Home > Comparison > Technology > MPWR vs ALAB

The strategic rivalry between Monolithic Power Systems, Inc. and Astera Labs, Inc. shapes the semiconductor sector’s evolution. Monolithic Power dominates as a diversified power electronics leader serving broad markets, while Astera Labs focuses on cutting-edge connectivity solutions for cloud and AI infrastructure. This head-to-head pits established operational scale against innovative niche specialization. This analysis aims to identify which trajectory offers superior risk-adjusted returns for a technology-focused, diversified portfolio.

Table of contents

Companies Overview

Monolithic Power Systems and Astera Labs stand as key innovators in semiconductor technologies shaping modern electronics and cloud infrastructure.

Monolithic Power Systems, Inc.: Powering Diverse Electronics

Monolithic Power Systems dominates the semiconductor power electronics niche. It generates revenue by designing DC-to-DC integrated circuits that regulate voltage in devices from laptops to automotive systems. In 2026, the company prioritizes expanding its global footprint through direct sales and distributors, focusing on versatile power solutions across computing, industrial, and consumer markets.

Astera Labs, Inc. Common Stock: Enabling Cloud & AI Connectivity

Astera Labs targets the connectivity semiconductor segment for cloud and AI infrastructure. It earns revenue by offering a software-defined platform of data, network, and memory connectivity products. The 2026 strategy revolves around scaling its Intelligent Connectivity Platform to support high-performance cloud deployments and AI applications, leveraging nimble innovation from its Santa Clara base.

Strategic Collision: Similarities & Divergences

Both firms focus on semiconductors but diverge sharply in business philosophy: Monolithic emphasizes broad, hardware-centric power management, while Astera pursues a software-driven connectivity ecosystem. Their primary battleground lies in the expanding data center and electronic device markets. Investors face distinct profiles—Monolithic with a mature, diversified revenue base, and Astera as an agile, growth-oriented player in emerging cloud infrastructure.

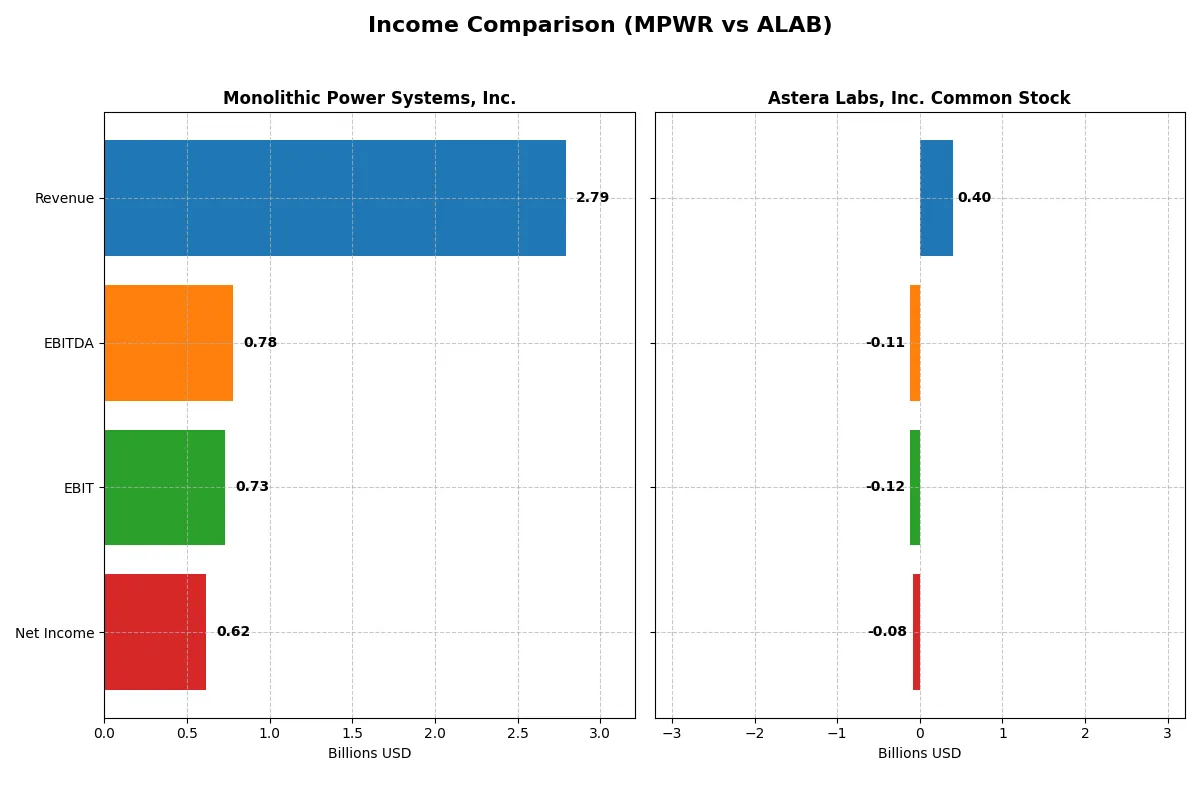

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Monolithic Power Systems, Inc. (MPWR) | Astera Labs, Inc. Common Stock (ALAB) |

|---|---|---|

| Revenue | 2.79B | 396M |

| Cost of Revenue | 1.25B | 94M |

| Operating Expenses | 811M | 419M |

| Gross Profit | 1.54B | 303M |

| EBITDA | 780M | -113M |

| EBIT | 729M | -116M |

| Interest Expense | 0 | 0 |

| Net Income | 616M | -83M |

| EPS | 12.82 | -0.64 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

The income statements reveal the true operational efficiency and profitability of these two companies over recent years.

Monolithic Power Systems, Inc. Analysis

MPWR shows consistent revenue growth from $1.2B in 2021 to $2.79B in 2025. Net income surged overall, despite a dip in 2025 to $616M from a high of $1.79B in 2024. Gross margins hold strong near 55%, and net margins remain favorable around 22%, reflecting solid cost control and profitability momentum.

Astera Labs, Inc. Common Stock Analysis

ALAB’s revenue jumped sharply from $80M in 2022 to $396M in 2024, driven by strong top-line momentum. However, the company remains unprofitable with net losses widening to $83M in 2024. Despite a high gross margin of 76%, negative EBIT and net margins near -21% highlight ongoing operational challenges and investment-heavy expenses.

Scale and Profitability: Growth vs. Efficiency

MPWR leads with sustainable revenue and profit growth, supported by robust margins and efficient cost management. ALAB exhibits rapid revenue expansion but struggles to convert sales into profits, weighed down by high operating expenses. For investors prioritizing profitability and margin stability, MPWR’s profile appears more attractive and fundamentally sound.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency across companies:

| Ratios | Monolithic Power Systems, Inc. (MPWR) | Astera Labs, Inc. Common Stock (ALAB) |

|---|---|---|

| ROE | 16.55% | -8.65% |

| ROIC | 14.93% | -11.97% |

| P/E | 70.69x | -208.41x |

| P/B | 11.70x | 18.02x |

| Current Ratio | 5.91 | 11.71 |

| Quick Ratio | 4.38 | 11.21 |

| D/E | 0.00 | 0.00 |

| Debt-to-Assets | 0.00 | 0.12% |

| Interest Coverage | 0 (not available) | 0 (not available) |

| Asset Turnover | 0.65 | 0.38 |

| Fixed Asset Turnover | 4.45 | 11.12 |

| Payout ratio | 46.25% | 0% |

| Dividend yield | 0.65% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and highlighting operational excellence in its core business.

Monolithic Power Systems, Inc.

Monolithic Power Systems displays robust profitability with a 16.55% ROE and a healthy 22.07% net margin, signaling operational efficiency. However, its valuation appears stretched, with a P/E of 70.69 and P/B of 11.7. The company rewards shareholders modestly via a 0.65% dividend yield while aggressively reinvesting in R&D, fueling growth.

Astera Labs, Inc. Common Stock

Astera Labs suffers from negative profitability metrics, posting an -8.65% ROE and a -21.05% net margin, reflecting operational challenges. Its P/E is negative but distorted by losses, and a high P/B of 18.02 suggests valuation risk. The firm pays no dividend, instead channeling capital into heavy R&D spending to build future capabilities.

Premium Valuation vs. Operational Safety

Monolithic Power Systems balances strong profitability and cautious growth despite a premium valuation. Astera Labs faces significant operational losses and valuation risks despite aggressive reinvestment. Investors seeking operational safety with moderate yield may prefer Monolithic, while those pursuing speculative growth might consider Astera’s high-risk profile.

Which one offers the Superior Shareholder Reward?

Monolithic Power Systems (MPWR) offers a more attractive shareholder reward than Astera Labs (ALAB) in 2026. MPWR maintains a dividend yield around 0.65-0.83% with a conservative payout ratio near 46%, supported by strong free cash flow and operating margins above 26%. It also executes steady buybacks, enhancing total returns sustainably. ALAB pays no dividends and suffers persistent losses, relying on reinvestment for growth but showing negative margins and poor solvency. MPWR’s disciplined distributions and robust cash generation present a superior, more sustainable total return profile.

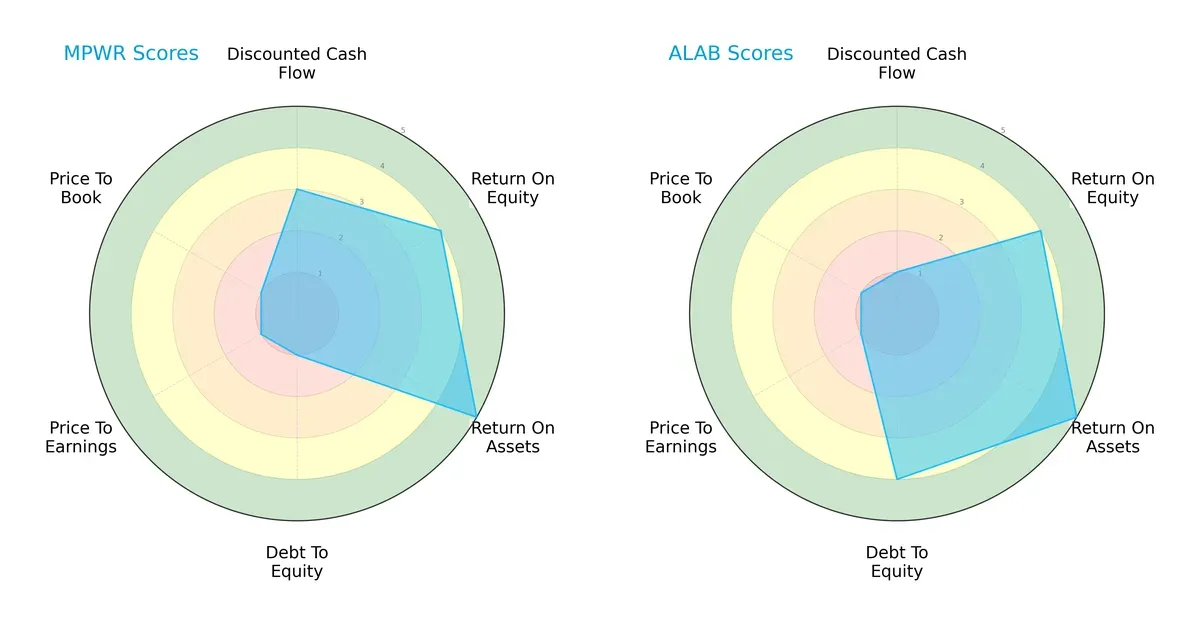

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Monolithic Power Systems and Astera Labs, highlighting their core financial strengths and vulnerabilities:

Monolithic Power Systems (MPWR) excels in asset efficiency (ROA 5) and equity returns (ROE 4) but suffers from high leverage risk (Debt/Equity 1) and poor valuation metrics (PE/PB 1). Astera Labs (ALAB) matches MPWR’s operational efficiency yet maintains a stronger balance sheet (Debt/Equity 4), though it struggles with discounted cash flow valuation (DCF 1). MPWR relies heavily on operational performance, while ALAB offers a more balanced financial profile.

Bankruptcy Risk: Solvency Showdown

Astera Labs’ Altman Z-Score of 121 vastly outperforms Monolithic Power’s 63, both deep in the safe zone, signaling strong long-term solvency but a clear edge for ALAB’s risk resilience in this cycle:

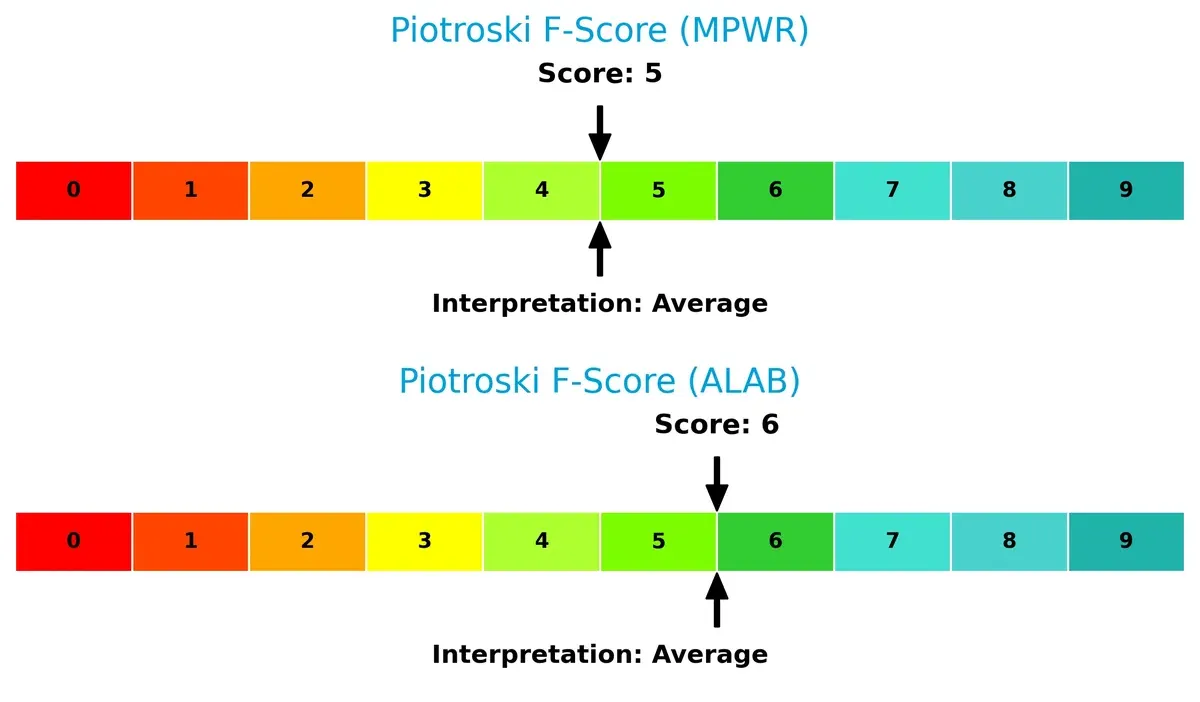

Financial Health: Quality of Operations

Both firms show average Piotroski F-Scores—MPWR at 5 and ALAB at 6—indicating moderate financial health with no immediate red flags, yet ALAB slightly leads in operational quality and internal metrics:

How are the two companies positioned?

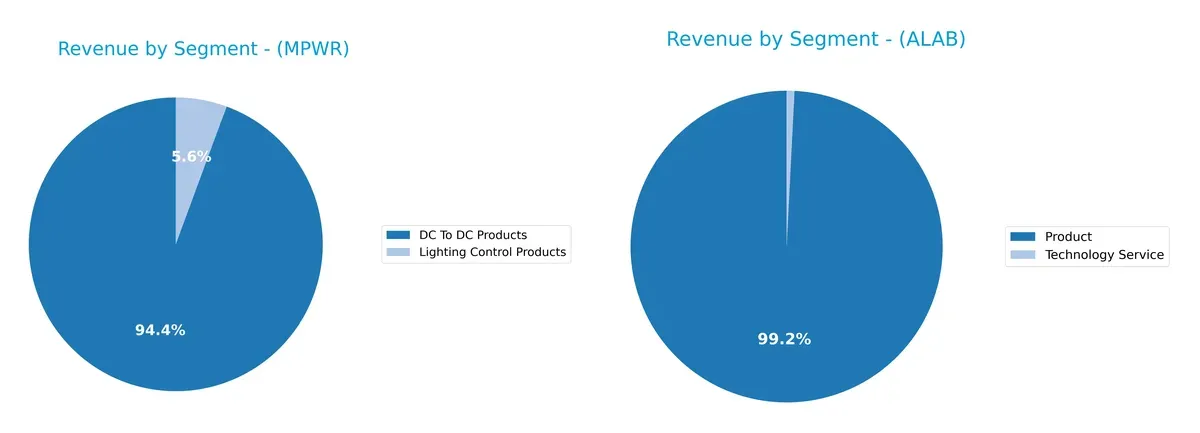

This section dissects the operational DNA of MPWR and ALAB by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which model offers the most resilient, sustainable advantage today.

Revenue Segmentation: The Strategic Mix

This comparison dissects how Monolithic Power Systems and Astera Labs diversify income streams and where their primary sector bets lie:

Monolithic Power Systems anchors revenue in DC To DC Products with $1.7B in 2023, while Lighting Control lags at $102M. This concentration signals a strong infrastructure dominance but carries some concentration risk. Astera Labs shows a narrower mix with $393M from Product and a minor $3.2M from Technology Service. MPWR’s diversified product lines contrast ALAB’s reliance on a single dominant segment, highlighting different strategic positions.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Monolithic Power Systems, Inc. (MPWR) and Astera Labs, Inc. (ALAB):

MPWR Strengths

- Strong profitability with 22.07% net margin

- Favorable ROE of 16.55% and ROIC of 14.93%

- Zero debt and infinite interest coverage

- Broad global presence, especially in China and Taiwan

- Diverse product segments including DC to DC and lighting control

ALAB Strengths

- Favorable quick ratio and low debt levels

- High fixed asset turnover indicating efficient asset use

- Presence in key markets including Taiwan and China

- Product and technology service revenue streams

MPWR Weaknesses

- Elevated P/E of 70.69 and high P/B of 11.7 signal overvaluation risks

- High current ratio may indicate excess liquidity or low working capital efficiency

- WACC higher than ROIC, reducing value creation

- Low dividend yield of 0.65%

ALAB Weaknesses

- Negative profitability metrics: net margin -21.05%, ROE -8.65%, ROIC -11.97%

- Negative interest coverage ratio of 0

- High P/B of 18.02 and unfavorable asset turnover at 0.38

- Concentrated revenue with limited diversification

Monolithic Power Systems shows robust profitability and low leverage, but faces valuation and capital efficiency challenges. Astera Labs struggles with profitability and operational efficiency despite some asset utilization strengths. These factors critically shape their strategic options and investor considerations.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competitive pressure. Only durable moats can sustain value creation in evolving markets:

Monolithic Power Systems, Inc. (MPWR): Integrated Circuit Cost Advantage

MPWR’s moat stems from its cost-efficient, vertically integrated power electronics. This translates to stable 26% EBIT margins and consistent value creation despite a slight ROIC decline. Expanding into automotive and industrial sectors in 2026 may deepen this advantage.

Astera Labs, Inc. (ALAB): Software-Defined Connectivity Innovation

ALAB leverages a software-defined architecture to disrupt cloud and AI infrastructure connectivity. Unlike MPWR, it currently sacrifices profitability with -29% EBIT margin but shows accelerating ROIC growth. Success in scaling new products could transform its competitive edge.

Cost Efficiency vs. Innovation Scalability

MPWR holds a wider moat with proven profitability and positive ROIC over WACC, signaling steady value creation. ALAB’s growing ROIC hints at potential, but its negative margins reveal risk. MPWR is better positioned to defend market share amid industry cycles.

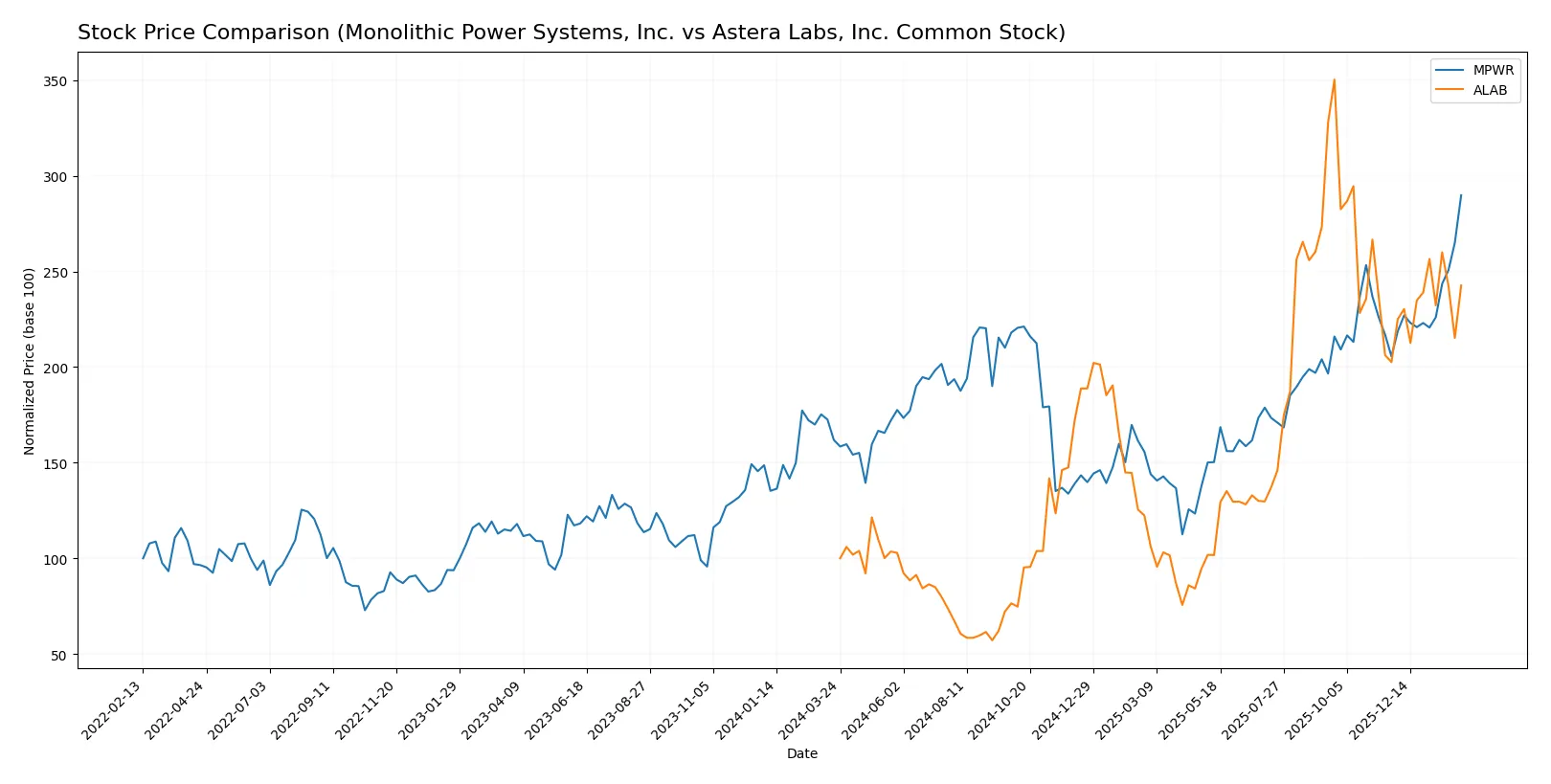

Which stock offers better returns?

The past year has seen Monolithic Power Systems and Astera Labs deliver strong gains, with both stocks accelerating upward amid rising trading volumes and buyer dominance.

Trend Comparison

Monolithic Power Systems’ stock rose 79.02% over the last 12 months, showing a bullish trend with accelerating momentum and high price volatility between 477.39 and 1229.82.

Astera Labs’ stock surged 142.64% in the same period, also bullish with accelerating gains and lower volatility, moving between 40.0 and 245.2 while maintaining strong buyer interest.

Astera Labs outperformed Monolithic Power Systems by a wide margin, delivering the highest market returns and steadier upward momentum over the past year.

Target Prices

Analysts present a confident target price consensus for Monolithic Power Systems, Inc. and Astera Labs, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Monolithic Power Systems, Inc. | 1200 | 1500 | 1313.71 |

| Astera Labs, Inc. Common Stock | 165 | 225 | 202.14 |

The consensus targets for MPWR exceed its current price of $1,230, suggesting upside potential. ALAB’s targets are also above its $170 price, indicating bullish analyst expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Monolithic Power Systems, Inc. and Astera Labs, Inc. Common Stock:

Monolithic Power Systems, Inc. Grades

This table shows recent grades from established financial institutions for Monolithic Power Systems, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-02-06 |

| Keybanc | Maintain | Overweight | 2026-02-06 |

| Rosenblatt | Maintain | Neutral | 2026-02-06 |

| Wells Fargo | Maintain | Overweight | 2026-02-06 |

| Needham | Maintain | Buy | 2026-02-06 |

| Stifel | Maintain | Buy | 2026-02-04 |

| Wells Fargo | Maintain | Overweight | 2026-01-26 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Citigroup | Maintain | Buy | 2025-11-03 |

Astera Labs, Inc. Common Stock Grades

Below is a summary of recent institutional grades for Astera Labs, Inc. Common Stock from reputable sources.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Northland Capital Markets | Maintain | Outperform | 2025-12-09 |

| Northland Capital Markets | Upgrade | Outperform | 2025-11-17 |

| Needham | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Barclays | Downgrade | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

Which company has the best grades?

Monolithic Power Systems consistently receives Buy and Overweight ratings, reflecting strong institutional confidence. Astera Labs shows a mix of Outperform and Buy grades but includes Hold and a recent downgrade, indicating more varied sentiment. Investors may view Monolithic Power Systems as having steadier analyst support.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Monolithic Power Systems, Inc. and Astera Labs, Inc. in the 2026 market environment:

1. Market & Competition

Monolithic Power Systems, Inc.

- Established semiconductor player with diversified markets and strong brand recognition.

Astera Labs, Inc. Common Stock

- Emerging firm focused on cloud and AI infrastructure connectivity, facing fierce competition and market adoption risks.

2. Capital Structure & Debt

Monolithic Power Systems, Inc.

- Zero debt with strong interest coverage, indicating financial stability and low leverage risk.

Astera Labs, Inc. Common Stock

- Minimal debt but zero interest coverage, reflecting limited earnings to cover financing costs and higher financial risk.

3. Stock Volatility

Monolithic Power Systems, Inc.

- Beta at 1.455 signals moderately higher volatility than the market, typical in semiconductors.

Astera Labs, Inc. Common Stock

- Beta of 1.51 indicates slightly higher volatility, amplified by early-stage growth and market uncertainties.

4. Regulatory & Legal

Monolithic Power Systems, Inc.

- Operates globally with exposure to semiconductor export controls and IP protection risks.

Astera Labs, Inc. Common Stock

- Faces regulatory scrutiny in cloud infrastructure markets, with evolving tech standards and compliance challenges.

5. Supply Chain & Operations

Monolithic Power Systems, Inc.

- Benefits from established supply chains but remains vulnerable to global semiconductor shortages.

Astera Labs, Inc. Common Stock

- Dependency on nascent supply networks increases risk amid component scarcity and scaling operations.

6. ESG & Climate Transition

Monolithic Power Systems, Inc.

- Moderate ESG focus; pressure to improve energy efficiency and reduce carbon footprint in manufacturing.

Astera Labs, Inc. Common Stock

- Emerging company likely under investor pressure to adopt robust ESG policies early to attract capital.

7. Geopolitical Exposure

Monolithic Power Systems, Inc.

- Significant international sales expose it to US-China tensions and trade restrictions.

Astera Labs, Inc. Common Stock

- Concentrated US-based operations reduce direct geopolitical risk but face indirect supply chain impacts.

Which company shows a better risk-adjusted profile?

Monolithic Power Systems faces its biggest risk from geopolitical tensions impacting its global supply chain and market access. Astera Labs contends primarily with operational risks linked to scaling and insufficient earnings coverage. I see Monolithic Power Systems offering a superior risk-adjusted profile owing to its debt-free capital structure, robust profitability, and safer Altman Z-score. Astera Labs’ negative margins and zero interest coverage highlight financial fragility despite growth potential. The recent surge in Monolithic Power’s stock price (+6.4%) versus Astera Labs’ higher volatility (+18.9%) confirms market preference for stability amid sector uncertainties.

Final Verdict: Which stock to choose?

Monolithic Power Systems (MPWR) shines with its unmatched capital efficiency and robust cash generation, creating tangible value despite a slight decline in ROIC trend. Its fortress-like balance sheet supports resilience, though its lofty valuation and stretched current ratio require vigilance. MPWR suits an Aggressive Growth portfolio seeking quality with a premium.

Astera Labs (ALAB) offers a strategic moat rooted in rapid revenue expansion and a growing ROIC, signaling improving profitability in a high-potential market. Its strong liquidity and moderate leverage provide a safety cushion compared to MPWR, but persistent losses and negative margins temper enthusiasm. ALAB fits a GARP investor willing to bet on turnaround momentum.

If you prioritize consistent value creation and operational strength, MPWR outshines with better stability and proven profitability. However, if you seek high-growth potential with improving fundamentals, ALAB offers a compelling, albeit riskier, growth story. Both require careful risk management aligned with your tolerance and time horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monolithic Power Systems, Inc. and Astera Labs, Inc. Common Stock to enhance your investment decisions: