Snowflake Inc. and Autodesk, Inc. are two prominent players in the software application industry, each leading innovation in cloud-based data platforms and 3D design software, respectively. While Snowflake focuses on data consolidation and analytics, Autodesk drives advancements in engineering and entertainment software. Their overlapping market presence and forward-thinking strategies make them compelling candidates for comparison. In this article, I will help you decide which company offers the most promising investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Snowflake Inc. and Autodesk, Inc. by providing an overview of these two companies and their main differences.

Snowflake Inc. Overview

Snowflake Inc. operates a cloud-based data platform that enables organizations to consolidate data into a unified source for business insights, data-driven applications, and data sharing. Founded in 2012 and headquartered in Bozeman, Montana, Snowflake serves a diverse range of industries globally. The company positions itself as a leader in cloud data management with a focus on scalability and integration.

Autodesk, Inc. Overview

Autodesk, Inc. delivers 3D design, engineering, and entertainment software worldwide, including solutions like AutoCAD, BIM 360, and Fusion 360. Established in 1982 and based in San Rafael, California, Autodesk targets professionals in architecture, engineering, construction, manufacturing, and media. Its diverse software portfolio supports design, simulation, manufacturing, and media production workflows through direct and reseller channels.

Key similarities and differences

Both Snowflake and Autodesk operate in the technology sector, focusing on software applications but serving distinct markets: data management versus design and engineering. Snowflake’s model revolves around cloud-based data consolidation and analytics, while Autodesk emphasizes 3D design and digital content creation tools. Each company serves global customers, yet Autodesk has a longer market presence and broader product range, whereas Snowflake is a newer entrant specializing in cloud data platforms.

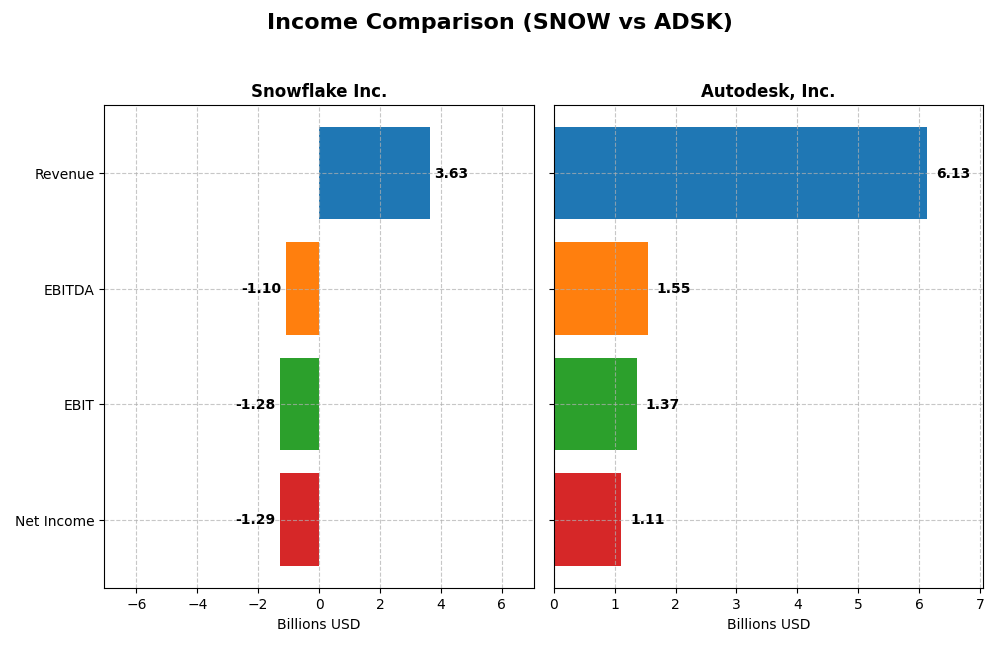

Income Statement Comparison

The following table presents a side-by-side comparison of Snowflake Inc. and Autodesk, Inc. income statement metrics for the fiscal year 2025, providing a snapshot of their financial performance.

| Metric | Snowflake Inc. (SNOW) | Autodesk, Inc. (ADSK) |

|---|---|---|

| Market Cap | 70.4B | 56.6B |

| Revenue | 3.63B | 6.13B |

| EBITDA | -1.10B | 1.55B |

| EBIT | -1.28B | 1.37B |

| Net Income | -1.29B | 1.11B |

| EPS | -3.86 | 5.17 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Snowflake Inc.

Snowflake’s revenue surged from $592M in 2021 to $3.63B in 2025, reflecting strong growth. However, net income remained negative, with a widening loss reaching -$1.29B in 2025. Gross margin stayed favorable at 66.5%, but EBIT and net margins were deeply negative, indicating ongoing operational challenges. The 2025 revenue growth slowed but remained robust, while losses expanded.

Autodesk, Inc.

Autodesk’s revenue increased steadily from $3.79B in 2021 to $6.13B in 2025. Net income fluctuated but stayed positive, reaching $1.11B in 2025. Margins improved, with a strong gross margin above 90% and EBIT margin at 22.3%. The 2025 financials showed continued margin expansion and solid revenue growth, supported by rising EPS and net margin.

Which one has the stronger fundamentals?

Autodesk shows stronger fundamentals with consistent profitability, robust margins, and positive net income growth, despite a slight net income decline over five years. Snowflake exhibits impressive revenue growth but ongoing net losses and negative margins raise concerns about profitability. Overall, Autodesk’s income statement profile is more favorable and stable compared to Snowflake’s.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Snowflake Inc. and Autodesk, Inc. as of fiscal year 2025, enabling a side-by-side comparison of key performance and financial health indicators.

| Ratios | Snowflake Inc. (SNOW) | Autodesk, Inc. (ADSK) |

|---|---|---|

| ROE | -42.86% | 42.43% |

| ROIC | -25.24% | 18.01% |

| P/E | -47.0 | 60.20 |

| P/B | 20.13 | 25.54 |

| Current Ratio | 1.75 | 0.68 |

| Quick Ratio | 1.75 | 0.68 |

| D/E (Debt-to-Equity) | 0.90 | 0.98 |

| Debt-to-Assets | 29.72% | 23.62% |

| Interest Coverage | -527.73 | 0 |

| Asset Turnover | 0.40 | 0.57 |

| Fixed Asset Turnover | 5.53 | 21.44 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Snowflake Inc.

Snowflake shows a mix of strong and weak financial ratios, with unfavorable net margin (-35.45%), ROE (-42.86%), and ROIC (-25.24%), indicating profitability challenges. The company’s liquidity is solid with a current ratio of 1.75. No dividends are paid, reflecting a reinvestment strategy typical for high-growth firms focusing on R&D and platform expansion.

Autodesk, Inc.

Autodesk reports favorable profitability ratios, including a net margin of 18.14%, ROE of 42.43%, and ROIC of 18.01%, suggesting strong operational performance. Liquidity ratios are weak with a current ratio of 0.68, which may signal short-term liquidity risks. Autodesk does not pay dividends, likely prioritizing growth investments and share repurchases to enhance shareholder value.

Which one has the best ratios?

Autodesk’s ratios indicate stronger profitability and operational efficiency compared to Snowflake’s negative returns and margin pressures. However, Autodesk’s lower liquidity ratios contrast with Snowflake’s healthier current ratio. Overall, Autodesk displays a more balanced profile, while Snowflake’s metrics reflect typical growth-phase challenges, leading to a neutral versus slightly unfavorable global opinion respectively.

Strategic Positioning

This section compares the strategic positioning of Snowflake Inc. and Autodesk, Inc., including market position, key segments, and exposure to technological disruption:

Snowflake Inc.

- Positioned as a cloud-based data platform leader facing typical software industry competition.

- Revenue driven mainly by Product sales with growing Professional Services contribution.

- Operates in cloud data management, exposed to evolving cloud technology and data trends.

Autodesk, Inc.

- Well-established in 3D design, engineering, and entertainment software amid diverse competitors.

- Diverse segments: Architecture, AutoCAD family, Manufacturing, Media & Entertainment.

- Engages in advanced design software, adapting to CAD/CAM technological developments.

Snowflake Inc. vs Autodesk, Inc. Positioning

Snowflake focuses on a concentrated cloud data platform business, while Autodesk operates a diversified portfolio across design, manufacturing, and media segments. Snowflake’s narrower focus contrasts with Autodesk’s broad market coverage, each with distinct growth drivers and market risks.

Which has the best competitive advantage?

Autodesk shows a strong, durable competitive advantage with growing profitability and value creation. Snowflake currently faces declining returns and value destruction, indicating a weaker competitive moat based on recent ROIC versus WACC analysis.

Stock Comparison

Key price movements over the past year reveal a bearish trend for Snowflake Inc. (SNOW) with significant deceleration, while Autodesk, Inc. (ADSK) exhibits a modest bullish trend despite recent declines.

Trend Analysis

Snowflake Inc. (SNOW) experienced an overall bearish trend with an 8.27% price decline over the past 12 months, showing deceleration and high volatility (std deviation 42.6). The stock peaked at 274.88 and bottomed at 108.56.

Autodesk, Inc. (ADSK) showed a 3.3% price increase over the past 12 months, qualifying as a bullish trend with deceleration and lower volatility (std deviation 29.87). Its price ranged between 201.6 and 326.37.

Comparing trends, Autodesk outperformed Snowflake over the last year, delivering positive returns while Snowflake’s stock declined notably during the same period.

Target Prices

Analyst consensus presents a confident outlook for both Snowflake Inc. and Autodesk, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Snowflake Inc. | 325 | 237 | 281.86 |

| Autodesk, Inc. | 400 | 343 | 373 |

The consensus target prices for Snowflake and Autodesk exceed their current prices of $210.38 and $265.69 respectively, indicating bullish analyst expectations for potential upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Snowflake Inc. and Autodesk, Inc.:

Rating Comparison

Snowflake Inc. Rating

- Rating: C-, considered very favorable overall.

- Discounted Cash Flow Score: Moderate, with a score of 3.

- ROE Score: Very unfavorable, with a low score of 1.

- ROA Score: Very unfavorable, scoring 1.

- Debt To Equity Score: Very unfavorable, score of 1.

- Overall Score: Very unfavorable with a score of 1.

Autodesk, Inc. Rating

- Rating: B-, also rated very favorable overall.

- Discounted Cash Flow Score: Moderate, also scoring 3.

- ROE Score: Very favorable, highest score of 5.

- ROA Score: Favorable, scoring 4.

- Debt To Equity Score: Very unfavorable, also scoring 1.

- Overall Score: Moderate, scoring 3.

Which one is the best rated?

Based strictly on the provided data, Autodesk, Inc. is better rated overall with a B- rating and higher scores in ROE, ROA, and overall score compared to Snowflake Inc., which holds a C- rating and lower financial metric scores.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for Snowflake Inc. and Autodesk, Inc.:

SNOW Scores

- Altman Z-Score: 5.36, in safe zone, low bankruptcy risk

- Piotroski Score: 4, average financial strength

ADSK Scores

- Altman Z-Score: 5.05, in safe zone, low bankruptcy risk

- Piotroski Score: 8, very strong financial strength

Which company has the best scores?

Autodesk has a slightly lower but still safe Altman Z-Score compared to Snowflake. However, Autodesk’s Piotroski Score is significantly higher, indicating stronger financial health than Snowflake based on these metrics.

Grades Comparison

The following tables present the latest grades issued by reputable grading companies for Snowflake Inc. and Autodesk, Inc.:

Snowflake Inc. Grades

This table summarizes recent grades and rating changes provided by recognized financial institutions for Snowflake Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Downgrade | Equal Weight | 2026-01-12 |

| Argus Research | Upgrade | Buy | 2026-01-08 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Wells Fargo | Maintain | Overweight | 2025-12-04 |

| Keybanc | Maintain | Overweight | 2025-12-04 |

| Piper Sandler | Maintain | Overweight | 2025-12-04 |

| Morgan Stanley | Maintain | Overweight | 2025-12-04 |

| Wedbush | Maintain | Outperform | 2025-12-04 |

| Deutsche Bank | Maintain | Buy | 2025-12-04 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-04 |

Snowflake’s grades predominantly indicate a positive outlook, with most ratings at Overweight or Buy, despite a recent downgrade by Barclays.

Autodesk, Inc. Grades

Below is the summary of recent grades issued by respected grading companies for Autodesk, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-26 |

| Wells Fargo | Maintain | Overweight | 2025-11-26 |

| Deutsche Bank | Upgrade | Buy | 2025-11-26 |

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Macquarie | Maintain | Outperform | 2025-11-26 |

| BMO Capital | Maintain | Market Perform | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-24 |

| Baird | Maintain | Outperform | 2025-11-18 |

Autodesk’s ratings are broadly positive as well, featuring mostly Overweight, Buy, and Outperform grades, with a few Neutral and Market Perform assessments.

Which company has the best grades?

Both Snowflake Inc. and Autodesk, Inc. maintain predominantly positive ratings, with consensus “Buy” from analysts. Snowflake features more recent upgrades but includes a notable downgrade, while Autodesk shows consistent maintenance of favorable grades. Investors may observe these trends for indications of analyst confidence and potential market sentiment.

Strengths and Weaknesses

Below is a comparative summary of key strengths and weaknesses for Snowflake Inc. (SNOW) and Autodesk, Inc. (ADSK) based on the latest financial and operational data.

| Criterion | Snowflake Inc. (SNOW) | Autodesk, Inc. (ADSK) |

|---|---|---|

| Diversification | Revenue mainly from Product segment (~3.46B USD in 2025), limited service revenue | Broad product range with strong segments: Architecture (~2.94B USD), AutoCAD (~1.57B USD), Manufacturing (~1.19B USD) |

| Profitability | Negative net margin (-35.45%), negative ROIC (-25.24%), value destroying | Positive net margin (18.14%), strong ROIC (18.01%), value creating and profitable |

| Innovation | High innovation but declining ROIC (-139% trend), profitability issues | Sustained innovation with growing ROIC (+15.4%), durable competitive advantage |

| Global presence | Strong cloud data platform presence globally but limited product diversification | Established global footprint across multiple industries and markets |

| Market Share | Expanding in cloud data warehousing but facing intense competition | Leading in design software with significant market share in architecture and manufacturing |

Key takeaways: Autodesk demonstrates a balanced diversification and strong profitability with a durable moat, making it a safer investment. Snowflake shows rapid growth and innovation potential but currently suffers from negative profitability and declining returns, implying higher risk.

Risk Analysis

Below is a summary table of key risks for Snowflake Inc. (SNOW) and Autodesk, Inc. (ADSK) based on 2025 financial data and market conditions.

| Metric | Snowflake Inc. (SNOW) | Autodesk, Inc. (ADSK) |

|---|---|---|

| Market Risk | Beta 1.14, moderate volatility | Beta 1.47, higher volatility |

| Debt Level | D/E 0.9, neutral risk | D/E 0.98, neutral risk |

| Regulatory Risk | Moderate, tech sector sensitive | Moderate, exposure to global rules |

| Operational Risk | Negative margins, efficiency issues | Strong margins, operational scale |

| Environmental Risk | Moderate, data center energy use | Moderate, software with cloud impact |

| Geopolitical Risk | US-based, moderate exposure | US-based, moderate exposure |

Snowflake faces higher operational risk due to persistent negative profitability and unfavorable efficiency ratios, despite a healthy liquidity position. Autodesk shows stronger financial health with favorable returns and a very strong Piotroski score, but its high valuation multiples and weak liquidity warrant caution. Market volatility and sector-specific regulatory changes remain key risks for both.

Which Stock to Choose?

Snowflake Inc. (SNOW) shows strong revenue growth of 29.2% in 2025 but suffers from negative profitability with a -35.45% net margin and declining returns on equity and invested capital. Its debt level is moderate, and the overall rating is slightly unfavorable.

Autodesk, Inc. (ADSK) presents steady income growth at 12.7% with favorable profitability indicators, including an 18.14% net margin and strong returns on equity and invested capital. The company carries moderate debt and holds a neutral to favorable overall rating.

Investors prioritizing growth might view Snowflake’s rapid revenue expansion as appealing despite profitability challenges, while those seeking financial stability and value creation may lean towards Autodesk’s consistent profitability and very favorable moat evaluation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Snowflake Inc. and Autodesk, Inc. to enhance your investment decisions: