Home > Comparison > Industrials > ADP vs TEAM

The strategic rivalry between Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM) shapes the evolution of workforce management and collaboration technology. ADP, a capital-intensive industrial leader in staffing and employment services, contrasts sharply with TEAM’s high-margin software application model. This analysis explores their battle for sector dominance and growth leadership, aiming to reveal which company offers the superior risk-adjusted return for a diversified portfolio in today’s dynamic market environment.

Table of contents

Companies Overview

Automatic Data Processing, Inc. and Atlassian Corporation both hold pivotal roles in their respective industries, shaping workforce and collaboration solutions globally.

Automatic Data Processing, Inc.: Workforce Management Powerhouse

Automatic Data Processing, Inc. dominates the staffing and employment services sector with cloud-based human capital management solutions. Its core revenue derives from two segments: Employer Services, offering payroll, benefits, and HR outsourcing, and Professional Employer Organization services targeting small and mid-sized businesses. In 2026, the company emphasized expanding strategic, cloud-based platforms to enhance integrated HCM offerings.

Atlassian Corporation: Collaborative Software Innovator

Atlassian Corporation leads in software applications that enable teamwork and project management. Its revenue engine centers on licensing and maintaining diverse products like Jira, Confluence, and Trello, connecting technical and business teams. The company’s 2026 strategy focused on enhancing enterprise agility solutions and expanding its portfolio for seamless collaboration and security across cloud products.

Strategic Collision: Similarities & Divergences

Both firms prioritize cloud-based solutions yet differ fundamentally: ADP offers comprehensive HR outsourcing with a co-employment model, while Atlassian provides open, flexible collaboration software. They compete indirectly by addressing workforce productivity—ADP through human capital management, Atlassian via team collaboration tools. Their distinct models offer contrasting investment profiles rooted in services versus software innovation.

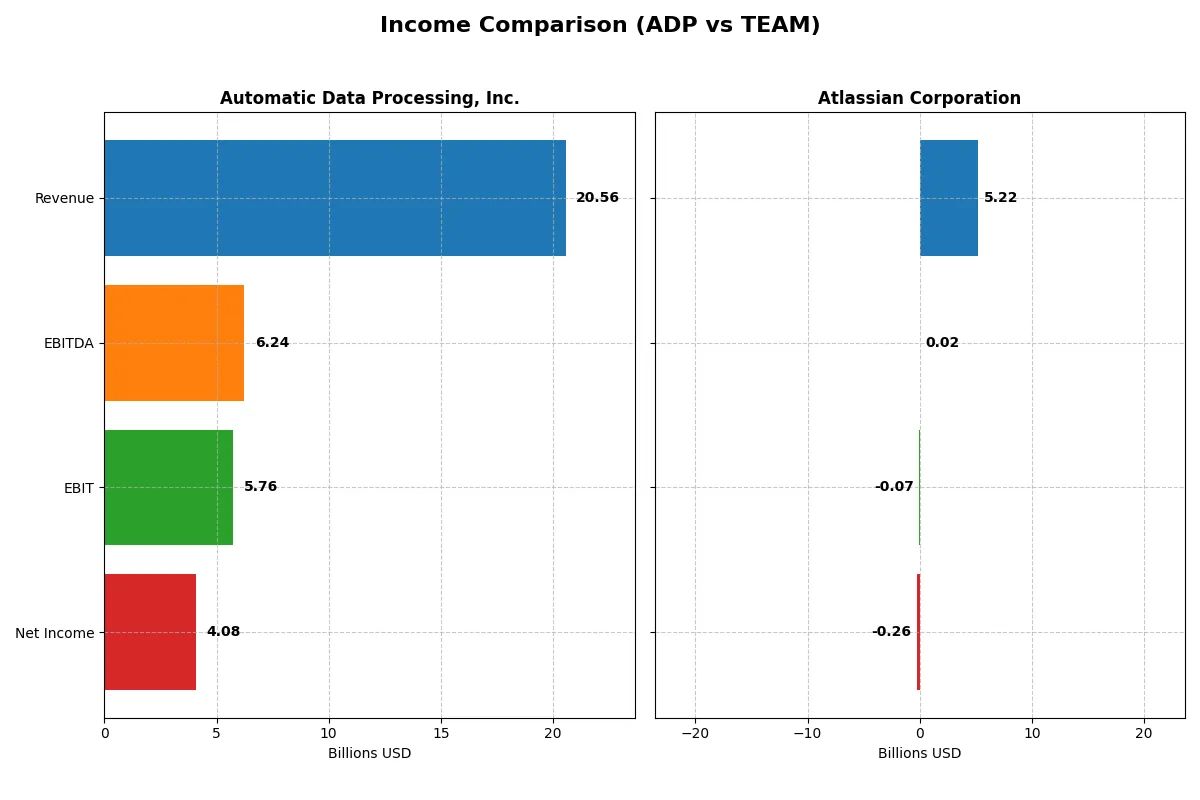

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Automatic Data Processing, Inc. (ADP) | Atlassian Corporation (TEAM) |

|---|---|---|

| Revenue | 20.6B | 5.2B |

| Cost of Revenue | 10.1B | 895M |

| Operating Expenses | 5.0B | 4.5B |

| Gross Profit | 10.5B | 4.3B |

| EBITDA | 6.2B | 24M |

| EBIT | 5.8B | -68M |

| Interest Expense | 456M | 31M |

| Net Income | 4.1B | -257M |

| EPS | 10.02 | -0.98 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with superior efficiency and delivers stronger profitability for shareholders.

Automatic Data Processing, Inc. Analysis

ADP steadily grows revenue from $15B in 2021 to $20.6B in 2025, while net income rises from $2.6B to $4.1B. Gross margin holds firm above 50%, and net margin improves to nearly 20%, showcasing robust profitability. The 2025 fiscal year highlights efficient expense control and consistent earnings momentum.

Atlassian Corporation Analysis

Atlassian expands revenue rapidly, surging from $2.1B in 2021 to $5.2B in 2025, with gross margin exceeding 82%. However, net income remains negative at -$257M in 2025 despite strong top-line growth. Operating losses persist, indicating ongoing scaling costs and pressure on profitability despite promising revenue momentum.

Margin Mastery vs. Growth Gambit

ADP demonstrates superior fundamental strength with sustained positive margins and solid profit growth, reflecting mature operational efficiency. Atlassian impresses with rapid revenue expansion but struggles to convert scale into profits. For investors prioritizing profitability and margin stability, ADP offers the more reliable profile, while Atlassian suits those focused on growth potential with higher risk.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of these companies:

| Ratios | Automatic Data Processing, Inc. (ADP) | Atlassian Corporation (TEAM) |

|---|---|---|

| ROE | 65.9% | -19.1% |

| ROIC | 24.7% | -4.5% |

| P/E | 30.8 | -207.1 |

| P/B | 20.3 | 39.5 |

| Current Ratio | 1.05 | 1.22 |

| Quick Ratio | 1.05 | 1.22 |

| D/E | 1.46 | 0.92 |

| Debt-to-Assets | 17.0% | 20.5% |

| Interest Coverage | 11.9 | -4.3 |

| Asset Turnover | 0.39 | 0.86 |

| Fixed Asset Turnover | 20.0 | 19.0 |

| Payout Ratio | 58.8% | 0% |

| Dividend Yield | 1.91% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths that numbers alone can’t reveal.

Automatic Data Processing, Inc.

ADP displays strong profitability with a robust 65.9% ROE and nearly 20% net margin, signaling operational excellence. However, its valuation appears stretched, with a P/E of 30.77 and P/B above 20. The company balances this by returning value through a modest 1.91% dividend yield, maintaining a prudent shareholder return approach.

Atlassian Corporation

Atlassian struggles with negative profitability metrics, including a -19.1% ROE and a -4.9% net margin, reflecting operational challenges. The stock’s valuation is mixed: an anomalous negative P/E contrasts with a high P/B of 39.51, suggesting market skepticism. It offers no dividends, instead reinvesting heavily in R&D to fuel growth, reflecting a high-risk, high-reward profile.

Premium Valuation vs. Operational Safety

ADP offers a superior balance of profitability and operational efficiency despite its premium valuation, supported by solid shareholder returns. Atlassian’s negative earnings and high valuation highlight riskier prospects focused on growth. ADP suits risk-averse investors; Atlassian fits those seeking aggressive expansion plays.

Which one offers the Superior Shareholder Reward?

I see ADP delivers consistent dividends with a 2.3% yield and a sustainable 58% payout ratio, backed by strong free cash flow of $11.7/share in 2025. ADP also aggressively buys back shares, enhancing total return. Atlassian (TEAM) pays no dividends but reinvests nearly all free cash flow ($5.4/share) into growth and R&D. However, TEAM shows persistent net losses and high valuation multiples (P/E negative, P/FCF ~38x), raising sustainability concerns. I consider ADP’s balanced dividend-plus-buyback model more dependable and attractive for long-term total shareholder reward in 2026.

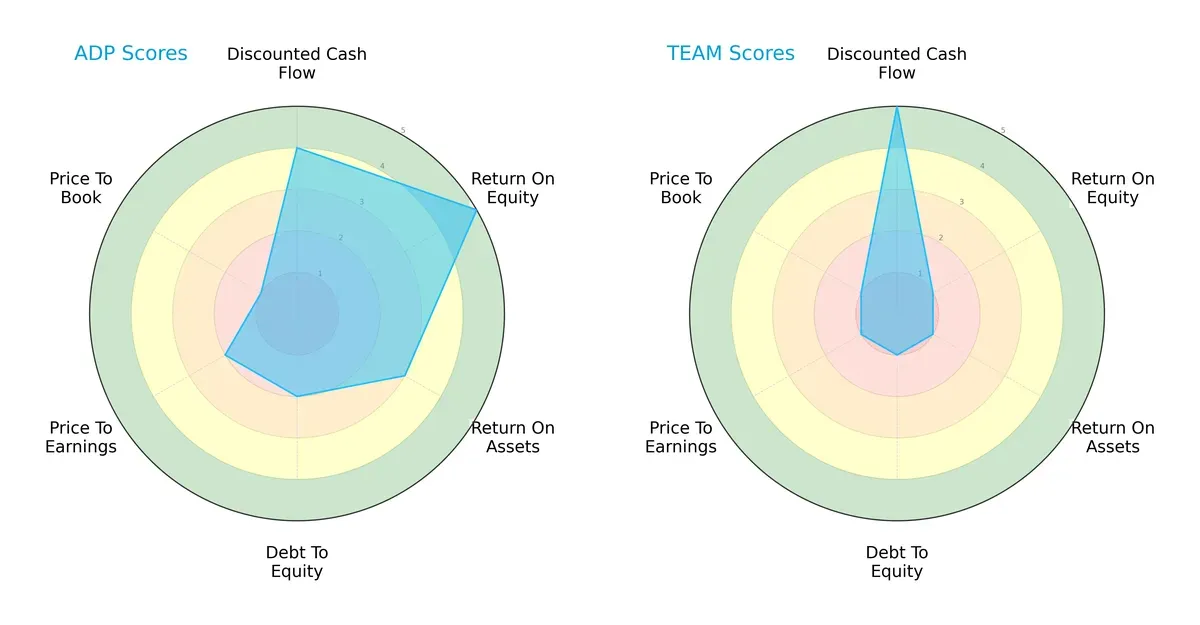

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Automatic Data Processing, Inc. and Atlassian Corporation, highlighting their core financial strengths and weaknesses:

Automatic Data Processing (ADP) shows a balanced profile with strong ROE (5) and moderate ROA (3), but a weak price-to-book score (1) indicating valuation concerns. Atlassian (TEAM) relies heavily on an outstanding DCF score (5) but scores poorly on profitability and leverage metrics, suggesting a riskier financial structure.

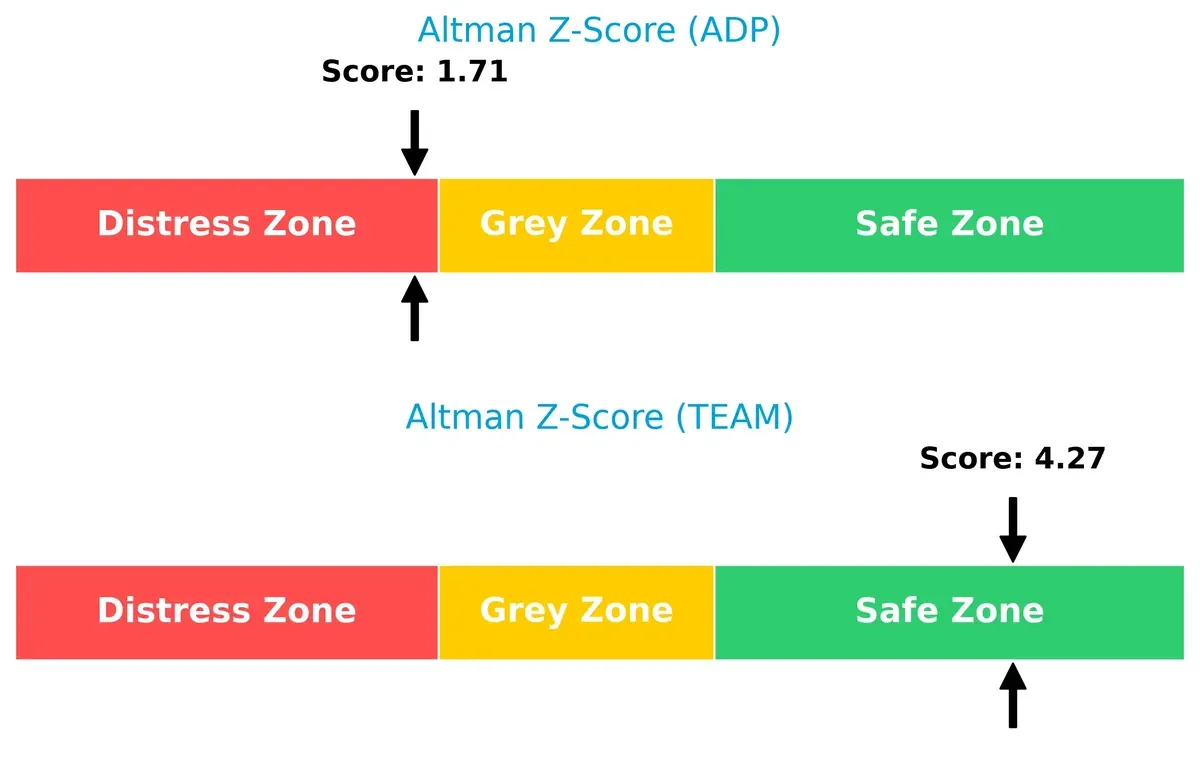

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap underscores stark differences: ADP (1.7) edges into distress territory, while Atlassian (4.3) sits comfortably in the safe zone, implying superior solvency and long-term survival prospects for Atlassian:

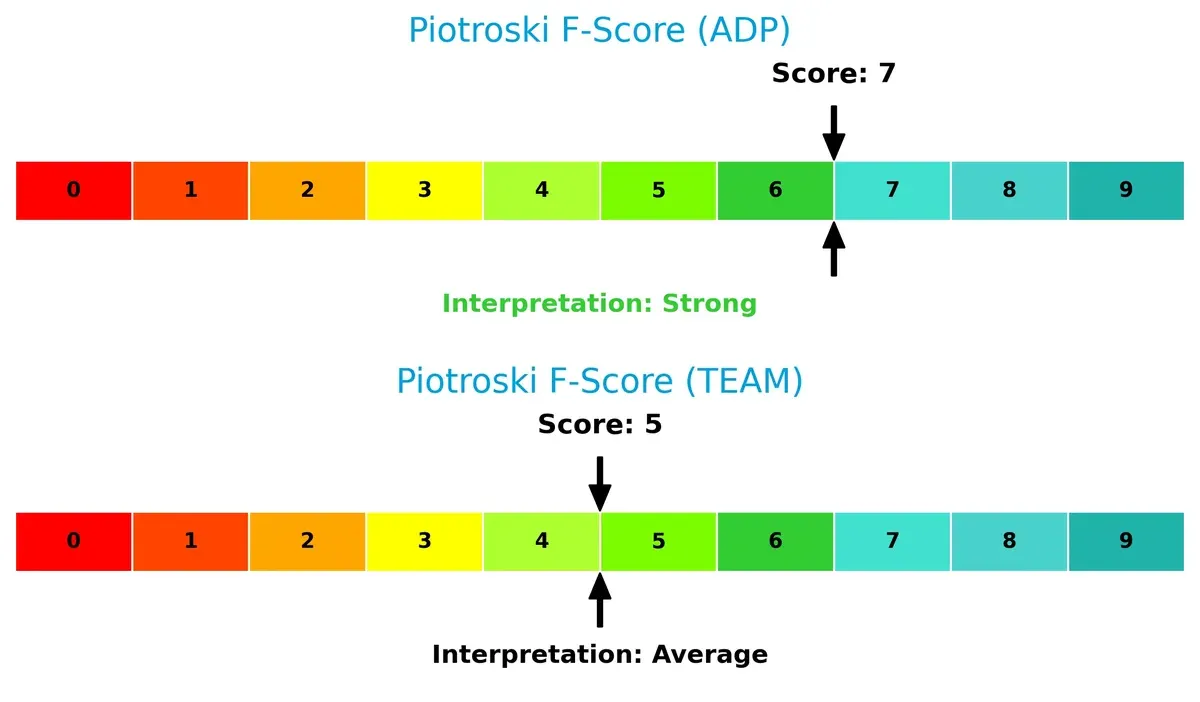

Financial Health: Quality of Operations

ADP’s Piotroski score of 7 signals strong operational quality and internal financial health. In contrast, Atlassian’s 5 reflects average financial strength, implying some internal red flags compared to ADP’s robust metrics:

How are the two companies positioned?

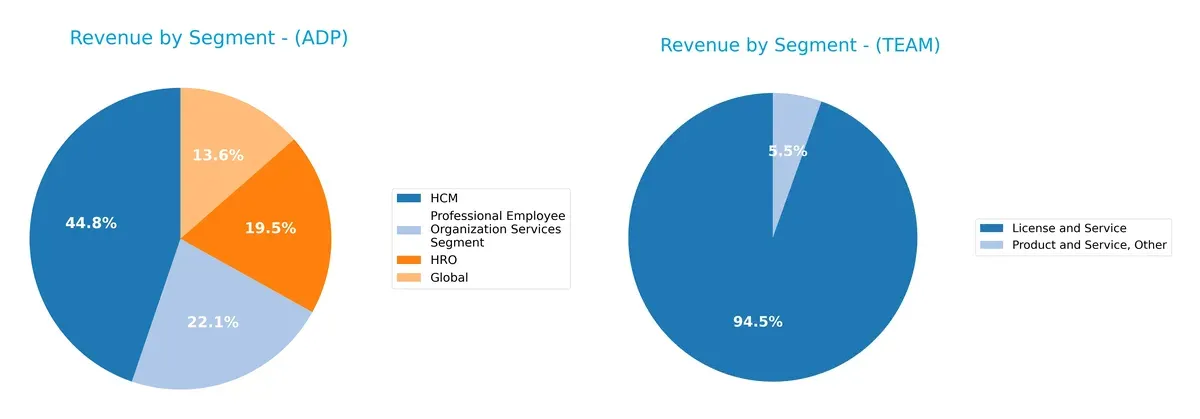

This section dissects ADP and TEAM’s operational DNA by comparing their revenue distribution and internal dynamics. The goal: confront their economic moats to find which model sustains the strongest competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Automatic Data Processing, Inc. and Atlassian Corporation diversify their income streams and reveals where their primary sector bets lie:

ADP anchors its revenue heavily in HCM at $8.67B, supported by three sizable segments around $2.6B to $4.3B, demonstrating a balanced, multifaceted portfolio. In contrast, Atlassian pivots sharply on License and Service at $4.93B, with much smaller contributions from ancillary streams under $300M. ADP’s diversified mix reduces concentration risk, while Atlassian’s focus underscores ecosystem lock-in but heightens dependency on its core software.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Automatic Data Processing, Inc. (ADP) and Atlassian Corporation (TEAM):

ADP Strengths

- Strong profitability with 19.84% net margin and 65.93% ROE

- Favorable ROIC at 24.66% well above WACC at 7.54%

- Diversified revenue streams across HCM, HRO, Global, and PEO segments

- Significant global presence with $18.2B US and $1.5B Europe revenues

- High fixed asset turnover at 19.97 indicating efficient asset use

TEAM Strengths

- Favorable WACC at 7.82% supports capital efficiency

- Growing revenues mainly from License and Service segment at $4.9B

- Geographic diversification including Americas, EMEA, and Asia Pacific

- Favorable quick ratio at 1.22 signals good short-term liquidity

- Reasonable debt-to-assets at 20.51% supports moderate leverage

ADP Weaknesses

- High P/E of 30.77 and PB of 20.29 indicate expensive valuation

- Debt-to-equity at 1.46 is elevated, posing leverage risk

- Asset turnover at 0.39 is relatively low, suggesting lower operational efficiency

- Current ratio at 1.05 is only marginally above 1, caution on liquidity

- Dividend yield at 1.91% is neutral, less attractive for income investors

TEAM Weaknesses

- Negative profitability with -4.92% net margin and -19.08% ROE

- Negative ROIC at -4.48% signals value destruction

- Interest coverage negative at -2.24, raising solvency concerns

- High PB ratio at 39.51 indicates overvaluation risk

- No dividend yield limits income appeal

Overall, ADP demonstrates robust profitability and diversified revenue with prudent debt levels, but valuation and efficiency metrics warrant attention. TEAM struggles with profitability and solvency despite geographic diversification and moderate leverage, highlighting challenges in capital allocation and operational execution.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only defense long-term profits have against relentless competitive erosion. Let’s dissect how these companies protect their profits:

Automatic Data Processing, Inc. (ADP): Switching Costs Moat

ADP’s moat stems from high switching costs embedded in its integrated HR and payroll systems. This drives stable margins near 28% EBIT and a robust 17% ROIC above WACC. In 2026, expanding cloud-based services deepens this moat but requires vigilance against tech disruption.

Atlassian Corporation (TEAM): Network Effects Moat

TEAM leverages network effects through collaborative software ecosystems, contrasting ADP’s cost lock-in. Despite soaring 83% gross margins, its declining ROIC signals weakening capital efficiency. Growth in enterprise agility tools offers upside if profitability improves.

Switching Costs vs. Network Effects: The Moat Showdown

ADP possesses a wider and deeper moat with durable ROIC growth and consistent value creation. TEAM’s innovative network effects show promise but face profitability erosion, making ADP better equipped to defend market share in 2026.

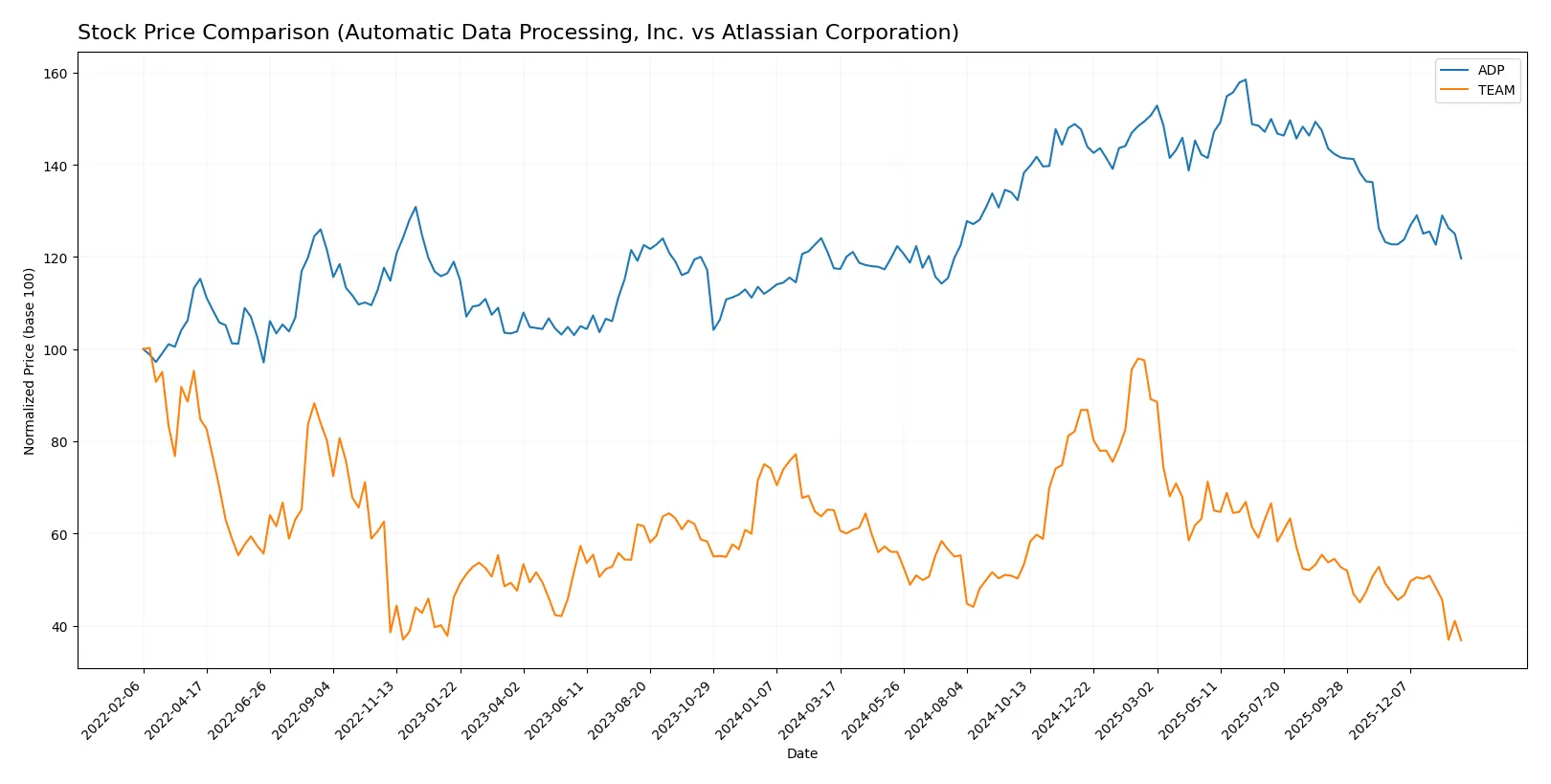

Which stock offers better returns?

Over the past 12 months, Automatic Data Processing, Inc. and Atlassian Corporation exhibited contrasting price trajectories, with ADP showing mild gains and TEAM enduring sharp declines amid volatile trading conditions.

Trend Comparison

Automatic Data Processing, Inc. recorded a 1.82% price increase over the last year, indicating a bullish trend with decelerating momentum and a price range from 235.56 to 326.81.

Atlassian Corporation’s stock fell 43.4% over the same period, reflecting a bearish trend with deceleration and a wider price range between 118.18 and 314.28.

Comparing both, ADP delivered the highest market performance, maintaining a positive trend, while TEAM suffered significant losses and heightened volatility.

Target Prices

Analysts present a cautiously optimistic consensus for Automatic Data Processing, Inc. and Atlassian Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Automatic Data Processing, Inc. | 230 | 306 | 274.71 |

| Atlassian Corporation | 145 | 290 | 226.29 |

The consensus target for ADP is roughly 11% above its current price of $246.82, signaling moderate upside. Atlassian’s target consensus sits almost 91% above its current $118.18, reflecting higher growth expectations despite recent volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Automatic Data Processing, Inc. and Atlassian Corporation:

Automatic Data Processing, Inc. Grades

This table shows the latest grades from major financial institutions for ADP.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Neutral | 2026-01-29 |

| Morgan Stanley | maintain | Equal Weight | 2026-01-29 |

| Stifel | maintain | Hold | 2026-01-29 |

| Wells Fargo | maintain | Underweight | 2026-01-29 |

| JP Morgan | maintain | Underweight | 2026-01-29 |

| Jefferies | downgrade | Underperform | 2025-12-16 |

| JP Morgan | maintain | Underweight | 2025-10-30 |

| Wells Fargo | maintain | Underweight | 2025-10-30 |

| UBS | maintain | Neutral | 2025-09-17 |

| Morgan Stanley | maintain | Equal Weight | 2025-07-31 |

Atlassian Corporation Grades

This table presents the most recent institutional grades for TEAM.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | maintain | Outperform | 2026-01-26 |

| Mizuho | maintain | Outperform | 2026-01-21 |

| TD Cowen | maintain | Hold | 2026-01-20 |

| Citigroup | maintain | Buy | 2026-01-16 |

| BTIG | maintain | Buy | 2026-01-13 |

| Piper Sandler | maintain | Overweight | 2026-01-05 |

| Bernstein | maintain | Outperform | 2025-11-18 |

| Macquarie | maintain | Outperform | 2025-11-03 |

| Mizuho | maintain | Outperform | 2025-10-31 |

| Bernstein | maintain | Outperform | 2025-10-31 |

Which company has the best grades?

Atlassian consistently earns outperform and buy ratings from top firms. ADP mostly holds neutral to underweight grades. Investors may view Atlassian as having stronger institutional support, potentially signaling better growth expectations.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Automatic Data Processing, Inc.

- Dominates staffing and HR services with a stable client base, but faces pressure from tech-driven payroll disruptors.

Atlassian Corporation

- Faces intense competition in software with constant innovation demands and fast-changing client preferences.

2. Capital Structure & Debt

Automatic Data Processing, Inc.

- Debt-to-equity ratio at 1.46 signals moderate leverage; interest coverage is strong at 12.63, indicating manageable debt costs.

Atlassian Corporation

- Lower debt at 0.92 D/E ratio but negative interest coverage (-2.24) raises red flags on ability to service debt.

3. Stock Volatility

Automatic Data Processing, Inc.

- Beta of 0.864 shows below-market volatility, providing a defensive profile in cyclical markets.

Atlassian Corporation

- Beta of 0.888 indicates moderate volatility, but wide price range (115-326) reflects high uncertainty.

4. Regulatory & Legal

Automatic Data Processing, Inc.

- Compliance-heavy sector with evolving labor laws; risk of fines but mitigated by decades of experience.

Atlassian Corporation

- Faces software data privacy and security regulations, with potential fines impacting reputation and finances.

5. Supply Chain & Operations

Automatic Data Processing, Inc.

- Operations rely on cloud infrastructure and global workforce; moderate risk of service disruptions.

Atlassian Corporation

- Dependent on continuous software development and cloud delivery; risks from tech outages and talent retention.

6. ESG & Climate Transition

Automatic Data Processing, Inc.

- Pressure to reduce carbon footprint in data centers and promote diversity in workforce.

Atlassian Corporation

- Faces scrutiny on energy use in cloud operations and social governance in tech culture.

7. Geopolitical Exposure

Automatic Data Processing, Inc.

- Primarily US-focused, relatively insulated from geopolitical tensions but exposed to domestic policy shifts.

Atlassian Corporation

- Global footprint, especially in Australia and US, faces risks from trade tensions and foreign regulatory pressures.

Which company shows a better risk-adjusted profile?

Automatic Data Processing’s strongest risk factor is moderate leverage but excellent interest coverage, reflecting prudent capital management. Atlassian’s most pressing risk is its negative interest coverage and uneven profitability, signaling financial stress. ADP’s stable market position and defensive beta give it a superior risk-adjusted profile. Notably, Atlassian’s wide stock price range reveals significant valuation volatility, amplifying investment risk.

Final Verdict: Which stock to choose?

Automatic Data Processing, Inc. (ADP) excels as a cash-generating powerhouse with a durable competitive moat. Its strong capital allocation and growing ROIC highlight disciplined management. A point of vigilance remains its moderate leverage and valuation premium. ADP suits investors aiming for steady, quality growth with resilience.

Atlassian Corporation (TEAM) commands a strategic moat through innovation and recurring revenue in cloud collaboration. While its growth trajectory is impressive, the company currently faces profitability challenges and value destruction signals. TEAM offers appeal to investors seeking high-growth potential with a tolerance for volatility and risk.

If you prioritize consistent value creation and financial strength, ADP outshines with its proven moat and stable cash flows. However, if you seek aggressive growth and can weather near-term profitability setbacks, TEAM offers superior innovation-driven upside. Each stock fits distinct investor profiles shaped by risk tolerance and strategic focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Automatic Data Processing, Inc. and Atlassian Corporation to enhance your investment decisions: