Home > Comparison > Real Estate > AVB vs EQR

The strategic rivalry between AvalonBay Communities, Inc. and Equity Residential shapes the trajectory of the U.S. residential real estate sector. AvalonBay operates as a capital-intensive REIT focused on premier apartment communities in key metropolitan areas. Equity Residential, also a leading residential REIT, emphasizes urban properties with strong renter demand. This analysis compares their operational models to identify which presents a superior risk-adjusted opportunity for diversified portfolios in a competitive market.

Table of contents

Companies Overview

AvalonBay Communities and Equity Residential stand as two heavyweight players in the US residential REIT sector.

AvalonBay Communities, Inc.: Premier Metropolitan Apartment Developer

AvalonBay focuses on developing, acquiring, and managing apartment communities primarily in top urban markets across the US, including New England and California. Its core revenue driver is rental income from 86K apartment homes, with 18 developments underway. In 2026, AvalonBay emphasizes strategic expansion into Southeast Florida and Denver, sharpening its metropolitan footprint.

Equity Residential: Urban Residential Property Specialist

Equity Residential builds its business around acquiring and managing residential properties in dynamic cities like Boston and San Francisco. It generates revenue from 78K apartment units, targeting long-term renters. The company’s 2026 strategy centers on sustaining growth and tenant quality in key urban centers, maintaining its status as a member of the S&P 500.

Strategic Collision: Similarities & Divergences

Both firms target high-demand urban rental markets but differ slightly in geographic emphasis and portfolio scale. AvalonBay leans on new developments and selective expansion. Equity Residential prioritizes tenant quality and stable income from established properties. Their battle for market share intensifies in gateway cities. Investors should note AvalonBay’s growth tilt versus Equity Residential’s steady income profile.

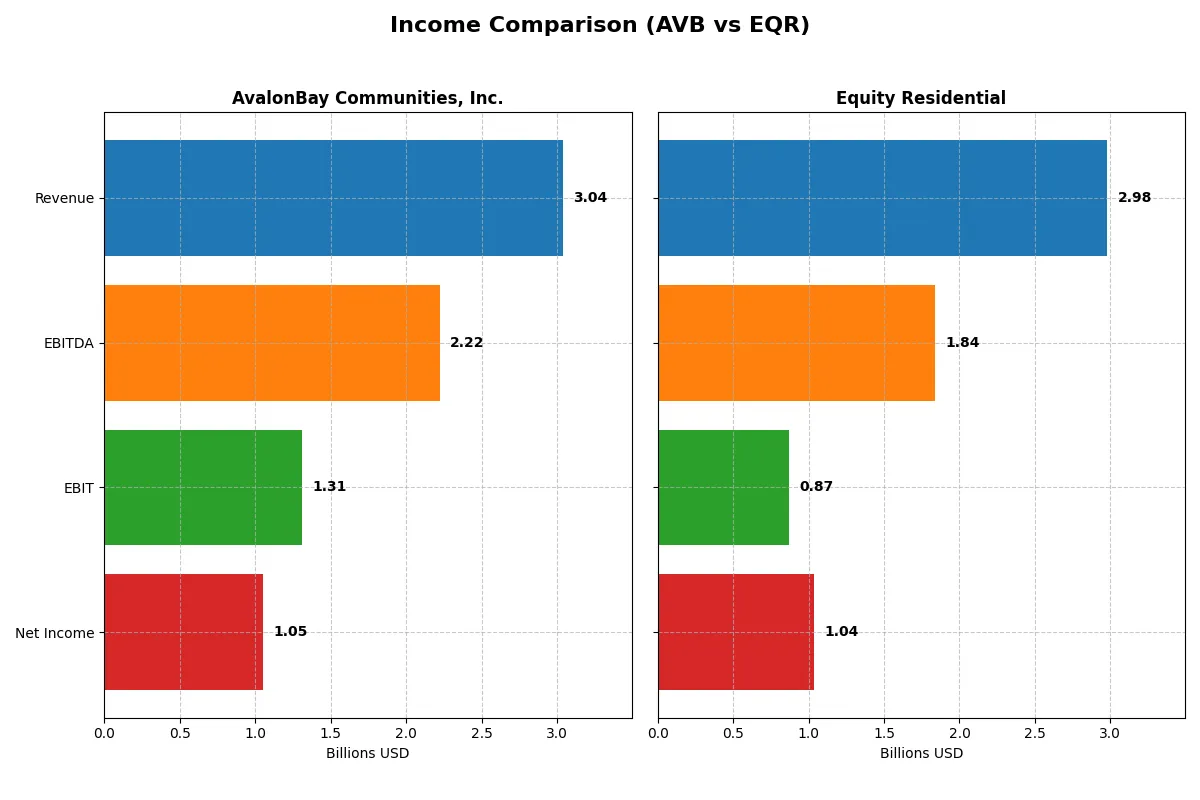

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | AvalonBay Communities, Inc. (AVB) | Equity Residential (EQR) |

|---|---|---|

| Revenue | 3.04B | 2.98B |

| Cost of Revenue | 1.00B | 1.09B |

| Operating Expenses | 889M | 62M |

| Gross Profit | 2.04B | 1.89B |

| EBITDA | 2.22B | 1.84B |

| EBIT | 1.31B | 872M |

| Interest Expense | 259M | 286M |

| Net Income | 1.05B | 1.04B |

| EPS | 7.40 | 2.73 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

The following income statement comparison reveals which company operates with greater efficiency and delivers stronger profitability momentum.

AvalonBay Communities, Inc. Analysis

AvalonBay’s revenue grew steadily from $2.29B in 2021 to $3.04B in 2025, marking a 32% increase over five years. Gross margin holds favorably high near 67%, while net margin remains robust at 34.6%. Despite a slight dip in EBIT and net margin growth last year, AvalonBay sustains strong profitability with an EPS of $7.40 in 2025, signaling solid operational efficiency.

Equity Residential Analysis

Equity Residential expanded revenue from $2.46B in 2021 to $2.98B in 2024, a 16% rise. Its gross margin stands at a healthy 63.3%, while net margin matches AvalonBay around 34.8%. Recent EPS surged 27.7% to $2.73, reflecting improved bottom-line momentum despite a modest EBIT contraction. Operating expenses growth remains well-managed, supporting steady profitability gains.

Margin Strength vs. Earnings Momentum

AvalonBay leads in scale and margin quality, showing higher gross and EBIT margins with consistent revenue growth. Equity Residential excels in EPS growth and net income expansion, driven by efficiency improvements despite slightly lower margins. Investors seeking stable, high-margin businesses may prefer AvalonBay, while those favoring earnings acceleration might find Equity Residential more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | AvalonBay Communities, Inc. (AVB) | Equity Residential (EQR) |

|---|---|---|

| ROE | 9.1% | 9.4% |

| ROIC | 4.5% | 8.9% |

| P/E | 28.9 | 26.2 |

| P/B | 2.62 | 2.46 |

| Current Ratio | 0.36 | 0.16 |

| Quick Ratio | 0.36 | 0.16 |

| D/E (Debt-to-Equity) | 0.69 | 0.76 |

| Debt-to-Assets | 39.3% | 40.4% |

| Interest Coverage | 4.04 | 6.38 |

| Asset Turnover | 0.139 | 0.143 |

| Fixed Asset Turnover | 18.8 | 6.54 |

| Payout ratio | 89% | 99% |

| Dividend yield | 3.08% | 3.76% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence vital for assessing investment quality.

AvalonBay Communities, Inc.

AvalonBay shows solid net margins at 37.13%, yet its ROE of 9.06% falls short of ideal returns. The stock trades at a stretched P/E of 28.87, suggesting expensive valuation. It supports shareholders with a 3.08% dividend yield, balancing modest profitability with steady income generation.

Equity Residential

Equity Residential posts a slightly lower net margin of 34.76% but edges AvalonBay with a higher ROE of 9.38%. The P/E of 26.24 is slightly less stretched, reflecting more reasonable pricing. Equity Residential offers a stronger dividend yield at 3.76%, prioritizing shareholder returns amid solid operational metrics.

Margin Strength vs. Dividend Appeal

AvalonBay commands higher margins but carries a more stretched valuation. Equity Residential delivers higher ROE and dividend yield at a more moderate price. Investors seeking income and reasonable valuation may favor Equity Residential, while margin-focused profiles might lean toward AvalonBay’s operational edge.

Which one offers the Superior Shareholder Reward?

AvalonBay Communities, Inc. (AVB) and Equity Residential (EQR) both reward shareholders through dividends and buybacks, but their strategies differ. AVB yields around 3.1% with a high payout ratio near 89%, supported by strong free cash flow coverage (1.39x). Its buybacks are less intense but steady. EQR offers a slightly higher yield near 3.8%, also with nearly full payout ratios above 98%, though free cash flow coverage is weaker (1.17x). EQR’s buyback activity is more modest. Historically, AVB’s distribution is more sustainable due to better free cash flow support and conservative capital allocation. I conclude AVB delivers a superior total shareholder return profile in 2026.

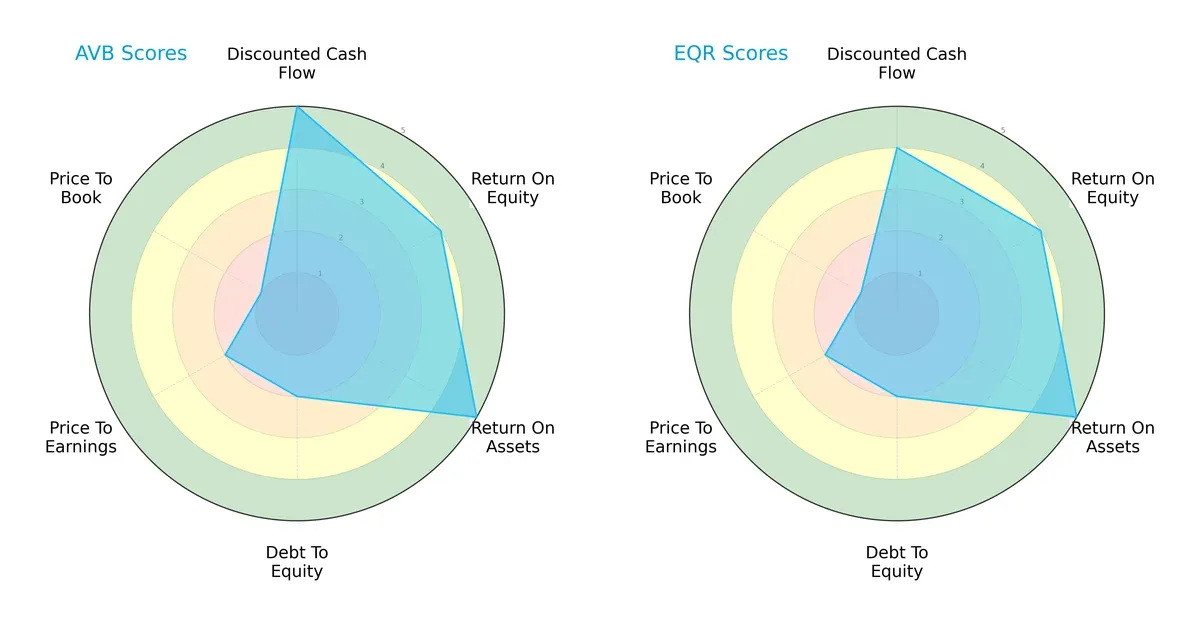

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of AvalonBay Communities, Inc. and Equity Residential, highlighting their financial strengths and valuation nuances:

AvalonBay shows a very favorable discounted cash flow (DCF) and return on assets (ROA) scores, indicating strong cash flow generation and asset efficiency. Equity Residential matches AvalonBay in ROA and return on equity (ROE) but scores slightly lower on DCF. Both firms share moderate debt-to-equity and price-to-earnings (P/E) scores, with weak price-to-book (P/B) valuations. AvalonBay’s profile is more reliant on cash flow strength, while Equity Residential presents a balanced but less pronounced edge.

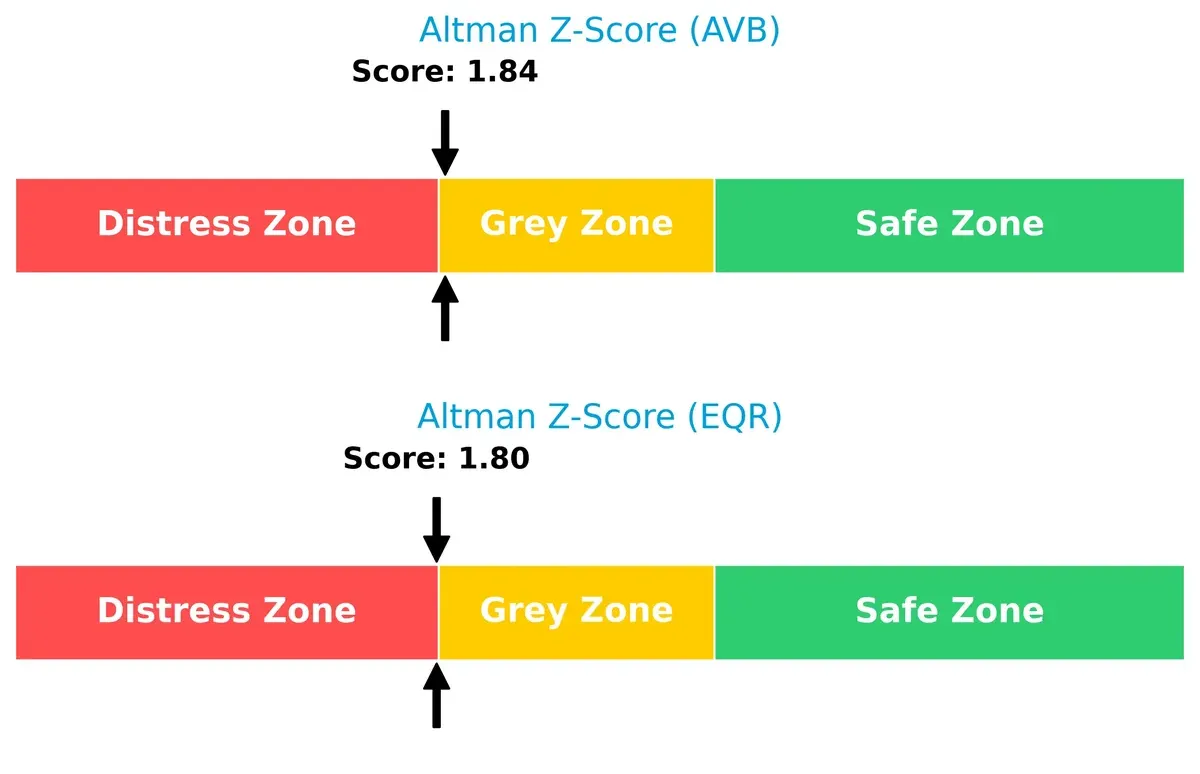

Bankruptcy Risk: Solvency Showdown

AvalonBay’s Altman Z-Score is 1.84 versus Equity Residential’s 1.80, both in the grey zone:

This proximity suggests comparable moderate bankruptcy risk. Both firms face cautionary signals amid cyclical pressures, requiring close monitoring of leverage and liquidity to ensure survival through market volatility.

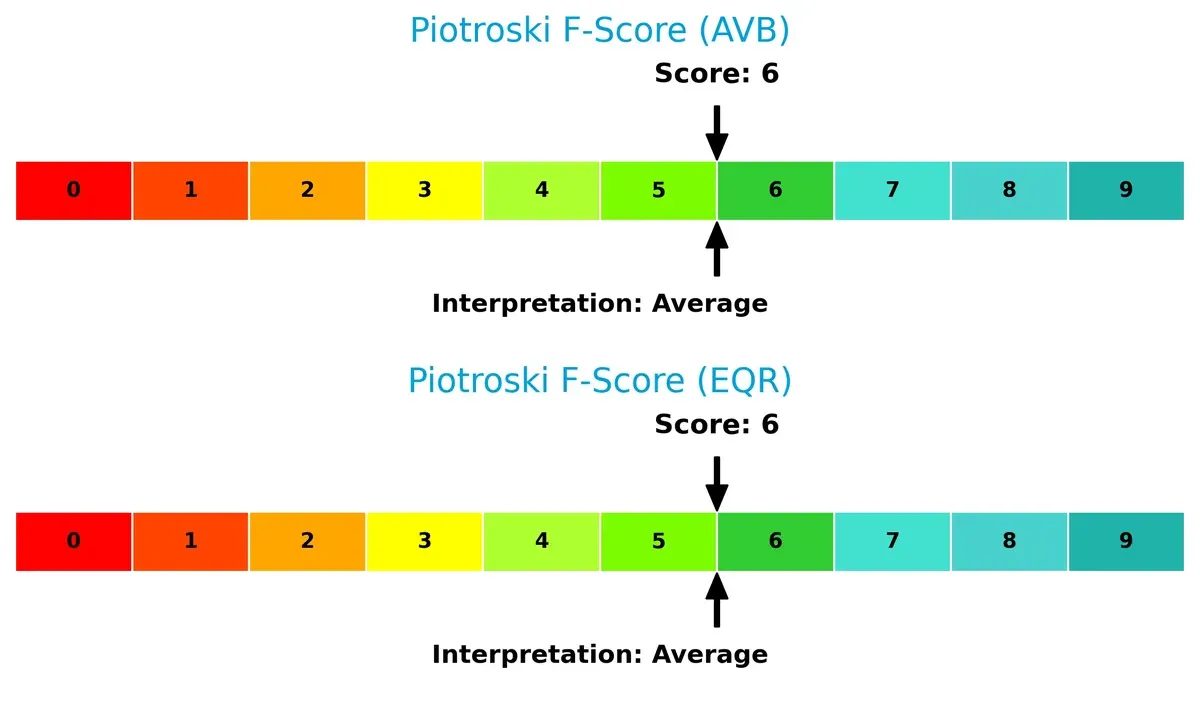

Financial Health: Quality of Operations

AvalonBay and Equity Residential each hold a Piotroski F-Score of 6, indicating average financial health:

Neither company displays red flags in operational quality, but neither achieves peak strength. Investors should view both as stable but not exceptionally robust in internal financial metrics at this cycle stage.

How are the two companies positioned?

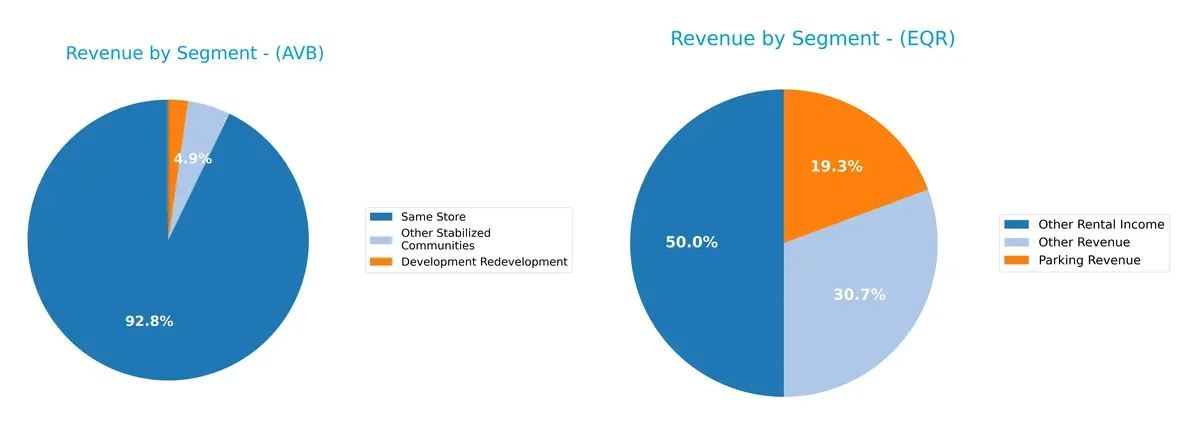

This section dissects the operational DNA of AVB and EQR by comparing their revenue distribution and internal dynamics, including strengths and weaknesses. The goal is to confront their economic moats to identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how AvalonBay Communities, Inc. and Equity Residential diversify their income streams and where their primary sector bets lie:

AvalonBay’s 2023 revenue anchors heavily on its Same Store segment with $2.54B, dwarfing Development Redevelopment ($62M) and Other Stabilized Communities ($135M). This concentration signals a mature, stable cash flow base with moderate growth bets. In contrast, Equity Residential’s recent data lacks clear dominant segments, reflecting either a diversified geographic approach or data gaps. AvalonBay’s focus anchors its ecosystem, while Equity Residential’s spread raises questions on segment clarity and strategic concentration risk.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of AvalonBay Communities, Inc. (AVB) and Equity Residential (EQR):

AVB Strengths

- Strong net margin at 37.13%

- Favorable interest coverage of 5.05

- High fixed asset turnover of 18.84

- Consistent dividend yield of 3.08%

- Neutral debt levels with 0.69 D/E ratio

EQR Strengths

- Solid net margin at 34.76%

- Favorable WACC at 6.45%

- Favorable fixed asset turnover of 6.54

- Higher dividend yield at 3.76%

- Balanced geographical revenue segmentation

AVB Weaknesses

- Unfavorable ROE of 9.06% below cost of capital

- Low current and quick ratios at 0.36 indicating liquidity concerns

- Unfavorable asset turnover of 0.14

- Elevated P/E at 28.87 suggests premium valuation

EQR Weaknesses

- Unfavorable ROE of 9.38% also below cost of capital

- Very low current and quick ratios at 0.16 pose liquidity risks

- Lower interest coverage at 3.05 compared to AVB

- Unfavorable asset turnover of 0.14

Both companies show strengths in profitability and asset utilization, but face liquidity challenges and ROE below WACC. Their financial structure and dividend policies suggest stable income focus, while valuation and turnover metrics warrant monitoring for strategic efficiency.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion:

AvalonBay Communities, Inc.: Steady Market Presence with Rising Profitability

AvalonBay’s moat stems from its scale and premium urban locations, supporting stable margins. Despite a slightly unfavorable ROIC vs. WACC, its growing ROIC signals improving capital efficiency in 2026.

Equity Residential: Value Creator with Expanding Capital Efficiency

Equity Residential’s moat leverages strategic urban property ownership and superior capital allocation. Its ROIC exceeds WACC by a healthy margin, showing robust value creation and a strong upward profitability trend.

Scale and Capital Efficiency: Who Holds the Stronger Defensive Line?

Equity Residential commands a deeper moat with ROIC comfortably above WACC and accelerating returns. AvalonBay’s improving profitability is encouraging but still trails. EQR is better positioned to defend market share amid competition.

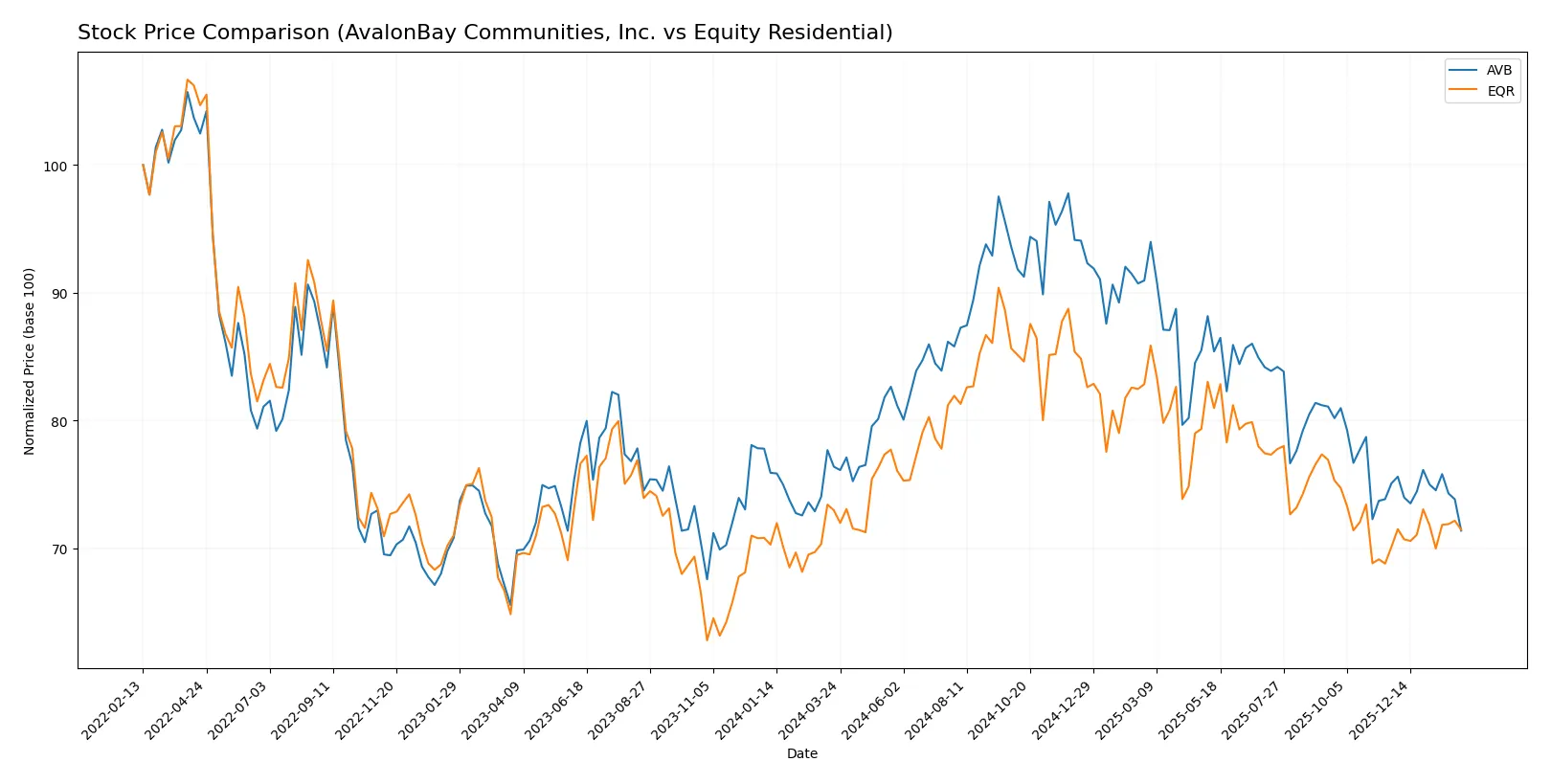

Which stock offers better returns?

The past year shows contrasting dynamics: AvalonBay Communities, Inc. declines steadily, while Equity Residential edges near stability with slight recent gains.

Trend Comparison

AvalonBay Communities, Inc. exhibits a 12-month price drop of -6.57%, marking a bearish trend with deceleration. It reached highs of 235.35 and lows near 171.75.

Equity Residential records a -2.09% decline over the same period, still bearish but with accelerating momentum. Recent weeks show a 1.92% gain and lower volatility.

Comparing trends, Equity Residential outperforms AvalonBay with a smaller overall loss and recent positive price movement, delivering the highest market performance in this timeframe.

Target Prices

Analysts present a clear consensus on target prices for AvalonBay Communities, Inc. and Equity Residential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| AvalonBay Communities, Inc. | 172 | 217 | 193.9 |

| Equity Residential | 35 | 79.75 | 69.4 |

AvalonBay’s consensus target of $193.9 exceeds its current $171.25 price, indicating upside potential. Equity Residential’s consensus target at $69.4 also suggests a favorable outlook versus its $61.7 market price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

AvalonBay Communities, Inc. Grades

This table summarizes recent grades assigned by major financial institutions to AvalonBay Communities, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-01-20 |

| Barclays | Maintain | Overweight | 2026-01-13 |

| UBS | Maintain | Neutral | 2026-01-08 |

| Colliers Securities | Downgrade | Neutral | 2025-12-04 |

| Truist Securities | Maintain | Buy | 2025-12-02 |

| Barclays | Upgrade | Overweight | 2025-11-25 |

| Mizuho | Maintain | Neutral | 2025-11-24 |

| Morgan Stanley | Maintain | Overweight | 2025-11-13 |

| UBS | Maintain | Neutral | 2025-11-10 |

| Wells Fargo | Maintain | Overweight | 2025-11-10 |

Equity Residential Grades

This table details recent grades assigned by leading financial firms to Equity Residential:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | Downgrade | Market Perform | 2026-01-09 |

| UBS | Maintain | Buy | 2026-01-08 |

| Barclays | Maintain | Overweight | 2025-11-25 |

| Mizuho | Maintain | Neutral | 2025-11-24 |

| Truist Securities | Maintain | Buy | 2025-11-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-13 |

| UBS | Maintain | Buy | 2025-11-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-10 |

| Scotiabank | Maintain | Sector Perform | 2025-11-04 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-03 |

Which company has the best grades?

AvalonBay Communities consistently receives Buy and Overweight grades from key firms, signaling generally positive sentiment. Equity Residential’s recent downgrade to Market Perform by BMO Capital contrasts with stable Buy and Overweight ratings elsewhere. AvalonBay’s stronger and more consistent grades may suggest better market positioning, influencing investor confidence accordingly.

Risks specific to each company

The following risk categories identify the critical pressure points and systemic threats facing AvalonBay Communities, Inc. and Equity Residential in the 2026 market environment:

1. Market & Competition

AvalonBay Communities, Inc.

- Strong presence in gateway and expansion markets but faces pricing pressure in high-demand metros.

Equity Residential

- Focused on dynamic urban centers with competition for high-quality renters and development opportunities.

2. Capital Structure & Debt

AvalonBay Communities, Inc.

- Moderate leverage with debt-to-assets near 39%, interest coverage favorable at 5.05x.

Equity Residential

- Slightly higher leverage at 40.45%, with weaker interest coverage at 3.05x, indicating tighter debt servicing capacity.

3. Stock Volatility

AvalonBay Communities, Inc.

- Beta of 0.75 indicates moderate stock sensitivity, lower trading volume than peer average.

Equity Residential

- Beta of 0.76, similar volatility but significantly higher average volume, suggesting more active trading.

4. Regulatory & Legal

AvalonBay Communities, Inc.

- Exposure to multi-state rental regulations; redevelopment projects may face permitting delays.

Equity Residential

- Faces stringent urban rental laws; acquisition strategies may attract regulatory scrutiny.

5. Supply Chain & Operations

AvalonBay Communities, Inc.

- Development pipeline includes 18 communities under construction, risking cost overruns and delays.

Equity Residential

- Manages 305 properties with operational complexity; development in competitive urban markets poses execution risks.

6. ESG & Climate Transition

AvalonBay Communities, Inc.

- Active in sustainable building practices but must adapt to evolving climate regulations in coastal markets.

Equity Residential

- ESG initiatives in place, but urban focus exposes it to higher climate transition risks and energy costs.

7. Geopolitical Exposure

AvalonBay Communities, Inc.

- Primarily U.S.-based with concentrated exposure in politically stable regions.

Equity Residential

- Similar U.S. concentration; urban locations may face localized political challenges but limited geopolitical risk.

Which company shows a better risk-adjusted profile?

AvalonBay’s strongest risk is its moderate liquidity constraints, with a current ratio at 0.36 indicating limited short-term buffer. Equity Residential’s biggest risk lies in its thinner interest coverage ratio of 3.05x, pointing to tighter debt servicing. Both firms operate in the grey zone for financial distress per Altman Z-scores, but AvalonBay’s higher interest coverage and more favorable debt metrics suggest a slightly better risk-adjusted profile. Notably, AvalonBay’s efficient fixed asset turnover at 18.84 versus Equity Residential’s 6.54 highlights superior operational efficiency, justifying my confidence in its resilience.

Final Verdict: Which stock to choose?

AvalonBay Communities, Inc. (AVB) excels as a cash-generating machine with a steadily growing return on invested capital, signaling improving profitability despite value erosion. Its low liquidity ratio is a point of vigilance, suggesting sensitivity to short-term shocks. AVB suits aggressive growth portfolios willing to navigate cyclical risks.

Equity Residential (EQR) boasts a strategic moat with a sustainable competitive advantage supported by a ROIC comfortably above its cost of capital. It offers greater stability relative to AVB, showing consistent earnings growth and a stronger income statement profile. EQR fits well in GARP portfolios balancing growth with prudent valuation.

If you prioritize aggressive expansion and can tolerate liquidity weaknesses, AVB’s improving profitability and operational efficiency outshines EQR. However, if you seek better stability and a proven economic moat, EQR offers superior value creation and steadier earnings growth, commanding a reasonable premium for risk-averse investors.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of AvalonBay Communities, Inc. and Equity Residential to enhance your investment decisions: