In the fast-evolving software industry, Atlassian Corporation and SoundHound AI, Inc. stand out for their innovation and market presence. Atlassian excels in collaborative and project management tools, while SoundHound pioneers voice AI technology for conversational experiences. Both companies address critical business needs through advanced software solutions, making them compelling contenders. This article will help you decide which company presents the most promising investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Atlassian Corporation and SoundHound AI by providing an overview of these two companies and their main differences.

Atlassian Corporation Overview

Atlassian Corporation, founded in 2002 and headquartered in Sydney, Australia, develops and licenses software products designed to improve team collaboration and project management. Its offerings include Jira Software, Confluence, Trello, and various developer tools like Bitbucket and Opsgenie. With a market cap of 31.1B USD and over 12K employees, Atlassian focuses on connecting technical and business teams worldwide.

SoundHound AI Overview

SoundHound AI, based in Santa Clara, California, specializes in voice artificial intelligence technology to create conversational experiences for businesses. Its flagship platform, Houndify, integrates speech recognition and natural language understanding to enable custom voice assistants. The company went public in 2022, has a market cap of 4.7B USD, and employs about 842 people, emphasizing AI-driven voice solutions across industries.

Key similarities and differences

Both companies operate in the software application industry within the technology sector, offering innovative platforms to enhance business operations. Atlassian focuses broadly on team collaboration and project management software with a large, established product suite and workforce. In contrast, SoundHound AI concentrates specifically on voice AI technology and conversational systems with a smaller scale and higher stock price volatility, as indicated by its beta of 2.879 versus Atlassian’s 0.888.

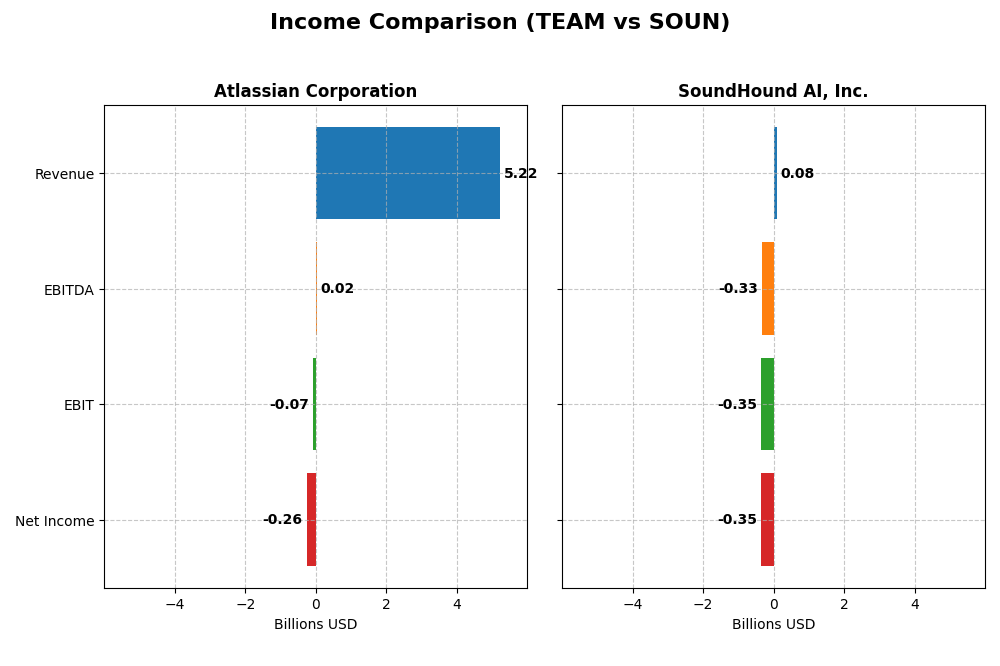

Income Statement Comparison

The table below compares key income statement metrics for Atlassian Corporation and SoundHound AI, Inc. for their most recent fiscal years, providing a snapshot of their financial performance.

| Metric | Atlassian Corporation (TEAM) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Cap | 31.1B | 4.7B |

| Revenue | 5.22B | 85M |

| EBITDA | 24M | -329M |

| EBIT | -68M | -348M |

| Net Income | -257M | -351M |

| EPS | -0.98 | -1.04 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Atlassian Corporation

Atlassian’s revenue grew significantly from $2.1B in 2021 to $5.2B in 2025, with net income losses narrowing from -$579M to -$257M. Gross margins remained strong around 83%, while EBIT margins stayed negative, indicating ongoing operating challenges. The 2025 fiscal year showed revenue growth slowing but net margin and EPS improvements, signaling cautious operational progress.

SoundHound AI, Inc.

SoundHound’s revenue surged from $13M in 2020 to $85M in 2024, yet net losses deepened from -$77M to -$351M. Gross margin held steady near 49%, but EBIT and net margins were deeply negative, reflecting heavy operational costs. In 2024, revenue growth accelerated sharply but was accompanied by worsening margins and EPS decline, underscoring persistent profitability struggles.

Which one has the stronger fundamentals?

Atlassian demonstrates stronger fundamentals with sustained revenue growth, high gross margins, and improving net margin trends despite losses. SoundHound shows rapid revenue expansion but suffers from severe margin erosion and larger net losses. Atlassian’s income statement reflects a more balanced growth and profitability trajectory compared to SoundHound’s ongoing operational deficits.

Financial Ratios Comparison

The table below presents the most recent fiscal year financial ratios for Atlassian Corporation (TEAM) and SoundHound AI, Inc. (SOUN), offering a side-by-side view of key performance and financial health metrics.

| Ratios | Atlassian Corporation (TEAM) 2025 | SoundHound AI, Inc. (SOUN) 2024 |

|---|---|---|

| ROE | -19.1% | -191.9% |

| ROIC | -4.5% | -68.1% |

| P/E | -207.1 | -19.1 |

| P/B | 39.5 | 36.8 |

| Current Ratio | 1.22 | 3.77 |

| Quick Ratio | 1.22 | 3.77 |

| D/E (Debt-to-Equity) | 0.92 | 0.02 |

| Debt-to-Assets | 20.5% | 0.8% |

| Interest Coverage | -4.27 | -28.1 |

| Asset Turnover | 0.86 | 0.15 |

| Fixed Asset Turnover | 19.0 | 14.3 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Atlassian Corporation

Atlassian shows a mixed financial profile with slightly unfavorable overall ratios. Key weaknesses include negative net margin (-4.92%) and return on equity (-19.08%), paired with poor interest coverage (-2.24). However, its low debt-to-assets ratio (20.51%) and strong fixed asset turnover (19.02) are favorable. The company does not pay dividends, likely reinvesting profits into R&D, which accounts for over 50% of revenue investment, supporting growth initiatives.

SoundHound AI, Inc.

SoundHound’s ratios reveal a challenging financial situation with a strongly unfavorable overall rating. It suffers from a severe negative net margin (-414.06%), poor return on equity (-191.99%), and weak asset turnover (0.15). The company maintains a very low debt level (debt-to-assets 0.79%) and a solid quick ratio (3.77), but interest coverage is deeply negative (-28.58). No dividends are paid, consistent with a focus on heavy R&D expenditure and early-stage growth.

Which one has the best ratios?

Atlassian’s ratios present a somewhat more stable financial position compared to SoundHound, with fewer unfavorable metrics and better capital structure indicators. SoundHound’s indicators reflect higher risk due to extremely negative profitability and liquidity challenges despite low leverage. Overall, Atlassian’s slightly unfavorable but more balanced ratios suggest a stronger financial footing relative to SoundHound’s unfavorable profile.

Strategic Positioning

This section compares the strategic positioning of Atlassian Corporation and SoundHound AI, Inc., including market position, key segments, and exposure to technological disruption:

Atlassian Corporation

- Established software application company with $31.1B market cap facing moderate competitive pressure.

- Focuses on project management, collaboration, and developer tools driving revenue from licenses and services.

- Operates in well-established software markets with diversified product portfolio reducing disruption risks.

SoundHound AI, Inc.

- Smaller firm with $4.7B market cap, higher beta indicating greater market volatility and competitive risk.

- Concentrates on voice AI platform, offering conversational AI tools mainly through hosted services and licensing.

- Specializes in voice AI technology, exposed to rapid innovation and evolving AI disruptions.

Atlassian Corporation vs SoundHound AI, Inc. Positioning

Atlassian’s diversified software portfolio targets multiple business functions, offering scale advantages but facing steady competition. SoundHound AI is more concentrated on voice AI technology, benefiting from focused innovation but exposed to higher technological risks and market volatility.

Which has the best competitive advantage?

Both companies are currently shedding value, but Atlassian’s well-established market position contrasts with SoundHound’s improving profitability trend. Atlassian’s broader product base may provide more stability despite declining returns, while SoundHound’s growing ROIC signals potential future competitive strength.

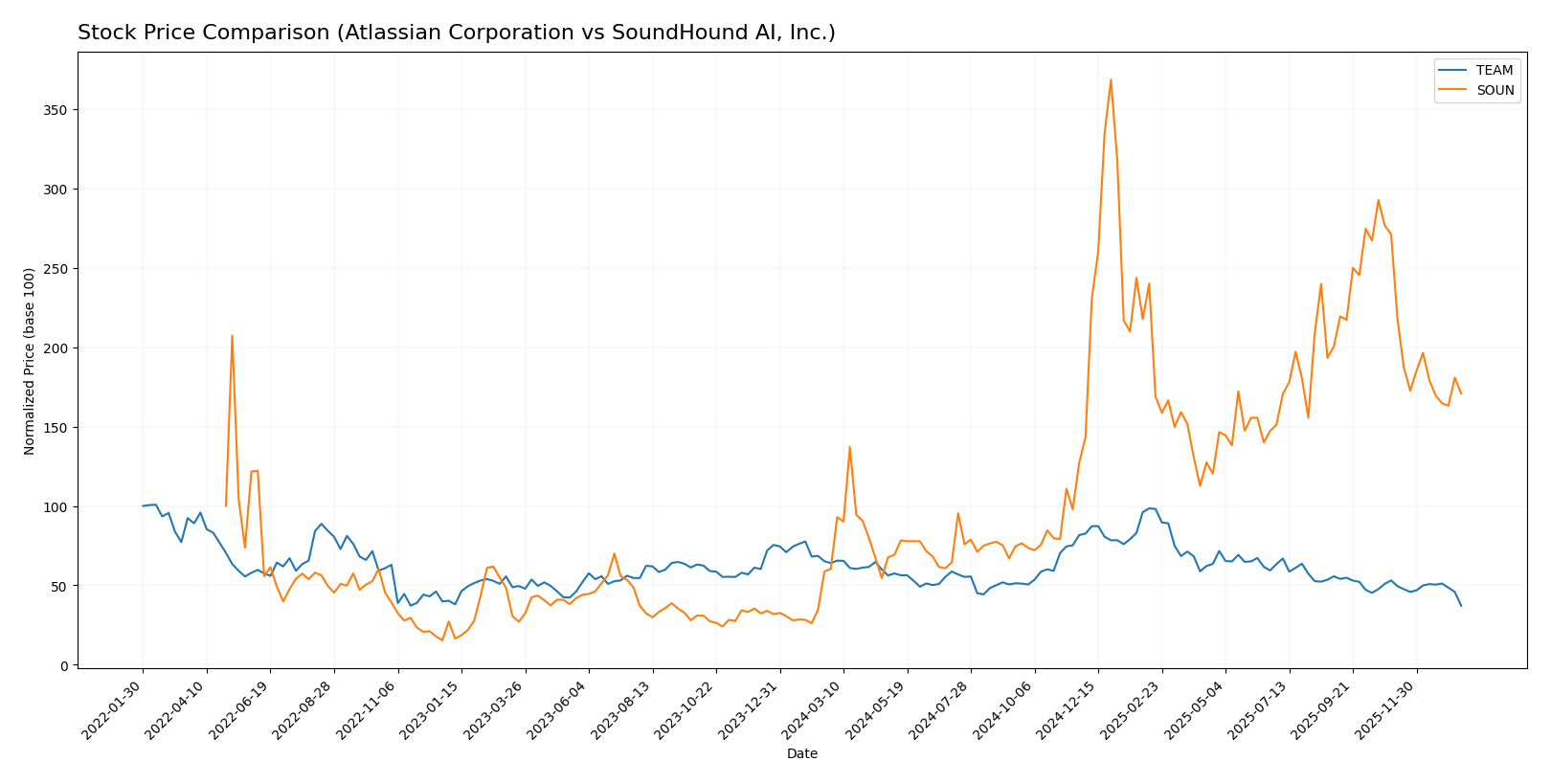

Stock Comparison

The stock price movements of Atlassian Corporation (TEAM) and SoundHound AI, Inc. (SOUN) over the past 12 months reveal contrasting trends with significant shifts in market dynamics and trading volumes.

Trend Analysis

Atlassian Corporation (TEAM) experienced a bearish trend over the past 12 months, with a price decline of 42.01%. The trend shows deceleration and high volatility, with prices ranging from 314.28 to 118.55.

SoundHound AI, Inc. (SOUN) displayed a bullish trend over the same period, gaining 183.16%, though with deceleration and low volatility. Its price fluctuated between 3.55 and 23.95.

Comparing the two, SOUN delivered the highest market performance with a strong positive return, while TEAM faced substantial losses and a bearish trend.

Target Prices

Analysts present a clear target price consensus for Atlassian Corporation and SoundHound AI, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Atlassian Corporation | 290 | 185 | 234.14 |

| SoundHound AI, Inc. | 15 | 11 | 13.33 |

The target consensus for Atlassian suggests a significant upside from its current price of 118.55 USD, while SoundHound’s consensus price of 13.33 USD indicates moderate growth potential above its current 11.1 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Atlassian Corporation and SoundHound AI, Inc.:

Rating Comparison

Atlassian Corporation Rating

- Rating: C, considered very favorable overall.

- Discounted Cash Flow Score: 5, very favorable.

- ROE Score: 1, very unfavorable.

- ROA Score: 1, very unfavorable.

- Debt To Equity Score: 1, very unfavorable.

- Overall Score: 2, moderate rating.

SoundHound AI, Inc. Rating

- Rating: C-, also very favorable overall.

- Discounted Cash Flow Score: 1, very unfavorable.

- ROE Score: 1, very unfavorable.

- ROA Score: 1, very unfavorable.

- Debt To Equity Score: 4, favorable.

- Overall Score: 1, very unfavorable rating.

Which one is the best rated?

Atlassian holds a better overall rating (C) and a higher overall score (2) compared to SoundHound’s C- rating and overall score of 1. Atlassian’s discounted cash flow score is notably stronger, while SoundHound scores better on debt to equity.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Atlassian Corporation and SoundHound AI, Inc.:

Atlassian Scores

- Altman Z-Score of 4.70 indicates a safe zone, low bankruptcy risk.

- Piotroski Score of 5 shows average financial strength.

SoundHound Scores

- Altman Z-Score of 6.62 indicates a safe zone, very low bankruptcy risk.

- Piotroski Score of 3 indicates very weak financial strength.

Which company has the best scores?

SoundHound AI has a higher Altman Z-Score, suggesting stronger bankruptcy protection, but a weaker Piotroski Score than Atlassian. Atlassian shows better financial strength per Piotroski’s criteria.

Grades Comparison

Here is the comparison of recent grades assigned by recognized grading companies for both Atlassian Corporation and SoundHound AI, Inc.:

Atlassian Corporation Grades

The table below shows recent grades from verified grading firms for Atlassian Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-01-13 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Bernstein | Maintain | Outperform | 2025-11-18 |

| Macquarie | Maintain | Outperform | 2025-11-03 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

| Bernstein | Maintain | Outperform | 2025-10-31 |

| TD Cowen | Maintain | Hold | 2025-10-27 |

| BMO Capital | Maintain | Outperform | 2025-10-24 |

| UBS | Maintain | Neutral | 2025-10-24 |

| Keybanc | Maintain | Overweight | 2025-10-23 |

The overall grading trend for Atlassian Corporation is predominantly positive, with multiple “Outperform” and “Buy” ratings maintained across several months.

SoundHound AI, Inc. Grades

The table below displays recent grades from verified grading firms for SoundHound AI, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

SoundHound AI’s grades show a positive trend with multiple “Buy,” “Outperform,” and an “Overweight” upgrade, indicating improving analyst sentiment.

Which company has the best grades?

Both Atlassian Corporation and SoundHound AI, Inc. maintain a “Buy” consensus, but Atlassian has a larger volume of “Outperform” and “Overweight” ratings, suggesting stronger analyst confidence. This may indicate a comparatively higher conviction in Atlassian’s stock performance potential, which investors might consider when assessing portfolio allocations.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Atlassian Corporation (TEAM) and SoundHound AI, Inc. (SOUN) based on recent financial and operational data.

| Criterion | Atlassian Corporation (TEAM) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Diversification | Strong product and service mix with License & Service revenues at $4.93B in 2025, plus other segments | Limited revenue streams, primarily Hosted Services ($57.2M) and Licensing ($17.6M) in 2024 |

| Profitability | Negative profitability metrics: net margin -4.92%, ROE -19.08%, ROIC -4.48%; value destroying | Worse profitability: net margin -414.06%, ROE -191.99%, ROIC -68.13%; but improving ROIC trend |

| Innovation | Established brand with wide product adoption; some value erosion suggests innovation challenges | Early-stage AI firm with growing ROIC trend indicating potential in innovation |

| Global presence | Large global footprint supported by diverse service offerings | Smaller scale, less global reach |

| Market Share | Significant market share in software collaboration tools | Niche player in voice AI technology with limited market share |

In summary, Atlassian offers strong diversification and market presence but is currently experiencing declining profitability and value destruction. SoundHound, while less diversified and profitable, shows promising improvement in capital efficiency, suggesting potential for future growth if it sustains its innovation momentum. Investors should weigh the risks of Atlassian’s profitability issues against SoundHound’s early-stage growth potential.

Risk Analysis

Below is a comparative risk assessment table for Atlassian Corporation (TEAM) and SoundHound AI, Inc. (SOUN) based on the most recent financial and operational data available.

| Metric | Atlassian Corporation (TEAM) | SoundHound AI, Inc. (SOUN) |

|---|---|---|

| Market Risk | Moderate (beta 0.888) | High (beta 2.879) |

| Debt Level | Moderate (Debt-to-Equity 0.92) | Low (Debt-to-Equity 0.02) |

| Regulatory Risk | Moderate (Tech industry, global presence) | Moderate (Emerging AI tech, US regulated) |

| Operational Risk | Moderate (Complex product suite, 12K employees) | High (Smaller scale, 842 employees) |

| Environmental Risk | Low (Software sector, low direct impact) | Low (Software sector, low direct impact) |

| Geopolitical Risk | Moderate (Australian HQ, global operations) | Moderate (US HQ, tech sector exposure) |

Atlassian shows moderate market and operational risks with a stable debt profile but suffers from profitability challenges. SoundHound faces higher market and operational risks, amplified by a high beta and weak profitability, despite low debt. The most impactful risk for both companies is operational execution amid evolving tech landscapes.

Which Stock to Choose?

Atlassian Corporation (TEAM) shows favorable income growth with a 19.66% revenue increase in 2025 and a strong gross margin of 82.84%. However, profitability ratios such as ROE at -19.08% and net margin at -4.92% are unfavorable, reflecting ongoing losses. Debt levels are moderate with a debt-to-assets ratio of 20.51%, and the overall rating is very favorable despite some weak financial ratios. The company is currently shedding value with a declining ROIC trend.

SoundHound AI, Inc. (SOUN) exhibits impressive revenue growth of 84.62% in 2024 but suffers from poor profitability metrics, including a net margin of -414.06% and ROE of -191.99%. Debt ratios are low, with a debt-to-equity score favorable at 4, yet the company’s overall financial ratios and income statement remain unfavorable. Its rating is very favorable mainly due to low debt, but the firm is destroying value despite an improving ROIC trend.

Investors focused on growth might find SoundHound AI appealing due to its rapid revenue expansion despite weak profitability and value destruction. Conversely, those prioritizing a more balanced financial profile and stability could see Atlassian’s favorable income statement and moderate debt as preferable, though it also faces value erosion. The choice could depend on an investor’s tolerance for risk and preference for growth versus financial steadiness.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Atlassian Corporation and SoundHound AI, Inc. to enhance your investment decisions: