Home > Comparison > Technology > ALAB vs CRUS

The strategic rivalry between Astera Labs and Cirrus Logic defines the current trajectory of the semiconductor industry. Astera Labs operates as a cutting-edge connectivity solutions provider for cloud and AI infrastructure, while Cirrus Logic excels as a fabless semiconductor specialist in mixed-signal processing for audio and industrial applications. This head-to-head highlights a contrast between innovative infrastructure growth and diversified mixed-signal expertise. This analysis will identify which business model offers superior risk-adjusted returns for a balanced portfolio.

Table of contents

Companies Overview

Astera Labs and Cirrus Logic are key players in the semiconductor industry, each shaping different tech niches.

Astera Labs, Inc. Common Stock: Cloud and AI Connectivity Innovator

Astera Labs focuses on semiconductor-based connectivity solutions for cloud and AI infrastructure. Its core revenue comes from its Intelligent Connectivity Platform, offering data, network, and memory connectivity products built on a software-defined architecture. In 2026, the company emphasizes scaling high-performance infrastructure deployments to meet growing cloud computing demands.

Cirrus Logic, Inc.: Mixed-Signal Audio and Industrial Semiconductor Specialist

Cirrus Logic leads in low-power, high-precision mixed-signal processing solutions. Its revenue engine relies on audio codecs, amplifiers, and digital signal processors that enhance sound quality in consumer electronics and industrial devices. The company’s 2026 strategy targets expanding its footprint in portable audio and industrial energy management markets.

Strategic Collision: Similarities & Divergences

Both firms operate within semiconductors but pursue distinct philosophies: Astera Labs drives a platform approach for cloud AI, while Cirrus Logic prioritizes specialized mixed-signal chips for audio and industrial sectors. Their battleground centers on innovation in connectivity versus integrated audio solutions. Astera Labs presents a growth-oriented profile; Cirrus Logic offers steadier diversification across consumer and industrial applications.

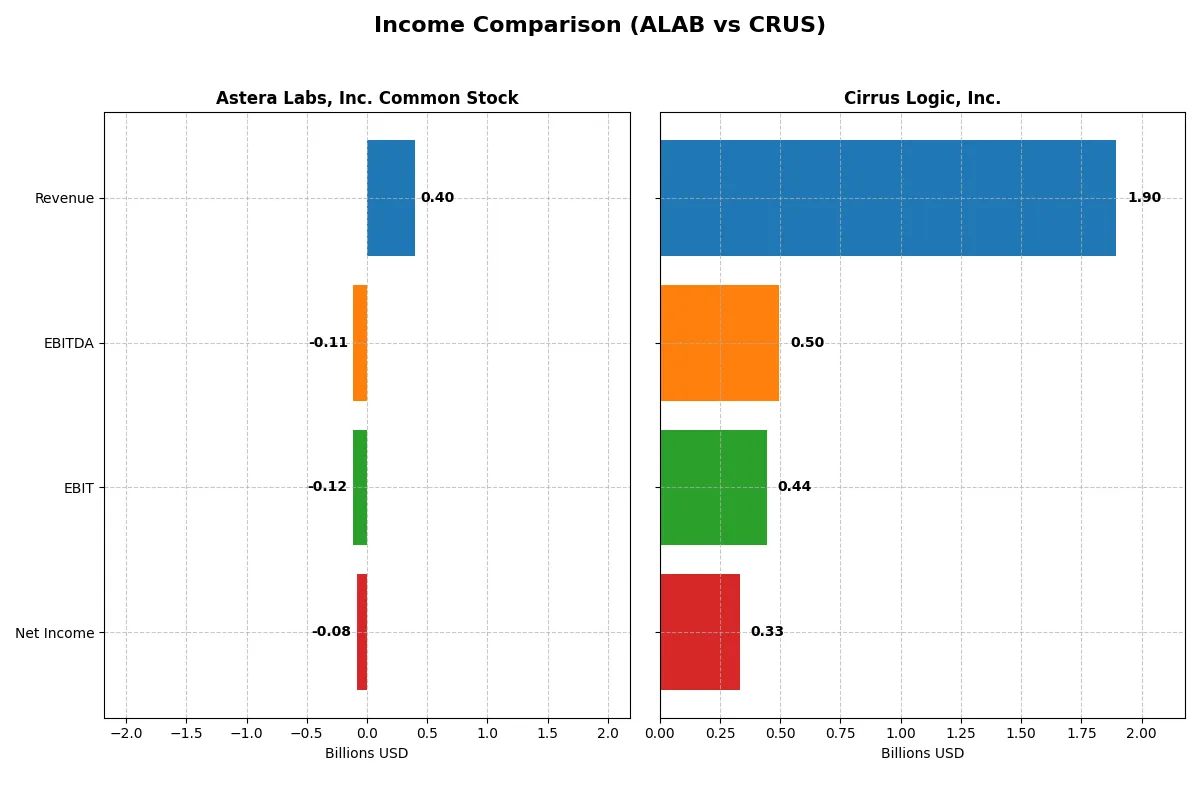

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Astera Labs, Inc. Common Stock (ALAB) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| Revenue | 396M | 1.90B |

| Cost of Revenue | 94M | 900M |

| Operating Expenses | 419M | 586M |

| Gross Profit | 303M | 996M |

| EBITDA | -113M | 497M |

| EBIT | -116M | 445M |

| Interest Expense | 0 | 0.9M |

| Net Income | -83M | 332M |

| EPS | -0.64 | 6.24 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison uncovers which company runs its business engine with greater efficiency and profitability in recent years.

Astera Labs, Inc. Common Stock Analysis

Astera Labs has shown impressive revenue growth, surging from 80M in 2022 to nearly 400M in 2024. Despite a strong gross margin of 76%, the company struggles with negative EBIT and net income margins, reflecting ongoing losses and high operating expenses. The 2024 net loss of 83M signals that momentum is hampered by inefficient cost control.

Cirrus Logic, Inc. Analysis

Cirrus Logic demonstrates steady revenue growth, reaching 1.9B in 2025 with a consistent gross margin above 50%. The company maintains positive EBIT and net income margins of 23% and 17%, respectively, signaling robust profitability. Its 2025 net income of 331M and rising EPS highlight operational efficiency and sustained momentum in earnings growth.

Margin Strength vs. Profit Sustainability

Cirrus Logic clearly outperforms Astera Labs by delivering strong, profitable growth with solid margins and positive net income. Astera Labs shows remarkable top-line expansion but remains unprofitable, weighed down by high expenses. Investors favor Cirrus Logic’s proven earnings power and margin discipline over Astera Labs’ growth-at-any-cost profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Astera Labs, Inc. (ALAB) | Cirrus Logic, Inc. (CRUS) |

|---|---|---|

| ROE | -8.65% | 17.01% |

| ROIC | -11.97% | 14.20% |

| P/E | -208.41 | 15.95 |

| P/B | 18.02 | 2.71 |

| Current Ratio | 11.71 | 6.35 |

| Quick Ratio | 11.21 | 4.82 |

| D/E (Debt-to-Equity) | 0.0013 | 0.0737 |

| Debt-to-Assets | 0.12% | 6.18% |

| Interest Coverage | 0 | 457 |

| Asset Turnover | 0.38 | 0.81 |

| Fixed Asset Turnover | 11.12 | 6.62 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence in its financial health and market perception.

Astera Labs, Inc. Common Stock

Astera Labs shows deeply negative profitability with ROE at -8.65% and net margin at -21.05%, signaling operational struggles. Its valuation looks stretched, reflected in a negative P/E and a high price-to-book ratio of 18.02. The company pays no dividend, instead reinvesting heavily in R&D, which consumes over 50% of revenue, indicating a growth-focused strategy despite current inefficiency.

Cirrus Logic, Inc.

Cirrus Logic delivers solid profitability with a 17.01% ROE and a healthy 17.48% net margin. Its valuation appears reasonable, with a P/E of 15.95 and price-to-book near 2.7, suggesting fair market pricing. The firm does not pay dividends but maintains strong free cash flow and invests around 23% of revenue in R&D, balancing growth with operational efficiency and shareholder value preservation.

Profitability vs. Valuation: Balancing Risk and Reward

Cirrus Logic offers a superior balance of profitability and valuation compared to Astera Labs, which struggles with negative returns and stretched multiples. Investors seeking operational stability and reasonable market pricing may prefer Cirrus Logic’s profile. Those tolerant of risk and focused on long-term growth might consider Astera’s heavy R&D reinvestment despite current losses.

Which one offers the Superior Shareholder Reward?

Astera Labs (ALAB) pays no dividends and shows negative net margins, reflecting ongoing investments rather than shareholder distributions. Cirrus Logic (CRUS) also pays no dividends but generates strong free cash flow (FCF) of 7.82/share in 2025, supporting robust buybacks. CRUS’s moderate payout ratio of zero with large buybacks aligns with sustainable capital allocation. ALAB’s lack of distributions and heavy losses suggest limited near-term shareholder reward. I see CRUS offering a superior total return profile in 2026, driven by healthy margins, cash generation, and buyback intensity that outpaces ALAB’s reinvestment strategy.

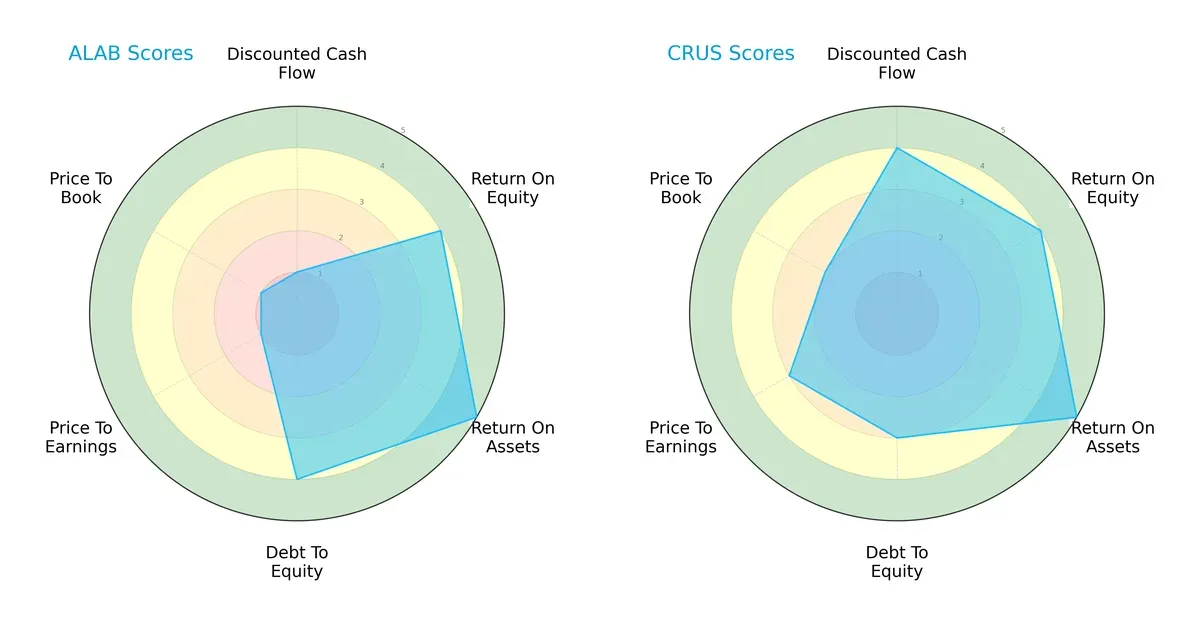

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Astera Labs, Inc. and Cirrus Logic, Inc., highlighting their financial strengths and valuation positioning:

Astera Labs shows strength in asset utilization (ROA 5) and conservative leverage (Debt/Equity 4) but suffers from poor valuation scores (PE and PB both 1) and weak discounted cash flow (DCF 1). Cirrus Logic presents a more balanced profile with strong DCF (4), solid ROE (4), and moderate valuation scores (PE 3, PB 2). Cirrus relies on consistent cash flow and fair valuation, while Astera leans heavily on operational efficiency but faces valuation skepticism.

Bankruptcy Risk: Solvency Showdown

Astera Labs and Cirrus Logic both reside comfortably in the safe zone, yet Astera’s Altman Z-Score (121.1) vastly exceeds Cirrus’s (12.4), reflecting exceptionally robust financial stability and minimal bankruptcy risk for Astera:

Financial Health: Quality of Operations

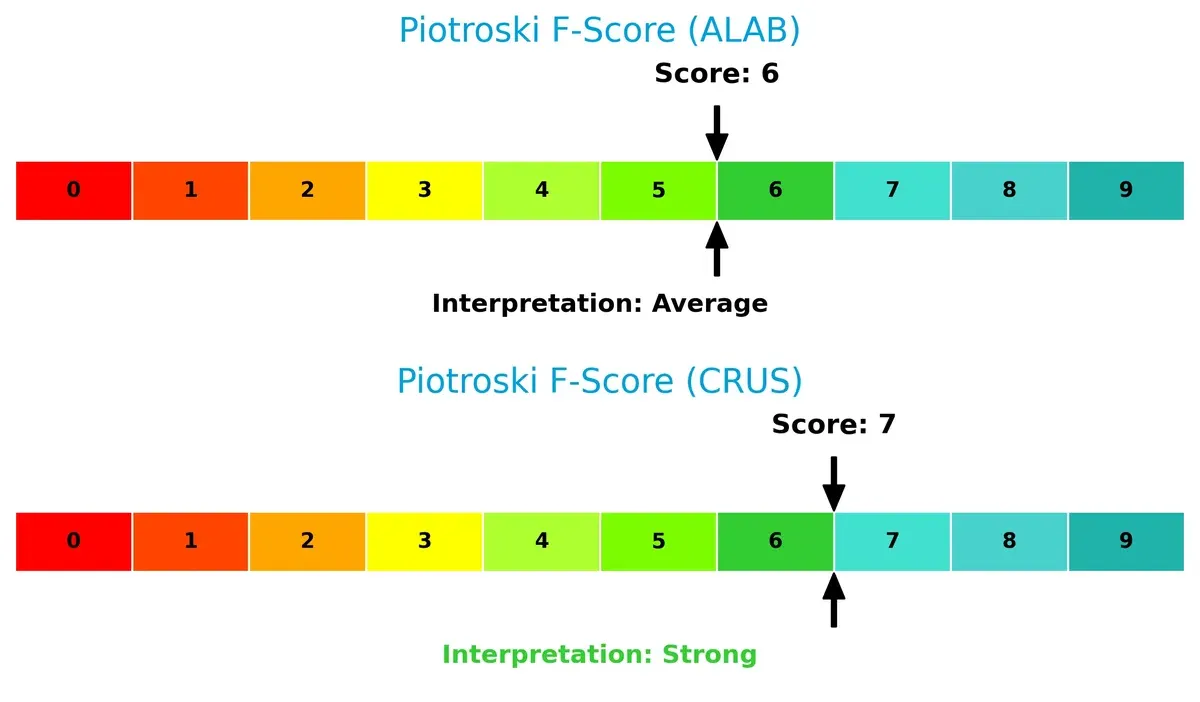

Cirrus Logic edges ahead with a Piotroski F-Score of 7, signaling strong financial health and operational quality. Astera’s score of 6 is average, suggesting room for improvement in internal metrics compared to Cirrus:

How are the two companies positioned?

This section dissects the operational DNA of ALAB and CRUS by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and reveal which model offers the most resilient, sustainable advantage today.

Revenue Segmentation: The Strategic Mix

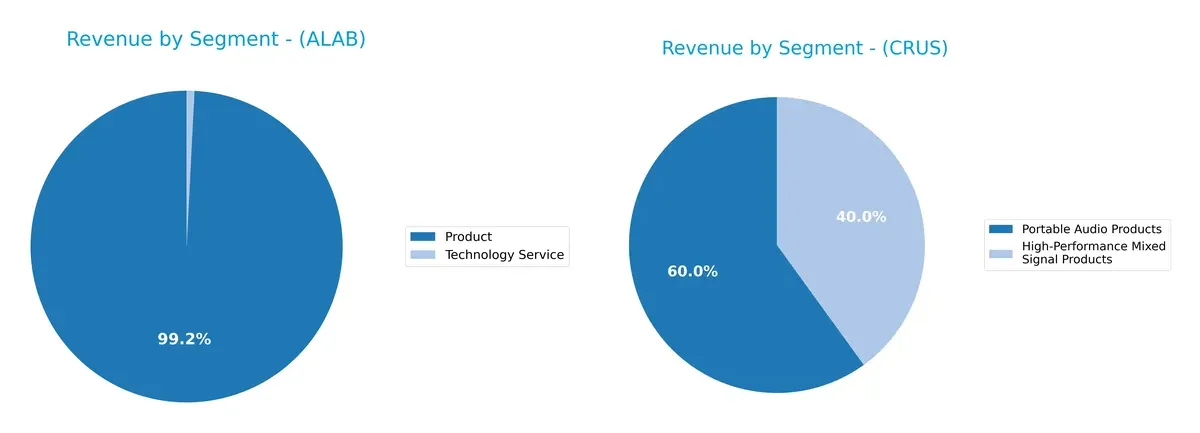

This comparison dissects how Astera Labs and Cirrus Logic diversify their income streams and reveals where each firm places its primary sector bets:

Astera Labs anchors 393M in Product revenue, with a minimal 3.2M from Technology Service, showing a concentrated focus. Cirrus Logic posts a broader mix, generating 1.14B from Portable Audio and 759M from High-Performance Mixed Signal Products. Cirrus Logic’s diversification reduces concentration risk and leverages its ecosystem lock-in, whereas Astera Labs’ heavy Product reliance signals vulnerability to single-segment shifts.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Astera Labs (ALAB) and Cirrus Logic (CRUS) based on diversification, profitability, financials, innovation, global presence, and market share:

ALAB Strengths

- High quick ratio (11.21) indicates strong short-term liquidity

- Zero debt enhances financial flexibility

- Low debt-to-assets ratio (0.12) reduces financial risk

- Strong fixed asset turnover (11.12) shows efficient use of fixed assets

CRUS Strengths

- Consistently high net margin (17.48%) and ROE (17.01%) demonstrate profitability

- Favorable ROIC (14.2%) exceeds WACC (9.07%) indicating value creation

- Very high interest coverage (495.45) ensures debt serviceability

- Diverse product lines with strong revenue streams

- Broad global footprint with significant China and Asia sales

ALAB Weaknesses

- Negative net margin (-21.05%) and ROE (-8.65%) indicate unprofitability

- ROIC (-11.97%) well below WACC (10.96%) signals value destruction

- Extremely high P/B ratio (18.02) suggests overvaluation or low asset base

- Zero interest coverage implies inability to cover interest expenses

- Low asset turnover (0.38) may reflect inefficient asset use

CRUS Weaknesses

- Current ratio (6.35) flagged as unfavorable, possibly indicating inventory or receivables issues

- Dividend yield is zero, offering no income to shareholders

- PE ratio (15.95) and PB (2.71) are neutral, reflecting average valuation

- Asset turnover (0.81) is neutral, leaving room for efficiency gains

Both companies show distinct profiles: ALAB’s financials reflect early-stage challenges and asset efficiency, while CRUS boasts strong profitability and global diversification. ALAB’s weaknesses highlight operational and valuation risks, whereas CRUS’s minor liquidity concerns contrast with solid earnings. Each must tailor strategies to leverage strengths and address weaknesses in competitive markets.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat alone shields long-term profits from relentless competitive erosion, defining sustainable value creation and market leadership:

Astera Labs, Inc. Common Stock: Innovative Connectivity Platform Moat

Astera Labs leverages intangible assets with its software-defined architecture, reflected in soaring revenue growth but negative EBIT margins. Its expanding AI infrastructure market could deepen this moat, though profitability remains pressured.

Cirrus Logic, Inc.: Precision Audio and Mixed-Signal Solutions Moat

Cirrus Logic commands a cost and intangible asset moat with stable, high EBIT margins and growing ROIC. Unlike Astera, it generates consistent profits while expanding into emerging audio and industrial applications.

Connectivity Innovation vs. Precision Signal Mastery

Cirrus Logic holds the deeper moat, earning ROIC above WACC with durable profitability. Astera Labs shows promising growth but currently destroys value. Cirrus is better equipped to defend and grow market share in 2026.

Which stock offers better returns?

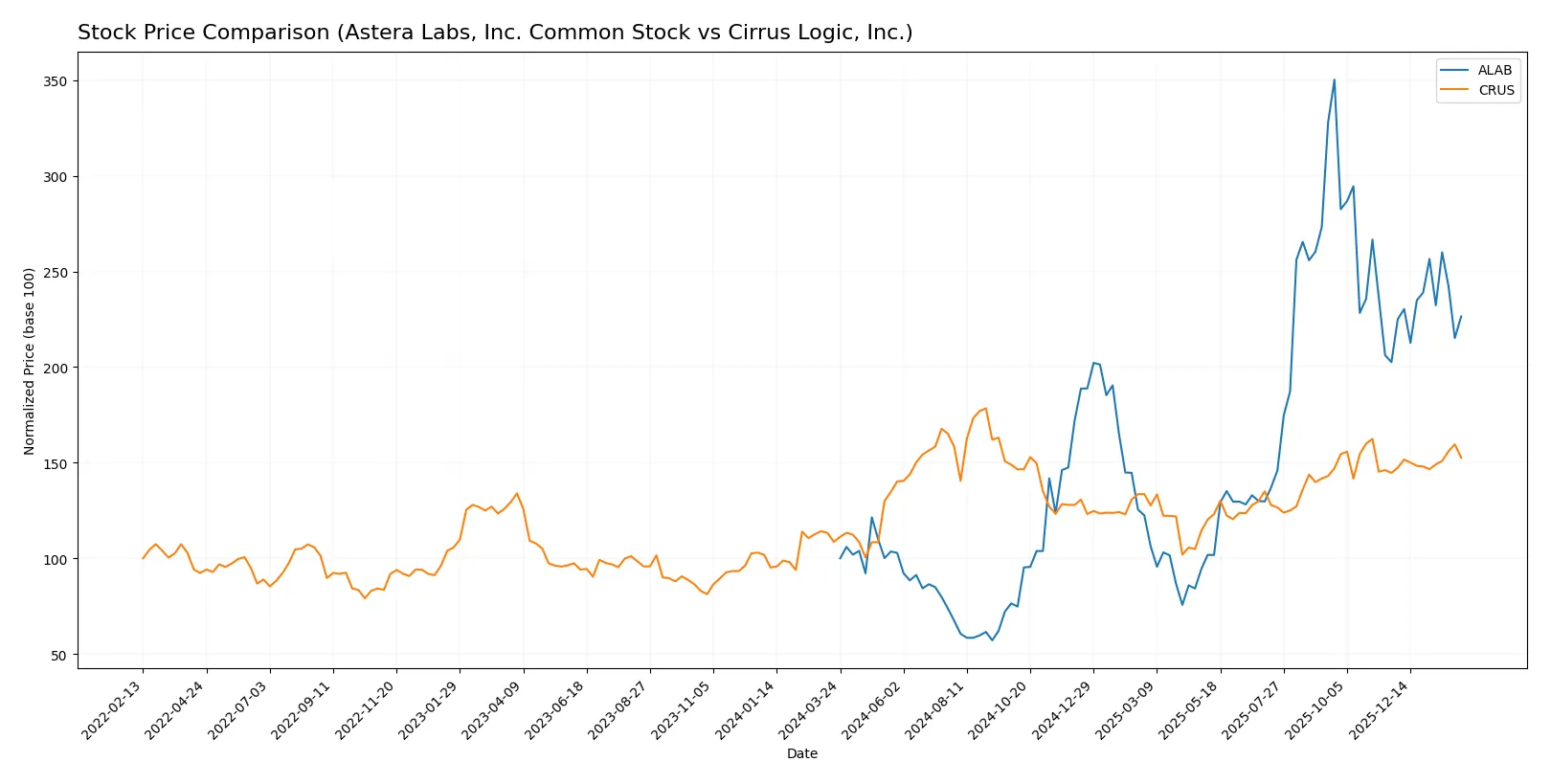

The past year shows strong bullish trends for both stocks, with Astera Labs surging significantly higher and Cirrus Logic gaining steadily amid rising trading volumes.

Trend Comparison

Astera Labs, Inc. stock rose 126.46% over the past 12 months, marking a bullish trend with decelerating momentum. Its price ranged from 40.0 to 245.2, showing notable volatility (std dev 50.42).

Cirrus Logic, Inc. gained 40.5% over the same period, also bullish but accelerating in momentum. Its price moved between 82.02 and 145.69, with lower volatility (std dev 14.36) than Astera Labs.

Astera Labs outperformed Cirrus Logic significantly in total return over the past year, despite higher volatility and decelerating trend momentum.

Target Prices

Analysts present a cautiously optimistic target consensus for both Astera Labs and Cirrus Logic.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Astera Labs, Inc. Common Stock | 165 | 225 | 202.14 |

| Cirrus Logic, Inc. | 100 | 155 | 138.75 |

Astera Labs’ consensus target at 202.14 exceeds its current 158.52 price, signaling upside potential. Cirrus Logic’s 138.75 target also surpasses its 124.58 price, indicating moderate expected growth.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

This section compares the recent grades assigned to Astera Labs, Inc. and Cirrus Logic, Inc. by major financial institutions:

Astera Labs, Inc. Common Stock Grades

The following table summarizes Astera Labs’ recent grades from reputable analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Northland Capital Markets | Maintain | Outperform | 2025-12-09 |

| Northland Capital Markets | Upgrade | Outperform | 2025-11-17 |

| Needham | Maintain | Buy | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Barclays | Downgrade | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

Cirrus Logic, Inc. Grades

Below is a summary of Cirrus Logic’s latest analyst grades from established firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2025-11-05 |

| Keybanc | Maintain | Overweight | 2025-11-05 |

| Stifel | Maintain | Buy | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Stifel | Maintain | Buy | 2025-09-12 |

| Barclays | Maintain | Equal Weight | 2025-05-07 |

| Barclays | Maintain | Equal Weight | 2025-04-22 |

| Stifel | Maintain | Buy | 2025-04-17 |

Which company has the best grades?

Astera Labs generally holds a stronger consensus with multiple “Buy” and “Outperform” grades, including an upgrade by Northland Capital Markets. Cirrus Logic maintains mostly “Buy” and “Overweight” ratings but lacks recent upgrades. This pattern suggests Astera Labs currently enjoys more positive analyst sentiment, potentially influencing investor confidence and market interest.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Astera Labs, Inc. Common Stock (ALAB)

- Faces intense competition in semiconductor connectivity for AI infrastructure with rapid innovation demands.

Cirrus Logic, Inc. (CRUS)

- Competes in mixed-signal semiconductor space with established products but faces pressure to innovate in audio and industrial markets.

2. Capital Structure & Debt

Astera Labs, Inc. Common Stock (ALAB)

- Zero debt and strong liquidity but unfavorable interest coverage hints at limited earnings to cover fixed costs.

Cirrus Logic, Inc. (CRUS)

- Low debt with strong interest coverage supports financial flexibility though current ratio below ideal.

3. Stock Volatility

Astera Labs, Inc. Common Stock (ALAB)

- Exhibits high beta (1.51), reflecting higher stock price volatility and sensitivity to market swings.

Cirrus Logic, Inc. (CRUS)

- More stable with beta of 1.14, showing moderate price fluctuations relative to the market.

4. Regulatory & Legal

Astera Labs, Inc. Common Stock (ALAB)

- Subject to semiconductor export controls and IP protections critical in US-China tech tensions.

Cirrus Logic, Inc. (CRUS)

- Faces regulatory scrutiny in US and international markets, particularly on product safety and environmental compliance.

5. Supply Chain & Operations

Astera Labs, Inc. Common Stock (ALAB)

- Operates in a complex semiconductor supply chain vulnerable to chip shortages and logistics disruptions.

Cirrus Logic, Inc. (CRUS)

- Supply chain diversified but exposed to raw material price volatility and manufacturing capacity constraints.

6. ESG & Climate Transition

Astera Labs, Inc. Common Stock (ALAB)

- Emerging firm with limited ESG track record; faces pressure to align with green manufacturing and energy efficiency.

Cirrus Logic, Inc. (CRUS)

- More established with ongoing ESG initiatives but must accelerate climate risk mitigation in operations.

7. Geopolitical Exposure

Astera Labs, Inc. Common Stock (ALAB)

- High exposure to US-China tensions impacting semiconductor supply and technology transfers.

Cirrus Logic, Inc. (CRUS)

- Moderate geopolitical risk with global sales but less concentrated in conflict zones.

Which company shows a better risk-adjusted profile?

Cirrus Logic demonstrates a stronger risk-adjusted profile due to superior profitability, manageable leverage, and lower stock volatility. Astera Labs faces significant operational and market risks amplified by negative profitability and high beta. The single most impactful risk for Astera Labs is its weak earnings and unfavorable capital efficiency metrics, which threaten sustainability. Cirrus Logic’s most pressing risk lies in supply chain vulnerabilities amid raw material price fluctuations. Recent data shows Astera Labs’s -21% net margin and negative ROIC starkly contrast Cirrus Logic’s 17.5% net margin, underscoring the wider risk gap.

Final Verdict: Which stock to choose?

Astera Labs excels as an innovation engine with rapid revenue growth fueling its potential. Its superpower lies in aggressive investment in R&D, positioning it for future breakthroughs. The point of vigilance is its current inability to convert this into profitability, which could pressure cash flow. It suits aggressive growth portfolios willing to weather volatility for outsized gains.

Cirrus Logic boasts a durable moat with consistent profitability and strong free cash flow, demonstrating efficient capital allocation. Its strategic advantage in audio semiconductor markets provides reliable recurring revenue and safety. Compared to Astera Labs, it offers better financial stability, fitting growth-at-a-reasonable-price portfolios seeking steady returns.

If you prioritize aggressive innovation and high growth potential, Astera Labs is the compelling choice due to its rapid top-line expansion and R&D focus. However, if you seek stable profitability and value creation with a durable moat, Cirrus Logic offers better stability and a proven track record. Both present distinct risk-reward profiles aligned with different investor appetites.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Astera Labs, Inc. Common Stock and Cirrus Logic, Inc. to enhance your investment decisions: