividend yields. AVB maintains better interest coverage and asset efficiency, while INVH has a higher fixed asset turnover. Both face liquidity concerns and modest returns on equity and invested capital, suggesting cautious capital management in their strategies.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only barrier protecting long-term profits from relentless competition erosion:

AvalonBay Communities, Inc.: Location and Scale Moat

AvalonBay leverages prime urban locations and scale to maintain premium rents and margin stability. Despite ROIC below WACC, improving profitability hints at moat strengthening in 2026.

Invitation Homes Inc.: Asset Specialization and Service Moat

Invitation Homes relies on single-family home specialization and high-touch resident services, differentiating from AvalonBay’s multifamily focus. Its rising ROIC signals a deepening moat amid market expansion.

Urban Density vs. Residential Niche: The Moat Face-off

Both firms currently shed value with ROIC below WACC but show improving profitability trends. Invitation Homes’ asset specialization and service model suggest a deeper moat, better poised to defend market share.

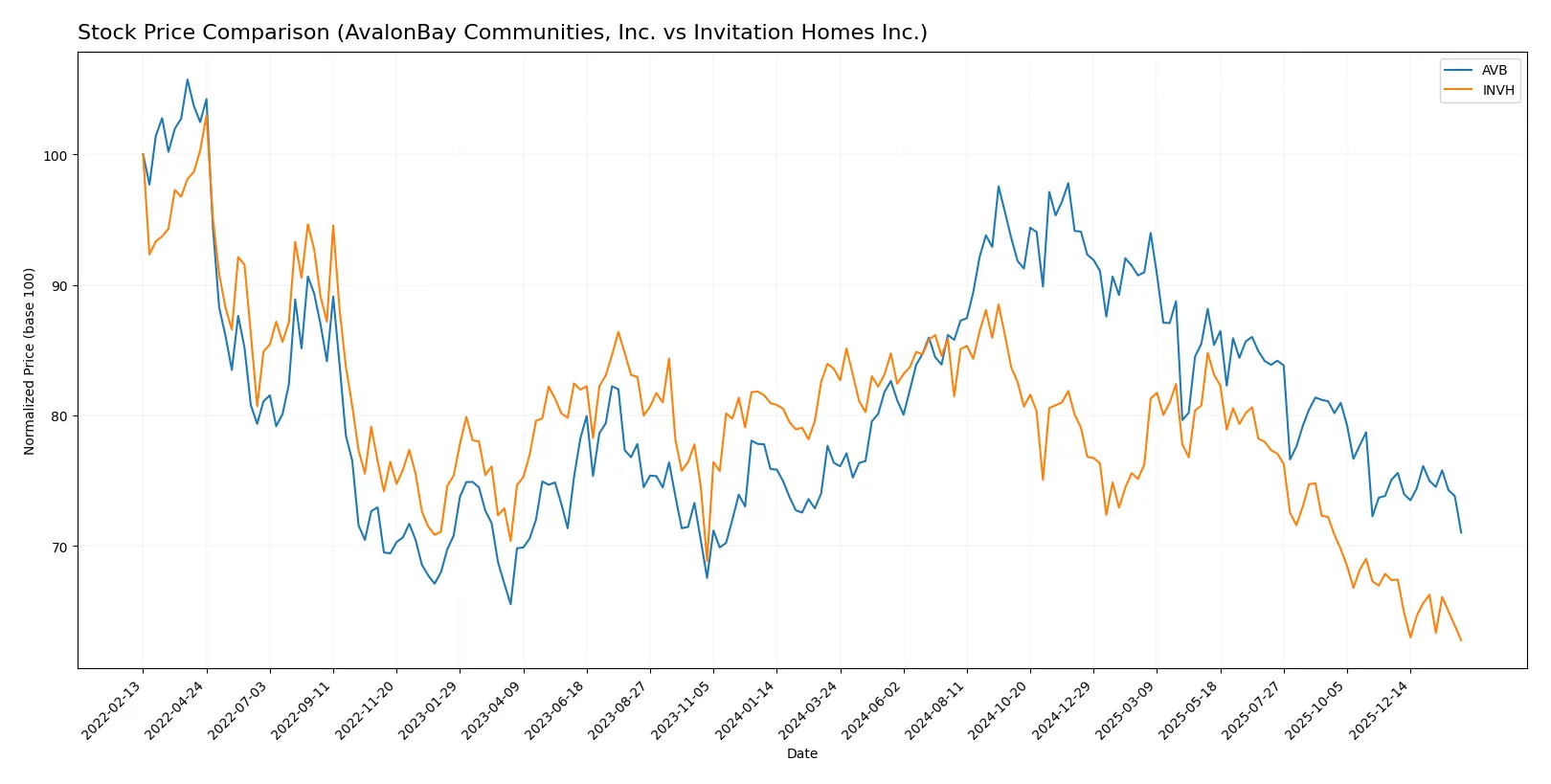

Which stock offers better returns?

Both AvalonBay Communities, Inc. and Invitation Homes Inc. show bearish trends over the past year, with notable price declines and decelerating momentum in their stock movements.

Trend Comparison

AvalonBay Communities, Inc. (AVB) experienced a 7.0% price decline over the past 12 months, reflecting a bearish trend with decelerating loss momentum and higher volatility at 16.8%. The stock’s highest price reached 235.35, while the lowest fell to 170.97.

Invitation Homes Inc. (INVH) posted a sharper bearish trend with a 24.9% price drop over the same period. It showed decelerating trend losses and lower volatility at 2.87%, with a high of 37.02 and a low of 26.26.

Comparing both, AVB’s price decline was less severe than INVH’s, indicating AVB delivered relatively better market performance despite both showing bearish trends.

Target Prices

Analysts present a cautious but optimistic consensus on these residential REITs.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| AvalonBay Communities, Inc. | 172 | 217 | 193.9 |

| Invitation Homes Inc. | 27 | 40 | 33.29 |

AvalonBay’s consensus target sits 13.5% above its current price, signaling moderate upside potential. Invitation Homes shows a more bullish spread, with targets up to 53% above its recent price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

AvalonBay Communities, Inc. Grades

The following table lists recent grades from established grading companies for AvalonBay Communities, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-20 |

| Barclays | Maintain | Overweight | 2026-01-13 |

| UBS | Maintain | Neutral | 2026-01-08 |

| Colliers Securities | Downgrade | Neutral | 2025-12-04 |

| Truist Securities | Maintain | Buy | 2025-12-02 |

| Barclays | Upgrade | Overweight | 2025-11-25 |

| Mizuho | Maintain | Neutral | 2025-11-24 |

| Morgan Stanley | Maintain | Overweight | 2025-11-13 |

| UBS | Maintain | Neutral | 2025-11-10 |

| Wells Fargo | Maintain | Overweight | 2025-11-10 |

Invitation Homes Inc. Grades

Below is a summary of recent grades from recognized grading companies for Invitation Homes Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Scotiabank | Maintain | Sector Perform | 2026-01-14 |

| UBS | Maintain | Buy | 2026-01-08 |

| Mizuho | Downgrade | Neutral | 2026-01-08 |

| Barclays | Maintain | Overweight | 2025-11-25 |

| JP Morgan | Maintain | Overweight | 2025-11-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-13 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| Scotiabank | Maintain | Sector Perform | 2025-11-10 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-31 |

Which company has the best grades?

AvalonBay Communities, Inc. generally receives higher and more consistent grades, including multiple “Buy” and “Overweight” ratings. Invitation Homes Inc. shows mixed grades, with several “Neutral” and “Sector Perform” ratings. This difference could affect investor confidence and portfolio positioning.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing AvalonBay Communities, Inc. and Invitation Homes Inc. in the 2026 market environment:

1. Market & Competition

AvalonBay Communities, Inc. (AVB)

- Operates in leading metro areas with strong brand and scale; faces intense competition in high-demand residential REIT sector.

Invitation Homes Inc. (INVH)

- Focuses on single-family rental homes nationwide; competes with emerging build-to-rent and traditional rental segments.

2. Capital Structure & Debt

AvalonBay Communities, Inc. (AVB)

- Debt-to-assets at 39.3%, interest coverage strong at 5.05x; moderate leverage but low liquidity ratios raise caution.

Invitation Homes Inc. (INVH)

- Higher debt-to-assets at 43.9%, weaker interest coverage at 2.24x; liquidity better but financial risk elevated.

3. Stock Volatility

AvalonBay Communities, Inc. (AVB)

- Beta of 0.75 shows moderate stock sensitivity; trading range narrowing, indicating less volatility.

Invitation Homes Inc. (INVH)

- Beta of 0.83 reflects slightly higher sensitivity; wide average volume suggests more active trading and potential swings.

4. Regulatory & Legal

AvalonBay Communities, Inc. (AVB)

- Subject to regional housing regulations and rent control trends in West Coast and Northeast markets.

Invitation Homes Inc. (INVH)

- Faces regulatory scrutiny on tenant protections and property standards across diverse state jurisdictions.

5. Supply Chain & Operations

AvalonBay Communities, Inc. (AVB)

- Development pipeline in expansion markets may face material and labor cost pressures; operational scale aids resilience.

Invitation Homes Inc. (INVH)

- Single-family home refurbishment dependent on supply chain efficiency; operational complexity higher due to geographic dispersion.

6. ESG & Climate Transition

AvalonBay Communities, Inc. (AVB)

- Exposure to climate risks in California and Pacific Northwest; active in sustainability initiatives.

Invitation Homes Inc. (INVH)

- ESG focus on energy efficiency in homes; broader geographic footprint diversifies climate risk but complicates compliance.

7. Geopolitical Exposure

AvalonBay Communities, Inc. (AVB)

- Primarily US domestic exposure, concentrated in stable metro regions with low geopolitical risk.

Invitation Homes Inc. (INVH)

- Also US-focused but with wider regional spread; no direct international geopolitical risks.

Which company shows a better risk-adjusted profile?

AvalonBay’s key risk lies in liquidity constraints despite strong interest coverage, while Invitation Homes faces heightened financial leverage and operational complexity. Both firms exhibit slightly unfavorable financial ratios, but AvalonBay’s stronger interest coverage and focused market presence suggest a marginally better risk-adjusted profile. Invitation Homes’ distress-level Altman Z-score signals elevated bankruptcy risk despite a very strong Piotroski score, warranting caution. Recent data shows Invitation Homes’ interest coverage at 2.24x, underscoring vulnerability to rising rates—this sharpens my concern over its capital structure risk compared to AvalonBay’s more robust coverage.

Final Verdict: Which stock to choose?

AvalonBay Communities, Inc. (AVB) stands out for its operational efficiency and strong cash generation, making it a cash machine in the residential REIT space. Its growing profitability signals improving fundamentals, yet a low current ratio is a point of vigilance. AVB suits investors targeting aggressive growth with some tolerance for liquidity risk.

Invitation Homes Inc. (INVH) boasts a strategic moat through its scale in single-family rental homes and recurring revenue stability. Its balance sheet appears safer than AVB’s, with a stronger liquidity profile, though its interest coverage raises caution. INVH fits portfolios seeking growth at a reasonable price with a focus on stability.

If you prioritize operational efficiency and cash flow strength, AVB is the compelling choice due to its accelerating profitability despite liquidity concerns. However, if you seek a more stable balance sheet paired with a resilient revenue base, INVH offers better stability and a stronger margin of safety, even at a premium valuation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of AvalonBay Communities, Inc. and Invitation Homes Inc. to enhance your investment decisions: