Home > Comparison > Technology > ASML vs MU

The strategic rivalry between ASML Holding N.V. and Micron Technology, Inc. shapes the semiconductor industry’s evolution. ASML excels as a capital-intensive equipment producer specializing in advanced lithography systems. In contrast, Micron operates as a high-volume memory manufacturer focusing on DRAM and NAND products. This clash highlights a battle between precision technology leadership and mass-market memory growth. This analysis will identify which trajectory delivers the superior risk-adjusted return for a diversified portfolio in 2026.

Table of contents

Companies Overview

ASML Holding N.V. and Micron Technology, Inc. both shape the semiconductor industry but serve distinctly different market needs.

ASML Holding N.V.: Advanced Lithography Pioneer

ASML dominates the semiconductor equipment sector by producing cutting-edge lithography machines essential for chip manufacturing. Its core revenue stems from sales and services of extreme ultraviolet (EUV) and deep ultraviolet (DUV) lithography systems. In 2026, ASML focuses strategically on expanding its computational lithography and inspection technologies to support next-generation semiconductor nodes.

Micron Technology, Inc.: Memory and Storage Specialist

Micron leads in memory and storage solutions, designing and selling DRAM, NAND, and NOR products globally. Its revenue engine revolves around supplying memory for cloud servers, mobile devices, and enterprise markets. The company’s strategic priority in 2026 emphasizes growth across embedded and SSD segments to capture demand in automotive and industrial applications.

Strategic Collision: Similarities & Divergences

Both firms operate within semiconductors but differ fundamentally: ASML excels in capital equipment manufacturing, while Micron focuses on component-level memory products. Their primary clash lies in enabling semiconductor innovation—ASML’s tools drive chip fabrication, whereas Micron provides critical memory components. These differences frame distinct risk-return profiles, with ASML’s high-tech equipment sales contrasting Micron’s volume-driven memory market exposure.

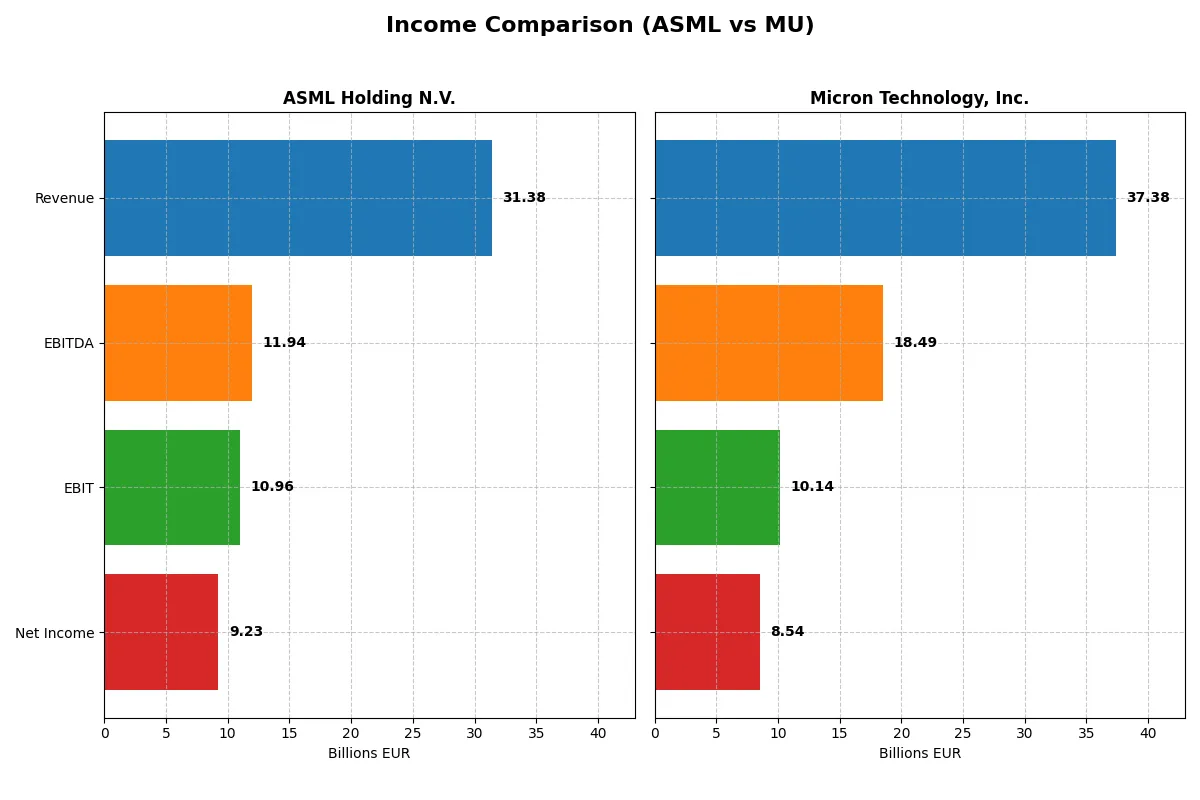

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | ASML Holding N.V. (ASML) | Micron Technology, Inc. (MU) |

|---|---|---|

| Revenue | 31.4B EUR | 37.4B USD |

| Cost of Revenue | 14.8B EUR | 22.5B USD |

| Operating Expenses | 5.7B EUR | 5.0B USD |

| Gross Profit | 16.6B EUR | 14.9B USD |

| EBITDA | 11.9B EUR | 18.5B USD |

| EBIT | 11.0B EUR | 10.1B USD |

| Interest Expense | 0 EUR | 477M USD |

| Net Income | 9.2B EUR | 8.5B USD |

| EPS | 23.76 EUR | 7.65 USD |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

The income statement comparison uncovers which company runs a more efficient and profitable business engine through recent growth and margin dynamics.

ASML Holding N.V. Analysis

ASML’s revenue climbs steadily from 18.6B EUR in 2021 to 31.4B EUR in 2025, with net income rising from 5.9B to 9.2B EUR. Gross margins hold strong above 50%, and net margins near 30%, signaling excellent profitability. In 2025, ASML’s 11% revenue growth and 9.8% net margin expansion confirm robust momentum and operational efficiency.

Micron Technology, Inc. Analysis

Micron’s revenue surged from 27.7B USD in 2021 to 37.4B USD in 2025, with net income recovering sharply from a loss in 2023 to 8.5B USD in 2025. Gross margin improved to nearly 40%, and net margin reached 22.8%, reflecting a strong turnaround. The 48.9% revenue boost and 637% net margin growth in 2025 highlight powerful growth and margin recovery.

Margin Leadership vs. High Growth Rebound

ASML exhibits superior margin control, sustaining over 50% gross and nearly 30% net margins consistently, while growing revenue steadily. Micron impresses with rapid growth and margin recovery post-2023 losses, but with lower overall margin levels. For investors prioritizing stable profitability, ASML’s profile stands out; for those seeking aggressive growth rebound, Micron offers compelling momentum.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | ASML Holding N.V. (ASML) | Micron Technology, Inc. (MU) |

|---|---|---|

| ROE | 47.1% | 15.8% |

| ROIC | 34.1% | 12.1% |

| P/E | 38.3 | 15.9 |

| P/B | 18.0 | 2.51 |

| Current Ratio | 1.26 | 2.52 |

| Quick Ratio | 0.79 | 1.79 |

| D/E (Debt-to-Equity) | 0.14 | 0.28 |

| Debt-to-Assets | 5.4% | 18.5% |

| Interest Coverage | N/A | 20.7 |

| Asset Turnover | 0.62 | 0.45 |

| Fixed Asset Turnover | 3.81 | 0.79 |

| Payout Ratio | 26.5% | 6.1% |

| Dividend Yield | 0.69% | 0.38% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and operational strengths crucial to investment decisions.

ASML Holding N.V.

ASML demonstrates stellar profitability with a 47.1% ROE and a 29.4% net margin, reflecting operational excellence. However, its valuation is stretched, with a 38.3 P/E and 18.1 P/B, signaling premium pricing. Shareholders receive a modest 0.69% dividend yield, indicating some return amid strong reinvestment in R&D (14.4% of revenue).

Micron Technology, Inc.

Micron posts a solid but lower 15.8% ROE and a 22.8% net margin, showing decent efficiency. The stock trades at a more reasonable 15.9 P/E and 2.5 P/B, highlighting fair valuation. It delivers a 0.38% dividend yield but invests heavily in growth and R&D (10.2% of revenue), balancing shareholder returns with future potential.

Premium Valuation vs. Operational Safety

ASML commands a premium valuation justified by superior returns and innovation-driven reinvestment. Micron offers a more conservative valuation with balanced profitability and stronger liquidity ratios. Investors seeking high operational efficiency at a premium may prefer ASML, while those favoring valuation discipline and liquidity might lean toward Micron.

Which one offers the Superior Shareholder Reward?

I observe ASML Holding N.V. maintains a disciplined dividend payout around 26-34% with yields near 0.7%-1.2%, supported by strong free cash flow coverage above 80%. Its buyback program is moderate but consistent, enhancing total return sustainably. Micron Technology, Inc. offers a lower dividend yield around 0.3%-0.7% with a very low payout ratio near 6%, signaling a cautious distribution policy. Micron’s buybacks have been more aggressive recently, yet free cash flow coverage is weak, raising sustainability concerns. I conclude ASML delivers a more balanced and sustainable shareholder reward in 2026, combining reliable dividends and prudent buybacks for superior total returns.

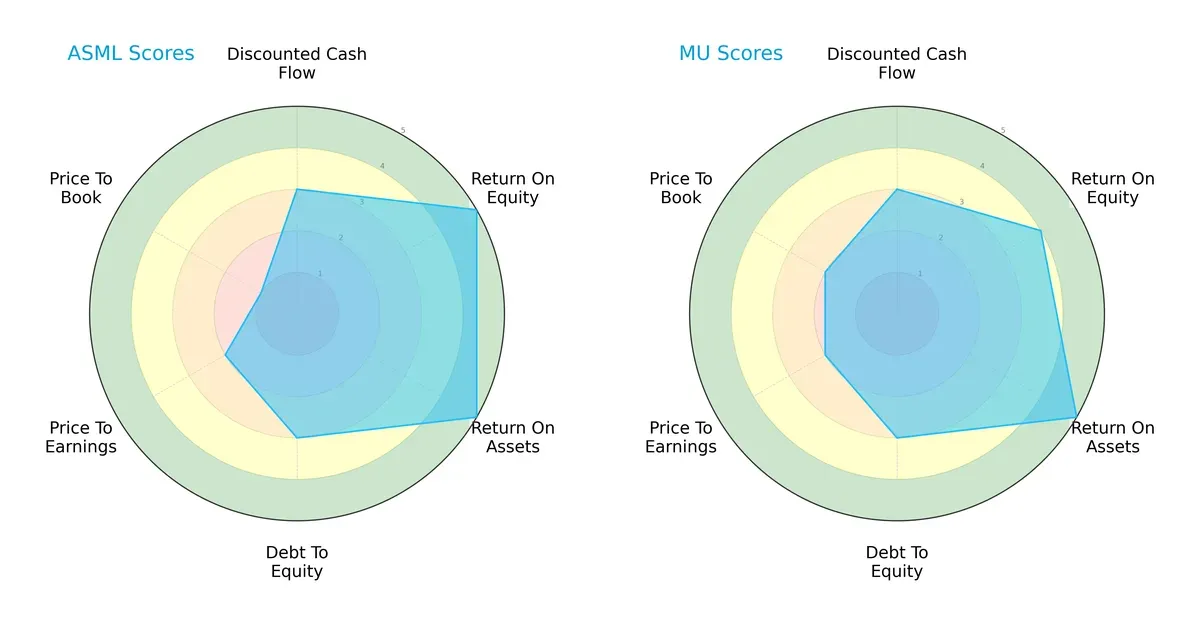

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of ASML Holding N.V. and Micron Technology, Inc.:

ASML excels in profitability metrics with a very favorable ROE and ROA of 5 each, while Micron scores slightly lower on ROE at 4 but matches ASML’s ROA at 5. Both companies share moderate scores in DCF and Debt/Equity, indicating balanced financial risk. Valuation metrics highlight divergence: ASML’s price-to-book score is very unfavorable at 1, suggesting overvaluation, whereas Micron’s slightly better P/B score of 2 signals more reasonable pricing. ASML’s profile leans on operational efficiency, while Micron offers a more balanced valuation approach.

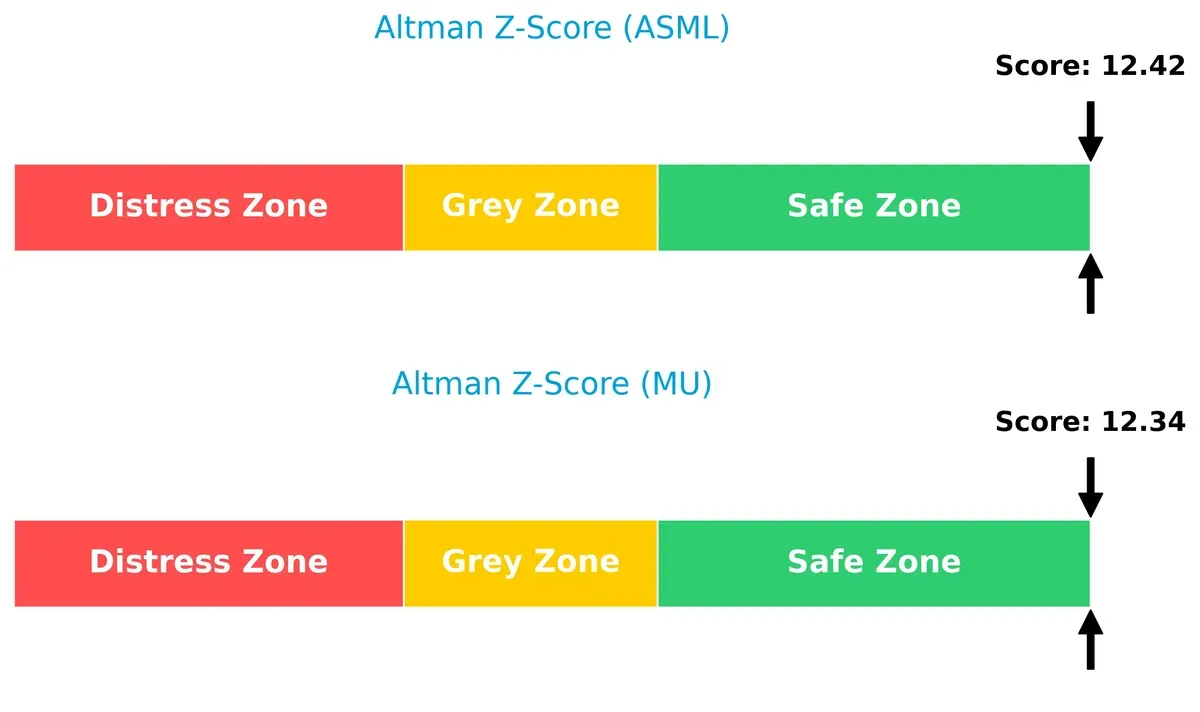

Bankruptcy Risk: Solvency Showdown

ASML’s Altman Z-Score of 12.42 slightly edges out Micron’s 12.34, placing both firmly in the safe zone for bankruptcy risk in today’s cycle:

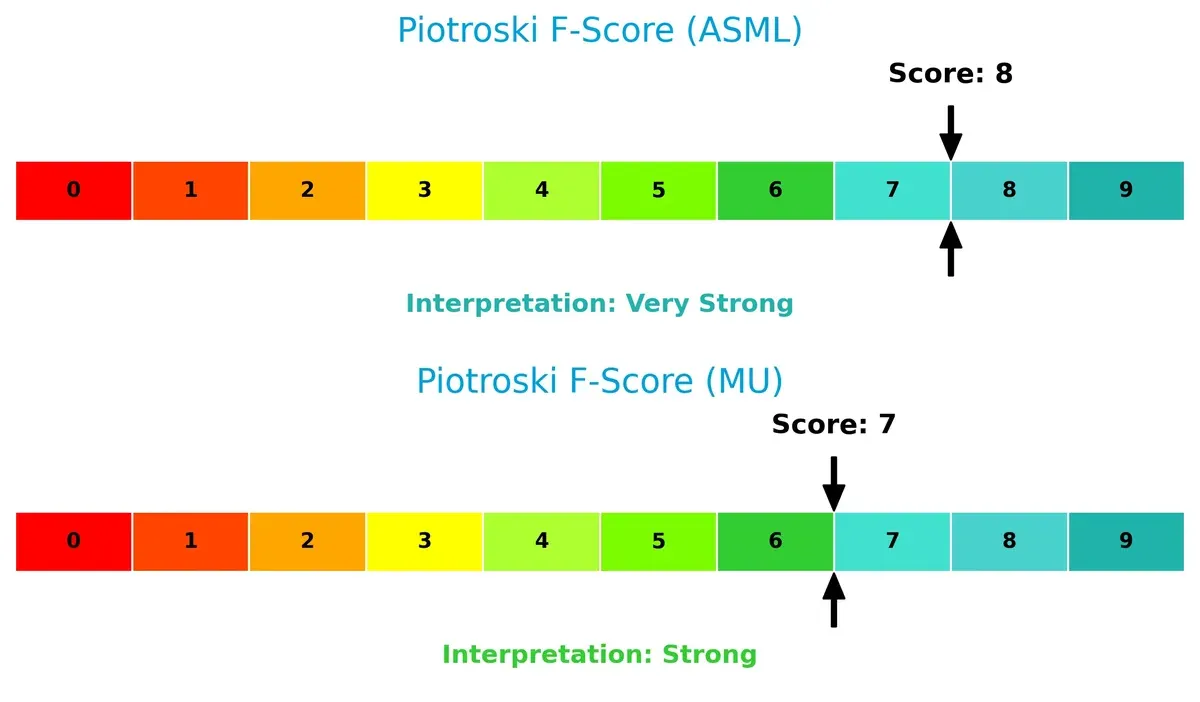

Financial Health: Quality of Operations

ASML scores an 8 on the Piotroski F-Score, indicating very strong financial health, while Micron’s 7 still reflects strength but with marginally more internal risk:

How are the two companies positioned?

This section dissects the operational DNA of ASML and Micron by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify the more resilient competitive advantage in today’s market.

Revenue Segmentation: The Strategic Mix

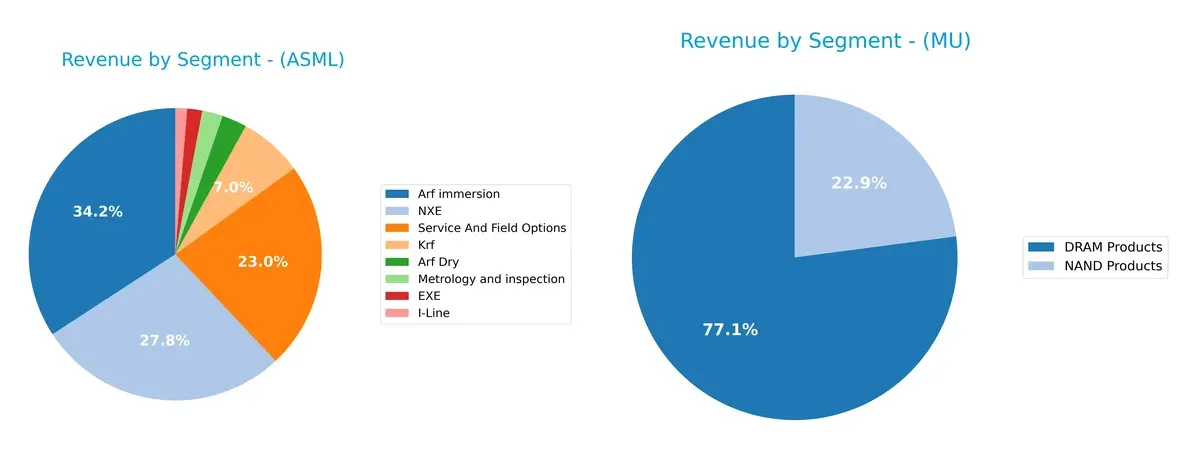

The following visual comparison dissects how ASML Holding N.V. and Micron Technology, Inc. diversify their income streams and where their primary sector bets lie:

ASML’s revenue pivots on a diversified portfolio, with ARF Immersion at $9.67B, NXE at $7.86B, and Services at $6.49B anchoring its mix. In contrast, Micron leans heavily on DRAM Products, which dwarfs NAND at $28.58B versus $8.5B in 2025. ASML’s mix reduces concentration risk, supporting ecosystem lock-in, while Micron’s heavy DRAM reliance raises exposure to memory market cycles.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of ASML Holding N.V. and Micron Technology, Inc.:

ASML Strengths

- High net margin of 29.42%

- Strong ROE at 47.08%

- Favorable ROIC of 34.14%

- Low debt-to-assets at 5.36%

- Diversified revenue in advanced lithography and services

- Significant global presence in Asia and US

MU Strengths

- Favorable net margin of 22.84%

- Solid ROE at 15.76%

- Strong current and quick ratios indicating liquidity

- Moderate debt levels with favorable coverage

- Large revenue from DRAM and NAND products

- Broad geographic sales including US and Taiwan

ASML Weaknesses

- Unfavorable WACC at 10.08% vs ROIC

- High PE (38.33) and PB (18.05) ratios

- Quick ratio below 1 at 0.79

- Dividend yield low at 0.69%

- Asset turnover moderate at 0.62

- Heavy revenue dependence on China and Taiwan

MU Weaknesses

- Unfavorable ROIC at 12.12% below WACC of 22.06%

- Unfavorable asset and fixed asset turnover ratios

- Dividend yield low at 0.38%

- High WACC signals expensive capital

- Geographic concentration in US and Taiwan

- Profitability metrics weaker than ASML

ASML excels in profitability and maintains a strong balance sheet with low leverage but faces valuation and liquidity challenges. MU shows solid liquidity and diversified product revenues but struggles with capital efficiency and profitability relative to its cost of capital. Both companies’ global footprints expose them to geopolitical risks that may affect future growth strategies.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competitive pressure. Without it, market share and margins erode swiftly:

ASML Holding N.V.: Technological Barrier & Intangible Asset Fortress

ASML’s moat stems from cutting-edge lithography tech and intellectual property. This drives a 24% ROIC above WACC and margin stability. Its EUV advancements deepen the moat into 2026.

Micron Technology, Inc.: Cost Leadership in Memory Manufacturing

Micron’s cost advantage supports strong revenue growth but yields a negative ROIC premium vs. WACC. Its expanding scale and product mix improve profitability, though competitive pricing pressure remains a risk.

Verdict: Technology Dominance vs. Cost Efficiency

ASML’s deeper moat, anchored in proprietary tech and pricing power, outmatches Micron’s cost-driven edge. ASML is better positioned to defend market share and sustain profits long term.

Which stock offers better returns?

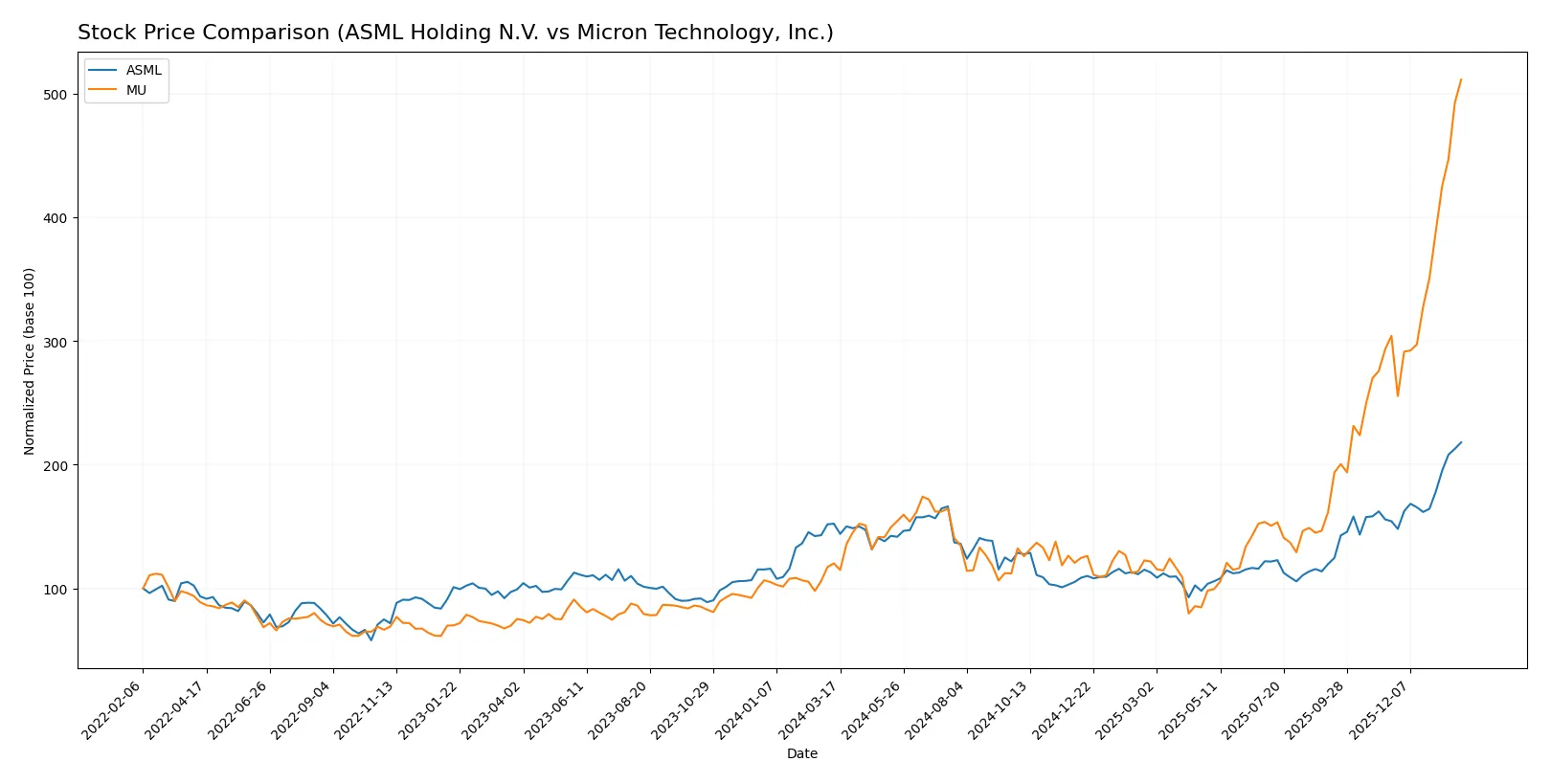

The past year shows strong bullish momentum for both stocks, with Micron Technology surging sharply and ASML Holding gaining steadily amid rising buyer dominance.

Trend Comparison

ASML Holding’s stock rose 43.11% over the last 12 months, showing accelerating bullish momentum from 2025-11-16 to 2026-02-01 with a 41.31% gain and high volatility (std dev 170.09).

Micron Technology’s stock soared 324.99% over the same period, also accelerating bullishly with a 68.08% recent gain and moderate volatility (std dev 70.04).

Micron Technology delivered the highest market performance, outpacing ASML’s gains by nearly 7.5 times over the past year.

Target Prices

Analysts present a broad but optimistic target price range for ASML Holding N.V. and Micron Technology, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| ASML Holding N.V. | 1150 | 1911 | 1458.5 |

| Micron Technology, Inc. | 190 | 480 | 345.61 |

The consensus target for ASML stands slightly above its current price of 1423, indicating modest upside potential. Micron’s target consensus of 346 suggests a valuation below its current price of 415, signaling possible downside risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

ASML Holding N.V. Grades

The table below shows recent grades issued by major financial institutions for ASML Holding N.V.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Upgrade | Overweight | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Bernstein | Maintain | Outperform | 2026-01-22 |

| KGI Securities | Upgrade | Outperform | 2026-01-15 |

| Wells Fargo | Maintain | Overweight | 2026-01-15 |

| JP Morgan | Maintain | Overweight | 2026-01-14 |

| Bernstein | Upgrade | Outperform | 2026-01-05 |

| B of A Securities | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-01 |

Micron Technology, Inc. Grades

The table below presents recent grades from reputable institutions for Micron Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-01-27 |

| TD Cowen | Maintain | Buy | 2026-01-20 |

| Stifel | Maintain | Buy | 2026-01-20 |

| Rosenblatt | Maintain | Buy | 2026-01-20 |

| Wells Fargo | Maintain | Overweight | 2026-01-15 |

| Citigroup | Maintain | Buy | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-14 |

| B of A Securities | Maintain | Buy | 2026-01-13 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Lynx Global | Maintain | Buy | 2026-01-12 |

Which company has the best grades?

ASML Holding N.V. consistently receives upgrades and strong “Outperform” and “Overweight” ratings from top-tier firms. Micron Technology, Inc. holds steady “Buy” and “Overweight” ratings without upgrades. ASML’s stronger momentum could attract investors seeking growth validated by institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

ASML Holding N.V.

- Dominates advanced lithography with high barriers to entry, but faces intense innovation pressure.

Micron Technology, Inc.

- Competes in commoditized memory markets, vulnerable to cyclical downturns and pricing pressure.

2. Capital Structure & Debt

ASML Holding N.V.

- Maintains low debt-to-equity (0.14) and strong interest coverage, reducing financial risk.

Micron Technology, Inc.

- Higher leverage (0.28 D/E) but manageable interest coverage; debt-to-assets higher at 18.45%.

3. Stock Volatility

ASML Holding N.V.

- Beta of 1.34 indicates moderate volatility relative to tech sector benchmarks.

Micron Technology, Inc.

- Higher beta of 1.50 signals elevated share price swings, increasing trading risk.

4. Regulatory & Legal

ASML Holding N.V.

- Exposed to export controls impacting semiconductor equipment sales globally.

Micron Technology, Inc.

- Faces regulatory scrutiny on memory exports and technology licensing, especially in China.

5. Supply Chain & Operations

ASML Holding N.V.

- Complex global supply chain with reliance on specialized components poses disruption risks.

Micron Technology, Inc.

- Heavily dependent on raw materials and foundry partners, vulnerable to supply bottlenecks.

6. ESG & Climate Transition

ASML Holding N.V.

- Progressive ESG initiatives but high energy use in manufacturing remains a challenge.

Micron Technology, Inc.

- Increasing focus on sustainable memory production; energy intensity still a material concern.

7. Geopolitical Exposure

ASML Holding N.V.

- Significant exposure to Asia-Pacific tensions affecting sales and operations.

Micron Technology, Inc.

- US-China trade tensions directly impact market access and supply chain stability.

Which company shows a better risk-adjusted profile?

ASML’s moat in lithography and superior capital structure mitigate key risks better than Micron’s exposure to cyclical memory markets and geopolitical tensions. Both maintain strong financial health, but ASML’s lower volatility and robust profitability provide a cleaner risk profile. Notably, Micron’s higher beta and debt-to-assets ratio highlight amplified market and leverage risks.

Final Verdict: Which stock to choose?

ASML’s superpower lies in its durable competitive advantage rooted in an exceptional ROIC well above its WACC, signaling consistent value creation. Its cutting-edge lithography technology powers the semiconductor industry’s backbone. A point of vigilance is its premium valuation, which could pressure returns during market lulls. It suits portfolios targeting long-term, high-quality growth.

Micron Technology leverages a strategic moat in memory chip production with strong income quality and robust liquidity metrics. It offers a comparatively safer financial profile amid cyclical volatility, supported by a reasonable valuation. This makes it appealing for investors seeking Growth at a Reasonable Price (GARP) with exposure to semiconductor cyclicals.

If you prioritize durable competitive advantage and technological leadership, ASML is the compelling choice due to its superior capital efficiency and market dominance. However, if you seek a more value-oriented profile with solid balance sheet strength and cyclical upside, Micron offers better stability and attractive growth potential at a lower entry point.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of ASML Holding N.V. and Micron Technology, Inc. to enhance your investment decisions: