Home > Comparison > Technology > TEAM vs FICO

The strategic rivalry between Atlassian Corporation and Fair Isaac Corporation shapes the evolution of the software application sector. Atlassian operates as a collaborative software powerhouse, focusing on project management and developer tools. Fair Isaac specializes in advanced analytics and decision management software, targeting financial and operational workflows. This analysis pits Atlassian’s broad collaboration platform against Fair Isaac’s niche analytics expertise to identify which offers a superior risk-adjusted return for diversified investors.

Table of contents

Companies Overview

Atlassian Corporation and Fair Isaac Corporation both shape critical software markets with distinct value propositions. Their influence spans project management and decision analytics sectors globally.

Atlassian Corporation: Collaborative Software Innovator

Atlassian dominates the project management and team collaboration space with products like Jira, Confluence, and Trello. Its core revenue engine relies on licensing and cloud subscriptions that connect technical and business teams. In 2026, Atlassian focuses on enhancing enterprise agility and security across its cloud platforms to support dynamic business environments.

Fair Isaac Corporation: Leader in Decision Analytics

Fair Isaac excels in advanced analytic and decision management software that automates business processes such as fraud detection and customer engagement. Its revenues stem from software licensing and scoring services. In 2026, the company prioritizes expanding its modular software platform and integrating AI-driven analytics to deepen client decision automation.

Strategic Collision: Similarities & Divergences

Both companies thrive on software innovation but differ sharply in approach. Atlassian builds an open collaboration ecosystem focused on workflow integration. Fair Isaac offers a highly specialized decisioning platform tailored for risk and compliance. Their primary battleground lies in enterprise software adoption, yet their investment profiles reflect distinct risk and growth trajectories driven by divergent market demands.

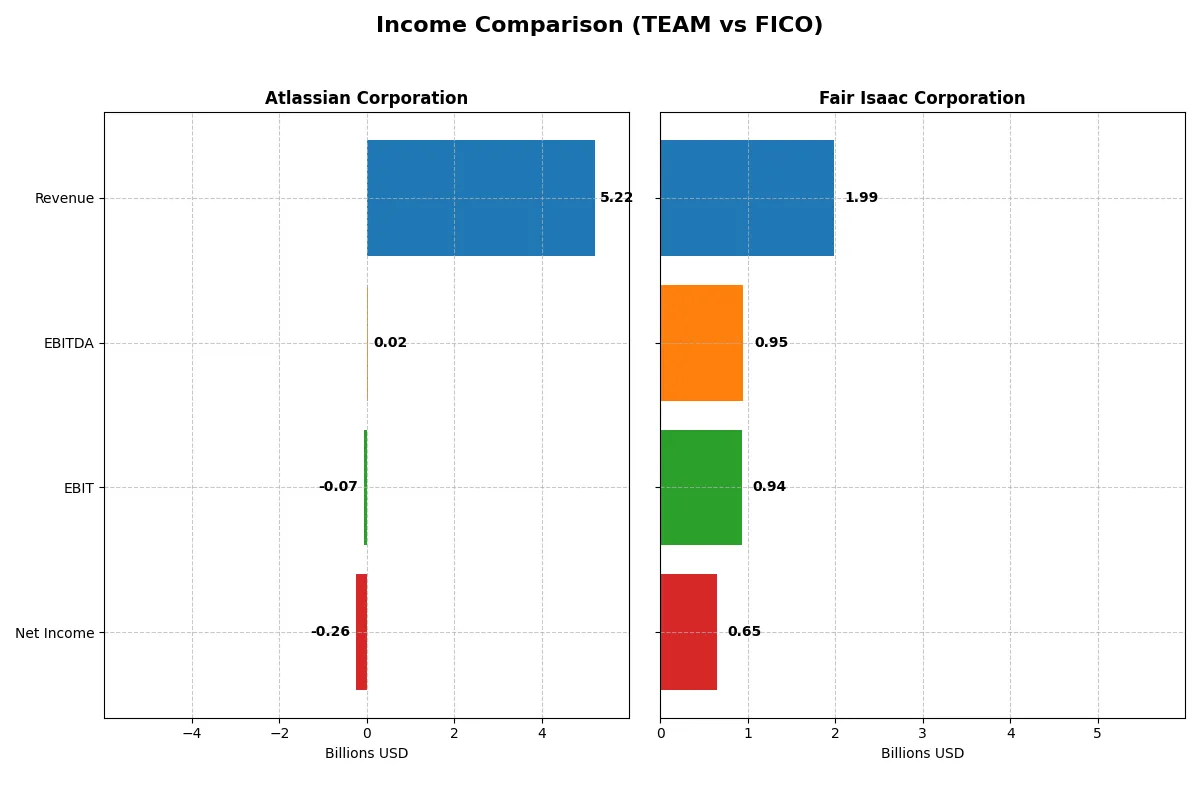

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Atlassian Corporation (TEAM) | Fair Isaac Corporation (FICO) |

|---|---|---|

| Revenue | 5.22B | 1.99B |

| Cost of Revenue | 895M | 354M |

| Operating Expenses | 4.45B | 712M |

| Gross Profit | 4.32B | 1.64B |

| EBITDA | 24M | 951M |

| EBIT | -68M | 936M |

| Interest Expense | 31M | 134M |

| Net Income | -257M | 652M |

| EPS | -0.98 | 26.9 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable corporate engine under current market conditions.

Atlassian Corporation Analysis

Atlassian’s revenue soared from 2.1B in 2021 to 5.2B in 2025, reflecting rapid growth. However, net income remained negative, improving from -579M to -257M. The gross margin holds strong at 82.8%, but the net margin stays unfavorable at -4.9%, signaling margin pressure. Recent momentum shows revenue growth outpacing expense control, dragging EBIT further negative.

Fair Isaac Corporation Analysis

Fair Isaac steadily grew revenue from 1.3B in 2021 to 2.0B in 2025 with a solid gross margin of 82.2%. Net income climbed robustly from 392M to 652M, delivering a strong net margin of 32.8%. EBIT margin improved to 47%, reflecting excellent operating efficiency and capital allocation. The company sustains healthy profitability and margin expansion year-over-year.

Margin Power vs. Revenue Scale

Fair Isaac dominates with superior profitability and margin expansion, while Atlassian focuses on aggressive top-line growth despite ongoing losses. Fair Isaac’s efficient cost structure and consistent net income gains position it as the clear fundamental winner. Investors seeking durable profitability will find Fair Isaac’s profile more attractive than Atlassian’s high-growth but unprofitable trajectory.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Atlassian Corporation (TEAM) | Fair Isaac Corporation (FICO) |

|---|---|---|

| ROE | -19.1% | -37.3% |

| ROIC | -4.5% | 52.96% |

| P/E | -207.1 | 55.6 |

| P/B | 39.5 | -20.8 |

| Current Ratio | 1.22 | 0.83 |

| Quick Ratio | 1.22 | 0.83 |

| D/E (Debt-to-Equity) | 0.92 | -1.76 |

| Debt-to-Assets | 20.5% | 164.6% |

| Interest Coverage | -4.27 | 6.92 |

| Asset Turnover | 0.86 | 1.07 |

| Fixed Asset Turnover | 19.0 | 21.2 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and operational strengths that raw numbers alone cannot reveal.

Atlassian Corporation

Atlassian shows weak core profitability with a -19.08% ROE and a negative net margin of -4.92%, signaling operational challenges. Its valuation appears attractive with a favorable P/E but stretched price-to-book at 39.51. The company returns no dividend, opting instead to reinvest heavily in R&D, dedicating over 50% of revenue to innovation.

Fair Isaac Corporation

Fair Isaac delivers robust operational efficiency with a 32.75% net margin and a strong 52.96% ROIC, despite a negative ROE of -37.34%. Its stock trades at a higher P/E of 55.64, indicating premium valuation. The firm pays no dividend, focusing capital on growth and maintaining favorable asset turnover and interest coverage ratios.

Premium Valuation vs. Operational Safety

Fair Isaac offers a stronger balance of profitability and operational efficiency but comes at a stretched valuation. Atlassian trades cheaper but struggles with profitability and returns. Investors seeking growth and operational resilience may favor Fair Isaac, while those wary of valuation risk might scrutinize Atlassian’s reinvestment strategy.

Which one offers the Superior Shareholder Reward?

Atlassian (TEAM) pays no dividends and allocates capital to growth, reflected in negative net margins and heavy reinvestment. Fair Isaac (FICO) also pays no dividend but delivers strong operating margins (~46%) and robust free cash flow (~$32/share), supporting buybacks. FICO’s buyback intensity is higher and more sustainable given its cash flow and profitability. TEAM’s growth focus carries execution risks without shareholder distributions. I conclude FICO offers a superior total return profile in 2026, blending cash flow strength with disciplined capital returns.

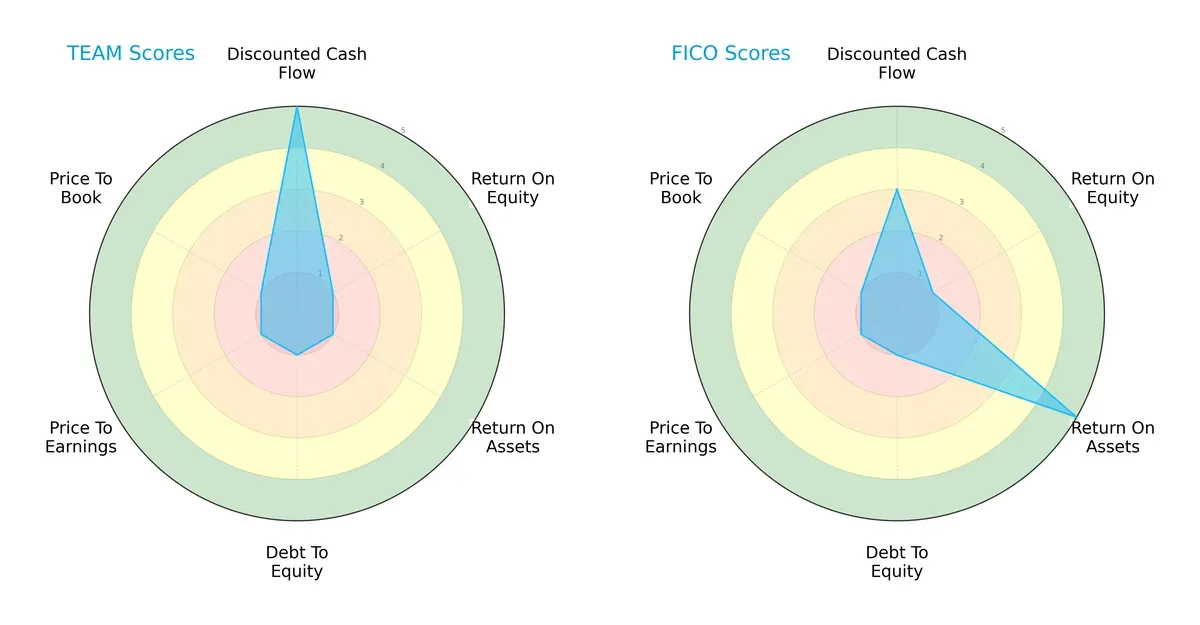

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Atlassian Corporation and Fair Isaac Corporation, highlighting their financial strengths and vulnerabilities:

Atlassian excels in discounted cash flow with a very favorable score of 5 but struggles with profitability and valuation metrics, scoring very unfavorably in ROE, ROA, and price multiples. Fair Isaac shows a more balanced asset efficiency with a very favorable ROA score of 5 yet shares the same weak equity returns and valuation scores as Atlassian. Overall, Fair Isaac presents a slightly more balanced profile, relying on operational efficiency, while Atlassian depends heavily on future cash flow potential.

Bankruptcy Risk: Solvency Showdown

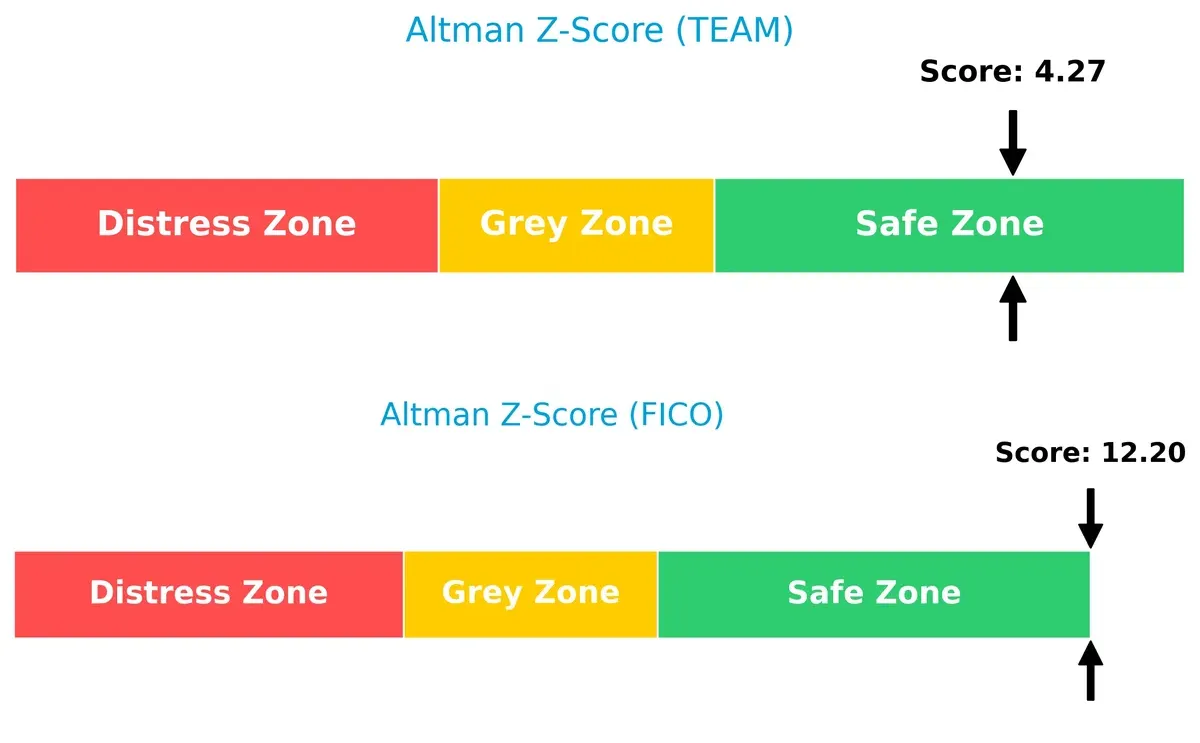

The Altman Z-Score gap between Atlassian (4.27) and Fair Isaac (12.20) underscores their differing survival prospects in this cycle:

Both firms reside safely above the distress threshold, but Fair Isaac’s exceptional score signals robust solvency and minimal bankruptcy risk, while Atlassian’s moderate safe-zone score indicates less cushion against financial shocks.

Financial Health: Quality of Operations

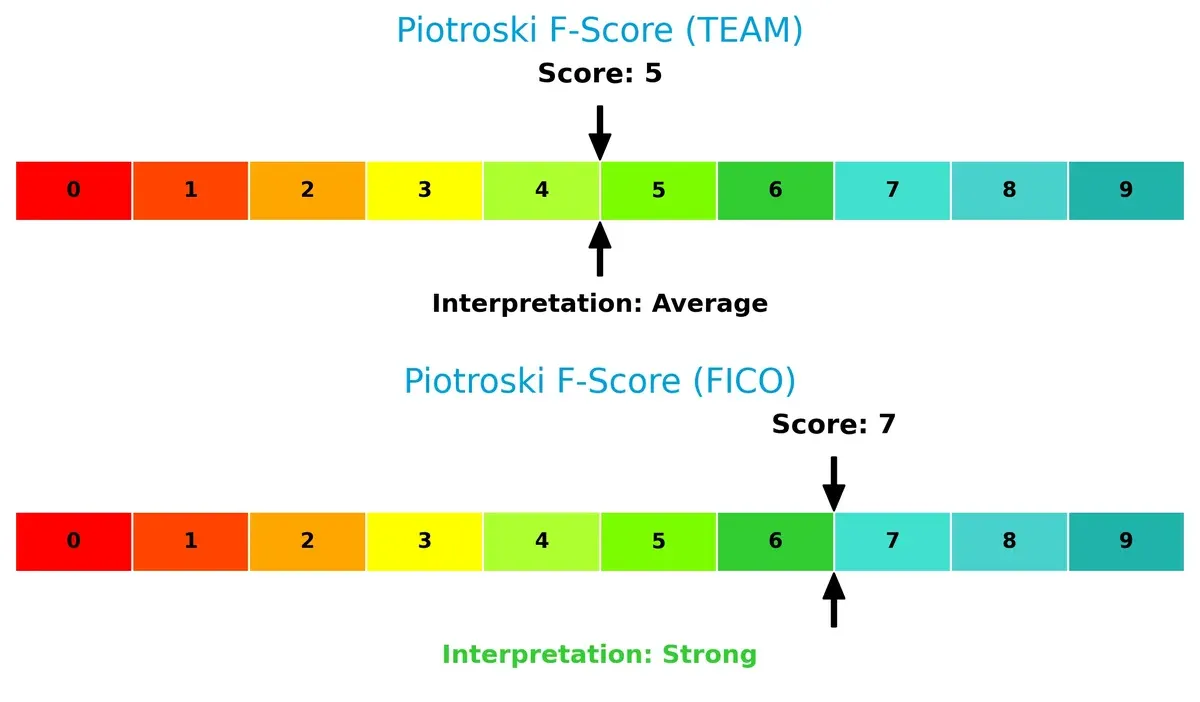

Piotroski F-Scores reveal contrasting internal financial health profiles between the companies:

Fair Isaac’s strong score of 7 suggests solid profitability, leverage control, and operational efficiency. Atlassian’s average score of 5 flags potential red flags in internal metrics, signaling room for improvement in financial quality. Investors should weigh these operational strengths carefully.

How are the two companies positioned?

This section dissects the operational DNA of Atlassian and Fair Isaac by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

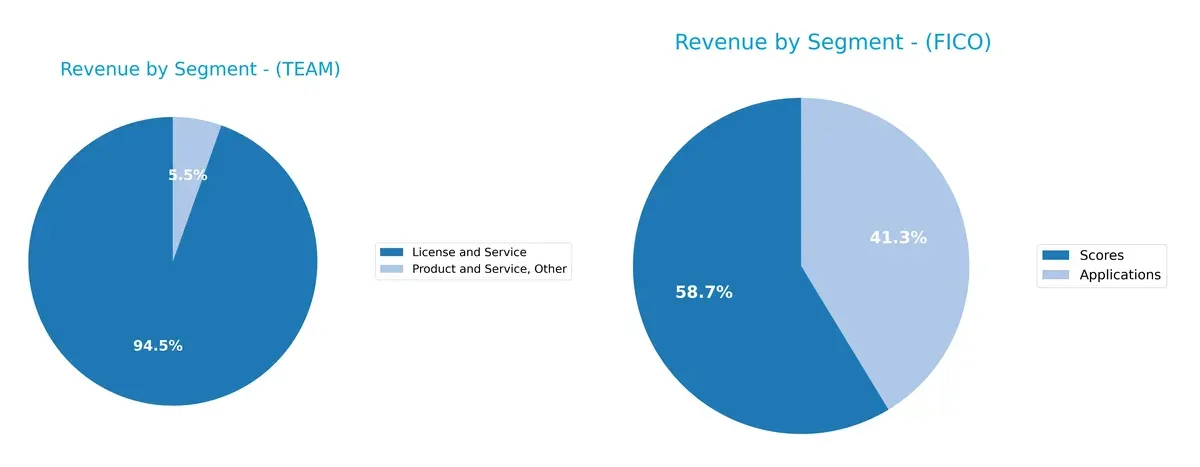

This visual comparison dissects how Atlassian Corporation and Fair Isaac Corporation diversify their income streams and highlights where their primary sector bets lie:

Atlassian’s 2025 revenue centers on License and Service at $4.93B, with a minor $285M from Product and Service, Other, showing moderate diversification. Fair Isaac pivots chiefly on Scores at $1.17B, with Applications trailing at $822M, indicating higher concentration risk. Atlassian’s broader mix supports ecosystem lock-in, while Fair Isaac relies on its scoring dominance, exposing it to sector-specific shifts.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Atlassian Corporation and Fair Isaac Corporation:

Atlassian Corporation Strengths

- Diversified revenue streams including License, Service, Subscription, and Maintenance

- Strong global presence across Americas, EMEA, and Asia Pacific

- Favorable weighted average cost of capital (7.82%)

- High fixed asset turnover ratio (19.02)

Fair Isaac Corporation Strengths

- High net margin (32.75%) and return on invested capital (52.96%)

- Strong asset turnover and fixed asset turnover ratios

- Favorable interest coverage ratio (7.01)

- Global presence primarily in Americas with growth in Asia Pacific and EMEA

Atlassian Corporation Weaknesses

- Negative profitability metrics: net margin (-4.92%), ROE (-19.08%), ROIC (-4.48%)

- Unfavorable interest coverage (-2.24) and high price-to-book ratio (39.51)

- No dividend yield

- Slightly unfavorable global ratio evaluation (42.86% unfavorable)

Fair Isaac Corporation Weaknesses

- Negative return on equity (-37.34%)

- High debt-to-assets ratio (164.6%) and low current ratio (0.83)

- Unfavorable price-to-earnings ratio (55.64) and no dividend yield

- Slightly favorable global ratio evaluation with some financial leverage concerns

Atlassian shows strength in diversification and capital efficiency but struggles with profitability and financial health. Fair Isaac excels in profitability and operational efficiency but faces risks from high leverage and weak equity returns. Both companies display different strategic challenges within their financial profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion in dynamic markets:

Atlassian Corporation (TEAM): Network Effects and Ecosystem Integration

Atlassian leverages network effects, connecting teams through integrated collaboration tools. Despite high gross margins, declining ROIC signals weakening profitability. New product launches may deepen the moat but risk margin pressure in 2026.

Fair Isaac Corporation (FICO): Data-Driven Intangible Assets

FICO’s moat stems from proprietary analytics and scoring models, delivering high ROIC and margin stability. Its durable advantage grows with expanding software applications and decision management, positioning it well for market expansion in 2026.

Network Effects vs. Intangible Asset Dominance: Who Defends Better?

FICO’s strong, growing ROIC and stable margins indicate a deeper, more durable moat than Atlassian’s weakening returns. I believe FICO is better equipped to defend and expand its market share in 2026.

Which stock offers better returns?

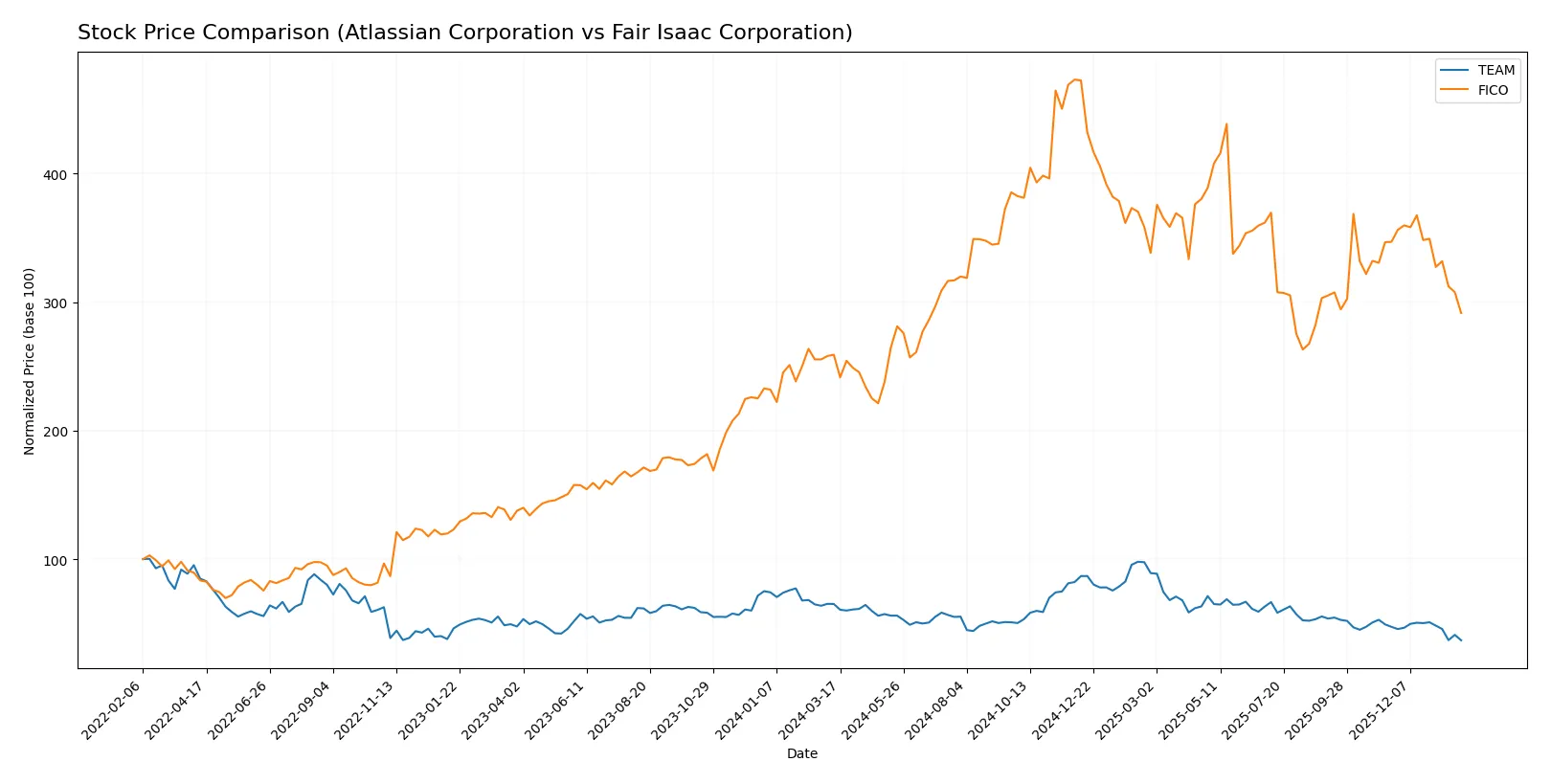

Over the past 12 months, Atlassian Corporation’s shares declined significantly, while Fair Isaac Corporation showed moderate gains despite recent downward pressure.

Trend Comparison

Atlassian’s stock fell 43.4% over the past year, marking a clear bearish trend with decelerating losses and a high volatility of 42.36. The highest price reached 314.28, with a low near 118.18.

Fair Isaac’s shares rose 12.51% over the same period, reflecting a bullish but decelerating trend. Volatility is notably higher at 285.65, with prices ranging from 1110.85 to 2375.03.

Comparing both, Fair Isaac outperformed Atlassian with positive overall returns, despite recent declines in both stocks. Fair Isaac delivered the stronger market performance over the past year.

Target Prices

Analysts project strong upside potential for both Atlassian Corporation and Fair Isaac Corporation based on current consensus targets.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Atlassian Corporation | 145 | 290 | 226.29 |

| Fair Isaac Corporation | 1640 | 2400 | 2115 |

Atlassian’s consensus target of 226.29 implies nearly 91% upside from its current 118.18 price. Fair Isaac’s 2115 target suggests a significant 45% potential gain from 1463.17, reflecting strong analyst confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Below is a comparison of institutional grades for Atlassian Corporation and Fair Isaac Corporation:

Atlassian Corporation Grades

This table summarizes recent grades assigned by reputable firms to Atlassian Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Baird | Maintain | Outperform | 2026-01-26 |

| Mizuho | Maintain | Outperform | 2026-01-21 |

| TD Cowen | Maintain | Hold | 2026-01-20 |

| Citigroup | Maintain | Buy | 2026-01-16 |

| BTIG | Maintain | Buy | 2026-01-13 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Bernstein | Maintain | Outperform | 2025-11-18 |

| Macquarie | Maintain | Outperform | 2025-11-03 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

| Bernstein | Maintain | Outperform | 2025-10-31 |

Fair Isaac Corporation Grades

This table presents recent institutional grades for Fair Isaac Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-29 |

| Jefferies | Maintain | Buy | 2026-01-16 |

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| JP Morgan | Maintain | Neutral | 2025-11-06 |

| Baird | Maintain | Outperform | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-11-06 |

| BMO Capital | Maintain | Outperform | 2025-11-06 |

| Wells Fargo | Maintain | Overweight | 2025-10-14 |

| Barclays | Maintain | Overweight | 2025-10-02 |

| Needham | Maintain | Buy | 2025-10-02 |

Which company has the best grades?

Atlassian Corporation consistently receives Outperform and Buy ratings from multiple firms, indicating strong confidence. Fair Isaac Corporation also earns mostly Buy and Outperform grades but includes a Neutral rating. This suggests Atlassian currently holds slightly stronger institutional support, which may influence investor sentiment positively.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Atlassian Corporation

- Faces intense competition in collaborative software amid pricing pressure and evolving user demands.

Fair Isaac Corporation

- Competes in analytics and decision software with strong incumbents, facing pressure from AI-driven entrants.

2. Capital Structure & Debt

Atlassian Corporation

- Maintains moderate debt with a debt-to-assets ratio of 20.5%, manageable but interest coverage is negative.

Fair Isaac Corporation

- High debt-to-assets at 164.6% signals aggressive leverage; however, interest coverage at 7.0x is strong.

3. Stock Volatility

Atlassian Corporation

- Beta of 0.89 indicates below-market volatility, providing some downside protection in turbulent markets.

Fair Isaac Corporation

- Beta at 1.29 shows elevated volatility, exposing investors to higher market swings.

4. Regulatory & Legal

Atlassian Corporation

- Subject to data privacy and software export regulations, particularly given international operations.

Fair Isaac Corporation

- Faces scrutiny in credit scoring practices and compliance with global financial regulations.

5. Supply Chain & Operations

Atlassian Corporation

- Operates cloud-based services, limiting physical supply chain risk but reliant on robust IT infrastructure.

Fair Isaac Corporation

- Heavily dependent on data centers and cloud platforms; operational disruptions could impact service delivery.

6. ESG & Climate Transition

Atlassian Corporation

- Increasing focus on sustainable operations and data center energy efficiency amid investor ESG demands.

Fair Isaac Corporation

- Faces pressure to enhance ESG disclosures and reduce environmental impact of data processing.

7. Geopolitical Exposure

Atlassian Corporation

- Australian headquarters with global reach exposes it to Asia-Pacific regional risks and trade policies.

Fair Isaac Corporation

- US-based but with global sales, vulnerable to US-China tensions and cross-border data regulations.

Which company shows a better risk-adjusted profile?

Atlassian’s most impactful risk is its negative profitability and weak interest coverage, signaling operational strain and potential liquidity issues. Fair Isaac’s primary concern is its massive leverage, posing financial risk despite strong earnings. Fair Isaac’s stronger profitability and Altman Z-Score place it in a safer financial zone. However, its excessive debt heightens risk. Atlassian’s below-market volatility and moderate debt provide more stability but profitability weaknesses weigh heavily. Overall, Fair Isaac offers a slightly better risk-adjusted profile, supported by a robust Altman Z-Score of 12.2 versus Atlassian’s 4.3, despite leverage concerns.

Final Verdict: Which stock to choose?

Atlassian Corporation (TEAM) shines with its unmatched innovation engine, powering rapid revenue growth despite current profitability challenges. Its main point of vigilance lies in declining returns on invested capital, signaling efficiency issues. TEAM suits investors with a high tolerance for volatility and a long-term aggressive growth horizon.

Fair Isaac Corporation (FICO) boasts a durable moat through its data-driven decision analytics, delivering strong operating returns and consistent cash generation. Compared to TEAM, FICO offers better financial stability but commands a premium valuation. It fits well in portfolios seeking GARP—growth at a reasonable price—with a focus on quality earnings.

If you prioritize breakthrough growth and can endure short-term profitability pressures, Atlassian’s dynamic innovation might be compelling. However, if you seek a proven value creator with stronger capital efficiency and steadier cash flows, Fair Isaac offers better stability and a more durable competitive advantage. Both present distinct scenarios aligned with differing investor profiles and risk appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Atlassian Corporation and Fair Isaac Corporation to enhance your investment decisions: