Home > Comparison > Technology > ALAB vs SWKS

The strategic rivalry between Astera Labs and Skyworks Solutions shapes the semiconductor industry’s evolution. Astera Labs operates as an agile, software-driven cloud connectivity innovator, while Skyworks commands scale as a diversified semiconductor manufacturer with broad application reach. This duel contrasts cutting-edge growth potential against entrenched market presence. I will analyze which trajectory—disruptive specialization or established scale—delivers superior risk-adjusted returns for a balanced, forward-looking portfolio.

Table of contents

Companies Overview

Astera Labs and Skyworks Solutions stand as pivotal players in the semiconductor sector, each shaping critical technology infrastructure.

Astera Labs, Inc. Common Stock: Innovator in AI Connectivity

Astera Labs focuses on semiconductor-based connectivity solutions for cloud and AI infrastructure. Its core revenue driver is the Intelligent Connectivity Platform, which integrates data, network, and memory connectivity products. In 2026, the company emphasizes a software-defined architecture to enable scalable, high-performance cloud environments, reinforcing its niche in AI infrastructure.

Skyworks Solutions, Inc.: Broad-Spectrum Semiconductor Supplier

Skyworks Solutions operates as a diversified semiconductor manufacturer with a vast product portfolio, including amplifiers, filters, and front-end modules. It generates revenue by serving multiple markets such as automotive, aerospace, and smartphones. In 2026, Skyworks prioritizes expanding its global reach and proprietary IP to maintain leadership across varied technology sectors.

Strategic Collision: Similarities & Divergences

Astera Labs and Skyworks share the semiconductor industry but diverge sharply in focus. Astera Labs targets AI-centric, scalable connectivity, while Skyworks embraces a broad, multi-market product strategy. Their primary battleground lies in servicing evolving cloud infrastructure versus diversified electronics markets. This contrast defines distinct investment profiles: Astera Labs as a high-growth innovator, Skyworks as a stable, diversified player.

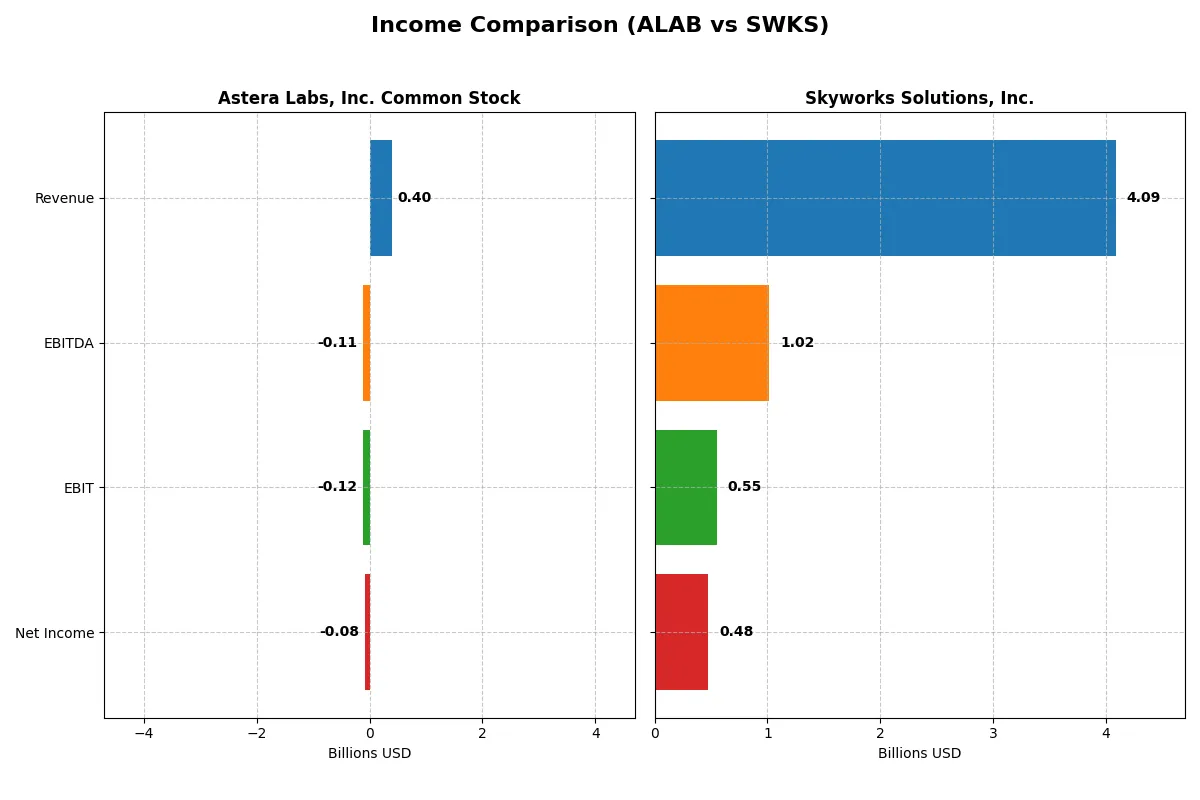

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Astera Labs, Inc. (ALAB) | Skyworks Solutions, Inc. (SWKS) |

|---|---|---|

| Revenue | 396M | 4.18B |

| Cost of Revenue | 94M | 2.46B |

| Operating Expenses | 419M | 933M |

| Gross Profit | 303M | 1.72B |

| EBITDA | -113M | 1.12B |

| EBIT | -116M | 667M |

| Interest Expense | 0 | 31M |

| Net Income | -83M | 596M |

| EPS | -0.64 | 3.72 |

| Fiscal Year | 2024 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes the true efficiency and profitability trends shaping each company’s financial engine.

Astera Labs, Inc. Common Stock (ALAB) Analysis

ALAB’s revenue surged from $80M in 2022 to $396M in 2024, reflecting aggressive growth. Despite a robust gross margin of 76%, the company remains unprofitable with a net loss of $83M in 2024. Operating expenses scale with revenue, dragging EBIT margin to -29%, signaling ongoing efficiency challenges amid expansion.

Skyworks Solutions, Inc. (SWKS) Analysis

SWKS shows a revenue decline from $5.5B in 2022 to $4.1B in 2024, marking contraction. Its gross margin stands at a healthy 41%, with EBIT margin positive at 13.55%. Net income fell sharply to $477M in 2025, down from $1.3B in 2022, indicating margin compression and reduced momentum in profitability.

Growth Surge vs. Margin Sustainability

ALAB’s rapid revenue growth contrasts with persistent net losses and negative EBIT margins, reflecting its investment-heavy phase. SWKS delivers consistent profitability but faces declining top-line and earnings momentum. For investors, ALAB’s profile suits growth seekers tolerant of losses, while SWKS appeals to those prioritizing stable margins despite slower growth.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Astera Labs, Inc. (ALAB) | Skyworks Solutions, Inc. (SWKS) |

|---|---|---|

| ROE | -8.6% | 8.3% |

| ROIC | -12.0% | 6.4% |

| P/E | -208.4 | 24.9 |

| P/B | 18.0 | 2.1 |

| Current Ratio | 11.7 | 2.3 |

| Quick Ratio | 11.2 | 1.8 |

| D/E | 0.0013 | 0.21 |

| Debt-to-Assets | 0.12% | 15.2% |

| Interest Coverage | 0 | 18.5 |

| Asset Turnover | 0.38 | 0.52 |

| Fixed Asset Turnover | 11.1 | 2.95 |

| Payout ratio | 0 | 90.7% |

| Dividend yield | 0 | 3.63% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and operational excellence that shape investor confidence and valuation.

Astera Labs, Inc. Common Stock

Astera Labs shows negative profitability with ROE at -8.65% and net margin at -21.05%, indicating operational struggles. Its valuation metrics are stretched, with an unfavorable P/B of 18.02 despite a favorable negative P/E due to losses. The company pays no dividends, focusing heavily on R&D, reinvesting over 50% of revenue to fuel growth.

Skyworks Solutions, Inc.

Skyworks posts a positive net margin of 11.67%, reflecting solid profitability, though ROE at 8.29% is modest. Valuation looks reasonable with a P/E near 25 and P/B around 2.07, suggesting the stock is fairly priced. Skyworks offers a 3.63% dividend yield, balancing shareholder returns with steady cash flow and moderate reinvestment in R&D.

Growth Struggles vs. Stable Profitability

Astera Labs faces significant profitability and valuation challenges, reflecting high operational risk and heavy reinvestment. Skyworks delivers more balanced metrics, combining stable profits and shareholder dividends with reasonable valuation. Risk-tolerant investors may consider Astera’s growth profile, while those favoring operational safety may lean toward Skyworks.

Which one offers the Superior Shareholder Reward?

Astera Labs (ALAB) pays no dividends and shows negative margins, reflecting early-stage reinvestment in growth rather than shareholder distributions. Skyworks Solutions (SWKS) delivers a 2.8–3.6% dividend yield with a sustainable payout ratio near 74%, supported by strong free cash flow of 7B+. SWKS also pursues steady buybacks, enhancing returns. ALAB’s zero dividend and minimal buyback activity limit near-term shareholder rewards despite promising top-line growth. I conclude Skyworks offers the superior total return profile in 2026, balancing income and capital appreciation with proven cash generation and disciplined capital allocation.

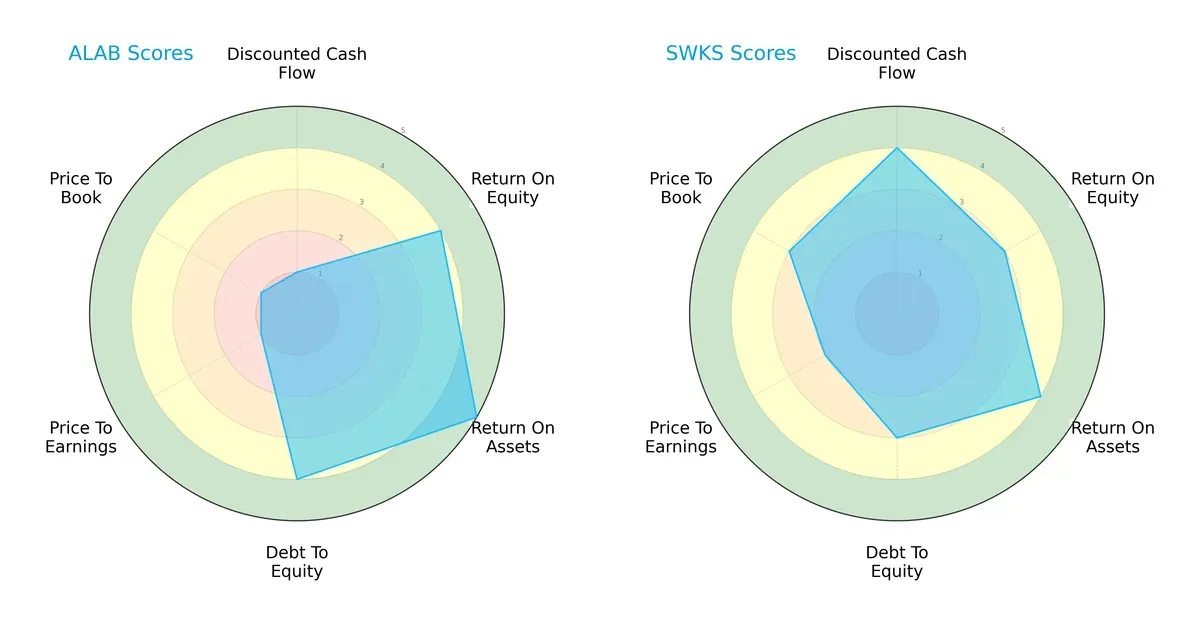

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Astera Labs and Skyworks Solutions, highlighting their core financial strengths and valuation differences:

Astera Labs excels in return on assets (5) and debt-to-equity (4), reflecting efficient asset use and prudent leverage. Skyworks leads in discounted cash flow (4) and valuation scores (P/E 2, P/B 3), indicating better market pricing and cash flow prospects. Astera shows a more asset-intensive profile, while Skyworks presents a balanced valuation and growth mix.

Bankruptcy Risk: Solvency Showdown

Astera Labs’ Altman Z-Score of 121 dramatically outpaces Skyworks’ 4.34, signaling an exceptionally strong solvency position for Astera well beyond the safe zone, compared to Skyworks’ good but more typical safety margin:

Financial Health: Quality of Operations

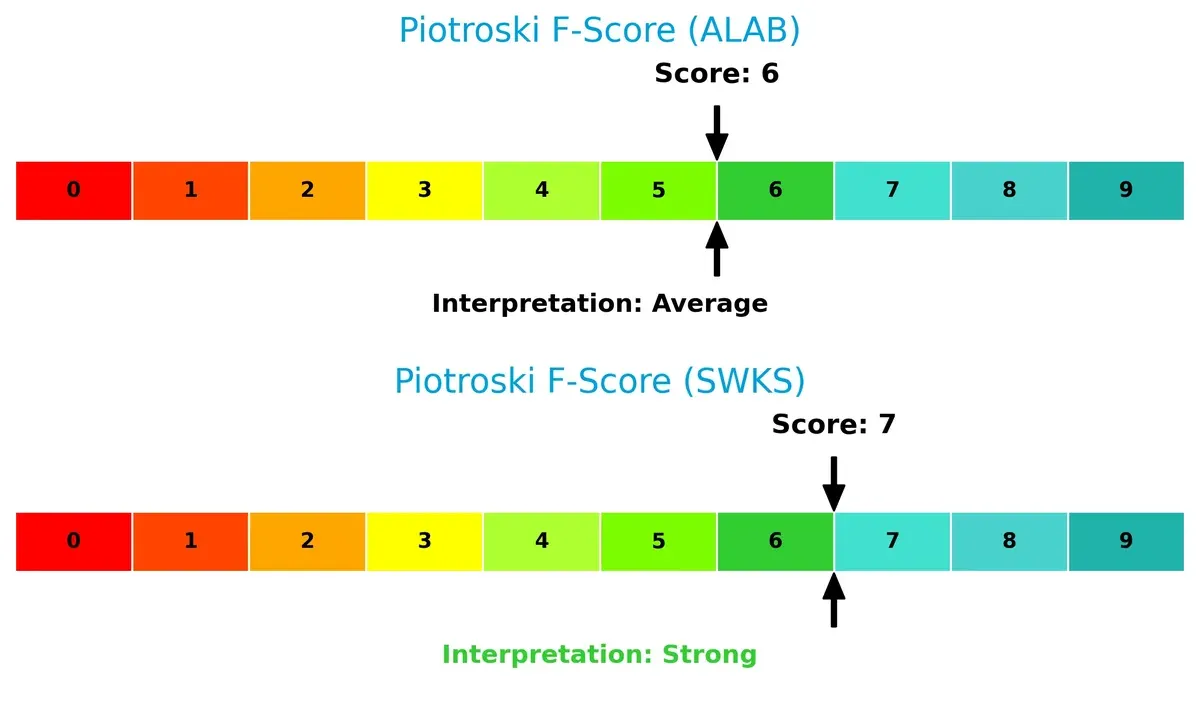

Skyworks scores a 7 on the Piotroski scale, indicating strong financial health, while Astera’s 6 suggests average operational quality with some room for improvement. Skyworks displays fewer red flags in internal metrics:

How are the two companies positioned?

This section dissects the operational DNA of ALAB and SWKS by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify the more resilient, sustainable competitive advantage.

Revenue Segmentation: The Strategic Mix

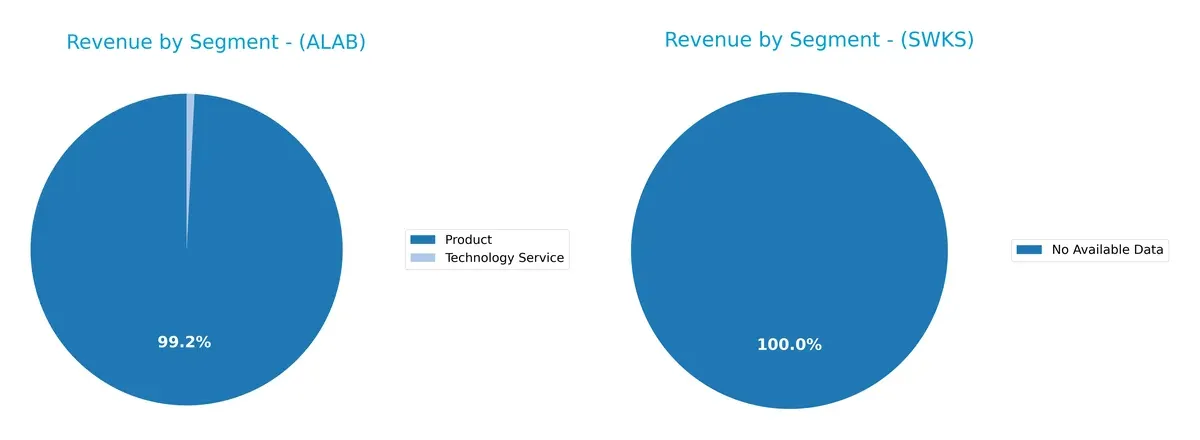

The following visual comparison dissects how both firms diversify their income streams and where their primary sector bets lie:

Astera Labs anchors its revenue in Product sales with $393M, while Technology Service contributes a mere $3.2M. Skyworks Solutions lacks available segmentation data. Astera’s heavy reliance on Product revenue signals concentration risk but also highlights its strong foothold in core hardware, potentially leveraging infrastructure dominance. The minimal service income suggests limited ecosystem lock-in compared to more diversified peers.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Astera Labs and Skyworks Solutions:

Astera Labs Strengths

- Very high current and quick ratios indicate excellent short-term liquidity

- Zero debt and low debt-to-assets ratio reduce financial risk

- Strong fixed asset turnover shows efficient use of capital assets

- Geographic revenue exposure includes China, Taiwan, and Non-US markets

Skyworks Solutions Strengths

- Positive net margin and favorable dividend yield reflect profitability and shareholder returns

- Balanced debt levels with good interest coverage enhance financial stability

- Diversified global presence with significant US, China, and Asia revenues

- Consistent asset turnover and moderate capital efficiency

Astera Labs Weaknesses

- Negative net margin, ROE, and ROIC signal unprofitable operations and poor capital returns

- High price-to-book ratio suggests overvaluation risk

- Zero interest coverage and unfavorable asset turnover imply operational strain

- Reliance on few geographic markets limits diversification

Skyworks Solutions Weaknesses

- ROE below benchmark and neutral ROIC indicate moderate profitability challenges

- Neutral valuation multiples may limit upside potential

- Geographic concentration in US and Asia could increase regional risk

Astera Labs shows strength in liquidity and low leverage but faces significant profitability and operational challenges. Skyworks Solutions maintains profitability and financial stability with broader geographic diversification. These contrasts highlight differing strategic focuses and risk profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competitive erosion. Only a durable advantage can sustain superior returns over decades:

Astera Labs, Inc. Common Stock: Emerging Network Effects in AI Connectivity

Astera Labs leverages network effects through its Intelligent Connectivity Platform, enabling cloud-scale AI infrastructure. Its 76% gross margin signals pricing power, though negative EBIT warns of early-stage investment. New AI market expansions could deepen this moat in 2026.

Skyworks Solutions, Inc.: Established Cost Advantage in Semiconductor Components

Skyworks relies on established cost advantages and scale in analog semiconductors, reflected by steady 13.5% EBIT margin. Unlike Astera, its ROIC trends downwards, signaling margin pressure. Market disruptions and slower growth challenge its moat in 2026.

Verdict: Network Effects vs. Cost Advantage in Semiconductor Moats

Astera Labs shows a growing ROIC trend despite current losses, signaling potential for a wider moat via innovative AI solutions. Skyworks’ entrenched cost moat weakens amid declining profitability. I see Astera better positioned to defend and expand market share long-term.

Which stock offers better returns?

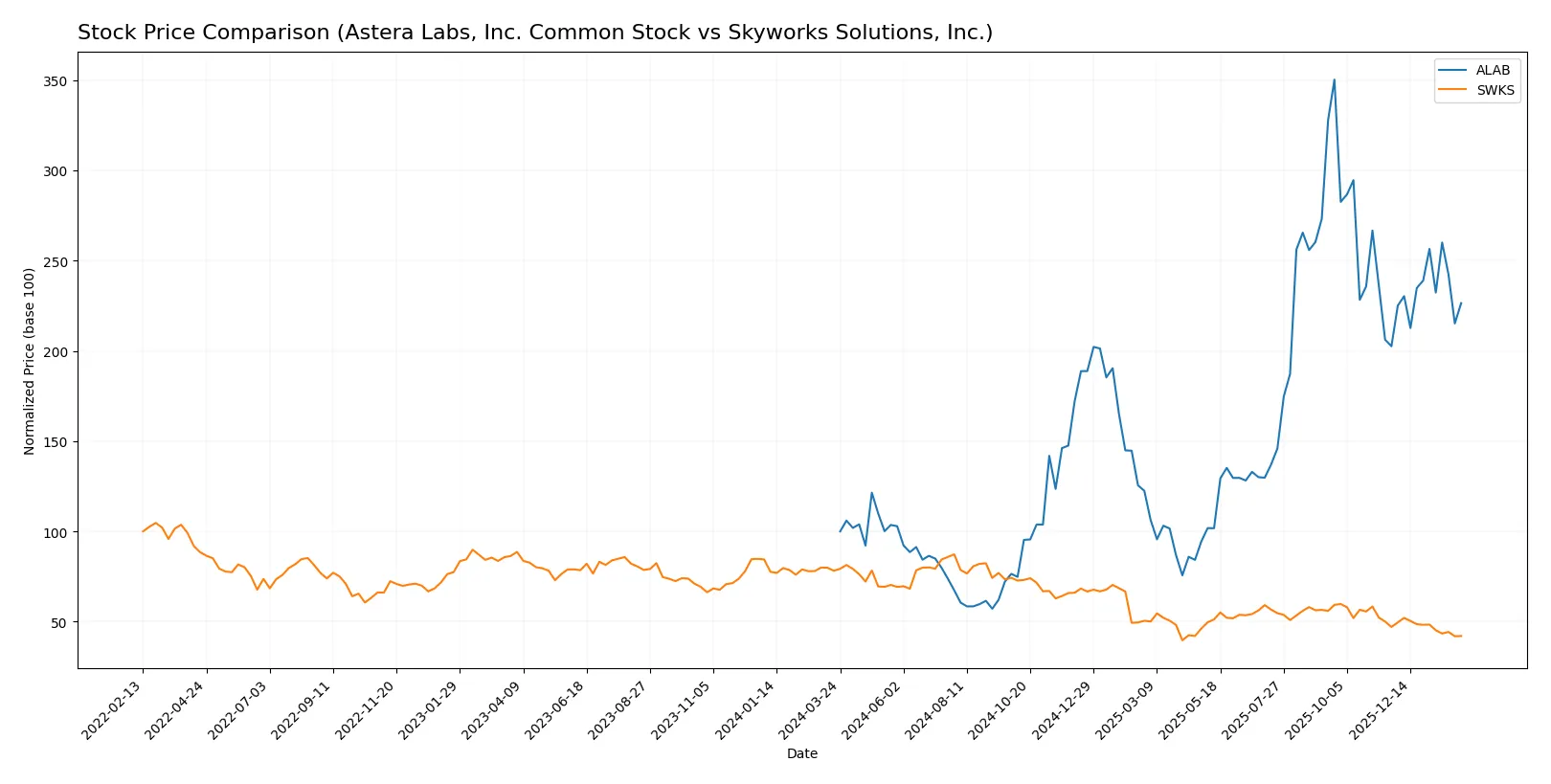

Astera Labs and Skyworks Solutions exhibit starkly different price dynamics over the past year, with Astera Labs showing strong gains while Skyworks struggles under sustained selling pressure.

Trend Comparison

Astera Labs’ stock rose 126.46% over the past year, signaling a bullish trend despite decelerating momentum. The price ranged between 40.0 and a peak of 245.2, reflecting high volatility with a standard deviation of 50.42.

Skyworks Solutions’ stock declined 46.26% in the same period, confirming a bearish trend with decelerating losses. Its price fluctuated between 52.78 and 116.18, showing moderate volatility with a 16.54 standard deviation.

Comparing both stocks, Astera Labs delivered the highest market performance with strong gains, while Skyworks experienced a significant downturn and weaker buyer interest.

Target Prices

Analysts present mixed but insightful target price ranges for these semiconductor firms, reflecting varied growth expectations.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Astera Labs, Inc. Common Stock | 165 | 225 | 202.14 |

| Skyworks Solutions, Inc. | 60 | 140 | 78.8 |

Astera Labs shows strong upside potential with a consensus target 27% above its current 158.52 price. Skyworks’ consensus target also suggests upside but is more conservative compared to its current 55.93 price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Astera Labs, Inc. Common Stock Grades

The following table shows recent institutional grades for Astera Labs, Inc. Common Stock:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Northland Capital Markets | Maintain | Outperform | 2025-12-09 |

| Northland Capital Markets | Upgrade | Outperform | 2025-11-17 |

| Needham | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Barclays | Downgrade | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

Skyworks Solutions, Inc. Grades

The following table summarizes recent institutional grades for Skyworks Solutions, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-02-02 |

| Mizuho | Maintain | Neutral | 2026-01-26 |

| B. Riley Securities | Maintain | Neutral | 2026-01-26 |

| Susquehanna | Maintain | Neutral | 2026-01-22 |

| UBS | Maintain | Neutral | 2026-01-20 |

| Mizuho | Upgrade | Neutral | 2025-11-11 |

| UBS | Maintain | Neutral | 2025-11-05 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| Citigroup | Upgrade | Neutral | 2025-10-29 |

| UBS | Maintain | Neutral | 2025-10-29 |

Which company has the best grades?

Astera Labs consistently receives higher and more positive grades, including multiple Buys and Outperforms. Skyworks Solutions holds mostly Neutral and Equal Weight ratings. Investors may view Astera Labs’ stronger grades as a sign of greater institutional confidence.

Risks specific to each company

The following categories highlight critical pressure points and systemic threats facing Astera Labs, Inc. Common Stock (ALAB) and Skyworks Solutions, Inc. (SWKS) in the 2026 market environment:

1. Market & Competition

Astera Labs, Inc. Common Stock

- Newer entrant facing intense competition from established semiconductor firms.

Skyworks Solutions, Inc.

- Established player with diversified product portfolio and broad market presence.

2. Capital Structure & Debt

Astera Labs, Inc. Common Stock

- Zero debt load, low financial risk, but limited capital flexibility.

Skyworks Solutions, Inc.

- Moderate debt with strong interest coverage, indicating prudent leverage management.

3. Stock Volatility

Astera Labs, Inc. Common Stock

- High beta (1.51) suggests above-average price volatility and sensitivity to market swings.

Skyworks Solutions, Inc.

- Moderate beta (1.32) reflects relatively lower volatility but still market sensitive.

4. Regulatory & Legal

Astera Labs, Inc. Common Stock

- Exposure to semiconductor export restrictions and intellectual property risks.

Skyworks Solutions, Inc.

- Faces complex regulations globally due to diversified geographic footprint.

5. Supply Chain & Operations

Astera Labs, Inc. Common Stock

- Smaller scale could mean greater disruption risk and supplier dependency.

Skyworks Solutions, Inc.

- Large global operations provide supply chain resilience but add complexity.

6. ESG & Climate Transition

Astera Labs, Inc. Common Stock

- Limited public ESG initiatives, potential risk as investor focus intensifies.

Skyworks Solutions, Inc.

- More established ESG programs aligned with industry standards.

7. Geopolitical Exposure

Astera Labs, Inc. Common Stock

- Primarily US-based, but semiconductor sector is geopolitically sensitive.

Skyworks Solutions, Inc.

- Significant international revenue exposure increases geopolitical risk.

Which company shows a better risk-adjusted profile?

Astera Labs faces intense competitive pressure and high stock volatility, with limited operating scale as a key risk. Skyworks mitigates risks through scale, diversified markets, and stronger financial metrics. Skyworks’ moderate debt and stable cash flow provide a safer capital structure. Its broader ESG and regulatory experience reduce systemic vulnerabilities. I consider Skyworks to have a superior risk-adjusted profile, especially given Astera Labs’ negative profitability and high beta in a volatile sector. The recent high beta of 1.51 for Astera Labs underlines its sensitivity to market turbulence, justifying caution despite its debt-free status.

Final Verdict: Which stock to choose?

Astera Labs stands out with its explosive revenue growth and relentless R&D investment, positioning it as a potential innovation leader. Its superpower is a rapidly expanding market footprint fueled by cutting-edge technology. The point of vigilance remains its current negative profitability and value destruction, signaling risk for conservative investors. Fits well in an Aggressive Growth portfolio.

Skyworks Solutions boasts a durable strategic moat anchored in steady cash flows and solid balance sheet management. Its strength lies in operational efficiency and a consistent dividend profile, offering better financial stability than Astera Labs. This makes it a suitable candidate for GARP – Growth at a Reasonable Price portfolios seeking measured growth and income.

If you prioritize high-growth potential with an appetite for volatility and future innovation, Astera Labs could be the compelling choice due to its accelerating top-line momentum and R&D focus. However, if you seek income reliability and financial resilience amid sector headwinds, Skyworks offers better stability and a proven operational moat despite recent margin pressures.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Astera Labs, Inc. Common Stock and Skyworks Solutions, Inc. to enhance your investment decisions: