Home > Comparison > Technology > ALAB vs SLAB

The strategic rivalry between Astera Labs and Silicon Laboratories defines the current trajectory of the semiconductor industry. Astera Labs operates as an innovative connectivity solutions provider focused on cloud and AI infrastructure. In contrast, Silicon Labs delivers broad analog-intensive mixed-signal products catering to IoT applications. This head-to-head highlights a battle between cutting-edge platform innovation and diversified product breadth. This analysis will assess which company offers superior risk-adjusted returns for a balanced technology portfolio.

Table of contents

Companies Overview

Astera Labs and Silicon Laboratories drive innovation in the semiconductor sector, shaping cloud and IoT infrastructure respectively.

Astera Labs, Inc. Common Stock: Intelligent Connectivity Pioneer

Astera Labs leads in semiconductor-based connectivity solutions for cloud and AI infrastructure. Its revenue stems from its Intelligent Connectivity Platform, offering data, network, and memory connectivity products. In 2026, the company focuses on scaling high-performance cloud infrastructure through a software-defined architecture that enhances deployment efficiency.

Silicon Laboratories Inc.: Analog-Intensive Mixed-Signal Specialist

Silicon Laboratories operates as a fabless semiconductor firm, generating revenue from analog-intensive mixed-signal solutions for IoT applications. Its product suite spans wireless microcontrollers and sensors used in smart home, industrial automation, and medical devices. The firm prioritizes expanding its global sales network and diversifying IoT applications in 2026.

Strategic Collision: Similarities & Divergences

Astera Labs and Silicon Labs both innovate in semiconductors but differ in approach—Astera embraces a platform-driven cloud focus, while Silicon Labs targets diverse, analog-heavy IoT markets. Their competition centers on connectivity and integration technologies. Investors face distinct profiles: Astera bets on cloud AI growth; Silicon Labs rides broad IoT adoption.

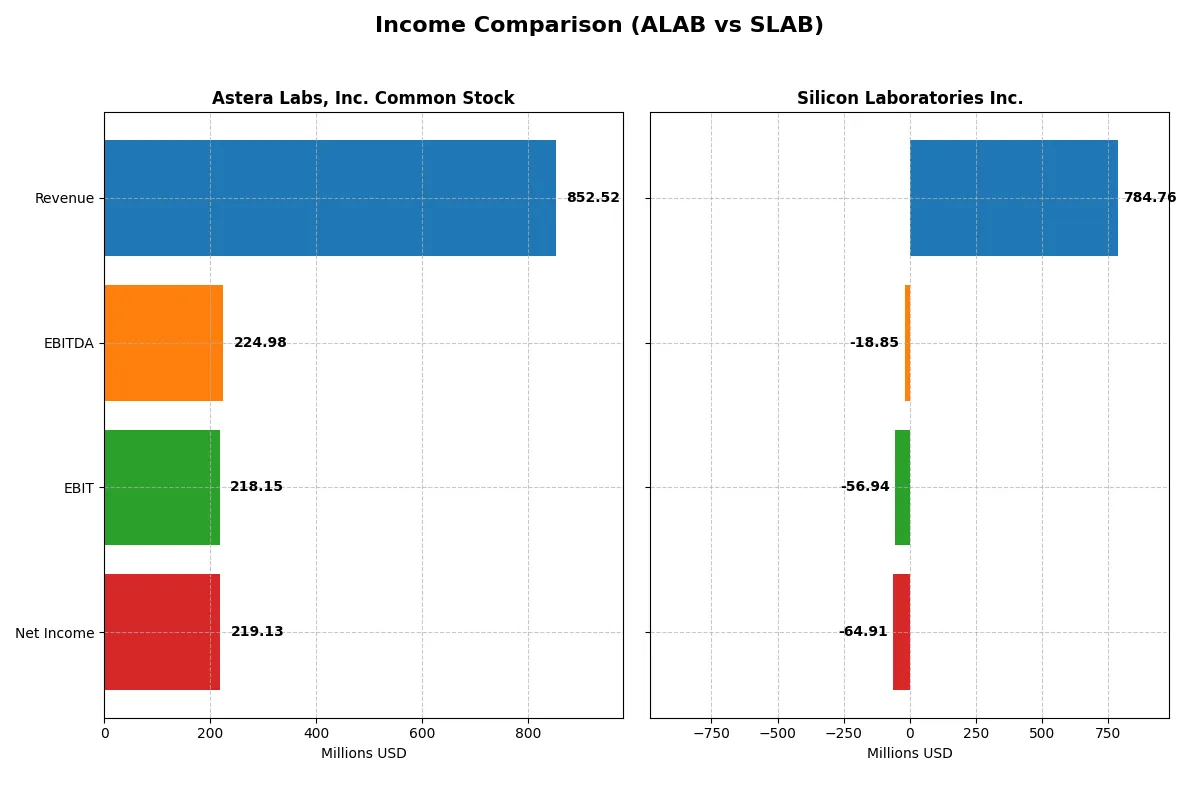

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Astera Labs, Inc. (ALAB) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| Revenue | 852.5M | 784.8M |

| Cost of Revenue | 207.3M | 327.8M |

| Operating Expenses | 471.8M | 527.5M |

| Gross Profit | 645.3M | 457.0M |

| EBITDA | 225.0M | -18.9M |

| EBIT | 218.2M | -56.9M |

| Interest Expense | 0 | 0.98M |

| Net Income | 219.1M | -64.9M |

| EPS | 1.32 | -1.98 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates its corporate engine with superior efficiency and growth momentum.

Astera Labs, Inc. Common Stock Analysis

Astera Labs shows explosive revenue growth, skyrocketing from $116M in 2023 to $853M in 2025. Its net income turned sharply positive to $219M in 2025 from a loss of $83M in 2024. Margins dominate with a gross margin near 76% and net margin of 25.7%, reflecting robust operational efficiency and rapid margin expansion.

Silicon Laboratories Inc. Analysis

Silicon Laboratories posts higher revenue at $785M in 2025 but with a more modest growth trajectory and a net loss of $65M. Gross margin at 58.2% trails Astera Labs, while a negative EBIT margin of -7.3% and net margin of -8.3% show ongoing profitability challenges despite a 34% revenue growth in 2025.

Verdict: Margin Power vs. Revenue Scale

Astera Labs outperforms Silicon Laboratories in margin quality and profitability growth, turning losses into strong profits swiftly. Silicon Labs, despite larger revenue, struggles to convert sales into earnings. For investors prioritizing efficient margin expansion and earnings momentum, Astera Labs presents a more attractive fundamental profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency for each company:

| Ratios | Astera Labs, Inc. (ALAB) | Silicon Laboratories Inc. (SLAB) |

|---|---|---|

| ROE | 16.1% | -5.9% |

| ROIC | 12.4% | -6.3% |

| P/E | 126.3 | -66.5 |

| P/B | 20.3 | 3.94 |

| Current Ratio | 10.2 | 4.69 |

| Quick Ratio | 9.79 | 4.02 |

| D/E | 0 | 0 |

| Debt-to-Assets | 0 | 0 |

| Interest Coverage | 0 | -72.3 |

| Asset Turnover | 0.56 | 0.62 |

| Fixed Asset Turnover | 9.26 | 6.10 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, unveiling hidden risks and operational strengths essential for investment analysis.

Astera Labs, Inc. Common Stock

Astera Labs delivers robust profitability with a 16.1% ROE and a strong 25.7% net margin, signaling operational excellence. However, its valuation is stretched, reflected in a high 126.3 P/E and 20.3 P/B ratios. The firm retains earnings for aggressive R&D, foregoing dividends to fuel growth.

Silicon Laboratories Inc.

Silicon Laboratories struggles with profitability, showing negative ROE at -5.9% and a net margin of -8.3%. Its P/E is negative, indicating losses, while a modest 3.9 P/B suggests undervaluation. The company invests in R&D rather than paying dividends, aiming to reverse its operational challenges.

Premium Valuation vs. Operational Safety

Astera Labs offers superior profitability but trades at a premium, increasing valuation risk. Silicon Laboratories presents a cheaper valuation but faces persistent losses and weak returns. Risk-tolerant investors may prefer Astera’s growth profile, while cautious investors might avoid both due to contrasting but significant concerns.

Which one offers the Superior Shareholder Reward?

Astera Labs (ALAB) and Silicon Laboratories (SLAB) both eschew dividends, focusing on reinvestment and buybacks. ALAB delivers no dividends, maintaining a zero payout ratio and reinvesting heavily in growth and R&D. Its free cash flow per share stands at $1.69, fueling an intense buyback program, though exact buyback volumes are not disclosed. SLAB also pays no dividends but supports a robust buyback strategy backed by $2.01 free cash flow per share in 2025. SLAB’s lower price-to-free-cash-flow ratio (66 vs. 98 for ALAB) suggests better valuation discipline. I see SLAB’s model as more sustainable given its stronger cash generation and moderate leverage, offering a superior shareholder reward through value accretion and buybacks in 2026.

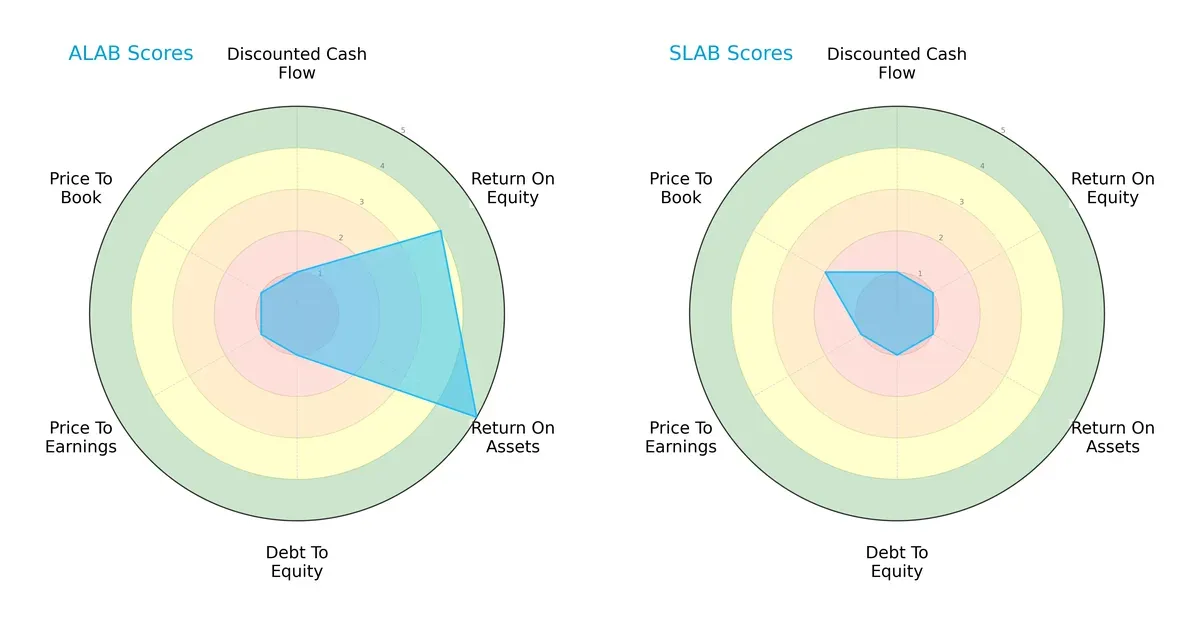

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their core financial strengths and vulnerabilities:

Astera Labs (ALAB) outperforms Silicon Laboratories (SLAB) in return on equity (4 vs. 1) and return on assets (5 vs. 1), signaling superior profitability and asset efficiency. Both firms struggle equally on discounted cash flow and debt-to-equity scores (1 each), indicating valuation and leverage concerns. SLAB slightly edges ALAB on price-to-book (2 vs. 1), but ALAB maintains a more balanced profile overall, relying less on isolated metrics.

Bankruptcy Risk: Solvency Showdown

Astera Labs and Silicon Laboratories both sit comfortably in the safe zone, with Altman Z-Scores of 78.7 and 25.2 respectively, indicating strong solvency and low bankruptcy risk in this cycle:

Financial Health: Quality of Operations

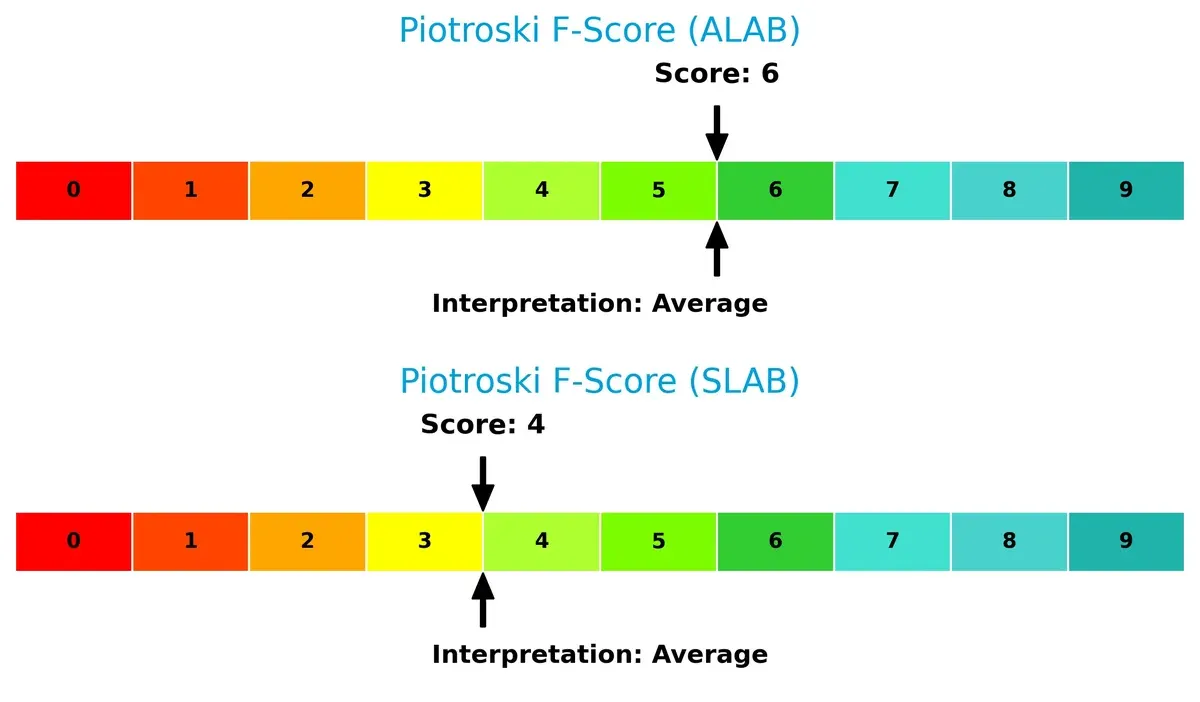

Astera Labs scores a 6 on the Piotroski F-Score, outperforming Silicon Laboratories’ 4, suggesting better operational quality and financial health; neither shows critical red flags, but ALAB demonstrates stronger internal metrics:

How are the two companies positioned?

This section dissects ALAB and SLAB’s operational DNA by comparing revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which model offers the most resilient, sustainable advantage today.

Revenue Segmentation: The Strategic Mix

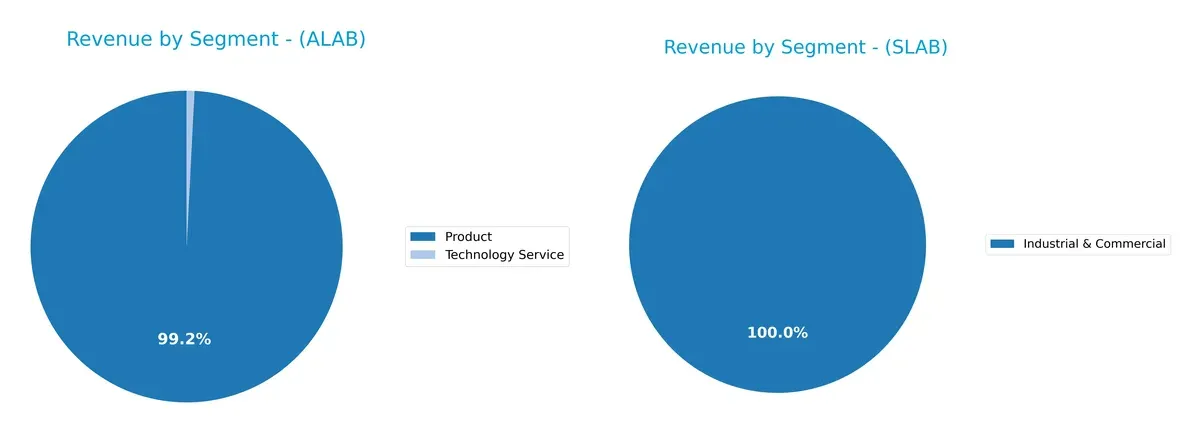

The following visual comparison dissects how both firms diversify their income streams and where their primary sector bets lie:

Astera Labs anchors 393M in Product revenue, with a minimal 3.2M from Technology Service, revealing a concentrated reliance on product sales. Silicon Laboratories, by contrast, pivots almost entirely on its Industrial & Commercial segment, posting 445M in 2025. Astera’s lean diversification suggests exposure to product cycle risks. Silicon Labs’ dominance in a single segment implies strong sector expertise but heightens concentration risk amid industrial cycle volatility.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Astera Labs (ALAB) and Silicon Laboratories (SLAB):

ALAB Strengths

- High net margin at 25.7%

- Favorable ROE of 16.07%

- Strong ROIC above WACC

- Zero debt with infinite interest coverage

- High quick ratio of 9.79

- Diverse geographic revenue including Taiwan and China

SLAB Strengths

- Favorable PE ratio despite negative earnings

- Zero debt and positive fixed asset turnover

- Global presence with large revenue in China, US, Taiwan, and rest of world

- Consistent industrial and commercial revenue base

ALAB Weaknesses

- High PE (126.33) and PB (20.3) ratios indicate valuation risk

- Unfavorable WACC at 10.74%

- Excessively high current ratio (10.24) may imply inefficient asset use

- No dividend yield

- Moderate asset turnover at 0.56

SLAB Weaknesses

- Negative net margin, ROE, and ROIC show unprofitability

- Unfavorable WACC at 10.86%

- Negative interest coverage (-58.4) raises solvency concerns

- Unfavorable PB ratio at 3.94

- No dividend yield

Both companies show strong balance sheets with zero debt, but ALAB’s superior profitability contrasts with SLAB’s current losses. ALAB’s high valuation and liquidity ratios suggest caution, while SLAB must address profitability and solvency to improve financial health.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from relentless competition and market commoditization. Let’s examine how Astera Labs and Silicon Laboratories defend their turf:

Astera Labs, Inc. Common Stock: Emerging Software-Defined Connectivity Moat

Astera Labs leverages a software-defined architecture to create switching costs in cloud and AI infrastructure connectivity. This drives strong gross margins (76%) and expanding profitability. New product launches in 2026 could deepen this moat by boosting integration complexity.

Silicon Laboratories Inc.: Analog and Mixed-Signal IoT Niche Moat

Silicon Labs competes through specialized mixed-signal solutions for IoT applications, a narrower cost and expertise moat than Astera’s platform approach. Despite solid revenue growth, declining ROIC and negative net margins highlight margin pressure and competitive threats. Expansion into new IoT segments offers growth potential but risks margin dilution.

Verdict: Software-Defined Architecture vs. Specialized Analog Solutions

Astera Labs holds a wider and more scalable moat, with growing ROIC and robust margin expansion signaling value creation. Silicon Labs’ shrinking ROIC and profitability losses reveal a fragile moat. Astera is better positioned to defend and grow its market share amid intensifying competition.

Which stock offers better returns?

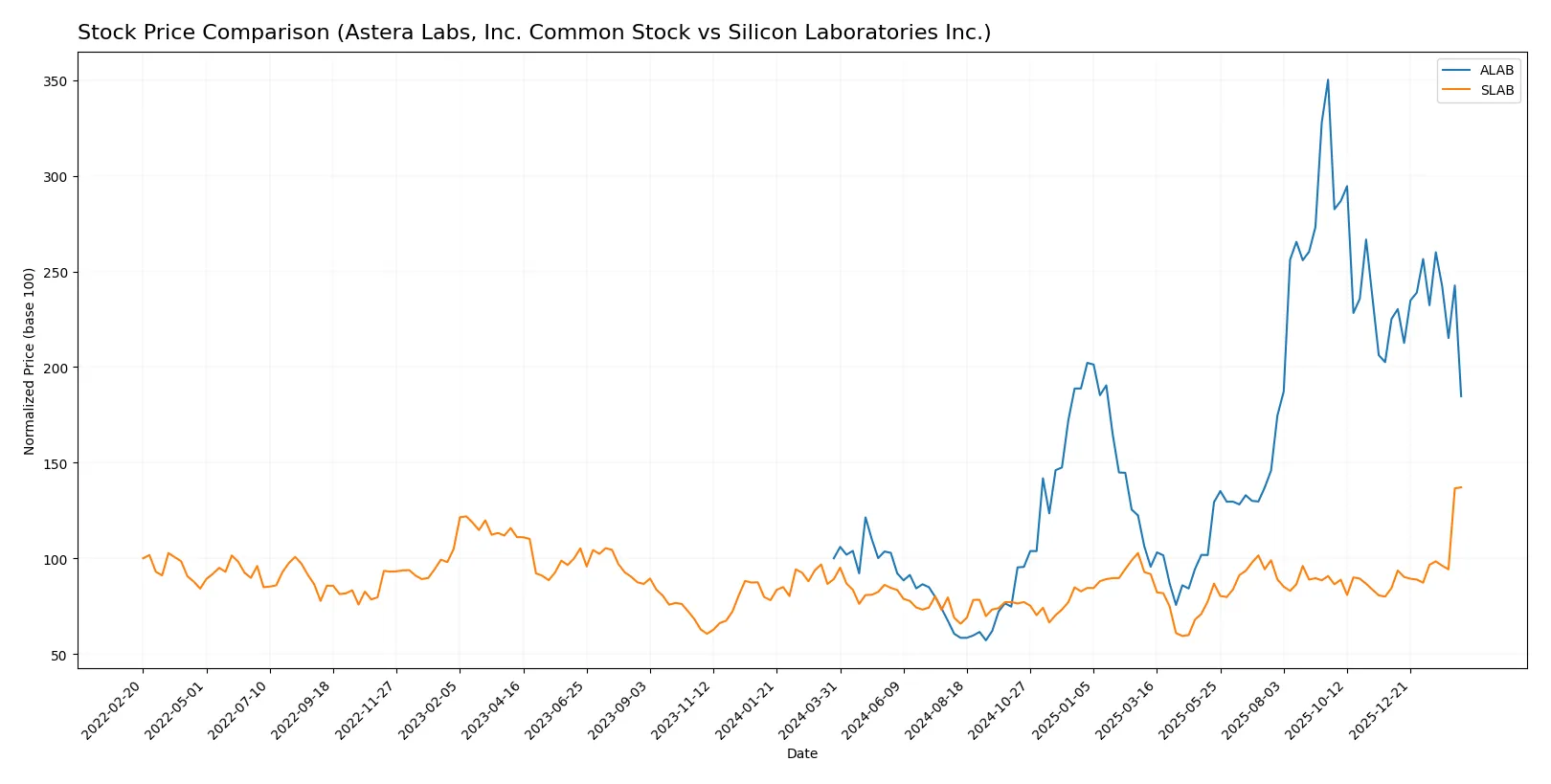

The past year saw Astera Labs’ stock surge sharply before recent deceleration, while Silicon Laboratories accelerated gains with strong buyer dominance through the latest quarter.

Trend Comparison

Astera Labs (ALAB) posted an 84.74% price increase over 12 months, indicating a bullish trend with decelerating momentum. The stock ranged from a low of 40.0 to a high of 245.2.

Silicon Laboratories (SLAB) gained 53.82% over the same period, also bullish but with accelerating momentum. Its price fluctuated between 89.82 and 207.27, showing a steadier climb.

Comparing both, Astera Labs delivered higher overall returns despite recent weakness, outperforming Silicon Laboratories by over 30 percentage points in market gains.

Target Prices

Analysts present a bullish consensus for both Astera Labs and Silicon Laboratories, signaling upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Astera Labs, Inc. Common Stock | 165 | 225 | 202.14 |

| Silicon Laboratories Inc. | 160 | 231 | 211.6 |

Astera Labs trades at $129.32, well below its $202 consensus target, indicating strong upside. Silicon Laboratories is near its $207 price, close to its $211 consensus, suggesting moderate growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the recent institutional grades for Astera Labs, Inc. Common Stock and Silicon Laboratories Inc.:

Astera Labs, Inc. Common Stock Grades

The following table lists recent grades from reputable financial institutions for Astera Labs:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-11 |

| Northland Capital Markets | Maintain | Outperform | 2025-12-09 |

| Northland Capital Markets | Upgrade | Outperform | 2025-11-17 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Barclays | Downgrade | Equal Weight | 2025-10-20 |

Silicon Laboratories Inc. Grades

Below are recent grades from recognized firms for Silicon Laboratories Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-02-06 |

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Benchmark | Downgrade | Hold | 2026-02-04 |

| Needham | Downgrade | Hold | 2026-02-04 |

| Keybanc | Downgrade | Sector Weight | 2026-02-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

| Susquehanna | Maintain | Neutral | 2025-08-06 |

| Barclays | Maintain | Equal Weight | 2025-08-05 |

| Susquehanna | Maintain | Neutral | 2025-07-22 |

| Stifel | Maintain | Buy | 2025-07-18 |

Which company has the best grades?

Astera Labs consistently received Buy or Outperform ratings from multiple firms, signaling stronger institutional confidence. Silicon Laboratories shows more Mixed to Neutral ratings with recent downgrades. Investors may interpret Astera Labs’ grades as more favorable for growth potential.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Astera Labs, Inc. Common Stock

- Operates in fast-evolving cloud and AI semiconductor space, facing intense innovation pressure and larger competitors.

Silicon Laboratories Inc.

- Competes in analog-intensive mixed-signal semiconductors with broad IoT applications, challenged by diverse rivals and margin pressures.

2. Capital Structure & Debt

Astera Labs, Inc. Common Stock

- Zero debt and infinite interest coverage signal strong financial stability and low leverage risk.

Silicon Laboratories Inc.

- Also debt-free but negative interest coverage raises concerns about operating losses and financial stress.

3. Stock Volatility

Astera Labs, Inc. Common Stock

- Beta of 1.51 and wide price range imply moderate-to-high volatility typical for recent IPOs in semiconductors.

Silicon Laboratories Inc.

- Slightly higher beta at 1.54 with a narrower price range, showing similar volatility but more stable trading volumes.

4. Regulatory & Legal

Astera Labs, Inc. Common Stock

- Subject to technology export controls and IP litigation risks, especially in AI cloud infrastructure.

Silicon Laboratories Inc.

- Faces regulatory scrutiny in global markets, notably China; compliance costs impact profit margins.

5. Supply Chain & Operations

Astera Labs, Inc. Common Stock

- Smaller scale (440 employees) may limit supply chain resilience amid semiconductor shortages.

Silicon Laboratories Inc.

- Larger workforce (1,889) and diversified product lines improve operational flexibility but increase complexity.

6. ESG & Climate Transition

Astera Labs, Inc. Common Stock

- Early-stage company with limited ESG disclosure; climate transition strategies remain unclear.

Silicon Laboratories Inc.

- More established with emerging ESG initiatives but faces pressure to improve sustainability in manufacturing.

7. Geopolitical Exposure

Astera Labs, Inc. Common Stock

- Primarily US-based but exposed to US-China tensions affecting semiconductor supply chains.

Silicon Laboratories Inc.

- Significant international sales increase vulnerability to geopolitical disruptions, especially in Asia.

Which company shows a better risk-adjusted profile?

Astera Labs faces its biggest risk in market competition due to rapid innovation demands and high valuation. Silicon Laboratories struggles most with capital structure, evident in sustained losses and poor profitability. Astera Labs shows a superior risk-adjusted profile, supported by zero debt and favorable profitability ratios. Recent data reveal Silicon Labs’ negative net margin (-8.3%) and return on equity (-5.9%) as red flags, confirming its weaker financial resilience.

Final Verdict: Which stock to choose?

Astera Labs (ALAB) excels as a cash-efficient growth engine, rapidly scaling revenue and profitability with improving capital returns. Its point of vigilance lies in lofty valuation multiples, which could pressure future gains. ALAB suits aggressive growth portfolios willing to tolerate elevated risk for outsized rewards.

Silicon Laboratories (SLAB) benefits from a strategic moat in diversified semiconductor solutions and steady recurring revenue streams. Compared to ALAB, SLAB offers comparatively better stability but faces challenges with declining profitability and value destruction. It fits a GARP portfolio seeking growth tempered by reasonable valuation.

If you prioritize high-growth potential and can withstand valuation volatility, ALAB outshines with accelerating fundamentals and expanding ROIC. However, if you seek more stability and a strategic business model with less speculative upside, SLAB offers better downside protection despite current profitability headwinds. Each represents a distinct analytical scenario for different investor risk appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Astera Labs, Inc. Common Stock and Silicon Laboratories Inc. to enhance your investment decisions: