Astera Labs, Inc. (ALAB) and indie Semiconductor, Inc. (INDI) are two innovative players in the semiconductor industry, each targeting rapidly evolving technology markets. Astera Labs focuses on connectivity solutions for cloud and AI infrastructure, while indie Semiconductor develops chips and software for advanced automotive applications. Their overlapping yet distinct innovation strategies make them compelling candidates for comparison. In this article, I will help you identify which company presents the most attractive investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Astera Labs and indie Semiconductor by providing an overview of these two companies and their main differences.

Astera Labs Overview

Astera Labs, Inc. specializes in designing, manufacturing, and selling semiconductor-based connectivity solutions focused on cloud and AI infrastructure. Their Intelligent Connectivity Platform offers data, network, and memory connectivity products built on a software-defined architecture. Founded in 2017 and based in Santa Clara, California, Astera Labs aims to enable high-performance cloud and AI infrastructure at scale with a current market cap of approximately 29.5B USD.

indie Semiconductor Overview

indie Semiconductor, Inc. provides automotive semiconductors and software solutions for advanced driver assistance, connected car, and electrification applications. Their products support a wide range of automotive systems including parking assistance, wireless charging, infotainment, and telematics. Founded in 2007 and headquartered in Aliso Viejo, California, indie Semiconductor operates with a market cap near 857M USD and focuses on enhancing user experience and connectivity in vehicles.

Key similarities and differences

Both Astera Labs and indie Semiconductor operate in the semiconductor industry within the technology sector and are headquartered in California. Astera Labs targets cloud and AI infrastructure connectivity, while indie Semiconductor focuses on automotive semiconductors and software solutions. Astera Labs has a significantly larger market capitalization and fewer employees, reflecting different scales and market niches. Both companies are publicly traded on NASDAQ but on different market segments.

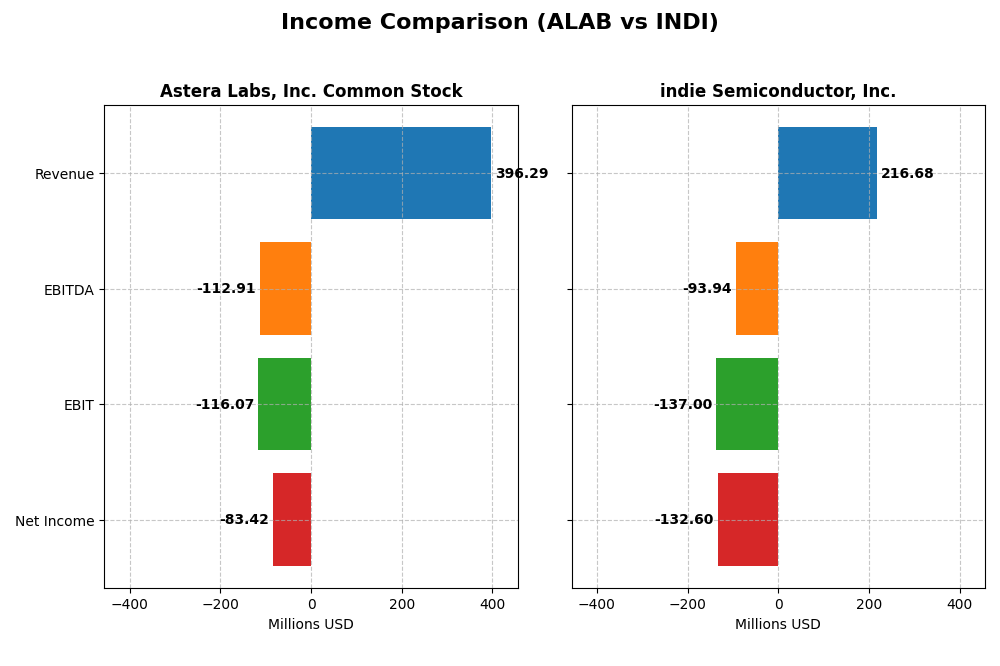

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for Astera Labs, Inc. and indie Semiconductor, Inc. based on their most recent fiscal year data.

| Metric | Astera Labs, Inc. Common Stock (ALAB) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Cap | 29.5B | 857M |

| Revenue | 396M | 217M |

| EBITDA | -113M | -94M |

| EBIT | -116M | -137M |

| Net Income | -83M | -133M |

| EPS | -0.64 | -0.76 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Astera Labs, Inc. Common Stock

Astera Labs showed strong revenue growth from $79.9M in 2022 to $396.3M in 2024, a 396% increase overall. Net income remained negative but improved from a loss of $58.3M in 2022 to $83.4M in 2024. Gross margins stayed robust at 76.4%, while EBIT and net margins stayed negative, reflecting ongoing investment costs. The 2024 year saw a sharp revenue increase but widening operating losses.

indie Semiconductor, Inc.

Indie Semiconductor’s revenue grew sharply from $22.6M in 2020 to $216.7M in 2024, an 858% rise. Net losses also deepened, from $97.5M in 2020 to $132.6M in 2024. Gross margin improved to 41.7% by 2024, but EBIT and net margins remained deeply negative, over -60%. The 2024 revenue slightly declined from 2023, with worsening EBIT and net margins, indicating pressure on profitability despite higher gross profits.

Which one has the stronger fundamentals?

Both companies exhibit strong revenue growth and improving gross margins but continue to report significant net losses and negative EBIT margins. Astera Labs demonstrates higher gross margins and a more favorable upward trend in net margin growth, while indie Semiconductor shows higher overall revenue growth but with larger losses and margin pressure. Both have balanced favorable and unfavorable income statement factors, resulting in a neutral fundamental outlook.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Astera Labs, Inc. Common Stock (ALAB) and indie Semiconductor, Inc. (INDI) based on their most recent fiscal year data for 2024.

| Ratios | Astera Labs, Inc. (ALAB) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | -8.65% | -31.73% |

| ROIC | -11.97% | -19.25% |

| P/E | -208.41 | -5.35 |

| P/B | 18.02 | 1.70 |

| Current Ratio | 11.71 | 4.82 |

| Quick Ratio | 11.21 | 4.23 |

| D/E | 0.0013 | 0.95 |

| Debt-to-Assets | 0.12% | 42.34% |

| Interest Coverage | 0 | -18.37 |

| Asset Turnover | 0.38 | 0.23 |

| Fixed Asset Turnover | 11.12 | 4.30 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Astera Labs, Inc. Common Stock

Astera Labs shows mostly unfavorable ratios with a negative net margin of -21.05% and a negative return on equity of -8.65%, indicating weak profitability and efficiency. The company’s current ratio is very high at 11.71, which may suggest inefficient asset usage. It does not pay dividends, likely reflecting reinvestment in growth or R&D priorities.

indie Semiconductor, Inc.

indie Semiconductor also reports unfavorable profitability ratios, with a net margin of -61.2% and a return on equity of -31.73%, signaling significant losses. Its debt-to-equity ratio is neutral at 0.95, but the interest coverage is negative, raising solvency concerns. The absence of dividends indicates a focus on growth and reinvestment rather than shareholder payouts.

Which one has the best ratios?

Both companies exhibit predominantly unfavorable financial ratios, with Astera Labs holding a slightly higher proportion of favorable metrics (35.71% vs. 21.43%) and a better quick ratio. However, both face profitability and efficiency challenges, and neither pays dividends, reflecting ongoing investment needs or operational difficulties.

Strategic Positioning

This section compares the strategic positioning of Astera Labs (ALAB) and indie Semiconductor (INDI), including their market position, key segments, and exposure to technological disruption:

Astera Labs (ALAB)

- Positioned as a cloud and AI infrastructure connectivity provider facing semiconductor industry competition.

- Key segments include data, network, memory connectivity products and technology services.

- Exposure linked to software-defined architecture enabling scalability in cloud and AI infrastructure.

indie Semiconductor (INDI)

- Focuses on automotive semiconductor market with competitive pressures in advanced driver assistance systems.

- Key segments cover automotive semiconductors, software solutions, and photonic components for vehicle applications.

- Exposure includes multiple photonic and electronic technologies for automotive and optical communication markets.

Astera Labs vs indie Semiconductor Positioning

Astera Labs has a concentrated focus on cloud and AI connectivity products, while indie Semiconductor targets a broader automotive semiconductor and software market. Astera Labs benefits from a unified software-defined approach; indie Semiconductor offers diverse photonic and electronic technologies.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC. Astera Labs shows improving profitability, while indie Semiconductor faces declining profitability, indicating a slightly better competitive advantage for Astera Labs based on MOAT evaluation.

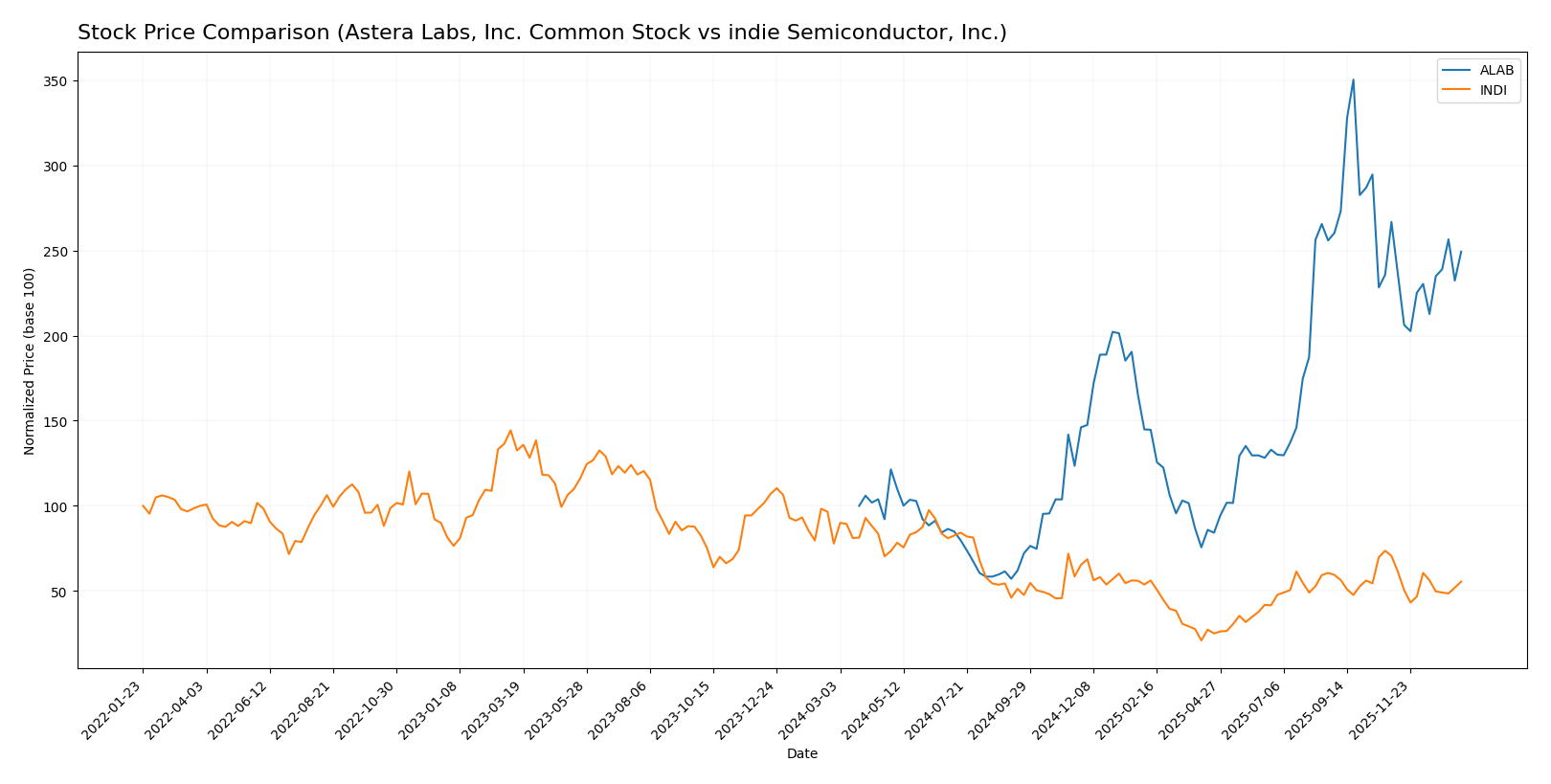

Stock Comparison

The stock price chart over the past 12 months displays a strong bullish trajectory for Astera Labs, Inc., with a notable deceleration in upward momentum, while indie Semiconductor, Inc. exhibits a sustained bearish trend marked by decelerating decline and lower volatility.

Trend Analysis

Astera Labs, Inc. (ALAB) showed a bullish trend with a 149.21% price increase over the past year, though recent months reveal a slight -6.55% pullback and decelerating growth amid high volatility. Indie Semiconductor, Inc. (INDI) experienced a bearish trend, declining -28.67% over the year with a further -21.38% drop recently, showing deceleration and very low volatility. Comparing both, Astera Labs delivered the highest market performance with significant gains versus indie Semiconductor’s sustained losses during the same period.

Target Prices

Here is the consensus target price overview for the companies analyzed.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Astera Labs, Inc. Common Stock | 225 | 165 | 202.14 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

Analysts expect Astera Labs to appreciate significantly, with a consensus target about 16% above the current price of 174.45 USD. indie Semiconductor’s target consensus matches its current price near 4.23 USD, suggesting limited upside.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Astera Labs, Inc. Common Stock (ALAB) and indie Semiconductor, Inc. (INDI):

Rating Comparison

ALAB Rating

- Rating: B, classified as Very Favorable.

- Discounted Cash Flow Score: 1, indicating Very Unfavorable valuation based on future cash flows.

- ROE Score: 4, Favorable, showing efficient profit generation from equity.

- ROA Score: 5, Very Favorable, demonstrating excellent asset utilization for earnings.

- Debt To Equity Score: 4, Favorable, reflecting a relatively strong balance sheet.

- Overall Score: 3, Moderate overall financial standing.

INDI Rating

- Rating: C-, status also Very Favorable.

- Discounted Cash Flow Score: 1, also Very Unfavorable for valuation.

- ROE Score: 1, Very Unfavorable, indicating weak efficiency in profit generation.

- ROA Score: 1, Very Unfavorable, suggesting poor asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk.

- Overall Score: 1, Very Unfavorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, ALAB holds a significantly stronger rating profile than INDI, with higher scores in return on equity, assets, debt management, and overall financial standing. INDI’s ratings and scores are uniformly very unfavorable except for a moderate price-to-book score not included here.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

ALAB Scores

- Altman Z-Score: 136.88, indicating a safe zone.

- Piotroski Score: 6, classified as average.

INDI Scores

- Altman Z-Score: 0.12, indicating a distress zone.

- Piotroski Score: 2, classified as very weak.

Which company has the best scores?

Based on the provided data, ALAB significantly outperforms INDI with a much higher Altman Z-Score in the safe zone and a stronger Piotroski Score classified as average versus very weak for INDI.

Grades Comparison

Here is a comparison of the latest available grades for Astera Labs, Inc. Common Stock and indie Semiconductor, Inc.:

Astera Labs, Inc. Common Stock Grades

This table summarizes recent grades from established grading companies for Astera Labs, Inc. Common Stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Northland Capital Markets | Maintain | Outperform | 2025-12-09 |

| Northland Capital Markets | Upgrade | Outperform | 2025-11-17 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| Needham | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Barclays | Downgrade | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

Astera Labs has mostly maintained buy and outperform ratings with a single downgrade to equal weight, indicating generally positive analyst sentiment.

indie Semiconductor, Inc. Grades

This table shows recent grades from recognized grading companies for indie Semiconductor, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

indie Semiconductor shows a consistent pattern of buy and overweight ratings with one neutral rating, reflecting steady analyst confidence.

Which company has the best grades?

Both companies have received predominantly positive grades, but Astera Labs shows slightly stronger recent upward momentum with an outperform consensus and notable upgrades, while indie Semiconductor maintains consistent buy ratings. This difference could influence investor perception of growth potential and risk exposure.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Astera Labs, Inc. (ALAB) and indie Semiconductor, Inc. (INDI) based on their recent financial and operational data.

| Criterion | Astera Labs, Inc. (ALAB) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Primarily product-driven with a small technology service segment (Product: $393M, Tech Service: $3.2M) | Balanced product and services, but services declining (Product: $203M, Service: $14M in 2024) |

| Profitability | Negative net margin (-21%), ROIC negative (-12%), but ROIC trending upward | Significant losses: net margin -61%, ROIC -19%, declining ROIC trend |

| Innovation | Improving ROIC suggests growing operational efficiency and potential innovation | Declining profitability and ROIC indicate challenges in sustaining innovation |

| Global presence | Not explicitly detailed, but strong fixed asset turnover (11.12) indicates efficient asset use | Moderate fixed asset turnover (4.3), indicating less efficiency in asset utilization |

| Market Share | Estimated stable with growing profitability trend despite value destruction | Market share under pressure given declining profitability and value destruction |

Key takeaways: Both companies face profitability challenges and are currently destroying value. However, Astera Labs shows signs of improvement in profitability and operational efficiency, whereas indie Semiconductor struggles with declining profitability and weaker financial stability. Investors should weigh these dynamics carefully in risk management decisions.

Risk Analysis

The table below summarizes key risk factors for Astera Labs, Inc. (ALAB) and indie Semiconductor, Inc. (INDI) based on the most recent financial and market data for 2024.

| Metric | Astera Labs, Inc. (ALAB) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | Beta 1.51 – Moderately volatile | Beta 2.54 – Highly volatile |

| Debt level | Very low debt (D/E 0.0, debt/assets 0.12%) | Moderate debt (D/E 0.95, debt/assets 42.34%) |

| Regulatory Risk | Moderate – Semiconductor industry regulations | Moderate to High – Automotive semiconductor regulations |

| Operational Risk | Moderate – New IPO, scaling operations | High – Negative margins and operational losses |

| Environmental Risk | Low – Standard semiconductor manufacturing | Moderate – Automotive sector focus with evolving regulations |

| Geopolitical Risk | Moderate – US-based with global supply chain exposure | Moderate to High – Automotive supply chains sensitive to global trade |

Astera Labs shows moderate market volatility but benefits from a very low debt burden and scores safely on bankruptcy risk, indicating lower financial distress. Indie Semiconductor faces greater market volatility and significantly higher debt levels, with financial distress signals including a very weak Piotroski score and Altman Z-score in the distress zone. The most impactful risks for INDI are high operational losses and financial instability, while ALAB’s primary concerns relate to market volatility and scaling post-IPO.

Which Stock to Choose?

Astera Labs, Inc. (ALAB) shows strong income growth with a 242% revenue increase in 2024, but profitability remains negative with a -21.05% net margin and unfavorable key ratios like ROE and ROIC. Its debt is low, and the overall rating is very favorable.

indie Semiconductor, Inc. (INDI) experienced a slight revenue decline of -2.91% in 2024 and a steep negative net margin of -61.2%. Financial ratios and profitability are largely unfavorable, with higher debt levels and a very unfavorable rating despite some moderate valuation metrics.

For investors, ALAB may appear more attractive for those focusing on growth potential and improving profitability, while INDI could be interpreted as higher risk with declining profitability, possibly suited for risk-tolerant profiles seeking turnaround opportunities. The ratings and income evaluations suggest careful consideration of risk tolerance and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Astera Labs, Inc. Common Stock and indie Semiconductor, Inc. to enhance your investment decisions: