Home > Comparison > Technology > ASML vs ADI

The strategic rivalry between ASML Holding N.V. and Analog Devices, Inc. defines the semiconductor sector’s innovation race. ASML operates as a capital-intensive equipment manufacturer specializing in advanced lithography systems. In contrast, Analog Devices focuses on high-margin analog and mixed-signal integrated circuits serving diverse industrial and automotive markets. This analysis will assess which company’s operational model and growth trajectory deliver superior risk-adjusted returns for a diversified portfolio in the evolving Technology landscape.

Table of contents

Companies Overview

ASML Holding N.V. and Analog Devices, Inc. shape the semiconductor industry’s critical infrastructure and innovation frontiers.

ASML Holding N.V.: The Lithography Giant

ASML dominates the advanced semiconductor equipment market, specializing in lithography systems essential for chip manufacturing. Its core revenue stems from selling and servicing extreme ultraviolet and deep ultraviolet lithography machines worldwide. In 2026, ASML emphasizes expanding its computational lithography and inspection systems to support ever-smaller semiconductor nodes.

Analog Devices, Inc.: The Signal Processing Leader

Analog Devices excels in integrated circuits that convert and manage analog and digital signals across multiple sectors. Its revenue relies on high-performance amplifiers, data converters, and power management ICs serving automotive, industrial, and communications markets. In 2026, the firm focuses on enhancing mixed-signal processing and microelectromechanical systems for diversified application integration.

Strategic Collision: Similarities & Divergences

ASML and Analog Devices both innovate within the semiconductor value chain but pursue distinct philosophies: ASML controls a capital-intensive hardware niche, while Analog Devices leverages versatile IC solutions across industries. Their primary competition unfolds in supplying semiconductor makers demanding precision and efficiency. These differences create distinct investment profiles—ASML as a specialized equipment stalwart, ADI as a broad-scope analog technology provider.

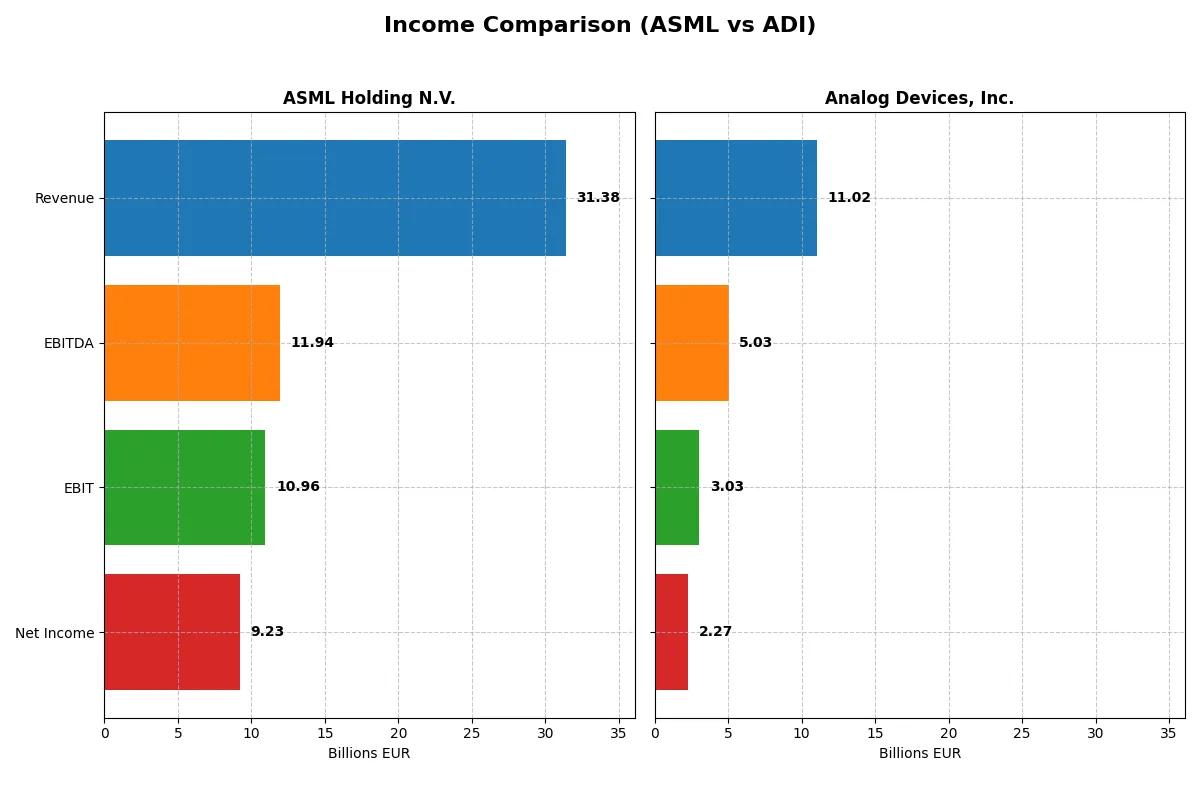

Income Statement Comparison

The following data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | ASML Holding N.V. (ASML) | Analog Devices, Inc. (ADI) |

|---|---|---|

| Revenue | 31.4B EUR | 11.0B USD |

| Cost of Revenue | 14.8B EUR | 5.0B USD |

| Operating Expenses | 5.7B EUR | 3.0B USD |

| Gross Profit | 16.6B EUR | 6.0B USD |

| EBITDA | 11.9B EUR | 5.0B USD |

| EBIT | 11.0B EUR | 3.0B USD |

| Interest Expense | 0 | 318M USD |

| Net Income | 9.2B EUR | 2.3B USD |

| EPS | 23.76 EUR | 4.59 USD |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes which company drives stronger profitability and operational efficiency through their financial performance.

ASML Holding N.V. Analysis

ASML’s revenue surged 11% in 2025 to €31.4B, with net income climbing nearly 22% to €9.2B. It sustains robust margins, boasting a gross margin above 52% and a net margin near 29%. The 2025 figures highlight excellent margin expansion and operational leverage, reflecting efficient cost controls amid growing R&D investments.

Analog Devices, Inc. Analysis

Analog Devices grew revenue by 17% to $11B in fiscal 2025, with net income rising 39% to $2.3B. It maintains a solid gross margin of 54.7% and a net margin of 20.6%. The company’s impressive EBIT growth of 44% signals accelerating profitability and effective expense management despite a modestly higher interest burden.

Margin Expansion vs. Earnings Momentum

ASML outperforms with superior absolute scale and higher net margins, generating €9.2B net income on €31.4B revenue. Analog Devices impresses with faster relative earnings growth and stronger margin improvement over the last year. For investors, ASML offers dominant profitability and scale, while ADI presents a compelling high-growth earnings profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of these semiconductor equipment and components companies:

| Ratios | ASML Holding N.V. (ASML) | Analog Devices, Inc. (ADI) |

|---|---|---|

| ROE | 47.1% | 6.7% |

| ROIC | 34.1% | 5.5% |

| P/E | 38.3 | 51.1 |

| P/B | 18.0 | 3.4 |

| Current Ratio | 1.26 | 2.19 |

| Quick Ratio | 0.79 | 1.68 |

| D/E (Debt-to-Equity) | 0.14 | 0.26 |

| Debt-to-Assets | 5.4% | 18.1% |

| Interest Coverage | N/A | 9.5 |

| Asset Turnover | 0.62 | 0.23 |

| Fixed Asset Turnover | 3.81 | 3.32 |

| Payout Ratio | 26.5% | 84.9% |

| Dividend Yield | 0.69% | 1.66% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, exposing hidden risks and operational strengths that shape investment decisions.

ASML Holding N.V.

ASML demonstrates exceptional profitability with a 47.08% ROE and a robust 29.42% net margin, signaling operational excellence. The stock trades at a stretched 38.33 P/E and high 18.05 P/B ratios, reflecting premium valuation. Shareholders receive modest 0.69% dividends, while significant R&D investment fuels future growth.

Analog Devices, Inc.

Analog Devices posts a modest 6.7% ROE and 20.58% net margin, indicating lower profitability. Its valuation appears expensive, with a 51.05 P/E and 3.42 P/B ratio. The company maintains a healthy dividend yield of 1.66%, balancing shareholder returns with steady reinvestment in R&D and operational improvements.

Premium Valuation vs. Operational Safety

ASML offers superior profitability but at a stretched valuation, while Analog Devices provides a safer liquidity profile with moderate returns. ASML suits growth-focused investors; Analog Devices appeals to those prioritizing balance sheet strength and steady income.

Which one offers the Superior Shareholder Reward?

I see ASML Holding N.V. balances dividends and buybacks with a 0.97% yield and a 34% payout ratio, maintaining strong free cash flow coverage above 2x. Analog Devices, Inc. yields higher at 1.66% but pays out 85% of earnings, risking sustainability. ADI’s buybacks are less intense, while ASML’s capital allocation includes steady buybacks supporting growth. Historically, ASML’s model better sustains long-term returns through disciplined reinvestment and shareholder returns. I conclude ASML offers a more attractive total return profile for 2026 investors.

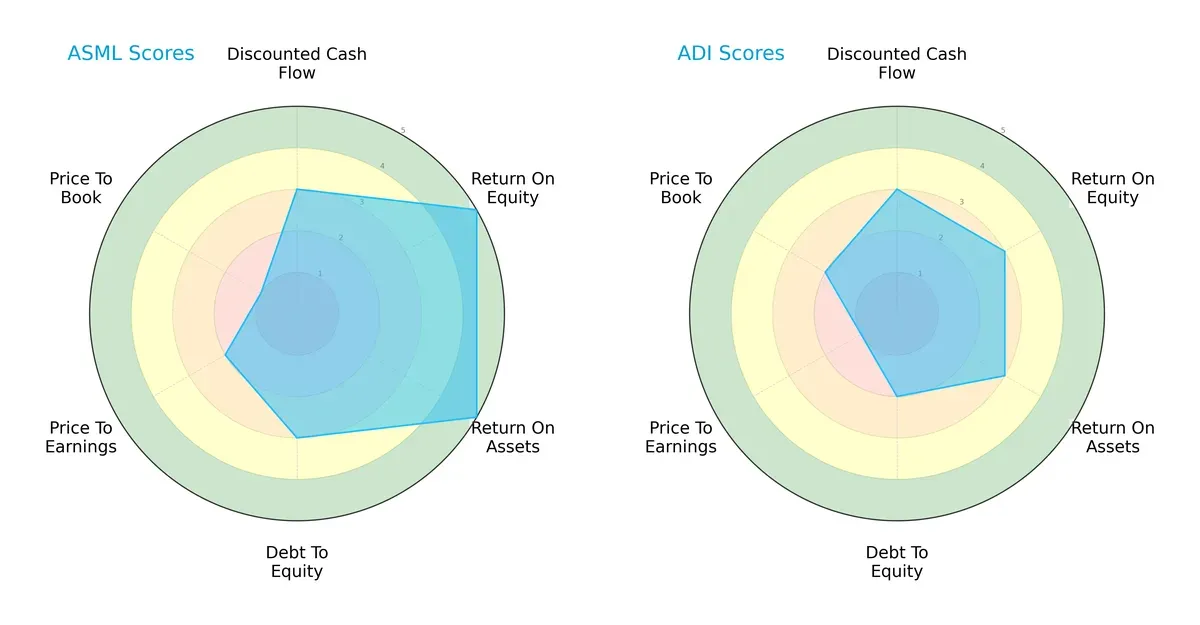

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of ASML Holding N.V. and Analog Devices, Inc., highlighting their distinct financial strengths and weaknesses:

ASML dominates in profitability with top-tier ROE and ROA scores of 5, reflecting superior capital efficiency. It maintains moderate leverage (Debt/Equity score 3) but shows valuation concerns, especially a very unfavorable Price-to-Book score of 1. Analog Devices offers a more modest but balanced profile, with moderate scores across all metrics and less valuation risk. ASML relies heavily on operational excellence, while Analog Devices presents a steadier, less volatile risk-return profile.

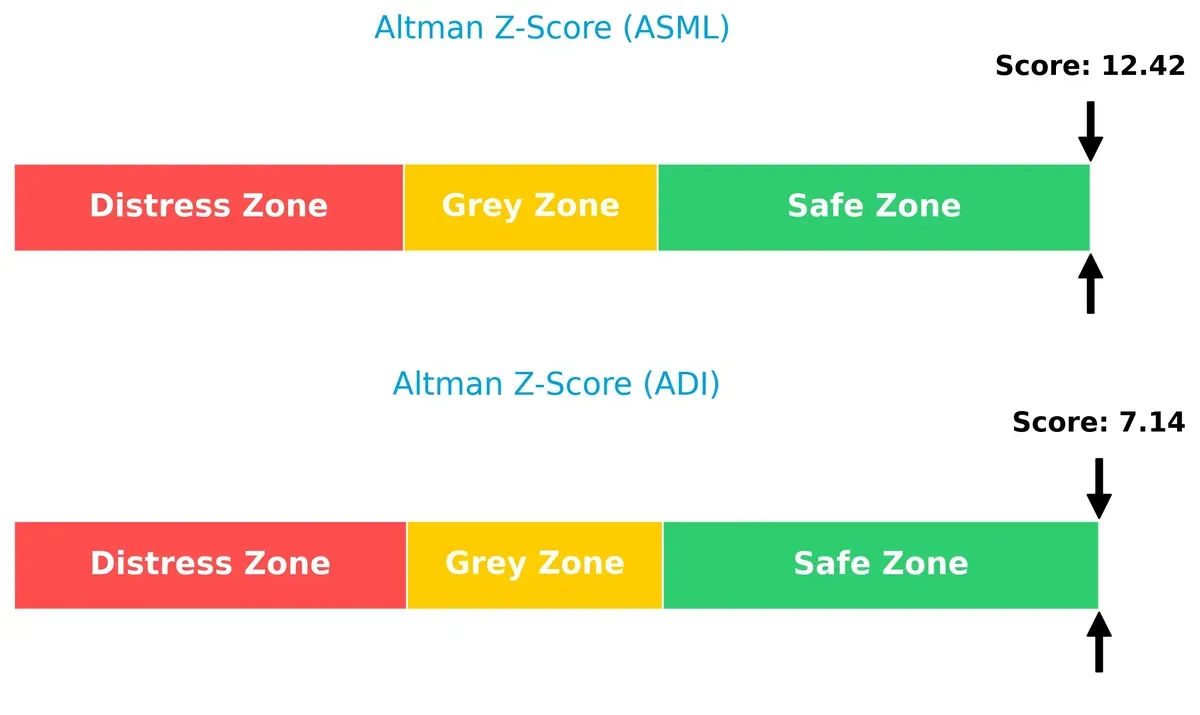

Bankruptcy Risk: Solvency Showdown

ASML’s Altman Z-Score of 12.4 far exceeds Analog Devices’ 7.1, both safely above the distress threshold, indicating robust solvency and resilience through economic cycles:

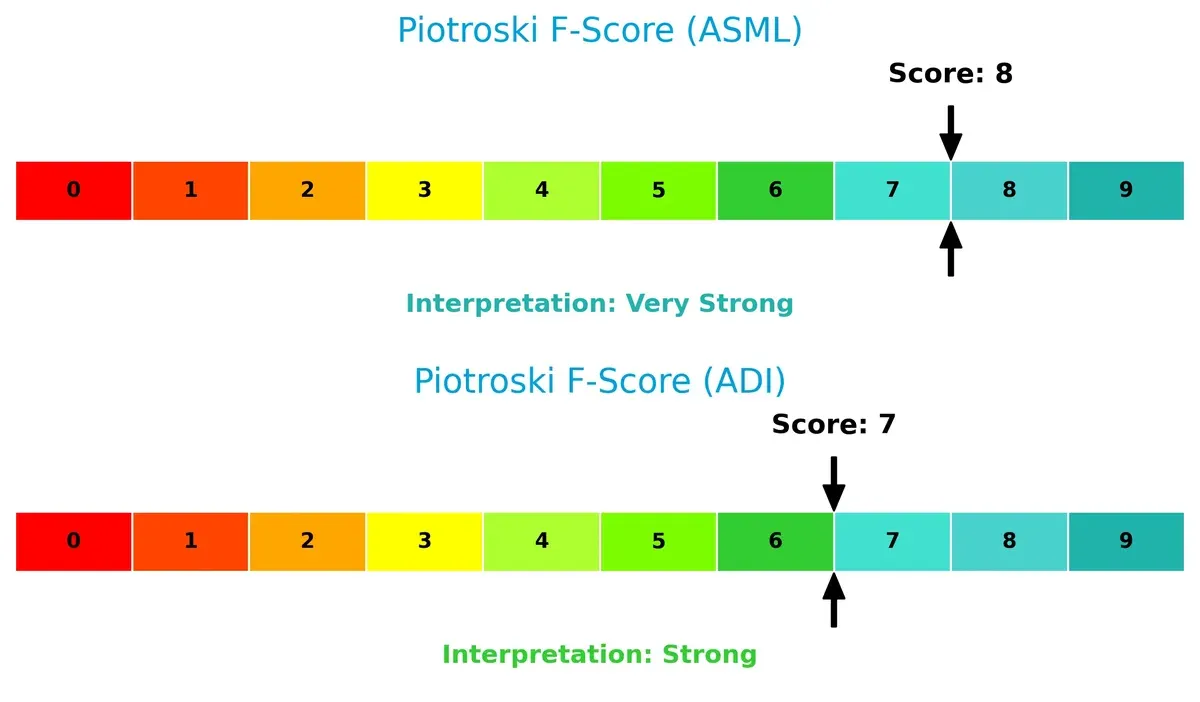

Financial Health: Quality of Operations

ASML’s Piotroski F-Score of 8 suggests peak financial health and operational strength, slightly outperforming Analog Devices’ strong 7, which still signals solid fundamentals with no immediate red flags:

How are the two companies positioned?

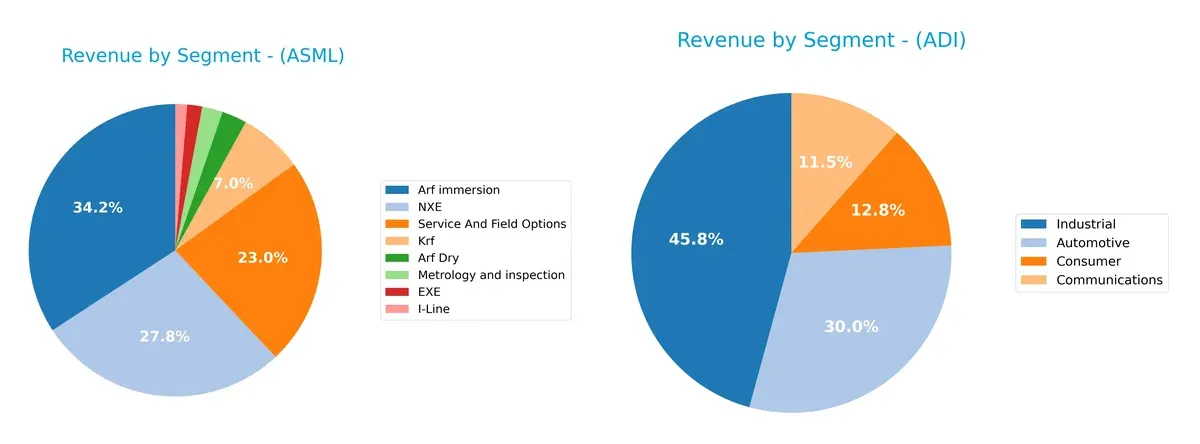

This section dissects ASML and ADI’s operational DNA by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats, revealing which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This comparison breaks down how ASML Holding N.V. and Analog Devices, Inc. diversify their revenue streams and where they place their main sector bets:

ASML pivots heavily on Arf immersion ($9.67B) and NXE ($7.86B), anchoring its revenue in advanced lithography. Service and field options also contribute significantly at $6.49B. Analog Devices shows a more balanced profile, with industrial ($4.31B) dominating but automotive ($2.83B), consumer ($1.20B), and communications ($1.08B) rounding out a well-diversified mix. ASML’s concentration signals strong ecosystem lock-in but higher segment risk compared to ADI’s broader industrial exposure.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of ASML and ADI:

ASML Strengths

- High net margin at 29.42%

- Strong ROE at 47.08%

- ROIC well above WACC at 34.14%

- Low debt-to-assets at 5.36%

- Diverse product segments including EUV and NXE systems

- Significant revenue from China and Korea

ADI Strengths

- Favorable net margin at 20.58%

- Strong liquidity with current ratio of 2.19 and quick ratio 1.68

- Favorable debt metrics with 18.05% debt-to-assets

- Broad end markets: automotive, industrial, communications, consumer

- Revenue well distributed across US, Europe, and Asia

- Solid fixed asset turnover at 3.32

ASML Weaknesses

- High valuation multiples (PE 38.33, PB 18.05)

- Quick ratio under 1 at 0.79 signals liquidity caution

- WACC higher than ROIC at 10.08%

- Moderate current ratio at 1.26

- Dividend yield low at 0.69%

- Less geographic revenue diversification outside Asia

ADI Weaknesses

- Low ROE at 6.7% and neutral ROIC at 5.55%

- High PE of 51.05 and unfavorable PB of 3.42

- Weak asset turnover at 0.23

- Dividend yield neutral at 1.66%

- Lower market share in key Asian markets compared to ASML

- Less product specialization evident in financials

ASML excels in profitability and product innovation but carries valuation and liquidity concerns. ADI benefits from strong liquidity and market diversification but shows weaker profitability and asset efficiency. These factors shape each company’s strategic priorities in capital allocation and growth focus.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from the relentless erosion of competition. Let’s dissect the core moats defending ASML and Analog Devices in 2026:

ASML Holding N.V.: Technological Monopoly via Intangible Assets

ASML’s moat roots in proprietary extreme ultraviolet lithography technology, reflected in a robust 34.9% EBIT margin and 24% ROIC above WACC. Its dominant tech position deepens with expanding chipmaking nodes, securing future profits in advanced semiconductors.

Analog Devices, Inc.: Operational Excellence with Cost Advantage

Analog Devices leverages integrated circuit specialization and efficient capital use, yet posts a negative ROIC versus WACC, signaling value destruction despite its rising profitability. Unlike ASML, ADI’s moat depends on incremental operational efficiencies rather than unique tech.

Moat Mastery: Intangible Assets vs. Operational Efficiency

ASML boasts a wider, deeper moat fueled by unmatched technology and strong value creation. Analog Devices shows promise with growing ROIC but lacks the durable competitive edge to defend market share against technological leaders like ASML.

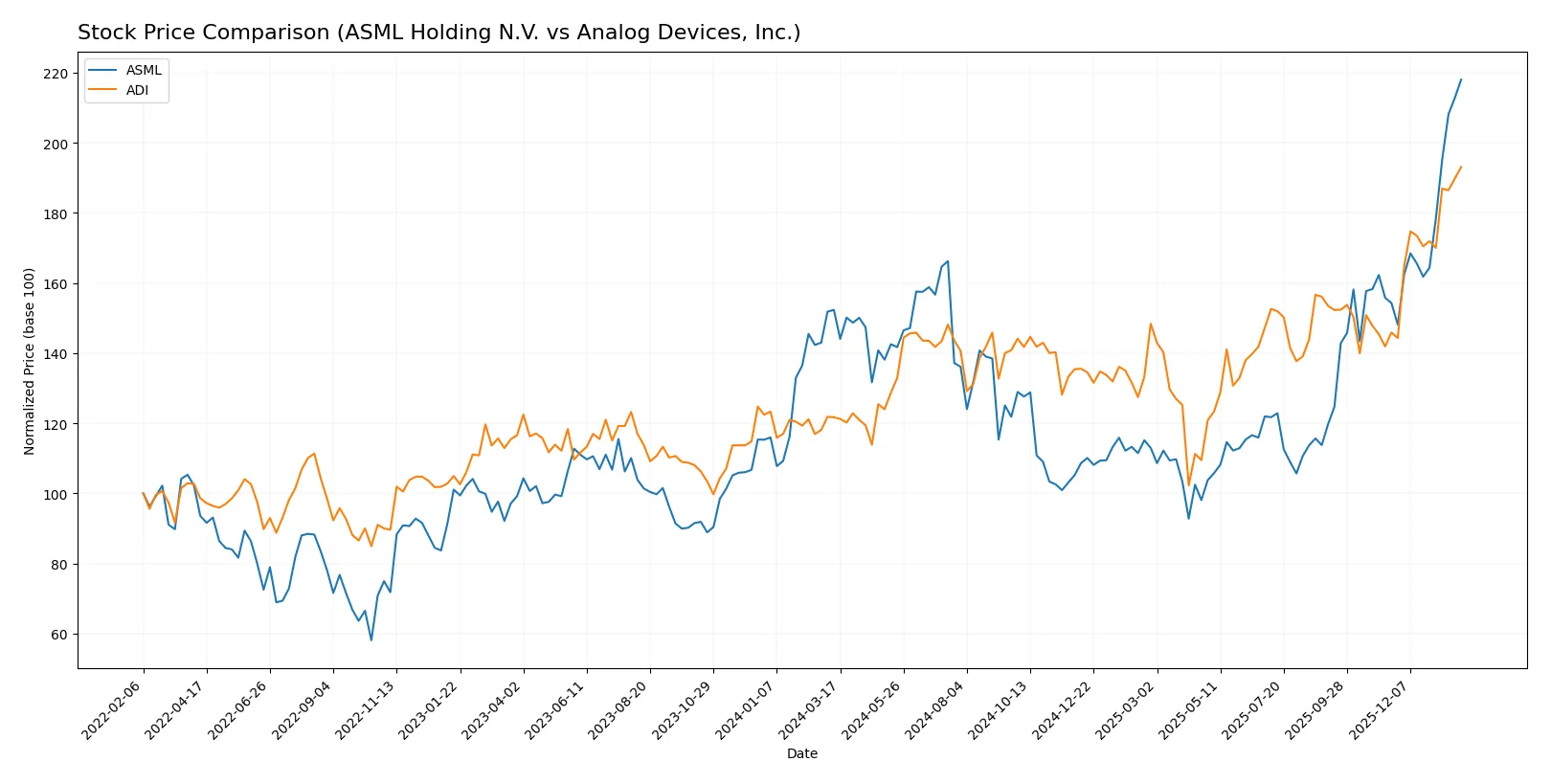

Which stock offers better returns?

Both ASML Holding N.V. and Analog Devices, Inc. exhibit strong bullish momentum over the past year, with notable price appreciation and increasing trading volumes signaling active investor interest.

Trend Comparison

ASML Holding N.V. shows a 43.11% price increase over the past 12 months with accelerating momentum and high volatility, peaking at 1423.0 and bottoming at 605.55.

Analog Devices, Inc. delivers a steeper 58.66% gain over the same period, also accelerating but with significantly lower volatility, reaching a high of 310.88 and a low of 164.6.

Comparatively, Analog Devices outperforms ASML in total returns, despite its lower volatility, indicating stronger market performance over the past year.

Target Prices

Analysts present a solid target consensus for ASML Holding N.V. and Analog Devices, Inc., reflecting cautious optimism in semiconductor prospects.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| ASML Holding N.V. | 1150 | 1911 | 1458.5 |

| Analog Devices, Inc. | 270 | 375 | 316 |

The consensus target for ASML at 1458.5 slightly exceeds its current price of 1423, suggesting modest upside potential. Analog Devices’ 316 target consensus also implies a small premium over the current 311 price, indicating stable analyst confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here is a summary of recent institutional grades for both companies:

ASML Holding N.V. Grades

The table below shows recent grade updates from reputable institutions for ASML Holding N.V.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Upgrade | Overweight | 2026-01-29 |

| Wells Fargo | Maintain | Overweight | 2026-01-29 |

| RBC Capital | Maintain | Outperform | 2026-01-29 |

| Bernstein | Maintain | Outperform | 2026-01-22 |

| KGI Securities | Upgrade | Outperform | 2026-01-15 |

| Wells Fargo | Maintain | Overweight | 2026-01-15 |

| JP Morgan | Maintain | Overweight | 2026-01-14 |

| Bernstein | Upgrade | Outperform | 2026-01-05 |

| B of A Securities | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-01 |

Analog Devices, Inc. Grades

The table below displays recent institutional ratings for Analog Devices, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-01-22 |

| B of A Securities | Maintain | Buy | 2026-01-21 |

| Stifel | Maintain | Buy | 2026-01-16 |

| Oppenheimer | Maintain | Outperform | 2026-01-16 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Citigroup | Maintain | Buy | 2026-01-15 |

| Keybanc | Maintain | Overweight | 2026-01-13 |

| Truist Securities | Maintain | Hold | 2025-12-19 |

| UBS | Maintain | Buy | 2025-12-08 |

| Truist Securities | Maintain | Hold | 2025-11-26 |

Which company has the best grades?

ASML Holding N.V. consistently receives high marks, mostly “Outperform” and “Overweight,” reflecting strong institutional confidence. Analog Devices, Inc. also earns solid ratings but includes several “Hold” grades, suggesting more mixed views. Investors may interpret ASML’s stronger consensus as a signal of greater institutional enthusiasm.

Risks specific to each company

In 2026, both ASML Holding N.V. and Analog Devices, Inc. face critical pressure points and systemic threats across multiple risk categories in a complex semiconductor market environment:

1. Market & Competition

ASML Holding N.V.

- Dominates advanced lithography equipment with high barriers to entry but faces intense innovation pressure.

Analog Devices, Inc.

- Competes in diverse analog and mixed-signal markets with strong rivals, risking margin compression.

2. Capital Structure & Debt

ASML Holding N.V.

- Maintains low debt-to-equity (0.14) and excellent interest coverage, signaling financial strength.

Analog Devices, Inc.

- Slightly higher leverage (0.26) but still manages solid interest coverage, indicating manageable debt risk.

3. Stock Volatility

ASML Holding N.V.

- Beta of 1.34 reflects above-market volatility, sensitive to semiconductor cycles and geopolitical factors.

Analog Devices, Inc.

- Beta near 1.03 suggests market-aligned volatility, offering relatively stable price movements.

4. Regulatory & Legal

ASML Holding N.V.

- Faces export controls on advanced tech amid geopolitical tensions, risking supply disruptions.

Analog Devices, Inc.

- US-based with regulatory scrutiny but benefits from more diversified product applications, mitigating legal risks.

5. Supply Chain & Operations

ASML Holding N.V.

- Complex global supply chain vulnerable to component shortages and geopolitical disruptions.

Analog Devices, Inc.

- More diversified supply chain and product portfolio reduce exposure to operational shocks.

6. ESG & Climate Transition

ASML Holding N.V.

- High energy use in manufacturing challenges ESG goals but invests heavily in sustainability initiatives.

Analog Devices, Inc.

- Focuses on energy-efficient products and has a stronger quick ratio, supporting liquidity amid ESG transitions.

7. Geopolitical Exposure

ASML Holding N.V.

- Significant exposure to Asia-Pacific tensions due to key markets in China, Taiwan, and South Korea.

Analog Devices, Inc.

- US-based with global reach but less dependent on any single geopolitical hotspot, lowering immediate risk.

Which company shows a better risk-adjusted profile?

ASML’s most impactful risk is geopolitical exposure combined with stock volatility, driven by its niche market dominance and export sensitivities. Analog Devices faces capital structure challenges and competitive margin pressure but benefits from greater operational diversification and steadier volatility. Both show slightly favorable financial ratios and strong Altman Z-scores, yet Analog Devices’ lower beta and stronger liquidity ratios suggest a more balanced risk-adjusted profile in 2026.

Final Verdict: Which stock to choose?

ASML’s superpower lies in its durable competitive advantage, driven by a consistently high ROIC well above its WACC. This cash-generating titan excels in capital efficiency and innovation leadership. However, its stretched valuation and modest liquidity ratios warrant vigilance. It suits aggressive growth portfolios seeking industry dominance.

Analog Devices (ADI) impresses with a strategic moat rooted in recurring revenue and strong balance sheet liquidity. While its ROIC trails its cost of capital, improving profitability and solid income quality offer a safety cushion versus ASML’s higher-risk profile. ADI fits well in GARP portfolios balancing growth and stability.

If you prioritize long-term value creation and can tolerate premium valuations, ASML outshines with superior capital returns and innovation. However, if your focus is on steady cash flow and financial stability with moderate growth, ADI offers better stability and less valuation risk. Both present compelling but distinct analytical scenarios.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of ASML Holding N.V. and Analog Devices, Inc. to enhance your investment decisions: