In the fast-evolving Communication Equipment sector, Cisco Systems, Inc. and AudioCodes Ltd. stand out as key players driving innovation. Cisco, a global giant with a vast product portfolio, competes alongside AudioCodes, a specialized provider focused on advanced communications software and VoIP solutions. This comparison explores their market positions and innovation strategies to help you decide which company could be the most compelling addition to your investment portfolio. Let’s uncover which one offers the best potential for investors.

Table of contents

Companies Overview

I will begin the comparison between Cisco Systems, Inc. and AudioCodes Ltd. by providing an overview of these two companies and their main differences.

Cisco Systems, Inc. Overview

Cisco Systems, Inc. designs, manufactures, and sells Internet Protocol-based networking products and related communication technology solutions globally. Its portfolio includes campus and data center switching, enterprise routing, wireless products, security, collaboration tools, and observability solutions. Cisco serves diverse customers including businesses, governments, and service providers, emphasizing secure and reliable connectivity across various network environments.

AudioCodes Ltd. Overview

AudioCodes Ltd. provides advanced communications software, products, and productivity solutions primarily for unified communications, contact centers, and service providers. Its offerings include session border controllers, VoIP routing solutions, IP phones, and voice network management tools, with a strong focus on Microsoft Teams integration and cloud migration services. AudioCodes operates mainly in the Americas, Europe, and Israel, targeting telecommunications and networking sectors.

Key similarities and differences

Both companies operate in the communication equipment industry, focusing on networking and communication technologies. Cisco is a global leader with a broad portfolio covering hardware, software, and services across multiple network domains, while AudioCodes specializes in unified communications and voice solutions with a niche focus on VoIP and Microsoft Teams products. Cisco’s scale and market cap vastly exceed those of AudioCodes, reflecting different market positions and scopes.

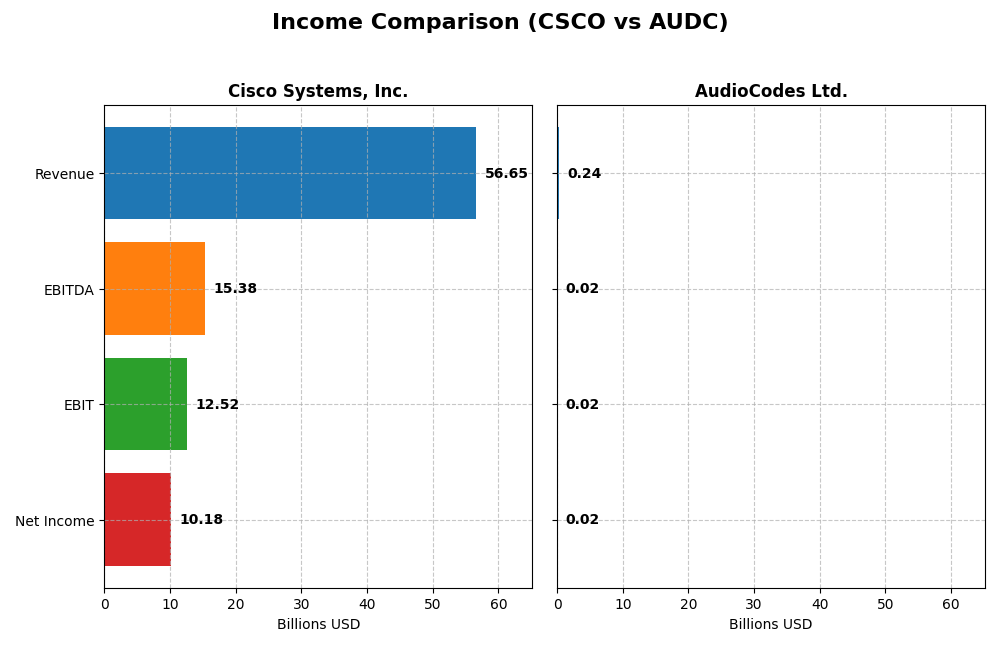

Income Statement Comparison

This table presents a side-by-side comparison of the most recent fiscal year income statement figures for Cisco Systems, Inc. and AudioCodes Ltd., providing a clear view of their financial performance.

| Metric | Cisco Systems, Inc. (CSCO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Market Cap | 298B | 257M |

| Revenue | 56.7B | 242M |

| EBITDA | 15.4B | 21M |

| EBIT | 12.5B | 17M |

| Net Income | 10.2B | 15M |

| EPS | 2.56 | 0.51 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Cisco Systems, Inc.

Cisco’s revenue showed a favorable overall growth of 13.72% from 2021 to 2025, reaching $56.65B in 2025. However, net income declined by 3.88% over the period, with net margin decreasing by 15.48%. In 2025, revenue grew modestly by 5.3%, but EBIT and net margin experienced declines, reflecting some margin pressure despite stable gross margins near 65%.

AudioCodes Ltd.

AudioCodes’ revenue grew by 9.69% over 2020-2024 but saw a sharp net income decline of 43.81% and net margin reduction of 48.77%. Despite a 0.9% revenue dip in 2024, EBIT and net margin rose strongly in the most recent year, with EPS growth of 78.57%, indicating margin recovery after previous declines. Gross margin remained steady above 65%.

Which one has the stronger fundamentals?

Cisco demonstrates stronger fundamentals with consistent revenue growth and favorable gross and net margins, despite recent margin compression and slower earnings growth. AudioCodes shows encouraging margin improvements in the latest year but faces significant long-term net income and EPS declines. Both companies have favorable income statement profiles, yet Cisco’s scale and margin stability suggest more robust fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Cisco Systems, Inc. and AudioCodes Ltd., based on their most recent fiscal year data.

| Ratios | Cisco Systems, Inc. (2025) | AudioCodes Ltd. (2024) |

|---|---|---|

| ROE | 21.7% | 8.0% |

| ROIC | 11.6% | 6.5% |

| P/E | 26.8 | 19.2 |

| P/B | 5.83 | 1.53 |

| Current Ratio | 1.00 | 2.09 |

| Quick Ratio | 0.91 | 1.69 |

| D/E (Debt-to-Equity) | 0.63 | 0.19 |

| Debt-to-Assets | 24.2% | 10.9% |

| Interest Coverage | 7.38 | 58.08 |

| Asset Turnover | 0.46 | 0.72 |

| Fixed Asset Turnover | 16.6 | 4.05 |

| Payout ratio | 63.2% | 71.2% |

| Dividend yield | 2.36% | 3.70% |

Interpretation of the Ratios

Cisco Systems, Inc.

Cisco shows a mostly favorable financial profile with strong profitability metrics such as a 17.97% net margin, 21.73% ROE, and 11.62% ROIC. However, valuation ratios like P/E at 26.83 and P/B at 5.83 appear stretched, and liquidity is borderline with a current ratio of 1.0. The company pays dividends with a yield of 2.36%, supported by a sustainable payout ratio and free cash flow coverage, indicating balanced shareholder returns.

AudioCodes Ltd.

AudioCodes presents a mixed ratio profile with neutral to favorable liquidity ratios (current ratio 2.09, quick ratio 1.69) and a low debt-to-equity ratio of 0.19. Profitability is moderate, with a 6.32% net margin and 7.98% ROE, which is considered unfavorable. It pays dividends with a relatively high yield of 3.7%, supported by manageable leverage and strong interest coverage, reflecting cautious but steady shareholder returns.

Which one has the best ratios?

Cisco’s ratios are globally more favorable, especially regarding profitability and return metrics, despite concerns over valuation and liquidity. AudioCodes offers stronger liquidity and lower leverage but weaker profitability and return on equity. Overall, Cisco demonstrates a more robust financial position, while AudioCodes shows strengths in balance sheet conservatism.

Strategic Positioning

This section compares the strategic positioning of Cisco Systems, Inc. and AudioCodes Ltd., including Market position, Key segments, and Exposure to technological disruption:

Cisco Systems, Inc.

- Market leader with a large market cap of $298B facing moderate competitive pressure in communication equipment.

- Diverse business segments: networking ($28B), services ($22B), security ($8B), collaboration, observability.

- Exposed to technological disruption through cloud collaboration, network security, and observability suites.

AudioCodes Ltd.

- Small player with a market cap of $257M, operating under higher competitive pressure in telecom niche.

- Concentrated on unified communications, VoIP, and managed services primarily in unified communications.

- Faces disruption risks from evolving VoIP and cloud communication technologies in niche markets.

Cisco Systems, Inc. vs AudioCodes Ltd. Positioning

Cisco adopts a diversified approach across networking, services, security, and collaboration with broad geographic reach. AudioCodes focuses on specialized communications software and managed services, limiting its scale but concentrating expertise. Cisco offers scale advantages; AudioCodes may respond faster to niche needs.

Which has the best competitive advantage?

Based on MOAT evaluation, Cisco is creating value with a slightly favorable moat despite declining ROIC, while AudioCodes is destroying value with a very unfavorable moat and declining profitability. Cisco holds a stronger competitive advantage.

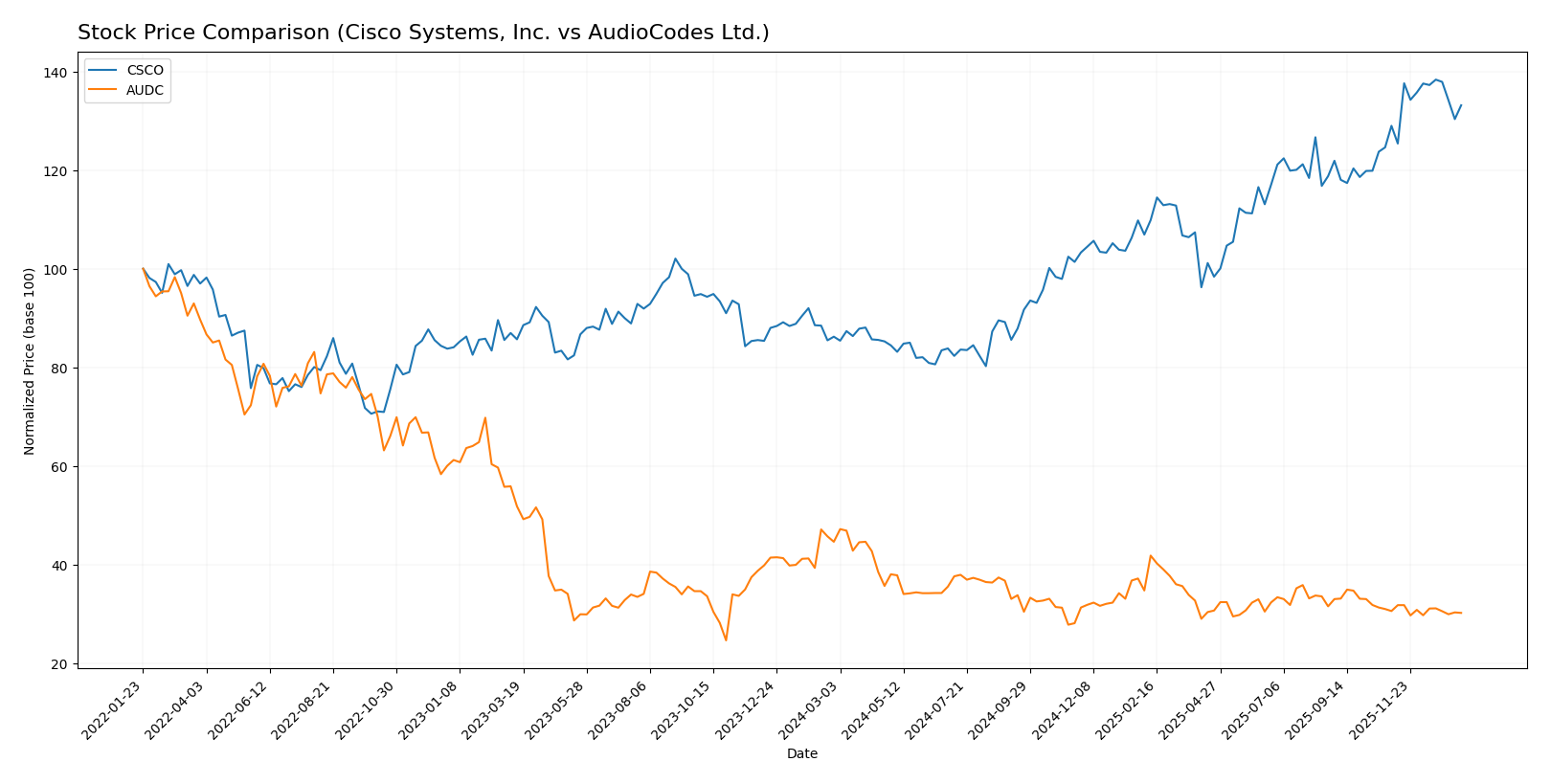

Stock Comparison

The stock price movements of Cisco Systems, Inc. (CSCO) and AudioCodes Ltd. (AUDC) over the past year reveal contrasting trends, with CSCO showing significant gains and AUDC facing notable declines, reflecting differing market dynamics.

Trend Analysis

Cisco Systems, Inc. (CSCO) experienced a strong bullish trend over the past 12 months with a 54.46% price increase, though the growth rate has decelerated recently. Volatility is moderate with a standard deviation of 9.65.

AudioCodes Ltd. (AUDC) displayed a bearish trend over the same period, declining by 32.36%. The downward trend has accelerated, and volatility remains low with a 1.16 standard deviation.

Comparing the two, CSCO has delivered the highest market performance with a substantial price increase, while AUDC’s stock has shown consistent negative returns throughout the year.

Target Prices

Here is the current consensus of target prices from verified analysts for Cisco Systems, Inc. and AudioCodes Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Cisco Systems, Inc. | 91 | 69 | 82.67 |

| AudioCodes Ltd. | 24 | 14 | 19 |

Analysts expect Cisco’s stock to appreciate from its current price of 75.47 USD toward the consensus target of 82.67 USD, indicating moderate upside potential. AudioCodes, trading at 8.82 USD, shows a significantly higher target consensus at 19 USD, suggesting strong growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Cisco Systems, Inc. and AudioCodes Ltd.:

Rating Comparison

Cisco Systems, Inc. Rating

- Rating: B, considered Very Favorable overall by analysts.

- Discounted Cash Flow Score: 4, indicating favorable valuation outlook.

- ROE Score: 4, showing strong efficiency in generating profits.

- ROA Score: 4, demonstrating effective asset utilization.

- Debt To Equity Score: 1, indicating very unfavorable financial risk.

- Overall Score: 3, categorized as moderate overall standing.

AudioCodes Ltd. Rating

- Rating: A-, also regarded as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, signaling favorable valuation.

- ROE Score: 3, reflecting moderate profit generation efficiency.

- ROA Score: 3, showing moderate effectiveness in asset use.

- Debt To Equity Score: 3, suggesting moderate financial risk.

- Overall Score: 4, rated as favorable overall.

Which one is the best rated?

Based strictly on the provided data, AudioCodes Ltd. holds a higher overall score (4) and a better debt-to-equity score, indicating a more favorable financial standing than Cisco Systems, Inc., which has a lower overall score (3) and a very unfavorable debt-to-equity rating.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Cisco Systems and AudioCodes:

CSCO Scores

- Altman Z-Score: 3.19, indicating a safe zone from bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health.

AUDC Scores

- Altman Z-Score: 2.19, placing the company in a grey zone.

- Piotroski Score: 7, reflecting strong financial health.

Which company has the best scores?

Cisco Systems has a higher Altman Z-Score indicating lower bankruptcy risk, while both companies share an equal Piotroski Score of 7, reflecting similarly strong financial health.

Grades Comparison

Here is a detailed comparison of the recent grades assigned by reputable grading companies for both Cisco Systems, Inc. and AudioCodes Ltd.:

Cisco Systems, Inc. Grades

The table below summarizes Cisco Systems’ grades from major financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Morgan Stanley | Maintain | Overweight | 2025-11-13 |

| B of A Securities | Maintain | Buy | 2025-11-13 |

| Evercore ISI Group | Maintain | In Line | 2025-11-13 |

| Barclays | Maintain | Equal Weight | 2025-11-13 |

| Piper Sandler | Maintain | Neutral | 2025-11-13 |

| UBS | Maintain | Buy | 2025-11-13 |

| Melius Research | Maintain | Buy | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-11-13 |

| Keybanc | Maintain | Overweight | 2025-11-13 |

Overall, Cisco’s grades reflect a predominantly positive outlook, with multiple “Buy” and “Overweight” ratings and no downgrades across recent assessments.

AudioCodes Ltd. Grades

The table below displays AudioCodes Ltd.’s grades from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-05-07 |

| Needham | Maintain | Buy | 2025-02-05 |

| Barclays | Maintain | Underweight | 2025-02-05 |

| Needham | Maintain | Buy | 2025-01-21 |

| Barclays | Maintain | Underweight | 2024-11-07 |

| Needham | Maintain | Buy | 2024-11-07 |

| Needham | Maintain | Buy | 2024-07-31 |

| Needham | Maintain | Buy | 2024-05-09 |

| Barclays | Maintain | Underweight | 2024-05-08 |

| Barclays | Maintain | Underweight | 2024-02-07 |

AudioCodes’ grades show a mixed pattern with consistent “Buy” ratings from Needham alongside persistent “Underweight” positions from Barclays.

Which company has the best grades?

Cisco Systems has received stronger and more consistent positive grades, predominantly “Buy” and “Overweight,” compared to AudioCodes, which has mixed “Buy” and “Underweight” ratings. This disparity may influence investor perception of relative stability and growth potential.

Strengths and Weaknesses

Here is a comparison of key strengths and weaknesses of Cisco Systems, Inc. (CSCO) and AudioCodes Ltd. (AUDC) based on recent financial and operational data:

| Criterion | Cisco Systems, Inc. (CSCO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Diversification | Highly diversified across networking, security, collaboration, and services with revenues >$80B in 2025 | Less diversified, mainly networking and services with revenues ~240M in 2024 |

| Profitability | Strong profitability: net margin 18%, ROIC 11.6%, creating value but with declining ROIC trend | Moderate profitability: net margin 6.3%, ROIC 6.5%, currently shedding value with declining ROIC |

| Innovation | Continuous innovation in security and observability segments with steady revenue growth | Smaller scale innovation focus, limited product range impacts growth potential |

| Global presence | Extensive global footprint with a broad product portfolio serving multiple industries | More niche and regional, less global scale and lower market penetration |

| Market Share | Leading market share in networking and security sectors globally | Smaller market share, focused on specific communication technologies |

In summary, Cisco stands out for its broad diversification, strong profitability, and global market leadership, though its profitability shows some decline. AudioCodes remains a smaller, more focused player with moderate financial health but faces challenges in value creation and market expansion. Investors should weigh Cisco’s scale and innovation against AudioCodes’ niche focus and risk profile.

Risk Analysis

Below is a comparison of key risk factors for Cisco Systems, Inc. (CSCO) and AudioCodes Ltd. (AUDC) based on the most recent data:

| Metric | Cisco Systems, Inc. (CSCO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Market Risk | Beta 0.86 – moderate market volatility sensitivity | Beta 1.05 – slightly higher market volatility sensitivity |

| Debt level | Debt/Equity 0.63 – moderate leverage | Debt/Equity 0.19 – low leverage, financially conservative |

| Regulatory Risk | Exposure to US and global regulations, especially in tech and security | Exposure to telecom regulations in Israel, US, Europe |

| Operational Risk | Complex global supply chain with large workforce (90.4K employees) | Smaller scale operations (946 employees), lower operational complexity |

| Environmental Risk | Moderate, with increasing focus on sustainability in tech hardware | Moderate, less publicly emphasized but relevant to telecom equipment |

| Geopolitical Risk | Significant exposure due to global operations including China, Europe | Moderate exposure, primarily Israel and global telecom markets |

Synthesis: Cisco faces notable geopolitical and regulatory risks due to its global scale, particularly in sensitive markets like China. Its moderate debt and operational complexity require careful management. AudioCodes, while smaller, benefits from lower leverage and a favorable liquidity position but remains exposed to telecom sector regulations and moderate geopolitical risk. Investors should weigh Cisco’s market influence against its higher operational and geopolitical risks, while AudioCodes offers a more conservative financial profile with slightly higher market volatility sensitivity.

Which Stock to Choose?

Cisco Systems, Inc. (CSCO) shows a favorable income evolution with strong profitability metrics including a 17.97% net margin and a 21.73% ROE despite some recent margin declines. Its debt levels are moderate with a favorable debt-to-assets ratio, and the company holds a very favorable overall rating B. However, some valuation ratios like PE and PB are unfavorable, and liquidity ratios are mixed.

AudioCodes Ltd. (AUDC) presents a slightly favorable income statement with a 6.32% net margin and moderate profitability ratios such as a 7.98% ROE. The company maintains low debt and strong liquidity ratios, reflected in a very favorable A- rating. Its valuation metrics are generally neutral, but the company’s overall financial ratios suggest slightly favorable conditions.

For investors prioritizing stability and strong value creation, Cisco Systems might appear more favorable given its higher profitability, favorable rating, and value-creating MOAT despite some declining ROIC. Conversely, those seeking exposure to a smaller firm with stronger liquidity and slightly favorable ratios may find AudioCodes to be more aligned with a moderate risk profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Cisco Systems, Inc. and AudioCodes Ltd. to enhance your investment decisions: