In today’s fast-evolving tech landscape, Datadog, Inc. and Atlassian Corporation stand out as prominent players in the software application industry. Both companies offer innovative solutions that enhance productivity and operational efficiency, serving overlapping markets of developers and IT professionals. By comparing their market strategies, growth potential, and innovation, this article will help you decide which company presents the most compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Datadog and Atlassian by providing an overview of these two companies and their main differences.

Datadog Overview

Datadog, Inc. offers a cloud-based monitoring and analytics platform targeting developers, IT operations, and business users globally. Its SaaS solution integrates infrastructure monitoring, application performance, log management, and security monitoring to deliver real-time observability. Headquartered in New York City and founded in 2010, Datadog serves a diverse client base with a comprehensive technology stack overview.

Atlassian Overview

Atlassian Corporation develops and licenses software products that facilitate project management, collaboration, and software development worldwide. Its portfolio includes Jira, Confluence, Trello, and other tools designed to enhance teamwork and service management. Founded in 2002 and based in Sydney, Australia, Atlassian focuses on connecting technical and business teams through innovative cloud solutions.

Key similarities and differences

Both companies operate in the software application industry, providing cloud-based solutions to improve operational efficiency. Datadog centers on monitoring and analytics for technology infrastructure, while Atlassian emphasizes project management and collaboration tools. Atlassian has a larger workforce of over 12K employees compared to Datadog’s 6.5K, and their market caps stand at approximately 31B and 41B respectively.

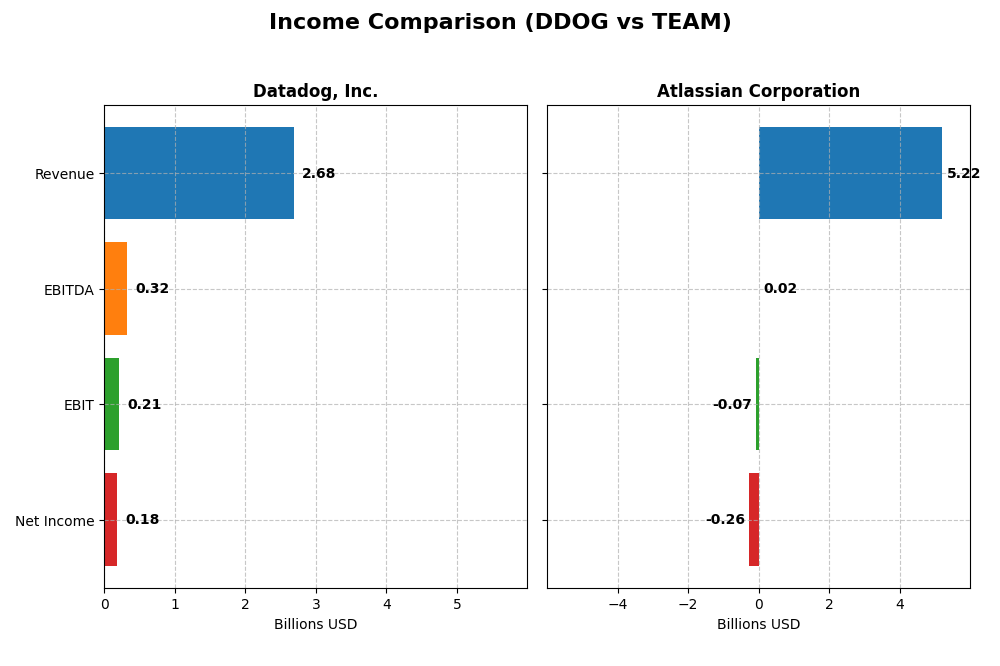

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent full fiscal year income statement figures for Datadog, Inc. and Atlassian Corporation.

| Metric | Datadog, Inc. (2024) | Atlassian Corporation (2025) |

|---|---|---|

| Market Cap | 41.7B | 31.1B |

| Revenue | 2.68B | 5.22B |

| EBITDA | 318M | 24M |

| EBIT | 211M | -68M |

| Net Income | 184M | -257M |

| EPS | 0.55 | -0.98 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Datadog, Inc.

Datadog’s revenue showed strong growth from 2020 to 2024, rising from $603M to $2.68B, with net income improving from a loss of $25M to a profit of $184M. Gross margins remained robust around 81%, while net margins improved significantly to 6.85%, reflecting operational efficiency gains. The 2024 fiscal year saw a notable acceleration in revenue and net income growth, with margins expanding favorably.

Atlassian Corporation

Atlassian’s revenue increased steadily from $2.09B in 2021 to $5.22B in the first half of 2025, though it remained unprofitable with net losses narrowing from $579M to $257M. Gross margins were strong at 82.8%, but EBIT and net margins stayed negative, reflecting ongoing investment expenses. The latest year showed slower EBIT decline but persistent net losses, despite improved net margin growth and EPS.

Which one has the stronger fundamentals?

Datadog exhibits stronger fundamentals, supported by consistent profitability, expanding net margins, and high revenue growth. Atlassian, while growing revenue impressively, continues to report net losses and negative EBIT margins, indicating less earnings stability. The favorable margin trends and profitability metrics favor Datadog as having a more solid income statement profile.

Financial Ratios Comparison

This table presents the most recent financial ratios for Datadog, Inc. and Atlassian Corporation, offering a side-by-side view of their key performance and financial health indicators for informed analysis.

| Ratios | Datadog, Inc. (DDOG) 2024 | Atlassian Corporation (TEAM) 2025 |

|---|---|---|

| ROE | 6.77% | -19.08% |

| ROIC | 1.07% | -4.48% |

| P/E | 261.42 | -207.13 |

| P/B | 17.70 | 39.51 |

| Current Ratio | 2.64 | 1.22 |

| Quick Ratio | 2.64 | 1.22 |

| D/E (Debt-to-Equity) | 0.68 | 0.92 |

| Debt-to-Assets | 31.8% | 20.5% |

| Interest Coverage | 7.68 | -4.27 |

| Asset Turnover | 0.46 | 0.86 |

| Fixed Asset Turnover | 6.72 | 19.02 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Datadog, Inc.

Datadog shows a mixed ratio profile with a favorable current and quick ratio of 2.64, indicating good short-term liquidity, but unfavorable returns on equity (6.77%) and invested capital (1.07%), and high valuation multiples like a P/E of 261.42 and P/B of 17.7. The dividend yield is 0%, reflecting no dividend payments, consistent with a growth-focused reinvestment strategy without share buybacks.

Atlassian Corporation

Atlassian exhibits challenges with negative net margin (-4.92%), return on equity (-19.08%), and return on invested capital (-4.48%), signaling operational losses and weak profitability. Liquidity ratios are neutral to favorable with a current ratio of 1.22. Like Datadog, Atlassian pays no dividends, likely prioritizing reinvestment in R&D and acquisitions during its growth phase, with no share buyback activity reported.

Which one has the best ratios?

Both companies present a slightly unfavorable overall ratio picture, balancing some liquidity strengths with profitability weaknesses. Datadog’s higher liquidity and interest coverage contrast with Atlassian’s better debt management and fixed asset turnover. However, both face high valuation concerns and lack dividend returns, making the ratio assessments comparable but with differing structural risks.

Strategic Positioning

This section compares the strategic positioning of Datadog and Atlassian, including market position, key segments, and exposure to technological disruption:

Datadog, Inc.

- Positioned in cloud monitoring and analytics with global reach; faces competitive pressure in SaaS infrastructure.

- Focuses on cloud infrastructure monitoring and observability platforms for developers and IT teams.

- Exposed to cloud computing and SaaS industry disruption, requiring continuous innovation in monitoring technology.

Atlassian Corporation

- Competes in software collaboration and project management globally; market pressure from diversified software tools.

- Key segments include project management, collaboration, and developer tools; driven by licenses and services.

- Faces technological disruption in collaborative software and cloud security, necessitating frequent product updates.

Datadog vs Atlassian Positioning

Datadog concentrates on cloud monitoring and observability, offering a specialized platform, whereas Atlassian has a more diversified software portfolio across project management and collaboration. Datadog’s focus may enable deeper expertise, while Atlassian’s breadth spreads market risk.

Which has the best competitive advantage?

Both companies are currently shedding value with negative ROIC versus WACC; Datadog shows improving profitability, while Atlassian experiences declining returns, indicating Datadog has a relatively stronger but still unfavorable competitive position.

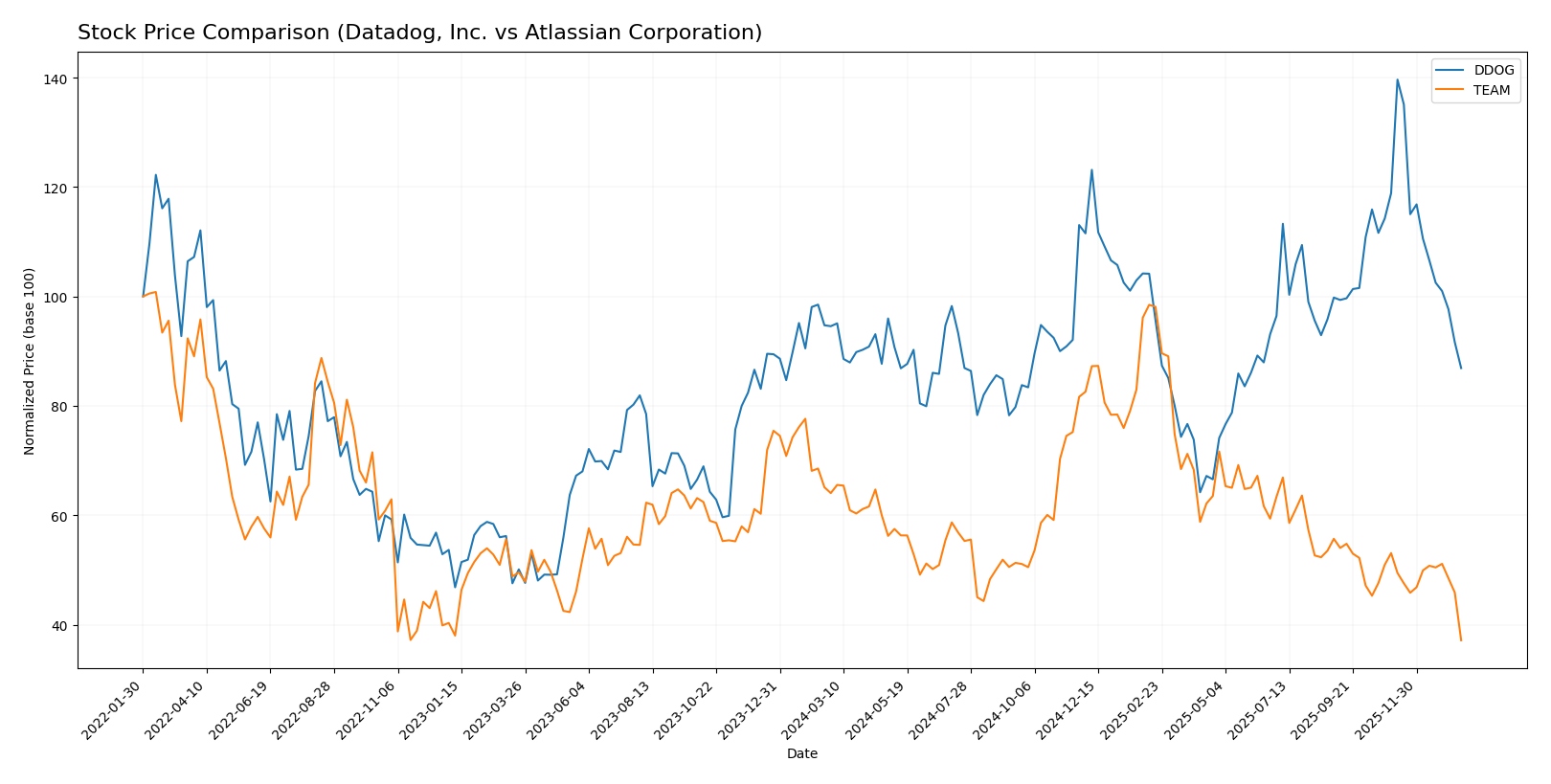

Stock Comparison

The stock prices of Datadog, Inc. (DDOG) and Atlassian Corporation (TEAM) over the past 12 months exhibit clear bearish trends, with significant declines and varying volatility impacting their trading dynamics.

Trend Analysis

Datadog, Inc. (DDOG) experienced an 8.1% price decline over the past year, indicating a bearish trend with deceleration. The stock ranged between $87.93 and $191.24, showing moderate volatility at 18.63 std deviation.

Atlassian Corporation (TEAM) showed a more pronounced bearish trend with a 42.01% price drop over the same period and deceleration. Its price fluctuated from $118.55 to $314.28, with higher volatility of 41.22 std deviation.

Comparing both stocks, DDOG delivered the higher market performance with a smaller decline of 8.1% versus TEAM’s 42.01% loss over the past year.

Target Prices

The current analyst consensus for target prices suggests significant upside potential for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Datadog, Inc. | 215 | 105 | 177.67 |

| Atlassian Corporation | 290 | 185 | 234.14 |

Analysts expect Datadog’s stock to rise substantially from its current price of 119.02, while Atlassian’s consensus target of 234.14 indicates a strong expected appreciation from its current price near 118.55.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Datadog, Inc. and Atlassian Corporation:

Rating Comparison

Datadog, Inc. Rating

- Rating: C+, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a favorable future cash flow valuation.

- ROE Score: 2, showing moderate efficiency in generating profit from equity.

- ROA Score: 3, reflecting moderate effectiveness in asset utilization.

- Debt To Equity Score: 2, moderate financial risk with balanced debt level.

- Overall Score: 2, a moderate overall financial standing assessment.

Atlassian Corporation Rating

- Rating: C, also considered very favorable by analysts.

- Discounted Cash Flow Score: 5, indicating a very favorable cash flow valuation.

- ROE Score: 1, rated very unfavorable for profit generation efficiency.

- ROA Score: 1, indicating very unfavorable asset utilization.

- Debt To Equity Score: 1, very unfavorable, suggesting higher financial risk from debt.

- Overall Score: 2, also reflecting a moderate overall financial standing.

Which one is the best rated?

Both companies share the same overall score of 2, indicating moderate financial standing. Atlassian leads with a higher discounted cash flow score, while Datadog outperforms in return on equity, return on assets, and debt to equity scores, suggesting a more balanced financial profile.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

DDOG Scores

- Altman Z-Score: 11.37, indicating a strong safe zone status.

- Piotroski Score: 6, showing an average financial strength.

TEAM Scores

- Altman Z-Score: 4.70, also in the safe zone but lower than DDOG.

- Piotroski Score: 5, slightly lower but also average financial strength.

Which company has the best scores?

DDOG has a higher Altman Z-Score indicating stronger financial stability and a marginally better Piotroski Score than TEAM. Both companies are in the safe zone, but DDOG’s scores suggest a more solid financial position based on this data.

Grades Comparison

Here is a comparison of the recent grades assigned to Datadog, Inc. and Atlassian Corporation by major grading companies:

Datadog, Inc. Grades

This table summarizes recent grades and rating actions from key financial institutions for Datadog, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Hold | 2026-01-07 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-11-12 |

| Truist Securities | Maintain | Hold | 2025-11-07 |

| DA Davidson | Maintain | Buy | 2025-11-07 |

The overall pattern for Datadog indicates a strong buy-side sentiment with multiple Overweight and Buy ratings and only a few Hold ratings.

Atlassian Corporation Grades

This table presents recent grades and rating actions from recognized grading companies for Atlassian Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-01-13 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Bernstein | Maintain | Outperform | 2025-11-18 |

| Macquarie | Maintain | Outperform | 2025-11-03 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

| Bernstein | Maintain | Outperform | 2025-10-31 |

| TD Cowen | Maintain | Hold | 2025-10-27 |

| BMO Capital | Maintain | Outperform | 2025-10-24 |

| UBS | Maintain | Neutral | 2025-10-24 |

| Keybanc | Maintain | Overweight | 2025-10-23 |

Atlassian’s ratings show a consistent pattern of Outperform and Buy-related grades with some Hold and Neutral ratings, reflecting generally positive analyst sentiment.

Which company has the best grades?

Both Datadog and Atlassian have received predominantly positive grades with strong Buy and Overweight ratings. Datadog has a slight edge with fewer Hold ratings and a recent upgrade, while Atlassian maintains a more frequent Outperform consensus. Investors may interpret these trends as generally favorable but should consider individual risk profiles.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Datadog, Inc. (DDOG) and Atlassian Corporation (TEAM) based on the latest financial and strategic data.

| Criterion | Datadog, Inc. (DDOG) | Atlassian Corporation (TEAM) |

|---|---|---|

| Diversification | Focused on cloud monitoring and analytics; moderate product range | Strong diversification with License, Service, Subscription, and Maintenance revenues |

| Profitability | Slightly profitable with net margin ~6.85%; ROIC positive but below WACC | Unprofitable with negative net margin and ROIC; declining profitability trend |

| Innovation | Growing ROIC trend suggests improving operational efficiency | Declining ROIC indicates challenges in sustaining innovation returns |

| Global presence | Solid presence in cloud infrastructure market globally | Global software collaboration footprint, expanding revenue streams |

| Market Share | Specialized niche leader in monitoring and analytics | Strong market position in team collaboration software |

Key takeaways: Datadog shows improving profitability and operational efficiency despite value shedding, making it a cautiously optimistic choice. Atlassian, while diversified and globally established, faces profitability and efficiency challenges, indicating higher investment risk.

Risk Analysis

Below is a comparative table summarizing key risk factors for Datadog, Inc. (DDOG) and Atlassian Corporation (TEAM) based on their most recent financial and market data.

| Metric | Datadog, Inc. (DDOG) | Atlassian Corporation (TEAM) |

|---|---|---|

| Market Risk | Beta 1.26: moderately volatile, sensitive to tech sector swings | Beta 0.89: less volatile, more stable in market fluctuations |

| Debt level | Debt-to-Equity 0.68, moderate leverage, manageable risk | Debt-to-Equity 0.92, higher leverage, slightly elevated risk |

| Regulatory Risk | Moderate: US tech regulations, data privacy laws impact | Moderate: Australian and global compliance, data protection concerns |

| Operational Risk | SaaS platform complexity; reliance on cloud infrastructure | Diverse product suite; integration and innovation risks |

| Environmental Risk | Low: primarily software with limited direct environmental impact | Low: software company with minimal direct environmental footprint |

| Geopolitical Risk | Moderate: US and international exposure | Moderate: Australian base with global operations, exposed to geopolitical tensions |

The most impactful risks for these companies include market volatility—particularly for Datadog due to its higher beta—and operational complexities in maintaining innovative SaaS solutions. Atlassian’s higher debt level and weaker profitability metrics also elevate its financial risk, despite a safer Altman Z-score. Both companies operate in a highly regulated environment with ongoing data privacy challenges.

Which Stock to Choose?

Datadog, Inc. (DDOG) shows strong income growth with a 344.81% revenue increase over five years and a 6.85% net margin rated favorable. Its financial ratios overall appear slightly unfavorable due to high valuation multiples, but liquidity and interest coverage are favorable. Debt levels are neutral, and the company’s rating is very favorable with a C+ grade.

Atlassian Corporation (TEAM) has a favorable income statement with 149.64% revenue growth over five years but carries negative net margins at -4.92%. Its financial ratios are also slightly unfavorable, impacted by weak profitability and leverage metrics, despite a strong discounted cash flow score. Debt metrics are favorable, and the company holds a very favorable rating with a C grade.

For risk-tolerant investors focused on growth, DDOG’s improving profitability and strong income growth might appear more attractive, while those prioritizing cash flow stability and lower debt might find TEAM’s profile more suitable. Both stocks show slightly unfavorable ratio evaluations and value destruction signals, suggesting cautious analysis is warranted.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Datadog, Inc. and Atlassian Corporation to enhance your investment decisions: