Home > Comparison > Technology > ALAB vs IPGP

The strategic rivalry between Astera Labs, Inc. and IPG Photonics Corporation shapes innovation in the semiconductor sector. Astera Labs operates as a nimble, software-driven connectivity solutions provider for cloud and AI infrastructure. IPG Photonics, in contrast, is a seasoned manufacturer of high-performance fiber lasers for materials processing and communications. This analysis evaluates which operational model delivers superior risk-adjusted returns, guiding investors seeking durable leadership in a dynamic technology landscape.

Table of contents

Companies Overview

Astera Labs and IPG Photonics each play pivotal roles in the semiconductor industry, shaping the future of advanced technology infrastructure.

Astera Labs, Inc.: Innovator in Semiconductor Connectivity

Astera Labs stands out as a leader in semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform generates revenue through data, network, and memory connectivity products, all unified by a software-defined architecture. In 2026, the company sharpens its focus on scaling high-performance cloud infrastructure deployment.

IPG Photonics Corporation: Pioneer in Fiber Laser Technology

IPG Photonics dominates the fiber laser and amplifier market, serving materials processing and communications globally. Its broad product range includes high-power fiber lasers and integrated laser systems, generating revenue from OEMs and system integrators. The company’s 2026 strategy emphasizes expanding advanced laser applications across industrial and medical sectors.

Strategic Collision: Similarities & Divergences

Astera Labs pursues a software-defined, scalable connectivity platform, while IPG Photonics emphasizes a hardware-centric, diversified fiber laser portfolio. Both compete in the semiconductor space but target distinct market needs—cloud infrastructure for Astera and materials processing for IPG. Investors face contrasting profiles: high-growth innovation versus established industrial specialization.

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Astera Labs, Inc. (ALAB) | IPG Photonics Corporation (IPGP) |

|---|---|---|

| Revenue | 853M | 1.00B |

| Cost of Revenue | 207M | 622M |

| Operating Expenses | 472M | 368M |

| Gross Profit | 645M | 381M |

| EBITDA | 225M | 90M |

| EBIT | 218M | 23M |

| Interest Expense | 0 | 0 |

| Net Income | 219M | 31M |

| EPS | 1.32 | 0.73 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates its business more efficiently and generates stronger profitability from its revenue base.

Astera Labs, Inc. Common Stock Analysis

Astera Labs demonstrates a striking revenue surge from $116M in 2023 to $853M in 2025, with net income flipping from a loss of $26M to a profit of $219M. Its gross margin stays robust near 75.7%, while net margin jumped to 25.7%, signaling excellent cost control and scaling efficiency in 2025.

IPG Photonics Corporation Analysis

IPG Photonics posts more stable revenue around $1B in 2025 but shows a modest 2.7% growth, down from $1.47B in 2021. Gross margin holds at a decent 38%, yet net margin remains thin at 3.1%. Despite a rebound from prior losses, its operating margin of 2.3% signals tight profitability pressures.

Verdict: Rapid Margin Expansion vs. Mature Scale Stability

Astera Labs outpaces IPG Photonics with explosive top-line and bottom-line growth, coupled with superior margin expansion. IPG’s revenues are larger but shrinking over five years, and its slim net margin reflects margin compression. Investors seeking dynamic profit growth may prefer Astera’s profile, while IPG offers scale with muted earnings power.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Astera Labs (ALAB) | IPG Photonics (IPGP) |

|---|---|---|

| ROE | 16.1% | 1.5% |

| ROIC | 12.4% | 0.4% |

| P/E | 126.3 | 98.1 |

| P/B | 20.3 | 1.43 |

| Current Ratio | 10.2 | 6.08 |

| Quick Ratio | 9.79 | 4.74 |

| D/E | 0 | 0 |

| Debt-to-Assets | 0 | 0 |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.56 | 0.41 |

| Fixed Asset Turnover | 9.26 | 1.57 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence critical for investment insight.

Astera Labs, Inc. Common Stock

Astera Labs delivers strong profitability with a 16.1% ROE and 25.7% net margin, showcasing solid operational efficiency. However, its valuation is stretched with a P/E of 126.3 and a P/B of 20.3, signaling expensive stock pricing. The firm does not pay dividends, instead reinvesting heavily in R&D (36% of revenue) to fuel growth.

IPG Photonics Corporation

IPG Photonics shows modest profitability, with ROE at 1.46% and a net margin of 3.1%, indicating limited earnings efficiency. Its valuation is also high, with a P/E of 98.1, although the P/B of 1.43 suggests reasonable asset pricing. The company pays no dividends and balances reinvestment with operational cash flow management, focusing on steady business stability.

Premium Valuation vs. Operational Safety

Astera Labs offers superior profitability but at a significantly higher valuation, increasing risk. IPG Photonics provides a more conservative asset valuation but with weaker returns. Growth-oriented investors may prefer Astera, while those seeking steadiness might lean toward IPG’s defensive profile.

Which one offers the Superior Shareholder Reward?

I observe that neither Astera Labs (ALAB) nor IPG Photonics (IPGP) pays dividends. ALAB reinvests heavily in growth, reflected by a 0% dividend payout ratio and no buybacks. IPGP also forgoes dividends but shows a modest buyback trend supporting shareholder returns. ALAB’s free cash flow per share improved to 1.69 in 2025, yet it carries a sky-high P/E of 126, indicating rich valuation and growth expectations. IPGP displays a more balanced approach, with positive net margins (~3%) and a lower P/E near 98, despite a slight negative free cash flow in 2025. IPGP’s buybacks and steadier margins suggest a more sustainable distribution strategy. For 2026, I favor IPGP for superior total shareholder reward due to its disciplined capital allocation and more realistic valuation.

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their competitive strengths and weaknesses across key financial metrics:

Astera Labs (ALAB) shines in operational efficiency with high ROE (4) and ROA (5) scores but suffers from poor valuation and financial leverage metrics (all scored 1). In contrast, IPG Photonics (IPGP) exhibits a more balanced profile, with moderate DCF (3), ROA (3), and a strong price-to-book score (4), though its ROE (2) and debt-to-equity (1) scores signal caution. IPGP’s diversified strengths suggest steadier valuation support, while ALAB relies heavily on operational efficiency despite financial risks.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score differential signals both firms are in the safe zone, but Astera Labs’ extraordinarily high score (78.7) provides a striking margin of safety over IPG Photonics (15.0):

This wide gap indicates Astera Labs is far less likely to face bankruptcy risk in this cycle. IPG Photonics, while safe, operates with tighter solvency margins, warranting closer monitoring in volatile markets.

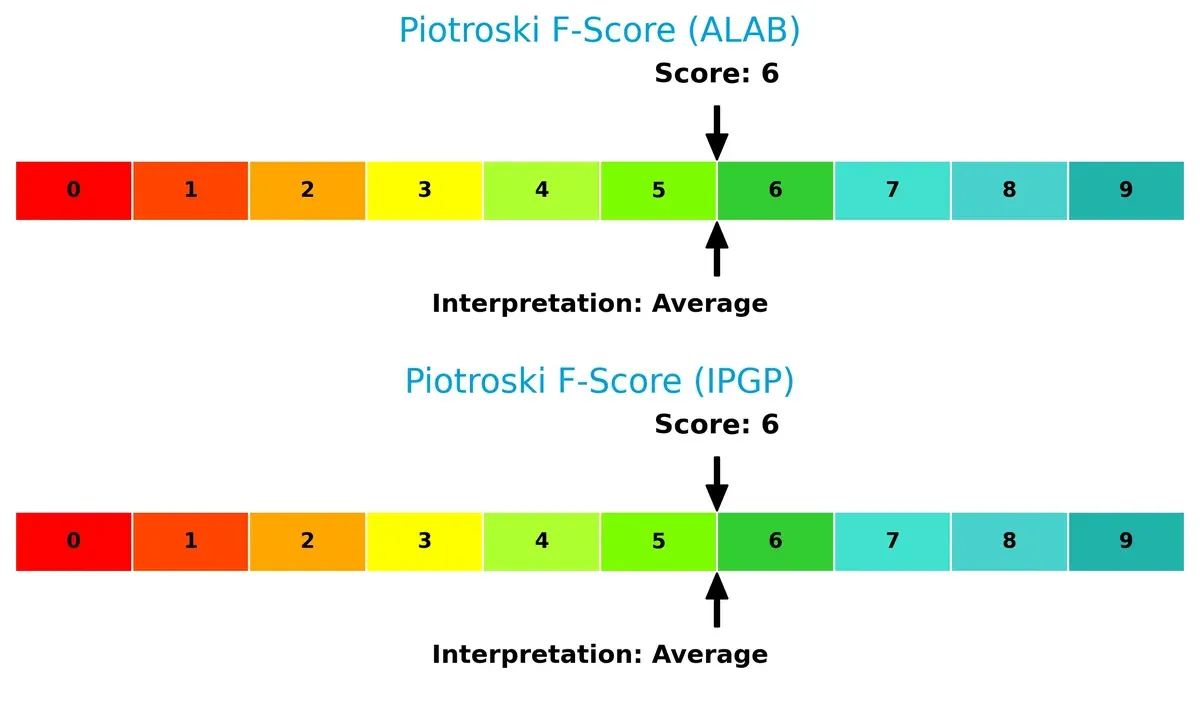

Financial Health: Quality of Operations

Both companies share an average Piotroski F-Score of 6, reflecting moderate financial health with no immediate red flags:

Neither firm shows peak strength (8-9) nor distress (0-2), implying stable but improvable internal operations. Investors should watch for improvements in profitability and efficiency to elevate these scores in coming quarters.

How are the two companies positioned?

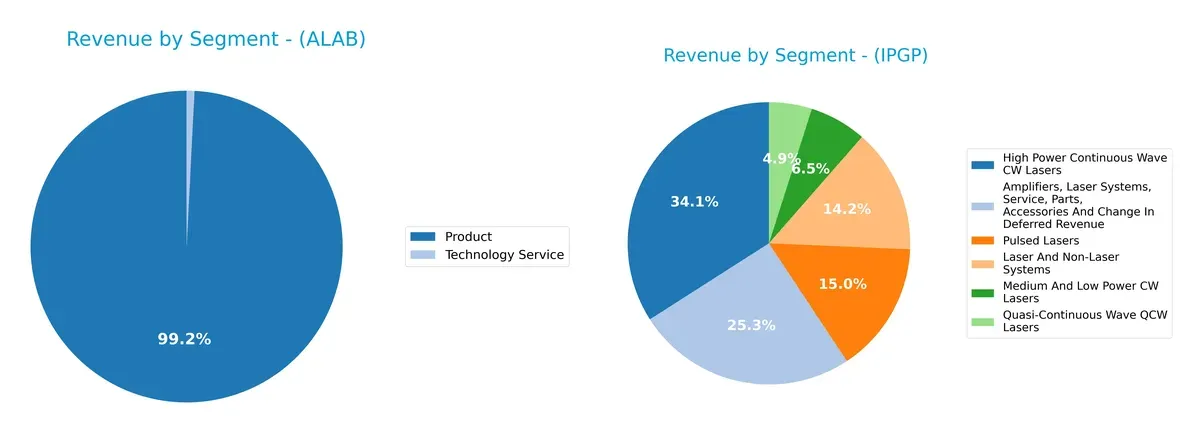

This section dissects the operational DNA of ALAB and IPGP by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and reveal which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Astera Labs and IPG Photonics diversify their income streams and where their primary sector bets lie:

Astera Labs leans heavily on its Product segment with $393M, while Technology Services contribute only $3.2M, revealing a concentrated revenue base. In contrast, IPG Photonics spreads $867M across multiple laser product lines, with no single segment dominating. IPG’s diversification reduces concentration risk and signals a broad laser ecosystem footprint. Astera’s narrow focus could mean higher risk but sharper market specialization.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Astera Labs, Inc. (ALAB) and IPG Photonics Corporation (IPGP):

ALAB Strengths

- Strong profitability with 25.7% net margin

- High ROE of 16.07%

- Zero debt ensures financial stability

- Quick ratio 9.79 indicates strong liquidity

- High fixed asset turnover of 9.26 boosts efficiency

IPGP Strengths

- Diversified revenue streams across multiple laser products

- Favorable PB ratio at 1.43

- Zero debt supports solid balance sheet

- Quick ratio 4.74 suggests good liquidity

- Global presence with significant sales in China, Europe, and North America

ALAB Weaknesses

- Unfavorable high PE of 126.33 may imply overvaluation

- Low current ratio of 10.24 is flagged as unfavorable

- WACC at 10.74% exceeds ROIC, indicating capital cost concerns

- No dividend yield limits income for investors

- Asset turnover neutral at 0.56

IPGP Weaknesses

- Very low profitability with 3.1% net margin

- ROE and ROIC below 2% signal weak returns

- Unfavorable PE at 98.08 suggests valuation risk

- Current ratio of 6.08 is also unfavorable

- Asset turnover low at 0.41 limits operational efficiency

Both companies show financial strengths with debt-free balance sheets and strong liquidity ratios. ALAB excels in profitability and capital efficiency but faces valuation and capital cost challenges. IPGP benefits from broader product diversification and global reach but struggles with weak profitability and operational efficiency. This mix will shape each company’s strategic priorities going forward.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield preserving long-term profits from relentless competitive erosion in technology sectors:

Astera Labs, Inc. Common Stock: Emerging Software-Defined Connectivity Moat

Astera Labs leverages a software-defined architecture creating switching costs in cloud and AI infrastructure connectivity. Its growing ROIC and high 25.7% net margin show improving profitability. New AI workloads in 2026 could deepen this moat.

IPG Photonics Corporation: Specialized Fiber Laser Technology Moat

IPG’s moat stems from intangible assets in fiber laser innovation, contrasting Astera’s software edge. Despite a 38% gross margin, IPG reports declining ROIC and shrinking profitability. Market disruptions and new laser applications in 2026 offer uncertain upside.

Connectivity Platform Innovation vs. Laser Tech Legacy

Astera Labs exhibits a wider moat with rising ROIC and accelerating growth, while IPG struggles with declining returns. Astera is better positioned to defend and expand its market share amid evolving technology demands.

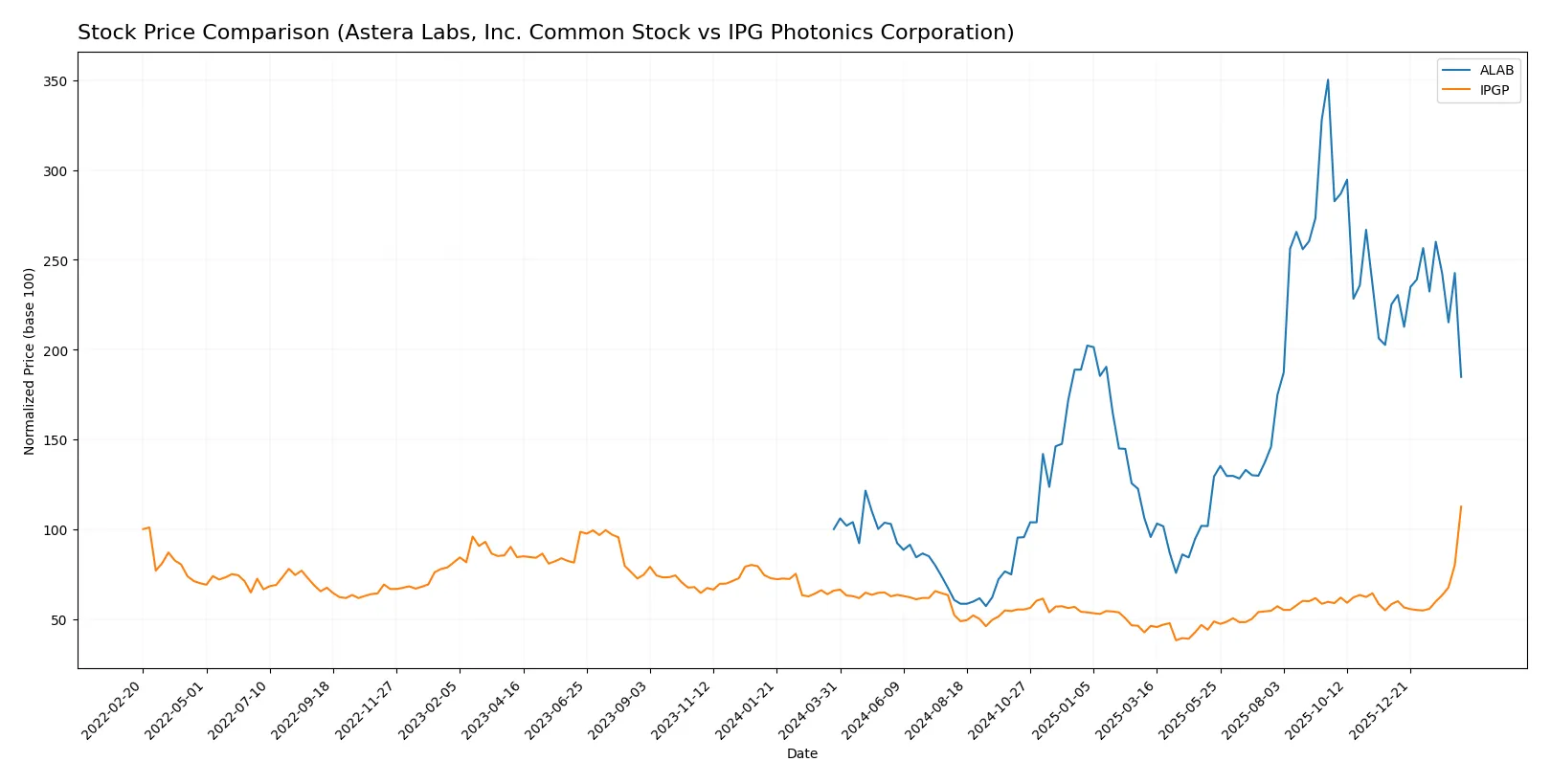

Which stock offers better returns?

The past year reveals contrasting dynamics: Astera Labs shows strong overall gains with recent pullback, while IPG Photonics accelerates sharply with robust buyer dominance.

Trend Comparison

Astera Labs, Inc. stock rose 84.74% over the past 12 months, marking a bullish trend with decelerating momentum. It hit a high of 245.2 and low of 40.0, showing significant volatility (std dev 50.35).

IPG Photonics Corporation gained 71.01% over the same period, also bullish but with accelerating momentum. Its price ranged from 52.12 to 153.91 with lower volatility (std dev 12.46). Recent gains accelerated sharply by 93.26%.

Astera Labs outperformed IPG Photonics in total annual returns, despite recent weakness. IPG shows stronger short-term acceleration and buyer dominance.

Target Prices

The consensus target prices for Astera Labs and IPG Photonics indicate promising upside potential from current levels.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Astera Labs, Inc. Common Stock | 165 | 225 | 202.14 |

| IPG Photonics Corporation | 110 | 180 | 151.67 |

Astera Labs’ consensus target is 56% above its current price of 129.32, signaling strong growth expectations. IPG Photonics’ target consensus closely aligns with its current price of 153.91, suggesting a balanced risk-reward profile.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Astera Labs, Inc. Common Stock Grades

The following table summarizes Astera Labs’ recent institutional grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-11 |

| Northland Capital Markets | Maintain | Outperform | 2025-12-09 |

| Northland Capital Markets | Upgrade | Outperform | 2025-11-17 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Barclays | Downgrade | Equal Weight | 2025-10-20 |

IPG Photonics Corporation Grades

The following table summarizes IPG Photonics’ recent institutional grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-02-13 |

| Raymond James | Downgrade | Outperform | 2026-02-13 |

| Roth Capital | Maintain | Buy | 2026-02-03 |

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Needham | Maintain | Hold | 2025-02-12 |

| Stifel | Maintain | Buy | 2025-02-12 |

Which company has the best grades?

IPG Photonics has a broader range of grades, including multiple Buy and Outperform ratings and a Strong Buy from Raymond James. Astera Labs mostly holds Buy and Outperform ratings, but with one downgrade to Equal Weight. Investors may see IPG Photonics’ grades as indicating relatively stronger institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Astera Labs, Inc. Common Stock (ALAB)

- Faces intense semiconductor sector competition with rapid innovation cycles.

IPG Photonics Corporation (IPGP)

- Competes in specialized fiber laser markets with pressure from emerging technologies.

2. Capital Structure & Debt

Astera Labs, Inc. Common Stock (ALAB)

- Zero debt, very strong interest coverage, but high current ratio may signal inefficient capital use.

IPG Photonics Corporation (IPGP)

- Also debt-free with strong interest coverage but lower liquidity ratios than ALAB.

3. Stock Volatility

Astera Labs, Inc. Common Stock (ALAB)

- Beta of 1.51 indicates higher volatility than the market, reflecting growth-stage risk.

IPG Photonics Corporation (IPGP)

- Beta near 1.03 shows moderate volatility, closer to broad market movements.

4. Regulatory & Legal

Astera Labs, Inc. Common Stock (ALAB)

- Subject to semiconductor export controls and IP protection risks.

IPG Photonics Corporation (IPGP)

- Faces regulatory scrutiny in global laser technology markets and export restrictions.

5. Supply Chain & Operations

Astera Labs, Inc. Common Stock (ALAB)

- Relies on complex semiconductor supply chains vulnerable to geopolitical tensions.

IPG Photonics Corporation (IPGP)

- Operations depend on specialized materials and manufacturing capacity with moderate risks.

6. ESG & Climate Transition

Astera Labs, Inc. Common Stock (ALAB)

- Early-stage efforts in sustainability; faces pressure to improve carbon footprint.

IPG Photonics Corporation (IPGP)

- Advanced manufacturing requires energy-intensive processes; ongoing transition risks exist.

7. Geopolitical Exposure

Astera Labs, Inc. Common Stock (ALAB)

- Headquartered in the US, exposed to US-China trade tensions impacting semiconductors.

IPG Photonics Corporation (IPGP)

- US-based but globally active, vulnerable to trade policies affecting laser components.

Which company shows a better risk-adjusted profile?

Astera Labs’ chief risk is its high stock volatility and stretched valuation metrics. IPG Photonics struggles with weak profitability and operational efficiency. Despite ALAB’s valuation concerns, its zero debt and strong liquidity provide a more resilient risk-adjusted profile. IPGP’s lower market cap and modest growth amplify its financial vulnerability, justifying caution.

Final Verdict: Which stock to choose?

Astera Labs (ALAB) stands out for its rapid revenue growth and scaling profitability, reflecting a potent operational engine fueled by aggressive R&D. Its superpower lies in unlocking value through innovation, though its sky-high valuation multiples and stretched current ratio warrant caution. ALAB suits investors pursuing aggressive growth with a tolerance for premium pricing risk.

IPG Photonics (IPGP) leverages a durable strategic moat in photonics with steady cash flow generation and a rock-solid balance sheet. It offers relative safety with a conservative capital structure and moderate valuation metrics. IPGP fits portfolios focused on Growth at a Reasonable Price, favoring stability amid sector cyclicality.

If you prioritize exponential growth fueled by innovation and can stomach valuation risk, ALAB outshines as the compelling choice due to its accelerating profitability and market momentum. However, if you seek better stability and a moat-backed business with reasonable valuation, IPGP offers superior risk-adjusted potential. Each caters to distinct investor profiles navigating a dynamic tech landscape.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Astera Labs, Inc. Common Stock and IPG Photonics Corporation to enhance your investment decisions: