In the fast-evolving communication equipment sector, Credo Technology Group Holding Ltd (CRDO) and AudioCodes Ltd. (AUDC) stand out for their innovative approaches and market presence. While Credo focuses on high-speed connectivity solutions and advanced chip technology, AudioCodes excels in communication software and unified communications products. This comparison explores their strengths and strategies to help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Credo Technology Group Holding Ltd and AudioCodes Ltd. by providing an overview of these two companies and their main differences.

Credo Technology Group Holding Ltd Overview

Credo Technology Group Holding Ltd specializes in high-speed connectivity solutions for optical and electrical Ethernet applications. The company operates internationally, including the United States, Mexico, and China. Its product portfolio includes integrated circuits, active electrical cables, and SerDes chiplets based on proprietary serializer/deserializer and digital signal processor technologies. Founded in 2008 and headquartered in San Jose, California, Credo focuses on advanced communication equipment.

AudioCodes Ltd. Overview

AudioCodes Ltd. delivers advanced communications software, products, and services designed for the digital workplace. Its offerings cover unified communications, contact centers, and VoiceAI, including session border controllers, VoIP network routing, and Microsoft Teams integration solutions. Founded in 1992 and based in Lod, Israel, AudioCodes markets mainly to original equipment manufacturers and network providers across the Americas, Europe, and Israel, aiming to enhance business communications infrastructure.

Key similarities and differences

Both companies operate in the communication equipment industry and serve global markets with technology-driven solutions. Credo focuses on hardware components like integrated circuits and chiplets for high-speed Ethernet, emphasizing semiconductor technology. In contrast, AudioCodes provides a broader range of software, networking products, and managed services tailored to unified communications and VoIP networks. Their business models differ with Credo concentrating on physical connectivity solutions, while AudioCodes prioritizes communication software and service integration.

Income Statement Comparison

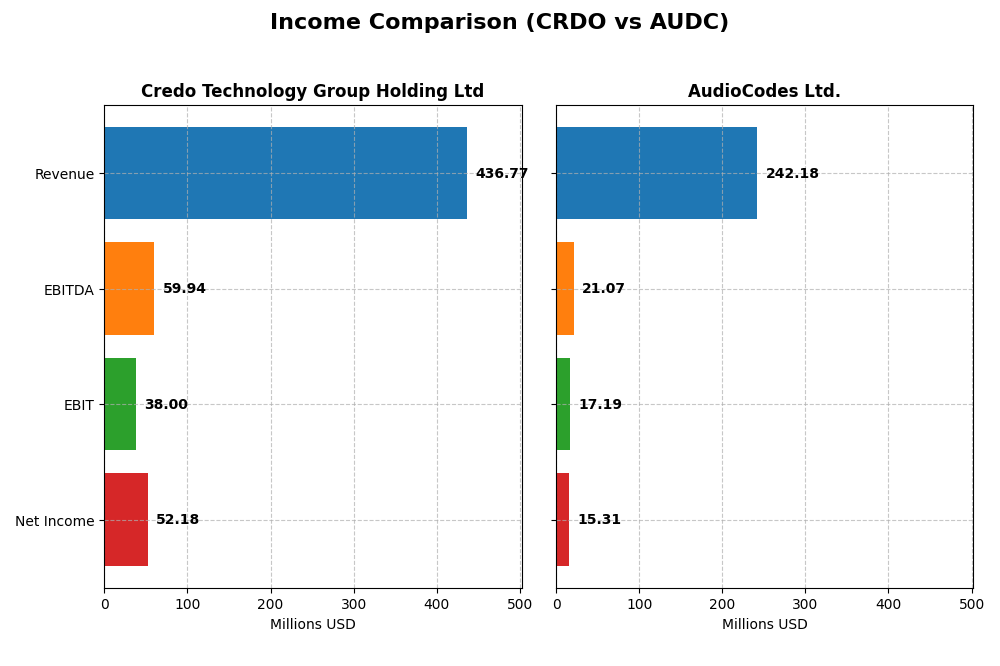

The table below compares the key income statement metrics for the fiscal year 2025 for Credo Technology Group Holding Ltd and fiscal year 2024 for AudioCodes Ltd., providing a snapshot of their recent financial performance.

| Metric | Credo Technology Group Holding Ltd (2025) | AudioCodes Ltd. (2024) |

|---|---|---|

| Market Cap | 27.7B USD | 257M USD |

| Revenue | 437M USD | 242M USD |

| EBITDA | 60M USD | 21M USD |

| EBIT | 38M USD | 17.2M USD |

| Net Income | 52.2M USD | 15.3M USD |

| EPS | 0.31 USD | 0.51 USD |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Credo Technology Group Holding Ltd

Credo Technology Group’s revenue surged from $58.7M in 2021 to $437M in 2025, reflecting a strong growth trajectory. Net income improved significantly, turning from a loss of $27.5M in 2021 to a profit of $52.2M in 2025. Gross margin was favorable at 64.77%, while net margin rose to 11.95% in 2025, indicating improved profitability and operating efficiency.

AudioCodes Ltd.

AudioCodes showed relatively stable revenue around $220M-$275M from 2020 to 2024 but experienced a slight decline of 0.9% in the latest year to $242M. Net income declined overall, with a notable drop of 43.8% over the period, despite a net margin improvement to 6.32% in 2024. EBIT margin remained neutral at 7.1%, reflecting consistent but modest operational profitability.

Which one has the stronger fundamentals?

Credo Technology demonstrates stronger fundamentals, with robust revenue and net income growth, favorable margins, and positive earnings per share trends. AudioCodes, while maintaining stable revenue and gross margin, faces challenges in net income growth and overall profitability declines. Credo’s sharper improvement in key income metrics provides a more favorable income statement profile.

Financial Ratios Comparison

The table below compares key financial ratios for Credo Technology Group Holding Ltd (CRDO) and AudioCodes Ltd. (AUDC) based on their most recent fiscal year data available.

| Ratios | Credo Technology Group Holding Ltd (CRDO) 2025 | AudioCodes Ltd. (AUDC) 2024 |

|---|---|---|

| ROE | 7.7% | 8.0% |

| ROIC | 5.0% | 6.5% |

| P/E | 138.2 | 19.2 |

| P/B | 10.6 | 1.53 |

| Current Ratio | 6.62 | 2.09 |

| Quick Ratio | 5.79 | 1.69 |

| D/E (Debt-to-Equity) | 0.024 | 0.19 |

| Debt-to-Assets | 2.0% | 10.9% |

| Interest Coverage | 0 (not available) | 58.1 |

| Asset Turnover | 0.54 | 0.72 |

| Fixed Asset Turnover | 5.54 | 4.05 |

| Payout ratio | 0% | 71.2% |

| Dividend yield | 0% | 3.7% |

Interpretation of the Ratios

Credo Technology Group Holding Ltd

Credo shows a balanced profile with a favorable net margin of 11.95% but an unfavorable return on equity (7.66%) and high valuation multiples (PE 138.19, PB 10.58) indicating possible overvaluation. The current ratio is unusually high at 6.62, suggesting excess liquidity or inefficient asset use. The company does not pay dividends, likely reflecting reinvestment in growth or R&D priorities.

AudioCodes Ltd.

AudioCodes exhibits generally favorable financial ratios, including a manageable debt level (D/E 0.19) and strong interest coverage (58.08). Its net margin of 6.32% and ROE of 7.98% are moderate, with valuation metrics near average (PE 19.21, PB 1.53). The company pays dividends, offering a 3.7% yield supported by stable cash flow with no apparent risks in payout sustainability.

Which one has the best ratios?

AudioCodes presents a more favorable ratio profile with half of its metrics rated positively and lower risk indicators, including a reasonable valuation and dividend yield. Credo’s ratios appear more mixed, with several unfavorable or neutral marks and no dividend returns, reflecting a neutral overall stance. Thus, AudioCodes demonstrates somewhat better financial health based on the available ratio data.

Strategic Positioning

This section compares the strategic positioning of Credo Technology Group Holding Ltd and AudioCodes Ltd., including market position, key segments, and exposure to technological disruption:

Credo Technology Group Holding Ltd

- Large market cap of 27.7B USD, facing competitive pressure in communication equipment

- Key segments: Products (412M in 2025), License, Product Engineering Services

- Exposure to disruption through advanced SerDes and digital signal processor technologies

AudioCodes Ltd.

- Small market cap of 257M USD, operates in a niche communication equipment market with moderate pressure

- Key segments: Products (112M in 2024), Services (130M in 2024) focusing on unified communications and VoiceAI

- Exposure through advanced communications software, VoIP solutions, and managed services for Microsoft Teams

Credo Technology Group Holding Ltd vs AudioCodes Ltd. Positioning

Credo has a large, product-focused business with significant licensing revenues, investing in high-speed connectivity technologies. AudioCodes operates a more service-oriented, niche portfolio centered on communications software and VoiceAI, showing a concentrated business approach with diverse communication solutions.

Which has the best competitive advantage?

Both companies are currently shedding value as ROIC is below WACC. Credo shows growing profitability trends, suggesting improving competitive strength, while AudioCodes faces declining profitability and a very unfavorable moat position.

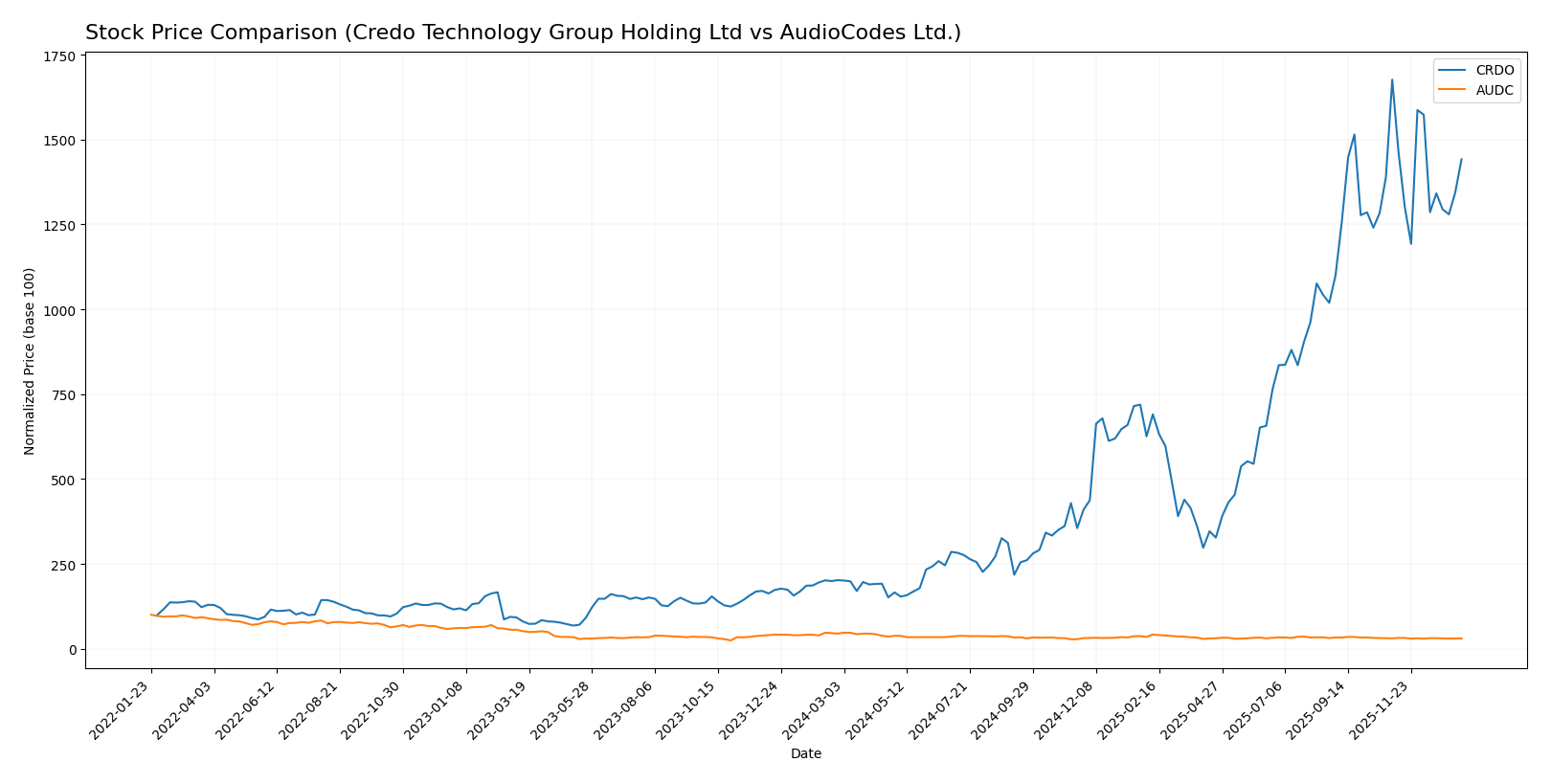

Stock Comparison

The stock prices of Credo Technology Group Holding Ltd (CRDO) and AudioCodes Ltd. (AUDC) revealed contrasting movements over the past year, with CRDO experiencing significant gains and AUDC showing a decline amid varying trading volumes and recent momentum shifts.

Trend Analysis

Credo Technology Group Holding Ltd’s stock showed a strong bullish trend with a price increase of 614.07% over the past 12 months, despite recent deceleration and a short-term decline of 13.99%. Volatility remains high with a standard deviation of 48.96.

AudioCodes Ltd. exhibited a bearish trend with a 32.36% price decrease over the last year, accompanied by accelerating decline. Recent performance softened to a near-neutral trend with a slight 1.23% drop and minimal volatility at 1.16 standard deviation.

Comparing both stocks, CRDO delivered the highest market performance with a markedly larger price appreciation, while AUDC faced sustained downward pressure throughout the same period.

Target Prices

The current analyst consensus presents optimistic target prices for both Credo Technology Group Holding Ltd and AudioCodes Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Credo Technology Group Holding Ltd | 250 | 160 | 217.5 |

| AudioCodes Ltd. | 24 | 14 | 19 |

Analysts expect Credo Technology’s price to rise significantly above its current 161.38 USD, while AudioCodes shows potential to more than double from 8.82 USD, indicating strong bullish sentiment for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Credo Technology Group Holding Ltd (CRDO) and AudioCodes Ltd. (AUDC):

Rating Comparison

CRDO Rating

- Rating: B, classified as Very Favorable overall.

- Discounted Cash Flow Score: 1, indicating a Very Unfavorable valuation signal.

- ROE Score: 4, showing a Favorable efficiency in generating profit from equity.

- ROA Score: 5, Very Favorable asset utilization.

- Debt To Equity Score: 4, Favorable financial risk profile.

- Overall Score: 3, Moderate overall financial standing.

AUDC Rating

- Rating: A-, classified as Very Favorable overall.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation signal.

- ROE Score: 3, a Moderate efficiency in profit generation from equity.

- ROA Score: 3, Moderate effectiveness in asset utilization.

- Debt To Equity Score: 3, Moderate financial risk profile.

- Overall Score: 4, Favorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, AUDC has a higher overall score (4 vs. 3) and a stronger discounted cash flow rating, while CRDO excels in return on assets and debt metrics. AUDC is better rated overall.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Credo Technology Group Holding Ltd and AudioCodes Ltd.:

CRDO Scores

- Altman Z-Score: 100.37, indicating a safe zone with extremely low bankruptcy risk.

- Piotroski Score: 5, reflecting average financial strength and investment potential.

AUDC Scores

- Altman Z-Score: 2.19, placing the company in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 7, showing strong financial health and good investment quality.

Which company has the best scores?

Based on the provided data, CRDO has a much higher Altman Z-Score, signaling very low bankruptcy risk, while AUDC has a stronger Piotroski Score, indicating better financial strength. Each company leads in different score categories.

Grades Comparison

The following grades summarize the recent analyst ratings for Credo Technology Group Holding Ltd and AudioCodes Ltd.:

Credo Technology Group Holding Ltd Grades

The table below presents Credo Technology Group Holding Ltd’s latest grades from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-12-02 |

| Needham | Maintain | Buy | 2025-12-02 |

| Mizuho | Maintain | Outperform | 2025-12-02 |

| Roth Capital | Maintain | Buy | 2025-12-02 |

| Barclays | Maintain | Overweight | 2025-12-02 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-07 |

| Barclays | Maintain | Overweight | 2025-09-04 |

| TD Cowen | Maintain | Buy | 2025-09-04 |

| Needham | Maintain | Buy | 2025-09-04 |

Credo Technology Group Holding Ltd consistently receives positive ratings, mainly “Buy” and equivalent, indicating a favorable analyst sentiment.

AudioCodes Ltd. Grades

The table below shows AudioCodes Ltd.’s recent grades from established grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-05-07 |

| Needham | Maintain | Buy | 2025-02-05 |

| Barclays | Maintain | Underweight | 2025-02-05 |

| Needham | Maintain | Buy | 2025-01-21 |

| Barclays | Maintain | Underweight | 2024-11-07 |

| Needham | Maintain | Buy | 2024-11-07 |

| Needham | Maintain | Buy | 2024-07-31 |

| Needham | Maintain | Buy | 2024-05-09 |

| Barclays | Maintain | Underweight | 2024-05-08 |

| Barclays | Maintain | Underweight | 2024-02-07 |

AudioCodes Ltd. shows mixed ratings with several “Buy” grades from Needham but repeated “Underweight” ratings from Barclays, suggesting divergent analyst views.

Which company has the best grades?

Credo Technology Group Holding Ltd has received predominantly positive grades, mostly “Buy” and “Outperform,” reflecting stronger analyst confidence than AudioCodes Ltd., which faces mixed ratings. This difference may affect investor perception of stability and growth potential between the two companies.

Strengths and Weaknesses

The following table summarizes the key strengths and weaknesses of Credo Technology Group Holding Ltd (CRDO) and AudioCodes Ltd. (AUDC) based on recent financial performance, profitability, innovation, diversification, global reach, and market share.

| Criterion | Credo Technology Group Holding Ltd (CRDO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Diversification | Moderate: Revenue split among Product (412M), License (12M), and Product Engineering Services (12M) in 2025 | Balanced: Products (112M) and Service (130M) segments in 2024 |

| Profitability | Mixed: Net margin favorable at 11.95%, ROIC neutral at 5.01%, but ROE and WACC unfavorable | Moderate: Net margin neutral at 6.32%, ROIC neutral at 6.51%, with favorable interest coverage |

| Innovation | Growing ROIC trend suggests improving operational efficiency despite current value destruction | Declining ROIC trend indicates challenges in maintaining profitability and innovation momentum |

| Global presence | Limited data but high fixed asset turnover (5.54) suggests efficient asset utilization; current ratio unfavorable | Strong liquidity and low debt levels support operations; global footprint implied by diversified revenue streams |

| Market Share | High P/E (138) and P/B (10.58) ratios indicate high market expectations but potential overvaluation | More reasonable valuation metrics (P/E 19.2, P/B 1.53) suggest market confidence with moderate growth prospects |

In summary, CRDO shows a promising upward trajectory in profitability despite currently shedding value, with strong product revenue but overvaluation risks. AUDC presents a more stable financial profile and balanced diversification but faces challenges in profitability trends and innovation sustainability. Investors should weigh CRDO’s growth potential against its financial risks and consider AUDC’s steadier but less dynamic profile.

Risk Analysis

Below is a comparative table summarizing key risks for Credo Technology Group Holding Ltd (CRDO) and AudioCodes Ltd. (AUDC) based on the most recent data available.

| Metric | Credo Technology Group Holding Ltd (CRDO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Market Risk | High (Beta 2.66 indicates high volatility) | Moderate (Beta 1.05 indicates moderate volatility) |

| Debt level | Very Low (Debt-to-equity 0.02, debt-to-assets 1.98%) | Low (Debt-to-equity 0.19, debt-to-assets 10.85%) |

| Regulatory Risk | Moderate (Technology sector with global operations, exposure to US and China regulations) | Moderate (Telecom sector with operations in multiple regions including Israel and Europe) |

| Operational Risk | Moderate (Relatively small workforce of 500, emerging technology products) | Moderate (946 employees, reliance on software and managed services) |

| Environmental Risk | Low (No significant environmental liabilities reported) | Low (No significant environmental liabilities reported) |

| Geopolitical Risk | Moderate (Operations in China and Hong Kong could face trade tensions) | Moderate (Headquartered in Israel with exposure to regional geopolitical instability) |

In synthesis, CRDO’s most impactful risk is its high market volatility (Beta 2.66) combined with moderate geopolitical exposure, which can lead to significant stock price fluctuations. AUDC presents lower market risk but faces moderate geopolitical and regulatory risks due to its location and industry. Both companies maintain low debt levels, reducing financial distress risk. Investors should weigh CRDO’s growth potential against its higher volatility, while AUDC offers more stability but with moderate external risks.

Which Stock to Choose?

Credo Technology Group Holding Ltd (CRDO) shows strong income growth with a 126% revenue increase in one year and a favorable net margin of 11.95%. Despite a high P/E and P/B ratio, its debt levels are low, and profitability is improving, though the ROIC is below WACC, indicating slight value destruction. The overall rating is very favorable with a moderate financial score.

AudioCodes Ltd. (AUDC) has a stable income statement with a 6.32% net margin and moderate revenue growth over five years. Financial ratios are slightly favorable, showing moderate profitability and manageable debt. However, the company’s ROIC is declining and below WACC, signaling sustained value erosion. Ratings are very favorable with a stronger Piotroski score but a grey zone Altman Z-Score.

For investors prioritizing growth and improving profitability, CRDO’s rapidly expanding income and strengthening returns might appear more attractive. Conversely, those seeking relative financial stability with less aggressive valuation metrics may find AUDC’s steady income and favorable rating more aligned with a cautious approach. Both companies show some value destruction, suggesting a need for careful risk assessment.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Credo Technology Group Holding Ltd and AudioCodes Ltd. to enhance your investment decisions: