Home > Comparison > Consumer Cyclical > AZO vs MBLY

The strategic rivalry between AutoZone, Inc. and Mobileye Global Inc. shapes the future of the auto parts industry. AutoZone operates as a capital-intensive retailer with an extensive physical footprint, while Mobileye pioneers high-tech autonomous driving solutions, reflecting a software-driven model. This matchup pits traditional distribution against cutting-edge innovation. This analysis seeks to identify which trajectory offers superior risk-adjusted returns for diversified portfolios navigating the evolving automotive landscape.

Table of contents

Companies Overview

AutoZone and Mobileye stand as influential players reshaping the auto parts and automotive tech landscapes globally.

AutoZone, Inc.: Leading Retailer in Auto Replacement Parts

AutoZone dominates the auto-parts retail market with over 6,700 stores across the Americas. Its core revenue stems from selling automotive replacement parts and accessories for various vehicles. In 2026, the company focuses on expanding its commercial credit sales and enhancing its online presence through digital platforms like ALLDATA.

Mobileye Global Inc.: Pioneer in Autonomous Driving Technologies

Mobileye leads in advanced driver assistance systems (ADAS) and autonomous driving solutions worldwide. It generates revenue by licensing its cutting-edge safety and navigation technologies to automakers. The 2026 strategy centers on advancing Level 4 autonomous systems and expanding cloud-enhanced driver assistance services.

Strategic Collision: Similarities & Divergences

AutoZone adopts a traditional, product-centric retail model, while Mobileye pursues a high-tech, software-driven approach. Their primary battleground lies in automotive innovation—parts supply versus vehicle intelligence. Investors face distinct profiles: AutoZone offers steady retail cash flow, whereas Mobileye presents growth potential in transformative mobility tech.

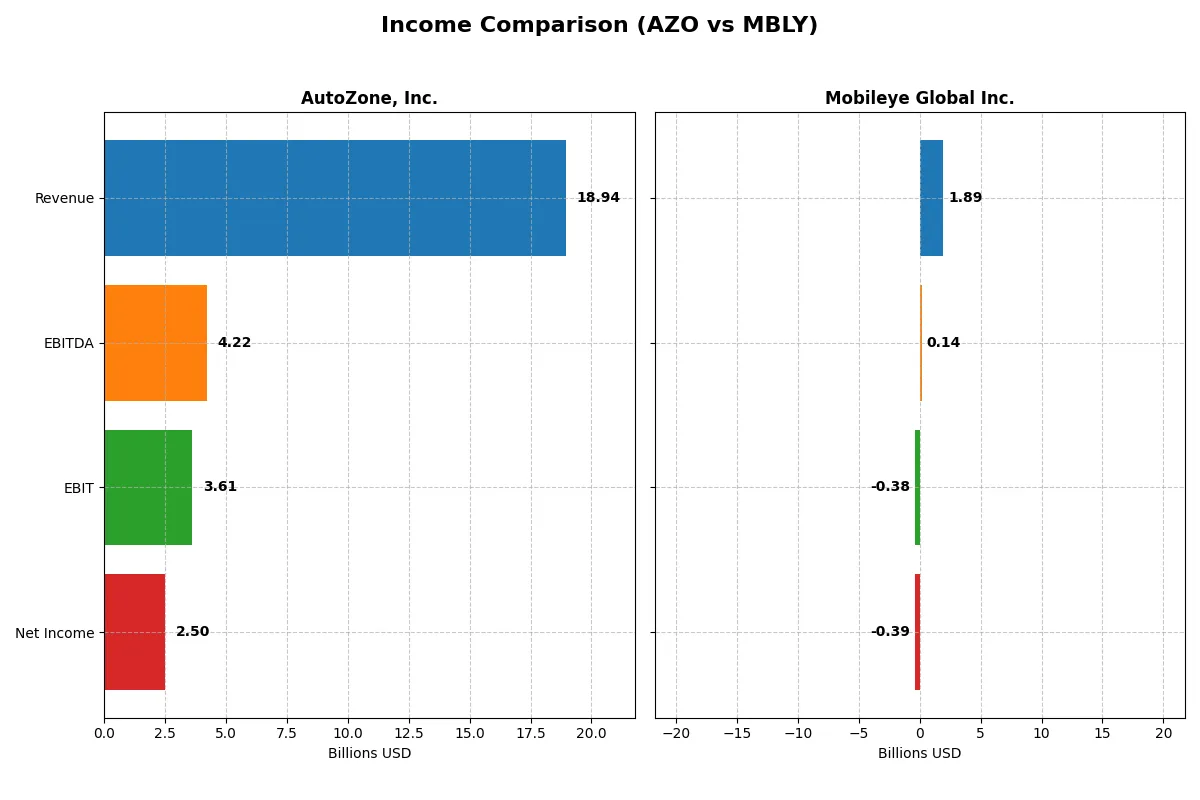

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | AutoZone, Inc. (AZO) | Mobileye Global Inc. (MBLY) |

|---|---|---|

| Revenue | 18.9B | 1.89B |

| Cost of Revenue | 8.97B | 990M |

| Operating Expenses | 6.36B | 1.34B |

| Gross Profit | 10.0B | 904M |

| EBITDA | 4.22B | 140M |

| EBIT | 3.61B | -377M |

| Interest Expense | 487M | 0 |

| Net Income | 2.50B | -392M |

| EPS | 148.8 | -0.48 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true operational efficiency and profitability of two distinct corporate engines in 2025.

AutoZone, Inc. Analysis

AutoZone’s revenue grew steadily to $18.9B in 2025, with net income at $2.5B, reflecting a favorable gross margin of 52.6%. Despite a slight decline in EBIT and net margin growth last year, its solid 19.1% EBIT margin shows sustained operational efficiency and robust profitability momentum.

Mobileye Global Inc. Analysis

Mobileye’s revenue jumped 14.5% to $1.9B in 2025, with gross margin at a healthy 47.7%. Yet, it posted a net loss of $392M, dragging net margin to -20.7%. The company improved EBIT by 88%, signaling operational progress but still struggles to convert growth into profits.

Margin Power vs. Revenue Scale

AutoZone delivers commanding margins and consistent profits on a much larger revenue base, while Mobileye drives faster top-line growth but remains unprofitable. AutoZone’s profile suits investors prioritizing stable earnings. Mobileye appeals more to those betting on future profitability from growth momentum.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | AutoZone, Inc. (AZO) | Mobileye Global Inc. (MBLY) |

|---|---|---|

| ROE | -73.2% | -3.3% |

| ROIC | 28.1% | -3.6% |

| P/E | 28.2 | -21.6 |

| P/B | -20.6 | 0.71 |

| Current Ratio | 0.88 | 6.10 |

| Quick Ratio | 0.14 | 5.30 |

| D/E | -3.60 | 0 |

| Debt-to-Assets | 63.5% | 0 |

| Interest Coverage | 7.42 | 0 |

| Asset Turnover | 0.98 | 0.15 |

| Fixed Asset Turnover | 1.85 | 4.00 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, exposing hidden risks and operational excellence critical for informed investment decisions.

AutoZone, Inc.

AutoZone posts a strong net margin at 13.19%, signaling operational efficiency, yet suffers from a deeply negative ROE at -73.17%. Its P/E ratio at 28.22 suggests the stock is somewhat expensive. With no dividend yield, the company appears to prioritize reinvestment or other shareholder value strategies, despite mixed financial health signals.

Mobileye Global Inc.

Mobileye shows a negative net margin of -20.7% and a modestly negative ROE of -3.3%, reflecting ongoing profitability challenges. Its negative P/E of -21.61 signals valuation complexity but a low price-to-book ratio of 0.71 suggests potential undervaluation. The firm lacks dividends, reinvesting heavily in R&D, as indicated by high operational expenses.

Operational Efficiency vs. Growth Challenges

AutoZone balances solid profitability and reinvestment with stretched valuation and weak equity returns. Mobileye faces profitability headwinds but offers favorable valuation metrics and aggressive growth investment. Investors seeking operational safety may lean toward AutoZone, while those favoring growth risk might consider Mobileye’s profile.

Which one offers the Superior Shareholder Reward?

I observe that neither AutoZone, Inc. (AZO) nor Mobileye Global Inc. (MBLY) pays dividends, focusing instead on reinvestment and buybacks. AZO shows zero dividend yield but generates robust free cash flow (106-130/share) consistently and maintains aggressive share repurchases, enhancing shareholder value sustainably. MBLY, however, posts negative net margins with no dividends, relying heavily on growth investments and minimal buybacks. Historically, AZO’s capital allocation aligns with stable long-term returns, while MBLY’s model bears higher risk amid profitability challenges. I conclude AZO offers a superior total shareholder return profile in 2026 due to its disciplined cash flow reinvestment and share buyback intensity.

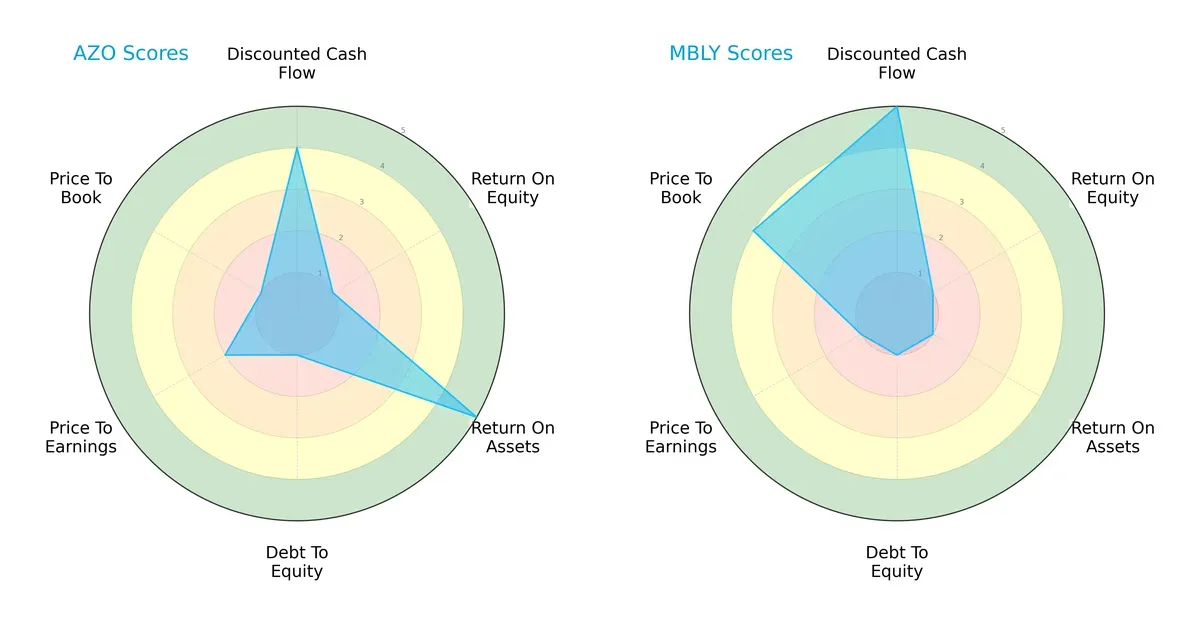

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of AutoZone, Inc. and Mobileye Global Inc., highlighting their strategic financial strengths and weaknesses:

AutoZone excels in asset utilization with a top ROA score (5) but struggles with equity returns (ROE score 1) and carries high financial risk (debt-to-equity score 1). Mobileye leads in discounted cash flow valuation (DCF score 5) and shows a strong price-to-book metric (4), yet falls short in asset and equity efficiency (ROA and ROE scores at 1). AutoZone presents a more balanced operational profile, while Mobileye relies heavily on future cash flow optimism and market valuation.

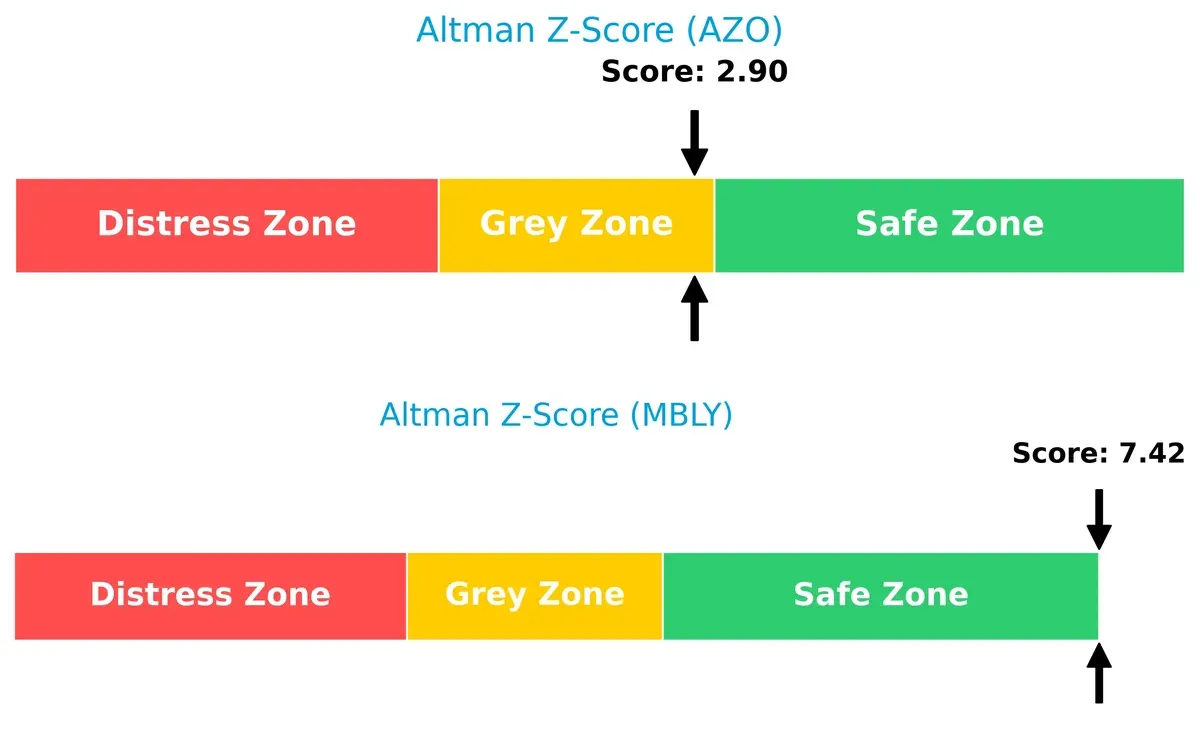

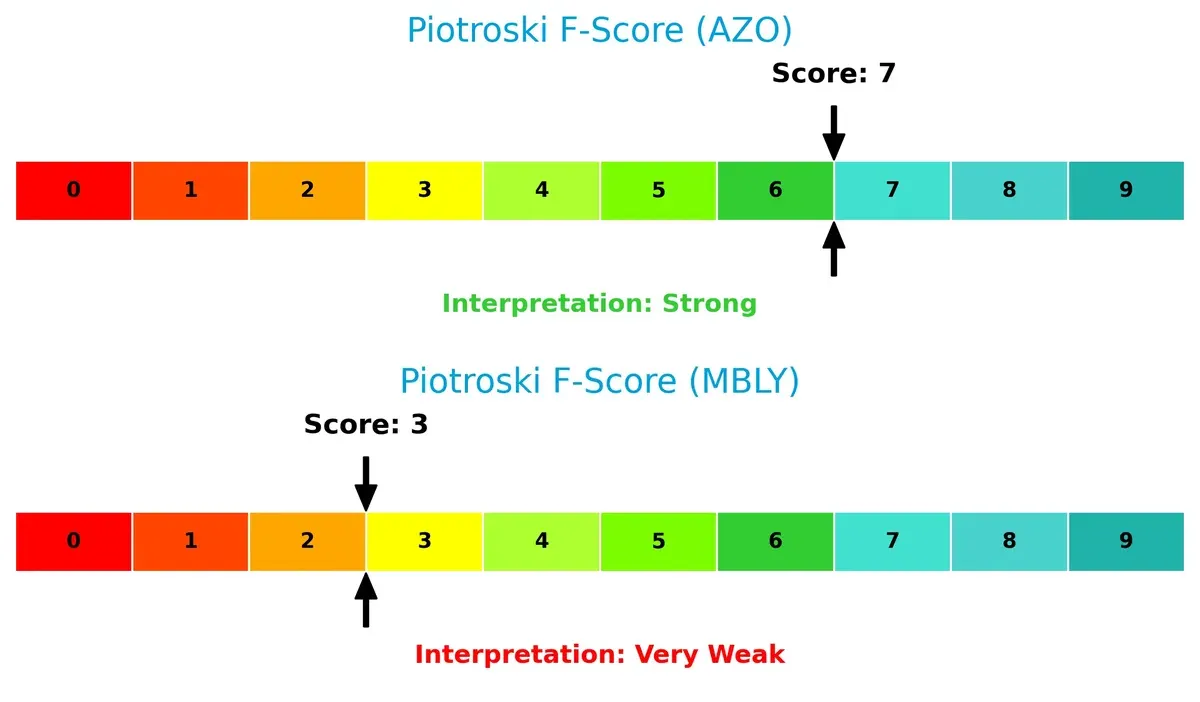

Bankruptcy Risk: Solvency Showdown

AutoZone’s Altman Z-Score (2.9) and Mobileye’s (7.4) place them in the grey and safe zones respectively, signaling a significant solvency advantage for Mobileye:

Mobileye’s high Z-Score reflects robust financial stability and lower bankruptcy risk amid market volatility. AutoZone’s score, nearing the grey zone threshold, suggests moderate caution despite operational strengths.

Financial Health: Quality of Operations

AutoZone’s Piotroski F-Score of 7 signals strong financial health, contrasting sharply with Mobileye’s weak score of 3, raising red flags on internal operational metrics:

AutoZone’s robust score reflects effective profitability, liquidity, and efficiency management. Mobileye’s low score suggests underlying weaknesses that could impair long-term value creation despite positive market sentiment.

How are the two companies positioned?

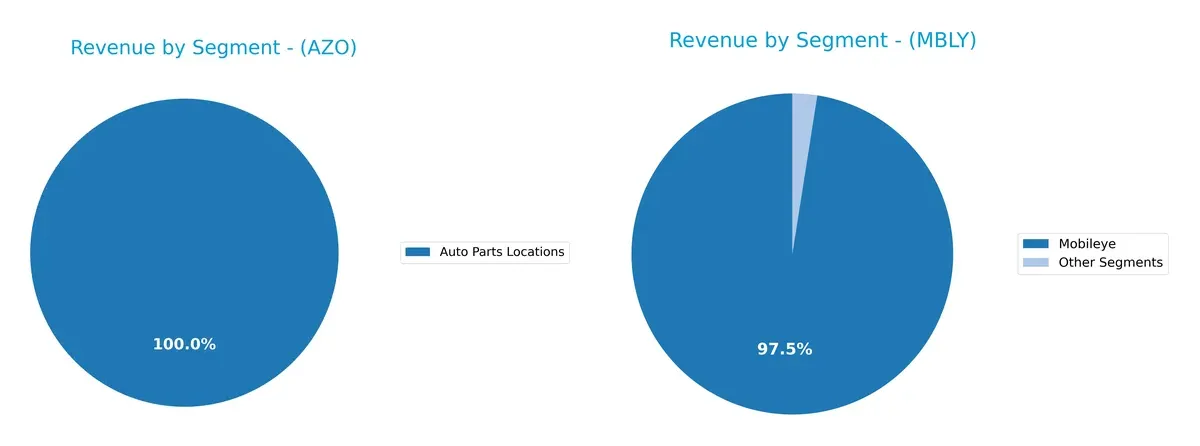

This section dissects AutoZone and Mobileye’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. Our goal is to confront their economic moats to identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how AutoZone and Mobileye diversify their income streams and highlights where their primary sector bets lie:

AutoZone anchors its revenue overwhelmingly in Auto Parts Locations, generating $18.9B in 2025 with minimal contribution from other segments, revealing high concentration risk. Conversely, Mobileye’s revenue, around $1.6B in 2024, pivots almost entirely on its Mobileye segment, with negligible other income. AutoZone’s reliance on physical retail contrasts Mobileye’s focus on technology, reflecting distinct strategic moats and ecosystem lock-ins in their respective industries.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of AutoZone, Inc. (AZO) and Mobileye Global Inc. (MBLY):

AZO Strengths

- Strong profitability with 13.19% net margin

- High ROIC (28.13%) above WACC (5.35%) indicates value creation

- Solid interest coverage (7.42) supports debt servicing

- Diverse revenue from US and Non-US markets

- Consistent revenue growth in auto parts segment

MBLY Strengths

- Favorable WACC (6.42%) and P/B (0.71) ratios

- Low debt to assets (0%) signals strong balance sheet

- High fixed asset turnover (4.0) shows efficient asset use

- Global presence across multiple countries including China and Europe

AZO Weaknesses

- Negative ROE (-73.17%) signals poor shareholder returns

- Low liquidity ratios (current 0.88, quick 0.14) pose short-term risk

- High debt to assets (63.49%) may constrain flexibility

- Unfavorable P/E (28.22) may reflect overvaluation

- No dividend yield limits income appeal

MBLY Weaknesses

- Negative profitability metrics: net margin (-20.7%), ROE (-3.3%), ROIC (-3.64%)

- Unfavorable current ratio (6.1) contrasts with quick ratio, indicating inventory concerns

- Zero interest coverage raises solvency risk

- Low asset turnover (0.15) suggests inefficiency

- No dividend yield limits investor income

Overall, AZO shows robust profitability and capital efficiency but faces liquidity and leverage concerns. MBLY benefits from a clean balance sheet and global reach but struggles with profitability and operational efficiency. These contrasts indicate differing strategic challenges and resource allocation priorities.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competition erosion. Its nature defines who wins market share battles:

AutoZone, Inc.: Durable Switching Costs Moat

AutoZone’s advantage lies in strong switching costs, anchored by its vast store network and customer loyalty. This reflects in a high 22.8% ROIC above WACC, though profitability slightly declines. Expansion in Mexico and Brazil may deepen this moat in 2026.

Mobileye Global Inc.: Innovation-Driven Technology Moat

Mobileye’s moat stems from proprietary autonomous driving tech and data network effects. Unlike AutoZone, Mobileye currently sheds value with a negative ROIC vs. WACC, but rapid revenue growth and improving margins signal potential to disrupt markets and strengthen its position.

Retail Footprint vs. Autonomous Innovation: The Moat Showdown

AutoZone commands a wider moat through efficient capital use and stable margins, defending market share via entrenched customer habits. Mobileye’s moat is nascent but promising, reliant on technology adoption and scaling. For now, AutoZone is better equipped to protect profits against competition.

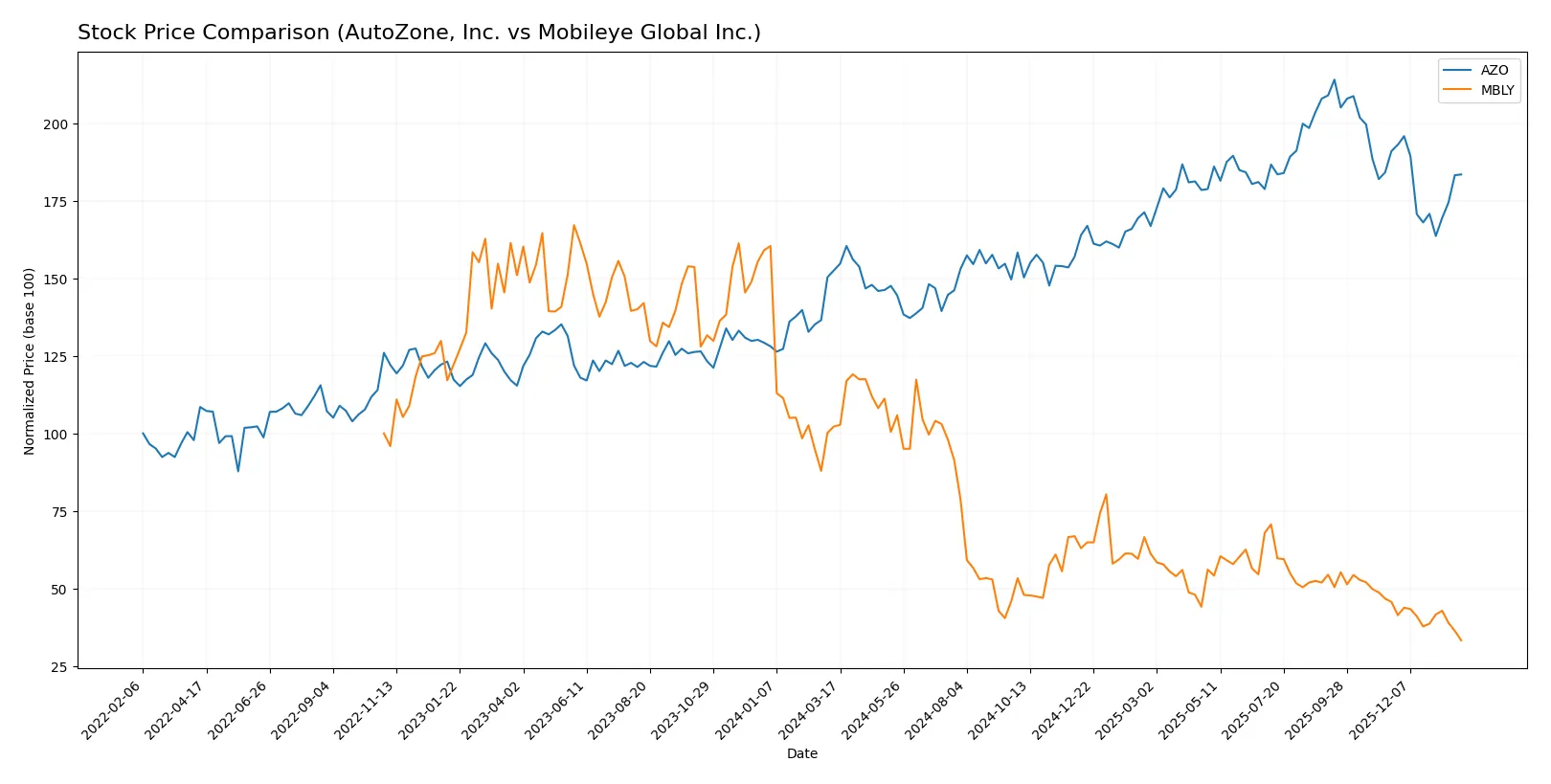

Which stock offers better returns?

The past year shows stark contrasts: AutoZone’s price rose steadily before a recent dip, while Mobileye’s stock endured a sharp, prolonged decline.

Trend Comparison

AutoZone, Inc. (AZO) posted a 20.29% price increase over the last 12 months, marking a bullish trend with decelerating momentum and notable volatility between 2,770 and 4,322.

Mobileye Global Inc. (MBLY) experienced a severe 67.46% decline over the past year, a clear bearish trend with deceleration and relatively low price volatility, ranging from 9 to 32.

AutoZone’s stock outperformed Mobileye’s significantly, delivering positive returns versus Mobileye’s heavy losses over the 12-month period.

Target Prices

Analysts present a clear target price range for both AutoZone, Inc. and Mobileye Global Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| AutoZone, Inc. | 3,550 | 4,800 | 4,321 |

| Mobileye Global Inc. | 11 | 28 | 16.71 |

AutoZone’s consensus target at 4,321 is about 17% above its current price of 3,704, reflecting confidence in its steady auto parts retail moat. Mobileye’s consensus target of 16.71 doubles its current 8.98 share price, indicating high growth expectations despite recent volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

AutoZone, Inc. Grades

The following table summarizes the latest institutional grades for AutoZone, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| Barclays | Maintain | Overweight | 2026-01-08 |

| Mizuho | Downgrade | Neutral | 2026-01-05 |

| JP Morgan | Maintain | Overweight | 2025-12-18 |

| Wolfe Research | Downgrade | Peer Perform | 2025-12-16 |

| Citigroup | Maintain | Buy | 2025-12-11 |

| Roth Capital | Maintain | Buy | 2025-12-10 |

| Barclays | Maintain | Overweight | 2025-12-10 |

| DA Davidson | Maintain | Buy | 2025-12-10 |

| BMO Capital | Maintain | Outperform | 2025-12-10 |

Mobileye Global Inc. Grades

The following table summarizes the latest institutional grades for Mobileye Global Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | Maintain | Buy | 2026-01-29 |

| RBC Capital | Maintain | Sector Perform | 2026-01-23 |

| Needham | Maintain | Buy | 2026-01-23 |

| UBS | Maintain | Neutral | 2026-01-23 |

| Canaccord Genuity | Maintain | Buy | 2026-01-23 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-23 |

| Wells Fargo | Maintain | Overweight | 2026-01-23 |

| HSBC | Downgrade | Hold | 2026-01-23 |

| UBS | Maintain | Neutral | 2026-01-14 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-12 |

Which company has the best grades?

AutoZone holds predominantly higher grades, including multiple “Overweight” and “Buy” ratings from major firms. Mobileye has more mixed grades, with several “Neutral” and “Hold” ratings. Investors may view AutoZone’s stronger grades as greater institutional confidence.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing AutoZone, Inc. and Mobileye Global Inc. in the 2026 market environment:

1. Market & Competition

AutoZone, Inc.

- Faces intense competition in automotive parts retail with pressure on margins from e-commerce and large chains.

Mobileye Global Inc.

- Competes in a rapidly evolving ADAS and autonomous driving market with high innovation demands and tech giants as rivals.

2. Capital Structure & Debt

AutoZone, Inc.

- High debt-to-assets ratio (63.5%) signals leverage risk despite favorable interest coverage.

Mobileye Global Inc.

- Virtually no debt, reflecting a strong balance sheet but limited financial leverage benefits.

3. Stock Volatility

AutoZone, Inc.

- Low beta (0.42) indicates defensive stock behavior with limited price swings.

Mobileye Global Inc.

- Moderate beta (0.56) suggests higher sensitivity to market movements and volatility.

4. Regulatory & Legal

AutoZone, Inc.

- Subject to automotive safety and emissions regulations across US, Mexico, Brazil markets.

Mobileye Global Inc.

- Faces complex autonomous vehicle regulatory scrutiny globally, with evolving standards impacting product deployment.

5. Supply Chain & Operations

AutoZone, Inc.

- Large store footprint depends on reliable parts supply; exposed to logistics disruptions and inflation.

Mobileye Global Inc.

- Depends on semiconductor supply chains and software development; vulnerable to tech component shortages.

6. ESG & Climate Transition

AutoZone, Inc.

- Moderate ESG pressure; transition to sustainable products and emissions reduction in supply chain needed.

Mobileye Global Inc.

- Faces strong ESG scrutiny due to tech impact and energy use; innovation in safety aligns with climate goals.

7. Geopolitical Exposure

AutoZone, Inc.

- Operations mainly in North America and Latin America, exposed to trade policies and currency risks.

Mobileye Global Inc.

- Based in Israel, with global operations; geopolitical tensions in the Middle East and trade conflicts pose risks.

Which company shows a better risk-adjusted profile?

AutoZone’s most impactful risk is its high financial leverage, which could strain cash flow in downturns. Mobileye struggles with regulatory complexity and technology execution risks amid intense innovation cycles. Despite Mobileye’s higher market volatility and weaker profitability, its debt-free structure reduces default risk. AutoZone shows cautious optimism with strong operational cash flow but risks from debt. Recent ratio trends highlight Mobileye’s poor profitability and liquidity challenges, underscoring regulatory and execution risks. Overall, AutoZone’s balanced financial performance and defensive stock behavior offer a superior risk-adjusted profile in 2026.

Final Verdict: Which stock to choose?

AutoZone’s superpower lies in its robust capital efficiency, consistently generating returns well above its cost of capital. This cash machine effectively leverages invested capital, though its stretched liquidity ratios warrant vigilance. It fits portfolios seeking steady value creation with a tilt toward slightly conservative growth.

Mobileye commands a strategic moat through its deep technological moat in advanced driver-assistance systems and recurring revenue potential. Its balance sheet strength enhances safety compared to AutoZone, despite ongoing profitability challenges. This makes it suitable for investors focused on growth at a reasonable price with patience for operational turnarounds.

If you prioritize disciplined capital allocation and proven value creation, AutoZone outshines as the more stable choice, rewarding investors with consistent returns. However, if you seek exposure to disruptive innovation and can tolerate higher volatility, Mobileye offers superior growth potential through its technology moat, albeit with greater execution risk.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of AutoZone, Inc. and Mobileye Global Inc. to enhance your investment decisions: