In today’s competitive landscape, understanding the nuances of business performance is crucial for investors. This analysis pits Automatic Data Processing, Inc. (ADP) against Workday, Inc. (WDAY), two leaders in the HR and financial management sectors. Both companies operate in overlapping markets, offering cloud-based solutions that reshape how organizations manage their workforce and finances. As we delve into their strategies and market positions, I invite you to discover which of these companies may be the more compelling investment opportunity for your portfolio.

Table of contents

Company Overview

Automatic Data Processing, Inc. Overview

Automatic Data Processing, Inc. (ADP) is a leader in cloud-based human capital management solutions, primarily serving businesses through its comprehensive Employer Services and Professional Employer Organization (PEO) segments. Founded in 1949 and headquartered in Roseland, NJ, ADP offers a wide array of services, including payroll, benefits administration, talent management, and compliance services. With a market capitalization of approximately $103.26B and a workforce of 64,000 employees, ADP is well-positioned in the staffing and employment services industry. Its robust platform allows organizations to manage their human resources efficiently, making it a trusted partner for companies of all sizes.

Workday, Inc. Overview

Workday, Inc. is a prominent player in the enterprise cloud applications sector, specializing in financial management and human capital management (HCM) solutions. Established in 2005 and based in Pleasanton, CA, Workday serves a diverse clientele across multiple industries, including healthcare, education, and technology. With a market cap of around $57.57B, the company delivers applications that enable businesses to streamline operations, enhance financial insights, and manage employee lifecycles effectively. Employing approximately 20,482 professionals, Workday stands out for its innovative approach to analytics and reporting, providing clients with real-time insights to improve decision-making.

Key similarities and differences

Both ADP and Workday operate in the realm of human capital management, offering comprehensive solutions for businesses looking to optimize their workforce. While ADP focuses heavily on payroll and compliance services, Workday emphasizes financial management and analytics. ADP’s long-standing presence in the staffing industry contrasts with Workday’s relatively recent emergence as a technology leader, underscoring the different approaches each company takes within the broader HR and financial management landscape.

Income Statement Comparison

The following table presents a comparison of the latest income statements for Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY) for the fiscal year 2025.

| Metric | ADP | WDAY |

|---|---|---|

| Market Cap | 103.26B | 57.57B |

| Revenue | 20.56B | 8.42B |

| EBITDA | 6.24B | 1.08B |

| EBIT | 5.76B | 0.75B |

| Net Income | 4.08B | 0.53B |

| EPS | 10.02 | 1.98 |

| Fiscal Year | 2025 | 2025 |

Interpretation of Income Statement

In 2025, ADP demonstrated strong revenue growth, increasing to 20.56B, compared to 19.20B in the previous year, reflecting a healthy trend. Net income also rose to 4.08B, showcasing improved profitability. Conversely, WDAY’s revenue rose to 8.42B, up from 7.20B; however, its net income remains modest at 0.53B, indicating potential challenges in controlling costs. Both companies maintain solid EBITDA margins, with ADP showing greater stability and higher profitability ratios than WDAY. Overall, while ADP continues to thrive, WDAY’s growth trajectory suggests ongoing operational challenges, warranting careful consideration for investors.

Financial Ratios Comparison

In the table below, I present a comparative analysis of key financial ratios for Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY) based on the most recent data available for fiscal year 2025.

| Metric | ADP | WDAY |

|---|---|---|

| ROE | 65.93% | 5.82% |

| ROIC | 24.66% | 3.22% |

| P/E | 30.77 | 132.15 |

| P/B | 20.29 | 7.69 |

| Current Ratio | 1.05 | 1.85 |

| Quick Ratio | 1.05 | 1.85 |

| D/E | 1.46 | 0.37 |

| Debt-to-Assets | 16.99% | 18.70% |

| Interest Coverage | 11.87 | 4.30 |

| Asset Turnover | 0.39 | 0.47 |

| Fixed Asset Turnover | 19.97 | 5.34 |

| Payout Ratio | 58.80% | 0% |

| Dividend Yield | 1.91% | 0% |

Interpretation of Financial Ratios

ADP showcases strong financial health with high ROE (65.93%) and ROIC (24.66%), indicating effective use of equity and investment capital. In contrast, WDAY struggles with a lower ROE (5.82%) and a significantly higher P/E ratio (132.15), suggesting overvaluation. While both companies maintain acceptable current ratios above 1, ADP’s debt levels (D/E of 1.46) present concerns regarding leverage compared to WDAY (D/E of 0.37). Overall, ADP appears to be the more robust investment option at this time, but investors should remain cautious about its debt levels.

Dividend and Shareholder Returns

Automatic Data Processing, Inc. (ADP) offers a dividend with a payout ratio of approximately 58.8%, reflecting a consistent annual yield of around 1.91% to 2.26%. The company has also engaged in share buybacks, which support shareholder returns. In contrast, Workday, Inc. (WDAY) does not pay dividends, focusing instead on reinvestment for growth. Despite this, WDAY’s share buyback strategy indicates a commitment to enhancing shareholder value. Each company’s approach, whether through dividends or buybacks, can create long-term value for shareholders, albeit with differing risk profiles.

Strategic Positioning

Automatic Data Processing, Inc. (ADP) holds a strong market share in the human capital management space, leveraging its extensive cloud-based solutions tailored for diverse industries. In contrast, Workday, Inc. (WDAY) focuses on enterprise cloud applications, offering integrated financial and human capital management tools. Both companies face competitive pressure from emerging technologies and startups, necessitating continual innovation to maintain their market positions. As technological disruptions evolve, their adaptability will be key to sustaining growth and competitiveness.

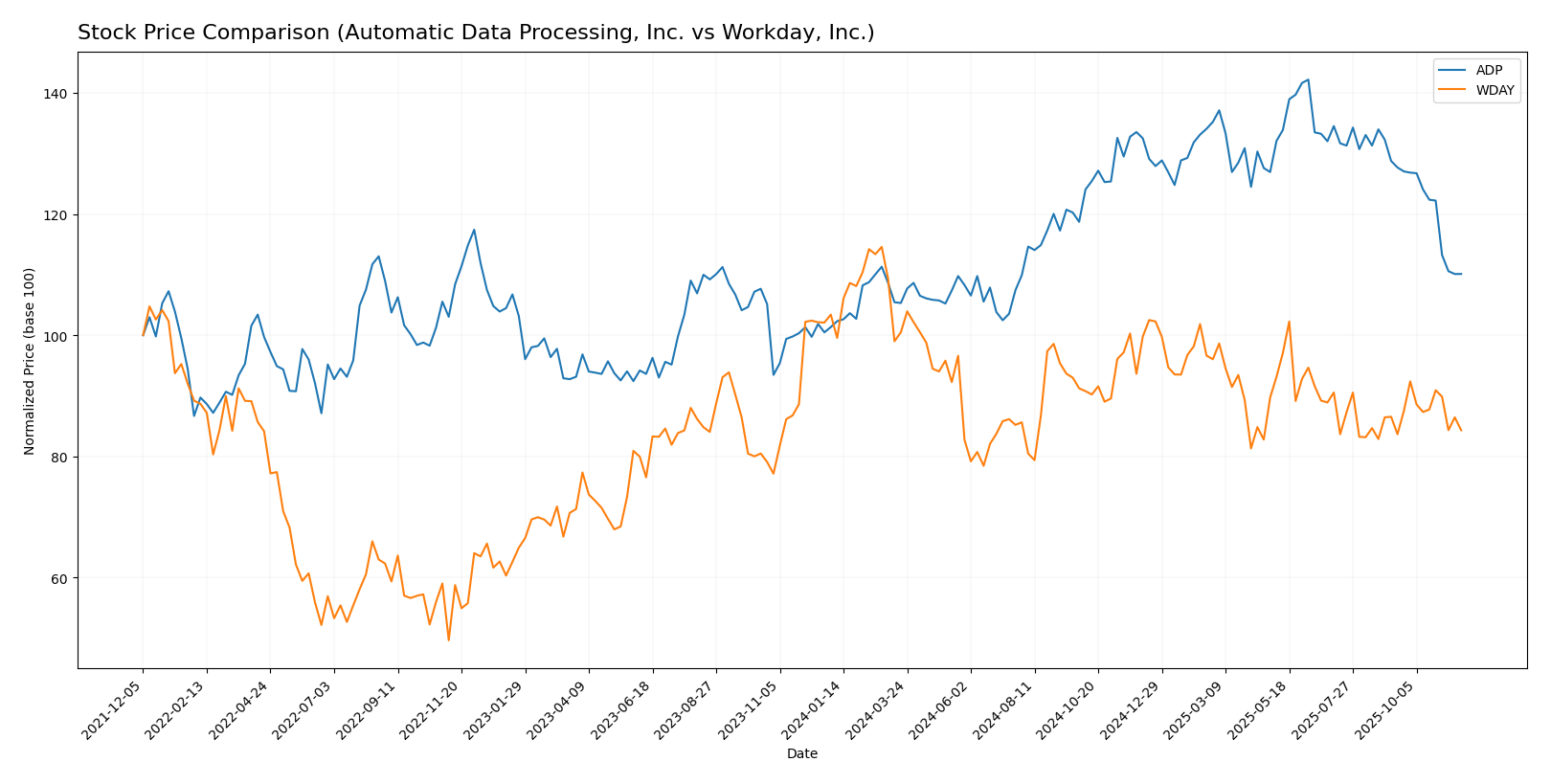

Stock Comparison

In this section, I will analyze the stock price movements of Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY) over the past year, highlighting key trends and trading dynamics.

Trend Analysis

ADP Over the past year, ADP’s stock price has experienced a percentage change of +8.54%. This indicates a bullish trend, although the acceleration status shows deceleration. The stock reached a notable high of 326.81 and a low of 235.21, with a standard deviation of 26.5 suggesting some volatility in its price movements.

In the recent period (from September 14, 2025, to November 30, 2025), ADP’s stock has seen a price change of -13.02%, indicating a downward trend. The standard deviation during this period is 16.69, which further highlights the recent price fluctuations.

WDAY In contrast, WDAY’s stock has experienced a percentage change of -18.88% over the past year, indicating a bearish trend. The stock has a high of 305.88 and a low of 209.48, with a standard deviation of 21.84, suggesting moderate volatility.

Recently, from September 14, 2025, to November 30, 2025, WDAY’s stock price has changed by -3.48%, further confirming its bearish trajectory. The standard deviation for this period is 8.46, indicating relative stability compared to its overall price movements.

Analyst Opinions

Recent analyst recommendations for Automatic Data Processing, Inc. (ADP) indicate a solid “Buy” rating with an overall score of 3, reflecting strong performance in return on equity and assets. Analysts praise its stable cash flow and low debt-to-equity ratio. Meanwhile, Workday, Inc. (WDAY) holds a “Hold” rating, also with an overall score of 3, due to moderate performance metrics, particularly in price-to-earnings. The consensus for 2025 leans towards a “Buy” for ADP and a cautious “Hold” for WDAY.

Stock Grades

In the current market landscape, it’s essential to keep an eye on stock ratings provided by reputable grading companies. Here’s an overview of the latest grades for Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY).

Automatic Data Processing, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Underweight | 2025-10-30 |

| Wells Fargo | maintain | Underweight | 2025-10-30 |

| UBS | maintain | Neutral | 2025-09-17 |

| Morgan Stanley | maintain | Equal Weight | 2025-07-31 |

| Stifel | maintain | Hold | 2025-07-31 |

| Morgan Stanley | maintain | Equal Weight | 2025-06-17 |

| Mizuho | maintain | Outperform | 2025-06-13 |

| UBS | maintain | Neutral | 2025-06-13 |

| RBC Capital | maintain | Sector Perform | 2025-06-05 |

| TD Securities | maintain | Hold | 2025-05-21 |

Workday, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | maintain | Overweight | 2025-11-26 |

| Citigroup | maintain | Neutral | 2025-11-26 |

| RBC Capital | maintain | Outperform | 2025-11-26 |

| Bernstein | maintain | Outperform | 2025-11-26 |

| Stifel | maintain | Hold | 2025-11-26 |

| Citizens | maintain | Market Outperform | 2025-11-26 |

| Wells Fargo | maintain | Overweight | 2025-11-26 |

| Morgan Stanley | maintain | Equal Weight | 2025-11-26 |

| Guggenheim | maintain | Buy | 2025-11-26 |

| DA Davidson | maintain | Neutral | 2025-11-26 |

Overall, both ADP and WDAY show a trend of maintaining existing grades with a mix of “Neutral” to “Overweight” ratings, indicating a cautious but stable outlook from analysts.

Target Prices

The consensus target prices for Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY) indicate positive growth expectations from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ADP | 290 | 245 | 278.25 |

| WDAY | 320 | 235 | 276.29 |

The consensus for ADP suggests a potential upside from its current price of 255.3, while WDAY’s consensus also indicates room for growth from its current price of 215.62. Both companies show promising analyst expectations relative to their market positions.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY) based on the most recent data.

| Criterion | Automatic Data Processing, Inc. (ADP) | Workday, Inc. (WDAY) |

|---|---|---|

| Diversification | High – Offers various HR solutions | Moderate – Focused on financial and workforce management applications |

| Profitability | Strong – Net profit margin at 19.84% | Weak – Net profit margin at 6.25% |

| Innovation | Moderate – Steady improvements in tech | High – Continuous updates and new features |

| Global presence | Strong – Operates globally | Moderate – Primarily focused in the US but expanding |

| Market Share | High – Significant share in HR services | Moderate – Growing but faces competition |

| Debt level | Low – Debt to equity ratio at 1.46 | Moderate – Debt to equity ratio at 0.37 |

Key takeaways indicate that ADP excels in profitability and market share, while WDAY shows strength in innovation but struggles with profitability metrics. Both companies have distinct strengths that can appeal to different investor strategies.

Risk Analysis

In the following table, I outline key risks associated with two companies: Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY).

| Metric | ADP | WDAY |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Low | Moderate |

| Operational Risk | Low | High |

| Environmental Risk | Moderate | Moderate |

| Geopolitical Risk | Low | Moderate |

In summary, Workday faces higher operational and market risks, primarily due to its reliance on a volatile tech sector and its current low profitability margins. Meanwhile, ADP enjoys a stable regulatory environment and lower operational risks, making it a more conservative investment choice.

Which one to choose?

When comparing Automatic Data Processing, Inc. (ADP) and Workday, Inc. (WDAY), ADP shows stronger financial fundamentals. With a gross profit margin of 50.8% and a net profit margin of 19.8%, ADP outperforms WDAY, which has a lower net profit margin of 6.3%. ADP’s price-to-earnings ratio stands at 30.8, in contrast to WDAY’s significantly higher 132.2, suggesting that ADP might be a more prudent investment based on valuation metrics. Additionally, ADP has a better overall rating of B+ compared to WDAY’s B.

For investors focusing on stability and profitability, ADP appears favorable. However, WDAY may attract those seeking growth potential despite its current challenges, evidenced by its bearish stock trend and high valuation ratios. It’s essential to consider the risks associated with WDAY, including its market dependence and competition.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of Automatic Data Processing, Inc. and Workday, Inc. to enhance your investment decisions: