Astera Labs, Inc. (ALAB) and SkyWater Technology, Inc. (SKYT) are two dynamic players in the semiconductor industry, each driving innovation in connectivity solutions and manufacturing services, respectively. Both companies focus on cutting-edge technology to serve cloud, AI, aerospace, and automotive markets, highlighting their overlapping yet distinct growth paths. In this article, I will analyze their strengths and risks to help you decide which stock could be the smarter addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Astera Labs and SkyWater Technology by providing an overview of these two companies and their main differences.

Astera Labs Overview

Astera Labs, Inc. designs and sells semiconductor-based connectivity solutions focused on cloud and AI infrastructure. Its Intelligent Connectivity Platform offers data, network, and memory connectivity products built on a software-defined architecture. Founded in 2017 and based in Santa Clara, California, Astera Labs aims to enable high-performance infrastructure deployment at scale within the technology sector.

SkyWater Technology Overview

SkyWater Technology, Inc. provides semiconductor development and manufacturing services, including process development and engineering support to co-create technologies with customers. Serving various industries such as aerospace, automotive, and bio-health, the company was also founded in 2017 and is headquartered in Bloomington, Minnesota. SkyWater specializes in silicon-based analog, mixed-signal, power discrete, and rad-hard integrated circuits.

Key similarities and differences

Both companies operate in the semiconductor industry and were founded in 2017. Astera Labs focuses on connectivity solutions for cloud and AI markets, while SkyWater emphasizes semiconductor manufacturing and engineering services across diverse sectors. Astera Labs has a larger market cap (~29.5B USD) compared to SkyWater (~1.5B USD) and employs fewer staff (440 vs. 702), highlighting differences in scale and business model focus.

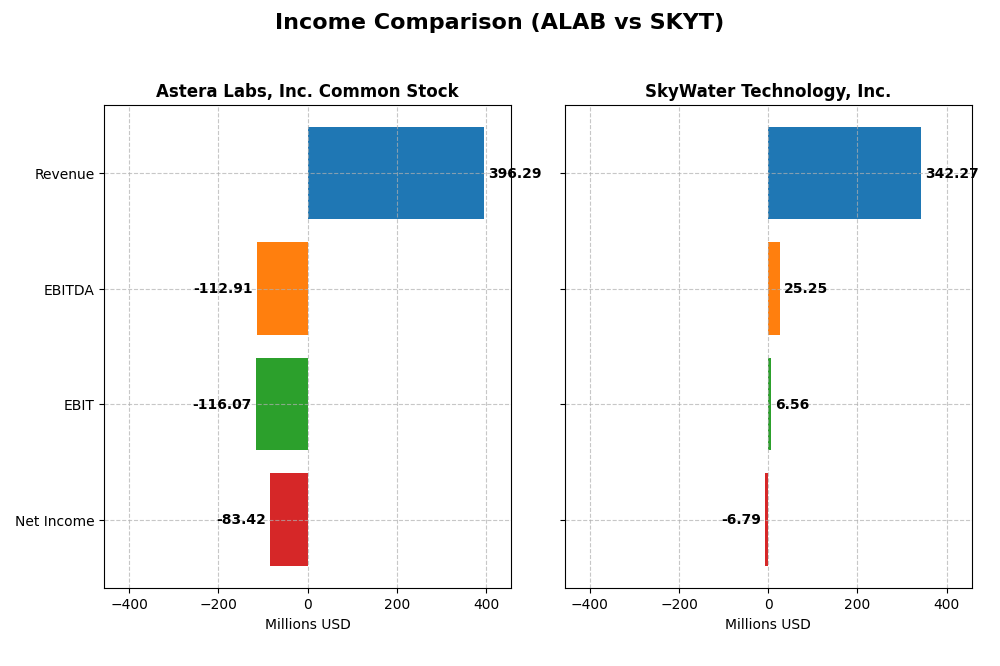

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Astera Labs, Inc. and SkyWater Technology, Inc. for the fiscal year 2024.

| Metric | Astera Labs, Inc. Common Stock (ALAB) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Cap | 29.5B | 1.54B |

| Revenue | 396.3M | 342.3M |

| EBITDA | -113.0M | 25.3M |

| EBIT | -116.1M | 6.56M |

| Net Income | -83.4M | -6.79M |

| EPS | -0.64 | -0.14 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Astera Labs, Inc. Common Stock

Astera Labs experienced strong revenue growth from $79.9M in 2022 to $396.3M in 2024, a 396% increase, but net income remained negative, widening from -$58.3M in 2022 to -$83.4M in 2024. Gross margin was favorable at 76.4%, yet EBIT margin stayed deeply negative at -29.3%. The latest year showed slower EBIT and EPS growth despite robust revenue gains.

SkyWater Technology, Inc.

SkyWater’s revenue rose steadily from $140.4M in 2020 to $342.3M in 2024, a 144% increase, accompanied by improving net income from -$20.6M in 2020 to -$6.8M in 2024. Gross margin remained modest but favorable at 20.3%, with EBIT margin slightly positive at 1.9%. The firm showed consistent EBIT and net margin improvements in the latest year, reflecting gradual operational progress.

Which one has the stronger fundamentals?

SkyWater Technology demonstrates stronger fundamentals with mostly favorable growth in income, margins, and profitability metrics, including a positive EBIT margin and net income improvements. Astera Labs shows impressive revenue expansion and high gross margins but sustained operating losses and negative net margins weigh on its financial stability. Overall, SkyWater’s income statement reflects more consistent operational improvement.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Astera Labs, Inc. (ALAB) and SkyWater Technology, Inc. (SKYT) based on their most recent fiscal year data.

| Ratios | Astera Labs, Inc. (ALAB) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | -8.65% | -11.79% |

| ROIC | -11.97% | 3.40% |

| P/E | -208.4 | -100.3 |

| P/B | 18.02 | 11.82 |

| Current Ratio | 11.71 | 0.86 |

| Quick Ratio | 11.21 | 0.76 |

| D/E (Debt to Equity) | 0.0013 | 1.33 |

| Debt-to-Assets | 0.12% | 24.46% |

| Interest Coverage | 0 | 0.74 |

| Asset Turnover | 0.38 | 1.09 |

| Fixed Asset Turnover | 11.12 | 2.07 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Astera Labs, Inc. Common Stock

Astera Labs shows mixed financial ratios, with strong quick ratio (11.21) and no debt, but weak profitability indicators: negative net margin (-21.05%), ROE (-8.65%), and ROIC (-11.97%). The high current ratio (11.71) may suggest inefficient asset use. The company does not pay dividends, likely focusing on reinvestment and R&D, reflected by a high R&D-to-revenue ratio.

SkyWater Technology, Inc.

SkyWater Technology has mostly unfavorable ratios, including negative net margin (-1.98%), ROE (-11.79%), and a low current ratio (0.86). Debt levels are relatively high (D/E 1.33), impacting interest coverage (0.74). The company also does not pay dividends, which may reflect reinvestment priorities and ongoing financial challenges, despite a favorable asset turnover (1.09).

Which one has the best ratios?

Both companies face unfavorable profitability and liquidity challenges, with Astera Labs showing slightly better liquidity and lower leverage but weaker returns. SkyWater has higher debt and weaker coverage but better asset utilization. Overall, both have predominantly unfavorable ratios, requiring cautious evaluation of their financial health.

Strategic Positioning

This section compares the strategic positioning of Astera Labs and SkyWater Technology, focusing on market position, key segments, and exposure to technological disruption:

Astera Labs

- Market leader in semiconductor connectivity with $29B market cap, facing competitive pressure in cloud and AI sectors.

- Focuses on semiconductor connectivity products for cloud and AI infrastructure; $393M product revenue in 2024.

- Operates on a software-defined architecture, adapting to evolving cloud and AI technologies, mitigating disruption risks.

SkyWater Technology

- Smaller $1.5B market cap, competes in semiconductor manufacturing services with diverse client industries.

- Provides semiconductor development and manufacturing services across multiple sectors including aerospace and automotive.

- Engages in co-creation of technologies with customers, exposed to risks related to semiconductor manufacturing innovation.

Astera Labs vs SkyWater Technology Positioning

Astera Labs pursues a concentrated strategy focused on connectivity solutions for cloud and AI, leveraging a software-defined platform. SkyWater adopts a more diversified approach serving multiple industries with manufacturing and development services, broadening its market exposure.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOATs, shedding value but improving profitability. Astera Labs benefits from a focused product portfolio in a high-growth niche, while SkyWater’s diversified services enhance resilience, yet neither currently demonstrates a strong sustainable competitive advantage.

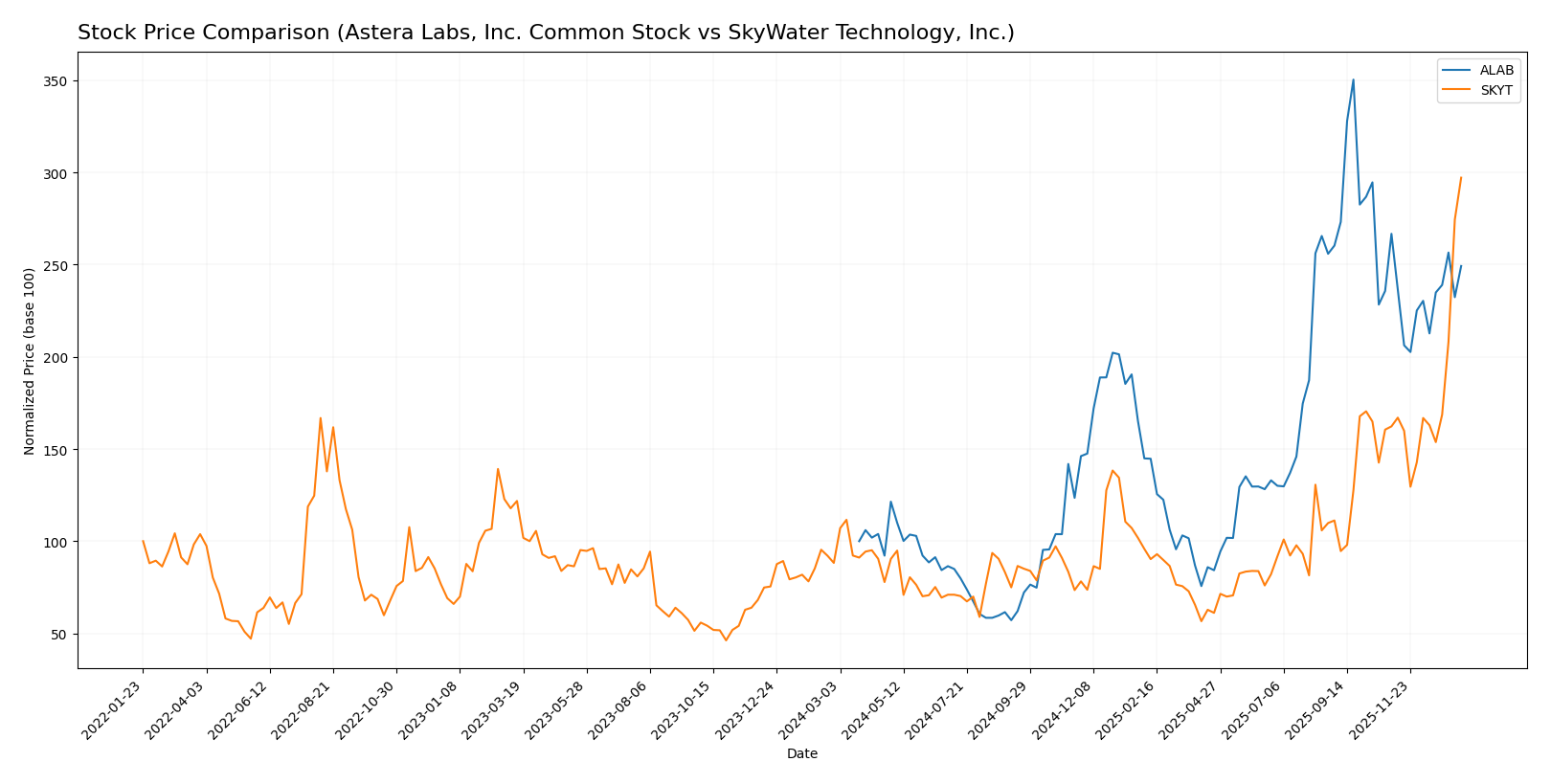

Stock Comparison

The past year saw significant price appreciation for both Astera Labs, Inc. and SkyWater Technology, Inc., with marked bullish trends and distinct trading volume dynamics shaping their market performance.

Trend Analysis

Astera Labs, Inc. (ALAB) experienced a 149.21% price increase over the past 12 months, indicating a strong bullish trend but with deceleration. The stock showed high volatility with a standard deviation of 50.14, peaking at 245.2 and bottoming at 40.0.

SkyWater Technology, Inc. (SKYT) posted a 236.8% gain over the same period, reflecting a bullish trend with acceleration. Notably less volatile, with a standard deviation of 4.41, its price ranged from a low of 6.1 to a high of 32.03.

Comparing both, SKYT delivered the highest market performance with a 236.8% increase, outperforming ALAB’s 149.21% gain over the last year.

Target Prices

Analysts present a clear consensus on target prices for Astera Labs, Inc. and SkyWater Technology, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Astera Labs, Inc. Common Stock | 225 | 165 | 202.14 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Astera Labs’ consensus target price of 202.14 USD suggests upside potential versus its current price of 174.45 USD. SkyWater’s consensus target of 25 USD is below its current price of 32.03 USD, indicating some analyst caution.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Astera Labs, Inc. Common Stock (ALAB) and SkyWater Technology, Inc. (SKYT):

Rating Comparison

ALAB Rating

- Rating: B, evaluated as Very Favorable overall.

- Discounted Cash Flow Score: 1, considered Very Unfavorable.

- ROE Score: 4, rated Favorable for efficient profit generation.

- ROA Score: 5, Very Favorable for effective asset utilization.

- Debt To Equity Score: 4, Favorable indicating lower financial risk.

- Overall Score: 3, rated Moderate overall.

SKYT Rating

- Rating: B+, evaluated as Very Favorable overall.

- Discounted Cash Flow Score: 1, considered Very Unfavorable.

- ROE Score: 5, rated Very Favorable indicating stronger profit efficiency.

- ROA Score: 5, also Very Favorable, showing excellent asset use.

- Debt To Equity Score: 1, Very Unfavorable suggesting higher financial risk.

- Overall Score: 3, rated Moderate overall.

Which one is the best rated?

SkyWater Technology (SKYT) holds a higher overall rating of B+ compared to Astera Labs (ALAB) with B. SKYT scores better in ROE and matches ALAB in ROA but has a weaker debt to equity score. Both share low discounted cash flow scores and moderate overall scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

ALAB Scores

- Altman Z-Score: 136.88, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength and value potential.

SKYT Scores

- Altman Z-Score: 2.20, placing the company in the grey zone with moderate risk.

- Piotroski Score: 5, also showing average financial health and investment quality.

Which company has the best scores?

Based strictly on the provided data, ALAB displays a significantly higher Altman Z-Score, indicating stronger financial stability and lower bankruptcy risk. Both companies have similar average Piotroski scores, reflecting comparable financial strength.

Grades Comparison

Here is a comparison of the recent grades assigned to Astera Labs, Inc. Common Stock and SkyWater Technology, Inc.:

Astera Labs, Inc. Common Stock Grades

This table summarizes the latest grades from major grading companies for Astera Labs, Inc. Common Stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Northland Capital Markets | Maintain | Outperform | 2025-12-09 |

| Northland Capital Markets | Upgrade | Outperform | 2025-11-17 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Barclays | Downgrade | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

Overall, Astera Labs shows a generally positive rating trend, with multiple buy and outperform ratings maintained or upgraded recently, despite a single downgrade.

SkyWater Technology, Inc. Grades

This table displays the latest grades reported by recognized grading firms for SkyWater Technology, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology maintains consistently positive grades, predominantly buy and overweight, with no recent downgrades or negative actions.

Which company has the best grades?

Both companies have a consensus “Buy” rating, but Astera Labs benefits from a broader variety of grading companies and occasional upgrades, while SkyWater Technology shows steady buy and overweight grades without changes. Investors might interpret these patterns as either stability or potential for momentum depending on market conditions.

Strengths and Weaknesses

Here is a comparative overview of key strengths and weaknesses for Astera Labs, Inc. (ALAB) and SkyWater Technology, Inc. (SKYT) based on recent financial and operational data.

| Criterion | Astera Labs, Inc. (ALAB) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Moderate product focus: $393M products, $3.2M tech services | More diversified tech services: $93M fixed price, $4.7M other, $27M wafer services |

| Profitability | Negative net margin (-21%), negative ROIC (-12%), shedding value | Negative net margin (-2%), positive but low ROIC (3.4%), also shedding value |

| Innovation | Growing ROIC trend (+65.5%) suggests improving efficiency and innovation | Strong growing ROIC trend (+171%) indicates accelerating innovation and operational improvements |

| Global presence | Limited data, likely focused on technology products | Broader service offerings, likely serving diverse global tech clients |

| Market Share | Smaller scale with $396M revenue mainly from products | Larger service revenue base ($128M in 2024) with diversified offerings |

Key takeaways: Both companies are currently value destroyers with negative or low profitability, but they show promising upward ROIC trends signaling improving operational efficiency. SkyWater’s diversified service revenue and higher ROIC growth may offer a more resilient growth trajectory, while Astera Labs’ strong product focus could benefit from continued innovation. Caution is advised given their unfavorable profitability metrics.

Risk Analysis

Below is a comparative table of key risk factors for Astera Labs, Inc. (ALAB) and SkyWater Technology, Inc. (SKYT) based on the latest 2024 data:

| Metric | Astera Labs, Inc. (ALAB) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Beta 1.51 – moderate volatility | Beta 3.49 – high volatility |

| Debt level | Very low debt (Debt/Equity 0.0) | High debt (Debt/Equity 1.33) |

| Regulatory Risk | Moderate – tech & semiconductor regulation | Moderate – defense & aerospace sector regulation |

| Operational Risk | Moderate – relies on AI/cloud infrastructure | Moderate to High – diverse semiconductor manufacturing |

| Environmental Risk | Low – standard tech industry impact | Moderate – manufacturing processes impact |

| Geopolitical Risk | Low – US-based with global customers | Moderate – exposure to defense sector and global supply chains |

In synthesis, SkyWater faces higher market and debt risks due to its elevated beta and leverage, combined with exposure to defense-related regulatory and geopolitical uncertainties. Astera Labs shows moderate market risk but benefits from a clean balance sheet. The most impactful risks for both stem from operational execution and sector-specific regulatory changes, with SkyWater’s financial leverage posing a significant risk factor.

Which Stock to Choose?

Astera Labs, Inc. Common Stock (ALAB) shows strong revenue growth of 242% in 2024 but suffers from negative profitability indicators, including an unfavorable net margin of -21.05% and a return on equity of -8.65%. The company has low debt levels and a solid quick ratio, but its overall financial ratios are mostly unfavorable. Its rating is very favorable with a “B” grade, reflecting moderate overall scores.

SkyWater Technology, Inc. (SKYT) demonstrates moderate revenue growth of 19.4% in 2024 and a much smaller net margin loss of -1.98%. Financial ratios indicate some weaknesses, including a high debt-to-equity ratio and low liquidity ratios, but it benefits from favorable asset turnover. SKYT holds a very favorable rating “B+” with moderate overall financial scores.

For investors, ALAB’s high revenue growth combined with moderate ratings and improving profitability might appeal to those with a growth-oriented and risk-tolerant profile. In contrast, SKYT’s steadier income evolution and favorable asset efficiency could align better with investors seeking moderate growth with cautious exposure to financial risk. Both companies show value destruction but with increasing profitability trends.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Astera Labs, Inc. Common Stock and SkyWater Technology, Inc. to enhance your investment decisions: