Investors seeking growth in the technology sector often consider software application companies with strong innovation and market presence. Autodesk, Inc. (ADSK) specializes in 3D design and engineering software, while Dayforce Inc (DAY) focuses on cloud-based human capital management solutions. Both operate in overlapping software markets and pursue distinct innovation strategies. This article will help you determine which company offers the most compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Autodesk and Dayforce by providing an overview of these two companies and their main differences.

Autodesk Overview

Autodesk, Inc. specializes in 3D design, engineering, and entertainment software and services, serving a global market. Its product suite includes AutoCAD Civil 3D for civil engineering, BIM 360 for construction management, and Fusion 360 for 3D CAD and CAM. Headquartered in San Rafael, California, Autodesk targets industries such as architecture, engineering, manufacturing, and media with a workforce of 15,300 employees.

Dayforce Overview

Dayforce Inc. operates as a human capital management (HCM) software provider, offering cloud-based platforms for HR, payroll, benefits, workforce, and talent management. Formerly Ceridian HCM Holding, Dayforce focuses on the US, Canadian, and international markets with solutions like Powerpay for small businesses. Based in Minneapolis, Minnesota, the company employs approximately 9,600 people.

Key similarities and differences

Both Autodesk and Dayforce operate in the software application industry, providing cloud-based solutions tailored to specific professional sectors. While Autodesk emphasizes design, engineering, and manufacturing software, Dayforce concentrates on human capital management and payroll services. Autodesk has a larger workforce and market capitalization compared to Dayforce, reflecting differences in scale and market focus.

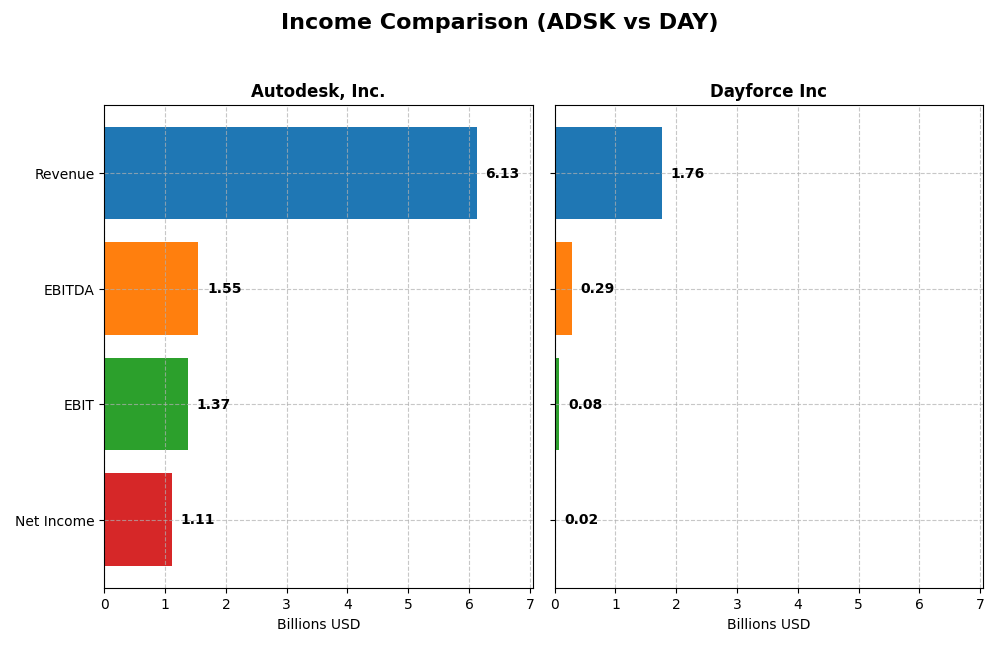

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Autodesk, Inc. and Dayforce Inc for their most recent fiscal year, providing a snapshot of their financial performance.

| Metric | Autodesk, Inc. (ADSK) | Dayforce Inc (DAY) |

|---|---|---|

| Market Cap | 56.6B | 11.1B |

| Revenue | 6.13B | 1.76B |

| EBITDA | 1.55B | 288M |

| EBIT | 1.37B | 78.2M |

| Net Income | 1.11B | 18.1M |

| EPS | 5.17 | 0.11 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Autodesk, Inc.

Autodesk’s revenue showed a steady increase from $3.79B in 2021 to $6.13B in 2025, reflecting 61.7% growth over the period. Net income fluctuated, peaking at $1.21B in 2021 before declining to $1.11B in 2025. Margins remained strong, with a gross margin above 90% and an improving EBIT margin reaching 22.3% in 2025. The latest year saw favorable revenue growth of 12.7% and margin improvements, indicating solid operational efficiency.

Dayforce Inc

Dayforce’s revenue doubled from $842M in 2020 to $1.76B in 2024, with net income swinging from losses to a positive $18M in 2024. Gross margin improved to 46.1%, though EBIT and net margins remain modest at 4.4% and 1.0%, respectively. Despite a 16.3% revenue increase in 2024, EBIT fell by 40.8%, signaling margin pressure. Overall, growth is strong, but profitability remains constrained.

Which one has the stronger fundamentals?

Autodesk demonstrates robust profitability with high and stable margins, supported by consistent revenue growth and improving operational efficiency. Dayforce exhibits rapid revenue growth and a significant turnaround in net income over the period, though profitability margins remain low and volatile. Autodesk’s stronger margins and more stable earnings suggest more resilient fundamentals compared to Dayforce’s emerging but less consistent profitability.

Financial Ratios Comparison

The table below compares key financial ratios for Autodesk, Inc. (ADSK) and Dayforce Inc (DAY) based on their most recent fiscal year data, providing a snapshot of their financial health and market valuation.

| Ratios | Autodesk, Inc. (ADSK) 2025 | Dayforce Inc (DAY) 2024 |

|---|---|---|

| ROE | 42.4% | 0.7% |

| ROIC | 18.0% | 1.3% |

| P/E | 60.2 | 633.3 |

| P/B | 25.5 | 4.5 |

| Current Ratio | 0.68 | 1.13 |

| Quick Ratio | 0.68 | 1.13 |

| D/E | 0.98 | 0.48 |

| Debt-to-Assets | 23.6% | 13.5% |

| Interest Coverage | 0 | 2.56 |

| Asset Turnover | 0.57 | 0.19 |

| Fixed Asset Turnover | 21.4 | 7.46 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Autodesk, Inc.

Autodesk demonstrates strong profitability ratios with a net margin of 18.14% and a return on equity (ROE) of 42.43%, both favorable. However, valuation multiples like PE at 60.2 and PB at 25.54 are high, indicating expensive stock pricing. Liquidity ratios are weak, with a current ratio of 0.68. Autodesk does not pay dividends, likely focusing on reinvestment and growth.

Dayforce Inc

Dayforce shows weak profitability metrics, with low net margin (1.03%) and ROE (0.71%), both unfavorable. Its PE ratio is extremely high at 633.29, suggesting overvaluation or growth expectations. Liquidity is better, with a current ratio of 1.13 and a favorable quick ratio. The company does not pay dividends, probably prioritizing reinvestment and managing debt, with a debt-to-equity ratio of 0.48.

Which one has the best ratios?

Autodesk presents a more favorable financial profile with higher profitability and returns despite weak liquidity and high valuation multiples. Dayforce struggles with profitability and valuation concerns, although it maintains better liquidity. Overall, Autodesk’s ratios suggest stronger operational performance, while Dayforce’s metrics reflect more challenges in profitability and efficiency.

Strategic Positioning

This section compares the strategic positioning of Autodesk, Inc. and Dayforce Inc, including market position, key segments, and exposure to technological disruption:

Autodesk, Inc.

- Large market cap $56.6B, facing competition in software applications with beta 1.466.

- Diversified segments: architecture, engineering, construction, manufacturing, media, and AutoCAD software families.

- Exposure through cloud-based construction management and CAD tools, moderate disruption risk.

Dayforce Inc

- Smaller market cap $11.1B, moderate competitive pressure with beta 1.181.

- Concentrated in human capital management software, payroll, and workforce solutions.

- Cloud-based HCM platform with emphasis on payroll and workforce, exposed to cloud tech disruption.

Autodesk, Inc. vs Dayforce Inc Positioning

Autodesk shows a diversified approach across multiple professional design and construction segments, offering broader market exposure. Dayforce focuses on HCM and payroll software, which narrows its market but targets a specific niche. Autodesk’s scale and segment variety contrast with Dayforce’s specialization and smaller market footprint.

Which has the best competitive advantage?

Autodesk demonstrates a very favorable moat with ROIC exceeding WACC by 7.6% and a growing profitability trend, indicating a durable competitive advantage. Dayforce has a slightly unfavorable moat, shedding value despite improving profitability, reflecting weaker competitive positioning.

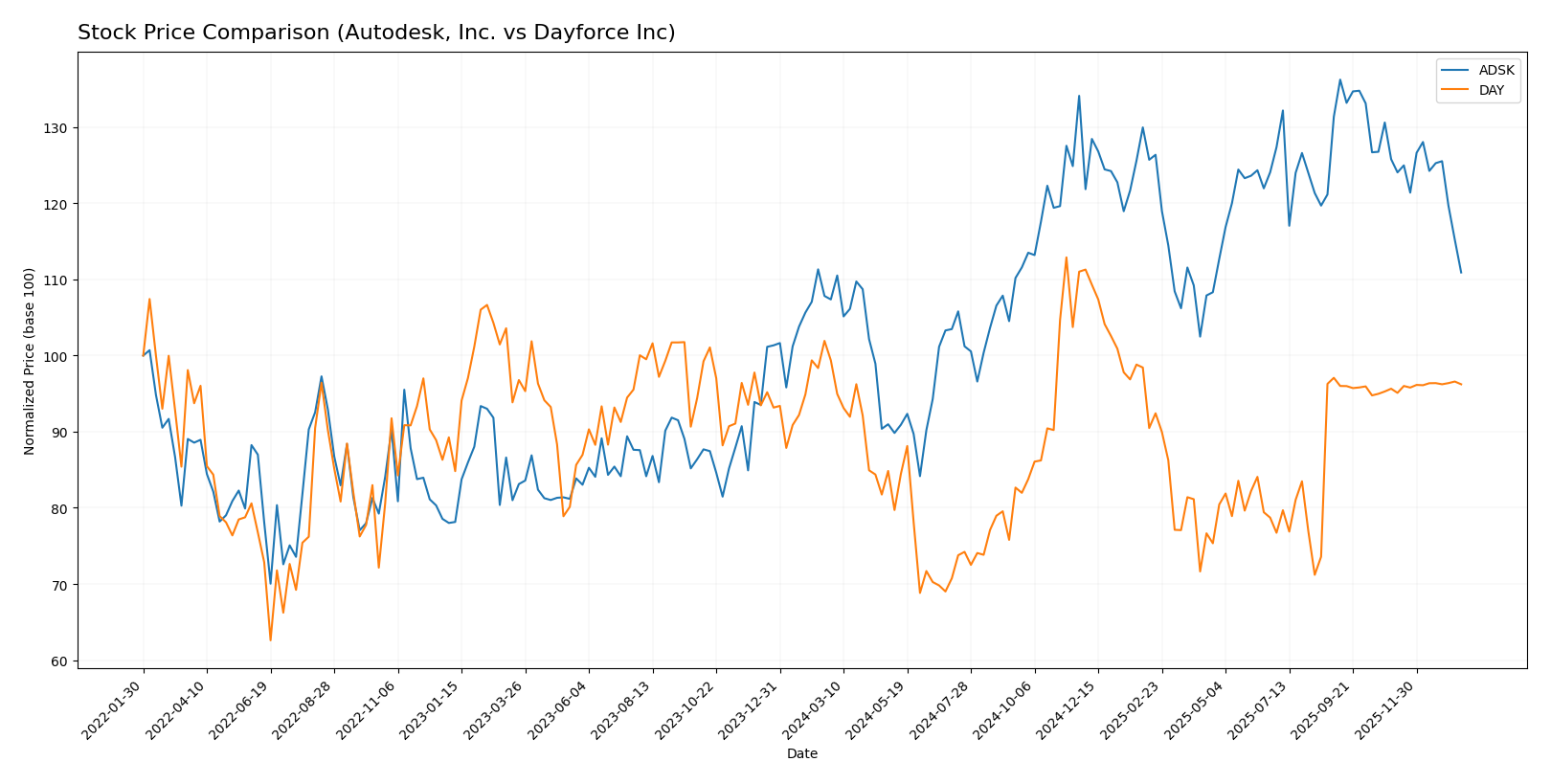

Stock Comparison

Autodesk, Inc. (ADSK) and Dayforce Inc (DAY) exhibited contrasting stock price movements over the past 12 months, with notable shifts in trend direction and volume dynamics affecting their trading patterns.

Trend Analysis

Autodesk, Inc. experienced a 3.3% price increase over the past year, indicating a bullish trend with deceleration. The stock ranged between 201.6 and 326.37, showing moderate volatility (std dev 29.87). Recently, the trend reversed with an 11.83% decline.

Dayforce Inc’s stock showed a 3.16% decline over the same 12-month period, marking a bearish trend with deceleration. The price fluctuated between 49.46 and 81.14, with lower volatility (std dev 7.84). Recently, the trend slightly improved, up 0.61%.

Comparing both, Autodesk delivered the highest market performance overall, despite recent weakness, while Dayforce underperformed with a negative yearly return but showed minor recent gains.

Target Prices

The target price consensus for Autodesk, Inc. and Dayforce Inc reflects moderate to strong upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Autodesk, Inc. | 400 | 343 | 373 |

| Dayforce Inc | 70 | 70 | 70 |

Analysts expect Autodesk’s stock to appreciate significantly from its current price of $265.69, while Dayforce’s target consensus is close to its current price of $69.16, suggesting limited near-term upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Autodesk, Inc. and Dayforce Inc:

Rating Comparison

ADSK Rating

- Rating: B-, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate at 3, indicating balanced valuation.

- ROE Score: Very favorable at 5, showing efficient profit generation.

- ROA Score: Favorable at 4, indicating effective asset utilization.

- Debt To Equity Score: Very unfavorable at 1, pointing to high financial risk.

- Overall Score: Moderate at 3, reflecting balanced overall financial health.

DAY Rating

- Rating: C-, also noted as very favorable despite the lower grade.

- Discounted Cash Flow Score: Moderate at 2, suggesting some valuation concerns.

- ROE Score: Very unfavorable at 1, reflecting weak equity returns.

- ROA Score: Very unfavorable at 1, showing poor asset efficiency.

- Debt To Equity Score: Moderate at 2, reflecting somewhat better financial stability.

- Overall Score: Very unfavorable at 1, indicating weaker overall financial performance.

Which one is the best rated?

Based strictly on the provided data, Autodesk, Inc. holds a stronger overall rating with higher scores in ROE, ROA, and discounted cash flow, despite a weaker debt to equity score. Dayforce Inc has generally lower scores and a weaker overall rating.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Autodesk, Inc. and Dayforce Inc:

Autodesk, Inc. Scores

- Altman Z-Score: 5.05, in safe zone indicating low bankruptcy risk.

- Piotroski Score: 8, very strong financial health and value potential.

Dayforce Inc Scores

- Altman Z-Score: 1.24, in distress zone signaling high bankruptcy risk.

- Piotroski Score: 5, average financial strength and investment quality.

Which company has the best scores?

Autodesk, Inc. demonstrates stronger financial stability and health with a safe zone Altman Z-Score and a very strong Piotroski Score. Dayforce Inc shows elevated bankruptcy risk and only average financial strength based on these scores.

Grades Comparison

Here is a comparison of the latest grades from established grading companies for Autodesk, Inc. and Dayforce Inc:

Autodesk, Inc. Grades

The table below shows recent grades assigned by recognized financial institutions for Autodesk, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-26 |

| Wells Fargo | Maintain | Overweight | 2025-11-26 |

| Deutsche Bank | Upgrade | Buy | 2025-11-26 |

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Macquarie | Maintain | Outperform | 2025-11-26 |

| BMO Capital | Maintain | Market Perform | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-24 |

| Baird | Maintain | Outperform | 2025-11-18 |

Overall, Autodesk’s grades indicate a strong positive consensus, with multiple buy and outperform ratings maintained or upgraded recently.

Dayforce Inc Grades

The table below shows recent grades assigned by recognized financial institutions for Dayforce Inc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Hold | 2025-10-30 |

| Stifel | Downgrade | Hold | 2025-09-19 |

| Citigroup | Downgrade | Neutral | 2025-09-17 |

| Wells Fargo | Upgrade | Equal Weight | 2025-08-22 |

| BMO Capital | Downgrade | Market Perform | 2025-08-22 |

| Keybanc | Downgrade | Sector Weight | 2025-08-22 |

| Needham | Downgrade | Hold | 2025-08-22 |

| Barclays | Maintain | Equal Weight | 2025-08-22 |

| Deutsche Bank | Maintain | Hold | 2025-08-22 |

| Jefferies | Maintain | Hold | 2025-08-21 |

Dayforce shows a more cautious trend with several downgrades and a consensus around hold or neutral ratings.

Which company has the best grades?

Autodesk, Inc. holds the better grades with a consensus strongly favoring buy and outperform ratings, while Dayforce Inc mostly receives hold or neutral grades. This suggests investors might see Autodesk as having stronger near-term growth prospects than Dayforce.

Strengths and Weaknesses

The following table compares key strengths and weaknesses of Autodesk, Inc. (ADSK) and Dayforce Inc (DAY) based on recent financial and strategic data:

| Criterion | Autodesk, Inc. (ADSK) | Dayforce Inc (DAY) |

|---|---|---|

| Diversification | Highly diversified across Architecture, Manufacturing, Media, and AutoCAD segments with growing revenues. | Focused mainly on cloud-based services with recurring revenues, less diversified. |

| Profitability | Strong profitability with 18.14% net margin and favorable ROIC (18.01%). | Low profitability: 1.03% net margin and ROIC at 1.31%, both unfavorable. |

| Innovation | Demonstrates durable competitive advantage with growing ROIC and strong innovation in software solutions. | Improving profitability trend but still shedding value, indicating challenges in innovation monetization. |

| Global presence | Established global footprint in multiple industries and regions. | Primarily focused on cloud HR/payroll services, with limited global scale. |

| Market Share | Robust market share in CAD and engineering software with increasing revenues across segments. | Smaller market share with high valuation multiples and pressure on margins. |

Key takeaway: Autodesk shows strong diversification, profitability, and a durable competitive advantage, making it a more stable investment. Dayforce, while improving, remains riskier due to low profitability and concentrated business lines. Caution and close monitoring are advised for Dayforce investments.

Risk Analysis

The following table summarizes key risks for Autodesk, Inc. (ADSK) and Dayforce Inc (DAY) based on the latest available data in 2026:

| Metric | Autodesk, Inc. (ADSK) | Dayforce Inc (DAY) |

|---|---|---|

| Market Risk | High beta (1.47) indicates higher market volatility sensitivity | Moderate beta (1.18), slightly less volatile |

| Debt level | Debt to equity ratio neutral at 0.98; debt to assets favorable at 23.6% | Lower debt to equity (0.48) and debt to assets (13.5%), favorable |

| Regulatory Risk | Moderate; operates globally with exposure to software and tech regulations | Moderate; HCM software subject to labor and data privacy laws |

| Operational Risk | Moderate; complex software suite with cloud-based services | Moderate; cloud platform reliant on service uptime and data security |

| Environmental Risk | Low; mainly software company with limited direct environmental impact | Low; software service provider with minimal environmental footprint |

| Geopolitical Risk | Moderate; exposure due to global sales and supply chain | Moderate; international operations subject to geopolitical tensions |

In synthesis, Autodesk faces notable market risk due to its high beta and valuation concerns (high P/E and P/B ratios) despite strong profitability metrics. Dayforce shows financial distress risks with a low Altman Z-score and weak profitability, despite lower leverage. Operational and regulatory risks remain moderate for both companies given their tech and cloud-based business models. Investors should weigh Autodesk’s valuation risks against its stability, while Dayforce requires cautious monitoring of financial health and market conditions.

Which Stock to Choose?

Autodesk, Inc. (ADSK) shows a favorable income evolution with 12.7% revenue growth in 2025, strong profitability indicated by an 18.14% net margin and 42.43% ROE, moderate debt levels, and a very favorable B- rating despite some unfavorable valuation ratios.

Dayforce Inc (DAY) reports mixed income results, with a 16.27% revenue increase in 2024 but weak profitability marked by a 1.03% net margin and 0.71% ROE, moderate debt with a net debt to EBITDA of 2.27, and a very favorable C- rating contrasting with an unfavorable overall financial ratios evaluation.

Investors focused on growth and strong profitability might find Autodesk’s durable competitive advantage and higher returns more appealing, while those willing to tolerate risks for potential turnaround opportunities might consider Dayforce’s improving income and ROIC trend despite its current value destruction signals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Autodesk, Inc. and Dayforce Inc to enhance your investment decisions: